In the fast-evolving semiconductor industry, Onto Innovation Inc. and indie Semiconductor, Inc. stand out as innovators with distinct but overlapping market focuses. Onto Innovation excels in process control and metrology tools, while indie Semiconductor targets automotive chips and software solutions. Comparing these companies reveals contrasting strategies in technology and market reach. This analysis will help you identify which stock aligns best with your investment goals in 2026.

Table of contents

Companies Overview

I will begin the comparison between Onto Innovation Inc. and indie Semiconductor, Inc. by providing an overview of these two companies and their main differences.

Onto Innovation Inc. Overview

Onto Innovation Inc. specializes in designing, developing, and manufacturing process control tools for semiconductor and advanced packaging device manufacturers. Its portfolio includes macro defect inspection, 2D/3D optical metrology, lithography systems, and process control software. Founded in 1940 and headquartered in Wilmington, Massachusetts, Onto supports a broad range of industrial and scientific applications with a market cap of approximately 10.7B USD.

indie Semiconductor, Inc. Overview

indie Semiconductor, Inc. focuses on automotive semiconductor and software solutions aimed at advanced driver assistance, connectivity, user experience, and electrification. Based in Aliso Viejo, California, and founded in 2007, indie provides devices for parking assistance, wireless charging, infotainment, LED lighting, and telematics. The company has a market cap near 857M USD and serves various photonic and optical communication markets.

Key similarities and differences

Both Onto Innovation and indie Semiconductor operate in the semiconductor industry within the technology sector in the US. Onto targets process control and manufacturing tools for semiconductor fabs, while indie concentrates on automotive applications and related photonic technologies. Onto’s business model emphasizes hardware and software for production process optimization, whereas indie integrates semiconductors with software for automotive and connectivity solutions. Their market caps and employee bases also differ significantly.

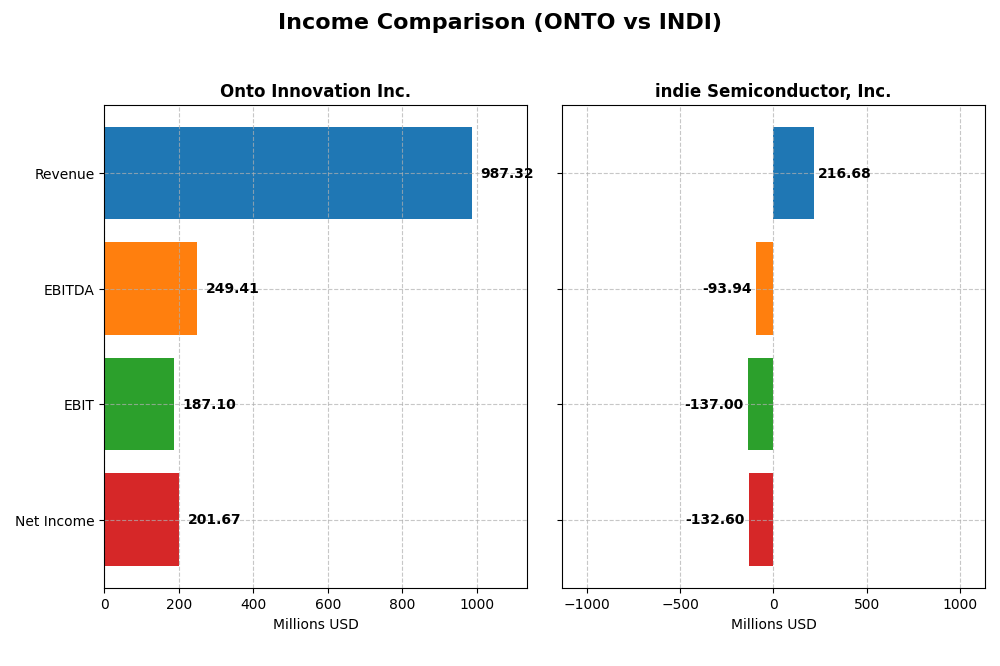

Income Statement Comparison

The table below presents a side-by-side comparison of the most recent fiscal year income statement metrics for Onto Innovation Inc. and indie Semiconductor, Inc., highlighting key financial figures.

| Metric | Onto Innovation Inc. | indie Semiconductor, Inc. |

|---|---|---|

| Market Cap | 10.7B | 857M |

| Revenue | 987M | 217M |

| EBITDA | 249M | -94M |

| EBIT | 187M | -137M |

| Net Income | 202M | -133M |

| EPS | 4.09 | -0.76 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Onto Innovation Inc.

Onto Innovation Inc. showed a strong upward trend in revenue and net income from 2020 to 2024, with revenue growing 77.4% overall and net income surging over 550%. Margins improved notably with a gross margin of 52.2% and a net margin of 20.4% in 2024. The latest year saw a 21% revenue increase and a 37.5% net margin growth, indicating robust profitability enhancement.

indie Semiconductor, Inc.

indie Semiconductor experienced substantial revenue growth of 858% over the period but struggled with consistent profitability. The gross margin was a solid 41.7% in 2024, yet the company reported negative EBIT and net margins, -63.2% and -61.2%, respectively. Revenue declined slightly by 2.9% in 2024, and net income remained negative, reflecting ongoing operational challenges despite some EPS improvement.

Which one has the stronger fundamentals?

Onto Innovation exhibits stronger fundamentals with favorable growth in revenue, net income, and margins, maintaining profitability throughout the period. In contrast, indie Semiconductor’s high revenue growth contrasts with persistent net losses and unfavorable EBIT and net margins. Overall, Onto’s consistent profitability and margin improvements present a more stable income statement profile.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for Onto Innovation Inc. and indie Semiconductor, Inc. for the fiscal year 2024, providing insight into their financial performance and position.

| Ratios | Onto Innovation Inc. (ONTO) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| ROE | 10.47% | -31.73% |

| ROIC | 8.77% | -19.25% |

| P/E | 41.76 | -5.35 |

| P/B | 4.37 | 1.70 |

| Current Ratio | 8.69 | 4.82 |

| Quick Ratio | 7.00 | 4.23 |

| D/E | 0.008 | 0.95 |

| Debt-to-Assets | 0.72% | 42.34% |

| Interest Coverage | 0 | -18.37 |

| Asset Turnover | 0.47 | 0.23 |

| Fixed Asset Turnover | 7.16 | 4.30 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Onto Innovation Inc.

Onto Innovation presents a balanced ratio profile with 43% favorable and 43% unfavorable metrics, leading to a neutral overall assessment. Strong points include a high quick ratio of 7.0 and low debt-to-equity at 0.01, but concerns arise from an elevated PE of 41.76 and a weak current ratio of 8.69. The company does not pay dividends, likely focusing on reinvestment or growth strategies.

indie Semiconductor, Inc.

indie Semiconductor’s ratios highlight significant challenges, with 57% unfavorable and only 21% favorable, yielding an unfavorable overall view. It suffers from negative net margin (-61.2%) and return on equity (-31.73%), alongside poor interest coverage at -14.8. No dividends are distributed, consistent with ongoing losses and high R&D expenses, reflecting a growth or development phase.

Which one has the best ratios?

Comparing both, Onto Innovation shows a more stable financial position with a neutral stance on ratios, supported by strong liquidity and low leverage. indie Semiconductor, however, struggles with profitability and coverage, reflected in mostly unfavorable ratios. Thus, Onto Innovation holds the comparatively better ratio profile based on the available data.

Strategic Positioning

This section compares the strategic positioning of Onto Innovation Inc. and indie Semiconductor, Inc. regarding market position, key segments, and exposure to technological disruption:

Onto Innovation Inc.

- Established market player with $10.7B market cap, moderate competitive pressure.

- Focuses on semiconductor process control tools and software, strong in systems and software revenue.

- Exposure centered on semiconductor manufacturing process technologies and related software solutions.

indie Semiconductor, Inc.

- Smaller market cap at $857M, facing high volatility and competitive pressure.

- Concentrated on automotive semiconductors and software for advanced driver assistance and connected cars.

- Exposure tied to automotive semiconductor innovation, including photonic components and connectivity.

Onto Innovation Inc. vs indie Semiconductor, Inc. Positioning

Onto Innovation has a diversified portfolio across semiconductor process control and software, serving multiple industrial applications. indie Semiconductor concentrates narrowly on automotive semiconductor solutions, which may limit diversification but targets a specialized market segment.

Which has the best competitive advantage?

Based on MOAT analysis, Onto Innovation shows a slightly unfavorable position with growing ROIC, indicating improving profitability despite value destruction. indie Semiconductor is very unfavorable, with declining ROIC and worsening value destruction, reflecting weaker competitive advantage.

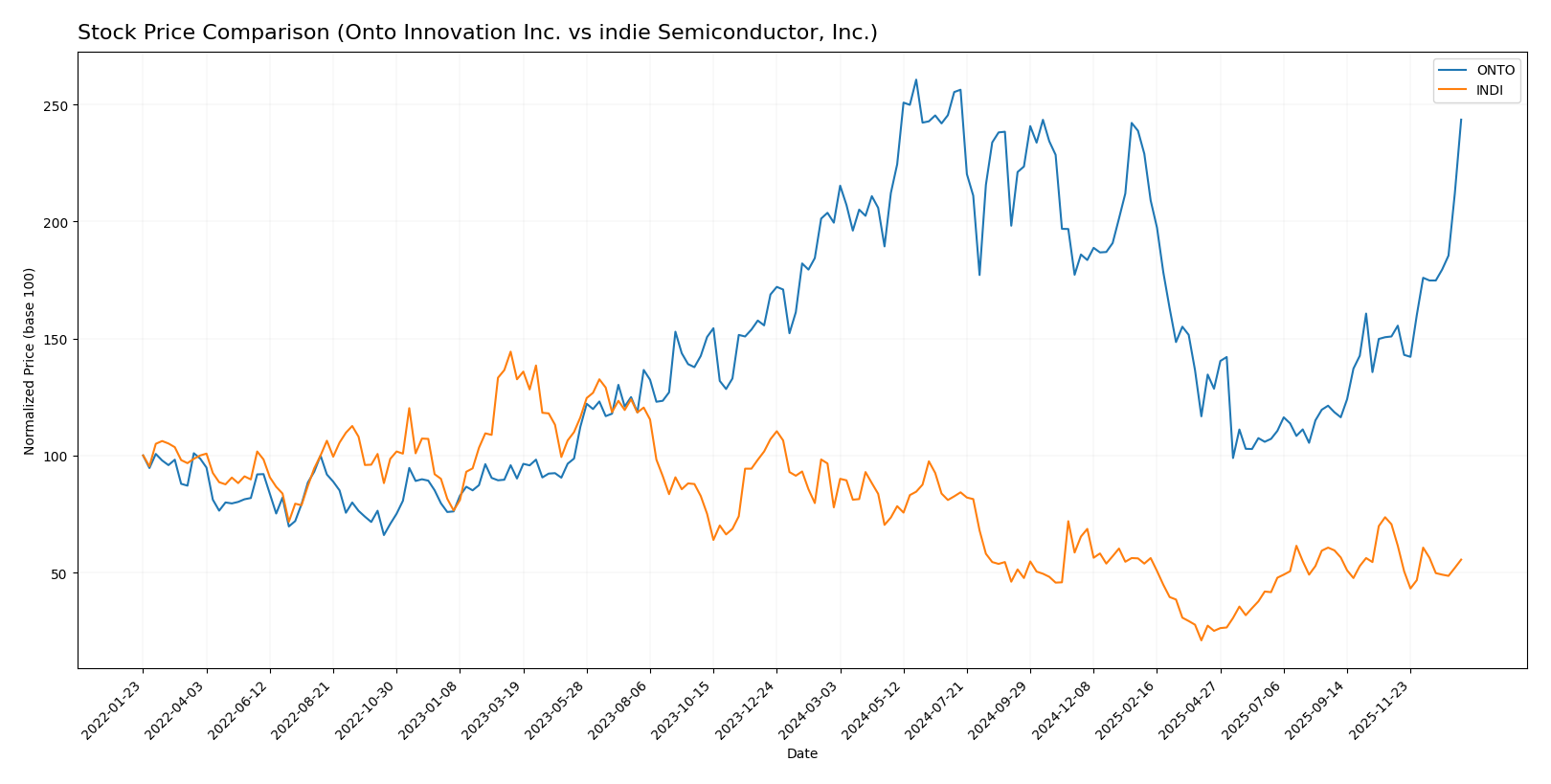

Stock Comparison

The stock price movements of Onto Innovation Inc. (ONTO) and indie Semiconductor, Inc. (INDI) over the past year reveal contrasting trends, with ONTO showing notable growth and INDI experiencing a decline in value.

Trend Analysis

Onto Innovation Inc. (ONTO) exhibited a bullish trend over the past 12 months, with a 22.07% price increase and accelerating momentum. Its price ranged between 88.5 and 233.14, showing high volatility with a standard deviation of 42.61.

indie Semiconductor, Inc. (INDI) faced a bearish trend, declining 28.67% over the year with decelerating losses. The stock price fluctuated between 1.6 and 7.43, displaying low volatility with a standard deviation of 1.35.

Comparing the two, ONTO delivered the highest market performance with a strong upward trend, while INDI showed significant depreciation, confirming ONTO’s relative strength in this period.

Target Prices

Analysts provide clear target price ranges reflecting their outlooks for these semiconductor firms.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Onto Innovation Inc. | 200 | 160 | 178 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

The consensus target for Onto Innovation is below its current price of 217.85 USD, suggesting cautious expectations, while indie Semiconductor’s target is nearly double its current 4.23 USD price, indicating strong upside potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Onto Innovation Inc. and indie Semiconductor, Inc.:

Rating Comparison

ONTO Rating

- Rating: B+, evaluated as Very Favorable overall financial standing.

- Discounted Cash Flow Score: 3, indicating a moderate valuation outlook.

- ROE Score: 3, showing moderate efficiency in generating profit from equity.

- ROA Score: 4, reflecting favorable asset utilization to generate earnings.

- Debt To Equity Score: 4, indicating favorable financial risk and balance sheet.

- Overall Score: 3, a moderate summary assessment of financial health.

INDI Rating

- Rating: C-, evaluated as Very Favorable overall financial standing.

- Discounted Cash Flow Score: 1, indicating a very unfavorable valuation outlook.

- ROE Score: 1, showing very unfavorable efficiency in generating profit from equity.

- ROA Score: 1, reflecting very unfavorable asset utilization.

- Debt To Equity Score: 1, indicating very unfavorable financial risk.

- Overall Score: 1, a very unfavorable summary assessment of financial health.

Which one is the best rated?

Based strictly on the provided data, Onto Innovation Inc. is better rated overall, with moderate to favorable scores across metrics, while indie Semiconductor, Inc. shows very unfavorable scores in key financial areas.

Scores Comparison

The comparison of Onto Innovation Inc. and indie Semiconductor, Inc. scores is as follows:

ONTO Scores

- Altman Z-Score: 34.16, indicating a safe zone.

- Piotroski Score: 4, classified as average.

INDI Scores

- Altman Z-Score: 0.12, indicating a distress zone.

- Piotroski Score: 2, classified as very weak.

Which company has the best scores?

Based strictly on the provided data, Onto Innovation Inc. has significantly better scores, with a very high Altman Z-Score and an average Piotroski Score, while indie Semiconductor is in financial distress with very weak strength indicators.

Grades Comparison

Here is the summary of the latest available grades from reputable grading companies for the two companies:

Onto Innovation Inc. Grades

The table below shows recent analyst grades for Onto Innovation Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Hold | 2026-01-14 |

| Needham | Maintain | Buy | 2026-01-06 |

| Jefferies | Maintain | Buy | 2025-12-15 |

| B. Riley Securities | Maintain | Buy | 2025-11-18 |

| Needham | Maintain | Buy | 2025-11-18 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| Oppenheimer | Maintain | Outperform | 2025-10-14 |

| Stifel | Maintain | Hold | 2025-10-13 |

| B. Riley Securities | Maintain | Buy | 2025-10-10 |

| Jefferies | Upgrade | Buy | 2025-09-23 |

Overall, Onto Innovation Inc. shows a strong buy consensus with mostly buy and outperform ratings and only a few hold ratings.

indie Semiconductor, Inc. Grades

The table below shows recent analyst grades for indie Semiconductor, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

indie Semiconductor, Inc. grades present a consistent buy and overweight stance, with one neutral rating, indicating a positive but slightly more cautious outlook.

Which company has the best grades?

Onto Innovation Inc. has a slightly stronger grades profile with multiple buy and outperform ratings, while indie Semiconductor shows mostly buy/overweight with one neutral. Investors may perceive Onto Innovation’s wider analyst support as a signal of more confident growth expectations.

Strengths and Weaknesses

Below is a summary table comparing key strengths and weaknesses of Onto Innovation Inc. (ONTO) and indie Semiconductor, Inc. (INDI) based on recent financial and operational data.

| Criterion | Onto Innovation Inc. (ONTO) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Diversification | Strong product mix: Systems & Software (85%), Parts & Services growing steadily | Product-focused (93%), Services small but fluctuating; less diversified |

| Profitability | Positive net margin 20.4%, ROIC 8.8% (neutral), but ROIC < WACC (value destroying) | Negative net margin -61.2%, ROIC -19.3%, ROIC < WACC with declining trend |

| Innovation | Growing ROIC trend suggests improving operational efficiency | Declining ROIC trend implies challenges in operational innovation |

| Global presence | Established with broad systems & software market reach | Smaller scale, less diversified global footprint |

| Market Share | Leading in semiconductor process equipment segments | Smaller share in semiconductor components space |

Key takeaways: Onto Innovation shows improving profitability and a strong foothold in systems/software with steady revenue growth, despite currently not creating value above capital costs. Indie Semiconductor faces significant profitability and operational challenges with shrinking returns, posing higher risk for investors. Caution and risk management are advised when considering INDI.

Risk Analysis

Below is a comparative table highlighting key risk factors for Onto Innovation Inc. (ONTO) and indie Semiconductor, Inc. (INDI) based on the most recent 2024 data.

| Metric | Onto Innovation Inc. (ONTO) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Risk | Beta 1.46 (moderate volatility) | Beta 2.54 (high volatility) |

| Debt Level | Very low debt-to-equity 0.01 (favorable) | High debt-to-equity 0.95 (neutral) |

| Regulatory Risk | Moderate, standard industry regulations | Moderate, automotive semiconductor regulations |

| Operational Risk | Moderate, stable operations with strong asset turnover | Elevated, weak profitability and asset efficiency |

| Environmental Risk | Standard semiconductor industry concerns | Moderate, automotive focus increases scrutiny |

| Geopolitical Risk | US-based, exposure to global supply chains | US-based, exposed to automotive market fluctuations |

The most impactful risks are market volatility and financial stability. indie Semiconductor faces high market volatility (beta 2.54) and significant debt, raising bankruptcy risk (Altman Z-Score in distress zone). Onto Innovation presents moderate market risk but strong financial health with minimal debt and a very safe Altman Z-Score, making it comparatively lower risk.

Which Stock to Choose?

Onto Innovation Inc. (ONTO) shows a favorable income evolution with 21% revenue growth in 2024 and a strong net margin of 20.43%. Financial ratios are balanced, with 43% favorable and unfavorable metrics each, reflecting moderate profitability, very low debt, and a highly positive rating of B+. Its Altman Z-Score indicates financial safety, though its ROIC remains slightly below WACC, signaling slight value destruction but improving profitability.

indie Semiconductor, Inc. (INDI) presents a mixed income profile with a 3% revenue decline in 2024, a negative net margin of -61.2%, and mostly unfavorable financial ratios at 57%. The company carries higher debt ratios, poor profitability metrics, and a C- rating with very weak Altman Z-Score and Piotroski Score, alongside a strongly negative ROIC trend, indicating significant value erosion and financial distress.

Investors favoring growth and improving profitability might find ONTO’s stable financials and favorable income trends more aligned with their goals, while those with a tolerance for higher risk and potential turnaround plays could interpret INDI’s valuation metrics and recent gross profit growth differently. Overall, ONTO’s stronger rating and income quality suggest a comparatively more stable financial footing.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Onto Innovation Inc. and indie Semiconductor, Inc. to enhance your investment decisions: