In the dynamic semiconductor industry, ON Semiconductor Corporation and indie Semiconductor, Inc. stand out for their innovative approaches to automotive technology and power solutions. ON Semiconductor leads with diverse applications in electrification and sensing, while indie Semiconductor focuses on advanced driver assistance and connected car systems. This comparison highlights their market overlap and strategic innovation, helping you decide which company offers the most promising investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between ON Semiconductor Corporation and indie Semiconductor, Inc. by providing an overview of these two companies and their main differences.

ON Semiconductor Overview

ON Semiconductor Corporation focuses on intelligent sensing and power solutions globally, targeting the electrification of the automotive industry. It offers a broad range of semiconductor products, including analog, discrete, and integrated solutions, serving multiple applications such as power switching, signal conditioning, and voltage regulation. The company operates through three segments and supports various end-markets including industrial power and sustainable energy.

indie Semiconductor Overview

indie Semiconductor, Inc. specializes in automotive semiconductors and software for advanced driver assistance, connectivity, and electrification. Its product portfolio covers ultrasound sensors, wireless charging, infotainment, LED lighting, and telematics, as well as photonic components for optical sensing and communication markets. The company emphasizes enhancing user experience and connectivity in automotive applications.

Key similarities and differences

Both ON Semiconductor and indie Semiconductor operate within the semiconductor industry with a focus on automotive applications. ON Semiconductor has a broader product range and larger market presence with multiple business segments, while indie Semiconductor concentrates on automotive semiconductors and software solutions with a stronger emphasis on advanced driver assistance and photonic technologies. ON Semiconductor is significantly larger in scale, with a workforce of 26,400 compared to indie’s 920 employees.

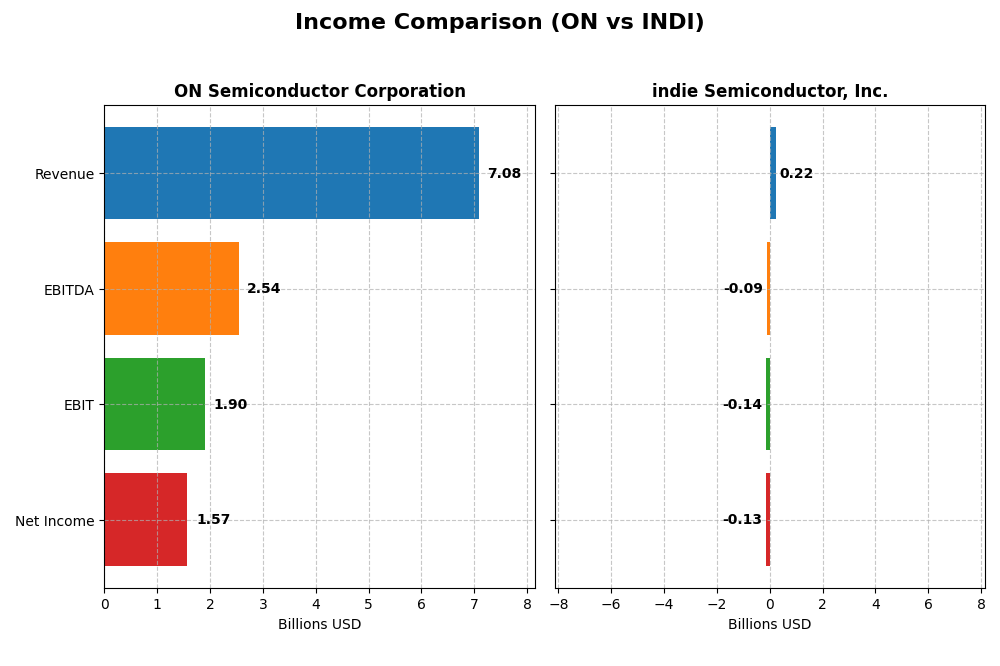

Income Statement Comparison

The following table compares key income statement metrics for ON Semiconductor Corporation and indie Semiconductor, Inc. for the fiscal year 2024.

| Metric | ON Semiconductor Corporation | indie Semiconductor, Inc. |

|---|---|---|

| Market Cap | 23.2B | 750M |

| Revenue | 7.08B | 217M |

| EBITDA | 2.54B | -94M |

| EBIT | 1.90B | -137M |

| Net Income | 1.57B | -133M |

| EPS | 3.68 | -0.76 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

ON Semiconductor Corporation

ON Semiconductor’s revenue increased by 34.77% from 2020 to 2024, with net income growing markedly by 572%, indicating strong profitability expansion. Margins remain robust, with a gross margin of 45.41% and net margin of 22.21%, both favorable. However, in 2024, revenue and net income declined by 14.19% and 16.07%, respectively, reflecting a recent slowdown in growth and margin compression.

indie Semiconductor, Inc.

indie Semiconductor’s revenue surged 858% over the 2020–2024 period, but net income declined by 36%, showing persistent losses. The company holds a decent gross margin of 41.68%, yet a deeply negative net margin of -61.20%, signaling ongoing operating challenges. In 2024, revenue fell slightly by 2.91%, and net losses widened, though EPS improved by 6.17%, a mixed recent performance.

Which one has the stronger fundamentals?

ON Semiconductor shows stronger fundamentals with consistent profitability, favorable margin levels, and significant net income growth over five years, despite a recent decline. indie Semiconductor displays rapid revenue growth but sustained net losses and unfavorable EBIT and net margins. Overall, ON demonstrates more stable and profitable income statement metrics compared to indie’s mixed financial results.

Financial Ratios Comparison

The table below presents the most recent financial ratios for ON Semiconductor Corporation and indie Semiconductor, Inc., allowing for a straightforward comparison of their key performance metrics for the fiscal year 2024.

| Ratios | ON Semiconductor Corporation | indie Semiconductor, Inc. |

|---|---|---|

| ROE | 17.9% | -31.7% |

| ROIC | 11.9% | -19.3% |

| P/E | 17.1 | -5.35 |

| P/B | 3.06 | 1.70 |

| Current Ratio | 5.06 | 4.82 |

| Quick Ratio | 3.38 | 4.23 |

| D/E | 0.38 | 0.95 |

| Debt-to-Assets | 23.9% | 42.3% |

| Interest Coverage | 28.4 | -18.4 |

| Asset Turnover | 0.50 | 0.23 |

| Fixed Asset Turnover | 1.61 | 4.30 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

ON Semiconductor Corporation

ON Semiconductor shows a mixed ratio profile with favorable net margin at 22.21% and strong returns on equity (17.88%) and invested capital (11.88%), indicating operational efficiency and profitability. However, concerns arise from an unfavorable weighted average cost of capital (WACC) at 10.21% and a high current ratio of 5.06, suggesting potential liquidity management issues. The company does not pay dividends, likely reflecting a reinvestment strategy to support its growth and technology development.

indie Semiconductor, Inc.

indie Semiconductor reports several unfavorable profitability ratios, including a negative net margin of -61.2% and a return on equity of -31.73%, indicating significant operational losses. Despite a favorable price-to-earnings ratio due to negative earnings, the company faces challenges with a negative interest coverage ratio and weak asset turnover. It also does not pay dividends, reflecting its high growth phase and prioritization of R&D, supported by share buybacks and reinvestment.

Which one has the best ratios?

ON Semiconductor presents a more balanced and slightly favorable ratio profile compared to indie Semiconductor, which struggles with mostly unfavorable profitability and coverage ratios. While ON shows robust returns and liquidity, indie faces operational challenges and negative returns, making ON’s financial health comparatively stronger based on the available ratio analysis.

Strategic Positioning

This section compares the strategic positioning of ON Semiconductor Corporation and indie Semiconductor, Inc., focusing on market position, key segments, and exposure to technological disruption:

ON Semiconductor Corporation

- Large market cap of 23.2B with NASDAQ Global Select listing; faces competitive pressure in semiconductors.

- Diverse segments: Power Solutions, Analog Solutions, Intelligent Sensing driving revenue over 7B in 2024.

- Develops analog, mixed-signal, and power technologies supporting automotive electrification and sensing.

indie Semiconductor, Inc.

- Smaller market cap of 750M on NASDAQ Capital Market, highly competitive automotive semiconductor niche.

- Focused on automotive semiconductors and software, with products and services generating ~216M in 2024.

- Offers advanced driver assistance and connectivity semiconductors; exposed to rapid automotive tech shifts.

ON Semiconductor Corporation vs indie Semiconductor, Inc. Positioning

ON Semiconductor pursues a diversified approach across multiple semiconductor segments, benefiting from broad revenue streams, while indie Semiconductor concentrates on automotive applications, yielding focused but smaller scale operations. This reflects a trade-off between scale and specialization based on available data.

Which has the best competitive advantage?

ON Semiconductor shows a slightly favorable moat with growing ROIC, indicating improving profitability and value creation. indie Semiconductor faces a very unfavorable moat with declining ROIC, reflecting value destruction and decreasing profitability.

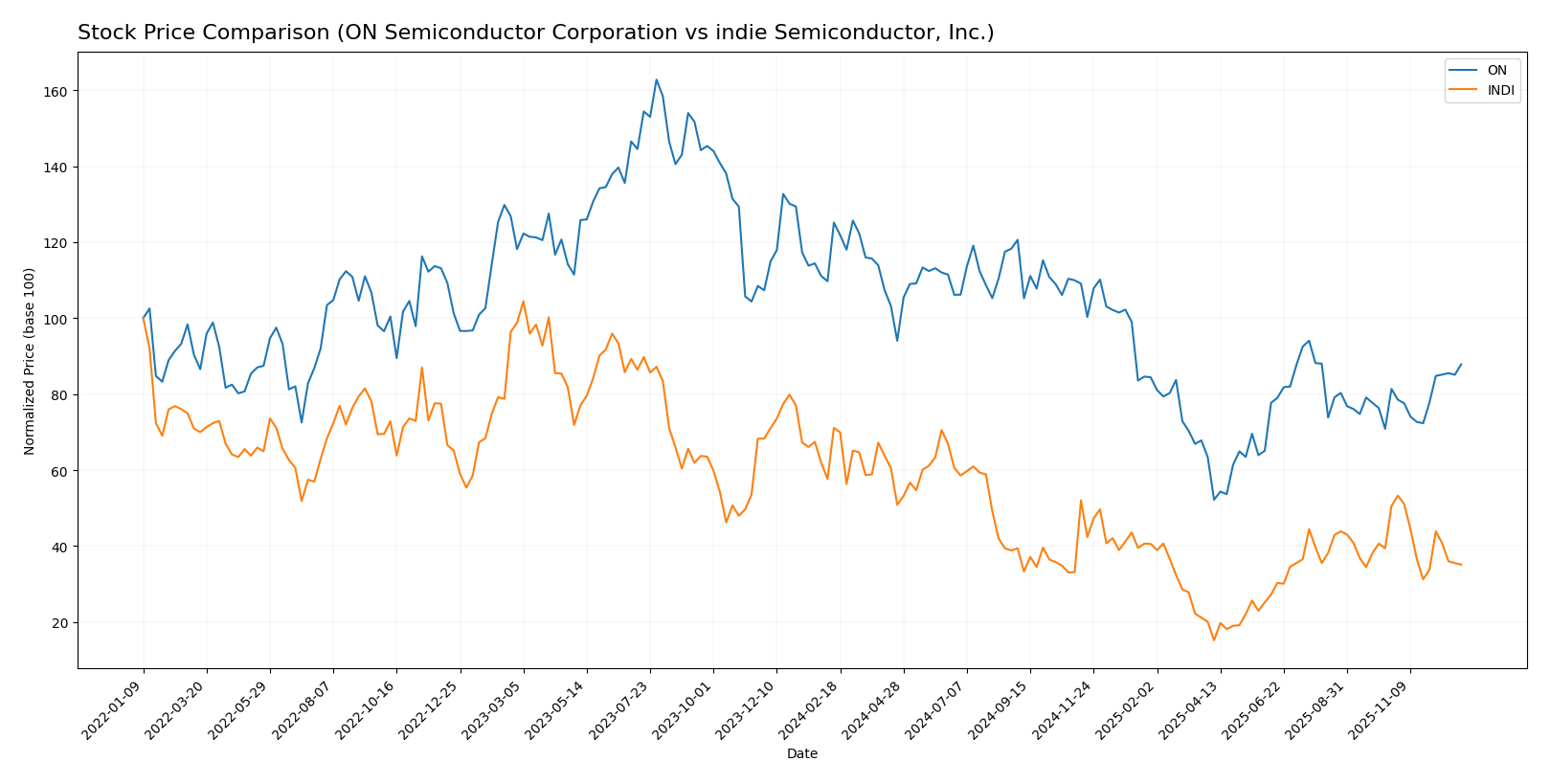

Stock Comparison

The stock price movements of ON Semiconductor Corporation and indie Semiconductor, Inc. over the past 12 months reveal significant bearish trends with notable differences in volatility and recent trading dynamics.

Trend Analysis

ON Semiconductor Corporation’s stock experienced a bearish trend over the past year, declining by 29.83% with accelerating downward momentum. The stock showed high volatility, with prices ranging from 33.7 to 81.14 and a standard deviation of 12.3.

indie Semiconductor, Inc. also followed a bearish trend, declining 50.6% over the past 12 months, though with decelerating downward momentum. The stock had lower volatility, with prices fluctuating between 1.6 and 7.49 and a standard deviation of 1.42.

Comparing both stocks, ON Semiconductor Corporation delivered the higher market performance despite the negative trend, with a smaller percentage loss than indie Semiconductor, Inc. over the same period.

Target Prices

The target price consensus for ON Semiconductor Corporation and indie Semiconductor, Inc. reflects moderate optimism among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| ON Semiconductor Corporation | 64 | 51 | 58.33 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

Analysts expect ON Semiconductor’s price to rise slightly above the current 56.7 USD, signaling moderate upside potential. indie Semiconductor’s consensus target of 8 USD suggests significant growth compared to its current 3.7 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for ON Semiconductor Corporation and indie Semiconductor, Inc.:

Rating Comparison

ON Rating

- Rating: B-, considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a favorable valuation outlook.

- ROE Score: 2, reflecting moderate efficiency in generating profit from equity.

- ROA Score: 3, showing moderate effectiveness in asset utilization.

- Debt To Equity Score: 2, suggesting moderate financial risk.

- Overall Score: 3, a moderate overall financial assessment.

INDI Rating

- Rating: C, also considered very favorable.

- Discounted Cash Flow Score: 1, showing a very unfavorable valuation outlook.

- ROE Score: 1, indicating very unfavorable profitability from equity.

- ROA Score: 1, indicating very unfavorable asset utilization.

- Debt To Equity Score: 3, indicating moderate financial risk but higher score.

- Overall Score: 2, a moderate but lower overall financial assessment.

Which one is the best rated?

Based strictly on the provided data, ON Semiconductor holds a stronger position with higher scores in discounted cash flow, ROE, ROA, and overall rating compared to indie Semiconductor, which has lower scores in key profitability and valuation metrics.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score of ON Semiconductor Corporation and indie Semiconductor, Inc.:

ON Scores

- Altman Z-Score: 4.54, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

INDI Scores

- Altman Z-Score: 0.14, indicating distress zone with high bankruptcy risk.

- Piotroski Score: 3, reflecting very weak financial strength.

Which company has the best scores?

ON Semiconductor shows significantly stronger financial health with a safe zone Altman Z-Score and an average Piotroski Score. indie Semiconductor falls into the distress zone with a very weak Piotroski Score, indicating higher risk.

Grades Comparison

Here is a comparison of recent analyst grades for ON Semiconductor Corporation and indie Semiconductor, Inc.:

ON Semiconductor Corporation Grades

This table summarizes recent grades assigned by reputable financial institutions to ON Semiconductor Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Hold | 2025-12-19 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-24 |

| Truist Securities | Maintain | Hold | 2025-11-04 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

| Rosenblatt | Maintain | Neutral | 2025-11-04 |

| TD Cowen | Maintain | Buy | 2025-11-04 |

| Baird | Maintain | Neutral | 2025-11-04 |

| UBS | Maintain | Neutral | 2025-10-27 |

| B of A Securities | Maintain | Neutral | 2025-09-05 |

| Susquehanna | Maintain | Positive | 2025-08-05 |

Overall, ON Semiconductor’s ratings show a predominance of neutral to hold recommendations with occasional buy and positive grades, indicating a generally cautious stance.

indie Semiconductor, Inc. Grades

The following table lists recent analyst grades for indie Semiconductor, Inc. from established firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

indie Semiconductor, Inc. consistently receives buy and overweight ratings, showing strong analyst confidence in its outlook.

Which company has the best grades?

indie Semiconductor, Inc. has received predominantly buy and overweight ratings, reflecting a more optimistic analyst sentiment compared to ON Semiconductor Corporation’s mostly neutral to hold grades. This distinction may influence investors prioritizing growth potential versus risk management.

Strengths and Weaknesses

Below is a comparative overview of ON Semiconductor Corporation and indie Semiconductor, Inc., focusing on key business and financial factors.

| Criterion | ON Semiconductor Corporation (ON) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Diversification | Highly diversified with three main segments: Power Solutions ($3.35B), Analog Solutions ($2.61B), and Intelligent Sensing ($1.13B) in 2024 | Less diversified; mainly products ($203M) and services ($14M) with a smaller overall scale |

| Profitability | Strong profitability: net margin 22.21%, ROIC 11.88%, ROE 17.88% (all favorable) | Weak profitability: negative net margin (-61.2%), ROIC (-19.25%), ROE (-31.73%), indicating losses |

| Innovation | Moderate innovation with stable growth in ROIC (+156%) indicating improving efficiency | Innovation concerns, with declining ROIC (-179%), showing deteriorating capital efficiency |

| Global presence | Established global player with broad market reach in multiple industrial segments | Smaller scale with limited global footprint and revenue scale |

| Market Share | Significant market share in power and analog semiconductor markets | Niche player with limited market share and shrinking profitability |

Key takeaways: ON Semiconductor shows a strong, diversified business model with improving profitability and solid financial health, making it a more stable investment. indie Semiconductor faces significant profitability challenges and declining efficiency, raising caution for investors.

Risk Analysis

The following table summarizes key risk factors for ON Semiconductor Corporation (ON) and indie Semiconductor, Inc. (INDI) based on their most recent financial data and market conditions in 2026:

| Metric | ON Semiconductor Corporation (ON) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Risk | Beta 1.57, moderate volatility | Beta 2.59, high volatility |

| Debt Level | Low leverage (D/E 0.38) | Moderate leverage (D/E 0.95) |

| Regulatory Risk | Moderate, automotive & tech sectors | Moderate, automotive focus |

| Operational Risk | Established operations, scale | Smaller scale, growth stage |

| Environmental Risk | Exposure to semiconductor supply chain | Emerging tech, moderate exposure |

| Geopolitical Risk | Global supply chain dependencies | Similar global exposure |

The most impactful risks are market volatility and financial stability. ON shows a safer financial profile with low debt and solid Altman Z-score (4.54), indicating low bankruptcy risk. INDI, however, faces high volatility and distress-level bankruptcy risk (Altman Z-score 0.14), compounded by negative profitability and weak operational metrics. Investors should weigh ON’s stability against INDI’s growth potential and higher risk.

Which Stock to Choose?

ON Semiconductor Corporation shows a favorable income evolution with strong profitability, evidenced by a 22.21% net margin and 17.88% ROE. The company maintains low debt levels and a B- rating, reflecting solid financial health despite some recent revenue declines.

indie Semiconductor, Inc. experiences a challenging income evolution marked by negative profitability metrics, including a -61.2% net margin and -31.73% ROE. The firm carries higher relative debt and holds a C rating, indicating financial difficulties and value destruction.

For investors, ON may appear more suitable for those prioritizing stable profitability and value creation given its favorable rating and income profile. In contrast, indie Semiconductor might be more relevant for risk-tolerant investors focused on potential turnaround or growth despite current financial headwinds.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of ON Semiconductor Corporation and indie Semiconductor, Inc. to enhance your investment decisions: