In the fast-evolving semiconductor industry, ON Semiconductor Corporation and Arm Holdings plc represent two distinct paths to innovation and growth. ON focuses on intelligent power solutions crucial for electric vehicles and sustainable energy, while Arm specializes in designing microprocessors that power a variety of tech products, from smartphones to automotive systems. Both companies share a commitment to technological advancement, making them compelling candidates for investors. Join me as we analyze these two leaders to determine which one offers the most intriguing investment opportunity.

Table of contents

Company Overview

ON Semiconductor Corporation Overview

ON Semiconductor Corporation, headquartered in Phoenix, Arizona, is a key player in the semiconductor industry, specializing in intelligent sensing and power solutions. The company’s mission is to facilitate the electrification of the automotive sector, enhancing electric vehicle efficiency and sustainability. With a market cap of approximately $20.5B, ON Semiconductor operates through three main segments: Power Solutions, Advanced Solutions, and Intelligent Sensing. Its diverse product range includes analog and discrete semiconductors, advanced logic, and image sensors, catering to various end-markets. Founded in 1992, the company has established itself as a crucial provider of innovative solutions that drive energy efficiency and power management in an increasingly electrified world.

Arm Holdings plc Overview

Arm Holdings plc, based in Cambridge, United Kingdom, is a leading designer of semiconductor technologies, focusing on microprocessors and related intellectual property. With a remarkable market cap of around $142.7B, Arm supports various industries, including automotive, computing infrastructure, and the Internet of Things. The company’s mission is to empower semiconductor manufacturers and original equipment makers with advanced technology solutions. Established in 1990, Arm has significantly influenced the industry by licensing its architecture to enable the development of high-performance, energy-efficient products globally. As a subsidiary of Kronos II LLC, Arm continues to innovate and lead in semiconductor design.

Key similarities and differences

Both ON Semiconductor and Arm Holdings operate in the semiconductor industry but focus on different aspects of the market. ON specializes in manufacturing and providing intelligent power solutions, while Arm is renowned for its microprocessor designs and IP licensing. This difference in business models reflects their unique contributions to the technological landscape, with ON emphasizing hardware solutions and Arm focusing on architecture and design.

Income Statement Comparison

In this section, I present a comparative analysis of the most recent income statements for ON Semiconductor Corporation and Arm Holdings plc, highlighting key financial metrics.

| Metric | ON Semiconductor (2024) | Arm Holdings (2025) |

|---|---|---|

| Market Cap | 20.5B | 142.7B |

| Revenue | 7.08B | 4.01B |

| EBITDA | 2.54B | 0.90B |

| EBIT | 1.90B | 0.72B |

| Net Income | 1.57B | 0.79B |

| EPS | 3.68 | 0.75 |

| Fiscal Year | 2024 | 2025 |

Interpretation of Income Statement

In examining the income statements, ON Semiconductor experienced a notable decline in revenue from 8.25B in 2023 to 7.08B in 2024, suggesting potential market challenges. Conversely, Arm Holdings has shown growth from 3.23B in 2024 to 4.01B in the current year, which reflects a positive trend in demand for its semiconductor technologies. While ON’s net income also decreased, Arm’s profitability increased, demonstrating improved operational efficiency. Overall, ON faces pressure on margins, while Arm’s performance highlights resilience and expansion in a competitive market.

Financial Ratios Comparison

The following table provides a comparative overview of the most recent financial metrics for ON Semiconductor Corporation (ON) and Arm Holdings plc (ARM).

| Metric | ON | ARM |

|---|---|---|

| ROE | 17.88% | 11.58% |

| ROIC | 11.88% | 11.31% |

| P/E | 17.13 | 141.58 |

| P/B | 3.06 | 16.40 |

| Current Ratio | 5.06 | 5.20 |

| Quick Ratio | 3.38 | 5.20 |

| D/E | 0.38 | 0.05 |

| Debt-to-Assets | 0.24 | 0.04 |

| Interest Coverage | 28.37 | N/A |

| Asset Turnover | 0.50 | 0.45 |

| Fixed Asset Turnover | 1.61 | 5.61 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of Financial Ratios

In evaluating these ratios, ON demonstrates strong profitability and efficient use of equity and assets with a lower P/E ratio, indicating relative undervaluation compared to ARM. However, ARM’s high P/E reflects investor expectations for future growth, although its profitability margins are significantly lower. Both companies maintain strong liquidity positions, but ON’s leverage is higher than ARM’s, which may present a risk in volatile markets. Thus, investors should weigh growth potential against risk profiles when considering these stocks for their portfolios.

Dividend and Shareholder Returns

ON Semiconductor Corporation (ON) does not pay dividends, reflecting a strategy focused on reinvestment and growth, particularly in the semiconductor sector. This aligns with their high net income and robust free cash flow, supporting share buybacks. Conversely, Arm Holdings plc (ARM) also refrains from dividends, prioritizing R&D and acquisitions to drive long-term growth. Their solid margins and low debt levels indicate potential for sustainable value creation despite the lack of immediate shareholder returns. Both companies emphasize strategic reinvestment over direct payouts, suggesting a focus on enhancing future shareholder value.

Strategic Positioning

In the semiconductor industry, ON Semiconductor (ON) holds a market cap of approximately $20.5B, focusing on intelligent sensing and power solutions, while Arm Holdings (ARM) is valued at around $142.7B, specializing in microprocessors and related technologies. ON faces competitive pressure from both established players and new entrants as it navigates rapid technological disruption, particularly in electric vehicle applications. Conversely, ARM is challenged by aggressive competitors in the CPU market, necessitating constant innovation to maintain its leading position.

Stock Comparison

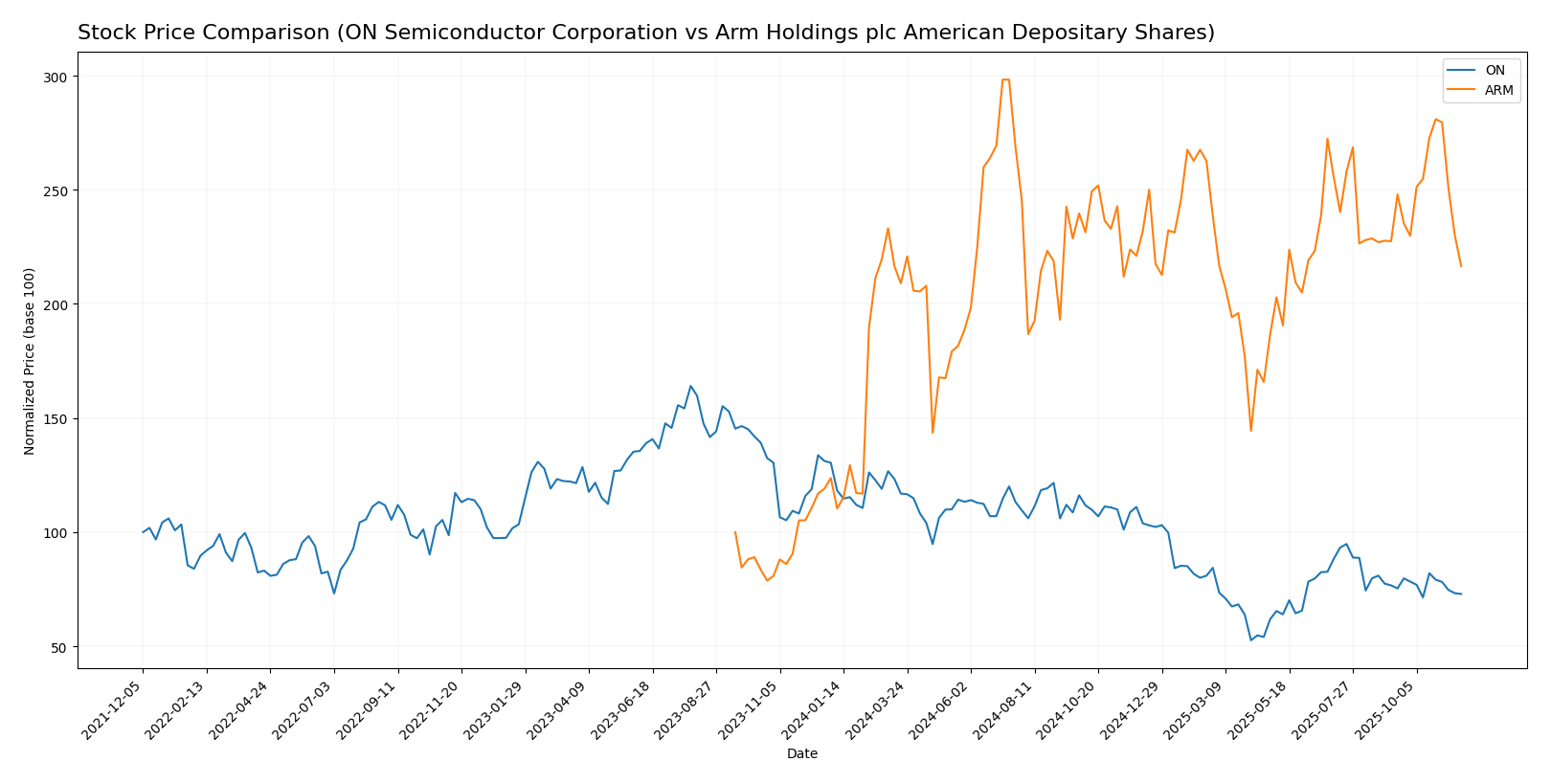

In the past year, ON Semiconductor Corporation (ON) and Arm Holdings plc (ARM) have exhibited notable price movements and trading dynamics that warrant careful examination.

Trend Analysis

ON Semiconductor Corporation (ON) Over the past year, ON’s stock has experienced a significant price change of -33.63%, indicating a bearish trend. The highest price recorded was 81.14, while the lowest was 33.7, suggesting notable volatility with a standard deviation of 12.59. Furthermore, the recent trend shows a slight recovery with a 4.1% change from September 14 to November 30, but it is important to note that the overall trend remains negative, with a trend slope of -0.13 indicating deceleration in upward movement.

Arm Holdings plc (ARM) In contrast, ARM has shown an impressive price increase of 102.18% over the past year, reflecting a bullish trend. The stock reached a high of 181.19 and a low of 67.05, with a standard deviation of 23.44, indicating considerable volatility. However, the recent trend from September 14 to November 30 revealed a decline of 10.01%, coupled with a trend slope of -0.76, which suggests deceleration in growth momentum despite the overall strong performance over the longer term.

Analyst Opinions

Recent analyst recommendations indicate a cautious but generally positive outlook for both ON Semiconductor Corporation (ON) and Arm Holdings plc (ARM). Analysts have rated ON with a “B,” highlighting its solid return on assets and discounted cash flow metrics, suggesting a buy stance. In contrast, ARM received a “B-,” with a mixed view on its financial ratios, leaning towards a hold. Overall, the consensus for ON appears to be a buy, while ARM is more balanced, leaning toward a hold.

Stock Grades

In this section, I present the latest stock grades for ON Semiconductor Corporation (ON) and Arm Holdings plc (ARM), provided by reputable grading companies.

ON Semiconductor Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-11-24 |

| Baird | maintain | Neutral | 2025-11-04 |

| Rosenblatt | maintain | Neutral | 2025-11-04 |

| Truist Securities | maintain | Hold | 2025-11-04 |

| TD Cowen | maintain | Buy | 2025-11-04 |

| UBS | maintain | Neutral | 2025-10-27 |

| B of A Securities | maintain | Neutral | 2025-09-05 |

| Wells Fargo | maintain | Overweight | 2025-08-05 |

| B of A Securities | downgrade | Neutral | 2025-08-05 |

Arm Holdings plc Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Loop Capital | maintain | Buy | 2025-11-12 |

| Benchmark | maintain | Hold | 2025-11-06 |

| Keybanc | maintain | Overweight | 2025-11-06 |

| Needham | maintain | Hold | 2025-11-06 |

| Mizuho | maintain | Outperform | 2025-11-06 |

| Barclays | maintain | Overweight | 2025-11-06 |

| UBS | maintain | Buy | 2025-11-06 |

| TD Cowen | maintain | Buy | 2025-11-06 |

| Rosenblatt | maintain | Buy | 2025-11-06 |

| JP Morgan | maintain | Overweight | 2025-11-06 |

Overall, the trend for ON shows a consistent maintenance of grades with a mix of neutral and overweight recommendations, indicating a stable outlook. In contrast, ARM enjoys a robust support from analysts with multiple “Buy” and “Overweight” ratings, reflecting strong investor confidence in its future potential.

Target Prices

The current target price consensus indicates strong expectations for both ON Semiconductor Corporation and Arm Holdings plc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| ON Semiconductor Corporation | 64 | 51 | 58.33 |

| Arm Holdings plc | 210 | 190 | 200 |

For ON Semiconductor, the consensus price of 58.33 suggests a potential upside from its current price of 50.24. Meanwhile, Arm Holdings’ consensus of 200 indicates a significant upside potential from its current price of 135.11, reflecting strong analyst confidence in both stocks.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of ON Semiconductor Corporation and Arm Holdings plc based on the most recent data.

| Criterion | ON Semiconductor | Arm Holdings |

|---|---|---|

| Diversification | Moderate | High |

| Profitability | Strong (22.2%) | Moderate (19.8%) |

| Innovation | High | High |

| Global presence | Strong | Strong |

| Market Share | Moderate | High |

| Debt level | Low (24%) | Very Low (4%) |

Key takeaways indicate that while ON Semiconductor exhibits solid profitability and a strong global presence, Arm Holdings excels in diversification and maintains an exceptionally low debt level, making it an attractive option for investors seeking stability.

Risk Analysis

The table below outlines the key risks associated with ON Semiconductor Corporation (ON) and Arm Holdings plc (ARM) as of the most recent year.

| Metric | ON Semiconductor | Arm Holdings |

|---|---|---|

| Market Risk | Moderate | High |

| Regulatory Risk | Moderate | High |

| Operational Risk | Low | Moderate |

| Environmental Risk | Low | Moderate |

| Geopolitical Risk | Moderate | High |

In summary, both companies face significant market and regulatory risks, particularly ARM, which operates in a highly competitive environment and is more sensitive to geopolitical tensions. Recent trade tensions and regulatory scrutiny in the semiconductor sector heighten these risks.

Which one to choose?

When comparing ON Semiconductor Corporation (ON) with Arm Holdings plc (ARM), I observe several key factors. ON shows a solid financial performance with a net profit margin of 22.2% and a reasonable P/E ratio of 17.13, indicating potential value. In contrast, ARM’s high P/E ratio of 141.58 suggests a premium valuation, reflecting growth expectations despite a lower overall rating of B- compared to ON’s B. Stock trends reflect a bearish sentiment for ON, with a 33.6% decline, while ARM has experienced a bullish increase of 102.2% over the same timeframe, although it recently faced a 10.01% drop.

For growth-oriented investors, ARM may be appealing due to its aggressive upward trend, while those seeking stability might prefer ON, given its stronger fundamentals and lower valuation. However, both companies face industry competition and varying market dependencies that could impact performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of ON Semiconductor Corporation and Arm Holdings plc American Depositary Shares to enhance your investment decisions: