In the dynamic semiconductor industry, ON Semiconductor Corporation and Ambarella, Inc. stand out as innovators driving market evolution through advanced technology. Both companies focus on cutting-edge semiconductor solutions, with ON emphasizing intelligent power and sensing, while Ambarella excels in video processing and AI vision chips. Their overlapping markets and innovation approaches make this comparison essential. Join me as we analyze which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between ON Semiconductor Corporation and Ambarella, Inc. by providing an overview of these two companies and their main differences.

ON Semiconductor Corporation Overview

ON Semiconductor focuses on intelligent sensing and power solutions globally, supporting the electrification of the automotive industry and sustainable energy applications. The company’s product portfolio includes analog, discrete, module, and integrated semiconductor products used for power switching, signal conditioning, and voltage regulation. It operates through three segments: Power Solutions, Advanced Solutions, and Intelligent Sensing, serving diverse end-markets with foundry and design services.

Ambarella, Inc. Overview

Ambarella specializes in semiconductor solutions for video processing, integrating HD video compression, image processing, and AI computer vision onto system-on-a-chip designs. Its products target automotive cameras, security cameras, robotics, and consumer devices such as wearable cameras and drones. The company sells primarily to original design and equipment manufacturers, leveraging advanced technology for high-quality video with low power consumption.

Key similarities and differences

Both companies operate in the semiconductor industry and serve technology markets related to imaging and sensing. ON Semiconductor focuses broadly on power and sensing solutions across multiple applications including automotive electrification and sustainable energy, while Ambarella concentrates on video processing solutions with AI integration primarily for automotive, security, and consumer markets. ON Semiconductor is significantly larger in market capitalization and employee count compared to Ambarella.

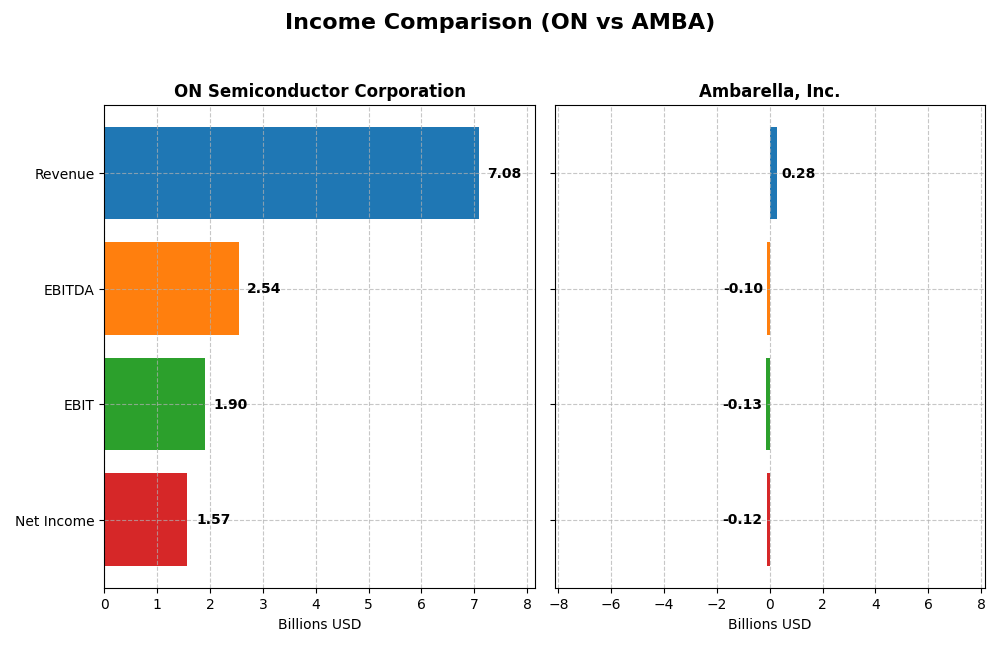

Income Statement Comparison

The table below summarizes the key income statement metrics for ON Semiconductor Corporation and Ambarella, Inc. for their most recent fiscal years, highlighting their financial performance.

| Metric | ON Semiconductor Corporation | Ambarella, Inc. |

|---|---|---|

| Market Cap | 23.2B | 3.18B |

| Revenue | 7.08B (2024) | 285M (2025) |

| EBITDA | 2.54B (2024) | -101M (2025) |

| EBIT | 1.90B (2024) | -127M (2025) |

| Net Income | 1.57B (2024) | -117M (2025) |

| EPS | 3.68 (2024) | -2.84 (2025) |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

ON Semiconductor Corporation

ON Semiconductor showed strong revenue growth of 34.77% from 2020 to 2024, with net income surging by 572% over the same period. Margins remain robust, with a favorable gross margin of 45.41% and net margin of 22.21%. However, in 2024, revenue and net income declined by over 14% and 16% respectively, indicating recent softness despite overall strong fundamentals.

Ambarella, Inc.

Ambarella’s revenue grew 27.75% from 2021 to 2025, with a 25.78% increase in revenue in the latest year. Gross margin remains high at 60.5%. Yet, net income has declined sharply by 96% over the period, and the company posted a net loss in 2025, reflecting an unfavorable net margin of -41.12%. Recent year improvements include positive growth in EBIT and net margin, signaling some operational progress.

Which one has the stronger fundamentals?

ON Semiconductor’s income statement reveals more stable and favorable margins and substantial net income growth over five years, despite a recent dip in revenue and earnings. Ambarella shows strong top-line growth and gross margin but suffers from persistent losses and negative net margins. Thus, ON Semiconductor currently exhibits stronger income fundamentals with more consistent profitability.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for ON Semiconductor Corporation and Ambarella, Inc. based on their most recent fiscal year data.

| Ratios | ON Semiconductor Corporation (2024) | Ambarella, Inc. (2025) |

|---|---|---|

| ROE | 17.88% | -20.86% |

| ROIC | 11.88% | -21.96% |

| P/E | 17.13 | -27.05 |

| P/B | 3.06 | 5.64 |

| Current Ratio | 5.06 | 2.65 |

| Quick Ratio | 3.38 | 2.36 |

| D/E (Debt-to-Equity) | 0.38 | 0.0094 |

| Debt-to-Assets | 23.90% | 0.76% |

| Interest Coverage | 28.37 | 0 |

| Asset Turnover | 0.50 | 0.41 |

| Fixed Asset Turnover | 1.61 | 19.96 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

ON Semiconductor Corporation

ON Semiconductor shows predominantly favorable financial ratios with strong net margin at 22.21% and return on equity at 17.88%, reflecting solid profitability and efficient capital use. Some concerns include an unfavorable current ratio of 5.06 and a price-to-book ratio of 3.06, indicating potential overvaluation and liquidity management issues. The company does not pay dividends, likely reinvesting earnings to sustain growth and innovation.

Ambarella, Inc.

Ambarella’s ratios reveal significant weaknesses, including a negative net margin of -41.12% and return on equity at -20.86%, signaling operational struggles and unprofitability. While it benefits from a low debt-to-assets ratio and strong fixed asset turnover, the interest coverage ratio of zero is alarming. Ambarella also does not pay dividends, focusing instead on R&D and acquisitions to fuel its business development.

Which one has the best ratios?

Comparing the two, ON Semiconductor presents a more favorable ratio profile with better profitability, capital efficiency, and coverage ratios. Ambarella exhibits multiple unfavorable metrics, highlighting financial challenges and negative returns. Overall, ON Semiconductor’s ratios suggest a stronger financial foundation relative to Ambarella’s current performance.

Strategic Positioning

This section compares the strategic positioning of ON Semiconductor Corporation and Ambarella, Inc. in terms of market position, key segments, and exposure to technological disruption:

ON Semiconductor Corporation

- Large market cap of 23B USD, facing typical semiconductor competitive pressures.

- Diversified segments: Power Solutions, Analog, and Intelligent Sensing drive revenues.

- Develops intelligent power technologies and image sensors supporting automotive electrification and sustainable energy.

Ambarella, Inc.

- Smaller 3.2B USD market cap, with higher beta indicating more volatility and competitive risk.

- Focused on semiconductor solutions for video processing and AI-driven vision applications.

- Concentrates on AI computer vision chips for automotive cameras and consumer video applications.

ON Semiconductor Corporation vs Ambarella, Inc. Positioning

ON Semiconductor pursues a diversified approach across power, analog, and sensing markets, providing a broad industrial footprint. Ambarella concentrates on video and AI vision semiconductors, offering specialized but narrower exposure. ON’s scale supports varied business drivers, while Ambarella’s niche focus limits diversification.

Which has the best competitive advantage?

ON Semiconductor shows a slightly favorable moat with growing ROIC, indicating improving profitability and efficient capital use. Ambarella displays a very unfavorable moat with declining ROIC, signaling value destruction and weaker competitive advantage.

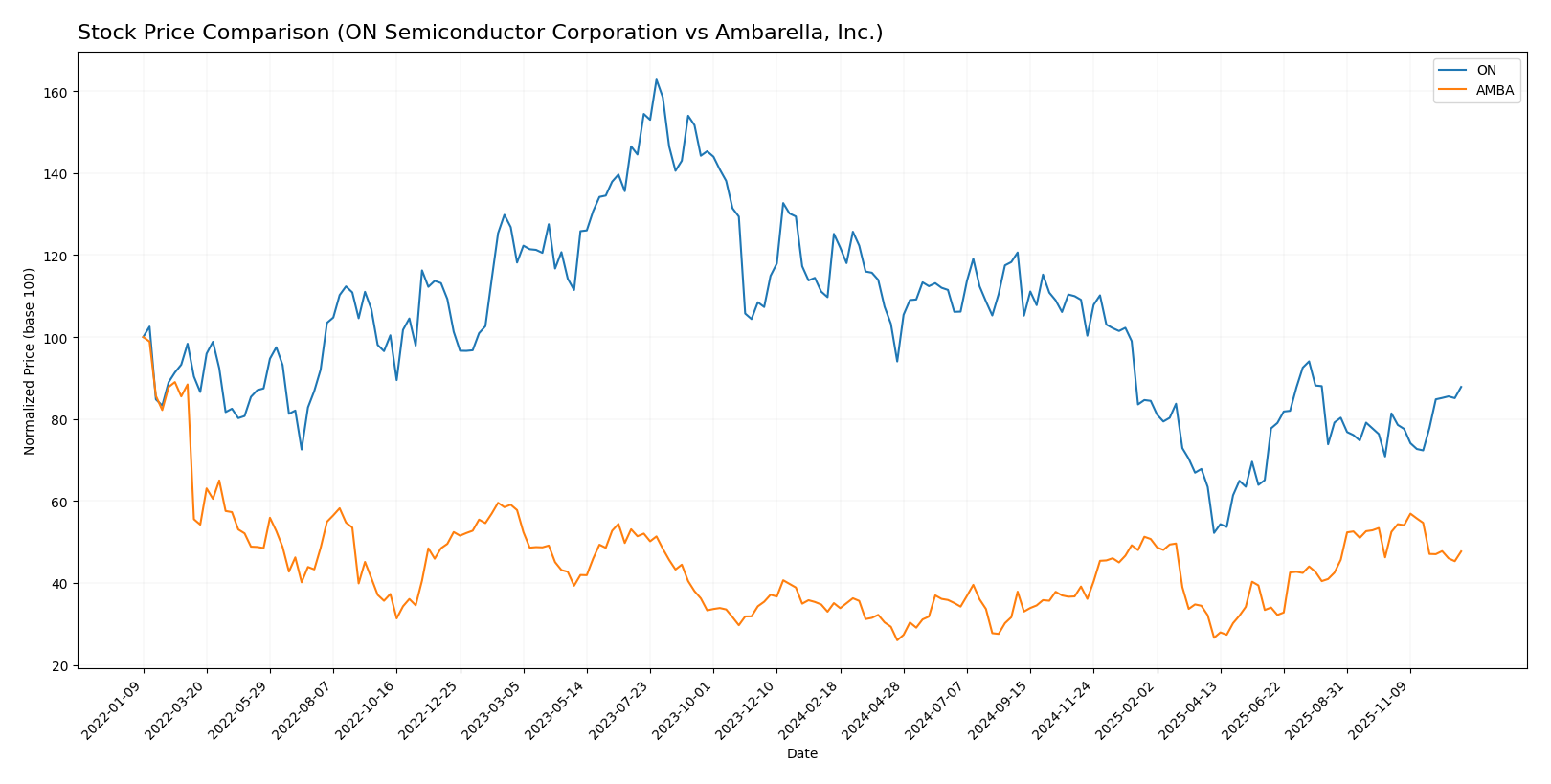

Stock Comparison

The stock price movements over the past 12 months show contrasting trends, with ON Semiconductor Corporation experiencing a marked decline, while Ambarella, Inc. posted significant gains before a recent downward correction.

Trend Analysis

ON Semiconductor Corporation’s stock declined by 29.83% over the past year, reflecting a bearish trend with accelerating downward momentum. The price ranged from a high of 81.14 to a low of 33.7, displaying considerable volatility with a 12.3 std deviation.

Ambarella, Inc. recorded a 35.96% price increase over the past year, indicating a bullish trend with decelerating gains. The stock fluctuated between 40.99 and 89.67, showing similar volatility at a 12.84 std deviation, but recently fell by 9.1%.

Comparing the two, Ambarella delivered the highest market performance over the 12-month period despite recent weakness, while ON Semiconductor’s stock showed a substantial loss with recent signs of recovery.

Target Prices

The current analyst consensus presents a clear outlook for the semiconductor companies ON Semiconductor Corporation and Ambarella, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| ON Semiconductor Corporation | 64 | 51 | 58.33 |

| Ambarella, Inc. | 115 | 80 | 97.5 |

Analysts expect ON Semiconductor’s price to modestly appreciate from its current 56.7 USD, while Ambarella shows a stronger upside potential from 75.16 USD, indicating overall positive sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for ON Semiconductor Corporation (ON) and Ambarella, Inc. (AMBA):

Rating Comparison

ON Rating

- Rating: B- indicating a very favorable assessment by analysts.

- Discounted Cash Flow Score: 4, considered favorable, showing good valuation.

- ROE Score: 2, moderate efficiency in generating profit from equity.

- ROA Score: 3, moderate asset utilization efficiency.

- Debt To Equity Score: 2, moderate financial risk with manageable debt levels.

- Overall Score: 3, moderate overall financial standing.

AMBA Rating

- Rating: C+ indicating a very favorable assessment by analysts.

- Discounted Cash Flow Score: 3, moderate score reflecting fair valuation.

- ROE Score: 1, very unfavorable, indicating poor equity profit generation.

- ROA Score: 1, very unfavorable, showing weak asset utilization.

- Debt To Equity Score: 4, favorable, indicating low financial risk.

- Overall Score: 2, moderate overall financial standing but lower than ON.

Which one is the best rated?

Based strictly on the provided data, ON holds a higher overall rating (B-) compared to AMBA’s C+. ON also outperforms AMBA in discounted cash flow, ROE, and ROA scores, while AMBA has an advantage only in debt to equity. Overall, ON is the better rated company.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

ON Scores

- Altman Z-Score: 4.54, indicating a safe zone for ON.

- Piotroski Score: 6, reflecting an average financial health.

AMBA Scores

- Altman Z-Score: 10.88, indicating a safe zone for AMBA.

- Piotroski Score: 3, reflecting a very weak financial health.

Which company has the best scores?

AMBA has the highest Altman Z-Score, showing stronger bankruptcy safety, but ON has a better Piotroski Score indicating relatively stronger financial health.

Grades Comparison

Here is the grades comparison for ON Semiconductor Corporation and Ambarella, Inc.:

ON Semiconductor Corporation Grades

This table summarizes recent grades from reputable grading companies for ON Semiconductor Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Hold | 2025-12-19 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-24 |

| Truist Securities | Maintain | Hold | 2025-11-04 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

| Rosenblatt | Maintain | Neutral | 2025-11-04 |

| TD Cowen | Maintain | Buy | 2025-11-04 |

| Baird | Maintain | Neutral | 2025-11-04 |

| UBS | Maintain | Neutral | 2025-10-27 |

| B of A Securities | Maintain | Neutral | 2025-09-05 |

| Susquehanna | Maintain | Positive | 2025-08-05 |

The overall trend for ON Semiconductor shows mostly neutral to hold ratings, with a few buy and positive grades, indicating cautious optimism.

Ambarella, Inc. Grades

This table summarizes recent grades from reputable grading companies for Ambarella, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Rosenblatt | Maintain | Buy | 2025-11-26 |

| Stifel | Maintain | Buy | 2025-11-26 |

| B of A Securities | Maintain | Neutral | 2025-11-26 |

| Needham | Maintain | Buy | 2025-11-26 |

| Rosenblatt | Maintain | Buy | 2025-11-24 |

| Oppenheimer | Maintain | Perform | 2025-08-29 |

| Morgan Stanley | Maintain | Overweight | 2025-08-29 |

| Northland Capital Markets | Maintain | Outperform | 2025-08-29 |

| B of A Securities | Maintain | Neutral | 2025-08-29 |

| Stifel | Maintain | Buy | 2025-08-29 |

Ambarella’s grades predominantly reflect buy ratings with several overweight and outperform opinions, suggesting a stronger positive outlook.

Which company has the best grades?

Ambarella, Inc. has received generally better grades than ON Semiconductor Corporation, with numerous buy and outperform ratings compared to ON’s more neutral and hold evaluations. This difference may influence investors seeking growth potential versus stability.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of ON Semiconductor Corporation (ON) and Ambarella, Inc. (AMBA) based on the most recent financial and operational data.

| Criterion | ON Semiconductor Corporation (ON) | Ambarella, Inc. (AMBA) |

|---|---|---|

| Diversification | Strong diversification with three main segments: Power Solutions (3.35B USD), Analog Solutions (2.61B USD), Intelligent Sensing (1.13B USD) | Limited product diversification, focused on video processing chips |

| Profitability | Favorable profitability: net margin 22.21%, ROIC 11.88%, ROE 17.88% | Unfavorable profitability: net margin -41.12%, ROIC -21.96%, ROE -20.86% |

| Innovation | Moderate innovation with stable revenue growth in key segments and growing ROIC trend (+156%) | Declining innovation impact, evidenced by shrinking ROIC (-81%) and value destruction |

| Global presence | Global player with broad industry exposure (automotive, industrial, consumer electronics) | More niche market presence, primarily in video and vision markets |

| Market Share | Solid market position in power and analog semiconductor markets | Smaller market share, struggling with profitability and growth |

Key takeaways: ON Semiconductor shows solid diversification and profitability with a growing return on invested capital, indicating improving operational efficiency and potential value creation. Ambarella faces significant challenges with declining profitability and value destruction, reflecting risks for investors considering its current financial health.

Risk Analysis

Below is a comparative risk overview for ON Semiconductor Corporation (ON) and Ambarella, Inc. (AMBA) based on the latest financial and operational data from 2024-2025.

| Metric | ON Semiconductor Corporation (ON) | Ambarella, Inc. (AMBA) |

|---|---|---|

| Market Risk | Beta 1.57, moderate volatility | Beta 1.98, higher volatility |

| Debt Level | Debt-to-Equity 0.38, low risk | Debt-to-Equity 0.01, very low |

| Regulatory Risk | Moderate, US tech industry | Moderate, US tech industry |

| Operational Risk | Large scale, 26.4K employees | Smaller scale, 941 employees |

| Environmental Risk | Exposure to semiconductor manufacturing impacts | Similar tech sector exposure |

| Geopolitical Risk | US-based, some global supply chain dependencies | US-based, global supply chain exposure |

The most significant risk for Ambarella is its unfavorable profitability and financial health, showing negative margins and weak return ratios, which heightens operational and market risk. ON Semiconductor demonstrates stronger financial stability with a safer Altman Z-Score and moderate debt, though its higher beta indicates sensitivity to market swings. Investors should weigh ON’s robust fundamentals against AMBA’s financial challenges and market volatility.

Which Stock to Choose?

ON Semiconductor Corporation shows a favorable income statement with strong profitability, despite a recent revenue decline. Its financial ratios are slightly favorable overall, supported by solid returns on equity and manageable debt levels, and it holds a very favorable B- rating.

Ambarella, Inc. has a favorable income growth trend but suffers from negative profitability and declining returns, reflected in unfavorable financial ratios overall. The company maintains low debt and a very favorable C+ rating, although its earnings yield and interest coverage are weak.

For investors prioritizing stability and consistent profitability, ON Semiconductor might appear more favorable due to its better income quality and financial strength. Conversely, those with a higher risk tolerance focusing on growth potential could find Ambarella’s recent revenue growth and low leverage somewhat appealing despite profitability challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of ON Semiconductor Corporation and Ambarella, Inc. to enhance your investment decisions: