In today’s rapidly evolving technology landscape, VeriSign, Inc. (VRSN) and Okta, Inc. (OKTA) stand out as prominent players in the software infrastructure sector. VeriSign focuses on domain name registry and internet security, while Okta specializes in identity management and cloud-based security solutions. Their overlapping commitment to securing digital environments makes them compelling candidates for comparison. Join me as we analyze which company presents a more attractive investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between VeriSign and Okta by providing an overview of these two companies and their main differences.

VeriSign Overview

VeriSign, Inc. operates in the software infrastructure sector, focusing on domain name registry services and internet infrastructure. The company supports the stability and security of the internet through services like maintaining root zone servers and managing .com and .net domain registrations. Founded in 1995 and headquartered in Reston, Virginia, VeriSign plays a critical role in enabling global e-commerce and internet navigation.

Okta Overview

Okta, Inc. provides identity management solutions to enterprises, SMBs, universities, and government agencies worldwide. Its platform, Okta Identity Cloud, includes services such as Single Sign-On, Multi-Factor Authentication, and API Access Management. Founded in 2009 and based in San Francisco, California, Okta focuses on securing digital identities across cloud and on-premise environments, enhancing access and security for organizations globally.

Key similarities and differences

Both VeriSign and Okta operate within the software infrastructure industry, focusing on internet security and reliability. VeriSign specializes in domain name system services ensuring internet stability, while Okta concentrates on identity and access management solutions. VeriSign’s business model hinges on domain registry and root server operations, whereas Okta offers a broad cloud-based identity platform with multiple security features tailored for diverse customer segments.

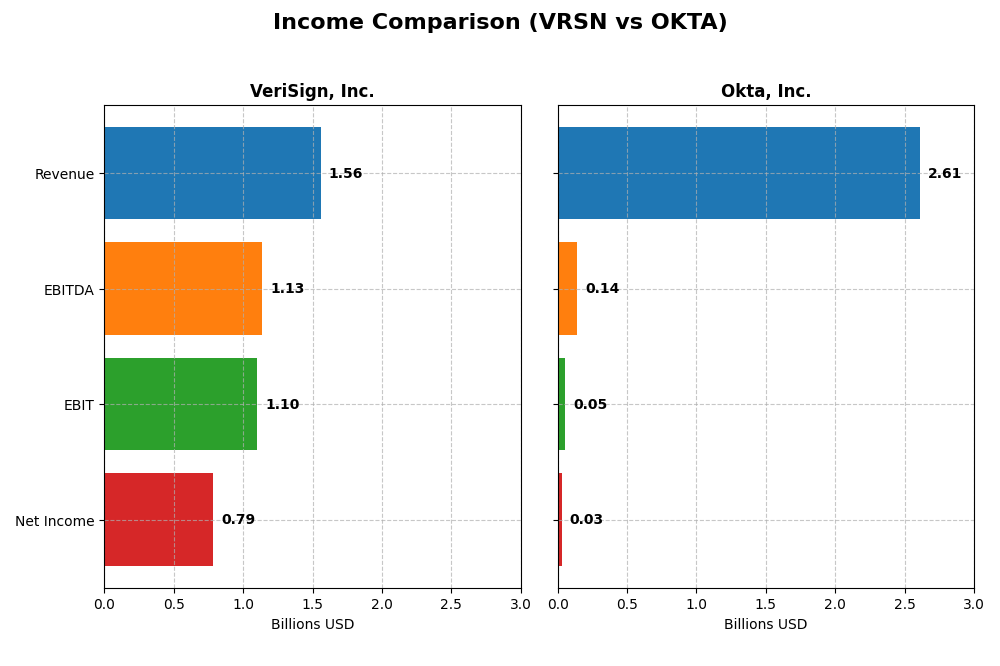

Income Statement Comparison

The table below compares key income statement metrics for VeriSign, Inc. and Okta, Inc. based on their most recent fiscal year results.

| Metric | VeriSign, Inc. (VRSN) | Okta, Inc. (OKTA) |

|---|---|---|

| Market Cap | 23.1B | 15.2B |

| Revenue | 1.56B | 2.61B |

| EBITDA | 1.13B | 139M |

| EBIT | 1.10B | 51M |

| Net Income | 786M | 28M |

| EPS | 8.01 | 0.17 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

VeriSign, Inc.

VeriSign’s revenue showed steady growth from 2020 to 2024, rising from $1.27B to $1.56B, a 23.11% increase overall. Net income exhibited slight decline over the period, dropping by 3.58%. Margins remain strong with a gross margin near 87.7% and net margin at 50.5%, though the net margin slightly decreased in the latest year. In 2024, revenue growth slowed to 4.3%, while net income dipped 7.9%, indicating margin pressure despite stable operating performance.

Okta, Inc.

Okta’s revenue grew significantly from $835M in 2021 to $2.61B in 2025, a 212.6% surge. Net income improved dramatically from a loss of $266M in 2021 to a positive $28M in 2025. Gross margin held favorably at 76.3%, with net and EBIT margins improving from negative to slightly positive levels most recently. In 2025, Okta posted 15.3% revenue growth and strong net margin improvement, signaling a recovery and operational leverage gain after prior losses.

Which one has the stronger fundamentals?

VeriSign demonstrates robust profitability with high margins and steady revenue growth but shows some net income and margin contraction recently. Okta presents impressive top-line expansion and a sharp net income turnaround, though its margins remain modest. VeriSign’s stable and high margins contrast with Okta’s rapid growth and improving profitability, reflecting differing fundamental strengths and risk profiles.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for VeriSign, Inc. (VRSN) and Okta, Inc. (OKTA) based on their most recent fiscal year data, highlighting profitability, liquidity, leverage, and efficiency metrics.

| Ratios | VeriSign, Inc. (2024) | Okta, Inc. (2025) |

|---|---|---|

| ROE | -40.1% | 0.44% |

| ROIC | 4.51% | -0.61% |

| P/E | 25.8 | 570.6 |

| P/B | -10.4 | 2.49 |

| Current Ratio | 0.43 | 1.35 |

| Quick Ratio | 0.43 | 1.35 |

| D/E | -0.92 | 0.15 |

| Debt-to-Assets | 128.1% | 10.1% |

| Interest Coverage | 14.1 | -14.8 |

| Asset Turnover | 1.11 | 0.28 |

| Fixed Asset Turnover | 6.66 | 22.31 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

VeriSign, Inc.

VeriSign shows a mixed ratio profile with 57.14% favorable and 42.86% unfavorable indicators. Strong points include a high net margin of 50.45%, robust return on invested capital at 451%, and solid interest coverage at 14.57. However, concerns arise from a negative return on equity at -40.13% and a weak current ratio of 0.43, signaling liquidity challenges. VeriSign pays dividends, but the dividend yield is currently zero, which may reflect payout coverage or strategic capital allocation choices.

Okta, Inc.

Okta displays a more balanced but cautious ratio set, with 42.86% favorable, 42.86% unfavorable, and 14.29% neutral ratios. The company’s net margin is low at 1.07%, and returns on equity and invested capital remain slightly positive or negative, indicating limited profitability. Liquidity ratios are healthier, with a current and quick ratio around 1.35. Okta does not pay dividends, consistent with its reinvestment focus and growth phase, prioritizing R&D and expansion over shareholder returns.

Which one has the best ratios?

VeriSign holds a more favorable overall ratio profile, with higher profitability and return metrics, despite liquidity concerns. Okta exhibits a neutral stance with modest profitability and better liquidity but lacks strong returns. Both companies do not currently provide dividend income, with VeriSign’s dividend yield at zero and Okta reinvesting for growth. Investors should weigh profitability against liquidity and growth strategies.

Strategic Positioning

This section compares the strategic positioning of VeriSign and Okta, including market position, key segments, and exposure to technological disruption:

VeriSign, Inc.

- Dominates domain registry for .com, .net with stable market, faces limited competitive pressure.

- Specializes in internet infrastructure and domain registry services; limited product diversification.

- Operates critical internet root servers, enabling internet resilience; moderate exposure to tech disruption.

Okta, Inc.

- Focuses on identity solutions for diverse customers, competitive cloud security market.

- Generates revenue mainly from subscription services and technology offerings.

- Provides cloud identity and security platforms, highly exposed to rapid technological changes.

VeriSign vs Okta Positioning

VeriSign has a concentrated focus on domain registry and infrastructure, providing internet stability with limited diversification. Okta offers a diversified cloud identity platform, addressing multiple sectors but facing intense competition and technological shifts.

Which has the best competitive advantage?

VeriSign demonstrates a very favorable moat with strong value creation and durable competitive advantage. Okta shows growing profitability but currently sheds value, indicating a weaker competitive moat in comparison.

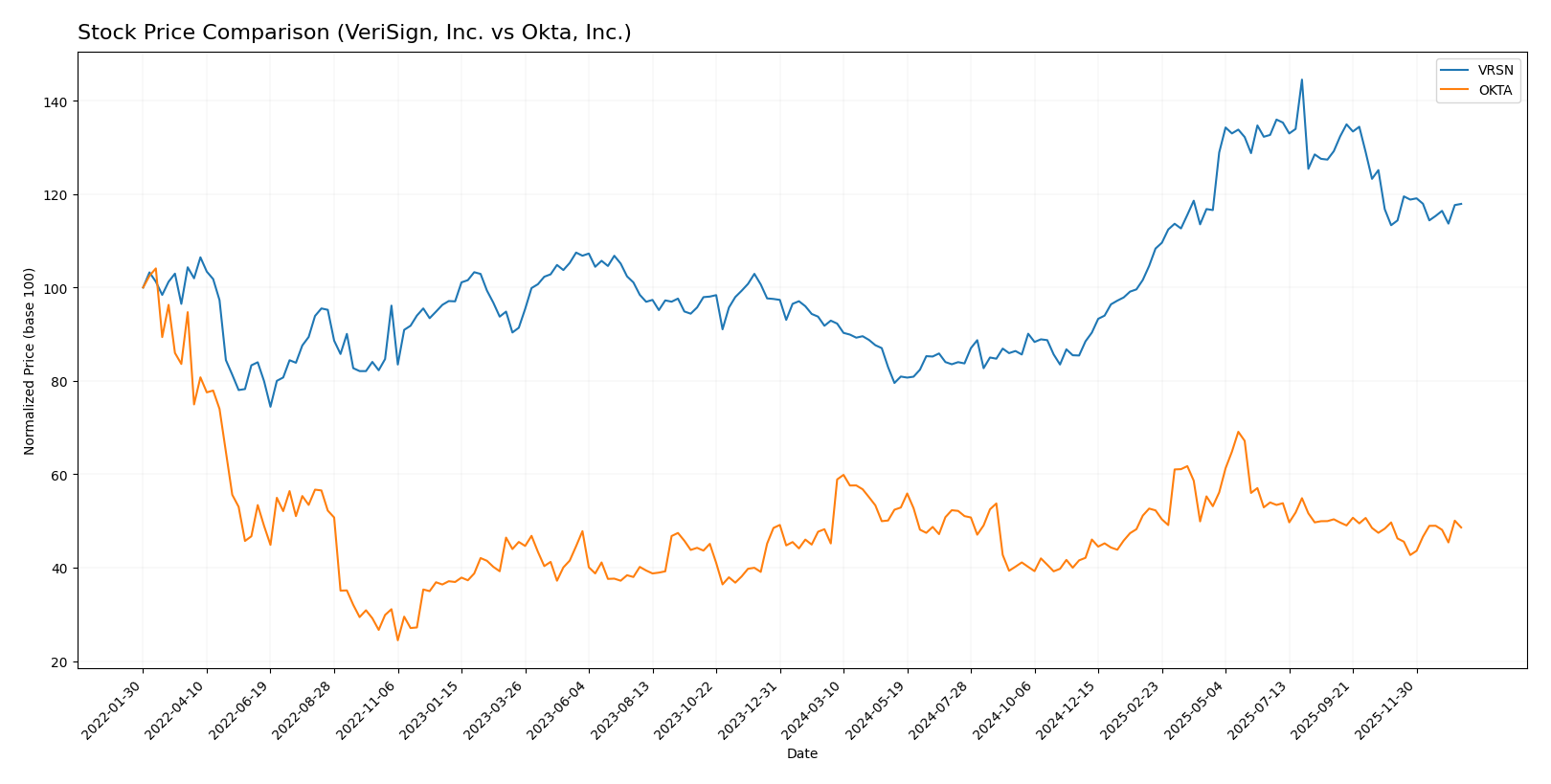

Stock Comparison

Over the past 12 months, VeriSign, Inc. (VRSN) and Okta, Inc. (OKTA) exhibited distinct bullish trends with varying acceleration patterns and volatility, reflecting differing trading dynamics and price momentum.

Trend Analysis

VeriSign, Inc. showed a strong bullish trend with a 26.92% price increase over the past year, though the trend is decelerating. The stock reached a high of 305.79 and a low of 168.32, with a high volatility level (std deviation 40.88).

Okta, Inc. recorded a moderate bullish trend, rising 7.58% over the past year with accelerating momentum. It exhibited less volatility (std deviation 11.38), hitting a high of 127.3 and a low of 72.24, but showed a slight recent decline of -2.16%.

Comparing both, VeriSign delivered the highest market performance over the last 12 months with a more pronounced bullish trend despite deceleration, while Okta showed acceleration but with smaller gains.

Target Prices

Here is the current target price consensus from reliable analysts for VeriSign, Inc. and Okta, Inc.:

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| VeriSign, Inc. | 325 | 325 | 325 |

| Okta, Inc. | 140 | 60 | 110.67 |

Analysts expect VeriSign’s stock to rise from its current price of $249.47 toward the firm $325 target. Okta’s consensus target of $110.67 suggests upside potential from its $89.55 price despite a wider target range, reflecting moderate analyst optimism.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for VeriSign, Inc. and Okta, Inc.:

Rating Comparison

VRSN Rating

- Rating: B-, considered very favorable overall.

- Discounted Cash Flow Score: 4, indicating favorable valuation based on cash flow.

- ROE Score: 1, very unfavorable, showing weak efficiency in generating equity returns.

- ROA Score: 5, very favorable, strong asset utilization to generate earnings.

- Debt To Equity Score: 1, very unfavorable, indicating high financial risk.

- Overall Score: 2, moderate overall financial standing.

OKTA Rating

- Rating: B, considered very favorable overall.

- Discounted Cash Flow Score: 4, also favorable for valuation assessment.

- ROE Score: 2, moderate efficiency in generating returns on equity.

- ROA Score: 3, moderate effectiveness in asset utilization.

- Debt To Equity Score: 4, favorable, showing lower financial risk.

- Overall Score: 3, moderate but better overall financial standing than VRSN.

Which one is the best rated?

Based strictly on the provided data, Okta holds a higher overall rating (B vs. B-) and better overall score (3 vs. 2). Okta also surpasses VeriSign in ROE, ROA, and debt-to-equity scores, indicating a stronger and more balanced financial profile.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for VeriSign, Inc. and Okta, Inc.:

VeriSign, Inc. Scores

- Altman Z-Score: -4.67, indicating financial distress zone

- Piotroski Score: 8, classified as very strong

Okta, Inc. Scores

- Altman Z-Score: 4.15, indicating financial safe zone

- Piotroski Score: 8, classified as very strong

Which company has the best scores?

Okta, Inc. has a significantly higher Altman Z-Score in the safe zone, while both companies share an equally very strong Piotroski Score. Thus, Okta shows better overall financial stability by this metric.

Grades Comparison

Here is the detailed grades comparison for VeriSign, Inc. and Okta, Inc.:

VeriSign, Inc. Grades

The following table summarizes recent grades assigned to VeriSign by major financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2026-01-06 |

| Baird | Maintain | Outperform | 2025-07-01 |

| Baird | Maintain | Outperform | 2025-04-25 |

| Baird | Maintain | Outperform | 2025-04-01 |

| Citigroup | Maintain | Buy | 2025-02-04 |

| Citigroup | Maintain | Buy | 2025-01-03 |

| Baird | Upgrade | Outperform | 2024-12-09 |

| Baird | Maintain | Neutral | 2024-06-27 |

| Baird | Maintain | Neutral | 2024-04-26 |

| Citigroup | Maintain | Buy | 2024-04-02 |

VeriSign’s grades primarily range from Neutral to Outperform and Buy, indicating a generally positive but cautious consensus.

Okta, Inc. Grades

Below is the table of recent grades assigned to Okta by recognized grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stephens & Co. | Upgrade | Overweight | 2026-01-14 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Jefferies | Upgrade | Buy | 2025-12-16 |

| Needham | Maintain | Buy | 2025-12-12 |

| BTIG | Maintain | Buy | 2025-12-04 |

| Susquehanna | Maintain | Neutral | 2025-12-03 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-03 |

| Scotiabank | Maintain | Sector Perform | 2025-12-03 |

Okta’s grades show a trend towards Buy and Overweight ratings, reflecting strong confidence from multiple analysts.

Which company has the best grades?

Both VeriSign and Okta hold a consensus “Buy” rating, but Okta has received more frequent upgrades and higher ratings such as Overweight, suggesting stronger analyst confidence. This may influence investors seeking growth potential differently than VeriSign’s more moderate outlook.

Strengths and Weaknesses

Below is a comparative table highlighting key strengths and weaknesses of VeriSign, Inc. (VRSN) and Okta, Inc. (OKTA) based on the most recent data available.

| Criterion | VeriSign, Inc. (VRSN) | Okta, Inc. (OKTA) |

|---|---|---|

| Diversification | Limited product range, focused on domain services | Moderate diversification with subscription and technology services |

| Profitability | Very high net margin (50.45%), strong ROIC (451%) | Low net margin (1.07%), negative ROIC (-0.61%) |

| Innovation | Stable, but less aggressive innovation profile | High innovation in identity management services |

| Global presence | Strong global presence in domain name industry | Growing global reach with expanding customer base |

| Market Share | Dominant in domain registry market | Significant player in identity security market |

In summary, VeriSign excels in profitability and market dominance with a very favorable economic moat, while Okta shows promising growth and innovation but struggles with profitability and value creation. Investors should weigh VeriSign’s stability against Okta’s growth potential with caution.

Risk Analysis

Below is a risk comparison table between VeriSign, Inc. (VRSN) and Okta, Inc. (OKTA) based on the most recent data for 2025-2026.

| Metric | VeriSign, Inc. (VRSN) | Okta, Inc. (OKTA) |

|---|---|---|

| Market Risk | Moderate (Beta 0.77, stable domain services) | Moderate (Beta 0.76, competitive identity market) |

| Debt level | High debt-to-assets (128%) unfavorable | Low debt-to-assets (10.1%), favorable |

| Regulatory Risk | Moderate (internet infrastructure regulations) | Moderate (data privacy and security laws impact) |

| Operational Risk | Low (critical internet infrastructure, stable revenues) | Moderate (high operational costs, scaling challenges) |

| Environmental Risk | Low (mostly digital infrastructure) | Low (cloud-based identity services) |

| Geopolitical Risk | Moderate (global DNS reliance) | Moderate (international client base exposure) |

The most likely and impactful risks are VeriSign’s high debt load despite its stable cash flow and critical internet infrastructure role, which could strain financial flexibility. Okta faces challenges from its high valuation and operational scaling, with moderate regulatory and geopolitical risks due to its cloud identity platform serving diverse clients worldwide. Both companies show moderate market risk but differ significantly in financial leverage and operational risk profiles.

Which Stock to Choose?

VeriSign, Inc. (VRSN) shows stable income growth with a favorable gross margin of 87.7% and a solid EBIT margin of 70.5%. Its financial ratios are mostly positive, including a strong return on invested capital (451%) well above its WACC (7.19%), indicating durable value creation. However, some liquidity ratios are weak, and return on equity is negative, reflected in a moderate overall rating B-.

Okta, Inc. (OKTA) exhibits strong revenue growth of 15.3% in the last year and favorable income statement trends overall, but profitability remains low with a net margin near 1%. Financial ratios reveal mixed results, with moderate debt levels and a slightly unfavorable moat rating due to ROIC below WACC, though improving. Its rating is slightly higher at B, showing moderate financial strength.

Investors focused on quality and durable competitive advantages might find VeriSign’s favorable moat and income stability appealing, while those prioritizing growth could see Okta’s accelerating revenue and improving profitability as attractive despite current lower returns. The choice may depend on risk tolerance and investment strategy given the contrasting profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of VeriSign, Inc. and Okta, Inc. to enhance your investment decisions: