The Southern Company and Oklo Inc. represent two distinct yet overlapping forces within the regulated electric utility sector. The Southern Company, a long-established giant, focuses on a diverse mix of energy sources including renewables and natural gas, while Oklo Inc. pioneers innovative fission power technology with a commitment to sustainable nuclear energy. This comparison explores their market positions and innovation strategies to help you identify the most compelling investment opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between The Southern Company and Oklo Inc. by providing an overview of these two companies and their main differences.

The Southern Company Overview

The Southern Company operates in the regulated electric industry, focusing on the generation, transmission, and distribution of electricity. It serves approximately 8.7M electric and gas utility customers across multiple states, managing diverse power generation assets including renewable energy projects, natural gas pipelines, and storage facilities. Headquartered in Atlanta, it has a long-standing presence since 1945 and employs over 28K full-time staff.

Oklo Inc. Overview

Oklo Inc. designs and develops fission power plants aimed at delivering reliable, commercial-scale energy in the U.S. The company also offers used nuclear fuel recycling services. Founded in 2013 and based in Santa Clara, California, Oklo is a much smaller enterprise with 120 employees. It emphasizes innovation in nuclear energy technology, operating within the regulated electric sector.

Key similarities and differences

Both The Southern Company and Oklo operate in the U.S. regulated electric utility sector, contributing to power generation and energy services. However, Southern Company is a large, diversified utility with multiple energy sources and extensive infrastructure, while Oklo is a niche player focused on advanced nuclear fission technology and fuel recycling. Their scale, operational scope, and technology focus mark key distinctions in their business models.

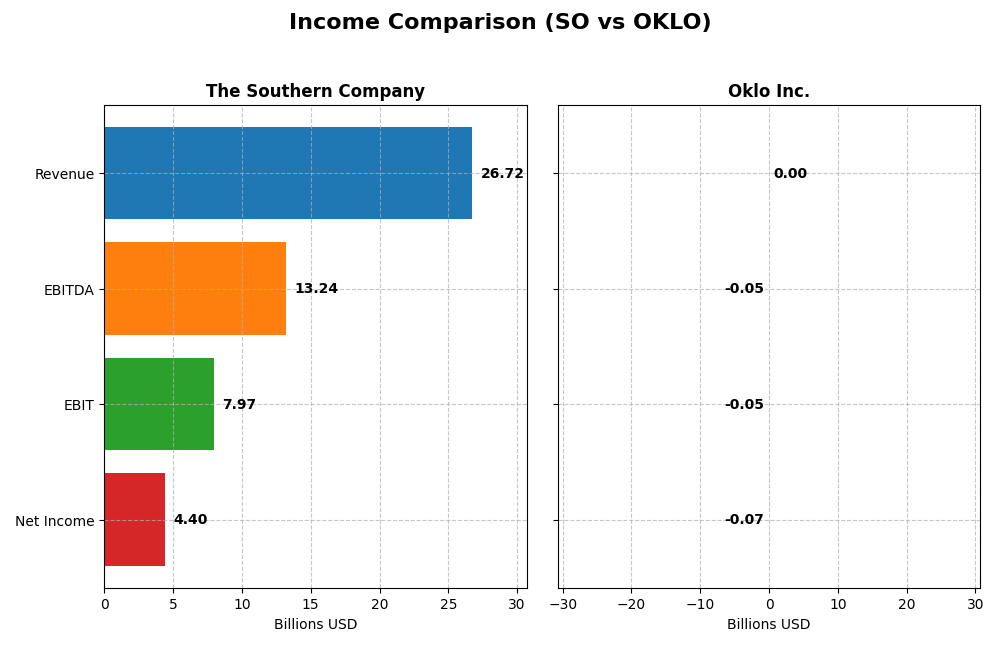

Income Statement Comparison

The following table compares key income statement metrics for The Southern Company and Oklo Inc. for the fiscal year 2024, reflecting their financial performance in the same period.

| Metric | The Southern Company | Oklo Inc. |

|---|---|---|

| Market Cap | 95.7B | 16.5B |

| Revenue | 26.7B | 0 |

| EBITDA | 13.2B | -52.5M |

| EBIT | 7.97B | -52.8M |

| Net Income | 4.40B | -73.6M |

| EPS | 4.02 | -0.7443 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

The Southern Company

The Southern Company has shown steady revenue growth from $20.4B in 2020 to $26.7B in 2024, a 31.16% increase over five years. Net income rose by 40.43% to $4.4B in 2024, with gross and EBIT margins remaining favorable at 49.93% and 29.83%, respectively. In 2024, revenue growth slowed moderately to 5.83%, but profitability improved, supported by a 17.39% EBIT increase and EPS growth of 10.22%.

Oklo Inc.

Oklo Inc. reported no revenue from 2021 to 2024, reflecting its early-stage development status. Net losses deepened from approximately -$5.2M in 2021 to -$73.6M in 2024, with EPS declining sharply. Margins remain unfavorable, with zero gross and EBIT margins due to no sales. Operating expenses and R&D costs increased substantially in 2024, indicating intensified investment but no income generation.

Which one has the stronger fundamentals?

Based on the income statement evaluations, The Southern Company demonstrates stronger fundamentals with consistent revenue and net income growth, healthy profit margins, and positive EPS trends. In contrast, Oklo Inc. shows unfavorable income metrics with no revenue and significant losses, reflecting its developmental phase. The Southern Company’s overall income statement profile is favorable, while Oklo’s is distinctly unfavorable.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for The Southern Company and Oklo Inc. based on their most recent fiscal year data (2024).

| Ratios | The Southern Company (SO) | Oklo Inc. (OKLO) |

|---|---|---|

| ROE | 13.3% | -29.3% |

| ROIC | 4.3% | -19.2% |

| P/E | 20.5 | -28.5 |

| P/B | 2.72 | 8.37 |

| Current Ratio | 0.67 | 43.47 |

| Quick Ratio | 0.46 | 43.47 |

| D/E (Debt to Equity) | 2.0 | 0.005 |

| Debt-to-Assets | 45.7% | 0.5% |

| Interest Coverage | 2.58 | 0 |

| Asset Turnover | 0.18 | 0 |

| Fixed Asset Turnover | 0.25 | 0 |

| Payout ratio | 67.1% | 0% |

| Dividend yield | 3.27% | 0% |

Interpretation of the Ratios

The Southern Company

The Southern Company shows a mixed ratio profile with strengths in net margin (16.47%, favorable) and dividend yield (3.27%, favorable), but weaknesses in liquidity (current ratio 0.67, unfavorable) and asset turnover (0.18, unfavorable). Its return on equity is neutral at 13.25%, while return on invested capital is unfavorable. The company pays dividends with a solid yield, supported by moderate payout risks.

Oklo Inc.

Oklo Inc.’s ratios reveal significant challenges, including negative net margin and return on equity (-29.35%, unfavorable), and poor asset turnover (0, unfavorable). Its liquidity ratios are unusually high, reflecting large current assets relative to liabilities, but this is flagged as unfavorable. The company does not pay dividends, likely due to losses and a focus on growth and R&D investment.

Which one has the best ratios?

The Southern Company presents a slightly unfavorable overall ratio profile but maintains profitability and dividend payments, contrasting with Oklo’s predominantly unfavorable ratios, negative returns, and lack of dividends. Southern’s mix of favorable and neutral indicators outweighs Oklo’s heavier ratio weaknesses, suggesting comparatively better financial stability.

Strategic Positioning

This section compares the strategic positioning of The Southern Company and Oklo Inc., focusing on market position, key segments, and exposure to technological disruption:

The Southern Company

- Large market cap of 95.7B, operating in regulated electric utilities with stable customer base.

- Diverse segments including gas distribution, electric utilities, renewable energy, and gas marketing services.

- Moderate exposure through operating multiple generation types including renewables and nuclear, less vulnerable to disruption.

Oklo Inc.

- Smaller market cap of 16.5B, emerging player in fission power plant design and nuclear fuel recycling.

- Concentrated focus on advanced nuclear fission power plants and used nuclear fuel recycling.

- High exposure as a technology innovator in nuclear power, facing risks from technological development.

The Southern Company vs Oklo Inc. Positioning

The Southern Company exhibits a diversified utility portfolio with extensive infrastructure and multiple energy sources, providing stability but potential regulatory challenges. Oklo Inc. focuses narrowly on innovative nuclear technologies, offering growth potential with higher technology risk and smaller scale.

Which has the best competitive advantage?

The Southern Company’s slightly unfavorable but improving MOAT contrasts with Oklo’s very unfavorable and declining MOAT. Southern Company’s established operations and growing profitability suggest a stronger competitive advantage based on current capital efficiency.

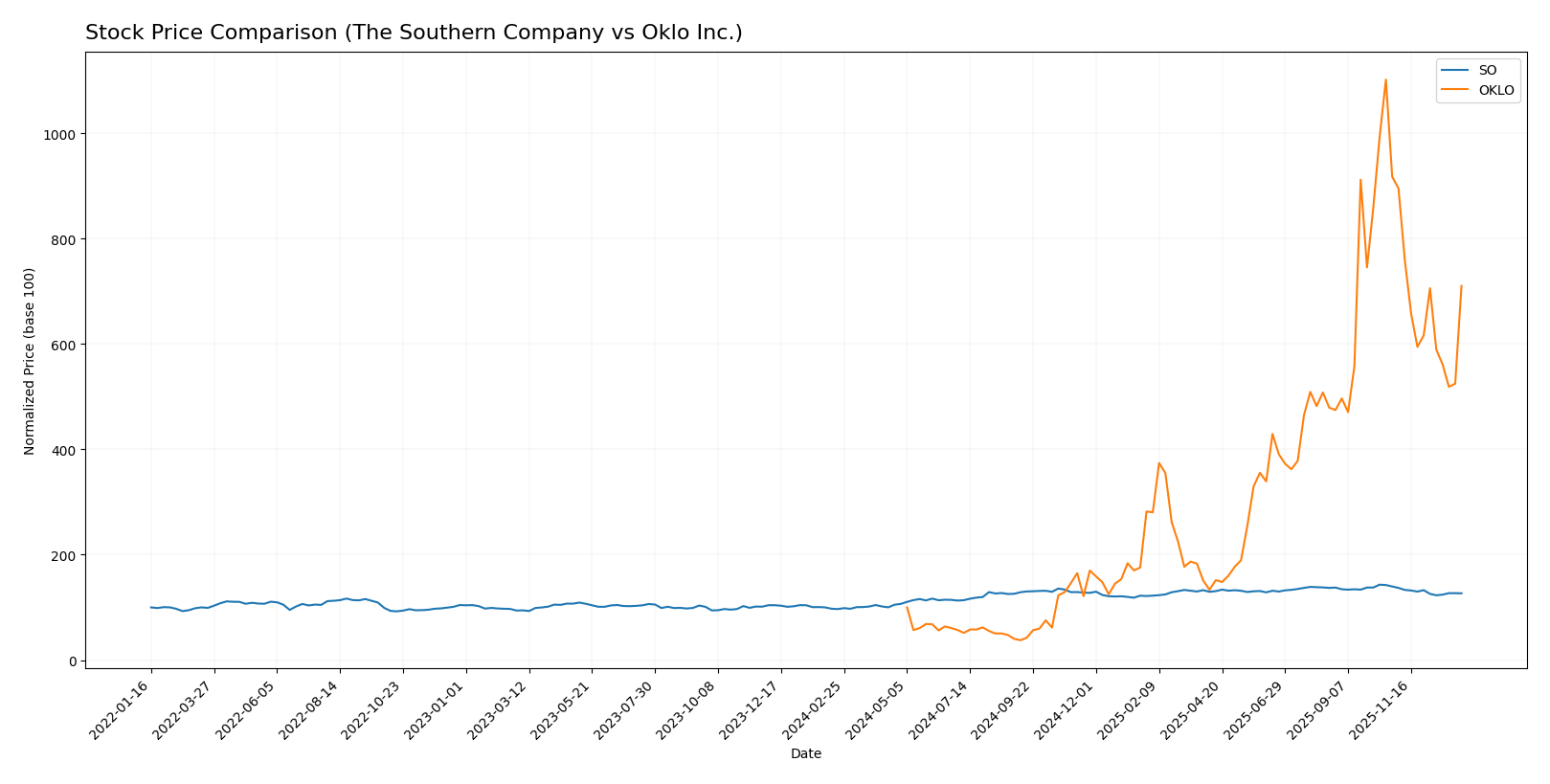

Stock Comparison

The stock prices of The Southern Company and Oklo Inc. have shown significant gains over the past 12 months, with notable deceleration in upward momentum and recent downward corrections in both equities.

Trend Analysis

The Southern Company experienced a bullish trend over the past year with a 30.88% price increase, decelerating toward the end of the period. The stock ranged between 66.48 and 98.29 with moderate volatility (std deviation 7.54).

Oklo Inc. posted a strong bullish trend with a 610.11% gain over the same timeframe, also showing deceleration. The stock’s price fluctuated widely from 5.59 to 163.39, indicating high volatility (std deviation 39.02).

Comparing both stocks, Oklo Inc. delivered the highest market performance with a substantially larger price increase than The Southern Company over the past year.

Target Prices

The current analyst consensus provides a clear outlook on the target prices for The Southern Company and Oklo Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Southern Company | 103 | 76 | 93.1 |

| Oklo Inc. | 150 | 95 | 125.67 |

Analysts expect The Southern Company to trade modestly above its current price of 87.01 USD, while Oklo Inc. shows significant upside potential from its current 105.31 USD, reflecting bullish market sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for The Southern Company and Oklo Inc.:

Rating Comparison

The Southern Company Rating

- Rating: B-, considered very favorable by evaluators.

- Discounted Cash Flow Score: Moderate at 3, showing balanced valuation expectations.

- ROE Score: Favorable at 4, indicating efficient profit generation from equity.

- ROA Score: Moderate at 3, reflecting average asset utilization.

- Debt To Equity Score: Very unfavorable at 1, suggesting high financial risk.

- Overall Score: Moderate at 3, reflecting a balanced overall financial standing.

Oklo Inc. Rating

- Rating: C+, also considered very favorable.

- Discounted Cash Flow Score: Moderate at 3, similar valuation outlook.

- ROE Score: Very unfavorable at 1, showing weak equity profit efficiency.

- ROA Score: Very unfavorable at 1, indicating poor asset use efficiency.

- Debt To Equity Score: Very favorable at 5, indicating strong financial stability.

- Overall Score: Moderate at 2, slightly lower overall financial strength.

Which one is the best rated?

Based on the provided data, The Southern Company holds higher ratings in ROE, ROA, and overall score, while Oklo Inc. outperforms only in debt-to-equity score. Overall, The Southern Company is better rated.

Scores Comparison

This table compares the Altman Z-Score and Piotroski Score of The Southern Company and Oklo Inc.:

SO Scores

- Altman Z-Score: 0.98, in the distress zone, indicating high bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

OKLO Scores

- Altman Z-Score: 339.43, in the safe zone, indicating very low bankruptcy risk.

- Piotroski Score: 2, classified as very weak financial strength.

Which company has the best scores?

Oklo has a significantly higher Altman Z-Score, placing it in the safe zone, while SO is in distress. However, SO’s Piotroski Score is stronger, indicating better financial health than Oklo’s very weak score.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to The Southern Company and Oklo Inc.:

The Southern Company Grades

This table summarizes recent grades and rating actions from reputable financial institutions for The Southern Company.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-12-17 |

| JP Morgan | Maintain | Neutral | 2025-12-15 |

| Jefferies | Maintain | Neutral | 2025-12-15 |

| RBC Capital | Maintain | Sector Perform | 2025-12-12 |

| Keybanc | Maintain | Underweight | 2025-12-12 |

| Mizuho | Maintain | Neutral | 2025-12-11 |

| Barclays | Maintain | Equal Weight | 2025-11-20 |

| Jefferies | Downgrade | Neutral | 2025-11-05 |

| Ladenburg Thalmann | Downgrade | Neutral | 2025-10-17 |

| Keybanc | Maintain | Underweight | 2025-10-15 |

The Southern Company’s grades show a consistent pattern of neutral to cautious assessments, with no recent upgrades and some downgrades from buy to neutral.

Oklo Inc. Grades

Below is the summary of recent reliable grades and rating changes for Oklo Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Seaport Global | Upgrade | Buy | 2025-12-08 |

| UBS | Maintain | Neutral | 2025-12-03 |

| B of A Securities | Maintain | Neutral | 2025-11-12 |

| B. Riley Securities | Maintain | Buy | 2025-11-12 |

| Wedbush | Maintain | Outperform | 2025-11-12 |

| B of A Securities | Downgrade | Neutral | 2025-09-30 |

| Seaport Global | Downgrade | Neutral | 2025-09-23 |

| Wedbush | Maintain | Outperform | 2025-09-22 |

| Wedbush | Maintain | Outperform | 2025-08-14 |

| Wedbush | Maintain | Outperform | 2025-08-12 |

Oklo Inc.’s grades reveal a predominantly positive outlook, with multiple buy and outperform ratings maintained and a recent upgrade from neutral to buy.

Which company has the best grades?

Oklo Inc. has received generally more favorable grades, including buy and outperform recommendations, compared to The Southern Company’s neutral to underweight ratings. This suggests Oklo may currently be viewed with greater growth or performance potential by analysts, potentially influencing investor sentiment toward higher confidence in Oklo’s prospects.

Strengths and Weaknesses

Below is a comparative summary of key strengths and weaknesses for The Southern Company (SO) and Oklo Inc. (OKLO) based on the latest financial and operational data.

| Criterion | The Southern Company (SO) | Oklo Inc. (OKLO) |

|---|---|---|

| Diversification | Moderate diversification with strong gas and electric utilities segments; multiple revenue streams including gas distribution and marketing | Limited diversification; primarily focused on nuclear technology development |

| Profitability | Moderate profitability with net margin at 16.47% and ROE neutral at 13.25%; ROIC slightly unfavorable at 4.25% but improving | Currently unprofitable, with negative net margin and ROIC; declining profitability |

| Innovation | Traditional energy provider with some investments in alternative energy but limited breakthrough innovation | High innovation potential in advanced nuclear tech, but still early stage and financially unproven |

| Global presence | Strong U.S. regional presence but limited global footprint | Minimal global presence; focused on U.S. market and technology development |

| Market Share | Established market leader in regional electric and gas utilities | Emerging player with negligible market share as a startup |

Key takeaways: The Southern Company offers stable, diversified energy operations with improving profitability, though facing challenges in capital efficiency. Oklo Inc. remains an innovative but high-risk venture with significant financial losses and limited market presence. Investors should weigh SO’s steady position against OKLO’s speculative growth potential.

Risk Analysis

Below is a comparative table detailing key risks for The Southern Company (SO) and Oklo Inc. (OKLO) based on the latest 2024 data:

| Metric | The Southern Company (SO) | Oklo Inc. (OKLO) |

|---|---|---|

| Market Risk | Moderate (Beta 0.447) | Higher (Beta 0.773) |

| Debt level | High (Debt/Equity 2.0) | Very Low (Debt/Equity 0.01) |

| Regulatory Risk | Elevated (Utility and gas regulations) | High (Nuclear energy and recycling regulations) |

| Operational Risk | Moderate (Large asset base, infrastructure complexity) | High (Early-stage tech, limited operational history) |

| Environmental Risk | Moderate (Fossil fuel and nuclear assets) | Moderate (Nuclear fuel recycling) |

| Geopolitical Risk | Low to Moderate (US-focused utilities) | Low to Moderate (US-based nuclear energy) |

The Southern Company carries significant debt and faces regulatory pressures from multiple energy sectors, but its established market position and moderate beta reduce volatility risk. Oklo, while having a very low debt load, is exposed to higher operational and regulatory risks due to its innovative nuclear technology and early growth phase, with a higher beta reflecting market sensitivity. Investors should weigh the stable cash flows and dividend yield of SO against the growth potential but elevated financial and execution risks of OKLO.

Which Stock to Choose?

The Southern Company (SO) shows favorable income growth with a 31.16% revenue increase over 2020-2024 and solid profitability, including a 16.47% net margin. Despite slightly unfavorable financial ratios and a high debt level, it maintains a very favorable overall rating of B- and a growing ROIC trend, although it currently destroys value.

Oklo Inc. (OKLO) presents an unfavorable income evolution with zero revenue growth and negative profitability metrics. Financial ratios largely signal weakness, despite strong liquidity and low debt. The company’s rating is C+ with a very unfavorable moat status, reflecting declining profitability and value destruction.

For investors prioritizing value stability and consistent profitability, SO might appear more favorable given its stable income growth and moderate rating. Conversely, risk-tolerant growth investors could interpret OKLO’s high volatility and potential upside indicated by a 610% price increase over the past year as attractive, despite its financial challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Southern Company and Oklo Inc. to enhance your investment decisions: