In the rapidly evolving landscape of clean energy, two companies stand out: NuScale Power Corporation (SMR) and Oklo Inc. (OKLO). Both operate within the utilities sector, focusing on innovative nuclear energy solutions to meet growing energy demands. While NuScale specializes in modular reactors, Oklo is pioneering compact fission power plants. This article aims to provide a comprehensive comparison of these two companies, guiding you to determine which one presents the most promising investment opportunity.

Table of contents

Company Overview

NuScale Power Corporation Overview

NuScale Power Corporation, trading under the ticker SMR, is a leader in the renewable utilities sector, specializing in modular light water reactor nuclear power plants. Founded in 2007 and headquartered in Portland, Oregon, NuScale develops innovative solutions aimed at diversifying energy sources and enhancing energy security. Their flagship product, the NuScale Power Module, can generate 77 megawatts of electricity, with larger configurations capable of producing up to 924 megawatts. With a market capitalization of approximately $5.9B and a commitment to sustainability, NuScale is positioned to capitalize on the global shift toward cleaner energy production.

Oklo Inc. Overview

Oklo Inc., listed as OKLO, is an emerging player in the regulated electric industry, focusing on designing and developing fission power plants that deliver reliable energy solutions across the United States. Established in 2013 and based in Santa Clara, California, Oklo also provides services for recycling used nuclear fuel, reflecting its dedication to sustainability. With a market cap of around $14.3B, Oklo’s innovative approach and commitment to commercial-scale energy production position it as a formidable competitor in the energy sector.

Key similarities and differences

Both NuScale and Oklo operate within the utilities sector, focusing on nuclear energy solutions. However, while NuScale emphasizes modular reactor technology for diverse applications, Oklo centers on commercial-scale fission power plants and recycling services. The strategic focus of each company reflects different market approaches within the broader energy landscape.

Income Statement Comparison

The following table illustrates the income statement comparison for NuScale Power Corporation (SMR) and Oklo Inc. (OKLO) based on their most recent fiscal year results.

| Metric | NuScale Power Corporation (SMR) | Oklo Inc. (OKLO) |

|---|---|---|

| Market Cap | 5.92B | 14.35B |

| Revenue | 37.05M | 0 |

| EBITDA | -133.65M | -52.53M |

| EBIT | -135.49M | -52.80M |

| Net Income | -136.62M | -73.62M |

| EPS | -1.47 | -0.74 |

| Fiscal Year | 2024 | 2024 |

Interpretation of Income Statement

In the most recent fiscal year, NuScale Power Corporation (SMR) showed a notable increase in revenue to $37.05M from $22.81M in the previous year, albeit still reporting a significant net loss of $136.62M. Conversely, Oklo Inc. (OKLO) reported no revenue, maintaining a consistent net loss trend from prior years. Both companies exhibit negative EBITDA and EBIT, indicating ongoing challenges in operational profitability. The increases in expenses, particularly in R&D for SMR, highlight strategic efforts to develop their technology, while OKLO’s costs remain high with no revenue generation, reflecting a critical need for operational efficiency.

Financial Ratios Comparison

In this section, I present a comparative analysis of the most recent financial ratios for NuScale Power Corporation (SMR) and Oklo Inc. (OKLO). This comparison will help you understand the financial health and performance of these companies.

| Metric | NuScale Power (SMR) | Oklo Inc. (OKLO) |

|---|---|---|

| ROE | -22.08% | -29.35% |

| ROIC | -30.66% | -19.23% |

| P/E | -12.24 | -28.52 |

| P/B | 2.70 | 8.37 |

| Current Ratio | 5.25 | 43.47 |

| Quick Ratio | 5.25 | 43.47 |

| D/E | 0 | 0.01 |

| Debt-to-Assets | 0 | 0.02 |

| Interest Coverage | 0 | 0 |

| Asset Turnover | 0.068 | 0 |

| Fixed Asset Turnover | 15.30 | 0 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of Financial Ratios

The financial ratios for both companies indicate significant challenges. NuScale Power shows a negative ROE and ROIC, highlighting poor profitability and inefficient capital allocation. Oklo Inc. also faces negative returns, albeit with a higher current and quick ratio, suggesting stronger liquidity. However, both companies lack profitability as reflected in their negative P/E ratios. Investors should exercise caution, given the weak financial performance and lack of dividends, indicating retained earnings could be necessary for future growth.

Dividend and Shareholder Returns

Neither NuScale Power Corporation (SMR) nor Oklo Inc. (OKLO) pays dividends, reflecting their current focus on reinvestment and growth rather than immediate shareholder returns. Both companies are in high-growth phases, prioritizing research and development over distributions. However, they engage in share buybacks, indicating some commitment to enhancing shareholder value. This approach may support long-term value creation if successfully executed, but investors should remain cautious about potential risks associated with their financial health and operational performance.

Strategic Positioning

NuScale Power Corporation (SMR) and Oklo Inc. (OKLO) are both key players in the renewable utilities and regulated electric sectors, respectively. NuScale holds a market cap of 5.9B, focusing on modular nuclear reactors, while Oklo, with a market cap of 14.3B, specializes in fission power plants and nuclear fuel recycling. Competitive pressure is evident as they both innovate in a rapidly evolving market, facing challenges from technological disruptions and regulatory changes that could impact their growth trajectories.

Stock Comparison

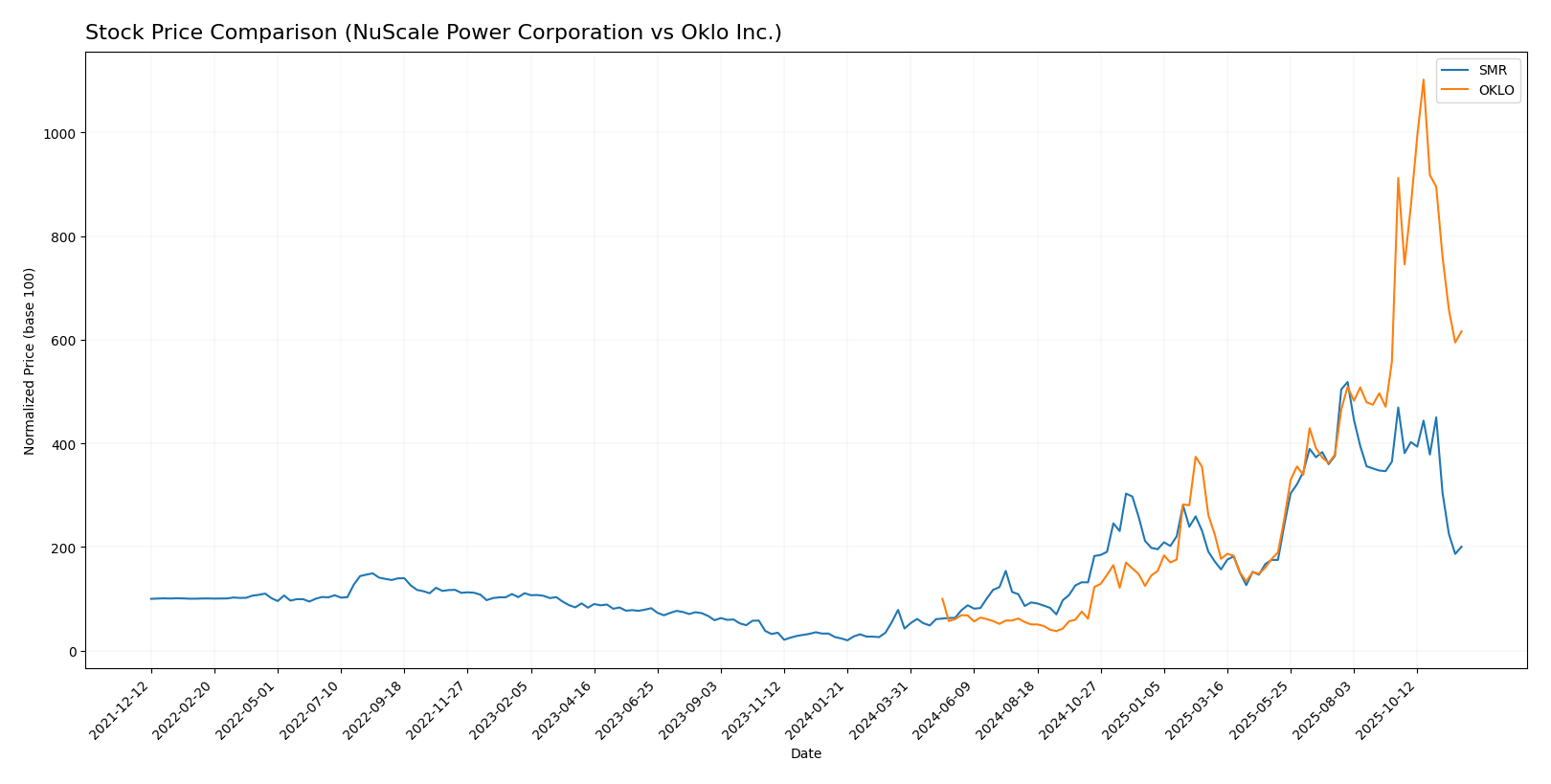

Over the past year, NuScale Power Corporation (SMR) and Oklo Inc. (OKLO) have experienced dramatic price movements, reflecting their respective trading dynamics amid market fluctuations.

Trend Analysis

For NuScale Power Corporation (SMR), the overall price trend has seen an impressive increase of +663.36% over the past 12 months, indicating a bullish trend. However, the recent analysis from September 14, 2025, to November 30, 2025, shows a -44.96% decline, which suggests a bearish trend in the short term. Notably, the stock reached a high of 51.67 and a low of 1.99 during this period, with the trend currently exhibiting deceleration and a standard deviation of 13.08, highlighting some volatility.

Turning to Oklo Inc. (OKLO), the stock’s overall price change stands at +516.18% for the past year, also indicating a bullish trend. In the recent period from September 14, 2025, to November 30, 2025, the price has increased by +10.48%, reflecting a neutral trend. The stock has seen a high of 163.39 and a low of 5.59, with a standard deviation of 38.39, suggesting higher volatility compared to SMR.

Both stocks exhibit strong overall growth but are currently facing different challenges in their recent price movements.

Analyst Opinions

Recent analyst recommendations indicate that NuScale Power Corporation (SMR) has received a rating of D+, suggesting caution for potential investors. Analysts argue that its financial metrics are weak across various categories, including return on equity and price-to-earnings ratios. Conversely, Oklo Inc. (OKLO) holds a C rating, indicating a more favorable outlook, though still reflecting some concerns, particularly in debt management. Overall, the consensus for 2025 leans towards a “sell” for SMR and a “hold” for OKLO, reflecting differing levels of investor confidence.

Stock Grades

The latest stock ratings provide valuable insights into the performance outlook for NuScale Power Corporation and Oklo Inc.

NuScale Power Corporation Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-25 |

| RBC Capital | Maintain | Sector Perform | 2025-11-10 |

| Citigroup | Downgrade | Sell | 2025-10-21 |

| B of A Securities | Downgrade | Underperform | 2025-09-30 |

| Canaccord Genuity | Maintain | Buy | 2025-09-03 |

| Canaccord Genuity | Maintain | Buy | 2025-08-11 |

| UBS | Maintain | Neutral | 2025-08-11 |

| BTIG | Downgrade | Neutral | 2025-06-25 |

| Canaccord Genuity | Maintain | Buy | 2025-05-29 |

| UBS | Maintain | Neutral | 2025-05-29 |

Oklo Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | Maintain | Outperform | 2025-11-12 |

| B of A Securities | Maintain | Neutral | 2025-11-12 |

| B. Riley Securities | Maintain | Buy | 2025-11-12 |

| B of A Securities | Downgrade | Neutral | 2025-09-30 |

| Seaport Global | Downgrade | Neutral | 2025-09-23 |

| Wedbush | Maintain | Outperform | 2025-09-22 |

| Wedbush | Maintain | Outperform | 2025-08-14 |

| Wedbush | Maintain | Outperform | 2025-08-12 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-12 |

| Citigroup | Maintain | Neutral | 2025-07-22 |

Overall, while NuScale shows a trend of downgrades signaling caution, Oklo maintains a more stable outlook with consistent outperform ratings from several analysts. This divergent trend indicates that investors may want to approach NuScale with caution while considering Oklo as a more favorable option.

Target Prices

The consensus target prices for NuScale Power Corporation (SMR) and Oklo Inc. (OKLO) indicate strong growth potential according to analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| NuScale Power Corporation (SMR) | 55 | 20 | 36 |

| Oklo Inc. (OKLO) | 175 | 75 | 129.5 |

For NuScale Power Corporation (SMR), the current stock price of 19.85 is significantly below the consensus target of 36, suggesting that analysts expect substantial upside. In contrast, Oklo Inc. (OKLO) is trading at 91.83, which is also below the consensus target of 129.5, indicating a positive outlook for its stock as well.

Strengths and Weaknesses

Below is a comparative analysis of the strengths and weaknesses of NuScale Power Corporation (SMR) and Oklo Inc. (OKLO).

| Criterion | NuScale Power Corporation (SMR) | Oklo Inc. (OKLO) |

|---|---|---|

| Diversification | Limited product range | Developing new fission technologies |

| Profitability | Negative profit margins | No profits yet |

| Innovation | High potential in modular reactors | Strong focus on recycling technology |

| Global presence | Primarily focused in the US | Emerging global interest in small reactors |

| Market Share | Small, niche market | Early stages, potential to grow |

| Debt level | Low debt levels | Low debt levels |

Key takeaways indicate that while NuScale Power has a more established presence in modular reactors, both companies face profitability challenges. Oklo shows promise in innovation but is still in the early stages of market development.

Risk Analysis

The following table outlines the key risks associated with NuScale Power Corporation (SMR) and Oklo Inc. (OKLO), highlighting their potential impact on investment decisions.

| Metric | NuScale Power Corporation (SMR) | Oklo Inc. (OKLO) |

|---|---|---|

| Market Risk | High due to volatility in energy prices and regulatory changes. | Moderate, influenced by competition and market acceptance of new technologies. |

| Regulatory Risk | Elevated, given the complex nuclear regulatory environment. | Moderate, impacted by evolving regulations on energy production. |

| Operational Risk | High, associated with technology development and project execution. | High, due to reliance on innovative technologies and project timelines. |

| Environmental Risk | Moderate, related to nuclear waste management and environmental scrutiny. | Low, as it focuses on cleaner energy solutions. |

| Geopolitical Risk | Moderate, potential impact from international nuclear policy changes. | Low, primarily U.S.-focused operations may mitigate geopolitical risks. |

In summary, both companies face significant operational and regulatory risks, particularly NuScale Power, which operates in a heavily regulated nuclear sector. The evolving energy landscape requires investors to be vigilant about market fluctuations and regulatory changes impacting these firms.

Which one to choose?

When comparing NuScale Power Corporation (SMR) and Oklo Inc. (OKLO), SMR shows a more substantial market capitalization at approximately 3.72B compared to OKLO’s 2.10B. However, SMR’s financials reveal a troubling trend with negative profit margins and a low rating of D+, indicating significant operational challenges. Conversely, OKLO, rated C, demonstrates better growth prospects with less severe losses and a higher current ratio of 43.47, signaling improved liquidity.

Despite both companies being in the same sector, SMR’s stock trend appears bullish but shows signs of deceleration, while OKLO’s is also bullish, though it has a recent price increase.

Investors focused on growth may prefer OKLO for its relatively stable outlook, while those prioritizing potential high-risk, high-reward scenarios might still consider SMR.

Specific risks include potential industry competition and financial volatility, which could impact both companies’ performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of NuScale Power Corporation and Oklo Inc. to enhance your investment decisions: