In the dynamic semiconductor industry, Nova Ltd. (NVMI) and SkyWater Technology, Inc. (SKYT) stand out as innovative players shaping the future of chip manufacturing. Nova specializes in advanced metrology systems for process control, while SkyWater focuses on semiconductor development and manufacturing services across diverse sectors. This article compares their market positions, innovation strategies, and growth potential to help you decide which company deserves a place in your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Nova Ltd. and SkyWater Technology, Inc. by providing an overview of these two companies and their main differences.

Nova Ltd. Overview

Nova Ltd. designs, develops, produces, and sells process control systems for semiconductor manufacturing globally. The company’s mission focuses on providing metrology platforms for dimensional, film, material, and chemical measurements across various process steps. Headquartered in Israel and established in 1993, Nova serves integrated circuit sectors such as logic, foundries, and memory manufacturers with advanced process control solutions.

SkyWater Technology, Inc. Overview

SkyWater Technology, Inc. provides semiconductor development and manufacturing services, focusing on silicon-based analog, mixed-signal, power discrete, MEMS, and rad-hard integrated circuits. Founded in 2017 and based in Minnesota, SkyWater supports customers in aerospace, defense, automotive, bio-health, consumer, and IoT industries through co-creation and engineering process development. The company emphasizes collaboration and diversified semiconductor applications.

Key similarities and differences

Both Nova and SkyWater operate in the semiconductor technology sector, focusing on process control and manufacturing services. Nova specializes in metrology systems for semiconductor fabrication, while SkyWater offers broader semiconductor development and manufacturing with a strong emphasis on customer co-creation. Nova is a more established player with a larger market cap and workforce, whereas SkyWater is younger with a focus on diverse end markets including aerospace and defense.

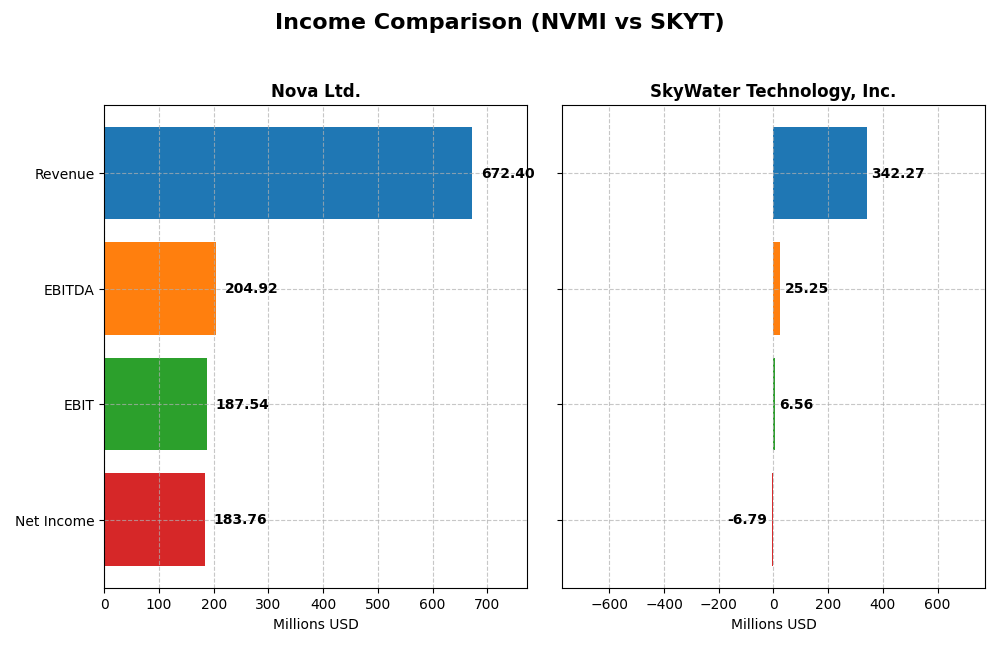

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Nova Ltd. and SkyWater Technology, Inc. for the fiscal year 2024.

| Metric | Nova Ltd. (NVMI) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Cap | 12.9B | 1.54B |

| Revenue | 672M | 342M |

| EBITDA | 205M | 25.3M |

| EBIT | 188M | 6.56M |

| Net Income | 184.9M | -6.79M |

| EPS | 6.31 | -0.14 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Nova Ltd.

Nova Ltd. demonstrated strong revenue growth from 2020 to 2024, with a 149.6% increase, and net income surged by 283.6% over the same period. Margins remained robust, with a gross margin of 57.6% and net margin near 27.3%, both considered favorable. In 2024, revenue grew 29.8% year-on-year, while net margins showed slight improvement, indicating sustained operational efficiency.

SkyWater Technology, Inc.

SkyWater Technology’s revenue rose 143.7% from 2020 to 2024, with net income growing 67.1%, albeit from negative to less negative levels. Gross margin improved to 20.3%, but net margin remained negative at -2.0%, signaling ongoing profitability challenges. The 2024 year saw a 19.4% revenue increase and a significant 81.5% improvement in net margin, reflecting progress toward profitability.

Which one has the stronger fundamentals?

Nova Ltd. exhibits stronger fundamentals, supported by high and stable margins, substantial net income growth, and consistent profitability. SkyWater Technology shows commendable revenue growth and margin improvements but continues to face negative net margins. Overall, Nova’s higher profitability and margin stability present a more favorable income statement profile.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Nova Ltd. (NVMI) and SkyWater Technology, Inc. (SKYT) based on their most recent full fiscal year data.

| Ratios | Nova Ltd. (NVMI) 2024 | SkyWater Technology (SKYT) 2024 |

|---|---|---|

| ROE | 19.81% | -11.79% |

| ROIC | 13.39% | 3.40% |

| P/E | 31.20 | -100.26 |

| P/B | 6.18 | 11.82 |

| Current Ratio | 2.32 | 0.86 |

| Quick Ratio | 1.92 | 0.76 |

| D/E (Debt-to-Equity) | 0.25 | 1.33 |

| Debt-to-Assets | 17.0% | 24.5% |

| Interest Coverage | 116.20 | 0.74 |

| Asset Turnover | 0.48 | 1.09 |

| Fixed Asset Turnover | 5.06 | 2.07 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Nova Ltd.

Nova Ltd. displays a majority of favorable ratios, including strong net margin at 27.33% and return on equity near 19.81%, highlighting solid profitability and efficient capital use. However, elevated price multiples like a PE of 31.2 and PB of 6.18 suggest market premiums that may pose valuation concerns. The company does not pay dividends, likely favoring reinvestment or growth strategies.

SkyWater Technology, Inc.

SkyWater Technology’s ratios show multiple weaknesses, with negative net margin (-1.98%) and ROE (-11.79%), indicating operational and profitability challenges. Its high debt-to-equity ratio (1.33) and low current ratio (0.86) raise liquidity and leverage concerns. Like Nova, SkyWater pays no dividends, possibly due to ongoing losses or strategic reinvestment priorities.

Which one has the best ratios?

Between the two, Nova Ltd. exhibits a more favorable financial profile with stronger profitability, capital efficiency, and liquidity ratios. SkyWater Technology faces considerable unfavorable metrics, including negative returns and liquidity strains, which weigh on its financial strength. Thus, Nova’s ratios are comparatively superior based on the data provided.

Strategic Positioning

This section compares the strategic positioning of Nova Ltd. and SkyWater Technology, Inc., including their market position, key segments, and exposure to technological disruption:

Nova Ltd.

- Leading semiconductor metrology systems provider, facing competition in global semiconductor markets.

- Focuses on process control systems for semiconductor manufacturing, serving logic, foundries, memory, and equipment makers.

- High exposure to semiconductor process control technology innovation and related industry trends.

SkyWater Technology, Inc.

- Semiconductor development and manufacturing services with competitive pressure in niche manufacturing segments.

- Offers engineering, process development, and manufacturing for silicon-based analog, mixed-signal, power discrete, and rad-hard ICs.

- Exposure to evolving semiconductor manufacturing technologies across diverse end markets including aerospace and automotive.

Nova Ltd. vs SkyWater Technology, Inc. Positioning

Nova Ltd. pursues a specialized strategy focused on advanced metrology platforms for semiconductor fabrication, offering diversified end-customer exposure. SkyWater concentrates on semiconductor manufacturing services with a broader industry reach but a more concentrated product scope, balancing engineering and manufacturing.

Which has the best competitive advantage?

Both companies show growing ROIC trends but are currently shedding value relative to WACC. Nova Ltd. has a slightly favorable moat status, indicating better potential for value creation, while SkyWater’s moat status is slightly unfavorable despite improving profitability.

Stock Comparison

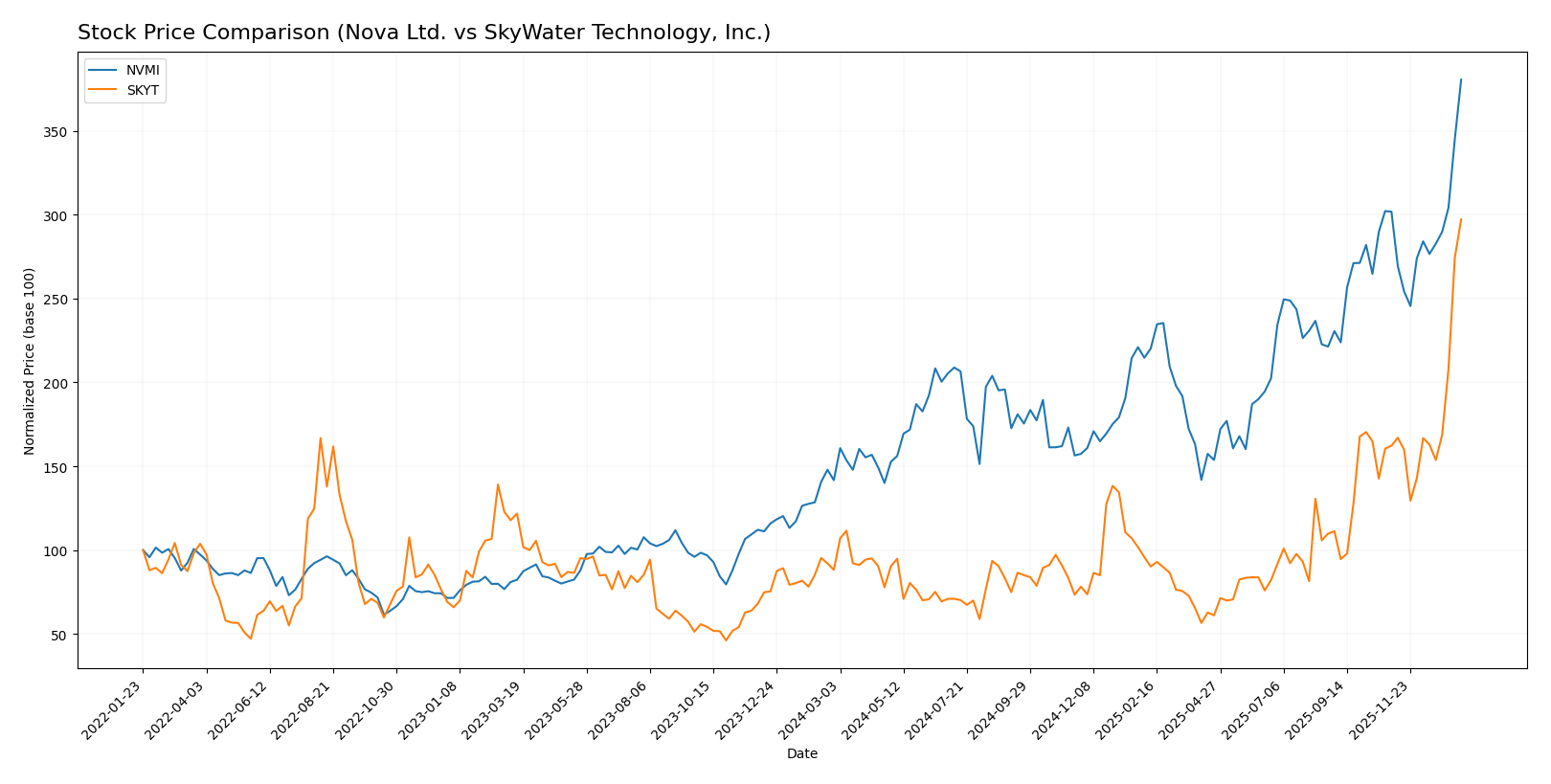

The stock price movements of Nova Ltd. (NVMI) and SkyWater Technology, Inc. (SKYT) over the past year reveal significant bullish trends with marked acceleration, highlighting strong trading dynamics and notable price appreciations.

Trend Analysis

Nova Ltd. (NVMI) has exhibited a robust bullish trend over the past 12 months, with a 168.54% price increase and accelerating momentum. Its price ranged from a low of 159.92 to a high of 434.55, with substantial volatility reflected in a 55.86 standard deviation.

SkyWater Technology, Inc. (SKYT) demonstrated an even stronger bullish trend, gaining 236.8% over the same period with acceleration and low volatility at 4.41 standard deviation. Its price moved between 6.1 and 32.03, supported by buyer dominance.

Comparatively, SKYT outperformed NVMI in market performance during the past year, delivering the highest price appreciation and showing stronger buyer dominance in recent trading activity.

Target Prices

Analysts present a clear target consensus for Nova Ltd. and SkyWater Technology, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Nova Ltd. (NVMI) | 390 | 335 | 362.5 |

| SkyWater Technology, Inc. (SKYT) | 25 | 25 | 25 |

The consensus target for Nova Ltd. is significantly below its current price of 434.55 USD, suggesting potential downside risk. Conversely, SkyWater Technology’s target consensus of 25 USD is also under its current price of 32.03 USD, indicating cautious analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial grades for Nova Ltd. and SkyWater Technology, Inc.:

Rating Comparison

NVMI Rating

- Rating: B-, considered very favorable overall.

- Discounted Cash Flow Score: Moderate at 3.

- ROE Score: Favorable at 4, indicating efficient equity use.

- ROA Score: Very favorable at 5, strong asset utilization.

- Debt to Equity Score: Very unfavorable at 1, indicating higher financial risk.

- Overall Score: Moderate at 3.

SKYT Rating

- Rating: B+, also very favorable overall.

- Discounted Cash Flow Score: Very unfavorable at 1.

- ROE Score: Very favorable at 5, showing excellent equity efficiency.

- ROA Score: Very favorable at 5, equally strong asset use.

- Debt to Equity Score: Very unfavorable at 1, also indicating higher financial risk.

- Overall Score: Moderate at 3.

Which one is the best rated?

Based strictly on provided data, SKYT holds a higher rating (B+) compared to NVMI’s B-. SKYT scores better on ROE and matches NVMI on ROA but fares worse in discounted cash flow and debt-to-equity metrics. Overall scores are equal.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score for Nova Ltd. and SkyWater Technology, Inc.:

NVMI Scores

- Altman Z-Score: 7.76, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

SKYT Scores

- Altman Z-Score: 2.20, indicating a grey zone with moderate bankruptcy risk.

- Piotroski Score: 5, classified as average financial health.

Which company has the best scores?

Based on the provided data, Nova Ltd. shows stronger financial stability with a higher Altman Z-Score in the safe zone and a stronger Piotroski Score than SkyWater Technology, which is in the grey zone with a moderate Piotroski rating.

Grades Comparison

Below is a comparison of the recent grades assigned by reputable grading companies for both Nova Ltd. and SkyWater Technology, Inc.:

Nova Ltd. Grades

The following table summarizes recent grades from established grading firms for Nova Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2026-01-13 |

| Jefferies | Maintain | Buy | 2025-12-15 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-07 |

| Benchmark | Maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-06-24 |

| B of A Securities | Maintain | Buy | 2025-06-24 |

| Benchmark | Maintain | Buy | 2025-05-09 |

| Citigroup | Maintain | Buy | 2025-05-09 |

| B of A Securities | Maintain | Buy | 2025-04-16 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-03-14 |

Overall, Nova Ltd. has consistently received buy and outperform grades, with no downgrades reported.

SkyWater Technology, Inc. Grades

The following table summarizes recent grades from reputable grading firms for SkyWater Technology, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology, Inc. grades show a stable trend of buy and overweight ratings with no downgrades.

Which company has the best grades?

Both Nova Ltd. and SkyWater Technology, Inc. have consistently received positive grades, predominantly buy and overweight ratings. Nova Ltd. has a larger number of buy ratings, which may suggest broader analyst confidence. This could influence investors’ perception of growth potential and relative stability.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Nova Ltd. (NVMI) and SkyWater Technology, Inc. (SKYT) based on their latest financial and operational data.

| Criterion | Nova Ltd. (NVMI) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Diversification | Moderate product focus; majority revenue from single product line (~$538M in 2024) | More diversified revenue streams across Advanced Technology Services and Wafer Services |

| Profitability | High net margin (27.33%), ROIC 13.39%, favorable profitability ratios | Negative net margin (-1.98%), low ROIC (3.4%), overall unfavorable profitability |

| Innovation | Growing ROIC trend suggests improving efficiency and innovation | Also shows growing ROIC trend but remains unprofitable and value-destroying |

| Global presence | Solid financial health with strong current and quick ratios indicating stability | Weak liquidity ratios (current ratio 0.86), higher leverage, indicating financial constraints |

| Market Share | Strong fixed asset turnover (5.06) indicates efficient asset use | Moderate asset turnover (1.09), but struggles with debt and interest coverage |

Key takeaways: Nova Ltd. demonstrates stronger profitability, financial stability, and efficient capital use, albeit with less diversification. SkyWater Technology shows improving profitability trends but remains financially challenged and less profitable overall. Investors should weigh Nova’s stability and growth prospects against SkyWater’s riskier profile with potential upside.

Risk Analysis

Below is a comparison of key risks for Nova Ltd. (NVMI) and SkyWater Technology, Inc. (SKYT) based on the latest 2024 data:

| Metric | Nova Ltd. (NVMI) | SkyWater Technology (SKYT) |

|---|---|---|

| Market Risk | Beta 1.83, moderate volatility | Beta 3.49, high volatility |

| Debt level | Low debt-to-equity (0.25), favorable | High debt-to-equity (1.33), unfavorable |

| Regulatory Risk | Moderate, operates globally with exposure to semiconductor regulations | Moderate, US-centric but defense-related regulations add complexity |

| Operational Risk | Moderate, stable operations with 1,177 employees | Elevated, smaller scale (702 employees), manufacturing risks |

| Environmental Risk | Standard semiconductor industry impact, manageable | Similar industry risks, potential higher energy use concerns |

| Geopolitical Risk | Exposure in Israel, Taiwan, China, Korea | Primarily US-based, but defense sector exposure to geopolitical shifts |

Synthesis: SkyWater’s high leverage and elevated market volatility represent the most impactful risks, coupled with moderate regulatory and operational challenges. Nova Ltd. shows stronger financial stability and lower debt risk, but geopolitical exposure in Asia could impact supply chains. Investors should weigh SkyWater’s growth potential against its financial and market risks, while Nova offers a more stable but geopolitically sensitive profile.

Which Stock to Choose?

Nova Ltd. (NVMI) shows strong income growth with a 29.83% revenue increase in 2024 and a favorable net margin of 27.33%. Its financial ratios are mostly favorable, including a solid ROE of 19.81% and low debt levels. The company has a slightly favorable moat rating, indicating growing profitability, and holds a very favorable overall rating despite some valuation concerns.

SkyWater Technology, Inc. (SKYT) presents positive revenue growth of 19.39% in 2024 but suffers from a negative net margin of -1.98% and unfavorable financial ratios such as a high debt-to-equity ratio and weak liquidity. Its moat rating is slightly unfavorable, reflecting value destruction despite improving profitability, yet it has a very favorable rating driven by strong returns on equity and assets.

For investors prioritizing strong profitability and financial stability, Nova Ltd. might appear more favorable given its robust income statement and predominantly favorable ratios. Conversely, those with a tolerance for higher risk and interest in companies with improving but still challenged financials could interpret SkyWater Technology as a potential growth opportunity.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Nova Ltd. and SkyWater Technology, Inc. to enhance your investment decisions: