In the fast-evolving semiconductor industry, Nova Ltd. and indie Semiconductor, Inc. stand out as innovative players with distinct market focuses. Nova Ltd. specializes in advanced process control systems for semiconductor manufacturing, while indie Semiconductor targets automotive semiconductors and software solutions. Both companies operate in overlapping technology sectors, making their strategies and growth prospects worthy of comparison. This article will help you uncover which company presents a more compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Nova Ltd. and indie Semiconductor, Inc. by providing an overview of these two companies and their main differences.

Nova Ltd. Overview

Nova Ltd. develops and sells process control systems for semiconductor manufacturing, serving logic, foundry, and memory sectors globally. The company specializes in metrology platforms that measure dimensional, film, material, and chemical properties during semiconductor fabrication. Headquartered in Rehovot, Israel, Nova operates internationally, focusing on enabling precision in advanced semiconductor production processes.

indie Semiconductor, Inc. Overview

indie Semiconductor, Inc. provides automotive semiconductors and software solutions targeting advanced driver assistance, connectivity, user experience, and electrification. Its products include devices for parking assistance, wireless charging, infotainment, and telematics, along with photonic components for optical sensing and communication markets. Based in Aliso Viejo, California, indie Semiconductor serves the automotive technology sector.

Key similarities and differences

Both Nova and indie Semiconductor operate in the semiconductor industry but target distinct market segments: Nova focuses on semiconductor manufacturing process control, while indie Semiconductor addresses automotive electronics and software. Nova’s business centers on metrology systems for chip fabrication, contrasting with indie’s automotive device and photonics technology solutions. Each company is headquartered in different countries and has a unique product portfolio tailored to their specialized industries.

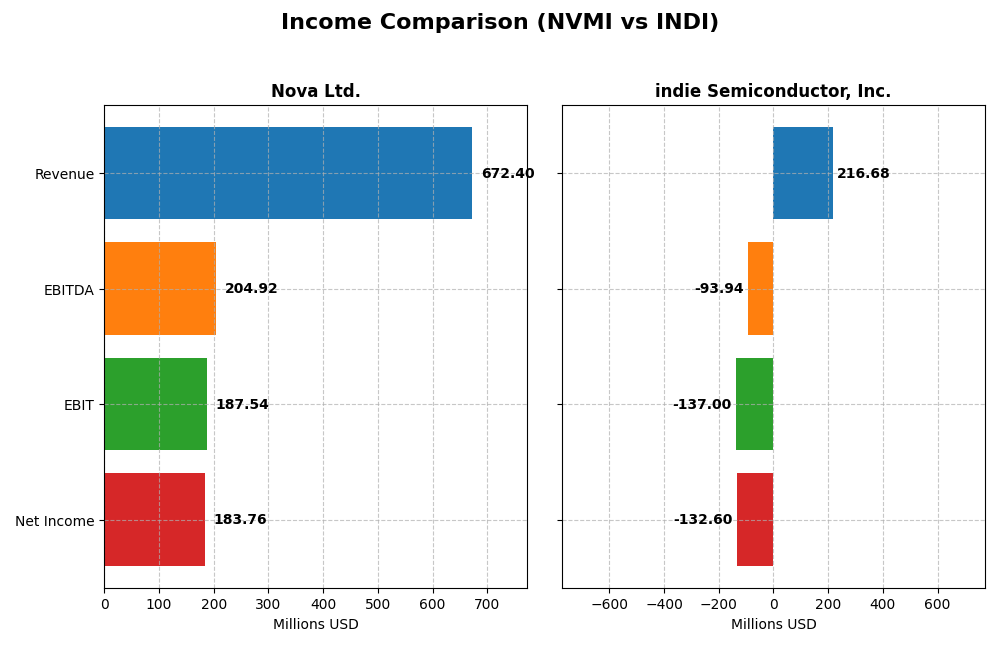

Income Statement Comparison

This table presents the key income statement metrics for Nova Ltd. and indie Semiconductor, Inc. for the fiscal year 2024, enabling a straightforward financial comparison.

| Metric | Nova Ltd. (NVMI) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Cap | 12.9B | 857M |

| Revenue | 672M | 217M |

| EBITDA | 205M | -94M |

| EBIT | 188M | -137M |

| Net Income | 185M | -133M |

| EPS | 6.31 | -0.76 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Nova Ltd.

Nova Ltd. showed strong revenue growth of 29.8% in 2024, reaching $672M, with net income rising 35% to $185M. Margins remained robust, with a gross margin of 57.6% and a net margin of 27.3%, reflecting stable profitability. The company maintained favorable operational efficiency, supporting sustained earnings expansion and margin improvement in the latest year.

indie Semiconductor, Inc.

indie Semiconductor’s revenue declined slightly by 2.9% to $217M in 2024, while net losses deepened to $133M. Despite a favorable gross margin increase to 41.7%, negative EBIT and net margins indicate ongoing profitability challenges. The recent year saw worsening operating losses and margin contraction, offset somewhat by modest EPS growth, highlighting mixed financial health.

Which one has the stronger fundamentals?

Nova Ltd. demonstrates stronger fundamentals with consistent revenue and net income growth, high and improving margins, and positive operational leverage. Conversely, indie Semiconductor faces profitability pressures with negative margins and net losses despite revenue growth over the period. Nova’s overall income statement evaluation is favorable, whereas indie’s remains neutral, reflecting higher risk in its financials.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Nova Ltd. (NVMI) and indie Semiconductor, Inc. (INDI) based on their most recent fiscal year data ending 2024.

| Ratios | Nova Ltd. (NVMI) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| ROE | 19.8% | -31.7% |

| ROIC | 13.4% | -19.3% |

| P/E | 31.2 | -5.35 |

| P/B | 6.18 | 1.70 |

| Current Ratio | 2.32 | 4.82 |

| Quick Ratio | 1.92 | 4.23 |

| D/E (Debt-to-Equity) | 0.25 | 0.95 |

| Debt-to-Assets | 17.0% | 42.3% |

| Interest Coverage | 116.2 | -18.4 |

| Asset Turnover | 0.48 | 0.23 |

| Fixed Asset Turnover | 5.06 | 4.30 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Nova Ltd.

Nova Ltd. presents mostly strong financial ratios, with favorable net margin at 27.33%, ROE at 19.81%, and ROIC at 13.39%, reflecting efficient profitability and capital use. However, high P/E of 31.2 and P/B of 6.18 indicate premium valuation, and WACC at 12.26% is a concern. Nova does not pay dividends, likely focusing on reinvestment and growth.

indie Semiconductor, Inc.

indie Semiconductor shows predominantly weak ratios, with negative net margin (-61.2%), ROE (-31.73%), and ROIC (-19.25%), signaling operational and profitability challenges. Its high current ratio (4.82) may indicate inefficient asset use. The company pays no dividends, consistent with its negative earnings and heavy R&D investments typical of a growth phase.

Which one has the best ratios?

Nova Ltd. outperforms indie Semiconductor with a higher proportion of favorable ratios (64.29% vs. 21.43%) and positive returns, despite some valuation concerns. indie Semiconductor’s ratios suggest ongoing struggles and negative returns, leading to an overall unfavorable assessment compared to Nova’s favorable financial health and operational efficiency.

Strategic Positioning

This section compares the strategic positioning of Nova Ltd. and indie Semiconductor, Inc. in terms of Market position, Key segments, and Exposure to technological disruption:

Nova Ltd.

- Established global presence in semiconductor process control with competitive pressure from integrated circuit sectors.

- Key segments include metrology platforms for semiconductor manufacturing steps serving logic, foundries, memory, and equipment makers.

- Exposure centered on semiconductor manufacturing technologies with emphasis on process control metrology, less on disruptive automotive tech.

indie Semiconductor, Inc.

- Smaller player focused on automotive semiconductors with intense competition in advanced driver assistance and connectivity.

- Key drivers are automotive applications including driver assistance, infotainment, and photonic components for sensing and communication.

- Faces disruption risks from rapid innovation in automotive semiconductor technologies and software integration.

Nova Ltd. vs indie Semiconductor, Inc. Positioning

Nova Ltd. pursues a diversified strategy across multiple semiconductor manufacturing segments, offering stable exposure and broad industry coverage. indie Semiconductor concentrates on automotive semiconductors, which can provide growth potential but increases risk from market and technological shifts.

Which has the best competitive advantage?

Nova Ltd. shows a slightly favorable moat with growing profitability and value creation, whereas indie Semiconductor has a very unfavorable moat, reflecting declining returns and value destruction. Thus, Nova Ltd. currently holds a stronger competitive advantage.

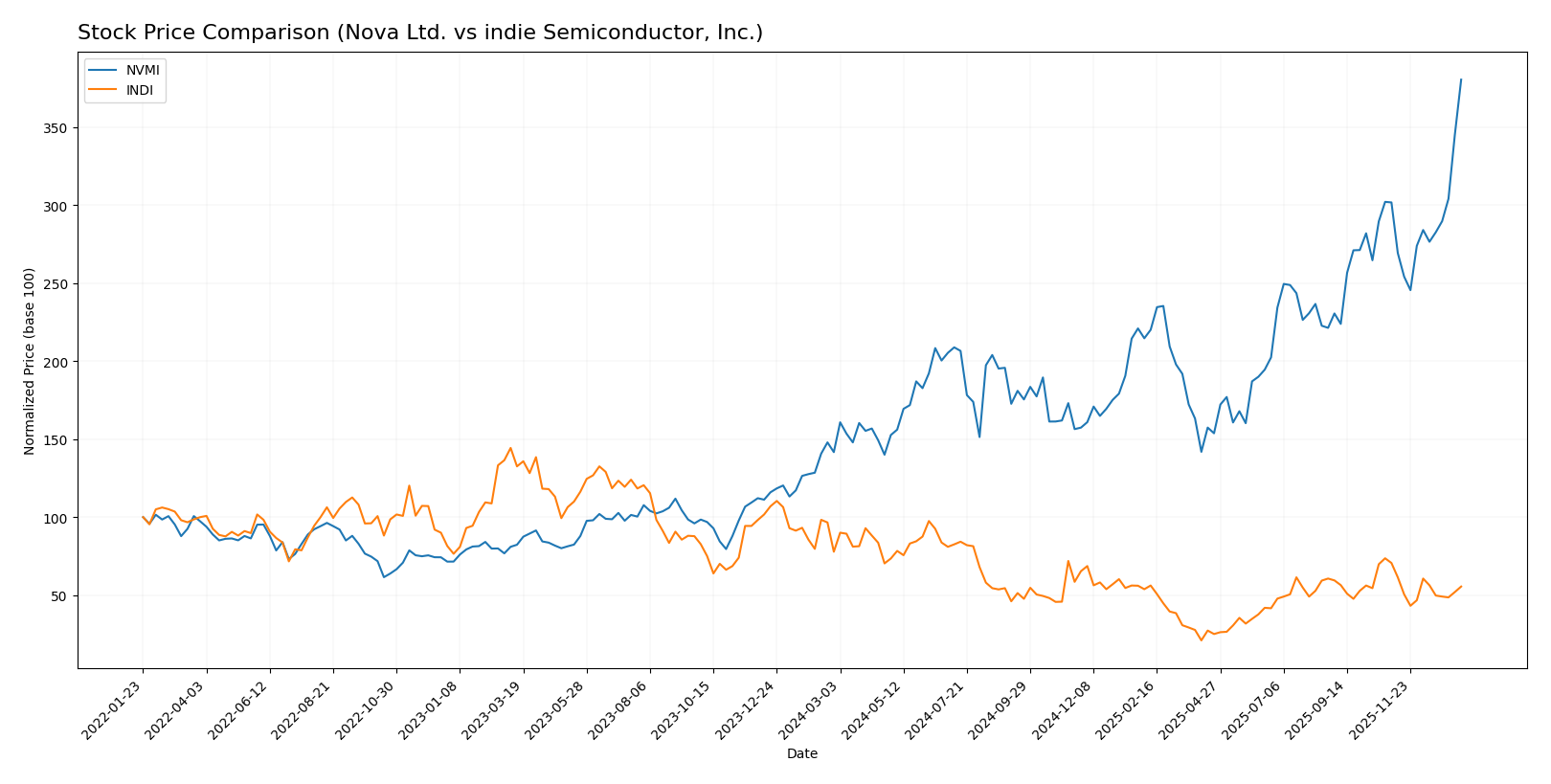

Stock Comparison

The stock price chart illustrates significant divergence in performance and trading dynamics between Nova Ltd. and indie Semiconductor, Inc. over the past 12 months, highlighting Nova Ltd.’s strong bullish acceleration and indie Semiconductor’s sustained bearish deceleration.

Trend Analysis

Nova Ltd.’s stock showed a bullish trend over the past year with a 168.54% price increase, marked by acceleration and high volatility, reaching a peak of 434.55. Recent months continue this positive momentum with a 26.09% gain.

indie Semiconductor, Inc. experienced a bearish trend with a 28.67% price decline over the year, showing deceleration and low volatility. The recent period confirms further downward movement with a 21.38% loss.

Comparing both stocks, Nova Ltd. delivered the highest market performance with a strong bullish trend and significant price gains, while indie Semiconductor maintained a bearish trajectory.

Target Prices

The latest analyst target consensus presents a mixed outlook for these semiconductor companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Nova Ltd. | 390 | 335 | 362.5 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

For Nova Ltd., the consensus target price of 362.5 USD is below the current stock price of 434.55 USD, suggesting potential downside. Conversely, indie Semiconductor’s target consensus of 8 USD is nearly double its current price of 4.23 USD, indicating significant upside potential as perceived by analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Nova Ltd. and indie Semiconductor, Inc.:

Rating Comparison

NVMI Rating

- Rating: B-, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate score of 3, indicating average valuation assessment.

- ROE Score: Favorable score of 4, showing good profit generation from equity.

- ROA Score: Very favorable score of 5, showing excellent asset utilization for earnings.

- Debt To Equity Score: Very unfavorable score of 1, suggesting high financial risk from debt.

- Overall Score: Moderate score of 3, reflecting average overall financial health.

INDI Rating

- Rating: C-, also considered very favorable despite lower scores.

- Discounted Cash Flow Score: Very unfavorable score of 1, indicating poor valuation outlook.

- ROE Score: Very unfavorable score of 1, reflecting weak efficiency in generating equity profits.

- ROA Score: Very unfavorable score of 1, indicating poor asset efficiency.

- Debt To Equity Score: Very unfavorable score of 1, indicating similarly high financial risk.

- Overall Score: Very unfavorable score of 1, showing weak overall financial condition.

Which one is the best rated?

Based strictly on the provided data, Nova Ltd. (NVMI) is better rated with a B- rating and higher scores in ROE, ROA, and overall metrics. indie Semiconductor (INDI) has weaker scores and a lower rating of C-.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

NVMI Scores

- Altman Z-Score: 7.76, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health and investment quality.

INDI Scores

- Altman Z-Score: 0.12, indicating distress zone and high bankruptcy risk.

- Piotroski Score: 2, reflecting very weak financial health and poor investment quality.

Which company has the best scores?

Based on the provided data, NVMI has significantly better scores, with a safe zone Altman Z-Score and a strong Piotroski Score, while INDI is in the distress zone with very weak financial strength.

Grades Comparison

Below is a comparison of recent grades assigned to Nova Ltd. and indie Semiconductor, Inc.:

Nova Ltd. Grades

This table summarizes the latest reliable grades from established grading companies for Nova Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2026-01-13 |

| Jefferies | Maintain | Buy | 2025-12-15 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-07 |

| Benchmark | Maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-06-24 |

| B of A Securities | Maintain | Buy | 2025-06-24 |

| Benchmark | Maintain | Buy | 2025-05-09 |

| Citigroup | Maintain | Buy | 2025-05-09 |

| B of A Securities | Maintain | Buy | 2025-04-16 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-03-14 |

Overall, Nova Ltd. consistently receives positive grades, mostly “Buy” and “Outperform,” indicating strong confidence from multiple analysts over time.

indie Semiconductor, Inc. Grades

This table summarizes the latest reliable grades from established grading companies for indie Semiconductor, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

Indie Semiconductor, Inc. shows a mostly positive rating trend with a majority of “Buy” and “Overweight” grades, though one “Neutral” rating indicates some analyst caution.

Which company has the best grades?

Nova Ltd. has received more consistent “Buy” and “Outperform” ratings from a wider range of firms compared to indie Semiconductor, which has some “Neutral” ratings. This suggests stronger analyst confidence in Nova Ltd., potentially affecting investor sentiment and portfolio allocation considerations.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Nova Ltd. (NVMI) and indie Semiconductor, Inc. (INDI) based on recent financial and operational data.

| Criterion | Nova Ltd. (NVMI) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Diversification | Focused on product sales with steady growth (538M in 2024); limited service segment | Product and service mix, but service revenue declining (14M in 2024) |

| Profitability | Strong net margin (27.3%), ROIC (13.4%) above WACC (12.3%); value creation improving | Negative margins (-61.2%), ROIC (-19.3%) well below WACC (11.4%); value destruction |

| Innovation | Moderate innovation suggested by improving ROIC trend (70% growth) | Declining ROIC (-179%), indicating struggles to innovate profitably |

| Global presence | Solid financial ratios and stable capital structure (D/E 0.25) | Weaker financials, higher leverage (D/E 0.95), limited profitability globally |

| Market Share | Growing revenue trend, product sales expanding | Revenue growth present but with profitability challenges; market position uncertain |

Key takeaways: Nova Ltd. demonstrates improving profitability and efficient capital use, suggesting a slightly favorable investment profile. In contrast, indie Semiconductor faces significant profitability and innovation challenges, with a very unfavorable outlook for value creation. Investors should weigh Nova’s stability against indie’s higher risk profile.

Risk Analysis

Below is a comparative risk assessment table for Nova Ltd. (NVMI) and indie Semiconductor, Inc. (INDI) based on their most recent financial and operational data from 2024.

| Metric | Nova Ltd. (NVMI) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Risk | Beta 1.83 – moderately volatile | Beta 2.54 – high volatility |

| Debt level | Low debt-to-equity 0.25 – favorable | High debt-to-equity 0.95 – neutral risk |

| Regulatory Risk | Moderate – global semiconductor regulations | Moderate – automotive semiconductor regulations |

| Operational Risk | Moderate – complex manufacturing processes | High – reliance on automotive sector innovation |

| Environmental Risk | Moderate – manufacturing impacts | Moderate – automotive product lifecycle impacts |

| Geopolitical Risk | Elevated – operations in multiple countries including Israel and China | Elevated – US-centric but exposed to global supply chains |

The most impactful risks include indie Semiconductor’s high market volatility and financial distress signals, with an Altman Z-Score in the distress zone and very weak Piotroski score, indicating potential bankruptcy risk. Nova Ltd. shows stronger financial resilience and lower leverage but faces moderate geopolitical and operational risks tied to its international footprint. Investors should weigh these factors carefully, prioritizing risk management in volatile sectors like semiconductors.

Which Stock to Choose?

Nova Ltd. (NVMI) shows a strong income evolution with 29.8% revenue growth in 2024 and sustained profitability, reflected in a favorable 27.3% net margin and solid financial ratios. Its low debt levels and very favorable rating underscore financial stability and growth potential.

Indie Semiconductor, Inc. (INDI) exhibits mixed income trends, with a 2.9% revenue decline in 2024 and an unfavorable net margin of -61.2%. Its financial ratios reveal high debt and weak profitability, though some ratios like the Piotroski score are moderate. The overall rating is very unfavorable.

From a rating and financial perspective, Nova Ltd. might appear more favorable for investors seeking growth and financial strength. Indie Semiconductor’s profile could be interpreted as suitable for risk-tolerant investors who focus on turnaround potential rather than stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Nova Ltd. and indie Semiconductor, Inc. to enhance your investment decisions: