Home > Comparison > Financial Services > NTRS vs TROW

The strategic rivalry between Northern Trust Corporation and T. Rowe Price Group defines the trajectory of the global asset management sector. Northern Trust operates a diversified model spanning wealth management and asset servicing, focusing on institutional and high-net-worth clients. In contrast, T. Rowe Price emphasizes active equity and fixed income fund management with a strong fundamental research base. This analysis will clarify which company offers a superior risk-adjusted return for a diversified portfolio.

Table of contents

Companies Overview

Northern Trust Corporation and T. Rowe Price Group, Inc. are heavyweight players in the asset management sector, each commanding significant market influence.

Northern Trust Corporation: Comprehensive Wealth and Asset Servicing

Northern Trust stands out as a diversified financial holding company focused on wealth management and asset servicing. Its core revenue derives from servicing institutional investors and high-net-worth clients through custody, fund administration, and private banking. In 2026, it sharpens its strategic focus on expanding asset servicing capabilities and integrating advanced risk management solutions for global clients.

T. Rowe Price Group, Inc.: Active and Responsible Investment Management

T. Rowe Price is a publicly owned investment manager specializing in actively managed equity and fixed income mutual funds. The firm’s revenue stems from management fees on globally diversified portfolios, emphasizing fundamental and quantitative research. Its 2026 strategy highlights socially responsible investing and late-stage venture capital, aiming to blend performance with environmental, social, and governance (ESG) principles.

Strategic Collision: Similarities & Divergences

Both firms compete in asset management but diverge sharply in approach. Northern Trust offers a full-service asset servicing ecosystem, targeting institutional and high-net-worth clients, while T. Rowe Price focuses on active fund management and ESG integration for individual and institutional investors. Their primary battleground lies in capturing discretionary client assets. These distinctions define their unique risk-return profiles and investor appeal.

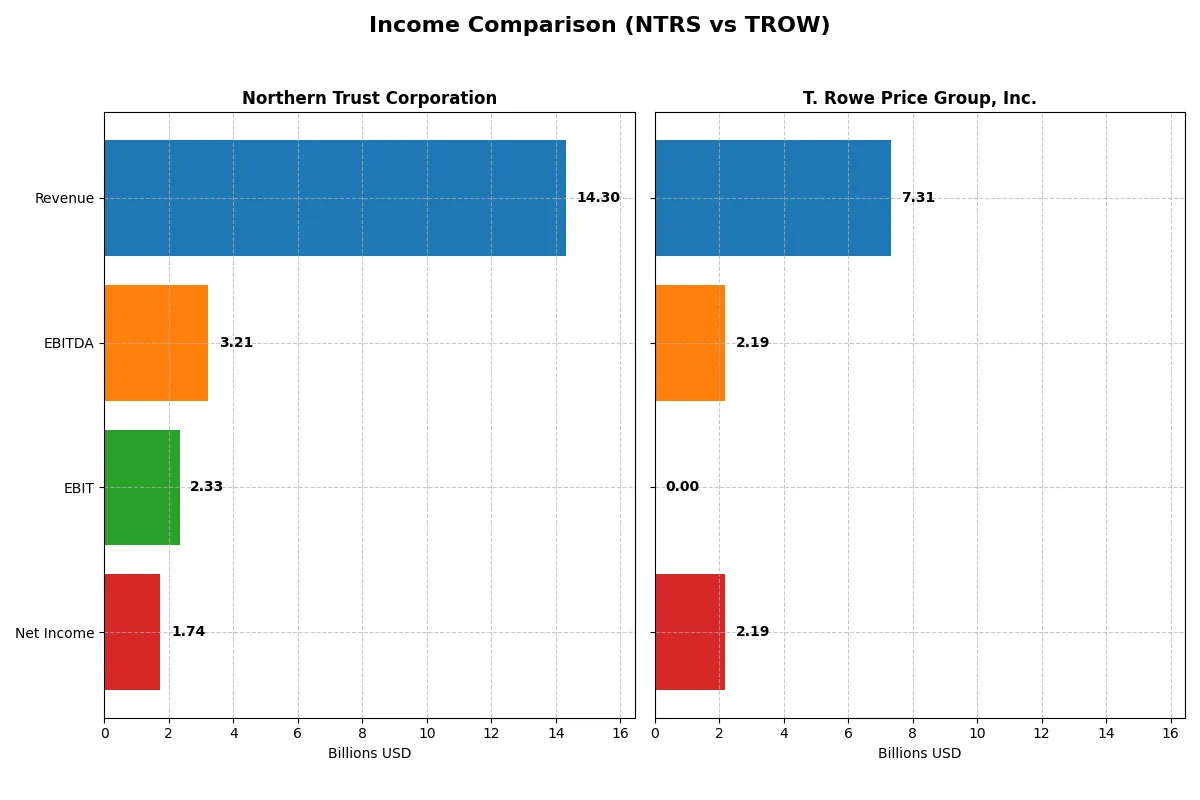

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Northern Trust Corporation (NTRS) | T. Rowe Price Group, Inc. (TROW) |

|---|---|---|

| Revenue | 14.3B | 7.3B |

| Cost of Revenue | 6.2B | 0 |

| Operating Expenses | 5.75B | 5.13B |

| Gross Profit | 8.1B | 0 |

| EBITDA | 3.2B | 2.2B |

| EBIT | 2.3B | 0 |

| Interest Expense | 6.2B | 0 |

| Net Income | 1.7B | 2.2B |

| EPS | 8.79 | 9.26 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates with greater efficiency and financial resilience amid recent market shifts.

Northern Trust Corporation Analysis

Northern Trust’s revenue grew from 6.5B in 2021 to 14.3B in 2025, showing strong expansion, though it dipped nearly 10% in 2025. Net income rose overall but fell 10.5% last year to 1.7B. Its gross margin remains healthy at 56.5%, and the net margin holds firm at 12.2%, reflecting solid profitability despite rising interest expenses weighing on margins.

T. Rowe Price Group, Inc. Analysis

T. Rowe Price posted relatively stable revenue around 7B in recent years, with a slight 3% increase in 2025. Net income declined overall, dropping 28.8% over five years but rose 6.2% last year to 2.2B. The absence of cost of revenue distorts gross margin reporting, yet a robust net margin of 30% signals strong bottom-line efficiency. Operating income and EBIT margins appear less transparent due to reporting inconsistencies.

Efficiency vs. Scale: Margin Strength Faces Growth Challenges

Northern Trust leads in scale and shows resilience with expanding revenues and solid gross margins, though its profitability took a recent hit. T. Rowe Price demonstrates superior net margin efficiency but struggles with revenue growth and volatile profitability. Investors seeking stable growth may favor Northern Trust, while those prioritizing margin strength could find T. Rowe Price’s profile more compelling.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Northern Trust Corporation (NTRS) | T. Rowe Price Group, Inc. (TROW) |

|---|---|---|

| ROE | 13.4% | 20.3% |

| ROIC | 5.0% | 13.6% |

| P/E | 14.7 | 12.0 |

| P/B | 2.0 | 2.4 |

| Current Ratio | 0.41 | 8.01 |

| Quick Ratio | 0.41 | 8.01 |

| D/E | 1.27 | 0.03 |

| Debt-to-Assets | 9.3% | 2.1% |

| Interest Coverage | 0.38 | N/A |

| Asset Turnover | 0.08 | 0.53 |

| Fixed Asset Turnover | 30.8 | 5.9 |

| Payout ratio | 33.5% | 54.1% |

| Dividend yield | 2.3% | 4.5% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, exposing hidden risks and operational strengths crucial for sound investment decisions.

Northern Trust Corporation

Northern Trust posts a moderate ROE of 13.4% with favorable net margins at 12.15%. Its P/E ratio of 14.75 suggests the stock trades at a reasonable valuation. However, liquidity ratios and interest coverage are weak, signaling operational risks. The company maintains a 2.27% dividend yield, balancing shareholder returns with prudent capital management.

T. Rowe Price Group, Inc.

T. Rowe Price excels with a robust 20.3% ROE and a strong net margin of 29.61%. The P/E of 12.0 highlights an attractively valued stock amid solid efficiency. Despite an unusually high current ratio raising questions, its 4.51% dividend yield reflects a shareholder-friendly approach. Asset and capital turnover further underline operational effectiveness.

Balanced Strength vs. Robust Growth: Ratio Verdict

T. Rowe Price shows superior profitability and valuation metrics, supported by strong dividends and operational efficiency. Northern Trust, while reasonably valued, carries notable liquidity and coverage risks. Growth-oriented investors may prefer T. Rowe’s profile; those prioritizing stability should weigh Northern Trust’s cautious payout and moderate returns.

Which one offers the Superior Shareholder Reward?

I compare Northern Trust Corporation (NTRS) and T. Rowe Price Group, Inc. (TROW) on dividend yield, payout ratios, and buyback intensity. NTRS yields 2.27% with a payout ratio near 33%, while TROW offers a higher 4.5% yield and a 54% payout ratio. Both sustain dividends well, but TROW’s stronger free cash flow (5.7/share) and robust operating cash flow coverage suggest a more reliable dividend. NTRS’s buybacks are less aggressive, with no free cash flow per share reported recently, indicating limited share repurchase capacity. Conversely, TROW consistently delivers substantial buybacks alongside dividends, enhancing total shareholder return. I see TROW’s balanced distribution and cash generation as more sustainable. For 2026 investors, TROW clearly offers the superior total return profile.

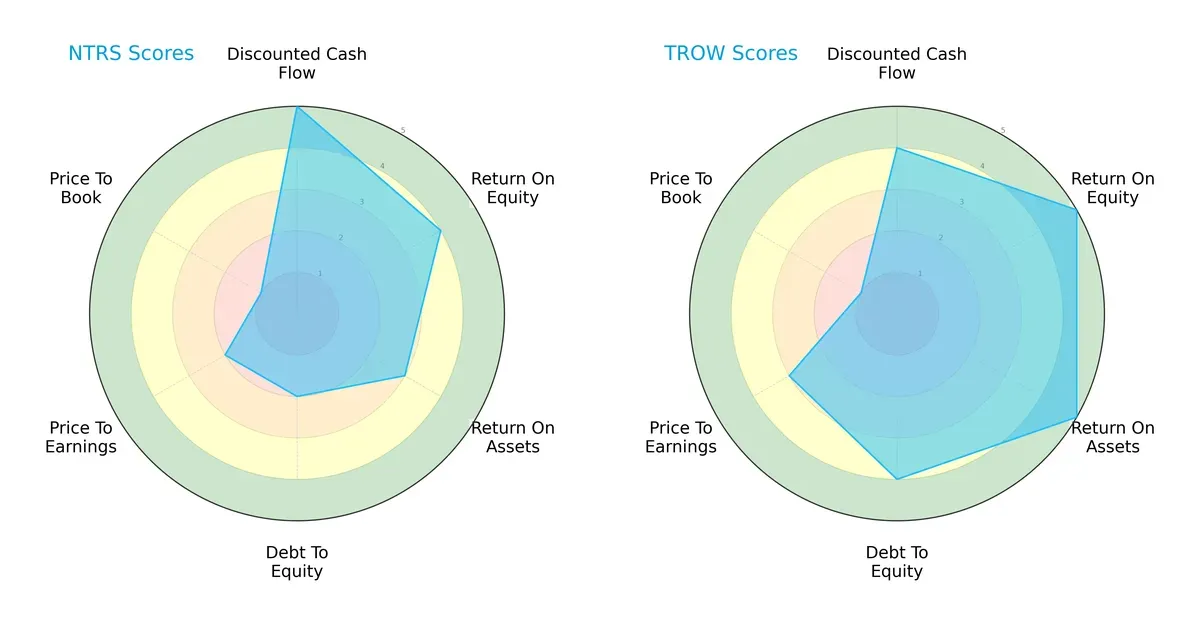

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Northern Trust Corporation and T. Rowe Price Group, Inc.:

Northern Trust excels in discounted cash flow (5) and return on equity (4), but struggles with debt-to-equity (2) and valuation scores (PE 2, PB 1). T. Rowe Price offers a more balanced profile with strong returns (ROE 5, ROA 5), better leverage (debt-to-equity 4), and moderate valuation metrics. I see T. Rowe Price as the more stable operator, while Northern Trust leans on cash flow strength amid leverage concerns.

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap highlights stark solvency contrasts between the two firms:

T. Rowe Price’s score (7.44) places it securely in the safe zone, signaling robust financial health and low bankruptcy risk. Northern Trust’s negative score (-0.30) signals distress, raising red flags about its long-term survival under current market pressures.

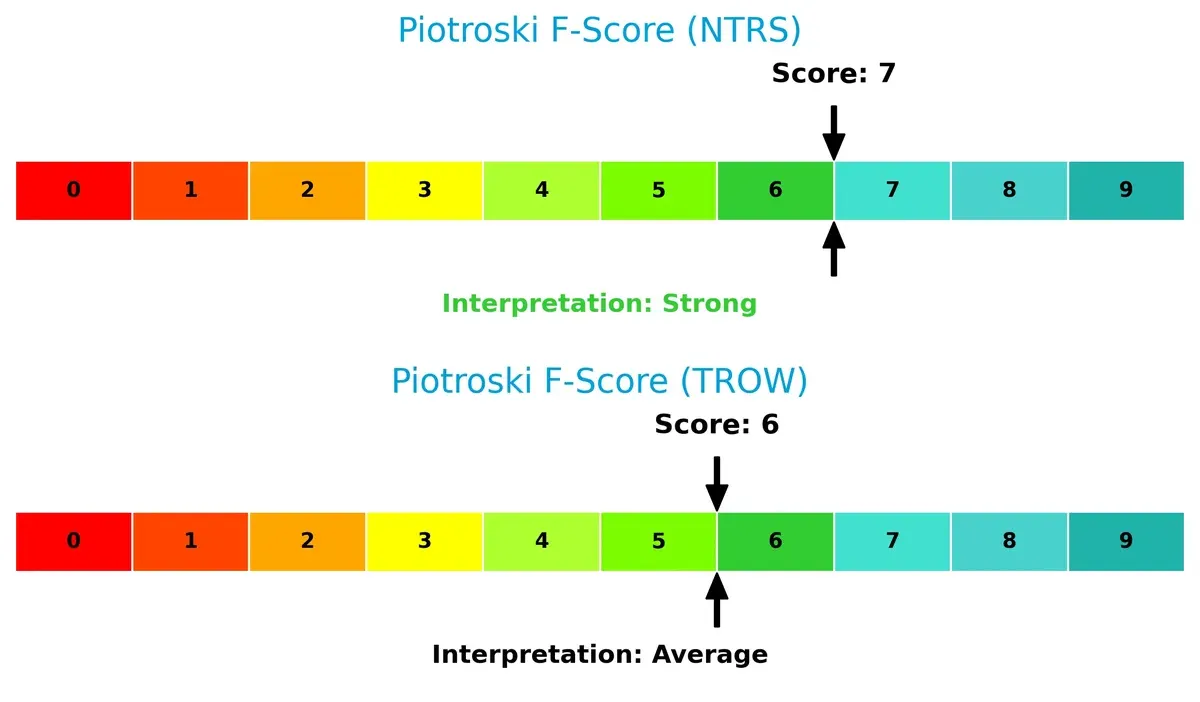

Financial Health: Quality of Operations

Piotroski F-Scores reveal operational quality and financial discipline differences:

Northern Trust scores a strong 7, reflecting solid profitability and efficiency. T. Rowe Price’s 6 is average, suggesting moderate internal strengths but some room for improvement. Despite Northern Trust’s distress in solvency, its operational metrics remain comparatively robust.

How are the two companies positioned?

This section dissects Northern Trust and T. Rowe Price’s operational DNA by comparing revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model delivers a more resilient, sustainable competitive advantage.

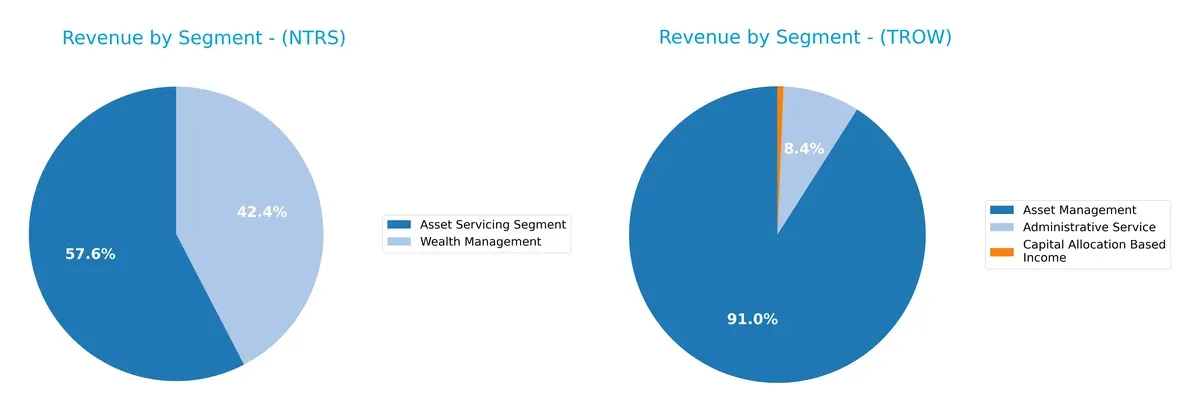

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Northern Trust Corporation and T. Rowe Price Group diversify their income streams and where their primary sector bets lie:

Northern Trust leans on Asset Servicing at $4.37B and Wealth Management at $3.21B, showing a two-pronged revenue base. T. Rowe Price pivots heavily on Asset Management with $6.40B, while smaller Administrative Service ($588M) and Capital Allocation ($47M) segments diversify its mix. Northern Trust’s model anchors on ecosystem lock-in through servicing, whereas T. Rowe’s concentrated asset management dominance highlights concentration risk despite modest diversification.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Northern Trust Corporation and T. Rowe Price Group, Inc.:

Northern Trust Corporation Strengths

- Diversified revenue with strong Wealth Management and Asset Servicing segments

- Favorable net margin at 12.15%

- Dividend yield at 2.27% supports shareholder returns

- Favorable fixed asset turnover at 30.78 indicates efficient asset use

T. Rowe Price Group, Inc. Strengths

- High net margin at 29.61% and strong ROE of 20.3% highlight robust profitability

- Favorable debt-to-equity ratio of 0.03 shows conservative leverage

- Quick ratio at 8.01 indicates strong short-term liquidity

- Dividend yield at 4.51% reflects attractive income for investors

Northern Trust Corporation Weaknesses

- Unfavorable current and quick ratios at 0.41 suggest liquidity concerns

- WACC (16.74%) exceeds ROIC (5.04%), indicating poor capital efficiency

- Debt-to-equity at 1.27 risks higher financial leverage

- Interest coverage at 0.38 raises solvency concerns

- Asset turnover is low at 0.08, signaling inefficiency

T. Rowe Price Group, Inc. Weaknesses

- Interest coverage at 0 signals risk in meeting interest expenses

- Unfavorable current ratio at 8.01 contrasts with quick ratio, indicating possible inventory or receivables issues

- Absence of WACC and ROIC data limits efficiency assessment

- Neutral asset turnover at 0.53 less efficient than peers

Northern Trust shows strength in asset servicing diversity but faces financial leverage and liquidity challenges. T. Rowe Price excels in profitability and capital structure but has solvency and data transparency limitations. These factors frame their strategic focus and risk profiles.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only safeguard long-term profits have against relentless competition erosion. Let’s examine the core moats of Northern Trust and T. Rowe Price:

Northern Trust Corporation: Intangible Asset Moat Anchored in Trust and Service Excellence

Northern Trust leverages deep client relationships and brand reputation as intangible assets. This moat shows in stable margins and a 12% net margin despite recent revenue declines. Expansion in global wealth management could reinforce its advantages in 2026.

T. Rowe Price Group, Inc.: Cost and Scale Advantages with Active Management Focus

T. Rowe Price’s moat stems from its scale and disciplined active management, driving a robust 30% net margin. Unlike Northern Trust, its moat relies on investment performance and fee generation. Growth opportunities lie in expanding ESG and retirement plan offerings.

Moat Strength Showdown: Intangible Trust vs. Scale-Driven Active Management

Northern Trust’s intangible asset moat runs deeper, sustaining value amid margin pressure. T. Rowe Price’s scale delivers strong profitability but faces margin volatility risks. I see Northern Trust better positioned to defend market share long-term.

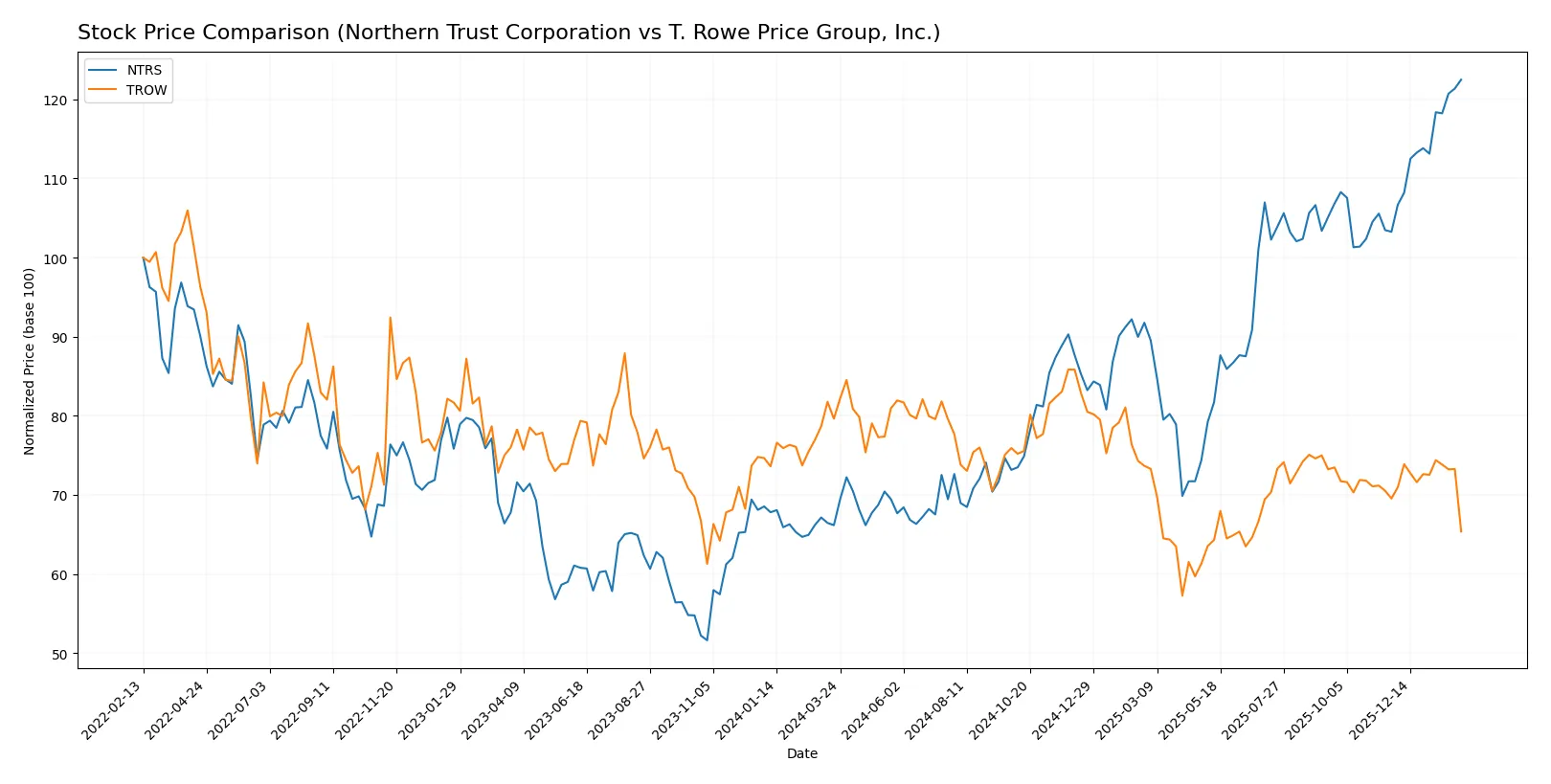

Which stock offers better returns?

Stock prices of Northern Trust Corporation and T. Rowe Price Group, Inc. diverged sharply over the past 12 months, with Northern Trust showing strong upward momentum while T. Rowe Price declined steadily.

Trend Comparison

Northern Trust’s stock surged 85.14% over the past year, indicating a bullish trend with accelerating gains. It reached a high of 150.81 and showed significant volatility (20.02 std deviation).

T. Rowe Price’s stock fell 17.9% in the same period, marking a bearish trend with accelerating losses. Its peak was 123.84, and volatility stood at 8.86 std deviation.

Northern Trust outperformed T. Rowe Price significantly, delivering the highest market returns with strong price appreciation and buyer dominance.

Target Prices

Analysts present a cautiously optimistic consensus for Northern Trust Corporation and T. Rowe Price Group, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Northern Trust Corporation | 131 | 160 | 146.17 |

| T. Rowe Price Group, Inc. | 102 | 123 | 113.33 |

Northern Trust’s target consensus slightly undercuts its current price of $150.47, suggesting limited upside. T. Rowe Price’s targets exceed its $95.13 price, signaling potential appreciation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for Northern Trust Corporation and T. Rowe Price Group, Inc.:

Northern Trust Corporation Grades

This table lists current grades from major financial institutions for Northern Trust Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-28 |

| Goldman Sachs | Maintain | Sell | 2026-01-28 |

| TD Cowen | Maintain | Buy | 2026-01-26 |

| RBC Capital | Maintain | Outperform | 2026-01-23 |

| Morgan Stanley | Maintain | Underweight | 2026-01-23 |

| Evercore ISI Group | Maintain | In Line | 2026-01-23 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-23 |

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Barclays | Maintain | Equal Weight | 2026-01-05 |

| Citigroup | Maintain | Neutral | 2025-12-30 |

T. Rowe Price Group, Inc. Grades

This table shows recent institutional grades for T. Rowe Price Group, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-02-03 |

| JP Morgan | Maintain | Underweight | 2026-01-20 |

| Barclays | Maintain | Underweight | 2026-01-15 |

| TD Cowen | Maintain | Hold | 2026-01-14 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-17 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2025-12-17 |

| Barclays | Maintain | Underweight | 2025-12-12 |

| Evercore ISI Group | Maintain | In Line | 2025-12-05 |

| TD Cowen | Maintain | Hold | 2025-11-03 |

| JP Morgan | Maintain | Underweight | 2025-11-03 |

Which company has the best grades?

Northern Trust Corporation has generally more positive grades, including Buy and Outperform ratings. T. Rowe Price Group’s grades lean toward Hold and Underweight. This difference may affect investor sentiment and perceived upside potential.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing Northern Trust Corporation and T. Rowe Price Group in the 2026 market environment:

1. Market & Competition

Northern Trust Corporation

- Faces intense competition in wealth and asset management with moderate ROE and ROIC performance.

T. Rowe Price Group, Inc.

- Enjoys stronger profitability and a higher ROE, but competes in a crowded global asset management market.

2. Capital Structure & Debt

Northern Trust Corporation

- High debt-to-equity ratio (1.27) and low interest coverage (0.38) signal financial leverage risks.

T. Rowe Price Group, Inc.

- Very low debt levels (0.03 D/E) reduce financial risk despite zero interest coverage.

3. Stock Volatility

Northern Trust Corporation

- Beta of 1.276 indicates moderate stock volatility relative to the market.

T. Rowe Price Group, Inc.

- Higher beta at 1.544 suggests greater sensitivity to market swings and higher volatility risk.

4. Regulatory & Legal

Northern Trust Corporation

- Subject to rigorous financial regulation; complexity in compliance could increase costs.

T. Rowe Price Group, Inc.

- Similarly heavily regulated with global operations, exposing it to diverse legal regimes.

5. Supply Chain & Operations

Northern Trust Corporation

- Operational risk from technology-dependent asset servicing and wealth management platforms.

T. Rowe Price Group, Inc.

- Relies on global research and fund management infrastructure; operational disruptions could impact performance.

6. ESG & Climate Transition

Northern Trust Corporation

- Moderate ESG focus; pressure to enhance climate-related disclosures and sustainable investment offerings.

T. Rowe Price Group, Inc.

- Stronger emphasis on socially responsible investing, but must navigate evolving ESG regulations globally.

7. Geopolitical Exposure

Northern Trust Corporation

- Primarily US-based but exposed to global institutional clients; geopolitical risks moderate.

T. Rowe Price Group, Inc.

- Extensive international footprint increases exposure to geopolitical instability and currency fluctuations.

Which company shows a better risk-adjusted profile?

Northern Trust’s most impactful risk is its stretched capital structure and low interest coverage, which could constrain financial flexibility in downturns. T. Rowe Price’s key risk lies in its higher stock volatility and broad geopolitical exposure. Overall, T. Rowe Price demonstrates a better risk-adjusted profile, supported by stronger profitability and a safer Altman Z-Score in 2026. Notably, Northern Trust’s negative Altman Z-Score signals distress, underscoring capital structure concerns as a critical red flag.

Final Verdict: Which stock to choose?

Northern Trust Corporation’s superpower lies in its ability to generate reliable cash flows and maintain a solid dividend yield, appealing to income-focused investors. However, its weak liquidity ratios and declining profitability signal a point of vigilance. It might suit portfolios favoring steady income with moderate risk tolerance.

T. Rowe Price Group commands a strategic moat through consistent operational efficiency and strong return metrics, bolstered by a favorable debt profile. Relative to Northern Trust, it offers better financial stability despite recent revenue softness. This makes it a fitting candidate for investors seeking growth at a reasonable price with a defensive tilt.

If you prioritize income stability with some growth potential, Northern Trust appears compelling due to its cash-generating ability and shareholder returns. However, if you seek stronger profitability and a more robust balance sheet, T. Rowe Price outshines in delivering better stability and operational resilience. Each fits distinct investor profiles, warranting careful alignment with your risk and return preferences.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Northern Trust Corporation and T. Rowe Price Group, Inc. to enhance your investment decisions: