In the dynamic industrial machinery sector, Pentair plc and Nordson Corporation stand out for their specialized solutions and innovative approaches. Pentair focuses on water treatment and fluid management, while Nordson excels in precision dispensing and coating technologies. Both companies share a commitment to advanced engineering and global markets, making their comparison compelling. In this article, I will help you uncover which company presents the most attractive investment opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Pentair plc and Nordson Corporation by providing an overview of these two companies and their main differences.

Pentair plc Overview

Pentair plc focuses on global water solutions, operating through Consumer Solutions and Industrial & Flow Technologies segments. The company designs and manufactures pool equipment, water treatment products, and fluid treatment systems. It serves diverse applications including residential water filtration, commercial water management, and industrial fluid handling. Founded in 1966, Pentair is headquartered in London and trades on the NYSE with a market cap of $16.9B.

Nordson Corporation Overview

Nordson Corporation engineers and markets dispensing and coating systems for adhesives, coatings, and fluids worldwide. It operates through Industrial Precision Solutions and Advanced Technology Solutions segments, offering products for automated dispensing, surface treatment, and inspection in various industries. Founded in 1935 and based in Westlake, Ohio, Nordson trades on NASDAQ with a market cap of $14.6B and focuses on precision application technologies.

Key similarities and differences

Both companies operate in the industrial machinery sector and provide specialized equipment for fluid handling and treatment. Pentair emphasizes water solutions and filtration systems, while Nordson specializes in dispensing and coating technologies for adhesives and coatings. Pentair’s business spans water management applications, whereas Nordson targets precision dispensing and surface treatment across multiple manufacturing industries. Their market caps and employee counts are comparable, reflecting similar scale but distinct product focuses.

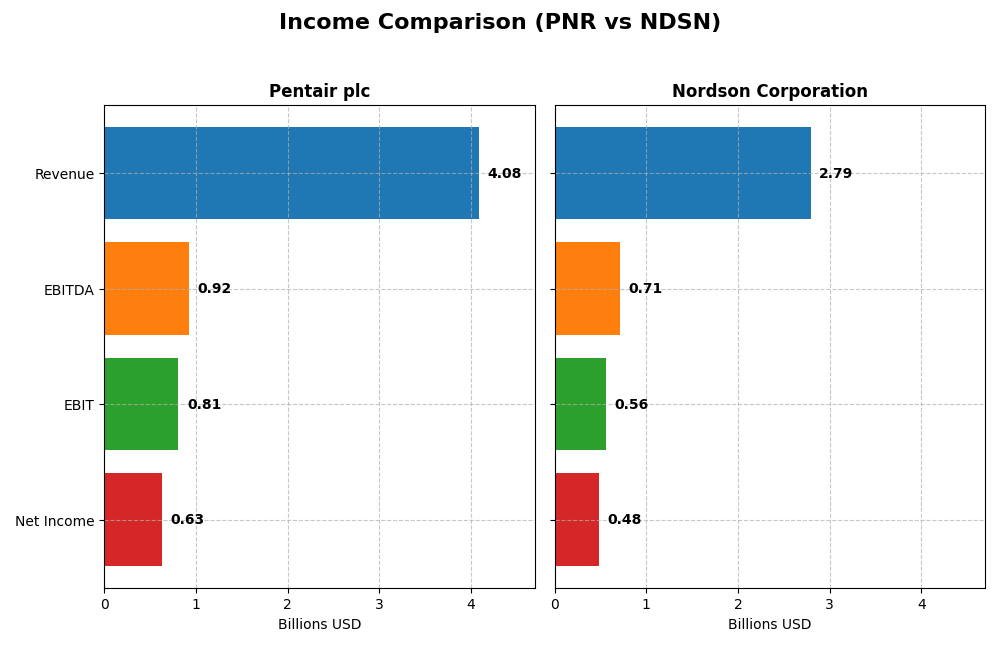

Income Statement Comparison

This table presents a side-by-side comparison of the key income statement metrics for Pentair plc and Nordson Corporation for their most recent fiscal years.

| Metric | Pentair plc (PNR) | Nordson Corporation (NDSN) |

|---|---|---|

| Market Cap | 16.9B | 14.6B |

| Revenue | 4.08B | 2.79B |

| EBITDA | 922M | 712M |

| EBIT | 808M | 561M |

| Net Income | 625M | 484M |

| EPS | 3.78 | 8.56 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Pentair plc

Pentair’s revenue showed a slight decline of -0.53% in 2024 but grew 35.29% over five years, while net income increased 74.4% during the same period. Margins improved overall, with a favorable gross margin of 39.16% and net margin of 15.32%. In 2024, EBIT rose by 9.54%, signaling margin improvement despite the minor revenue dip.

Nordson Corporation

Nordson experienced steady revenue growth of 3.78% in 2025 and 18.18% over five years, with net income rising 6.63% overall. The company posted a strong gross margin of 55.16% and net margin of 17.35%, though EBIT declined by 16.79% in the latest year. Margins showed some contraction, with net margin falling by -9.78% over the period.

Which one has the stronger fundamentals?

Both companies have favorable income statement evaluations, but Pentair displays stronger overall growth in net income and margins over the period. Nordson’s higher gross and net margins are offset by recent EBIT and net margin declines. Pentair’s consistent margin improvements and earnings growth suggest more robust fundamentals in the latest fiscal year.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Pentair plc and Nordson Corporation, reflecting their most recent fiscal year results to assist investors in evaluating operational efficiency, profitability, liquidity, and leverage.

| Ratios | Pentair plc (PNR) 2024 | Nordson Corporation (NDSN) 2025 |

|---|---|---|

| ROE | 17.55% | 15.92% |

| ROIC | 12.52% | 10.49% |

| P/E | 26.89 | 27.10 |

| P/B | 4.72 | 4.31 |

| Current Ratio | 1.60 | 1.64 |

| Quick Ratio | 0.92 | 1.05 |

| D/E (Debt-to-Equity) | 0.50 | 0.69 |

| Debt-to-Assets | 27.41% | 35.36% |

| Interest Coverage | 9.07 | 7.04 |

| Asset Turnover | 0.63 | 0.47 |

| Fixed Asset Turnover | 8.60 | 4.70 |

| Payout ratio | 24.35% | 36.96% |

| Dividend yield | 0.91% | 1.36% |

Interpretation of the Ratios

Pentair plc

Pentair plc exhibits mostly favorable financial ratios, including strong returns on equity (17.55%) and invested capital (12.52%), alongside a solid current ratio of 1.6, indicating good short-term liquidity. However, valuation ratios such as P/E (26.89) and P/B (4.72) are less attractive. The company pays dividends with a low yield of 0.91%, suggesting modest shareholder returns but risks from a relatively low payout.

Nordson Corporation

Nordson Corporation shows favorable profitability with a net margin of 17.35% and return on equity of 15.92%, but its asset turnover is weak at 0.47, signaling less efficient asset use. The current ratio of 1.64 and interest coverage of 5.55 are adequate. Dividend yield is slightly higher at 1.36%, reflecting reasonable shareholder returns with a balanced payout approach.

Which one has the best ratios?

Pentair’s ratios are globally more favorable, notably in returns and liquidity, despite some valuation concerns, while Nordson has a slightly weaker asset efficiency and more neutral leverage ratios. Both companies face unfavorable P/E and P/B ratios, but Pentair’s overall stronger profitability and coverage metrics give it a slight edge in ratio quality.

Strategic Positioning

This section compares the strategic positioning of Pentair plc and Nordson Corporation, including market position, key segments, and exposure to technological disruption:

Pentair plc

- Large market cap with NYSE listing; faces industrial machinery competition with moderate beta.

- Diverse segments: Consumer Solutions (pool equipment, water treatment) and Industrial & Flow Technologies (fluid treatment, pumps, valves).

- Exposure through industrial water treatment and filtration technologies; operates in established industrial sectors.

Nordson Corporation

- Slightly smaller market cap, NASDAQ-listed, with lower beta indicating somewhat less volatility.

- Two main segments: Industrial Precision Solutions and Advanced Technology Solutions focusing on fluid dispensing and coating systems.

- Exposure via precision dispensing and coating technologies; includes advanced systems with potential tech innovation.

Pentair plc vs Nordson Corporation Positioning

Pentair shows a diversified approach across consumer and industrial water solutions, leveraging multiple brands and applications. Nordson concentrates on precision fluid dispensing and coating, focusing on specialized industrial and medical technologies, reflecting a more concentrated business model.

Which has the best competitive advantage?

Pentair demonstrates a very favorable moat with growing ROIC exceeding WACC by 3.5%, indicating durable competitive advantage. Nordson, while creating value, shows a slightly favorable moat with declining ROIC, suggesting less sustainable profitability.

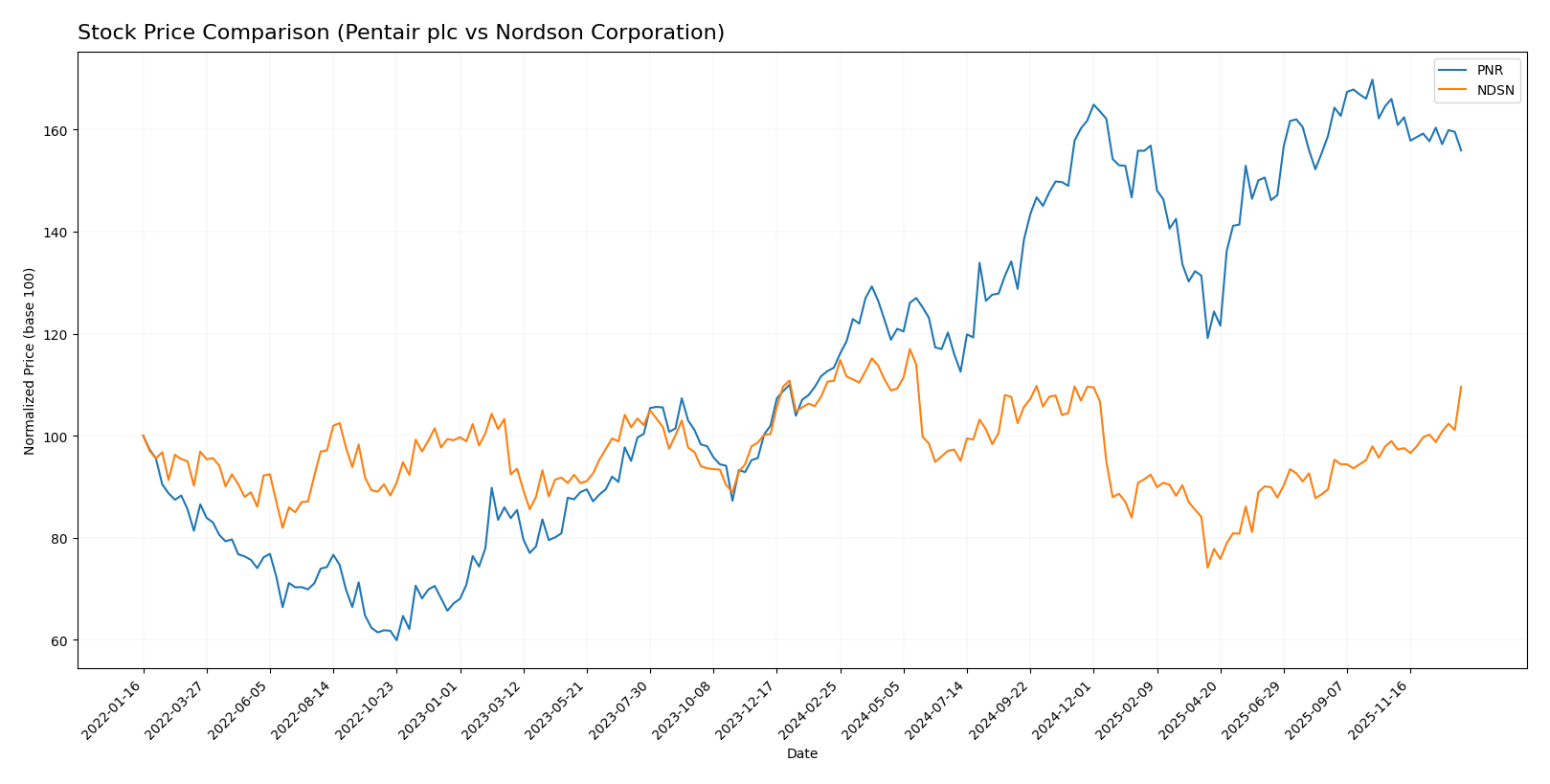

Stock Comparison

The stock price movements over the past 12 months reveal distinct trading dynamics: Pentair plc (PNR) showed a strong bullish trend with notable deceleration, while Nordson Corporation (NDSN) experienced a mild overall bearish trend but recent acceleration.

Trend Analysis

Pentair plc’s stock gained 37.56% over the past year, indicating a bullish trend with price deceleration and a standard deviation of 11.1. The stock ranged between 74.39 and 112.23 but recently declined by 6.08%.

Nordson Corporation’s price fell slightly by 1.08% over the year, reflecting a bearish trend despite accelerating momentum and higher volatility, with a standard deviation of 23.45. Its recent trend shows a 10.73% increase.

Comparing both, Pentair plc delivered the highest market performance with a 37.56% gain, outperforming Nordson’s modest 1.08% loss over the 12-month period.

Target Prices

The target price consensus for Pentair plc and Nordson Corporation reflects moderate upside potential based on recent analyst estimates.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Pentair plc | 135 | 90 | 122.63 |

| Nordson Corporation | 295 | 240 | 274.17 |

Analysts see Pentair plc’s stock price (103.06 USD) below its consensus target, suggesting potential appreciation. Nordson Corporation’s current price (261.22 USD) is also slightly below the consensus target, indicating moderate expected growth.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Pentair plc and Nordson Corporation:

Rating Comparison

PNR Rating

- Rating: B, classified as Very Favorable overall.

- Discounted Cash Flow Score: 3, indicating a moderate valuation based on future cash flows.

- ROE Score: 4, showing favorable efficiency in generating profit from shareholders’ equity.

- ROA Score: 5, very favorable in utilizing assets to generate earnings.

- Debt To Equity Score: 2, moderate financial risk from debt levels compared to equity.

- Overall Score: 3, a moderate summary of financial standing.

NDSN Rating

- Rating: B, classified as Very Favorable overall.

- Discounted Cash Flow Score: 3, indicating a moderate valuation based on future cash flows.

- ROE Score: 4, showing favorable efficiency in generating profit from shareholders’ equity.

- ROA Score: 4, favorable in utilizing assets to generate earnings.

- Debt To Equity Score: 2, moderate financial risk from debt levels compared to equity.

- Overall Score: 3, a moderate summary of financial standing.

Which one is the best rated?

Both companies share the same overall rating (B) and overall score (3), indicating similar moderate financial standing. Pentair has a higher ROA score (5 vs. 4), suggesting more effective asset use, while other scores are equivalent.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score for Pentair plc and Nordson Corporation:

Pentair plc Scores

- Altman Z-Score of 5.05 places Pentair well in the safe zone.

- Piotroski Score of 8 indicates very strong financial health.

Nordson Corporation Scores

- Altman Z-Score of 4.90 places Nordson well in the safe zone.

- Piotroski Score of 7 indicates strong financial health.

Which company has the best scores?

Pentair plc shows higher scores in both Altman Z-Score and Piotroski Score, indicating a stronger financial safety margin and very strong financial health compared to Nordson Corporation.

Grades Comparison

Here is a detailed comparison of the latest grades issued by reputable financial institutions for both companies:

Pentair plc Grades

The following table summarizes recent grades and rating changes for Pentair plc by established grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BNP Paribas Exane | Downgrade | Underperform | 2026-01-07 |

| TD Cowen | Downgrade | Sell | 2026-01-05 |

| Jefferies | Upgrade | Buy | 2025-12-10 |

| Barclays | Downgrade | Equal Weight | 2025-12-04 |

| Oppenheimer | Maintain | Outperform | 2025-11-20 |

| UBS | Maintain | Buy | 2025-10-22 |

| RBC Capital | Maintain | Outperform | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-22 |

| Oppenheimer | Maintain | Outperform | 2025-10-20 |

| JP Morgan | Maintain | Overweight | 2025-10-15 |

Overall, Pentair plc has experienced several downgrades in recent months, though some firms still maintain positive ratings such as Outperform and Buy.

Nordson Corporation Grades

The table below presents recent grades and rating changes for Nordson Corporation from recognized grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Buy | 2025-12-12 |

| Baird | Maintain | Neutral | 2025-12-12 |

| DA Davidson | Maintain | Buy | 2025-12-11 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| Oppenheimer | Maintain | Outperform | 2025-08-25 |

| Baird | Maintain | Neutral | 2025-08-22 |

| Keybanc | Maintain | Overweight | 2025-07-15 |

| Baird | Maintain | Neutral | 2025-05-30 |

| Oppenheimer | Upgrade | Outperform | 2025-05-30 |

| Keybanc | Maintain | Overweight | 2025-04-08 |

Nordson Corporation’s grades show consistent positive ratings, with multiple Buy and Outperform grades maintained and one recent upgrade.

Which company has the best grades?

Nordson Corporation generally holds stronger and more stable grades than Pentair plc, with more Buy and Outperform ratings and fewer downgrades. This pattern may indicate greater analyst confidence in Nordson, potentially influencing investor perception of relative stability and growth prospects.

Strengths and Weaknesses

Below is a comparative overview of the strengths and weaknesses of Pentair plc (PNR) and Nordson Corporation (NDSN) based on key financial and strategic criteria.

| Criterion | Pentair plc (PNR) | Nordson Corporation (NDSN) |

|---|---|---|

| Diversification | Well diversified across Industrial & Flow Technologies (1.51B), Pool (1.44B), and Water Unit (1.13B) | Diversified in Advanced Technology Systems (510M), Industrial Precision Solutions (1.48B), Medical and Fluid Solutions (695M) |

| Profitability | Strong profitability with 15.3% net margin, 17.6% ROE, and 12.5% ROIC; generating value with growing ROIC (+13.9%) | Good profitability: 17.4% net margin, 15.9% ROE, 10.5% ROIC; creating value but facing declining ROIC (-26.6%) |

| Innovation | Moderate innovation reflected by favorable ROIC and strong operational metrics | Innovation driven by advanced precision and medical tech segments; ROIC slightly lower and declining trend noted |

| Global presence | Established global footprint in water and industrial markets with consistent segment revenues | Global reach with focus on industrial and medical markets; steady revenue but growth pressure apparent |

| Market Share | Solid market share in water solutions and industrial flow tech segments | Strong niche market share in adhesive dispensing and precision systems, but smaller scale than PNR |

Pentair shows a durable competitive advantage with growing profitability and balanced diversification, making it a favorable choice for investors prioritizing stable growth. Nordson offers specialized innovation and solid profitability but faces challenges in sustaining ROIC growth, suggesting a need for cautious monitoring.

Risk Analysis

Below is a comparative table of key risks for Pentair plc (PNR) and Nordson Corporation (NDSN) based on the most recent data available from 2024-2025:

| Metric | Pentair plc (PNR) | Nordson Corporation (NDSN) |

|---|---|---|

| Market Risk | Beta 1.214 indicates moderate volatility relative to the market | Beta 1.025 indicates slightly above market volatility |

| Debt Level | Debt-to-equity 0.5 (favorable), debt-to-assets 27.41% (favorable) | Debt-to-equity 0.69 (neutral), debt-to-assets 35.36% (neutral) |

| Regulatory Risk | Moderate, due to global water and industrial equipment regulations | Moderate, impacted by regulations in industrial manufacturing and health sectors |

| Operational Risk | Exposure to supply chain disruptions in water solutions manufacturing | Risk from precision manufacturing complexity and reliance on specialized tech |

| Environmental Risk | Medium, water treatment products sensitive to environmental compliance | Medium, chemical coatings and adhesives require environmental controls |

| Geopolitical Risk | Moderate, global operations including UK base can be affected by trade policies | Moderate, US-based but global sales expose to geopolitical trade tensions |

The most impactful and likely risks are market volatility and moderate debt exposure for both companies. Pentair’s stronger debt metrics and very strong financial health scores reduce financial distress risk. However, Nordson’s slightly higher debt and operational complexity may require closer monitoring amid evolving regulatory and geopolitical landscapes.

Which Stock to Choose?

Pentair plc (PNR) shows a generally favorable income evolution with a 35.29% revenue growth over five years and a strong 74.4% net income increase. Its financial ratios are mostly positive, boasting a 17.55% ROE and 12.52% ROIC, low debt levels, and a very favorable overall rating. The company demonstrates a very favorable economic moat with a growing ROIC exceeding WACC, signaling durable value creation.

Nordson Corporation (NDSN) presents a slightly favorable income profile, with moderate revenue growth of 18.18% and a 6.63% net income rise over five years, though recent EBIT and net margin declines have been noted. Its financial ratios are mixed but lean positive, including a 15.92% ROE and 10.49% ROIC, moderate debt, and a slightly favorable rating. The economic moat is slightly favorable, with ROIC above WACC but a declining trend.

For investors prioritizing consistent value creation and a durable competitive advantage, Pentair’s very favorable rating and improving profitability might appear more attractive. Conversely, those valuing moderate growth with some recent operational challenges may see Nordson as a slightly favorable option, especially if they tolerate some risk associated with declining profitability trends.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Pentair plc and Nordson Corporation to enhance your investment decisions: