In the dynamic world of industrial machinery, Nordson Corporation (NDSN) and Columbus McKinnon Corporation (CMCO) stand out as key players with distinct yet overlapping market focuses. Nordson excels in precision dispensing and coating technologies, while Columbus McKinnon leads in intelligent motion and material handling solutions. Both companies showcase innovation in industrial applications, making them compelling choices for investors seeking exposure to this sector. This article will help you decide which company offers the most promising investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Nordson Corporation and Columbus McKinnon Corporation by providing an overview of these two companies and their main differences.

Nordson Corporation Overview

Nordson Corporation engineers and manufactures precision dispensing and coating systems for adhesives, coatings, and fluids worldwide. Operating through Industrial Precision Solutions and Advanced Technology Solutions, it serves industries such as packaging, paper converting, and semiconductor production. Founded in 1935 and headquartered in Westlake, Ohio, Nordson holds a strong position in the industrial machinery sector with approximately 8,000 employees.

Columbus McKinnon Corporation Overview

Columbus McKinnon Corporation designs and markets intelligent motion solutions for material handling, including hoists, cranes, rigging equipment, and power and motion technology products. Serving diverse sectors like construction, life sciences, and e-commerce, it operates globally with 3,515 employees. Founded in 1875 and based in Buffalo, New York, Columbus McKinnon focuses on agricultural machinery and industrial automation.

Key similarities and differences

Both companies operate in the industrial sector with a focus on machinery, serving global markets and offering engineered solutions. Nordson specializes in precise fluid dispensing and coating systems, while Columbus McKinnon emphasizes material handling and motion control products. Nordson is larger in market capitalization and workforce, reflecting its broader product scope and industrial reach compared to Columbus McKinnon’s niche in lifting and rigging technologies.

Income Statement Comparison

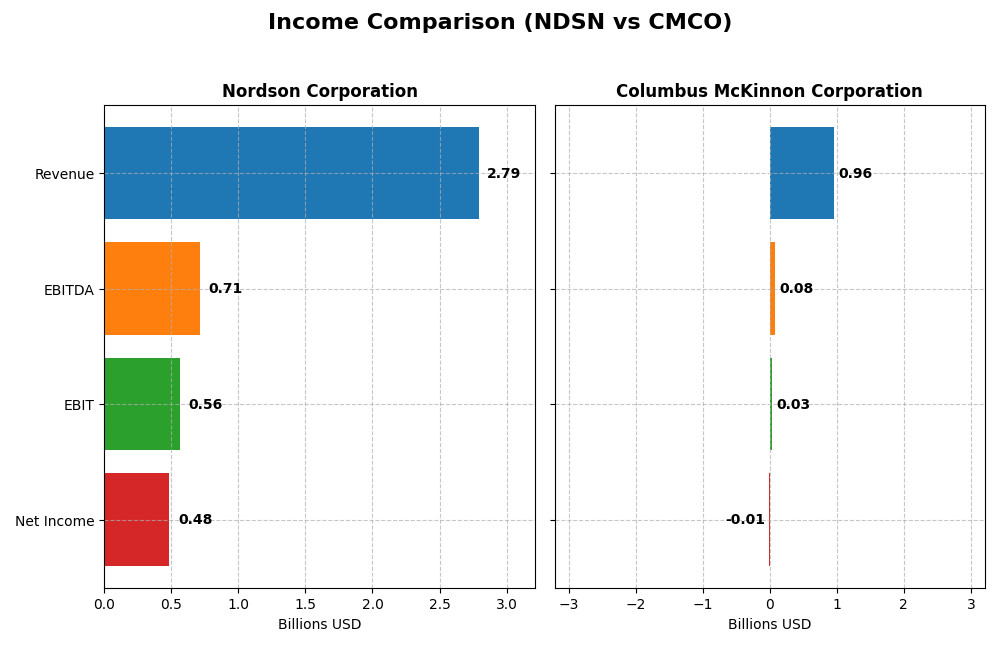

This table compares the most recent fiscal year income statement figures for Nordson Corporation and Columbus McKinnon Corporation, highlighting key financial metrics for investors.

| Metric | Nordson Corporation | Columbus McKinnon Corporation |

|---|---|---|

| Market Cap | 13.5B | 494M |

| Revenue | 2.79B | 963M |

| EBITDA | 712M | 75M |

| EBIT | 561M | 27M |

| Net Income | 484M | -5.1M |

| EPS | 8.56 | -0.18 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Nordson Corporation

Nordson’s revenue showed steady growth from 2.36B in 2021 to 2.79B in 2025, with net income rising moderately from 454M to 484M. Margins remain strong, with a gross margin around 55% and net margin near 17%. The latest year saw revenue growth slow to 3.78%, EBIT declined by 16.79%, but EPS improved by 4.93%, indicating mixed but overall favorable financial health.

Columbus McKinnon Corporation

Columbus McKinnon experienced fluctuating revenue, peaking near 1.01B in 2023 before falling to 963M in 2024. Net income deteriorated sharply, turning negative to -5M in 2024 from a positive 47M in 2023. Margins weakened significantly, with a gross margin of 33.82% but a negative net margin of -0.53%. The latest year showed declines across most metrics, reflecting unfavorable income trends.

Which one has the stronger fundamentals?

Nordson Corporation displays stronger fundamentals with consistent revenue growth, favorable gross and net margins, and positive EPS momentum despite some EBIT pressure. Columbus McKinnon’s income statement reveals volatility, margin contraction, and recent losses, signaling weaker financial stability. Thus, Nordson’s overall income statement evaluations are more favorable compared to Columbus McKinnon’s predominantly unfavorable results.

Financial Ratios Comparison

The table below compares key financial ratios for Nordson Corporation and Columbus McKinnon Corporation based on their most recent fiscal year data.

| Ratios | Nordson Corporation (NDSN) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| ROE | 15.9% | -0.6% |

| ROIC | 10.5% | 3.3% |

| P/E | 27.1 | -94.7 |

| P/B | 4.31 | 0.55 |

| Current Ratio | 1.64 | 1.81 |

| Quick Ratio | 1.05 | 1.04 |

| D/E (Debt-to-Equity) | 0.69 | 0.61 |

| Debt-to-Assets | 35.4% | 31.1% |

| Interest Coverage | 7.04 | 1.68 |

| Asset Turnover | 0.47 | 0.55 |

| Fixed Asset Turnover | 4.70 | 9.07 |

| Payout Ratio | 37.0% | -156.5% |

| Dividend Yield | 1.36% | 1.65% |

Interpretation of the Ratios

Nordson Corporation

Nordson shows a majority of favorable ratios, including a strong net margin of 17.35% and a robust ROE of 15.92%. However, its high P/E of 27.1 and PB of 4.31 are less attractive, signaling potential overvaluation. Its dividend yield is moderate at 1.36%, supported by a balanced payout, with no evident risks from distributions or buybacks.

Columbus McKinnon Corporation

Columbus McKinnon faces challenges with negative net margin (-0.53%) and ROE (-0.58%), indicating profitability issues. Despite favorable valuation multiples like a low PB of 0.55, its interest coverage is weak at 0.83, reflecting risk in debt servicing. The company pays dividends with a 1.65% yield, but its financial health suggests caution.

Which one has the best ratios?

Nordson holds a more favorable overall ratio profile with stronger profitability, solid returns, and manageable debt levels, despite some valuation concerns. Columbus McKinnon’s ratios display mixed signals, with weaker profitability and interest coverage offset by attractive valuation metrics. Nordson’s financial stability and returns generally outweigh Columbus McKinnon’s vulnerabilities.

Strategic Positioning

This section compares the strategic positioning of Nordson Corporation and Columbus McKinnon Corporation, including market position, key segments, and exposure to technological disruption:

Nordson Corporation

- Large market cap $13.5B, moderate beta 1.02, faces industrial machinery competition.

- Diverse segments: Industrial Precision, Advanced Technology, and Medical & Fluid Solutions driving growth.

- Advanced dispensing and coating systems, with some exposure to automated inspection and plasma treatment technologies.

Columbus McKinnon Corporation

- Smaller market cap $494M, higher beta 1.29, active in agricultural machinery sector.

- Focus on hoists, conveyors, digital power controls, and crane systems across multiple industries.

- Exposure to motion control, automation, and power delivery technologies with moderate innovation scope.

Nordson Corporation vs Columbus McKinnon Corporation Positioning

Nordson shows a diversified industrial technology portfolio spanning adhesives, coatings, and medical devices, supporting broader market reach. Columbus McKinnon concentrates on material handling and lifting solutions, focusing on niche industrial applications with less diversification but specialized products.

Which has the best competitive advantage?

Nordson is creating value with ROIC above WACC but with declining profitability, showing a slightly favorable moat. Columbus McKinnon is shedding value with ROIC below WACC despite improving profitability, resulting in a slightly unfavorable moat.

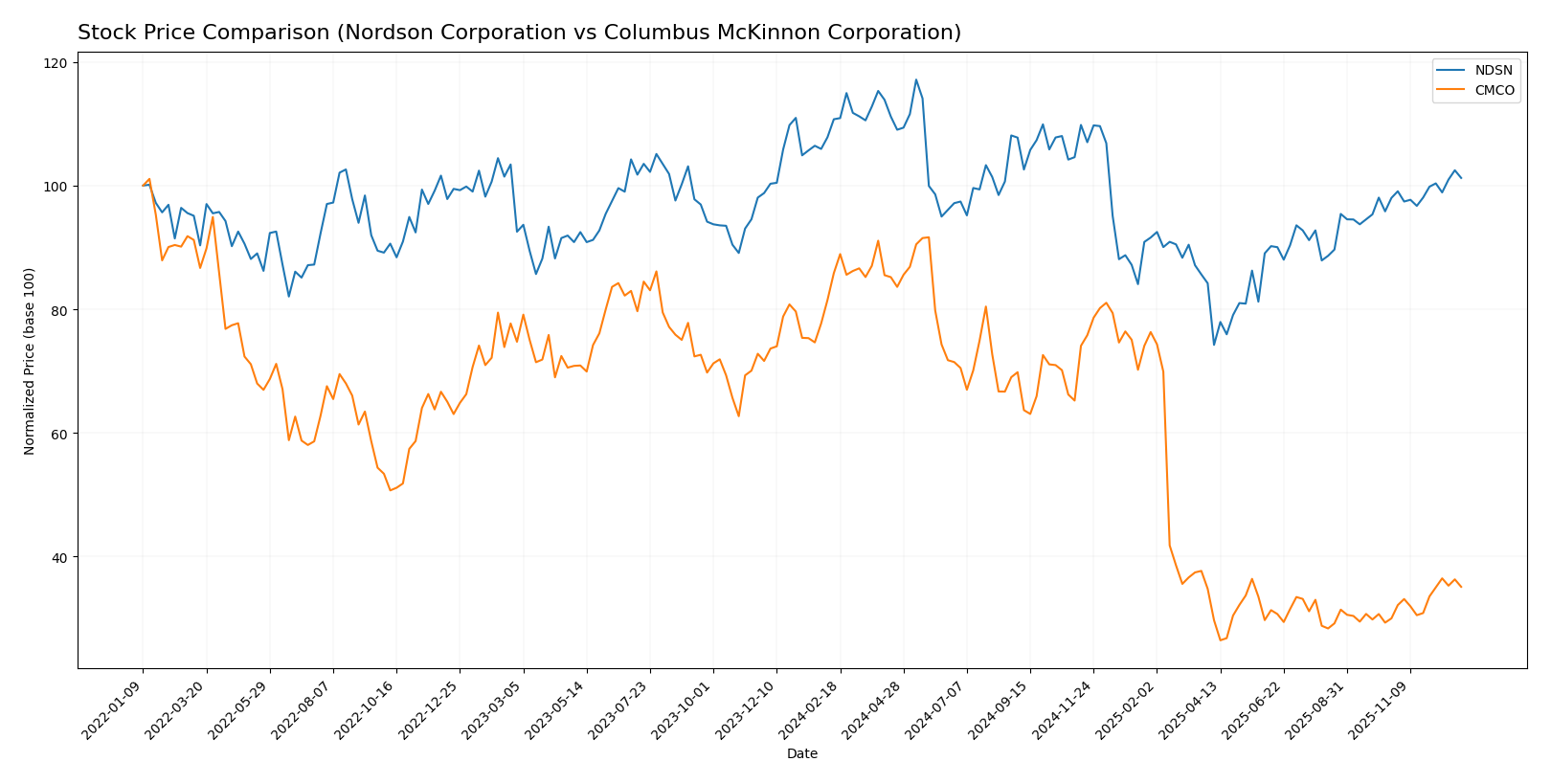

Stock Comparison

The stock prices of Nordson Corporation and Columbus McKinnon Corporation have demonstrated distinct bearish trends over the past 12 months, with notable recent recoveries indicating shifts in trading momentum.

Trend Analysis

Nordson Corporation’s stock experienced a bearish trend over the past year, declining by 8.57% with accelerating downward momentum and a high volatility level (std deviation 23.48). The stock showed a recent bullish reversal, rising 3.3% between October 2025 and January 2026.

Columbus McKinnon Corporation’s stock also followed a bearish trend, falling sharply by 59.11% over the year with accelerating losses and moderate volatility (std deviation 11.28). Its recent trend shows a stronger bullish rebound of 17.01%, albeit with lower volatility (std deviation 1.07).

Comparing the two, Columbus McKinnon’s stock has delivered the lowest market performance over the past year but exhibited a more pronounced recent recovery than Nordson.

Target Prices

The current analyst consensus for Nordson Corporation and Columbus McKinnon Corporation indicates potential upside from their current stock prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Nordson Corporation | 295 | 240 | 274.17 |

| Columbus McKinnon Corporation | 50 | 48 | 49 |

Analysts expect Nordson’s price to rise moderately above its current 241.03 USD, while Columbus McKinnon’s target consensus far exceeds its current 17.2 USD price, implying significant upside potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Nordson Corporation and Columbus McKinnon Corporation:

Rating Comparison

NDSN Rating

- Rating: B+, evaluated as Very Favorable

- Discounted Cash Flow Score: 4, Favorable

- ROE Score: 4, Favorable

- ROA Score: 4, Favorable

- Debt To Equity Score: 2, Moderate

- Overall Score: 3, Moderate

CMCO Rating

- Rating: B, evaluated as Very Favorable

- Discounted Cash Flow Score: 5, Very Favorable

- ROE Score: 1, Very Unfavorable

- ROA Score: 2, Moderate

- Debt To Equity Score: 2, Moderate

- Overall Score: 3, Moderate

Which one is the best rated?

Based solely on the provided data, NDSN holds a higher overall rating (B+) with favorable scores in ROE and ROA. CMCO has a slightly better discounted cash flow score but much weaker profitability metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Nordson Corporation and Columbus McKinnon Corporation:

NDSN Scores

- Altman Z-Score: 4.9, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial health.

CMCO Scores

- Altman Z-Score: 1.4, indicating a distress zone with high bankruptcy risk.

- Piotroski Score: 8, reflecting very strong financial health.

Which company has the best scores?

Based on the data, NDSN has a significantly higher Altman Z-Score, indicating lower bankruptcy risk, while CMCO has a higher Piotroski Score, showing stronger financial health. Each company excels in one score category.

Grades Comparison

Here is the detailed grades comparison for Nordson Corporation and Columbus McKinnon Corporation:

Nordson Corporation Grades

The following table shows recent grades assigned to Nordson Corporation by reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Buy | 2025-12-12 |

| Baird | Maintain | Neutral | 2025-12-12 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| DA Davidson | Maintain | Buy | 2025-12-11 |

| Oppenheimer | Maintain | Outperform | 2025-08-25 |

| Baird | Maintain | Neutral | 2025-08-22 |

| Keybanc | Maintain | Overweight | 2025-07-15 |

| Baird | Maintain | Neutral | 2025-05-30 |

| Oppenheimer | Upgrade | Outperform | 2025-05-30 |

| Keybanc | Maintain | Overweight | 2025-04-08 |

Nordson’s recent grades trend mostly shows stability with consistent Buy, Overweight, and Outperform ratings, indicating a positive outlook from analysts.

Columbus McKinnon Corporation Grades

Below are the latest grades given to Columbus McKinnon Corporation by recognized grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Downgrade | Neutral | 2025-02-11 |

| DA Davidson | Maintain | Buy | 2024-02-05 |

| DA Davidson | Maintain | Buy | 2022-10-04 |

| DA Davidson | Maintain | Buy | 2022-10-03 |

| Barrington Research | Maintain | Outperform | 2022-07-29 |

| Barrington Research | Maintain | Outperform | 2022-07-28 |

| JP Morgan | Downgrade | Neutral | 2022-05-26 |

| Barrington Research | Maintain | Outperform | 2022-05-26 |

| Barrington Research | Maintain | Outperform | 2022-05-25 |

| JP Morgan | Downgrade | Neutral | 2022-05-25 |

Columbus McKinnon’s grades show a recent downgrade to Neutral from Buy and Overweight ratings, reflecting a more cautious stance from analysts compared to earlier optimism.

Which company has the best grades?

Nordson Corporation generally holds stronger and more consistent Buy, Overweight, and Outperform grades compared to Columbus McKinnon’s recent Neutral downgrades. This suggests Nordson’s evaluations are more favorable, which may influence investor confidence and portfolio decisions accordingly.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Nordson Corporation (NDSN) and Columbus McKinnon Corporation (CMCO) based on their latest financial and operational data.

| Criterion | Nordson Corporation (NDSN) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Diversification | Highly diversified with strong segments in Industrial Precision Solutions (1.48B), Medical and Fluid Solutions (695M), and Advanced Technology Systems (510M) | Moderately diversified with key products including Hoists (480M), High Precision Conveyors (155M), and Digital Power Control (110M) |

| Profitability | Strong profitability: net margin 17.35%, ROE 15.92%, ROIC 10.49% | Poor profitability: negative net margin (-0.53%) and ROE (-0.58%), though ROIC is positive but low (3.3%) |

| Innovation | Moderate innovation indicated by stable advanced technology revenues and favorable ROIC above WACC | Innovation improving, supported by growing ROIC trend (+67%) despite current value destruction |

| Global presence | Established global presence with broad industrial applications | Strong U.S. industrial market presence, but less diversified internationally |

| Market Share | Solid market share in precision systems and medical fluid markets | Significant presence in hoists and conveyor markets but under pressure due to profitability issues |

Key takeaways: Nordson stands out for its diversified revenue streams and strong profitability, though its ROIC is declining. Columbus McKinnon shows potential with an improving ROIC trend but currently suffers from weak profitability and value destruction. Investors should weigh Nordson’s stability against Columbus McKinnon’s turnaround prospects.

Risk Analysis

Below is a comparative table summarizing key risks for Nordson Corporation (NDSN) and Columbus McKinnon Corporation (CMCO) in 2025-2026:

| Metric | Nordson Corporation (NDSN) | Columbus McKinnon Corporation (CMCO) |

|---|---|---|

| Market Risk | Moderate (Beta 1.02) stable industrial demand | Higher (Beta 1.29) volatile with wider price range |

| Debt level | Moderate leverage (D/E 0.69, debt/assets 35%) | Moderate leverage (D/E 0.61, debt/assets 31%) |

| Regulatory Risk | Moderate, industrial regulations primarily US-based | Moderate, exposure to safety and environmental standards globally |

| Operational Risk | Moderate, diverse product lines but favorable fixed asset turnover | Moderate to high, weaker profitability and interest coverage ratio (0.83) |

| Environmental Risk | Moderate, industrial coatings and materials handling involve chemicals | Moderate, material handling and lifting equipment with environmental compliance needs |

| Geopolitical Risk | Low to moderate, US-based with global sales | Low to moderate, US-based but with exposure to international markets |

Nordson’s most impactful risk is market sensitivity reflected in its valuation multiples, despite strong operational metrics and low bankruptcy risk (Altman Z-Score 4.9 safe zone). Columbus McKinnon faces higher operational and financial stress, evidenced by negative profitability, low interest coverage, and a distress-zone Altman Z-Score (1.4), increasing bankruptcy risk. Investors should weigh NDSN’s stable fundamentals against CMCO’s financial fragility and market volatility.

Which Stock to Choose?

Nordson Corporation (NDSN) shows a generally favorable income evolution with solid profitability metrics, including a 17.35% net margin and a 15.92% ROE. Its financial ratios are mostly positive, though some valuation multiples appear elevated. Debt levels are moderate with a neutral assessment, and the company holds a very favorable B+ rating.

Columbus McKinnon Corporation (CMCO) presents an unfavorable income statement trend marked by negative net margin and ROE. Despite some favorable liquidity ratios and valuation metrics, its profitability and interest coverage are weak, and its debt remains a concern. The overall rating is very favorable B, reflecting mixed financial health.

For investors, NDSN’s strong profitability and value-creating moat might appear more suitable for those seeking quality and moderate growth, while CMCO’s improving ROIC trend but weaker profitability could be interpreted as more fitting for risk-tolerant investors focused on potential turnaround opportunities.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Nordson Corporation and Columbus McKinnon Corporation to enhance your investment decisions: