In the dynamic landscape of media and entertainment, Warner Bros. Discovery, Inc. (WBD) and News Corporation (NWSA) stand out as influential players shaping content consumption worldwide. Both headquartered in New York, these giants overlap in digital media, streaming, and news services, yet follow distinct innovation strategies within the communication sector. This article will help you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Warner Bros. Discovery, Inc. and News Corporation by providing an overview of these two companies and their main differences.

Warner Bros. Discovery Overview

Warner Bros. Discovery, Inc. operates as a global media and entertainment company focused on producing and distributing content through its Studios, Network, and Direct-to-Consumer (DTC) segments. It offers a diverse portfolio of brands and franchises across television, film, streaming, and gaming, including HBO, DC, and Discovery Channel. Headquartered in New York, WBD aims to deliver premium entertainment experiences worldwide.

News Corporation Overview

News Corporation is a media and information services company creating and distributing content across multiple platforms, including newspapers, digital media, and subscription services. Its operations span six segments, such as News Media, Digital Real Estate Services, and Book Publishing. The company owns notable publications like The Wall Street Journal and The Times and is headquartered in New York, focusing on authoritative content and data products.

Key similarities and differences

Both companies operate in the communication services sector and are headquartered in New York City with strong media presences. WBD focuses on entertainment content production and streaming services, while News Corp emphasizes news media, publishing, and data services. WBD’s business model centers on content creation and direct consumer engagement, whereas News Corp integrates traditional and digital news distribution with diversified information services.

Income Statement Comparison

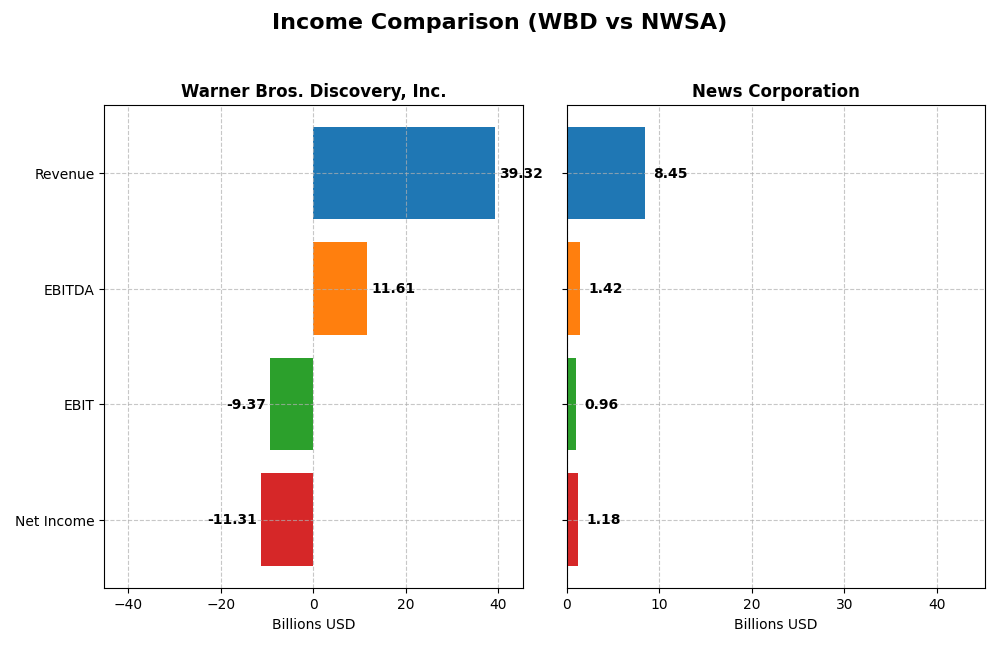

The table below compares the latest available income statement figures for Warner Bros. Discovery, Inc. and News Corporation, highlighting key financial metrics for their respective most recent fiscal years.

| Metric | Warner Bros. Discovery, Inc. (WBD) | News Corporation (NWSA) |

|---|---|---|

| Market Cap | 70.4B USD | 15.0B USD |

| Revenue | 39.3B USD | 8.5B USD |

| EBITDA | 11.6B USD | 1.4B USD |

| EBIT | -9.4B USD | 956M USD |

| Net Income | -11.3B USD | 1.18B USD |

| EPS | -4.62 USD | 2.08 USD |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Warner Bros. Discovery, Inc.

From 2020 to 2024, Warner Bros. Discovery’s revenue grew significantly by 268.48%, but net income declined sharply by over 1,000%, resulting in a net loss of $11.3B in 2024. Gross margin remained relatively stable at 41.58%, yet operating and net margins turned deeply negative. The latest year showed revenue and profitability deteriorating, with a 4.84% revenue drop and a worsening net margin.

News Corporation

News Corporation’s revenue declined by 9.68% over the 2021-2025 period, yet net income rose by 257.58%, reaching $1.18B in 2025. The company maintained a perfect gross margin of 100% and improved its EBIT margin to 11.31%. The most recent fiscal year saw modest revenue growth of 2.42% and strong increases in EBIT and net margin, indicating improving profitability.

Which one has the stronger fundamentals?

News Corporation exhibits stronger fundamentals with a favorable global income statement evaluation, driven by consistent profitability, margin improvements, and net income growth. Warner Bros. Discovery, despite revenue growth, faces significant profitability challenges and unfavorable margin trends. These contrasting profiles highlight News Corporation’s more stable and improving income statement compared to Warner Bros. Discovery’s ongoing losses.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Warner Bros. Discovery, Inc. (WBD) and News Corporation (NWSA) based on their most recent fiscal year data.

| Ratios | Warner Bros. Discovery, Inc. (WBD) (2024) | News Corporation (NWSA) (2025) |

|---|---|---|

| ROE | -33.23% | 13.45% |

| ROIC | -11.00% | 5.16% |

| P/E | -2.29 | 14.30 |

| P/B | 0.76 | 1.92 |

| Current Ratio | 0.89 | 1.84 |

| Quick Ratio | 0.89 | 1.72 |

| D/E | 1.26 | 0.34 (Debt to Capital) |

| Debt-to-Assets | 41.13% | 18.96% |

| Interest Coverage | -4.97 | 95.60 |

| Asset Turnover | 0.38 | 0.55 |

| Fixed Asset Turnover | 6.46 | 3.99 |

| Payout ratio | 0 | 15.68% |

| Dividend yield | 0 | 1.10% |

Interpretation of the Ratios

Warner Bros. Discovery, Inc.

Warner Bros. Discovery’s financial ratios reveal significant weaknesses, with unfavorable net margin (-28.77%), return on equity (-33.23%), and return on invested capital (-11.0%). The company also shows a low current ratio (0.89) and negative interest coverage, signaling liquidity and solvency concerns. Warner Bros. Discovery does not pay dividends, likely reflecting ongoing losses and a focus on operational restructuring.

News Corporation

News Corporation presents stronger financial ratios overall, including a favorable net margin of 13.96% and a solid current ratio of 1.84, indicating better liquidity. The company’s debt levels are conservative with a debt-to-equity ratio of 0.34 and strong interest coverage at 95.6. News Corporation pays a modest dividend with a 1.1% yield, supported by stable earnings and manageable payout risk.

Which one has the best ratios?

News Corporation clearly exhibits superior financial health with predominantly favorable ratios, including profitability, liquidity, and leverage metrics. In contrast, Warner Bros. Discovery struggles with multiple unfavorable ratios and negative profitability indicators. The overall ratio evaluations strongly favor News Corporation as the financially stronger entity of the two.

Strategic Positioning

This section compares the strategic positioning of Warner Bros. Discovery and News Corporation, including market position, key segments, and exposure to technological disruption:

Warner Bros. Discovery

- Larger market cap of 70B USD with higher beta, facing intense entertainment competition

- Operates Studios, Network, DTC segments; revenue driven by distribution, advertising, licensing

- Exposure to disruption through streaming, digital distribution, and gaming innovations

News Corporation

- Smaller market cap of 15B USD with moderate beta, competing in media and information services

- Six segments: Digital Real Estate, Dow Jones, News Media, Subscription Video, Book Publishing

- Faces disruption in digital content delivery and subscription video services

Warner Bros. Discovery vs News Corporation Positioning

Warner Bros. Discovery adopts a diversified media entertainment approach with studios, TV networks, and streaming, while News Corporation focuses on diversified media, publishing, and digital real estate. Warner Bros. Discovery benefits from scale but faces rapid industry shifts; News Corp’s varied segments offer resilience but with smaller scale.

Which has the best competitive advantage?

Both companies are shedding value as ROIC is below WACC; however, News Corporation shows improving profitability with a growing ROIC trend, while Warner Bros. Discovery experiences a declining ROIC, indicating weaker competitive advantage.

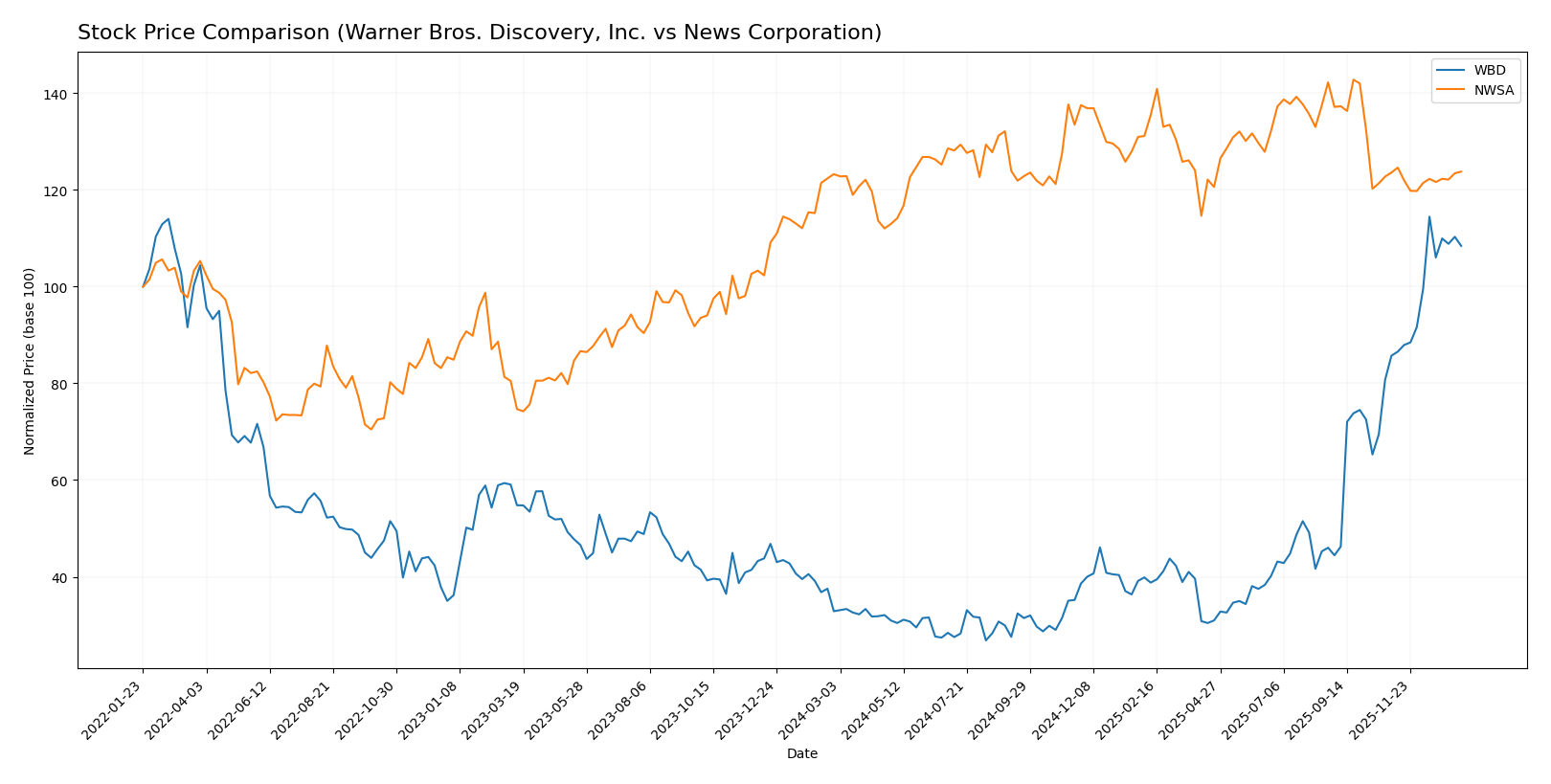

Stock Comparison

The stock price chart highlights significant bullish momentum for Warner Bros. Discovery, Inc. (WBD) over the past year, contrasted with a largely neutral trend for News Corporation (NWSA), reflecting differing trading dynamics and volume patterns.

Trend Analysis

Warner Bros. Discovery, Inc. (WBD) exhibited a strong bullish trend with a 229.85% price increase over the past 12 months, showing acceleration and a high volatility level (std dev 6.02). The stock reached a peak of 29.98 and a low of 7.03.

News Corporation (NWSA) recorded a marginal 0.42% price increase over the same period, indicating a neutral trend with deceleration and lower volatility (std dev 1.5). Its price fluctuated between 24.02 and 30.62.

Comparatively, WBD has delivered substantially higher market performance than NWSA, reflecting stronger bullish momentum and greater investor demand during the analyzed period.

Target Prices

The analyst consensus presents a balanced outlook for Warner Bros. Discovery, Inc. and News Corporation with defined high and low target prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Warner Bros. Discovery, Inc. | 29.5 | 16 | 23.68 |

| News Corporation | 45 | 16 | 33.33 |

Overall, Warner Bros. Discovery’s consensus target price is slightly below its current stock price of 28.4 USD, suggesting limited upside. News Corporation’s consensus target of 33.33 USD indicates a moderately bullish expectation compared to its 26.54 USD current price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Warner Bros. Discovery, Inc. (WBD) and News Corporation (NWSA):

Rating Comparison

WBD Rating

- Rating: B- with a very favorable status overall.

- Discounted Cash Flow Score: 3, indicating moderate valuation.

- ROE Score: 2, showing moderate efficiency in generating profit from equity.

- ROA Score: 2, moderate effectiveness in asset utilization.

- Debt To Equity Score: 4, favorable financial risk profile.

- Overall Score: 3, moderate overall financial standing.

NWSA Rating

- Rating: B+ with a very favorable status overall.

- Discounted Cash Flow Score: 3, indicating moderate valuation.

- ROE Score: 4, showing favorable efficiency in generating profit from equity.

- ROA Score: 5, very favorable effectiveness in asset utilization.

- Debt To Equity Score: 2, moderate financial risk profile.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

Based strictly on the data, NWSA holds a higher rating (B+) compared to WBD’s B-. NWSA outperforms WBD notably in ROE and ROA scores, while WBD shows a stronger debt-to-equity score. Overall scores are equal.

Scores Comparison

Here is a comparison of the financial scores for Warner Bros. Discovery, Inc. (WBD) and News Corporation (NWSA):

WBD Scores

- Altman Z-Score: 0.88, in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

NWSA Scores

- Altman Z-Score: 2.35, in the grey zone with moderate bankruptcy risk.

- Piotroski Score: 7, classified as strong financial health.

Which company has the best scores?

NWSA’s Altman Z-Score places it in a safer financial position than WBD, which is in distress. However, WBD has a slightly higher Piotroski Score, indicating stronger financial health by that metric.

Grades Comparison

Here is the grades comparison for Warner Bros. Discovery, Inc. and News Corporation based on recent analyst ratings:

Warner Bros. Discovery, Inc. Grades

The following table summarizes recent grades assigned by reputable grading companies for Warner Bros. Discovery, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Seaport Global | Downgrade | Neutral | 2025-12-09 |

| Benchmark | Maintain | Buy | 2025-12-08 |

| Barrington Research | Downgrade | Market Perform | 2025-12-05 |

| Barrington Research | Maintain | Outperform | 2025-11-14 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

| Rothschild & Co | Upgrade | Buy | 2025-10-30 |

| Argus Research | Upgrade | Buy | 2025-10-28 |

| Barrington Research | Maintain | Outperform | 2025-10-28 |

| Benchmark | Maintain | Buy | 2025-10-22 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-16 |

Overall, Warner Bros. Discovery exhibits a mixed trend with several downgrades to neutral or market perform but retains multiple buy and outperform ratings.

News Corporation Grades

The following table summarizes recent grades assigned by reputable grading companies for News Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-11-25 |

| Guggenheim | Maintain | Buy | 2025-11-13 |

| JP Morgan | Maintain | Overweight | 2025-08-20 |

| Macquarie | Downgrade | Neutral | 2025-08-06 |

| Morgan Stanley | Maintain | Overweight | 2025-04-11 |

| UBS | Upgrade | Buy | 2025-02-04 |

| Guggenheim | Maintain | Buy | 2025-01-22 |

| Loop Capital | Maintain | Buy | 2024-12-23 |

| Loop Capital | Maintain | Buy | 2024-12-09 |

| Guggenheim | Maintain | Buy | 2024-11-12 |

News Corporation shows a predominantly positive rating trend with multiple buy and overweight grades, and only one downgrade to neutral.

Which company has the best grades?

News Corporation has received generally stronger and more consistent positive grades, including multiple buy and overweight ratings, compared to Warner Bros. Discovery’s mixed ratings with downgrades. This difference may influence investors seeking stocks with stronger analyst conviction.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses of Warner Bros. Discovery, Inc. (WBD) and News Corporation (NWSA) based on their most recent financial and operational data:

| Criterion | Warner Bros. Discovery, Inc. (WBD) | News Corporation (NWSA) |

|---|---|---|

| Diversification | Moderate: Focus on advertising, distribution, and content licensing; limited recent expansion | High: Diverse segments including digital real estate, news, subscription video, and publishing |

| Profitability | Weak: Negative net margin (-28.77%), negative ROIC (-11%), value destroying | Strong: Positive net margin (13.96%), positive ROIC (5.16%), value improving |

| Innovation | Limited evidence of innovation; declining ROIC trend (-274.9%) | Moderate: Growing ROIC (38.4%) signals improving efficiency and potential innovation |

| Global presence | Strong US and international networks but recent value destruction | Strong international footprint with multiple revenue streams |

| Market Share | Significant in media distribution but challenged by profitability issues | Solid in news and digital services with steady revenue growth |

Key takeaways: Warner Bros. Discovery struggles with profitability and value creation despite a broad media presence, signaling caution. News Corporation shows improving profitability and operational efficiency, benefiting from diverse revenue sources and a more favorable financial profile.

Risk Analysis

Below is a summary table presenting key risk factors for Warner Bros. Discovery, Inc. (WBD) and News Corporation (NWSA) based on the most recent data available from 2025-2026:

| Metric | Warner Bros. Discovery, Inc. (WBD) | News Corporation (NWSA) |

|---|---|---|

| Market Risk | High beta (1.572) indicates higher volatility | Moderate beta (0.974), lower volatility |

| Debt level | Elevated debt-to-equity (1.26) and interest coverage negative (-4.65) | Low debt-to-equity (0.34), strong interest coverage (95.6) |

| Regulatory Risk | Moderate, media industry subject to content regulation changes | Moderate, global media regulation exposure |

| Operational Risk | Negative net margin (-28.77%) and ROE (-33.23%) indicate operational challenges | Positive net margin (13.96%) and stable ROE (13.45%) |

| Environmental Risk | Moderate, industry impact from sustainability pressures | Moderate, traditional media with increasing digital footprint |

| Geopolitical Risk | Exposure due to global content distribution and streaming | Exposure through international news and publishing operations |

Warner Bros. Discovery faces significant operational and financial risks due to its negative profitability and high leverage, while News Corporation presents a more stable financial profile with moderate market and regulatory risks. The most impactful risk for WBD is its financial distress indicated by a low Altman Z-score (0.88), suggesting potential bankruptcy risk, whereas NWSA remains in a grey zone with a healthier balance sheet.

Which Stock to Choose?

Warner Bros. Discovery, Inc. (WBD) shows a mixed income evolution with a strong revenue growth of 268% over 2020-2024 but unfavorable net margin and profitability ratios, including a negative ROE of -33.23%. Its financial ratios are mostly unfavorable, reflecting weak liquidity and profitability, while its debt level is relatively high. The company holds a very favorable rating of B- despite these challenges.

News Corporation (NWSA) presents a favorable income statement with positive net margin of 13.96% and improving profitability metrics, including a neutral to favorable ROE of 13.45%. Financial ratios are generally favorable with solid liquidity and low debt. NWSA’s rating is slightly higher at B+, supported by its stronger financial health and moderate valuation ratios.

For investors seeking growth potential, WBD’s accelerating bullish price trend and strong revenue growth might appear attractive despite its financial weaknesses. Conversely, NWSA’s more stable profitability and favorable financial ratios could be more suitable for risk-averse investors prioritizing quality and financial stability. The differing profiles of these companies suggest the choice may depend on an investor’s risk tolerance and strategic focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Warner Bros. Discovery, Inc. and News Corporation to enhance your investment decisions: