In today’s dynamic entertainment sector, TKO Group Holdings, Inc. (TKO) and News Corporation (NWSA) stand out as influential players shaping media and content consumption worldwide. Both companies operate within the communication services industry, leveraging diverse platforms and innovative strategies to engage global audiences. This comparison explores their market positions and growth potential, helping you decide which company holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between TKO Group Holdings, Inc. and News Corporation by providing an overview of these two companies and their main differences.

TKO Group Holdings, Inc. Overview

TKO Group Holdings, Inc. operates as a sports and entertainment company focusing on media and content, live events, sponsorships, and consumer products licensing. It produces diverse video content across broadcast, pay television, streaming, and digital platforms in about 170 countries. The company also engages in merchandising and corporate sponsorships, offering advertising and content integration services. TKO is a subsidiary of Endeavor Group Holdings, based in New York City.

News Corporation Overview

News Corporation is a media and information services company delivering authoritative content and products globally. It operates across six segments, including digital real estate, subscription video, news media, book publishing, and more. The company distributes content via newspapers, websites, mobile apps, and other channels, owning several major newspapers and digital mastheads. Headquartered in New York City, News Corp also provides financial, property advertising, and sports broadcasting services.

Key similarities and differences

Both TKO and News Corp operate in the communication services sector, producing and distributing media content globally. TKO specializes in sports entertainment with a focus on live events and merchandising, while News Corp covers a broader media spectrum including news, publishing, real estate services, and subscription video. TKO has a smaller workforce and is a subsidiary, whereas News Corp is a larger, independent entity with diversified media and information offerings.

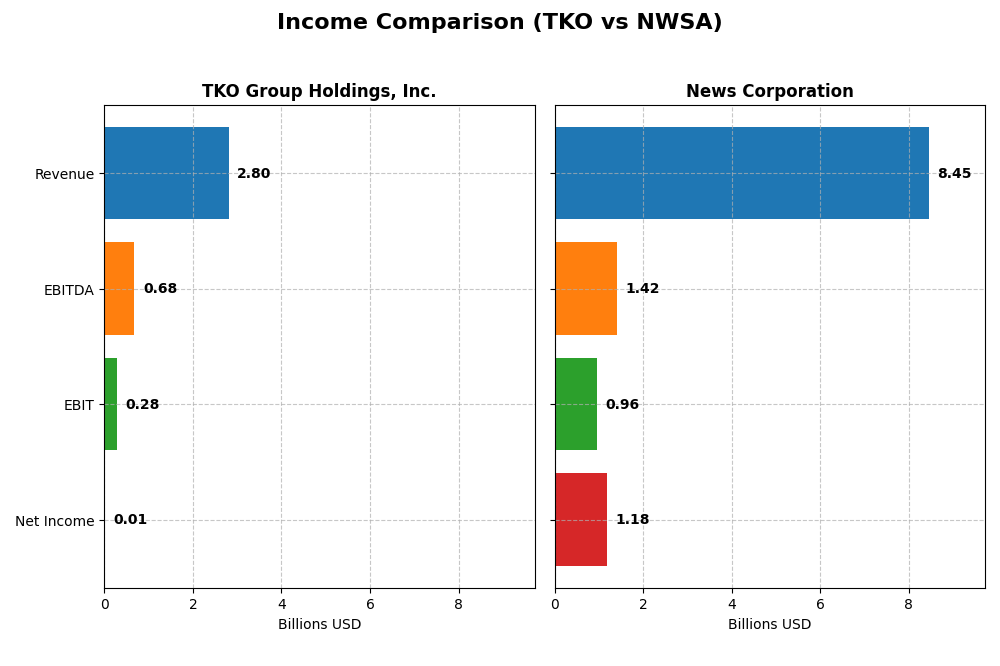

Income Statement Comparison

This table provides a side-by-side comparison of key income statement metrics for TKO Group Holdings, Inc. and News Corporation for their most recent fiscal years.

| Metric | TKO Group Holdings, Inc. | News Corporation |

|---|---|---|

| Market Cap | 16.2B | 15.0B |

| Revenue | 2.8B | 8.5B |

| EBITDA | 676M | 1.4B |

| EBIT | 283M | 956M |

| Net Income | 9.4M | 1.18B |

| EPS | 0.12 | 2.08 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

TKO Group Holdings, Inc.

TKO’s revenue grew significantly by 187.9% from 2020 to 2024, reaching $2.8B in 2024, but net income declined sharply over the same period, turning positive at $9.4M in 2024 after a loss in 2023. Gross margin remained strong at 53.9%, while EBIT margin dropped to 10.11%. The latest year showed strong revenue and gross profit growth, but EBIT declined by 36.5%.

News Corporation

News Corp’s revenue slightly declined by 9.7% over 2021-2025, standing at $8.45B in 2025, while net income rose substantially to $1.18B. Margins were consistently favorable, with a 100% gross margin and a 13.96% net margin in 2025. The most recent year showed modest revenue growth of 2.4%, but notable improvements in EBIT and net margin, reflecting profitable operational leverage.

Which one has the stronger fundamentals?

News Corporation demonstrates stronger fundamentals with consistent profitability, high and stable gross margins, and significant net income growth over the period. TKO shows impressive revenue expansion but struggles with profitability and margin volatility, especially in EBIT and net income. News Corp’s margin stability and net income growth outweigh TKO’s revenue gains when assessing fundamental strength.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for TKO Group Holdings, Inc. and News Corporation, based on their most recent fiscal year data.

| Ratios | TKO Group Holdings, Inc. (2024) | News Corporation (2025) |

|---|---|---|

| ROE | 0.23% | 13.45% |

| ROIC | 1.28% | 5.16% |

| P/E | 1228.66 | 14.30 |

| P/B | 2.83 | 1.92 |

| Current Ratio | 1.30 | 1.84 |

| Quick Ratio | 1.30 | 1.72 |

| D/E (Debt-to-Equity) | 0.74 | 0.34 |

| Debt-to-Assets | 23.90% | 18.96% |

| Interest Coverage | 3.11 | 95.60 |

| Asset Turnover | 0.22 | 0.55 |

| Fixed Asset Turnover | 3.48 | 3.99 |

| Payout Ratio | 7.15% | 15.68% |

| Dividend Yield | 0.58% | 1.10% |

Interpretation of the Ratios

TKO Group Holdings, Inc.

TKO exhibits several weak financial ratios, including a very low net margin of 0.34% and a ROE of just 0.23%, both unfavorable. The company’s high P/E ratio of 1228.66 signals overvaluation risk, while its debt-to-assets ratio at 23.9% is favorable. The dividend yield is low at 0.58%, with potential concerns on payout sustainability given mixed free cash flow. TKO pays dividends, but coverage by free cash flow is weak, hinting at cautious dividend maintenance.

News Corporation

News Corporation shows strong financial ratios, with a favorable net margin of 13.96% and a solid P/E of 14.3. The company benefits from a high interest coverage ratio of 95.6, indicating robust debt service capacity. Its current and quick ratios are also favorable, reflecting good liquidity. News Corp pays dividends with a 1.1% yield, supported by stable cash flows and manageable payout levels, maintaining shareholder returns steadily.

Which one has the best ratios?

Between the two, News Corporation presents a more favorable overall ratio profile, with 64.29% of its ratios rated favorable and no unfavorable ones, indicating better profitability, liquidity, and debt management. In contrast, TKO’s ratios skew slightly unfavorable, with half of them weak, suggesting more financial risk and operational challenges relative to News Corp.

Strategic Positioning

This section compares the strategic positioning of TKO Group Holdings, Inc. and News Corporation, including their market position, key segments, and exposure to technological disruption:

TKO Group Holdings, Inc.

- Operates globally in sports and entertainment with low beta, facing moderate competitive pressure.

- Four segments: Media and Content, Live Events, Sponsorships, Consumer Products Licensing.

- Operates across broadcast, pay TV, streaming, and digital media with merchandising and advertising.

News Corporation

- Large media and information services company with diverse media presence, moderate competitive pressure.

- Six segments including Digital Real Estate, Dow Jones, Subscription Video, Book Publishing, News Media.

- Broad digital and print content distribution, with strong presence in newspapers, digital real estate, and subscription services.

TKO Group Holdings, Inc. vs News Corporation Positioning

TKO focuses on a concentrated portfolio in sports and entertainment, emphasizing live events and content licensing, while News Corp maintains a diversified media and information services portfolio across multiple segments. TKO benefits from niche specialization; News Corp leverages broad market coverage.

Which has the best competitive advantage?

Both companies currently shed value as ROIC is below WACC. TKO has a very unfavorable moat with declining profitability, whereas News Corp shows improving ROIC trends despite slight unfavorable moat status, indicating a more resilient competitive position.

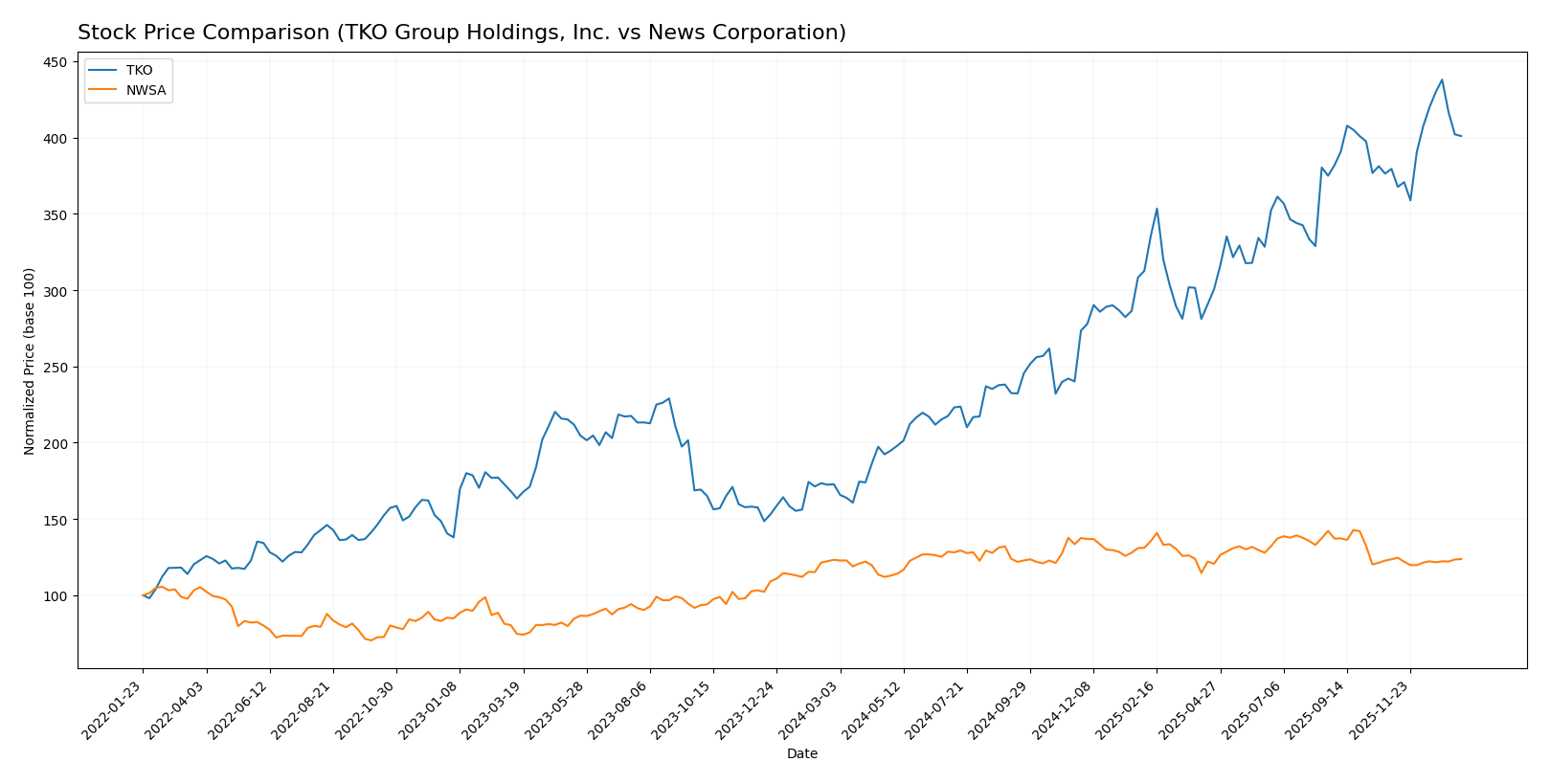

Stock Comparison

The stock price movements over the past year reveal distinct trading dynamics, with TKO Group Holdings exhibiting strong gains and acceleration, while News Corporation shows a marginal increase and deceleration in trend.

Trend Analysis

TKO Group Holdings, Inc. recorded a robust 132.01% price increase over the past 12 months, indicating a bullish trend with acceleration. The stock ranged from a low of 79.79 to a high of 217.44, with notable volatility at a 36.57 std deviation.

News Corporation showed a slight 0.42% price increase over the same period, qualifying as a bullish but decelerating trend. Price fluctuated between 24.02 and 30.62, with low volatility reflected by a 1.5 std deviation.

Comparing both, TKO delivered the highest market performance with significant appreciation and volatility, whereas News Corp remained nearly flat with minimal gains.

Target Prices

The current analyst consensus shows promising upside potential for TKO Group Holdings, Inc. and News Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| TKO Group Holdings, Inc. | 250 | 210 | 228.1 |

| News Corporation | 45 | 16 | 33.33 |

Analysts expect TKO’s stock price to rise above its current $199.09, indicating moderate growth potential. News Corporation’s consensus target of $33.33 also suggests upside from the current $26.54 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for TKO Group Holdings, Inc. and News Corporation:

Rating Comparison

TKO Rating

- Rating: B-, considered very favorable overall.

- Discounted Cash Flow Score: 4, favorable valuation based on future cash flows.

- ROE Score: 3, moderate efficiency in generating profit from equity.

- ROA Score: 3, moderate effectiveness in asset utilization.

- Debt To Equity Score: 2, moderate financial risk.

- Overall Score: 2, moderate financial standing.

NWSA Rating

- Rating: B+, considered very favorable overall.

- Discounted Cash Flow Score: 3, moderate valuation based on future cash flows.

- ROE Score: 4, favorable efficiency in generating profit from equity.

- ROA Score: 5, very favorable effectiveness in asset utilization.

- Debt To Equity Score: 2, moderate financial risk.

- Overall Score: 3, moderate financial standing.

Which one is the best rated?

Based strictly on the provided data, News Corporation holds a better overall rating (B+) than TKO (B-), with superior ROE and ROA scores, while both have similar debt-to-equity scores. News Corporation’s overall score is also higher at 3 versus 2 for TKO.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

TKO Scores

- Altman Z-Score: 2.17, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 6, reflecting average financial strength.

NWSA Scores

- Altman Z-Score: 2.35, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 7, reflecting strong financial strength.

Which company has the best scores?

Based strictly on the provided data, NWSA surpasses TKO with a higher Altman Z-Score and a stronger Piotroski Score, indicating relatively better financial health.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to TKO Group Holdings, Inc. and News Corporation by notable grading companies:

TKO Group Holdings, Inc. Grades

The table below presents recent analyst grades for TKO Group Holdings, Inc. from established grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2025-12-31 |

| Susquehanna | Maintain | Positive | 2025-12-10 |

| TD Cowen | Maintain | Buy | 2025-12-08 |

| JP Morgan | Maintain | Overweight | 2025-12-02 |

| BTIG | Maintain | Buy | 2025-11-18 |

| Seaport Global | Upgrade | Buy | 2025-10-15 |

| BTIG | Maintain | Buy | 2025-10-10 |

| Bernstein | Maintain | Outperform | 2025-10-06 |

| Guggenheim | Maintain | Buy | 2025-10-03 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-25 |

TKO’s grades show a strong buy consensus with mostly maintained positive ratings and occasional upgrades reflecting consistent analyst confidence.

News Corporation Grades

Below is the recent grading summary for News Corporation from recognized grading entities:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-11-25 |

| Guggenheim | Maintain | Buy | 2025-11-13 |

| JP Morgan | Maintain | Overweight | 2025-08-20 |

| Macquarie | Downgrade | Neutral | 2025-08-06 |

| Morgan Stanley | Maintain | Overweight | 2025-04-11 |

| UBS | Upgrade | Buy | 2025-02-04 |

| Guggenheim | Maintain | Buy | 2025-01-22 |

| Loop Capital | Maintain | Buy | 2024-12-23 |

| Loop Capital | Maintain | Buy | 2024-12-09 |

| Guggenheim | Maintain | Buy | 2024-11-12 |

News Corporation’s grades predominantly indicate a buy or overweight stance, though one downgrade to neutral indicates some caution among analysts.

Which company has the best grades?

Both companies hold a consensus “Buy” rating, but TKO Group Holdings has more frequent buy and outperform ratings alongside fewer neutral positions. This suggests stronger analyst confidence in TKO’s prospects, which may influence investor sentiment toward stability and potential upside. News Corporation displays solid buy signals but also a downgrade and some hold ratings, indicating slightly more mixed views among analysts.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for TKO Group Holdings, Inc. (TKO) and News Corporation (NWSA) based on recent financial and strategic data.

| Criterion | TKO Group Holdings, Inc. | News Corporation |

|---|---|---|

| Diversification | Limited product range; media-focused | Highly diversified across digital real estate, news, publishing, and subscription video services |

| Profitability | Very low net margin (0.34%), ROIC 1.28%, shedding value | Strong net margin (13.96%), ROIC 5.16%, slightly unfavorable but improving profitability |

| Innovation | Limited data on innovation initiatives; declining ROIC trend | Growing ROIC, indicating improving operational efficiency and innovation |

| Global presence | Moderate, mainly US-based media | Extensive global footprint with multiple business segments worldwide |

| Market Share | Small to moderate in media sector | Leading market positions in digital real estate and news services |

In summary, News Corporation demonstrates strong diversification, solid profitability, and an improving profitability trend, making it a more resilient choice. In contrast, TKO struggles with profitability and value creation, highlighting higher risk for investors.

Risk Analysis

Below is a comparative table highlighting key risks for TKO Group Holdings, Inc. and News Corporation as of the most recent fiscal years:

| Metric | TKO Group Holdings, Inc. | News Corporation |

|---|---|---|

| Market Risk | Low beta (0.225), less volatile but high P/E (1228.66) signals valuation risk | Moderate beta (0.974), more sensitive to market swings |

| Debt Level | Moderate debt-to-equity (0.74), interest coverage low (1.14), signaling some risk | Low debt-to-equity (0.34), strong interest coverage (95.6), low financial risk |

| Regulatory Risk | Moderate, sports and entertainment subject to media regulations | Moderate, diverse media assets face content and antitrust regulations |

| Operational Risk | Unfavorable margins and returns, operational efficiency concerns | Favorable margins and returns, strong operational control |

| Environmental Risk | Low direct impact, but live events can be affected by environmental factors | Moderate, due to broad operations including real estate and publishing |

| Geopolitical Risk | Moderate exposure via global broadcasting (170 countries) | Moderate exposure through international media and real estate markets |

TKO faces significant operational and valuation risks, with a very high P/E ratio indicating potential overvaluation and low interest coverage suggesting vulnerability to debt costs. News Corp shows stronger financial health and operational efficiency, with risks mostly tied to market volatility and regulatory environment. Investors should weigh TKO’s growth prospects against its financial fragility, while News Corp appears more stable but exposed to broader media industry risks.

Which Stock to Choose?

TKO Group Holdings, Inc. shows a favorable income statement with strong gross and EBIT margins and significant revenue growth. However, its net margin and profitability ratios are mostly unfavorable, with high debt levels and a very unfavorable economic moat indicating value destruction.

News Corporation presents a favorable income evolution with robust net margin and steady EBIT margin. Its financial ratios are generally favorable or neutral, supported by low debt and a slightly unfavorable but improving economic moat, suggesting increasing profitability.

Considering ratings and comprehensive financial evaluation, TKO might appear more suited for risk-tolerant investors seeking growth potential despite volatility. Conversely, NWSA could be more attractive to investors focused on stability and improving profitability given its favorable ratios and moderate risk profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of TKO Group Holdings, Inc. and News Corporation to enhance your investment decisions: