News Corporation, represented by tickers NWS and NWSA, stands as a prominent player in the media and entertainment industry, delivering diverse content from news to digital real estate services. Both companies operate under the same corporate umbrella but differ in share structure and investor appeal. This comparison aims to clarify their market positions and innovation approaches, guiding you to the most compelling choice for your investment portfolio. Let’s explore which option holds greater promise.

Table of contents

Companies Overview

I will begin the comparison between News Corporation (NWS) and News Corporation (NWSA) by providing an overview of these two companies and their main differences.

NWS Overview

News Corporation operates as a media and information services company, delivering authoritative content and products globally. It covers six segments including Digital Real Estate Services, Subscription Video Services, Dow Jones, Book Publishing, and News Media. Its offerings span newspapers, digital mastheads, books, sports, entertainment, and financial services, positioning it as a diversified player in the Communication Services sector with a market cap of approximately 17B USD.

NWSA Overview

News Corporation (NWSA) shares the same business model as NWS, focusing on media and information services worldwide. It operates identically across six segments and distributes content via various media channels including newspapers and digital platforms. With a market cap near 15B USD, NWSA also emphasizes diversified media products and services under its communication services umbrella, headquartered in New York with 23,900 employees.

Key similarities and differences

Both NWS and NWSA operate the same diversified media business, covering identical segments and content distribution channels. The primary difference lies in their market capitalization, with NWS valued higher at 17B USD versus NWSA’s 15B USD. They share the same CEO, employee count, and headquarters, reflecting parallel business models and operational strategies within the Communication Services sector.

Income Statement Comparison

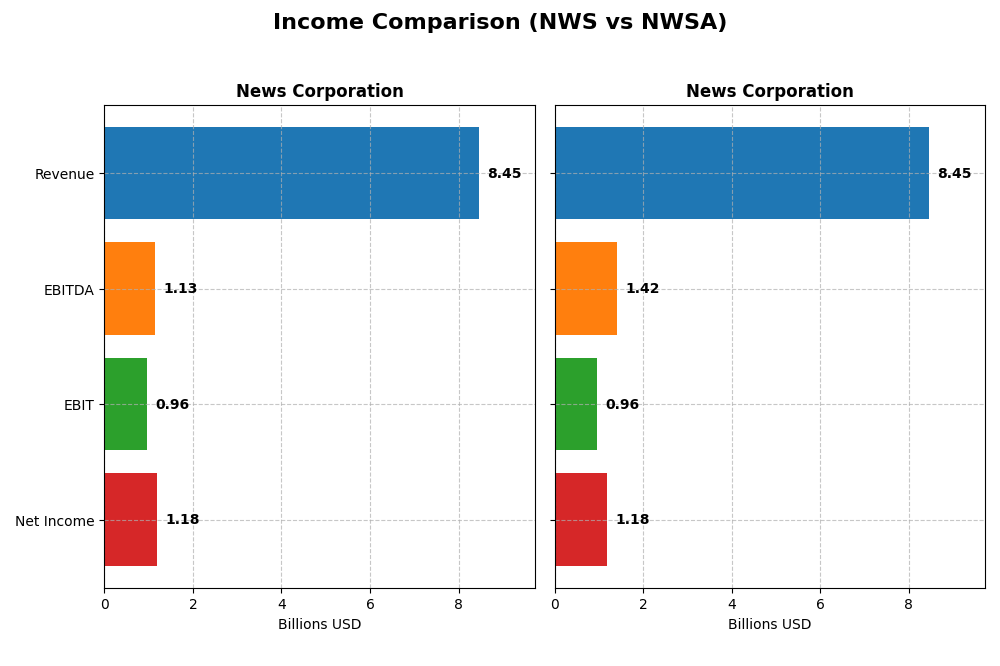

The table below compares the key income statement metrics for News Corporation under tickers NWS and NWSA for the fiscal year 2025.

| Metric | News Corporation (NWS) | News Corporation (NWSA) |

|---|---|---|

| Market Cap | 17B | 15B |

| Revenue | 8.45B | 8.45B |

| EBITDA | 1.13B | 1.42B |

| EBIT | 956M | 956M |

| Net Income | 1.18B | 1.18B |

| EPS | 2.08 | 2.08 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

News Corporation (NWS)

Over 2021-2025, News Corporation’s revenue declined by 9.68%, while net income grew by 257.58%, reflecting improved profitability. Gross margin remained favorable at 56.19%, with net margin reaching 13.96%. In 2025, revenue growth slowed to 2.42%, but EBIT increased strongly by 22.25%, and net margin expanded significantly, signaling better operational efficiency.

News Corporation (NWSA)

NWSA mirrored NWS’s trends with a 9.68% revenue decline over the period and a 257.58% surge in net income. Gross margin stood at a perfect 100%, with net margin also at 13.96%. In 2025, revenue growth slowed similarly to 2.42%, with EBIT growing 19.35%. Net margin and EPS growth were robust, supported by favorable operating expense trends.

Which one has the stronger fundamentals?

Both NWS and NWSA exhibit strong fundamentals, with favorable gross, EBIT, and net margins, alongside significant net income and EPS growth over five years. NWS shows a slightly higher EBIT growth rate, while NWSA benefits from a perfect gross margin and favorable operating expense management. Both companies face revenue growth challenges, but overall, their income statements demonstrate solid profitability improvements.

Financial Ratios Comparison

Below is a comparison of key financial ratios for News Corporation’s two ticker variants, NWS and NWSA, based on the most recent fiscal year data available for 2025.

| Ratios | News Corporation (NWS) | News Corporation (NWSA) |

|---|---|---|

| ROE | 13.4% | 13.4% |

| ROIC | 7.6% | 5.2% |

| P/E | 16.5 | 14.3 |

| P/B | 2.22 | 1.92 |

| Current Ratio | 1.84 | 1.84 |

| Quick Ratio | 1.72 | 1.72 |

| D/E (Debt-to-Equity) | 0.34 | 0.34 |

| Debt-to-Assets | 19.0% | 19.0% |

| Interest Coverage | 141.5 | 95.6 |

| Asset Turnover | 0.55 | 0.55 |

| Fixed Asset Turnover | 3.99 | 3.99 |

| Payout ratio | 15.7% | 15.7% |

| Dividend yield | 0.95% | 1.10% |

Interpretation of the Ratios

News Corporation (NWS)

News Corporation’s 2025 financial ratios present a generally favorable picture, with strong liquidity shown by a current ratio of 1.84 and a low debt-to-equity of 0.34. Profitability is moderate, featuring a net margin of 13.96% and a neutral return on equity at 13.45%. The dividend yield is low at 0.95%, which is seen as unfavorable, indicating limited income from dividends for shareholders despite regular payouts.

News Corporation (NWSA)

NWSA displays slightly stronger valuation metrics with a price-to-earnings ratio of 14.3 rated favorable, alongside a dividend yield of 1.1% classified as neutral. Liquidity and leverage ratios mirror those of NWS, both favorable at 1.84 and 0.34 respectively. Return on invested capital is lower at 5.16%, but overall financial health remains solid with no unfavorable ratios reported.

Which one has the best ratios?

Comparing both, NWSA has a higher proportion of favorable ratios (64.29% vs. 57.14%) and no unfavorable ratings, whereas NWS has a small fraction of unfavorable ratios related to dividend yield. Both maintain favorable liquidity and leverage metrics, but NWSA’s valuation and dividend yield metrics provide a marginally stronger financial profile in 2025.

Strategic Positioning

This section compares the strategic positioning of News Corporation under tickers NWS and NWSA, including market position, key segments, and exposure to technological disruption:

NWS

- Operates in entertainment, faces typical competitive pressure of global media companies.

- Diverse segments: Digital Real Estate, Dow Jones, News & Info Services, Book Publishing.

- Exposure through multiple media channels including newspapers, digital, video, and podcasts.

NWSA

- Operates in entertainment, faces typical competitive pressure of global media companies.

- Diverse segments: Digital Real Estate, Dow Jones, News & Info Services, Book Publishing.

- Exposure through multiple media channels including newspapers, digital, video, and podcasts.

NWS vs NWSA Positioning

Both NWS and NWSA share identical diversified business segments with broad media distribution channels. Their similar market positions imply comparable competitive dynamics and exposure to technological shifts. Differences arise mainly in financial performance, not strategic scope.

Which has the best competitive advantage?

Both NWS and NWSA are slightly unfavorable in MOAT evaluation, with NWS showing declining profitability and NWSA improving profitability but still destroying value. Neither currently demonstrates a strong sustainable competitive advantage.

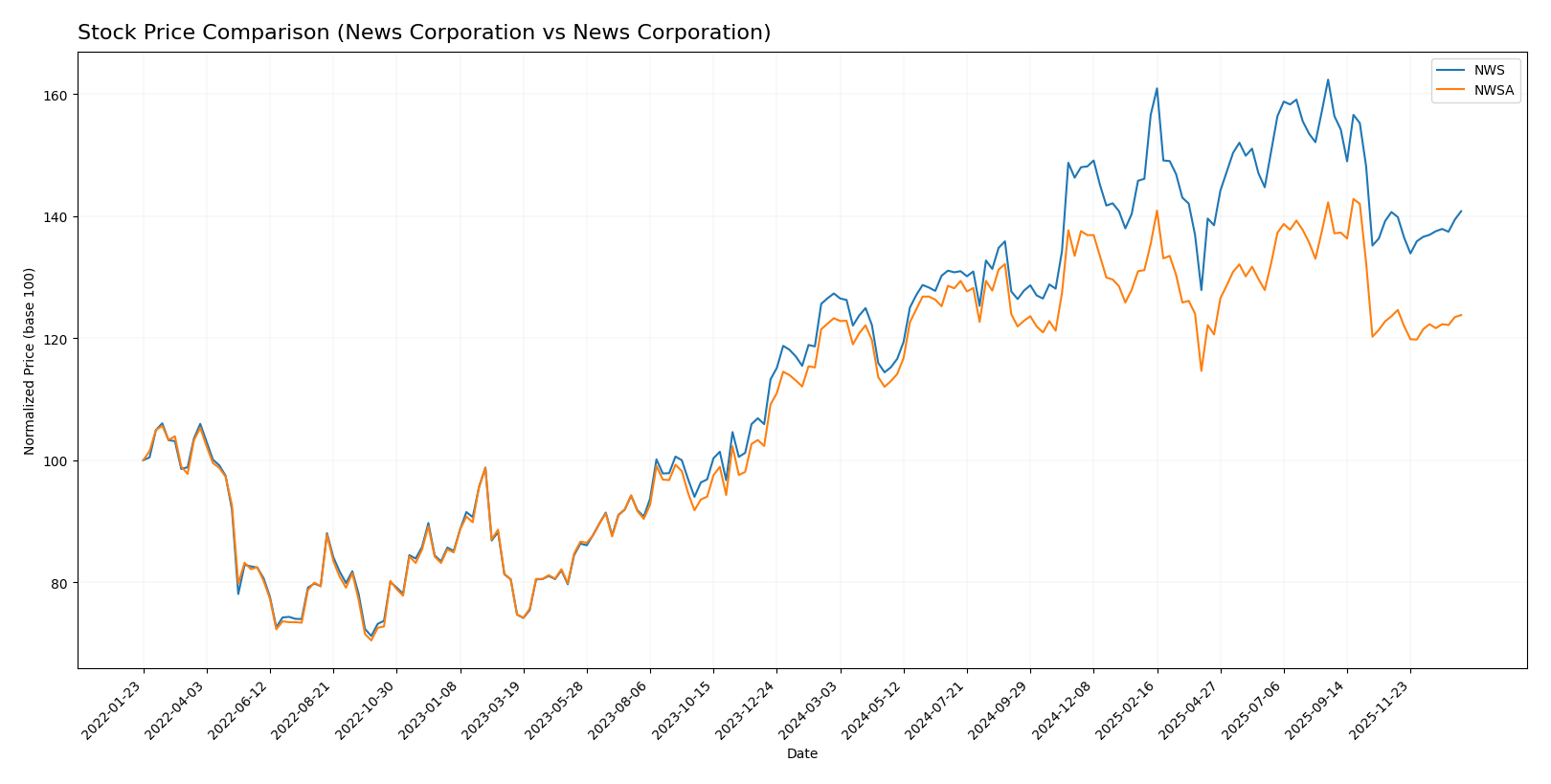

Stock Comparison

The stock price movements of News Corporation’s two tickers, NWS and NWSA, over the past 12 months show distinct trading dynamics with NWS exhibiting a stronger price appreciation while NWSA’s gains remain modest and accompanied by differing volume trends.

Trend Analysis

NWS has demonstrated a bullish trend over the past year with a 10.59% price increase, showing deceleration in momentum and price fluctuations reflected by a 2.52 standard deviation. The stock reached a high of 35.17 and a low of 24.78.

NWSA’s stock exhibited a mild bullish trend with a 0.42% gain over the same period, also with decelerating momentum and lower volatility at 1.5 standard deviation. Its price ranged between 24.02 and 30.62.

Comparing the two, NWS has delivered the highest market performance with a significantly stronger upward price movement than NWSA within the analyzed 12-month timeframe.

Target Prices

The consensus target price for News Corporation’s NWSA stock reflects cautious optimism among analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| News Corporation | 45 | 16 | 33.33 |

Analysts expect NWSA to trade moderately above its current price of 26.54 USD, indicating potential upside with some volatility risk. No verified target price data is available for NWS stock.

Analyst Opinions Comparison

This section compares analysts’ ratings and financial scores for News Corporation’s two tickers:

Rating Comparison

NWS Rating

- Overall rating of B+, considered Very Favorable by analysts.

- Discounted Cash Flow Score of 3, indicating a Moderate valuation level.

- Return on Equity Score of 4, reflecting Favorable profit generation efficiency.

- Return on Assets Score of 5, showing Very Favorable asset utilization.

- Debt To Equity Score of 2, assessed as Moderate financial risk.

- Overall Score of 3, signaling a Moderate overall financial standing.

NWSA Rating

- Overall rating of B+, considered Very Favorable by analysts.

- Discounted Cash Flow Score of 3, indicating a Moderate valuation level.

- Return on Equity Score of 4, reflecting Favorable profit generation efficiency.

- Return on Assets Score of 5, showing Very Favorable asset utilization.

- Debt To Equity Score of 2, assessed as Moderate financial risk.

- Overall Score of 3, signaling a Moderate overall financial standing.

Which one is the best rated?

Based strictly on the available data, both NWS and NWSA share identical ratings and financial scores across all key metrics. Neither ticker is rated better than the other according to these analyst evaluations.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

NWS Scores

- Altman Z-Score: 2.51, in the grey zone, moderate bankruptcy risk.

- Piotroski Score: 8, very strong financial health and value indicator.

NWSA Scores

- Altman Z-Score: 2.35, in the grey zone, moderate bankruptcy risk.

- Piotroski Score: 7, strong financial health and value indicator.

Which company has the best scores?

NWS has slightly higher scores with a better Piotroski Score of 8 versus 7 for NWSA, although both have similar Altman Z-Scores in the grey zone indicating moderate risk.

Grades Comparison

Here is the detailed comparison of analyst grades for the two News Corporation listings:

News Corporation (NWS) Grades

The following table summarizes recent grades from reputable financial institutions for NWS:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2023-08-20 |

| Guggenheim | Maintain | Buy | 2023-08-13 |

| Loop Capital | Upgrade | Buy | 2023-01-25 |

| Loop Capital | Upgrade | Buy | 2023-01-24 |

| Macquarie | Downgrade | Neutral | 2022-07-28 |

| Macquarie | Downgrade | Neutral | 2022-07-27 |

| Guggenheim | Maintain | Buy | 2022-07-21 |

| Guggenheim | Maintain | Buy | 2022-07-20 |

| UBS | Upgrade | Buy | 2021-07-26 |

| UBS | Upgrade | Buy | 2021-07-25 |

Overall, analyst grades for NWS have mostly been positive, with a consensus rating of “Buy” supported by upgrades and maintenance of buy/overweight ratings. Some downgrades to neutral occurred in mid-2022.

News Corporation (NWSA) Grades

The following table summarizes recent grades from reputable financial institutions for NWSA:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-11-25 |

| Guggenheim | Maintain | Buy | 2025-11-13 |

| JP Morgan | Maintain | Overweight | 2025-08-20 |

| Macquarie | Downgrade | Neutral | 2025-08-06 |

| Morgan Stanley | Maintain | Overweight | 2025-04-11 |

| UBS | Upgrade | Buy | 2025-02-04 |

| Guggenheim | Maintain | Buy | 2025-01-22 |

| Loop Capital | Maintain | Buy | 2024-12-23 |

| Loop Capital | Maintain | Buy | 2024-12-09 |

| Guggenheim | Maintain | Buy | 2024-11-12 |

NWSA shows a similar positive trend with consistent “Buy” and “Overweight” grades, a few downgrades to neutral, and an overall consensus rating of “Buy.”

Which company has the best grades?

Both NWS and NWSA have received predominantly positive grades from major analysts, with numerous buy and overweight ratings maintained or upgraded. However, NWSA’s most recent grades extend through late 2025, showing sustained analyst confidence. Investors may interpret these consistent positive grades as signals of steady market sentiment for both listings.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for News Corporation under the tickers NWS and NWSA, based on recent financial and operational data.

| Criterion | NWS | NWSA |

|---|---|---|

| Diversification | Strong with multiple revenue streams: Digital Real Estate ($1.8B), Dow Jones ($2.3B), News & Info Services ($2.17B), Book Publishing ($2.15B) | Identical segment diversification and revenue figures as NWS |

| Profitability | Net margin 13.96% (favorable), ROIC 7.64% (neutral), but ROIC declining, shedding value overall | Net margin 13.96% (favorable), ROIC 5.16% (neutral), ROIC growing though still shedding value |

| Innovation | Moderate; stable fixed asset turnover 3.99 (favorable) indicates efficient asset use | Similar innovation profile with favorable asset turnover and improving profitability trend |

| Global presence | Strong through global brands like Dow Jones and diverse media segments | Same global footprint and brand strength as NWS |

| Market Share | Significant in digital real estate and news publishing segments, though facing competitive pressure | Comparable market position and segment leadership as NWS |

Key takeaways: Both NWS and NWSA demonstrate strong diversification and solid profitability metrics, with favorable liquidity and leverage ratios. However, both are currently shedding value relative to their cost of capital. NWS shows a declining return on invested capital, while NWSA is improving, suggesting potential for turnaround but requiring cautious monitoring.

Risk Analysis

Below is a comparative table of key risks for News Corporation under its two ticker symbols, NWS and NWSA, based on the most recent 2025 data:

| Metric | News Corporation (NWS) | News Corporation (NWSA) |

|---|---|---|

| Market Risk | Beta 0.974, moderate volatility relative to market | Beta 0.974, moderate volatility relative to market |

| Debt Level | Debt-to-equity 0.34, favorable leverage | Debt-to-equity 0.34, favorable leverage |

| Regulatory Risk | Medium – media industry faces evolving content regulations | Medium – media industry faces evolving content regulations |

| Operational Risk | Moderate – diverse segments may increase complexity | Moderate – diverse segments may increase complexity |

| Environmental Risk | Low – limited exposure as a media company | Low – limited exposure as a media company |

| Geopolitical Risk | Medium – international content distribution sensitive to geopolitical tensions | Medium – international content distribution sensitive to geopolitical tensions |

The most likely and impactful risks for News Corporation are regulatory and geopolitical challenges. Media companies face increasing scrutiny on content regulation globally, which can affect operations and profitability. Additionally, geopolitical tensions could disrupt international content distribution. Their moderate debt levels and stable market risk provide some cushion.

Which Stock to Choose?

News Corporation (NWS) shows a favorable income statement with strong net margin growth and profitability, supported by mostly favorable financial ratios. Its debt levels remain manageable, and the overall rating is very favorable, despite a slightly unfavorable MOAT due to declining ROIC.

News Corporation (NWSA) also presents a favorable income profile with robust net margin and EPS growth, accompanied by favorable financial ratios and controlled debt. Its rating matches NWS’s, though it has a slightly unfavorable MOAT reflecting value destruction but improving profitability.

For investors, NWS might appear more attractive for those valuing stable profitability and income growth, while NWSA could suit those who emphasize improving profitability trends despite current value challenges. Both stocks share a very favorable rating and favorable income profiles but differ in MOAT dynamics.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of News Corporation to enhance your investment decisions: