Home > Comparison > Communication Services > NFLX vs NWSA

The strategic rivalry between Netflix, Inc. and News Corporation defines the current trajectory of the Communication Services sector. Netflix excels as a high-margin streaming entertainment provider with a global subscriber base. In contrast, News Corp operates a diversified media conglomerate spanning publishing, digital real estate, and subscription services. This analysis pits Netflix’s growth-driven model against News Corp’s multi-segment stability to identify the superior risk-adjusted investment opportunity for diversified portfolios.

Table of contents

Companies Overview

Netflix and News Corporation both wield significant influence in the entertainment and communication services sectors.

Netflix, Inc.: Streaming Pioneer and Global Content Leader

Netflix commands the streaming entertainment market with 222M paid members worldwide. Its core revenue stems from subscription fees for TV series, films, documentaries, and mobile games delivered over internet-connected devices. In 2026, Netflix focuses on expanding its diverse content library and enhancing user engagement to sustain subscriber growth and maintain its dominant market position.

News Corporation: Multifaceted Media and Information Powerhouse

News Corporation operates as a diversified media conglomerate, generating revenue through digital real estate, subscription video, news media, publishing, and financial services. It distributes authoritative content via newspapers, websites, and broadcasting. The company’s 2026 strategy emphasizes strengthening its digital platforms and expanding subscription video services to capture evolving consumer preferences across global markets.

Strategic Collision: Similarities & Divergences

Both firms prioritize subscription-based revenue models but diverge in scope—Netflix leads with direct-to-consumer streaming, while News Corp balances broad media channels and data services. Their primary battleground is content delivery and subscriber retention. Netflix’s focused entertainment ecosystem contrasts with News Corp’s multifaceted media portfolio, offering distinct risk and growth profiles for investors.

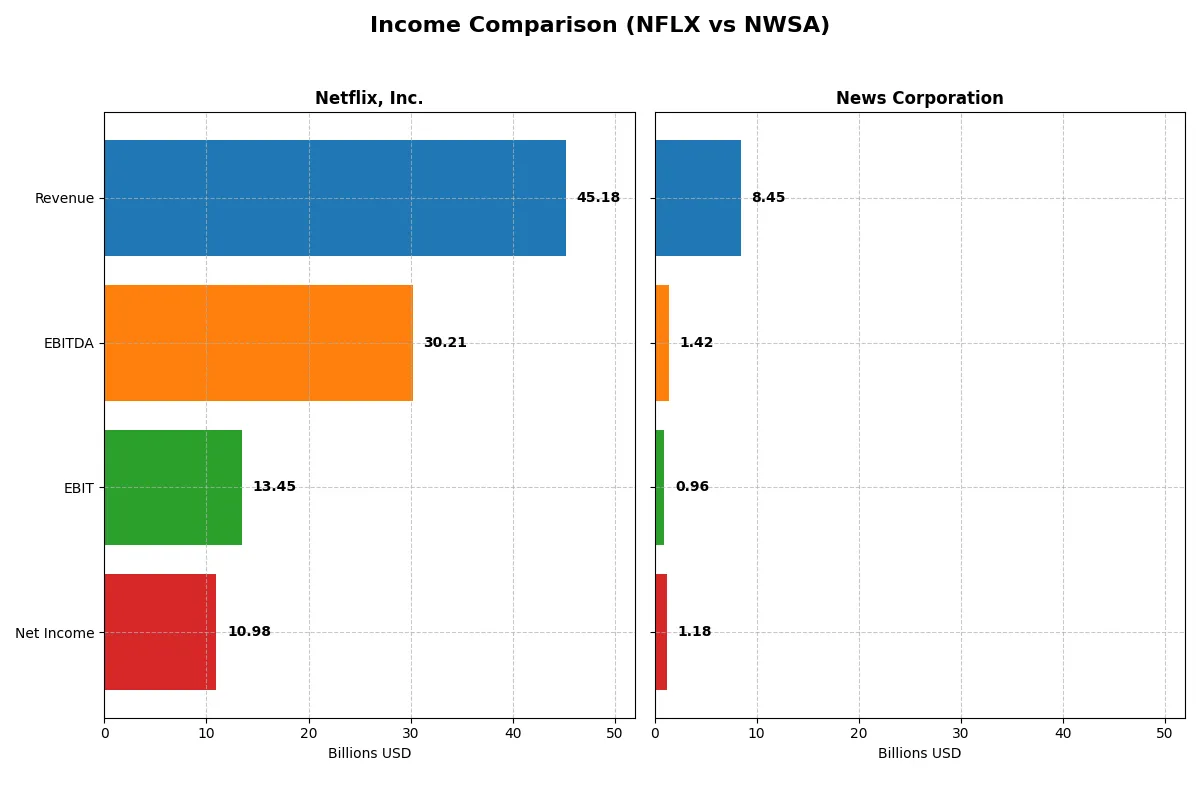

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Netflix, Inc. (NFLX) | News Corporation (NWSA) |

|---|---|---|

| Revenue | 45.2B | 8.45B |

| Cost of Revenue | 23.3B | 0 |

| Operating Expenses | 8.58B | 7.50B |

| Gross Profit | 21.9B | 8.45B |

| EBITDA | 30.2B | 1.42B |

| EBIT | 13.5B | 956M |

| Interest Expense | 777M | 10M |

| Net Income | 11.0B | 1.18B |

| EPS | 2.58 | 2.08 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs its financial engine with superior efficiency and growth momentum.

Netflix, Inc. Analysis

Netflix displays a robust revenue climb, hitting $45.2B in 2025, up 15.9% from 2024. Its net income surges to $11B, doubling since 2021. Gross margin stands strong at 48.5%, with net margin at a healthy 24.3%. In 2025, Netflix accelerates EBIT by 25.9%, reflecting effective cost control and operational leverage.

News Corporation Analysis

News Corp posts $8.45B revenue in mid-2025, a modest 2.4% rise year-over-year but down nearly 10% since 2021. Net income rebounds sharply to $1.18B, showing 257.6% growth over five years. Gross margin is a perfect 100%, but the EBIT margin trails at 11.3%. Despite slower revenue growth, net margin improves markedly to 14.0%.

Verdict: Margin Excellence vs. Scale and Growth

Netflix clearly outpaces News Corp in revenue scale and margin efficiency, boasting double the net income and superior EBIT margins. News Corp impresses with explosive net income growth despite flat revenues. For investors, Netflix offers high-growth momentum and margin power, while News Corp’s profile suits those valuing turnaround potential in a smaller, niche player.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | Netflix, Inc. (NFLX) | News Corporation (NWSA) |

|---|---|---|

| ROE | 41.3% | 13.4% |

| ROIC | 25.2% | 5.2% |

| P/E | 36.1x | 14.3x |

| P/B | 14.9x | 1.92x |

| Current Ratio | 1.19 | 1.84 |

| Quick Ratio | 1.19 | 1.72 |

| D/E | 0.54 | 0.34 |

| Debt-to-Assets | 26.0% | 18.9% |

| Interest Coverage | 17.2x | 95.6x |

| Asset Turnover | 0.81 | 0.55 |

| Fixed Asset Turnover | 22.5x | 4.0x |

| Payout ratio | 0% | 15.7% |

| Dividend yield | 0% | 1.10% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence that numbers alone cannot show.

Netflix, Inc.

Netflix delivers strong profitability with a 41.3% ROE and a robust 24.3% net margin, showcasing operational efficiency. However, its valuation is stretched, trading at a high P/E of 36.1 and P/B of 14.9. The firm reinvests heavily in R&D, foregoing dividends to fuel growth and maintain its competitive edge.

News Corporation

News Corp posts moderate profitability, with a 13.5% ROE and 14.0% net margin, indicating steady but less dynamic returns. Its valuation appears reasonable, with a P/E of 14.3 and P/B near 1.9, suggesting a fair price. The company offers a modest 1.1% dividend yield, balancing shareholder returns with conservative capital allocation.

Premium Valuation vs. Operational Safety

Netflix commands a premium valuation backed by superior profitability, whereas News Corp offers more conservative valuation and steady dividends. Investors seeking growth might prefer Netflix’s aggressive reinvestment, while those valuing stability and income may lean toward News Corp’s safer profile.

Which one offers the Superior Shareholder Reward?

I observe Netflix (NFLX) pays no dividends, reinvesting heavily in content and growth. Its free cash flow per share stands at 2.24, with no payout strain. Buybacks are minimal, limiting direct shareholder returns. News Corporation (NWSA) yields about 1.1%, with a moderate 15.7% payout ratio, supported by steady free cash flow of 1.28 per share. NWSA also executes consistent buybacks, enhancing total returns. NFLX’s growth reinvestment suits long-term capital gains but lacks immediate income. NWSA provides a more balanced, sustainable distribution combining dividends and buybacks. For 2026, I favor News Corporation’s superior total shareholder return profile due to its income and buyback mix.

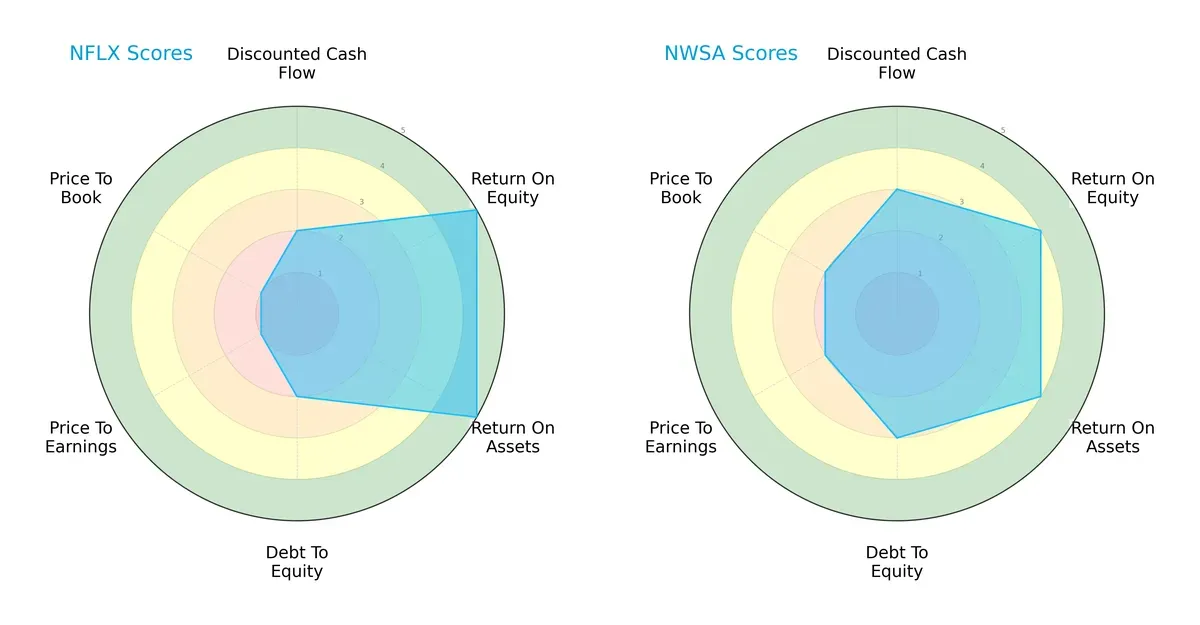

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both firms, highlighting their financial strengths and vulnerabilities:

Netflix, Inc. excels in profitability metrics with top ROE and ROA scores (5 each), demonstrating superior asset and equity efficiency. However, it struggles with valuation, scoring very low on P/E and P/B (1 each), indicating potential overvaluation or market skepticism. News Corporation offers a more balanced profile, with moderate scores across DCF (3), debt-to-equity (3), and valuation metrics (2 each), suggesting steadier financial footing but less standout profitability. Netflix relies heavily on operational efficiency, while News Corp maintains stability through measured capital structure and valuation.

Bankruptcy Risk: Solvency Showdown

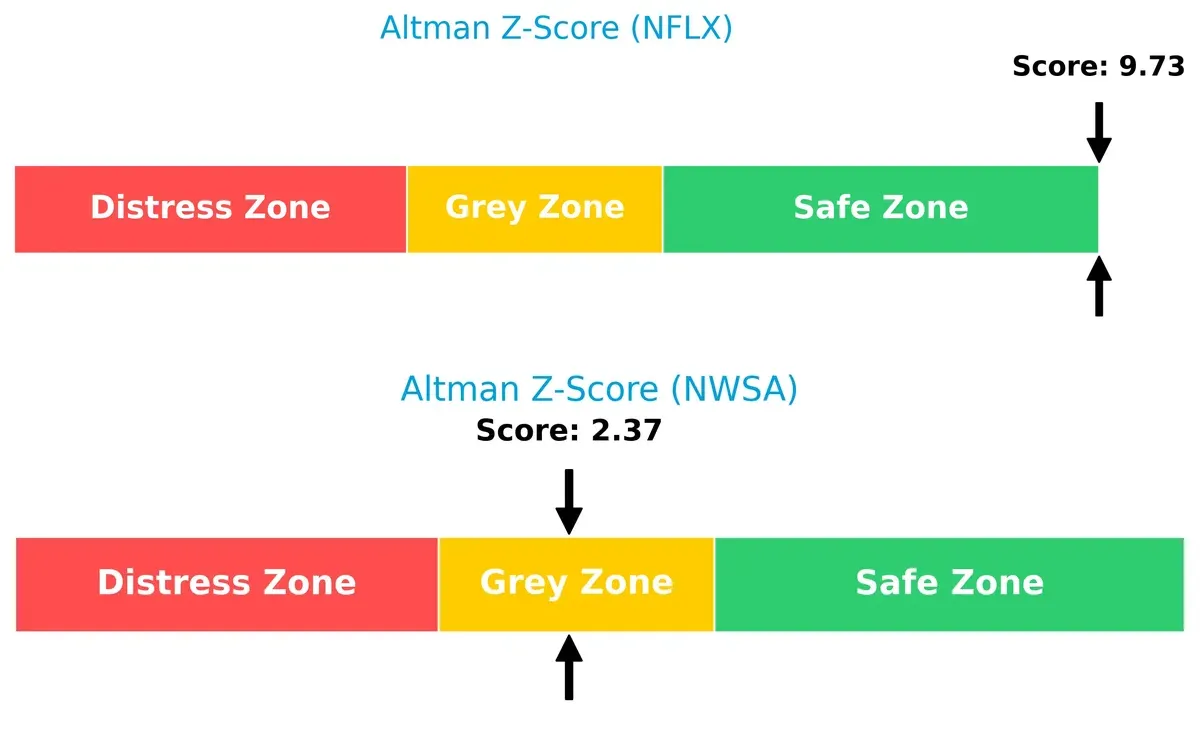

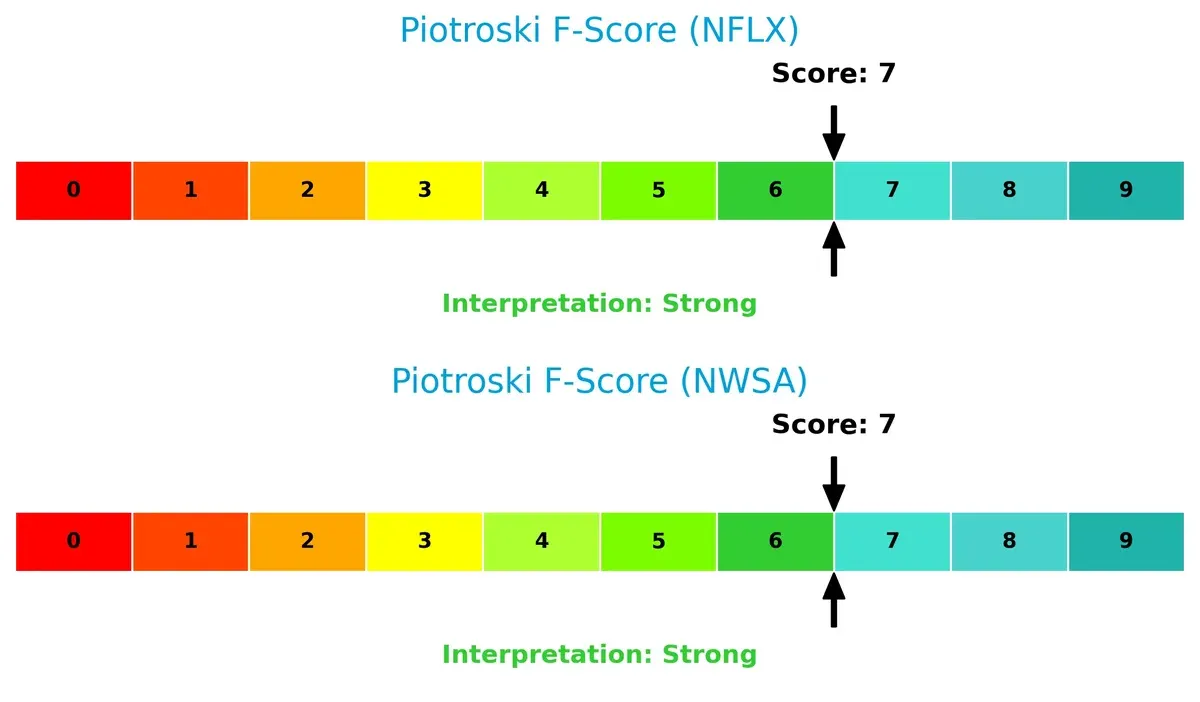

Netflix’s Altman Z-Score of 9.73 places it firmly in the safe zone, signaling robust financial resilience. News Corporation’s 2.37 falls in the grey zone, indicating moderate bankruptcy risk in this economic cycle:

Financial Health: Quality of Operations

Both companies score a strong 7 on the Piotroski F-Score, reflecting solid internal financial health and operational quality without red flags, supporting their investment viability:

How are the two companies positioned?

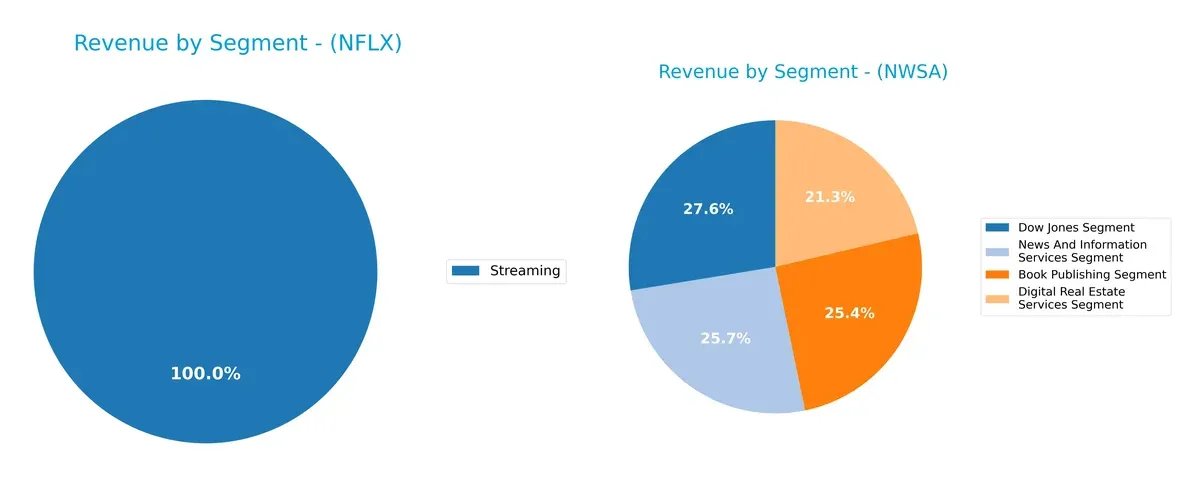

This section dissects the operational DNA of Netflix and News Corp by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and pinpoint which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Netflix, Inc. and News Corporation diversify their income streams and where their primary sector bets lie:

Netflix anchors nearly 100% of its revenue in Streaming, reaching $39B in 2024, showing extreme concentration risk but strong ecosystem lock-in. In contrast, News Corporation demonstrates a balanced portfolio, with its four main segments each generating between $1.8B and $2.3B in 2025. This diversification reduces dependency on a single market and supports more stable cash flows amid sector volatility.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Netflix, Inc. and News Corporation based on diversification, profitability, financials, innovation, global presence, and market share:

Netflix Strengths

- High net margin at 24.3%

- Strong ROE at 41.26%

- Robust ROIC of 25.22%

- Favorable quick ratio and interest coverage

- Significant global streaming revenue across multiple regions

- Large market share in streaming entertainment

News Corporation Strengths

- Favorable net margin at 13.96%

- Low WACC at 7.4% supporting efficient capital use

- Strong interest coverage at 95.6

- Good current and quick ratios

- Diversified revenue from digital services, news, publishing, and subscriptions

- Stable US and international presence

Netflix Weaknesses

- High P/E at 36.11 and high P/B at 14.9 indicating potential overvaluation

- WACC at 11.62% exceeds ROE, signaling capital cost concerns

- No dividend yield

- Moderate current ratio at 1.19

- Asset turnover neutral at 0.81

News Corporation Weaknesses

- Moderate ROE of 13.45% and ROIC of 5.16% limit profitability upside

- Higher neutral asset turnover at 0.55

- No recent international expansion data beyond Australasia, Europe, US

- Dividend yield low at 1.1%, limiting income appeal

Netflix excels in profitability and global streaming dominance but faces valuation and cost of capital challenges. News Corporation shows financial prudence and diversification but has moderate profitability and less global revenue breadth. Each company’s strategic focus aligns with these financial and market characteristics.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only barrier protecting long-term profits from relentless competitive erosion and market entry threats:

Netflix, Inc.: Content & Scale Network Effect

Netflix’s moat stems from its massive global subscriber base and exclusive content library, generating a robust 13.6% ROIC premium over WACC. Its margin stability and 15.9% revenue growth fuel durable competitive advantage. Expansion into mobile gaming and international markets in 2026 should deepen its network effects.

News Corporation: Diversified Media Brand Portfolio

News Corp leverages a diversified media and information services portfolio, relying on brand strength and subscription loyalty rather than scale. Despite a growing ROIC trend, it remains below WACC, indicating value erosion. Opportunities lie in digital real estate and subscription video segments for growth in 2026.

Netflix’s Scale Network vs. News Corp’s Brand Diversification

Netflix commands a wider, more durable moat with sustained ROIC above WACC and rapid growth. News Corp’s moat is narrower, challenged by value destruction despite improvement. Netflix is better positioned to defend and grow its market share amid increasing competition.

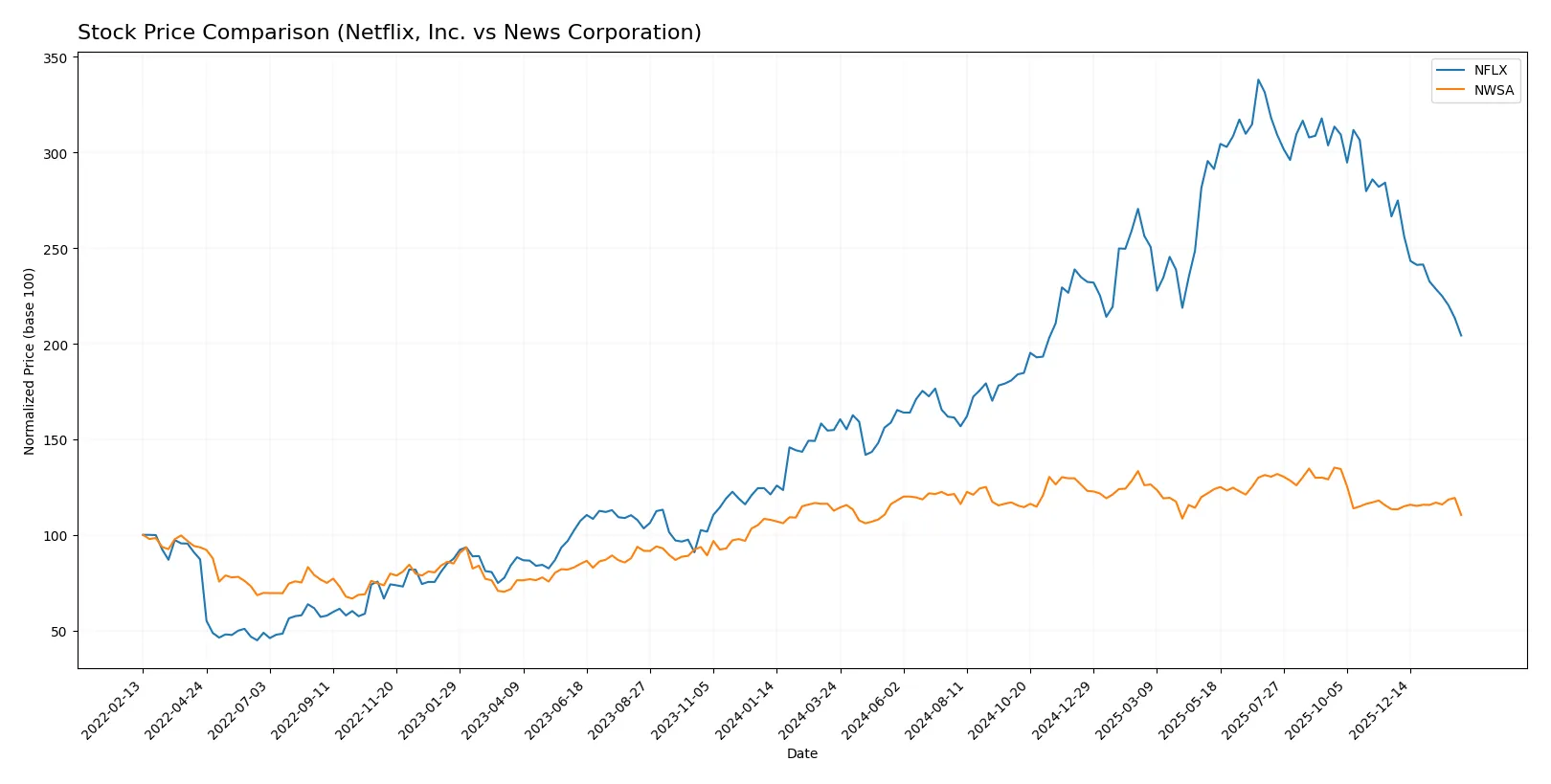

Which stock offers better returns?

Over the past 12 months, Netflix, Inc. displayed strong gains with a 31.94% price increase despite recent deceleration. News Corporation showed a marginal -1.96% decline with accelerating bearish momentum.

Trend Comparison

Netflix’s stock surged 31.94% over the past year, marking a bullish trend with decelerating momentum and notable volatility (22.19 std deviation). The price peaked at 132.31 and bottomed at 55.5.

News Corporation’s stock fell slightly by -1.96%, signaling a bearish trend with accelerating decline but low volatility (1.51 std deviation). The highest and lowest prices were 30.62 and 24.02, respectively.

Netflix outperformed News Corporation significantly, delivering the highest market returns over the 12-month period analyzed.

Target Prices

Analysts present a mixed but cautiously optimistic consensus for Netflix, Inc. and News Corporation.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Netflix, Inc. | 95 | 152 | 117.25 |

| News Corporation | 16 | 45 | 33.33 |

Netflix’s consensus target of 117.25 suggests a significant upside from its current price of 79.94, reflecting confidence in its growth potential. News Corporation’s midpoint of 33.33 also implies upside from 25.01, indicating moderate market optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Here are the recent institutional grades for Netflix, Inc. and News Corporation:

Netflix, Inc. Grades

The following table summarizes recent grades from reputable analysts for Netflix, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Freedom Capital Markets | Buy | Buy | 2026-01-27 |

| Argus Research | Maintain | Buy | 2026-01-22 |

| Wedbush | Maintain | Outperform | 2026-01-21 |

| Deutsche Bank | Maintain | Hold | 2026-01-21 |

| Guggenheim | Maintain | Buy | 2026-01-21 |

| Wolfe Research | Maintain | Outperform | 2026-01-21 |

| Morgan Stanley | Maintain | Overweight | 2026-01-21 |

| Canaccord Genuity | Maintain | Buy | 2026-01-21 |

| Piper Sandler | Maintain | Overweight | 2026-01-21 |

| TD Cowen | Maintain | Buy | 2026-01-21 |

News Corporation Grades

The table below shows recent institutional grades for News Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2025-11-25 |

| Guggenheim | Maintain | Buy | 2025-11-13 |

| JP Morgan | Maintain | Overweight | 2025-08-20 |

| Macquarie | Downgrade | Neutral | 2025-08-06 |

| Morgan Stanley | Maintain | Overweight | 2025-04-11 |

| UBS | Upgrade | Buy | 2025-02-04 |

| Guggenheim | Maintain | Buy | 2025-01-22 |

| Loop Capital | Maintain | Buy | 2024-12-23 |

| Loop Capital | Maintain | Buy | 2024-12-09 |

| Guggenheim | Maintain | Buy | 2024-11-12 |

Which company has the best grades?

Netflix holds stronger and more recent buy and outperform ratings from multiple leading institutions. News Corporation’s grades are generally positive but include a recent downgrade, signaling more mixed sentiment. Investors may view Netflix’s upgrades as a sign of greater confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Netflix, Inc.

- Faces intense streaming competition with high content costs and subscriber saturation risks.

News Corporation

- Competes in diversified media but grapples with declining print revenues and digital transformation challenges.

2. Capital Structure & Debt

Netflix, Inc.

- Moderate debt-to-equity ratio (0.54) with solid interest coverage (17.33x) but high WACC (11.62%).

News Corporation

- Lower leverage (0.34 D/E), exceptional interest coverage (95.6x), and lower WACC (7.4%) indicate a more conservative capital structure.

3. Stock Volatility

Netflix, Inc.

- High beta (1.71) signals elevated volatility and greater sensitivity to market swings.

News Corporation

- Beta near 1 (0.97) suggests more stable stock behavior relative to the market.

4. Regulatory & Legal

Netflix, Inc.

- Subject to content regulation and data privacy laws across 190 countries, increasing compliance complexity.

News Corporation

- Faces regulatory scrutiny on media ownership, data usage, and broadcasting rights in multiple jurisdictions.

5. Supply Chain & Operations

Netflix, Inc.

- Relies heavily on internet infrastructure and licensing agreements; risks from tech disruptions persist.

News Corporation

- Diverse operations across print, digital, and broadcasting supply chains may face integration and cost efficiency challenges.

6. ESG & Climate Transition

Netflix, Inc.

- Growing pressure to improve content diversity and reduce carbon footprint from digital operations.

News Corporation

- ESG risks tied to media influence, print emissions, and transition to sustainable digital platforms.

7. Geopolitical Exposure

Netflix, Inc.

- Global footprint exposes it to geopolitical tensions, censorship, and trade restrictions, especially in emerging markets.

News Corporation

- U.S.-based but with significant international media holdings, vulnerable to geopolitical shifts and regulation changes.

Which company shows a better risk-adjusted profile?

Netflix’s biggest risk lies in fierce market competition and a high valuation multiple that pressures returns. News Corporation, while facing digital disruption, boasts a stronger balance sheet and lower stock volatility. The safer capital structure and moderate P/E ratio give News Corp a more favorable risk-adjusted profile in 2026. Notably, Netflix’s beta of 1.71 versus News Corp’s 0.97 underscores its higher market sensitivity amid sector turbulence.

Final Verdict: Which stock to choose?

Netflix, Inc. stands out as a powerhouse of growth and profitability, with a superpower in delivering expanding returns on invested capital well above its cost of capital. Its main point of vigilance remains its premium valuation, which demands continued execution to justify. Netflix suits aggressive growth portfolios hungry for innovation and market leadership.

News Corporation offers a strategic moat grounded in stable cash flow and a conservative capital structure. It provides a more defensive profile compared to Netflix’s higher volatility and valuation risk. This stock fits well in GARP portfolios seeking steady income with moderate growth potential.

If you prioritize rapid value creation and scalable innovation, Netflix is the compelling choice due to its robust moat and high returns. However, if you seek better stability and lower valuation risk, News Corporation offers a favorable safety margin and consistent cash generation. Each stock appeals to distinct investor avatars, balancing growth ambition against risk tolerance.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Netflix, Inc. and News Corporation to enhance your investment decisions: