In today’s fast-evolving industrial landscape, Symbotic Inc. and Nano Nuclear Energy Inc. represent two cutting-edge players driving innovation in machinery and technology. Symbotic focuses on automation systems that revolutionize warehouse efficiency, while Nano Nuclear Energy pioneers microreactor technology with potential to reshape energy production. Both companies share an industrial sector focus but pursue distinct growth paths. This article will help you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Symbotic Inc. and Nano Nuclear Energy Inc by providing an overview of these two companies and their main differences.

Symbotic Inc. Overview

Symbotic Inc. is an automation technology company specializing in robotics and technology aimed at enhancing efficiency for retailers and wholesalers in the United States. Its flagship offering, the Symbotic System, is a comprehensive warehouse automation solution designed to reduce costs, improve operational efficiency, and optimize inventory management. The company operates within the industrial machinery sector and is headquartered in Wilmington, Massachusetts.

Nano Nuclear Energy Inc Overview

Nano Nuclear Energy Inc. focuses on microreactor technology development, including the ZEUS solid-core battery reactor and the ODIN low-pressure coolant reactor. The company also plans to establish a facility for fabricating high-assay low-enriched uranium fuel and provides fuel transportation and nuclear consultation services. Founded in 2021 and based in New York City, NNE operates in the industrial machinery sector with a highly specialized product portfolio.

Key similarities and differences

Both Symbotic and Nano Nuclear Energy are positioned within the industrial machinery industry but serve distinctly different markets: warehouse automation versus nuclear microreactors. Symbotic emphasizes robotics and efficiency improvements for supply chain operations, while NNE develops advanced nuclear reactor technologies and fuel solutions. Additionally, Symbotic has a significantly larger workforce and market capitalization, reflecting broader commercial deployment compared to NNE’s focused, early-stage nuclear technology development.

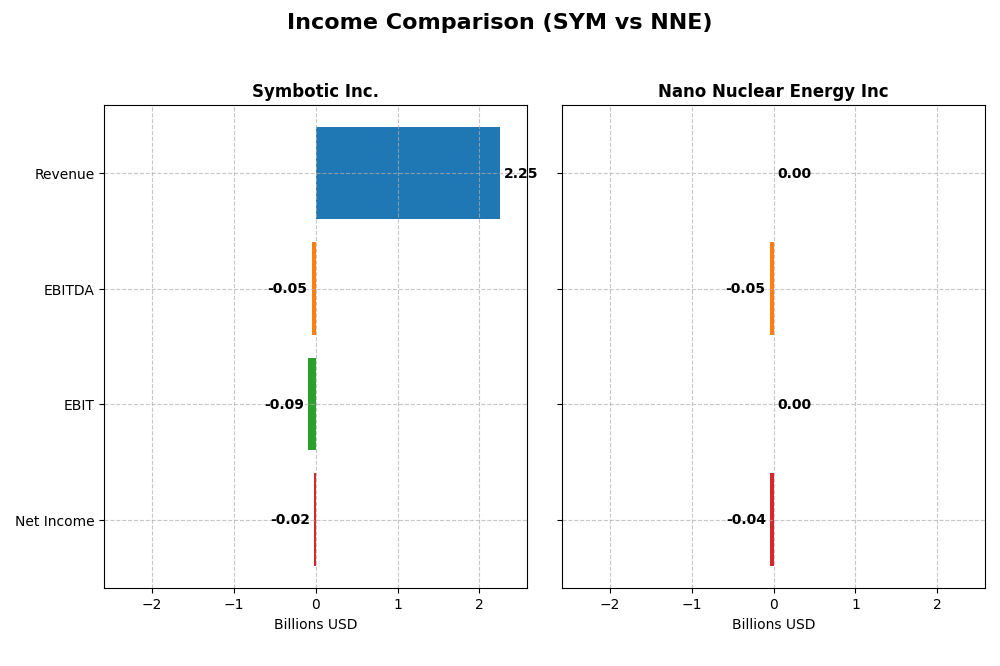

Income Statement Comparison

The table below compares key income statement metrics for Symbotic Inc. and Nano Nuclear Energy Inc. for their most recent fiscal year, highlighting differences in scale and profitability.

| Metric | Symbotic Inc. (SYM) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| Market Cap | 42.8B | 1.33B |

| Revenue | 2.25B | 0 |

| EBITDA | -48.0M | -46.2M |

| EBIT | -92.1M | 0 |

| Net Income | -16.9M | -40.1M |

| EPS | -0.16 | -1.06 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Symbotic Inc.

Symbotic Inc. showed strong revenue growth from 251M in 2021 to 2.25B in 2025, with net income losses narrowing from -122M to -17M. Gross margin remained stable around 18.8%, while EBIT and net margins stayed negative but improved slightly. The latest year saw revenue growth slow to 25.65%, with EBIT margin declining and net margin stable, reflecting ongoing operating challenges.

Nano Nuclear Energy Inc

Nano Nuclear Energy reported no revenues from 2022 to 2025, with consistent net losses increasing to -40M in 2025. Margins remained at zero due to lack of sales, and expenses consistently outweighed any income. The most recent year showed no revenue growth but improved EPS growth of nearly 100%, driven by reduced losses, though overall margins and income remain unfavorable.

Which one has the stronger fundamentals?

Symbotic Inc. demonstrates stronger fundamentals with robust revenue growth and improving margins despite losses, reflecting operational scale-up. Nano Nuclear Energy’s lack of revenue and persistent losses weigh heavily, despite some EPS improvement. Symbotic’s income statement shows more favorable trends, while Nano Nuclear faces significant financial challenges and uncertainty in profitability.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Symbotic Inc. (SYM) and Nano Nuclear Energy Inc (NNE) based on their 2025 fiscal year data, providing a clear side-by-side comparison.

| Ratios | Symbotic Inc. (SYM) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| ROE | -7.65% | -18.00% |

| ROIC | -16.63% | -20.51% |

| P/E | -334.54 | -0.04 |

| P/B | 25.60 | 0.01 |

| Current Ratio | 1.08 | 53.48 |

| Quick Ratio | 0.99 | 53.48 |

| D/E (Debt to Equity) | 0.14 | 0.01 |

| Debt-to-Assets | 1.32% | 1.22% |

| Interest Coverage | 0 | 0 |

| Asset Turnover | 0.94 | 0 |

| Fixed Asset Turnover | 15.92 | 0 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Symbotic Inc.

Symbotic’s ratios present a mixed picture with a slightly unfavorable overall assessment. Key weaknesses include negative net margin (-0.75%) and return on equity (-7.65%), indicating profitability challenges. The company’s debt levels are low, with favorable debt-to-equity and debt-to-assets ratios. Symbotic does not pay dividends, reflecting a reinvestment strategy likely tied to its growth and R&D focus.

Nano Nuclear Energy Inc

Nano Nuclear shows a generally unfavorable ratio profile with significant negative returns, including a -18% ROE and -20.51% ROIC. Its current ratio is unusually high at 53.48, which may signal inefficient asset use. The company also pays no dividends, consistent with its early-stage development and prioritization of investment in technology and infrastructure over shareholder returns.

Which one has the best ratios?

Between the two, Symbotic exhibits a more balanced ratio profile with some favorable leverage and turnover metrics despite profitability issues. Nano Nuclear’s ratios are more heavily skewed toward unfavorable, reflecting its nascent stage and operational inefficiencies. Overall, Symbotic’s slightly unfavorable rating is less severe compared to Nano Nuclear’s outright unfavorable evaluation.

Strategic Positioning

This section compares the strategic positioning of Symbotic Inc. and Nano Nuclear Energy Inc., including market position, key segments, and exposure to technological disruption:

Symbotic Inc.

- Large market cap of 42.7B with moderate competitive pressure in industrial machinery automation.

- Focus on warehouse automation systems and software maintenance driving revenue growth.

- Exposure to disruption through robotics and automation technology improving efficiency.

Nano Nuclear Energy Inc

- Smaller market cap of 1.3B, niche player in microreactor technology facing high volatility.

- Concentrated on developing microreactors and nuclear fuel fabrication services.

- Faces disruption by introducing innovative nuclear microreactor technology.

Symbotic Inc. vs Nano Nuclear Energy Inc. Positioning

Symbotic follows a diversified business model emphasizing warehouse automation services and software, benefiting from scale and steady revenue streams. Nano Nuclear pursues a concentrated approach focused on advanced nuclear technologies, with higher operational risk and limited scale.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC. Symbotic shows declining profitability, while Nano Nuclear has improving ROIC trends, indicating slightly better potential for future competitive advantage despite current challenges.

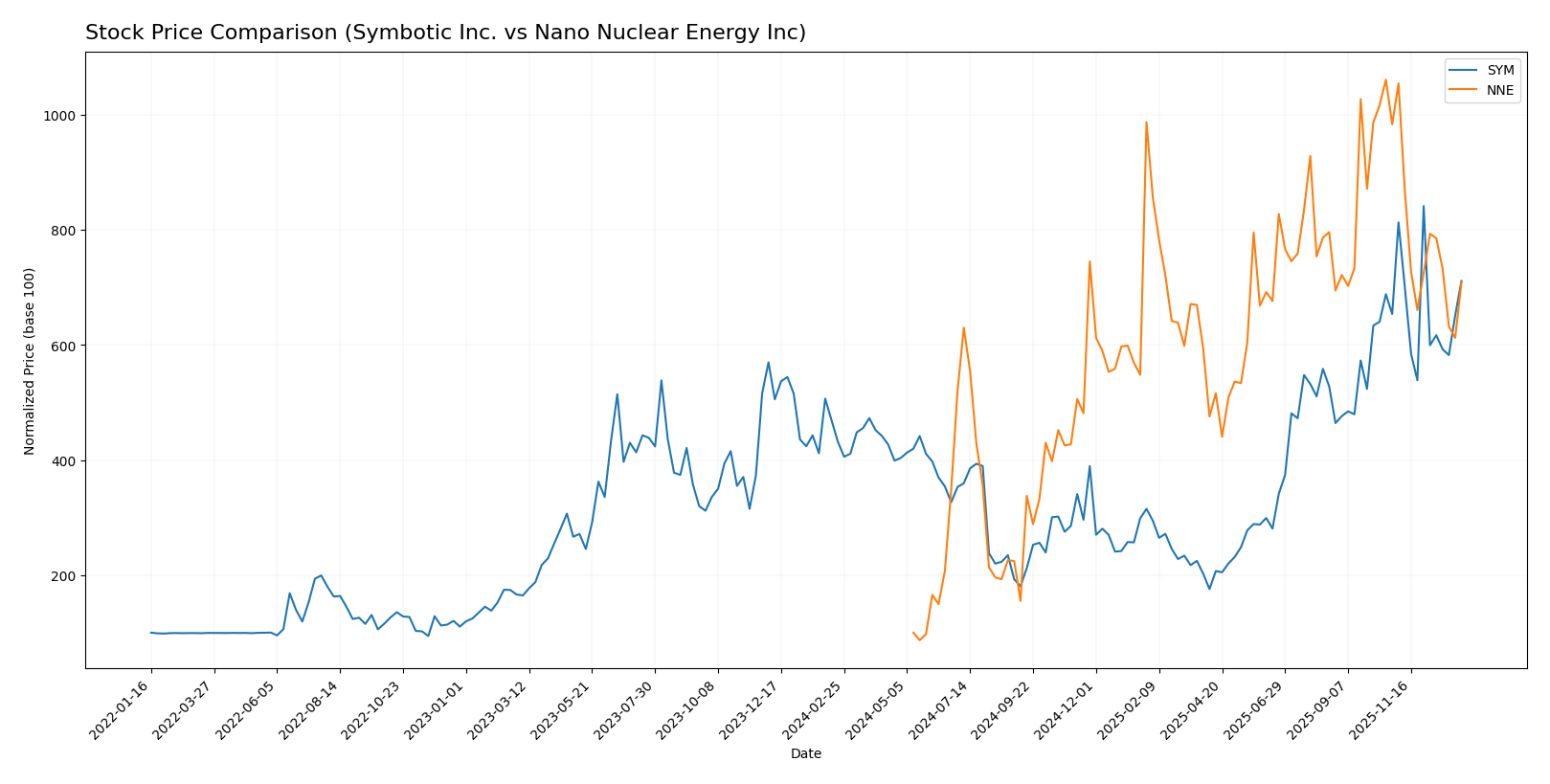

Stock Comparison

The stock price chart over the past year reveals significant price appreciation in both Symbotic Inc. and Nano Nuclear Energy Inc., with notable trading volume shifts and recent downward pressure on both stocks.

Trend Analysis

Symbotic Inc. (SYM) has experienced a bullish trend with a 64.58% price increase over the past 12 months, though the trend shows deceleration. The stock’s price ranged between 17.5 and 83.77, with a standard deviation of 15.15%.

Nano Nuclear Energy Inc. (NNE) exhibited a strong bullish trend with a 609.76% price increase over the past year, also decelerating. Its price fluctuated between 3.92 and 47.84, supported by a standard deviation of 10.81%.

Comparing both, Nano Nuclear Energy Inc. delivered the highest market performance with a substantially larger price increase, despite recent negative short-term trends for both stocks.

Target Prices

Analysts present a clear consensus on target prices for Symbotic Inc. and Nano Nuclear Energy Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Symbotic Inc. | 83 | 41 | 65.11 |

| Nano Nuclear Energy Inc | 50 | 50 | 50 |

For Symbotic Inc., the consensus target price of 65.11 USD is slightly below the current price of 70.82 USD, suggesting modest downside risk. Nano Nuclear Energy’s target consensus at 50 USD indicates potential upside from its current 32.01 USD price, reflecting optimistic analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Symbotic Inc. and Nano Nuclear Energy Inc.:

Rating Comparison

SYM Rating

- Rating: C+, considered very favorable overall by analysts.

- Discounted Cash Flow Score: 5, very favorable indicating strong future cash flow projections.

- ROE Score: 1, very unfavorable, reflecting poor profit generation from equity.

- ROA Score: 1, very unfavorable, showing ineffective asset utilization.

- Debt To Equity Score: 3, moderate, implying balanced financial risk.

- Overall Score: 2, moderate, summarizing average financial standing.

NNE Rating

- Rating: C, also regarded as very favorable overall.

- Discounted Cash Flow Score: 2, moderate outlook on cash flow valuation.

- ROE Score: 1, very unfavorable, similarly indicating weak equity returns.

- ROA Score: 1, very unfavorable, matching poor asset efficiency.

- Debt To Equity Score: 5, very favorable, indicating low financial leverage.

- Overall Score: 2, moderate, reflecting similar overall financial health.

Which one is the best rated?

Based strictly on the provided data, SYM holds a higher discounted cash flow score, suggesting better valuation prospects, while NNE excels in debt to equity score, implying stronger balance sheet health. Both have the same overall moderate rating.

Scores Comparison

Here is a comparison of the key financial scores for Symbotic Inc. and Nano Nuclear Energy Inc.:

SYM Scores

- Altman Z-Score: 13.05, indicating a safe zone.

- Piotroski Score: 3, classified as very weak.

NNE Scores

- Altman Z-Score: 143.56, indicating a safe zone.

- Piotroski Score: 2, classified as very weak.

Which company has the best scores?

Both companies are in the safe zone according to their Altman Z-Scores, with NNE having a notably higher score. However, both show very weak Piotroski Scores, with SYM scoring slightly higher than NNE.

Grades Comparison

Here is a comparison of recent grades and rating trends for Symbotic Inc. and Nano Nuclear Energy Inc.:

Symbotic Inc. Grades

The following table summarizes the latest grades from reputable financial institutions for Symbotic Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Downgrade | Sell | 2025-12-02 |

| Barclays | Maintain | Underweight | 2025-11-26 |

| Baird | Maintain | Neutral | 2025-11-26 |

| Craig-Hallum | Upgrade | Buy | 2025-11-25 |

| Northland Capital Markets | Maintain | Outperform | 2025-11-25 |

| Needham | Maintain | Buy | 2025-11-25 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-25 |

| DA Davidson | Maintain | Neutral | 2025-11-25 |

| Citigroup | Maintain | Buy | 2025-11-25 |

| UBS | Downgrade | Sell | 2025-09-23 |

Symbotic’s ratings show a mixed trend with several buy and outperform ratings but notable downgrades to sell from Goldman Sachs and UBS recently.

Nano Nuclear Energy Inc. Grades

This table presents the most recent grades from recognized grading companies for Nano Nuclear Energy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-08-19 |

| Ladenburg Thalmann | Downgrade | Sell | 2025-08-18 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-15 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-01-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-27 |

| Benchmark | Maintain | Buy | 2024-11-07 |

| Benchmark | Maintain | Buy | 2024-07-15 |

| Benchmark | Maintain | Buy | 2024-06-25 |

Nano Nuclear Energy has mainly consistent buy ratings, with a single sell downgrade by Ladenburg Thalmann in August 2025.

Which company has the best grades?

Both Symbotic Inc. and Nano Nuclear Energy hold overall “Buy” consensus ratings, but Nano Nuclear Energy displays more stable buy ratings with fewer downgrades. This may indicate a steadier analyst confidence level, potentially influencing investor sentiment and risk assessment accordingly.

Strengths and Weaknesses

Below is a comparative table highlighting key strengths and weaknesses of Symbotic Inc. (SYM) and Nano Nuclear Energy Inc. (NNE) based on their latest financial and operational data.

| Criterion | Symbotic Inc. (SYM) | Nano Nuclear Energy Inc. (NNE) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from Systems (2.12B in 2025), with smaller contributions from Operation Services and Software Maintenance | Low: Limited revenue data, focus on nuclear energy innovation |

| Profitability | Unfavorable: Negative net margin (-0.75%), ROIC -16.63%, ROE -7.65% indicating value destruction | Unfavorable: Zero net margin, ROIC -20.51%, ROE -18%, also shedding value but improving ROIC trend |

| Innovation | Strong in automation and systems integration, reflected in high fixed asset turnover (15.92) | Emerging technology with growing ROIC, but financials show early-stage investment losses |

| Global presence | Established with significant system sales and service operations | Smaller scale, primarily focused on niche nuclear technology |

| Market Share | Significant in automation systems for logistics and operations | Limited market penetration, niche segment with future potential |

In summary, Symbotic Inc. demonstrates strong operational scale and asset efficiency but struggles with profitability and value creation. Nano Nuclear Energy shows early-stage innovation with improving profitability trends but remains financially unfavorable. Investors should weigh Symbotic’s market presence against Nano Nuclear’s growth potential, considering both carry notable risks.

Risk Analysis

Below is a comparative risk table for Symbotic Inc. (SYM) and Nano Nuclear Energy Inc. (NNE) based on the most recent 2025 data:

| Metric | Symbotic Inc. (SYM) | Nano Nuclear Energy Inc. (NNE) |

|---|---|---|

| Market Risk | Beta 2.14, high volatility | Beta 7.49, extremely high volatility |

| Debt level | Low debt-to-equity 0.14 (favorable) | Very low debt-to-equity 0.01 (favorable) |

| Regulatory Risk | Moderate (industrial automation) | High (nuclear energy regulation) |

| Operational Risk | Moderate (automation tech execution) | High (technology development stage, microreactors) |

| Environmental Risk | Moderate (industrial machinery) | High (nuclear safety and waste concerns) |

| Geopolitical Risk | Low (US-based, stable environment) | Moderate (nuclear tech sensitive globally) |

Symbotic presents moderate operational and environmental risks with manageable debt, but its high beta suggests market volatility. Nano Nuclear Energy faces significant regulatory, operational, and environmental risks inherent to nuclear technology, compounded by very high market volatility. Investors should weigh the impactful nuclear sector risks of NNE against SYM’s market sensitivity and technology execution challenges.

Which Stock to Choose?

Symbotic Inc. (SYM) shows a favorable income evolution with 25.65% revenue growth in 2025 and overall 792% since 2021, despite negative profitability and declining returns on capital. Its financial ratios are slightly unfavorable but include low debt levels and a moderate current ratio. The company’s rating is very favorable (C+), though profitability metrics remain weak, and its MOAT evaluation is very unfavorable due to value destruction.

Nano Nuclear Energy Inc. (NNE) presents an unfavorable income statement with stagnant revenues and negative net income growth. Its financial ratios are mostly unfavorable, although it benefits from very low debt and a strong current ratio. The rating is very favorable (C) with a slightly unfavorable MOAT, reflecting value destruction but an improving ROIC trend, while profitability remains negative.

For risk-averse investors seeking stability, SYM’s stronger income growth and moderate financial ratios might appear more favorable, whereas risk-tolerant investors focused on turnaround potential may find NNE’s improving profitability trend and low leverage noteworthy despite its weak income performance. Both companies exhibit value destruction, suggesting cautious interpretation of their financials.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Symbotic Inc. and Nano Nuclear Energy Inc to enhance your investment decisions: