In the ever-evolving industrial machinery sector, Pentair plc and Nano Nuclear Energy Inc represent two distinct paths of innovation and market presence. Pentair, a global leader in water solutions, contrasts sharply with Nano Nuclear Energy’s cutting-edge microreactor technology. Despite their different approaches, both companies are shaping the future of industrial machinery. Join me as we analyze which offers the most compelling opportunity for investors in 2026.

Table of contents

Companies Overview

I will begin the comparison between Pentair plc and Nano Nuclear Energy Inc by providing an overview of these two companies and their main differences.

Pentair plc Overview

Pentair plc provides a wide range of water solutions globally, operating through Consumer Solutions and Industrial & Flow Technologies segments. It offers residential and commercial pool equipment, water treatment products, and advanced fluid treatment systems under multiple brand names. Founded in 1966 and headquartered in London, Pentair is a well-established player in the industrial machinery sector with a market cap of $16.9B.

Nano Nuclear Energy Inc Overview

Nano Nuclear Energy Inc focuses on microreactor technology development, including solid-core and low-pressure coolant reactors. The company is also working on uranium fuel fabrication and nuclear consultation services. Founded in 2021 and based in New York, it is a younger, smaller firm in the industrial machinery industry, with a market cap of $1.3B and a very limited workforce of five employees.

Key similarities and differences

Both companies operate within the industrial machinery sector but serve fundamentally different markets: Pentair specializes in water treatment and fluid management solutions, while Nano Nuclear Energy concentrates on advanced nuclear reactor technologies. Pentair is a mature, large-cap company with a diverse product portfolio and global presence, whereas Nano Nuclear is an early-stage, niche player focused on innovation in nuclear energy. Their business models reflect these contrasts in scale, scope, and technological focus.

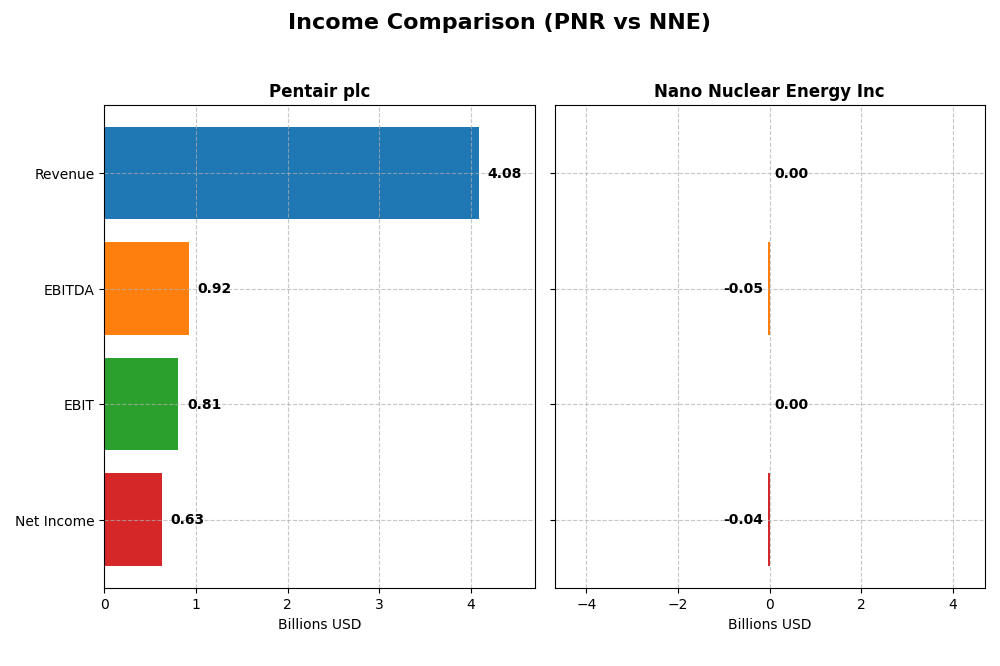

Income Statement Comparison

This table compares the most recent fiscal year income statement metrics for Pentair plc and Nano Nuclear Energy Inc, presenting key financial figures side by side.

| Metric | Pentair plc (PNR) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| Market Cap | 16.9B | 1.33B |

| Revenue | 4.08B | 0 |

| EBITDA | 922.1M | -46.2M |

| EBIT | 807.5M | 0 |

| Net Income | 625.4M | -40.1M |

| EPS | 3.78 | -1.06 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Pentair plc

Pentair plc showed a revenue increase of 35.29% from 2020 to 2024, with net income rising 74.4%, reflecting strong profitability growth. Margins improved overall, with a gross margin of 39.16% and a net margin of 15.32%. In 2024, revenue slightly declined by 0.53%, but gross profit and EBIT margins improved, indicating operational efficiency gains.

Nano Nuclear Energy Inc

Nano Nuclear Energy Inc reported no revenue from 2022 to 2025, resulting in zero gross and net margins. Net losses persisted, though EPS improved by nearly 100% in the latest year, reflecting reduced losses rather than profit. Operating expenses remained high and stable, indicating continued investment in development without generating revenue.

Which one has the stronger fundamentals?

Pentair plc demonstrates stronger fundamentals with favorable margin trends, significant income growth, and operational improvements despite a recent slight revenue dip. Conversely, Nano Nuclear Energy faces unfavorable income metrics, persistent losses, and no revenue generation, reflecting early-stage development risks and weaker financial stability over the period.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Pentair plc (PNR) and Nano Nuclear Energy Inc (NNE) based on their most recent fiscal data.

| Ratios | Pentair plc (PNR) 2024 | Nano Nuclear Energy Inc (NNE) 2025 |

|---|---|---|

| ROE | 17.55% | -18.00% |

| ROIC | 12.52% | -20.51% |

| P/E | 26.89 | -0.04 |

| P/B | 4.72 | 0.01 |

| Current Ratio | 1.60 | 53.48 |

| Quick Ratio | 0.92 | 53.48 |

| D/E (Debt-to-Equity) | 0.50 | 0.01 |

| Debt-to-Assets | 27.41% | 1.22% |

| Interest Coverage | 9.07 | 0 |

| Asset Turnover | 0.63 | 0 |

| Fixed Asset Turnover | 8.60 | 0 |

| Payout Ratio | 24.35% | 0 |

| Dividend Yield | 0.91% | 0 |

Interpretation of the Ratios

Pentair plc

Pentair plc exhibits generally strong financial ratios with favorable net margin at 15.32%, ROE of 17.55%, and ROIC of 12.52%, reflecting efficient profitability and capital use. Some ratios such as PE at 26.89 and PB at 4.72 are less favorable, indicating a relatively high valuation. The company maintains a dividend yield of 0.91%, supported by steady dividends, but the yield is considered low relative to industry peers.

Nano Nuclear Energy Inc

Nano Nuclear Energy shows predominantly weak ratios, including a negative ROE of -18.0% and ROIC of -20.51%, signaling operational challenges and poor profitability. The company does not pay dividends, consistent with its negative earnings and ongoing development stage. Favorable metrics include a low debt-to-assets ratio of 1.22% and a high quick ratio of 53.48, indicating strong liquidity despite operational losses.

Which one has the best ratios?

Comparing both, Pentair plc demonstrates the most favorable financial health with stronger profitability, manageable leverage, and consistent dividend payments. Nano Nuclear Energy’s ratios highlight significant operational and financial risks, reflecting its early growth phase and lack of earnings. Overall, Pentair’s ratios present a more stable profile relative to Nano Nuclear Energy’s unfavorable metrics.

Strategic Positioning

This section compares the strategic positioning of Pentair plc and Nano Nuclear Energy Inc, including Market position, Key segments, and exposure to technological disruption:

Pentair plc

- Large market cap of 16.9B with moderate beta of 1.21, facing industrial machinery competition.

- Diverse segments: Consumer pool equipment, water treatment, and industrial fluid technologies.

- Exposure to established industrial tech; no specific mention of disruption risks or innovations.

Nano Nuclear Energy Inc

- Smaller market cap of 1.3B with high beta of 7.49, operating in niche microreactor technology sector.

- Focused on microreactors, nuclear fuel fabrication, and consultancy services.

- Positioned in emerging nuclear tech, potentially highly exposed to technological advancements and risks.

Pentair plc vs Nano Nuclear Energy Inc Positioning

Pentair exhibits a diversified business model across water and industrial solutions with stable market presence. Nano Nuclear Energy is concentrated in innovative nuclear microreactors, reflecting higher risk and growth potential based on its niche focus and small scale.

Which has the best competitive advantage?

Pentair demonstrates a very favorable moat with consistent value creation and growing profitability. Nano Nuclear Energy shows a slightly unfavorable moat, currently shedding value despite improving profitability.

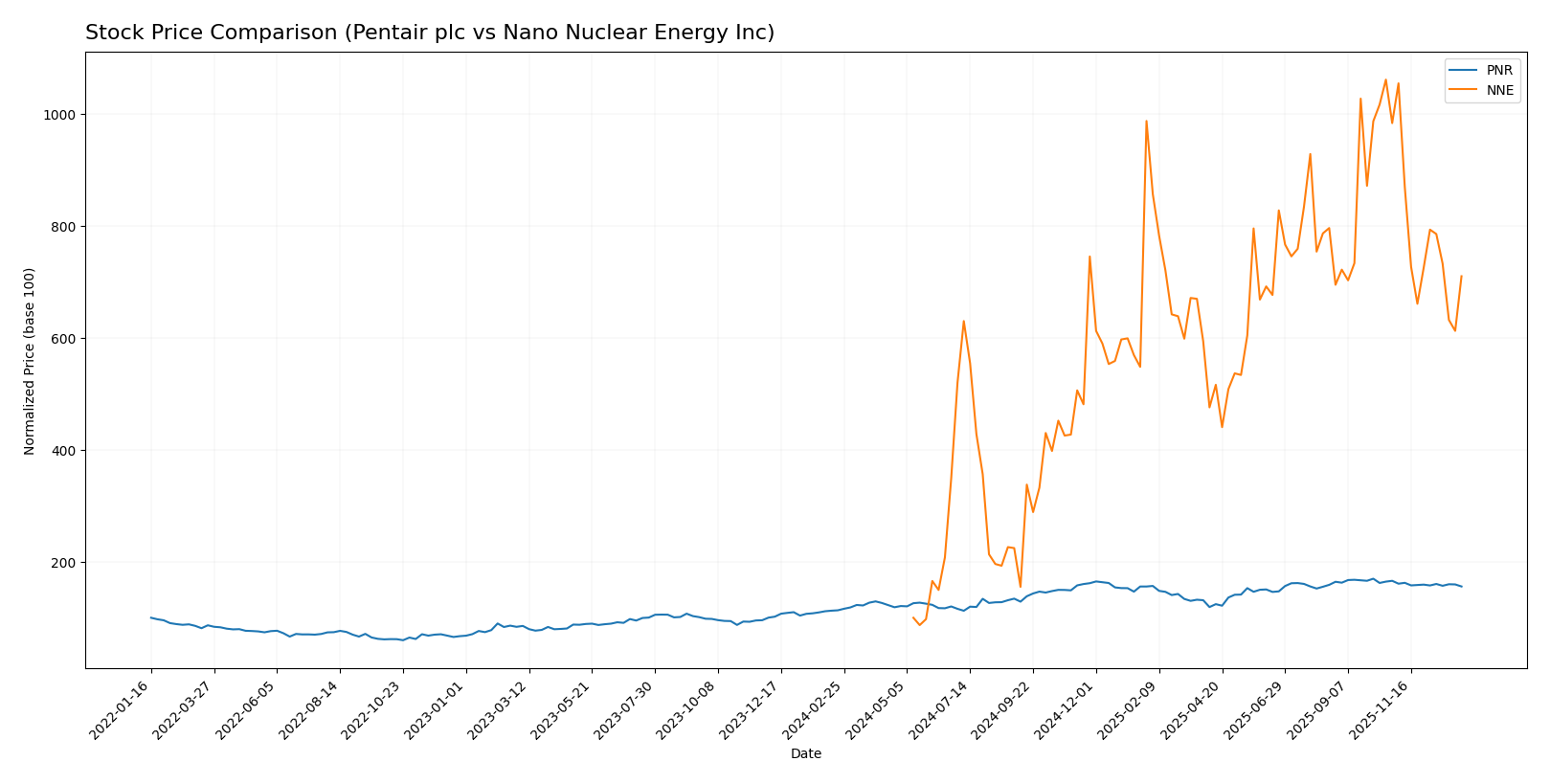

Stock Comparison

The stock price movements of Pentair plc (PNR) and Nano Nuclear Energy Inc (NNE) over the past year reveal significant bullish trends with notable deceleration and recent downturns in both cases, reflecting dynamic trading conditions.

Trend Analysis

Pentair plc’s stock showed a strong bullish trend over the past 12 months with a 37.56% price increase, accompanied by deceleration and a standard deviation of 11.1. Recent months reveal a slight bearish correction of -6.08%.

Nano Nuclear Energy Inc experienced an exceptionally bullish trend with a 609.76% rise over the year, also decelerating and a standard deviation of 10.81. However, recent performance declined sharply by -27.81%, indicating increased volatility.

Comparing both, NNE delivered the highest market performance with a substantially larger annual gain despite recent declines, while PNR showed moderate but steady growth and less volatility recently.

Target Prices

The current consensus target prices reflect optimistic outlooks from recognized analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Pentair plc | 135 | 90 | 122.63 |

| Nano Nuclear Energy Inc | 50 | 50 | 50 |

Analysts expect Pentair plc’s stock price to rise from the current 103.06 USD toward a consensus near 123 USD, signaling moderate upside potential. Nano Nuclear Energy Inc’s consensus target of 50 USD suggests significant growth from its present 32.01 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Pentair plc and Nano Nuclear Energy Inc:

Rating Comparison

Pentair plc Rating

- Rating: B, considered very favorable overall.

- Discounted Cash Flow Score: 3, moderate valuation status.

- ROE Score: 4, favorable efficiency in generating profit.

- ROA Score: 5, very favorable asset utilization.

- Debt To Equity Score: 2, moderate financial risk.

Nano Nuclear Energy Inc Rating

- Rating: C, also categorized as very favorable overall.

- Discounted Cash Flow Score: 2, moderate valuation status.

- ROE Score: 1, very unfavorable profit generation.

- ROA Score: 1, very unfavorable asset utilization.

- Debt To Equity Score: 5, very favorable financial risk.

Which one is the best rated?

Pentair plc holds a higher overall rating with stronger scores in ROE and ROA, indicating better profitability and asset use. Nano Nuclear Energy Inc has a superior debt-to-equity score but lower profitability metrics, resulting in a lower overall score.

Scores Comparison

The scores comparison between Pentair plc and Nano Nuclear Energy Inc is as follows:

Pentair plc Scores

- Altman Z-Score: 5.05, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

Nano Nuclear Energy Inc Scores

- Altman Z-Score: 143.56, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 2, classified as very weak financial health.

Which company has the best scores?

Nano Nuclear Energy Inc has a much higher Altman Z-Score, suggesting very low bankruptcy risk. However, Pentair plc shows a significantly stronger Piotroski Score, indicating better overall financial health.

Grades Comparison

The following is a comparison of the latest available grades for Pentair plc and Nano Nuclear Energy Inc:

Pentair plc Grades

This table summarizes recent grades and rating changes from established grading companies for Pentair plc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BNP Paribas Exane | Downgrade | Underperform | 2026-01-07 |

| TD Cowen | Downgrade | Sell | 2026-01-05 |

| Jefferies | Upgrade | Buy | 2025-12-10 |

| Barclays | Downgrade | Equal Weight | 2025-12-04 |

| Oppenheimer | Maintain | Outperform | 2025-11-20 |

| UBS | Maintain | Buy | 2025-10-22 |

| RBC Capital | Maintain | Outperform | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-22 |

| Oppenheimer | Maintain | Outperform | 2025-10-20 |

| JP Morgan | Maintain | Overweight | 2025-10-15 |

Pentair plc’s grades show a mixed trend with recent downgrades from BNP Paribas Exane and TD Cowen, contrasting with several maintained or upgraded ratings earlier, reflecting some analyst caution.

Nano Nuclear Energy Inc Grades

This table presents recent grades from recognized grading firms for Nano Nuclear Energy Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-08-19 |

| Ladenburg Thalmann | Downgrade | Sell | 2025-08-18 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-15 |

| HC Wainwright & Co. | Maintain | Buy | 2025-03-31 |

| HC Wainwright & Co. | Maintain | Buy | 2025-01-29 |

| HC Wainwright & Co. | Maintain | Buy | 2024-11-27 |

| Benchmark | Maintain | Buy | 2024-11-07 |

| Benchmark | Maintain | Buy | 2024-07-15 |

| Benchmark | Maintain | Buy | 2024-06-25 |

Nano Nuclear Energy Inc largely maintains “Buy” ratings from HC Wainwright & Co. and Benchmark, with a single recent downgrade from Ladenburg Thalmann to “Sell,” indicating predominantly positive analyst sentiment.

Which company has the best grades?

Nano Nuclear Energy Inc holds a stronger overall consensus with a majority of “Buy” ratings, while Pentair plc’s consensus leans toward “Hold” with some recent downgrades. This difference may influence investor perception of potential risk and reward profiles for each stock.

Strengths and Weaknesses

The table below summarizes the key strengths and weaknesses of Pentair plc (PNR) and Nano Nuclear Energy Inc (NNE) based on recent financial and strategic data.

| Criterion | Pentair plc (PNR) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| Diversification | Well-diversified with Industrial, Pool, and Water units contributing over $4B in revenue | Limited diversification; early-stage with no reported revenue segments |

| Profitability | Strong profitability: net margin 15.3%, ROIC 12.5%, ROE 17.6% | Negative profitability: net margin 0%, ROIC -20.5%, ROE -18% |

| Innovation | Consistent innovation in water and flow technologies, supporting durable competitive advantage | Emerging player with growing ROIC trend but currently value destructive |

| Global presence | Established global footprint with broad market reach | Limited global presence, still in development phase |

| Market Share | Significant market share in water solutions and industrial flow technologies | Minimal market share, industry entrant |

Pentair stands out with a durable competitive advantage, strong profitability, and diversified revenue streams, making it a relatively lower-risk investment. Nano Nuclear Energy shows promise with improving ROIC but remains a high-risk option due to ongoing value destruction and limited market presence.

Risk Analysis

Below is a comparison of key risks for Pentair plc (PNR) and Nano Nuclear Energy Inc (NNE) based on the most recent data from 2025-2026:

| Metric | Pentair plc (PNR) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| Market Risk | Moderate (Beta 1.21) – industrial machinery sector exposure, cyclical demand | Very High (Beta 7.49) – early-stage microreactor tech, volatile market |

| Debt level | Moderate (D/E 0.5, debt/assets 27%) – manageable leverage | Very Low (D/E 0.01, debt/assets 1.2%) – minimal debt, low financial risk |

| Regulatory Risk | Moderate – global water and industrial regulations | High – nuclear energy is heavily regulated with evolving policies |

| Operational Risk | Moderate – established operations with diversified product lines | High – early development stage, small team, technology and scale-up risks |

| Environmental Risk | Moderate – water treatment focus but industrial footprint | High – nuclear technology risks, waste management, and safety concerns |

| Geopolitical Risk | Moderate – global operations, exposure to trade policies | High – sensitive technology with geopolitical and export control considerations |

In synthesis, Nano Nuclear Energy faces the highest risks, especially regulatory, operational, and geopolitical, due to its pioneering nuclear microreactor technology and small scale. Pentair shows more balanced risk with moderate market, regulatory, and operational exposure but benefits from scale and diversification. Investors should weigh NNE’s high volatility and regulatory hurdles against the more stable, though cyclical, profile of PNR.

Which Stock to Choose?

Pentair plc (PNR) exhibits a favorable income evolution with 35.29% revenue growth over 2020-2024 and solid profitability metrics, including a 15.32% net margin and 17.55% ROE. Its debt levels are moderate, supported by a 1.6 current ratio, and its overall rating is very favorable (B).

Nano Nuclear Energy Inc (NNE) shows unfavorable income statement trends with zero revenue growth and negative returns, including a -18% ROE and negative ROIC versus WACC. However, it maintains very low debt levels and a strong current ratio, yet its global financial ratios and rating remain unfavorable (C).

Considering the ratings and financial evaluations, PNR could appear more favorable for investors prioritizing stability, profitability, and value creation, while NNE might appeal to risk-tolerant investors interested in high-growth potential despite current financial challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Pentair plc and Nano Nuclear Energy Inc to enhance your investment decisions: