Home > Comparison > Industrials > OTIS vs NNE

The strategic rivalry between Otis Worldwide Corporation and Nano Nuclear Energy Inc shapes the evolution of the Industrials sector. Otis operates as a capital-intensive machinery manufacturer and global service provider in elevators and escalators. In contrast, Nano Nuclear pioneers cutting-edge microreactor technology with a lean operational model. This analysis compares their distinct growth trajectories to identify the superior risk-adjusted opportunity for a diversified portfolio seeking industrial innovation and stability.

Table of contents

Companies Overview

Otis Worldwide and Nano Nuclear Energy represent two distinct pillars in the industrial machinery sector, shaping infrastructure and energy futures.

Otis Worldwide Corporation: Elevator and Escalator Industry Leader

Otis Worldwide dominates the elevator and escalator market with its core business of manufacturing and servicing vertical transportation systems. It generates revenue through new equipment sales and an extensive service network boasting 34,000 mechanics globally. In 2026, Otis focuses strategically on modernizing aging infrastructure and expanding its maintenance footprint to sustain steady cash flow.

Nano Nuclear Energy Inc: Microreactor Innovator

Nano Nuclear Energy pioneers microreactor technology, developing solid-core and low-pressure coolant reactors. Its revenue engine centers on advancing nuclear fuel fabrication and consultation services for the nuclear industry. In 2026, Nano Nuclear emphasizes scaling its ZEUS and ODIN reactor projects while establishing supply chains for high-assay low-enriched uranium fuel, positioning itself at the frontier of clean energy innovation.

Strategic Collision: Similarities & Divergences

Otis and Nano Nuclear share an industrial machinery foundation but diverge sharply in business philosophy. Otis operates a mature, service-driven ecosystem, while Nano Nuclear pursues breakthrough energy technology with high volatility risk. Their competition lies in infrastructure’s future—vertical mobility versus clean energy generation. Investors face contrasting profiles: Otis offers stable, cash-generative operations; Nano Nuclear embodies high-growth potential with technological and regulatory uncertainties.

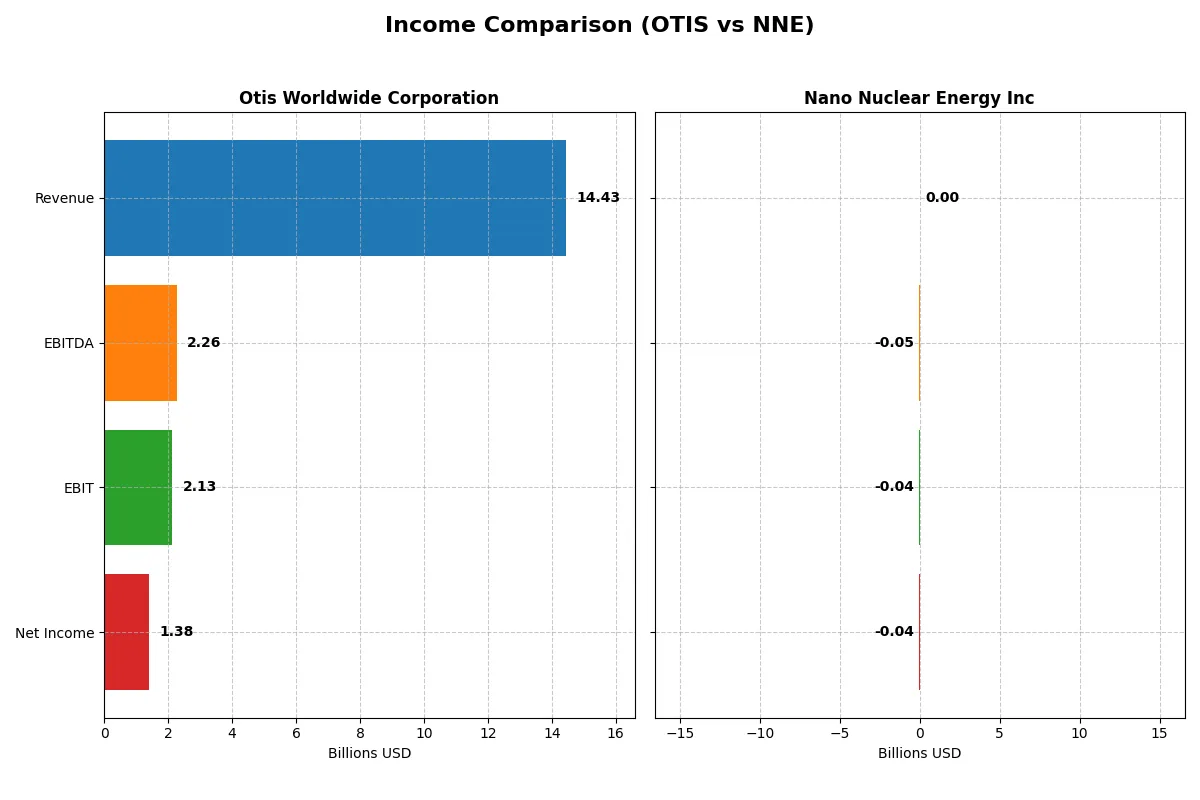

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Otis Worldwide Corporation (OTIS) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| Revenue | 14.43B | 0 |

| Cost of Revenue | 10.04B | 651K |

| Operating Expenses | 2.20B | 44.36M |

| Gross Profit | 4.40B | -651K |

| EBITDA | 2.26B | -46.22M |

| EBIT | 2.13B | -40.07M |

| Interest Expense | 196M | 0 |

| Net Income | 1.38B | -40.07M |

| EPS | 3.53 | -1.06 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes each company’s operational efficiency and profitability over recent fiscal years.

Otis Worldwide Corporation Analysis

Otis’s revenue shows a steady, if modest, growth, reaching $14.4B in 2025. Net income climbs to $1.38B, reflecting solid profitability. Gross margin holds firm around 30%, while net margin remains favorable near 9.6%. Despite a slight dip in net margin growth in 2025, Otis maintains strong operational momentum and efficient cost management.

Nano Nuclear Energy Inc Analysis

Nano Nuclear Energy reports zero revenue through 2025, with persistent net losses enlarging to -$40M. Gross and net margins remain unfavorable at 0%, reflecting continued startup-phase challenges. Operating expenses sharply outweigh any income, though interest income offers some offset. The company shows no revenue growth and mounting losses, signaling early-stage operational inefficiencies.

Verdict: Established Profitability vs. Early-Stage Losses

Otis dominates with consistent revenue and positive net income, demonstrating operational strength and margin control. Nano Nuclear Energy struggles with zero revenue and escalating losses, typical for pre-commercial ventures. For investors, Otis’s proven profitability offers a stable profile, while Nano Nuclear’s risk profile remains high due to ongoing negative earnings.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Otis Worldwide Corporation (OTIS) | Nano Nuclear Energy Inc (NNE) |

|---|---|---|

| ROE | -25.7% | -0.02% |

| ROIC | 40.7% | -0.02% |

| P/E | 24.8 | -36.5 |

| P/B | -6.4 | 0.007 |

| Current Ratio | 0.85 | 53.5 |

| Quick Ratio | 0.77 | 53.5 |

| D/E | -1.62 | 0.013 |

| Debt-to-Assets | 82.1% | 1.2% |

| Interest Coverage | 11.2 | 0 |

| Asset Turnover | 1.35 | 0 |

| Fixed Asset Turnover | 11.1 | 0 |

| Payout ratio | 46.7% | 0 |

| Dividend yield | 1.88% | 0 |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence that shape investment decisions.

Otis Worldwide Corporation

Otis posts a mixed profitability profile with a strong ROIC at 40.7% but a deeply negative ROE at -25.7%. The stock trades at a neutral P/E of 24.85 and a modest dividend yield of 1.88%, indicating balanced valuation and shareholder returns. Efficiency shines through a high asset turnover, while debt levels raise caution.

Nano Nuclear Energy Inc

Nano Nuclear suffers from unfavorable profitability metrics, with negative ROE and ROIC near zero. Its P/E is negative but considered favorable due to valuation distortion. The current ratio is unusually high at 53.5, signaling atypical liquidity, while no dividends are paid, reflecting early-stage reinvestment or operational challenges.

Balanced Profitability vs. Early-Stage Risk

Otis offers a better risk-reward balance, delivering operational efficiency and stable shareholder returns despite some leverage concerns. Nano Nuclear’s metrics reveal high risk and poor profitability, fitting speculative investors seeking early-stage opportunities. Choose Otis for stability, Nano Nuclear for high-risk growth potential.

Which one offers the Superior Shareholder Reward?

Otis offers consistent dividends with a yield near 1.8% and a sustainable payout ratio around 37%-47%, backed by strong free cash flow coverage above 90%. It also maintains steady buybacks, enhancing total returns. Nano Nuclear Energy pays no dividends and burns cash with negative free cash flow, relying heavily on cash reserves for growth. Otis’s balanced distribution and capital allocation provide a far more attractive and sustainable shareholder reward profile in 2026.

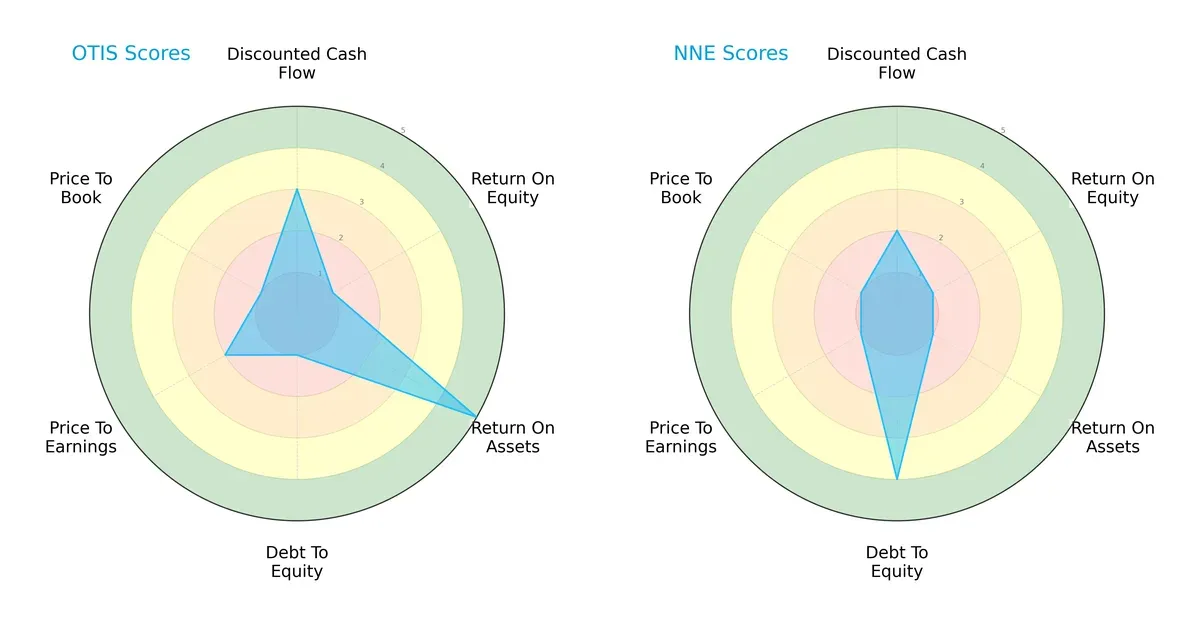

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of both Otis Worldwide Corporation and Nano Nuclear Energy Inc:

Otis shows strength in asset utilization (ROA score 5) but struggles with leverage (Debt/Equity score 1) and equity returns (ROE score 1). Nano Nuclear Energy posts a stronger Debt/Equity score (4), signaling better financial stability, yet suffers from weak operational efficiency (ROA score 1) and valuation metrics (PE and PB scores both 1). Otis presents a more balanced profile, leveraging asset efficiency despite debt concerns, while Nano Nuclear Energy relies heavily on low leverage as its key advantage.

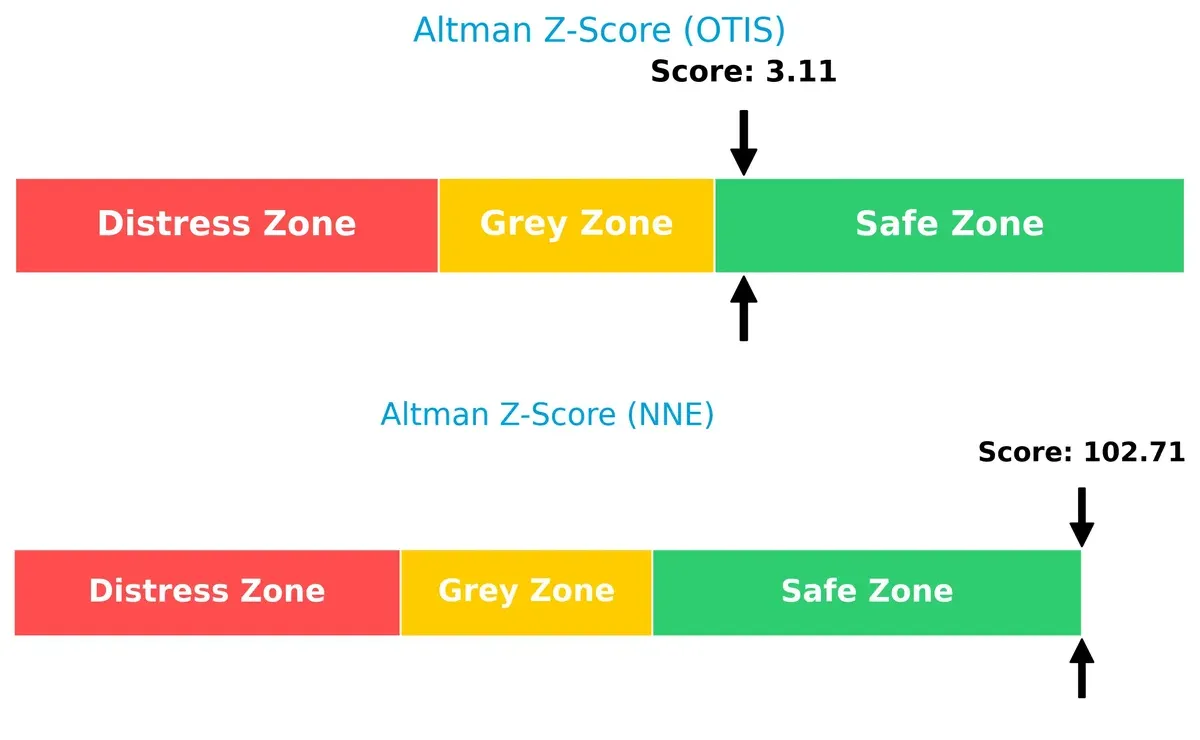

Bankruptcy Risk: Solvency Showdown

Otis and Nano Nuclear Energy both fall in the safe zone by Altman Z-Score standards, but Nano Nuclear Energy’s score (103) far exceeds Otis’s 3.1, indicating exceptional solvency and minimal bankruptcy risk in this cycle:

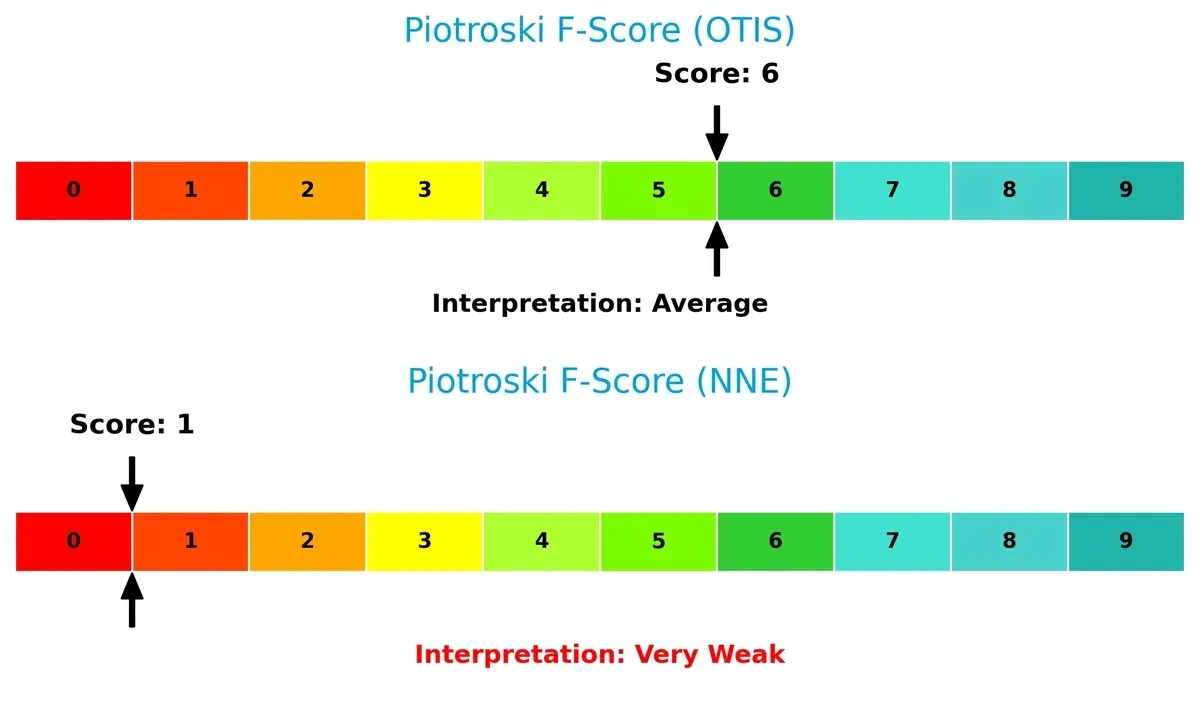

Financial Health: Quality of Operations

Otis scores a solid 6 on the Piotroski F-Score, reflecting average financial health with some operational strengths. In contrast, Nano Nuclear Energy’s score of 1 signals significant internal red flags, suggesting weak profitability and poor financial quality compared to Otis:

How are the two companies positioned?

This section dissects OTIS and NNE’s operational DNA by comparing revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to reveal which model offers the most resilient competitive advantage today.

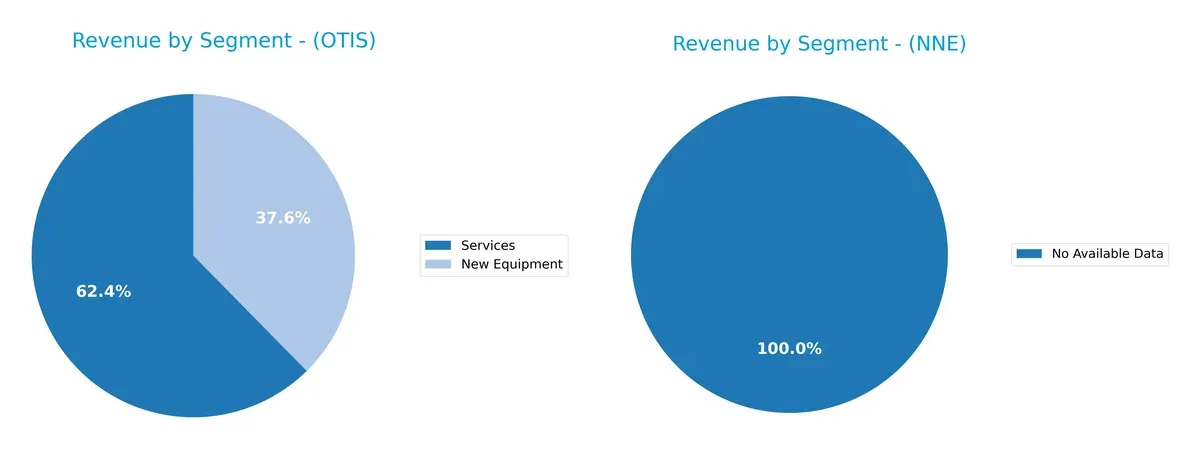

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Otis Worldwide Corporation and Nano Nuclear Energy Inc diversify their income streams and where their primary sector bets lie:

Otis anchors its revenue with a strong services segment, generating $8.9B in 2024, dwarfing its $5.4B new equipment sales. This mix reflects a mature, recurring revenue model typical in infrastructure dominance. Nano Nuclear Energy lacks available data, preventing segmentation analysis. Otis’s reliance on services reduces concentration risk while leveraging ecosystem lock-in, signaling strategic stability amid market cycles.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Otis Worldwide Corporation and Nano Nuclear Energy Inc:

Otis Strengths

- Diverse revenue from New Equipment and Services segments

- Significant global presence including US and China

- Favorable ROIC of 40.74%, exceeding WACC at 7.4%

- Strong asset and fixed asset turnover ratios

- Positive interest coverage ratio

NNE Strengths

- Favorable price-to-earnings and price-to-book ratios

- Very low debt-to-assets ratio at 1.22%

- Favorable quick ratio indicating liquidity

- Low debt-to-equity ratio suggesting conservative leverage

Otis Weaknesses

- Negative ROE at -25.67%

- High debt-to-assets ratio at 82.14%

- Current and quick ratios below 1 signal liquidity concerns

- Negative price-to-book ratio

- Neutral net margin and dividend yield

NNE Weaknesses

- Zero net margin, ROE, ROIC, and interest coverage reflect unprofitability

- High WACC at 14.03%, exceeding returns

- Current ratio unusually high at 53.48 (potential data anomaly)

- Zero asset turnover ratios indicate operational inefficiency

- No dividend yield

Otis shows operational scale and efficiency with balanced diversification but faces liquidity and profitability challenges. NNE struggles with profitability and operational metrics despite low leverage. These contrasts highlight differing strategic and financial maturity stages.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat shields long-term profits from relentless competition and market pressures. Only a durable competitive advantage ensures sustained value creation:

Otis Worldwide Corporation: Service Network Switching Costs

Otis leverages a vast, entrenched service network creating high switching costs. Its 33% ROIC above WACC confirms efficient capital use and margin stability. Innovations in modernization services could solidify its lead into 2026.

Nano Nuclear Energy Inc: Emerging Technology Disruption

Nano Nuclear pursues cutting-edge microreactor tech, contrasting Otis’s established network. Despite negative ROIC, rapid R&D investments fuel growth potential. Commercialization success in 2026 could reshape nuclear energy markets but remains speculative.

Market Entrenchment vs. Technological Gambit

Otis’s wide, durable moat from service integration outpaces Nano Nuclear’s nascent technological advantage. Otis stands better equipped to defend and grow market share, while Nano Nuclear faces steep execution risks.

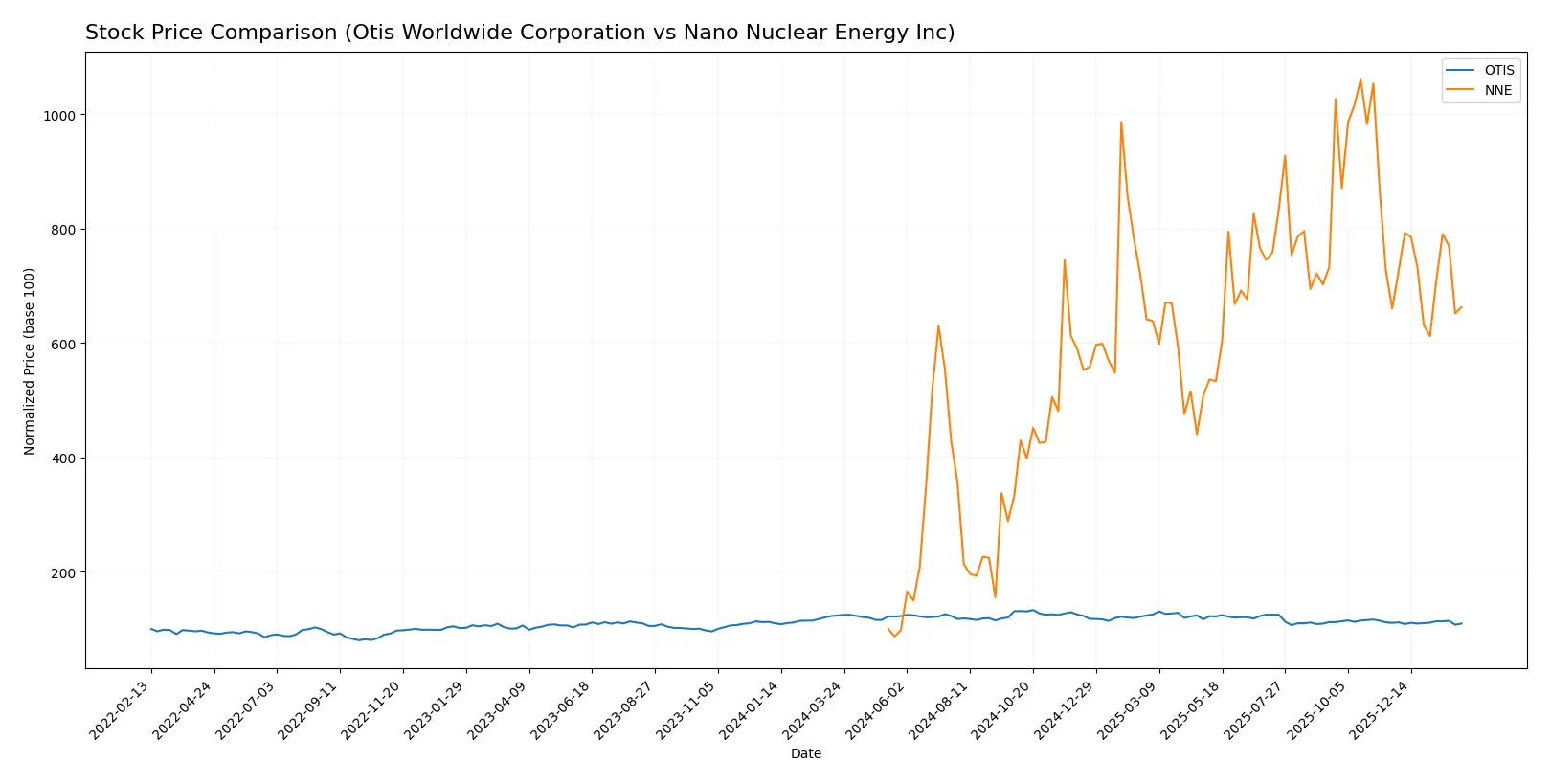

Which stock offers better returns?

Over the past year, Otis Worldwide Corporation’s stock declined sharply by 11.51%, while Nano Nuclear Energy Inc surged dramatically, reflecting contrasting trading dynamics and volatility profiles.

Trend Comparison

Otis Worldwide Corporation’s stock shows a bearish trend with an 11.51% decline over 12 months, accelerating downward from a high of 106.01 to a low of 84.93 with moderate volatility (4.92 std dev).

Nano Nuclear Energy Inc exhibits a strong bullish trend, gaining 562.75% over the same 12-month period, though with decelerating momentum and higher volatility (10.65 std dev), moving from 3.92 to 47.84.

Comparing these stocks, Nano Nuclear Energy clearly delivered the highest market performance, outperforming Otis by a wide margin throughout the past year.

Target Prices

Analysts present a clear consensus on target prices for Otis Worldwide Corporation and Nano Nuclear Energy Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Otis Worldwide Corporation | 92 | 109 | 97.75 |

| Nano Nuclear Energy Inc | 50 | 50 | 50 |

The target consensus for Otis suggests upside potential from its current price of 87.16, indicating moderate analyst confidence. Nano Nuclear Energy’s target of 50 is significantly above its current 29.89, reflecting high growth expectations but also elevated risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Otis Worldwide Corporation Grades

Here are the most recent institutional grades for Otis Worldwide Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | maintain | Overweight | 2026-01-16 |

| Wells Fargo | maintain | Equal Weight | 2025-12-15 |

| Barclays | maintain | Underweight | 2025-10-30 |

| JP Morgan | maintain | Overweight | 2025-10-15 |

| Wolfe Research | upgrade | Outperform | 2025-10-08 |

| Wells Fargo | maintain | Equal Weight | 2025-10-06 |

| JP Morgan | maintain | Overweight | 2025-09-18 |

| RBC Capital | maintain | Outperform | 2025-07-28 |

| Wolfe Research | upgrade | Peer Perform | 2025-07-25 |

| Wells Fargo | maintain | Equal Weight | 2025-07-24 |

Nano Nuclear Energy Inc Grades

Below are the latest institutional grades for Nano Nuclear Energy Inc:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | maintain | Buy | 2025-08-19 |

| Ladenburg Thalmann | downgrade | Sell | 2025-08-18 |

| HC Wainwright & Co. | maintain | Buy | 2025-08-15 |

| HC Wainwright & Co. | maintain | Buy | 2025-03-31 |

| HC Wainwright & Co. | maintain | Buy | 2025-01-29 |

| HC Wainwright & Co. | maintain | Buy | 2024-11-27 |

| Benchmark | maintain | Buy | 2024-11-07 |

| Benchmark | maintain | Buy | 2024-07-15 |

| Benchmark | maintain | Buy | 2024-06-25 |

Which company has the best grades?

Otis Worldwide shows a mixed but stable profile with several Overweight and Outperform ratings. Nano Nuclear Energy carries mostly Buy ratings but also a notable Sell downgrade. Otis’s higher-grade diversity may indicate more nuanced institutional confidence.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Otis Worldwide Corporation and Nano Nuclear Energy Inc in the 2026 market environment:

1. Market & Competition

Otis Worldwide Corporation

- Established global presence in elevators with steady demand but faces intense competition from new tech entrants.

Nano Nuclear Energy Inc

- Emerging microreactor tech with high growth potential but faces uncertain market adoption and strong industry incumbents.

2. Capital Structure & Debt

Otis Worldwide Corporation

- High debt-to-assets ratio at 82%, signaling leverage risk despite strong interest coverage.

Nano Nuclear Energy Inc

- Minimal debt with 1.2% debt-to-assets, indicating low financial risk but limited capital access for expansion.

3. Stock Volatility

Otis Worldwide Corporation

- Beta near 1.0 reflects market-level volatility, suitable for risk-averse investors.

Nano Nuclear Energy Inc

- Extremely high beta of 7.5 exposes investors to sharp price swings and speculative risk.

4. Regulatory & Legal

Otis Worldwide Corporation

- Subject to industry safety standards and international trade regulations, manageable compliance risk.

Nano Nuclear Energy Inc

- Faces complex nuclear regulatory hurdles and licensing risks, delaying commercialization timelines.

5. Supply Chain & Operations

Otis Worldwide Corporation

- Mature supply chain with large service network but exposed to raw material cost inflation.

Nano Nuclear Energy Inc

- Early-stage operations with limited supply chain establishment, vulnerable to disruption and scalability issues.

6. ESG & Climate Transition

Otis Worldwide Corporation

- Moderate ESG risks; opportunity to improve energy efficiency in products and reduce carbon footprint.

Nano Nuclear Energy Inc

- High ESG sensitivity due to nuclear energy, facing public perception and environmental regulatory challenges.

7. Geopolitical Exposure

Otis Worldwide Corporation

- Global footprint includes exposure to trade tensions, especially in China and emerging markets.

Nano Nuclear Energy Inc

- Primarily US-based but dependent on geopolitical stability for nuclear fuel supply and regulatory policy.

Which company shows a better risk-adjusted profile?

Otis Worldwide’s main risk is heavy leverage amid moderate operational volatility. Nano Nuclear faces existential risks from regulatory uncertainty and extreme stock volatility. Otis’s diversified operations and solid Altman Z-score (3.11, safe zone) suggest a better risk-adjusted profile. Nano Nuclear’s very weak Piotroski score (1) and speculative beta highlight substantial risk. Prudence favors Otis for risk-conscious investors.

Final Verdict: Which stock to choose?

Otis Worldwide Corporation’s superpower lies in its durable competitive advantage and impressive capital efficiency. It consistently delivers strong returns on invested capital, signaling a clear value creator. A point of vigilance is its weak liquidity ratios, which could pressure short-term operational flexibility. Otis suits portfolios targeting stable, long-term growth with moderate risk tolerance.

Nano Nuclear Energy Inc offers a strategic moat through its innovative technology potential and low debt burden. While it lacks current profitability, its balance sheet strength relative to Otis suggests a safer financial footing for early-stage growth bets. Nano Nuclear fits investors with a high-risk appetite, seeking speculative exposure to breakthrough energy solutions.

If you prioritize consistent value creation and operational resilience, Otis outshines as the compelling choice due to its proven moat and profitability. However, if you seek high-risk, high-reward exposure to emerging tech, Nano Nuclear offers better stability in capital structure with potential upside from its innovation trajectory. Both present distinct analytical scenarios tailored to different investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Otis Worldwide Corporation and Nano Nuclear Energy Inc to enhance your investment decisions: