In the fast-evolving semiconductor industry, Monolithic Power Systems, Inc. (MPWR) and Tower Semiconductor Ltd. (TSEM) stand out as innovative leaders with distinct approaches. MPWR focuses on power electronics solutions, while TSEM operates an independent foundry specializing in analog and mixed-signal devices. Both companies address overlapping markets, making their comparison essential for investors seeking growth and stability. This article will help you decide which company is the more compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Monolithic Power Systems and Tower Semiconductor by providing an overview of these two companies and their main differences.

Monolithic Power Systems Overview

Monolithic Power Systems, Inc. specializes in designing, developing, marketing, and selling semiconductor-based power electronics solutions. Its products serve markets including computing, automotive, industrial, communications, and consumer electronics. The company focuses on DC to DC integrated circuits and lighting control ICs used in various devices such as portable electronics, wireless LAN access points, and medical equipment. Headquartered in Kirkland, Washington, it operates globally through distributors and direct sales.

Tower Semiconductor Overview

Tower Semiconductor Ltd. is an independent semiconductor foundry offering analog intensive mixed-signal semiconductor devices and customizable process technologies like SiGe, BiCMOS, RF CMOS, and MEMS. It provides wafer fabrication and design support services to integrated device manufacturers and fabless companies. Tower serves diverse markets, including consumer electronics, automotive, aerospace, and medical devices. The company is based in Migdal Haemek, Israel, and operates internationally.

Key similarities and differences

Both companies operate in the semiconductor industry and serve multiple end markets such as automotive and consumer electronics. Monolithic Power Systems primarily designs and markets semiconductor power solutions and ICs, while Tower Semiconductor focuses on foundry services and manufacturing customizable semiconductor devices. Monolithic Power has a stronger emphasis on power electronics design, whereas Tower provides wafer fabrication and design enablement services to external customers.

Income Statement Comparison

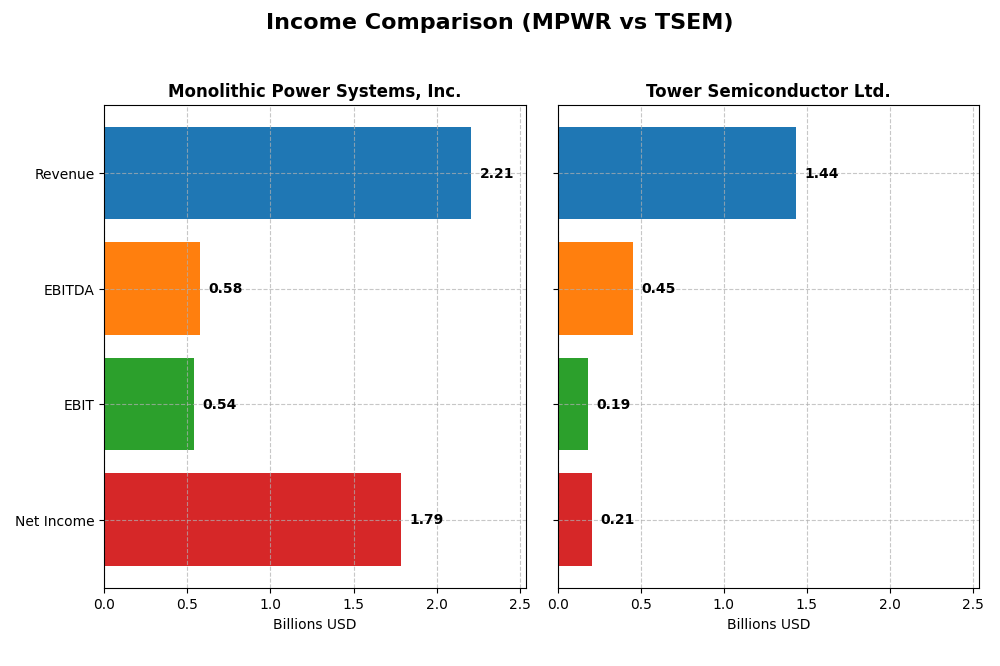

The table below compares key income statement metrics for Monolithic Power Systems, Inc. and Tower Semiconductor Ltd. for the fiscal year 2024.

| Metric | Monolithic Power Systems, Inc. (MPWR) | Tower Semiconductor Ltd. (TSEM) |

|---|---|---|

| Market Cap | 48.4B | 13.9B |

| Revenue | 2.21B | 1.44B |

| EBITDA | 576M | 451M |

| EBIT | 539M | 185M |

| Net Income | 1.79B | 208M |

| EPS | 36.76 | 1.87 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Monolithic Power Systems, Inc.

Monolithic Power Systems showed strong growth from 2020 to 2024, with revenue increasing from 844M to 2.21B and net income surging from 164M to 1.79B. Margins remained robust, especially net margin reaching 81% in 2024. The latest year exhibited a significant 21.2% revenue rise, with an outstanding 245% net margin growth, reflecting improved profitability despite slightly higher operating expenses.

Tower Semiconductor Ltd.

Tower Semiconductor experienced moderate revenue growth from 1.27B in 2020 to 1.44B in 2024, with net income rising from 82M to 208M. Margins showed stability but at lower levels than MPWR, with a 14.5% net margin in 2024. However, the most recent year saw revenue growth slow to under 1%, accompanied by a sharp 60% decline in net margin and EPS, indicating margin pressures and earnings contraction.

Which one has the stronger fundamentals?

Monolithic Power Systems demonstrates stronger fundamentals with higher revenue and net income growth rates, superior margins, and consistent profitability improvements over the period. Tower Semiconductor, while showing overall growth, faced margin compression and earnings decline in the latest year. MPWR’s financial metrics suggest more favorable income statement dynamics compared to TSEM’s mixed results.

Financial Ratios Comparison

The table below compares key financial ratios for Monolithic Power Systems, Inc. (MPWR) and Tower Semiconductor Ltd. (TSEM) based on their most recent fiscal year data from 2024.

| Ratios | Monolithic Power Systems, Inc. (MPWR) | Tower Semiconductor Ltd. (TSEM) |

|---|---|---|

| ROE | 56.8% | 7.8% |

| ROIC | 16.2% | 6.4% |

| P/E | 16.1 | 27.5 |

| P/B | 9.14 | 2.16 |

| Current Ratio | 5.31 | 6.18 |

| Quick Ratio | 3.89 | 5.23 |

| D/E (Debt-to-Equity) | 0.005 | 0.068 |

| Debt-to-Assets | 0.44% | 5.87% |

| Interest Coverage | 0 | 32.6 |

| Asset Turnover | 0.61 | 0.47 |

| Fixed Asset Turnover | 4.17 | 1.11 |

| Payout Ratio | 13.5% | 0% |

| Dividend Yield | 0.84% | 0% |

Interpretation of the Ratios

Monolithic Power Systems, Inc.

Monolithic Power Systems shows predominantly strong ratios, including a high net margin (80.95%) and return on equity (56.8%), indicating robust profitability and efficient equity use. However, concerns include an unfavorable weighted average cost of capital (10.64%) and a high price-to-book ratio (9.14). The company pays dividends with a modest yield of 0.84%, but the payout appears low and potentially cautious.

Tower Semiconductor Ltd.

Tower Semiconductor presents mixed ratios with a favorable net margin (14.47%) and strong interest coverage (31.57), yet its return on equity (7.83%) and price-to-earnings ratio (27.54) raise caution. The current ratio is unfavorably high at 6.18, suggesting possible inefficiency. The company does not pay dividends, likely prioritizing reinvestment or growth given its zero dividend yield.

Which one has the best ratios?

Monolithic Power Systems has a more favorable overall ratio profile with 57.14% favorable metrics versus Tower Semiconductor’s 42.86%. Despite some valuation and liquidity concerns, Monolithic Power’s stronger profitability and returns outweigh Tower’s weaker equity returns and lack of dividends, suggesting a comparatively better financial position based on the ratios provided.

Strategic Positioning

This section compares the strategic positioning of Monolithic Power Systems (MPWR) and Tower Semiconductor (TSEM) in terms of market position, key segments, and exposure to technological disruption:

Monolithic Power Systems, Inc. (MPWR)

- Leading in semiconductor-based power electronics with strong competitive pressure in multiple regions including US, Asia, and Europe.

- Focuses on DC to DC and lighting control ICs serving computing, automotive, industrial, and consumer sectors.

- Exposure to technological disruption through integrated circuits focused on power management and lighting control innovations.

Tower Semiconductor Ltd. (TSEM)

- Independent foundry with competitive pressure serving diverse markets globally including US, Japan, and Europe.

- Manufactures analog mixed-signal semiconductors supporting consumer electronics, automotive, aerospace, and medical markets.

- Faces technological disruption risks in foundry services and customizable process technologies like SiGe and RF CMOS.

Monolithic Power Systems vs Tower Semiconductor Positioning

MPWR has a diversified product portfolio centered on power management and lighting ICs, addressing multiple end markets globally. TSEM concentrates on analog mixed-signal foundry services and specialized semiconductor technologies, serving broad but distinct industry verticals. MPWR’s direct product focus contrasts with TSEM’s foundry and design enablement approach.

Which has the best competitive advantage?

MPWR demonstrates a very favorable moat with ROIC exceeding WACC by 5.58% and growing profitability, reflecting durable competitive advantages. TSEM shows a slightly unfavorable moat with ROIC below WACC despite improving returns, indicating ongoing value challenges.

Stock Comparison

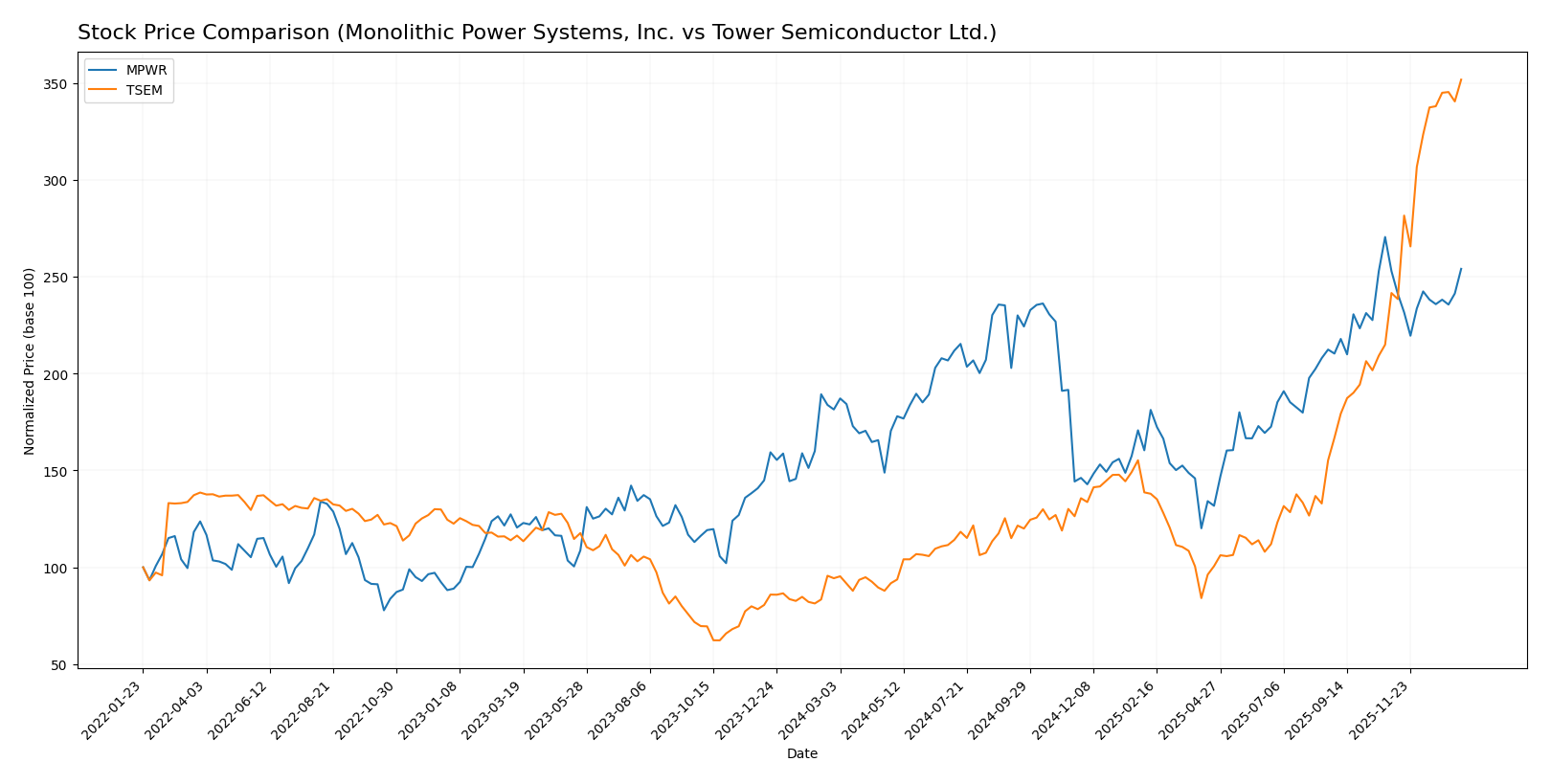

This stock price chart highlights significant bullish momentum for both Monolithic Power Systems, Inc. (MPWR) and Tower Semiconductor Ltd. (TSEM) over the past year, with notable acceleration in gains and rising trading volumes.

Trend Analysis

Monolithic Power Systems, Inc. (MPWR) has experienced a strong bullish trend over the past 12 months, with a 39.99% price increase and accelerating momentum, reaching a high of 1074.91 and a low of 477.39.

Tower Semiconductor Ltd. (TSEM) recorded an even more pronounced bullish trend during the same period, with a 272.71% price increase, acceleration in gains, and a high volatility range between 29.65 and 124.0.

Comparing both, TSEM outperformed MPWR with substantially higher market performance and stronger recent price gains, supported by dominant buyer volume trends.

Target Prices

The current analyst consensus for target prices shows a generally positive outlook for both Monolithic Power Systems, Inc. and Tower Semiconductor Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Monolithic Power Systems, Inc. | 1375 | 1025 | 1187.5 |

| Tower Semiconductor Ltd. | 125 | 66 | 96 |

Analysts expect Monolithic Power Systems to trade significantly above its current price of 1009.54 USD, while Tower Semiconductor’s target consensus is slightly below its current price of 124 USD, indicating mixed near-term expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Monolithic Power Systems, Inc. (MPWR) and Tower Semiconductor Ltd. (TSEM):

Rating Comparison

MPWR Rating

- Rating: A- indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 3, reflecting a moderate valuation.

- ROE Score: 5, showing very favorable profitability from equity.

- ROA Score: 5, indicating very effective asset utilization.

- Debt To Equity Score: 5, indicating very strong financial stability.

- Overall Score: 4, a favorable summary of financial health.

TSEM Rating

- Rating: B+ indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 3, also reflecting a moderate valuation.

- ROE Score: 3, showing moderate profitability from equity.

- ROA Score: 4, indicating favorable asset utilization.

- Debt To Equity Score: 4, indicating favorable financial stability.

- Overall Score: 3, a moderate summary of financial health.

Which one is the best rated?

Based strictly on provided data, MPWR holds a higher rating (A-) and stronger scores in ROE, ROA, debt-to-equity, and overall metrics compared to TSEM’s B+ rating and moderate scores, making MPWR the better rated company.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Monolithic Power Systems and Tower Semiconductor:

MPWR Scores

- Altman Z-Score: 46.83, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 4, classified as average financial strength.

TSEM Scores

- Altman Z-Score: 21.06, also in the safe zone, signaling low bankruptcy risk.

- Piotroski Score: 7, rated as strong financial health.

Which company has the best scores?

Based on the provided data, MPWR has a higher Altman Z-Score indicating a very safe financial status, while TSEM shows stronger financial health with a higher Piotroski Score. Each company leads in one score category.

Grades Comparison

Here is a comparison of the recent grades assigned to Monolithic Power Systems, Inc. and Tower Semiconductor Ltd.:

Monolithic Power Systems, Inc. Grades

The table below summarizes recent grades from reliable grading companies for Monolithic Power Systems, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2025-12-19 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| TD Cowen | Maintain | Buy | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

| Rosenblatt | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-23 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-20 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Wolfe Research | Upgrade | Outperform | 2025-10-14 |

| Citigroup | Maintain | Buy | 2025-10-03 |

The overall trend for Monolithic Power Systems shows mostly buy and overweight ratings, with a recent upgrade to outperform, indicating positive analyst sentiment.

Tower Semiconductor Ltd. Grades

The table below summarizes recent grades from reliable grading companies for Tower Semiconductor Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2026-01-09 |

| Wedbush | Downgrade | Neutral | 2025-12-31 |

| Benchmark | Maintain | Buy | 2025-11-11 |

| Susquehanna | Maintain | Positive | 2025-11-11 |

| Wedbush | Maintain | Outperform | 2025-11-11 |

| Barclays | Maintain | Equal Weight | 2025-11-11 |

| Benchmark | Maintain | Buy | 2025-09-08 |

| Susquehanna | Maintain | Positive | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-04 |

Tower Semiconductor’s ratings are mostly buy and positive, but include a recent downgrade from outperform to neutral, indicating some cautiousness among analysts.

Which company has the best grades?

Monolithic Power Systems, Inc. has received consistently strong buy and overweight grades, including an upgrade to outperform, suggesting stronger analyst confidence. Tower Semiconductor Ltd. also holds mostly buy ratings but shows more mixed signals with a recent downgrade to neutral. These differences could influence investors’ perception of risk and growth potential.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Monolithic Power Systems, Inc. (MPWR) and Tower Semiconductor Ltd. (TSEM) based on their recent financial and operational data.

| Criterion | Monolithic Power Systems, Inc. (MPWR) | Tower Semiconductor Ltd. (TSEM) |

|---|---|---|

| Diversification | Primarily focused on DC to DC and lighting control products, showing strong growth in core segments. | Less diversified product base; mainly semiconductor manufacturing. |

| Profitability | Very high net margin (80.95%) and ROE (56.8%), indicating excellent profitability. | Moderate net margin (14.47%) but low ROE (7.83%), suggesting weaker profitability. |

| Innovation | Strong innovation reflected in growing ROIC (+11.8%) and durable competitive advantage. | Improving profitability with growing ROIC (+44.6%) but still value destructive overall. |

| Global presence | Strong global presence with significant revenue scale (over $1.7B in DC to DC products). | Established global footprint in semiconductor foundry but smaller scale. |

| Market Share | Solid market share in power management ICs with consistent revenue growth. | Competitive in niche semiconductor segments but lower market share and value creation. |

Key takeaways: MPWR stands out with strong profitability, innovation, and value creation, making it a favorable investment. TSEM shows improving trends but still faces challenges in profitability and value generation, warranting cautious consideration.

Risk Analysis

Below is a comparative table outlining key risk metrics for Monolithic Power Systems, Inc. (MPWR) and Tower Semiconductor Ltd. (TSEM) based on their latest 2024 financial data.

| Metric | Monolithic Power Systems, Inc. (MPWR) | Tower Semiconductor Ltd. (TSEM) |

|---|---|---|

| Market Risk | Beta 1.46 (higher volatility) | Beta 0.88 (lower volatility) |

| Debt Level | Very low debt-to-equity 0.01 (favorable) | Low debt-to-equity 0.07 (favorable) |

| Regulatory Risk | Moderate, US-based with global sales | Moderate, Israel-based with global exposure |

| Operational Risk | Low, strong operational efficiency (ROE 56.8%) | Moderate, lower ROE 7.8% |

| Environmental Risk | Typical semiconductor industry exposure | Typical semiconductor industry exposure |

| Geopolitical Risk | Moderate, exposed to Asia and US markets | Elevated, due to Israel location and global sales |

In synthesis, MPWR’s most significant risk lies in its higher market volatility and unfavorable valuation multiples, despite exceptionally strong profitability and minimal debt. TSEM faces moderate operational and geopolitical risks due to its Israel base and lower profitability, though it maintains a sound balance sheet. Investors should weigh MPWR’s growth potential against its market swings, while TSEM’s geopolitical exposure calls for caution.

Which Stock to Choose?

Monolithic Power Systems, Inc. (MPWR) shows strong income growth with a 21.2% revenue increase in 2024 and very favorable profitability metrics, including an 80.95% net margin and a 56.8% ROE. Its debt levels are low and well-managed, and it holds a very favorable overall rating (A-).

Tower Semiconductor Ltd. (TSEM) exhibits modest revenue growth of 0.94% in 2024 and a net margin of 14.47%, with more mixed financial ratios. While it maintains low debt and a solid current ratio, its ROE is unfavorable at 7.83%, paired with a slightly favorable overall rating (B+).

For risk-averse investors prioritizing financial stability and strong profitability, MPWR’s very favorable rating and robust income statement could be more appealing. Conversely, those with a higher risk tolerance seeking growth potential might find TSEM’s accelerating stock price and improving profitability trends to be of interest.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Monolithic Power Systems, Inc. and Tower Semiconductor Ltd. to enhance your investment decisions: