In the fast-evolving semiconductor industry, Taiwan Semiconductor Manufacturing Company Limited (TSM) and Monolithic Power Systems, Inc. (MPWR) stand out as key innovators with distinct market focuses. While TSM dominates wafer fabrication and chip manufacturing, MPWR specializes in power management integrated circuits, serving diverse sectors like automotive and consumer electronics. This comparison explores their strategies and growth potential to help you identify the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Taiwan Semiconductor Manufacturing Company Limited and Monolithic Power Systems, Inc. by providing an overview of these two companies and their main differences.

Taiwan Semiconductor Manufacturing Company Limited Overview

Taiwan Semiconductor Manufacturing Company Limited (TSM) is a leading semiconductor manufacturer headquartered in Hsinchu City, Taiwan. Founded in 1987, it specializes in wafer fabrication processes for integrated circuits and semiconductor devices, serving markets worldwide including high performance computing, smartphones, and automotive sectors. TSM operates as a key player in the semiconductor industry with a broad technology portfolio and extensive global reach.

Monolithic Power Systems, Inc. Overview

Monolithic Power Systems, Inc. (MPWR), based in Kirkland, Washington, designs and markets semiconductor-based power electronics solutions. Established in 1997, the company focuses on DC-to-DC integrated circuits and lighting control ICs primarily used in computing, automotive, industrial, and consumer applications. MPWR distributes its products globally through various channels, targeting original equipment manufacturers and other technology-driven sectors.

Key similarities and differences

Both TSM and MPWR operate in the semiconductor industry, serving diverse technological markets globally. However, TSM primarily focuses on wafer fabrication and integrated circuit manufacturing, whereas MPWR specializes in power electronics ICs and lighting control solutions. TSM’s scale is significantly larger, with over 65K employees and a market cap exceeding 1.6T USD, compared to MPWR’s 4K employees and a market cap around 47B USD, reflecting different scopes within the semiconductor sector.

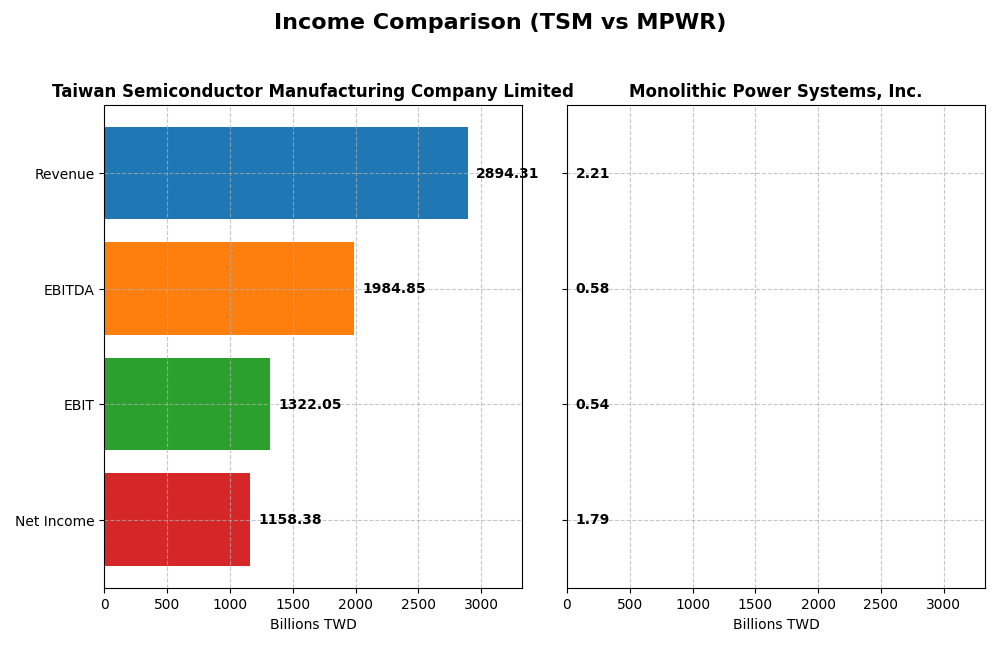

Income Statement Comparison

This table compares the key income statement metrics for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Monolithic Power Systems, Inc. (MPWR) for the fiscal year 2024.

| Metric | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Monolithic Power Systems, Inc. (MPWR) |

|---|---|---|

| Market Cap | 1.70T TWD | 47.1B USD |

| Revenue | 2.89T TWD | 2.21B USD |

| EBITDA | 1.98T TWD | 576M USD |

| EBIT | 1.32T TWD | 539M USD |

| Net Income | 1.16T TWD | 1.79B USD |

| EPS | 223.4 TWD | 36.76 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Taiwan Semiconductor Manufacturing Company Limited

Taiwan Semiconductor Manufacturing Company Limited (TSM) showed strong revenue growth of 116.11% from 2020 to 2024, with net income increasing 126.8% over the same period. Margins remained stable and favorable, with a gross margin of 56.12% and net margin around 40%. In 2024, the company experienced a 33.89% revenue growth and a slight net margin increase, reflecting sustained operational strength.

Monolithic Power Systems, Inc.

Monolithic Power Systems, Inc. (MPWR) reported revenue growth of 161.36% from 2020 to 2024, accompanied by a remarkable 986.97% increase in net income. Its gross margin held steady near 55.32%, while net margin was exceptionally high at 80.95%. In 2024, revenue and net income continued to grow, although operating expenses grew proportionally, slightly impacting margin expansion.

Which one has the stronger fundamentals?

Both companies demonstrate favorable income statement trends, but MPWR exhibits more pronounced growth in net income and margins, with a net margin growth of 315.88% over the period compared to TSM’s 4.95%. TSM maintains strong, stable margins and consistent growth. MPWR’s higher volatility in operating expenses poses a slight caution, but overall, its fundamentals show more aggressive expansion.

Financial Ratios Comparison

The table below compares key financial ratios for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Monolithic Power Systems, Inc. (MPWR) based on their most recent fiscal year data (2024).

| Ratios | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Monolithic Power Systems, Inc. (MPWR) |

|---|---|---|

| ROE | 27.29% | 56.80% |

| ROIC | 19.99% | 16.22% |

| P/E | 29.04 | 16.09 |

| P/B | 7.92 | 9.14 |

| Current Ratio | 2.36 | 5.31 |

| Quick Ratio | 2.14 | 3.89 |

| D/E (Debt-to-Equity) | 0.25 | 0.005 |

| Debt-to-Assets | 15.65% | 0.44% |

| Interest Coverage | 126.0 | 0 |

| Asset Turnover | 0.43 | 0.61 |

| Fixed Asset Turnover | 0.88 | 4.17 |

| Payout Ratio | 31.34% | 13.47% |

| Dividend Yield | 1.08% | 0.84% |

Interpretation of the Ratios

Taiwan Semiconductor Manufacturing Company Limited

Taiwan Semiconductor shows strong profitability with a 40.02% net margin and 27.29% ROE, supported by a solid 20% ROIC. Favorable leverage and liquidity ratios indicate financial stability. However, high P/E and P/B ratios suggest the stock may be overvalued. The dividend yield is modest at 1.08%, reflecting a balanced payout policy with manageable shareholder returns.

Monolithic Power Systems, Inc.

Monolithic Power demonstrates exceptional profitability, with an 80.95% net margin and 56.8% ROE, though its WACC is unfavorable at 10.59%. The company maintains very low debt and strong interest coverage. Despite a favorable free cash flow profile, its dividend yield is low at 0.84%, indicating limited dividend returns, possibly due to reinvestment or growth priorities.

Which one has the best ratios?

Both companies have a favorable overall ratio profile, each showing strengths in profitability and financial health. Taiwan Semiconductor offers balanced leverage and dividend returns with some valuation concerns, while Monolithic Power excels in profitability with very low debt but faces challenges in cost of capital and dividend yield. The choice depends on individual investor priorities.

Strategic Positioning

This section compares the strategic positioning of TSM and MPWR, focusing on their market position, key segments, and exposure to technological disruption:

Taiwan Semiconductor Manufacturing Company Limited (TSM)

- Leading global semiconductor foundry with significant competitive pressure from industry peers.

- Focuses on wafer fabrication for integrated circuits across diverse applications like computing, smartphones, automotive, and consumer electronics.

- Exposed to technological disruption through continuous innovation in wafer fabs and advanced semiconductor processes.

Monolithic Power Systems, Inc. (MPWR)

- Niche semiconductor power electronics player facing competitive pressure in specialized markets.

- Concentrates on DC to DC power ICs and lighting control ICs serving computing, automotive, industrial, and communications sectors.

- Faces technological disruption risks in power electronics but benefits from specialized product development and market focus.

TSM vs MPWR Positioning

TSM adopts a diversified strategy with broad market coverage and large scale wafer production, offering resilience but facing intense global competition. MPWR pursues a concentrated approach in power electronics, enabling focused innovation but limiting scale compared to industry giants.

Which has the best competitive advantage?

TSM shows a slightly favorable moat with value creation but declining profitability, while MPWR demonstrates a very favorable moat with growing ROIC and durable competitive advantage, indicating stronger sustainability in returns.

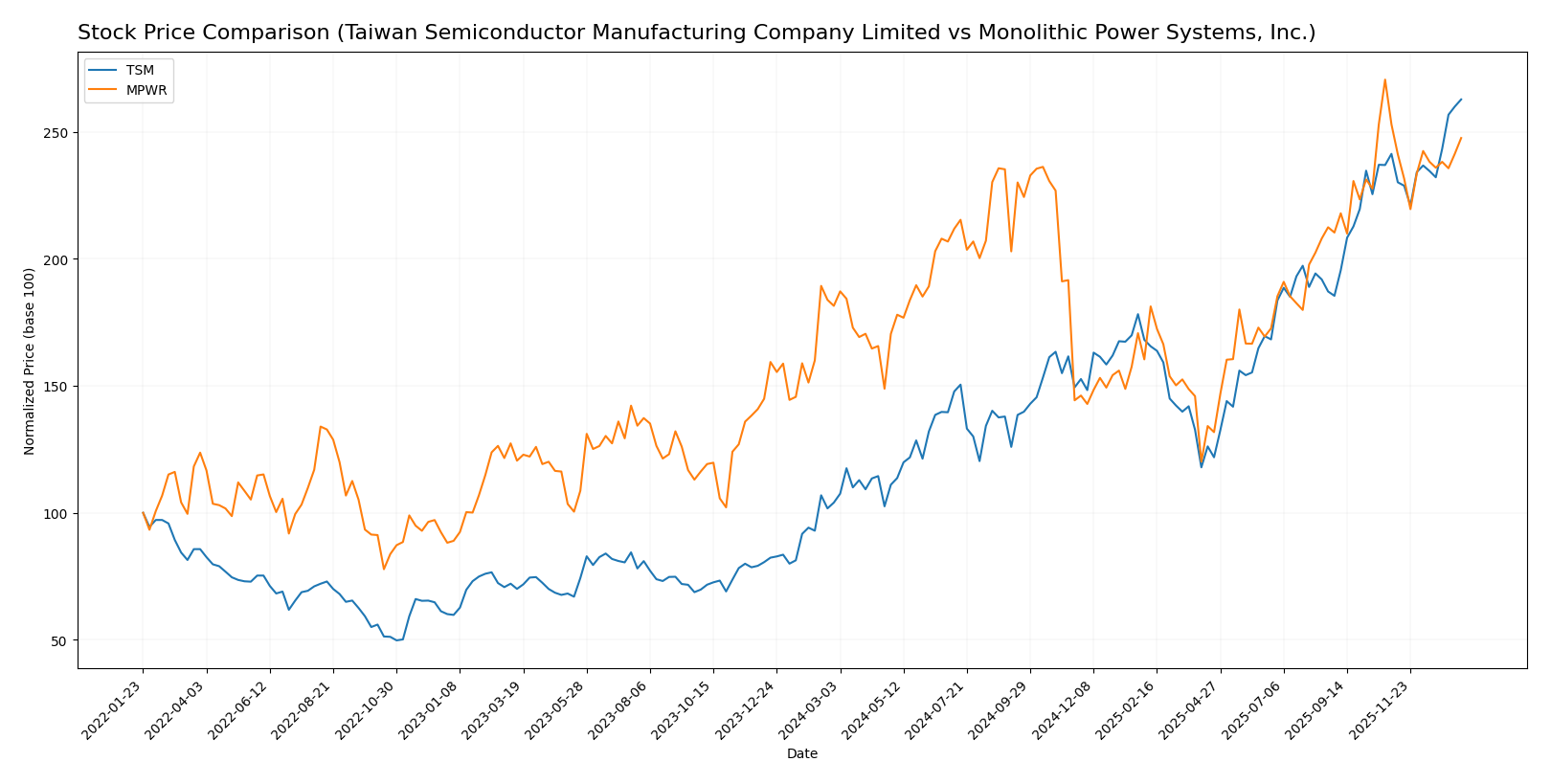

Stock Comparison

The stock price movements over the past year reveal significant bullish momentum for Taiwan Semiconductor Manufacturing Company Limited (TSM) with accelerating gains, while Monolithic Power Systems, Inc. (MPWR) shows a more moderate bullish trend with deceleration and recent weakness.

Trend Analysis

Taiwan Semiconductor Manufacturing Company Limited (TSM) exhibited a strong bullish trend over the past 12 months with a 152.54% price increase, acceleration in the trend, and a high volatility standard deviation of 51.25. The stock reached a high of 327.11 and a low of 127.7.

Monolithic Power Systems, Inc. (MPWR) also showed a bullish trend over the same period with a 36.4% price increase but experienced deceleration. Its volatility was higher with a standard deviation of 135.37, and the price ranged between 477.39 and 1074.91.

Comparing both, TSM delivered the highest market performance with a substantially larger price increase and positive acceleration, outperforming MPWR over the past year.

Target Prices

The current analyst target consensus for these semiconductor companies reflects moderate upside potential from current prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Taiwan Semiconductor Manufacturing Company Limited | 400 | 330 | 361.25 |

| Monolithic Power Systems, Inc. | 1375 | 970 | 1161.67 |

Analysts expect Taiwan Semiconductor’s stock to rise modestly above its current price of 327.11, while Monolithic Power Systems shows a stronger potential gain from 983.6 to the consensus target of 1161.67.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Monolithic Power Systems, Inc. (MPWR):

Rating Comparison

TSM Rating

- Rating: A-; classified as Very Favorable overall rating by analysts.

- Discounted Cash Flow Score: 5, indicating a very favorable valuation outlook.

- ROE Score: 5, showing very efficient profit generation from equity.

- ROA Score: 5, demonstrating very effective asset utilization.

- Debt To Equity Score: 3, indicating moderate financial risk.

- Overall Score: 4, rated as favorable overall financial health.

MPWR Rating

- Rating: A-; also classified as Very Favorable overall rating.

- Discounted Cash Flow Score: 3, reflecting a moderate valuation outlook.

- ROE Score: 5, equally showing very efficient profit generation from equity.

- ROA Score: 5, equally demonstrating very effective asset utilization.

- Debt To Equity Score: 5, indicating very favorable financial stability.

- Overall Score: 4, also rated as favorable overall financial health.

Which one is the best rated?

Both TSM and MPWR share the same overall rating of A- and an overall score of 4, indicating favorable financial health. TSM excels in discounted cash flow, while MPWR has a stronger debt-to-equity score, reflecting different strengths in their financial profiles.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

TSM Scores

- Altman Z-Score: 2.94, indicating moderate bankruptcy risk in the grey zone.

- Piotroski Score: 8, reflecting very strong financial health.

MPWR Scores

- Altman Z-Score: 46.83, indicating very low bankruptcy risk in the safe zone.

- Piotroski Score: 4, reflecting average financial health.

Which company has the best scores?

Based on the provided data, MPWR has a significantly higher Altman Z-Score, indicating stronger bankruptcy safety, while TSM has a much stronger Piotroski Score, signaling better overall financial health. Each leads in a different score category.

Grades Comparison

The following presents a detailed comparison of the latest grades assigned to Taiwan Semiconductor Manufacturing Company Limited and Monolithic Power Systems, Inc.:

Taiwan Semiconductor Manufacturing Company Limited Grades

This table summarizes recent grades and actions from leading grading companies for TSM:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2025-12-08 |

| Needham | Maintain | Buy | 2025-10-27 |

| Barclays | Maintain | Overweight | 2025-10-17 |

| Needham | Maintain | Buy | 2025-10-16 |

| Susquehanna | Maintain | Positive | 2025-10-10 |

| Barclays | Maintain | Overweight | 2025-10-09 |

| Barclays | Maintain | Overweight | 2025-09-16 |

| Needham | Maintain | Buy | 2025-07-17 |

| Susquehanna | Maintain | Positive | 2025-07-14 |

| Needham | Maintain | Buy | 2025-07-01 |

Grades for TSM consistently reflect a positive outlook with multiple “Buy,” “Outperform,” and “Overweight” ratings maintained by reputable firms.

Monolithic Power Systems, Inc. Grades

This table details recent grading actions for MPWR from recognized grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2025-12-19 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| TD Cowen | Maintain | Buy | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

| Rosenblatt | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-23 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-20 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Wolfe Research | Upgrade | Outperform | 2025-10-14 |

| Citigroup | Maintain | Buy | 2025-10-03 |

MPWR’s grades predominantly indicate a favorable stance, with several “Buy,” “Overweight,” and an upgraded “Outperform” rating, showing some recent positive momentum.

Which company has the best grades?

Both Taiwan Semiconductor Manufacturing Company Limited and Monolithic Power Systems, Inc. hold consensus “Buy” ratings from analysts. However, TSM’s grades are consistently positive with multiple stable “Buy” and “Outperform” ratings, while MPWR shows a mix of “Buy,” “Overweight,” and a notable recent “Outperform” upgrade. Investors should note these sustained positive assessments might influence confidence differently, reflecting each company’s market positioning and growth outlook.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Monolithic Power Systems, Inc. (MPWR) based on their latest financial and operational data.

| Criterion | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Monolithic Power Systems, Inc. (MPWR) |

|---|---|---|

| Diversification | Primarily focused on wafer manufacturing with some other products; less diversified | Focused on DC to DC and lighting control products; niche but growing segments |

| Profitability | High net margin (40.02%), ROIC 20%, but declining ROIC trend | Very high net margin (80.95%), ROIC 16.22%, with growing ROIC trend |

| Innovation | Leading-edge semiconductor manufacturing technology; strong R&D investment | Innovative power management solutions with continuous product development |

| Global presence | Significant global footprint as a major semiconductor foundry | Growing presence, mainly in power electronics market; smaller scale globally |

| Market Share | Dominant in semiconductor foundry market | Smaller market share but rapidly expanding in power management |

Key takeaways: TSM boasts strong profitability and global leadership but faces a declining ROIC trend, signaling caution. MPWR demonstrates exceptional profitability growth and innovation in a focused niche, indicating a durable competitive advantage with potential for expansion.

Risk Analysis

Below is a comparative table highlighting key risks for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Monolithic Power Systems, Inc. (MPWR) as of 2026:

| Metric | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Monolithic Power Systems, Inc. (MPWR) |

|---|---|---|

| Market Risk | Moderate (Beta 1.27; subject to global semiconductor demand fluctuations) | Higher (Beta 1.46; more volatile tech niche exposure) |

| Debt level | Low (Debt-to-equity 0.25; favorable leverage) | Very Low (Debt-to-equity 0.01; very strong balance sheet) |

| Regulatory Risk | High (Taiwan’s geopolitical tensions and export restrictions) | Moderate (US-based, subject to trade policies) |

| Operational Risk | Moderate (Large scale manufacturing complexity) | Moderate (Smaller scale but reliant on specialized supply chains) |

| Environmental Risk | Moderate (Energy-intensive manufacturing with sustainability initiatives ongoing) | Low to moderate (Less energy-intensive operations) |

| Geopolitical Risk | High (Taiwan-China tensions impact global supply chains) | Moderate (US-China trade tensions affect market access) |

The most impactful risks are geopolitical for TSM, given Taiwan’s strategic position and export sensitivity, and market volatility for MPWR, due to its higher beta and tech sector exposure. Debt levels are well-managed for both, reducing financial distress risk.

Which Stock to Choose?

Taiwan Semiconductor Manufacturing Company Limited (TSM) shows a strong income evolution with a 33.89% revenue growth in 2024 and favorable profitability metrics, including a 40.02% net margin and 27.29% ROE. Its financial ratios are mostly favorable, supported by a low debt level and a very favorable rating of A-, despite some concerns around valuation multiples.

Monolithic Power Systems, Inc. (MPWR) also exhibits robust income growth, with a 21.2% increase in revenue and an outstanding 80.95% net margin in 2024. Its financial ratios are favorable overall, featuring very low debt and a strong ROE of 56.8%, paired with a very favorable rating of A-. However, some ratios like WACC and dividend yield are less favorable.

Considering ratings and the global evaluation of income statements and financial ratios, MPWR might signal a very favorable economic moat with growing ROIC and higher profitability, suitable for growth-oriented investors. Conversely, TSM’s slightly favorable moat and more stable income growth could appeal to investors valuing consistent value creation and financial stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Taiwan Semiconductor Manufacturing Company Limited and Monolithic Power Systems, Inc. to enhance your investment decisions: