In the fast-evolving semiconductor industry, Monolithic Power Systems, Inc. (MPWR) and SkyWater Technology, Inc. (SKYT) stand out for their innovation and market presence. While MPWR specializes in power electronics solutions across diverse sectors, SKYT focuses on semiconductor development and manufacturing services tailored to high-tech applications. This article will analyze both companies to help you identify the most promising investment opportunity in this competitive landscape.

Table of contents

Companies Overview

I will begin the comparison between Monolithic Power Systems and SkyWater Technology by providing an overview of these two companies and their main differences.

Monolithic Power Systems Overview

Monolithic Power Systems, Inc. focuses on designing and marketing semiconductor-based power electronics solutions across several markets including automotive, industrial, and consumer electronics. The company develops DC-to-DC integrated circuits and lighting control ICs used in various electronic devices. Founded in 1997 and headquartered in Kirkland, Washington, it operates globally with a strong market presence.

SkyWater Technology Overview

SkyWater Technology, Inc. offers semiconductor development and manufacturing services, specializing in engineering and process support to co-create technologies. It serves industries such as aerospace, defense, automotive, bio-health, and IoT. Established in 2017 and based in Bloomington, Minnesota, SkyWater emphasizes custom manufacturing of analog, power discrete, and rad-hard integrated circuits.

Key similarities and differences

Both companies operate in the semiconductor industry within the technology sector, serving diverse markets including automotive and industrial. Monolithic Power Systems focuses on designing and selling power electronics ICs, while SkyWater Technology provides manufacturing and engineering services for custom semiconductor solutions. Monolithic is a larger, more established firm, whereas SkyWater is a newer, service-oriented company with a narrower employee base.

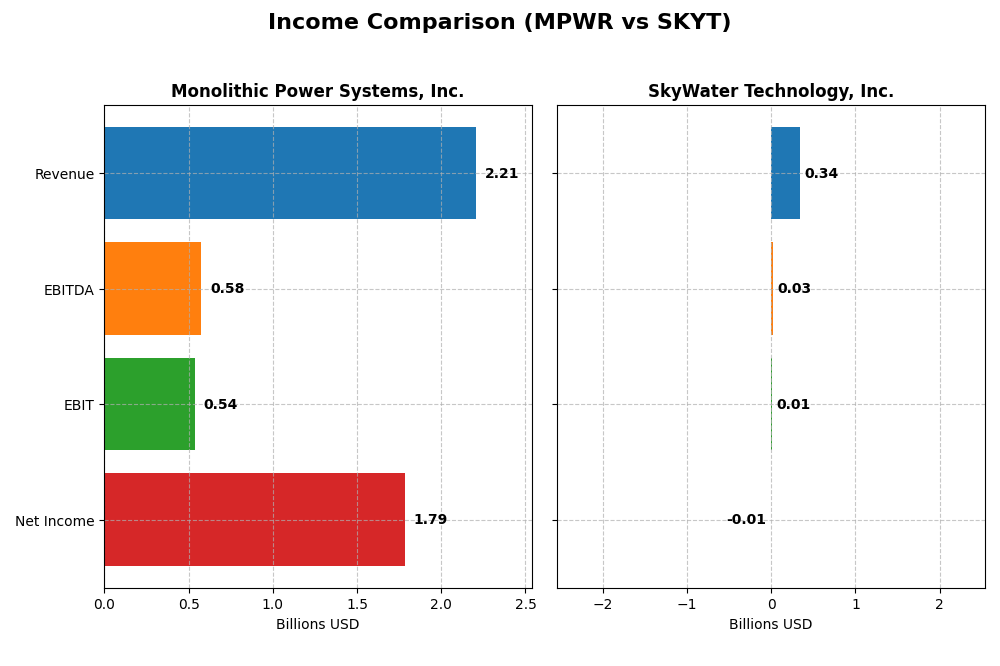

Income Statement Comparison

The table below compares the latest fiscal year income statement metrics for Monolithic Power Systems, Inc. and SkyWater Technology, Inc., highlighting their revenue, profitability, and earnings per share.

| Metric | Monolithic Power Systems, Inc. | SkyWater Technology, Inc. |

|---|---|---|

| Market Cap | 48.4B | 1.54B |

| Revenue | 2.21B | 342M |

| EBITDA | 576M | 25.3M |

| EBIT | 539M | 6.56M |

| Net Income | 1.79B | -6.79M |

| EPS | 36.76 | -0.14 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Monolithic Power Systems, Inc.

Monolithic Power Systems demonstrated strong growth from 2020 to 2024, with revenue increasing from 844M to 2.2B and net income surging from 164M to 1.79B. Margins improved notably, with gross margin at 55.3% and net margin reaching 81%. In 2024, revenue growth accelerated to 21.2%, while net margin and EPS soared, reflecting robust profitability despite rising operating expenses.

SkyWater Technology, Inc.

SkyWater Technology’s revenue rose steadily from 140M in 2020 to 342M in 2024, with net income losses narrowing from -20.6M to -6.8M. Gross margin improved to 20.3%, but net margin remained negative at -2%. The latest year showed favorable growth in revenue (19.4%) and EBIT (144%), with net margin and EPS improving, yet the company remains unprofitable overall.

Which one has the stronger fundamentals?

Monolithic Power Systems exhibits stronger fundamentals, marked by high and improving margins, significant net income growth, and positive net margins. SkyWater Technology shows encouraging revenue and EBIT growth but continues to report net losses and negative margins. The overall income statement evaluations favor Monolithic Power Systems for both profitability and margin stability.

Financial Ratios Comparison

The following table presents the key financial ratios for Monolithic Power Systems, Inc. (MPWR) and SkyWater Technology, Inc. (SKYT) for the fiscal year 2024, providing a side-by-side view of their latest performance metrics.

| Ratios | Monolithic Power Systems, Inc. (MPWR) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| ROE | 56.8% | -11.8% |

| ROIC | 16.2% | 3.4% |

| P/E | 16.1 | -100.3 |

| P/B | 9.14 | 11.82 |

| Current Ratio | 5.31 | 0.86 |

| Quick Ratio | 3.89 | 0.76 |

| D/E (Debt to Equity) | 0.005 | 1.33 |

| Debt-to-Assets | 0.44% | 24.5% |

| Interest Coverage | 0 | 0.74 |

| Asset Turnover | 0.61 | 1.09 |

| Fixed Asset Turnover | 4.17 | 2.07 |

| Payout Ratio | 13.5% | 0% |

| Dividend Yield | 0.84% | 0% |

Interpretation of the Ratios

Monolithic Power Systems, Inc.

Monolithic Power Systems exhibits predominantly strong financial ratios with favorable net margin (80.95%) and return on equity (56.8%), indicating profitability and efficient equity use. However, some concerns include an unfavorable current ratio (5.31) and price-to-book ratio (9.14). The company pays dividends, but the low dividend yield (0.84%) suggests cautious shareholder returns with a focus on sustainable payout.

SkyWater Technology, Inc.

SkyWater Technology shows generally weak ratios marked by negative net margin (-1.98%) and return on equity (-11.79%), reflecting losses and poor equity returns. Its liquidity ratios are unfavorable, and debt levels are high. The company does not pay dividends, likely due to negative earnings and reinvestment needs during growth, prioritizing R&D and expansion over shareholder returns.

Which one has the best ratios?

Comparing the two, Monolithic Power Systems clearly demonstrates stronger and more favorable financial ratios overall, especially in profitability and returns. SkyWater Technology faces significant challenges with mostly unfavorable metrics and no dividend payments, reflecting a less robust financial position relative to Monolithic Power Systems.

Strategic Positioning

This section compares the strategic positioning of Monolithic Power Systems (MPWR) and SkyWater Technology (SKYT), including market position, key segments, and exposure to technological disruption:

Monolithic Power Systems, Inc. (MPWR)

- Large market cap ($48.4B), operates in a competitive semiconductor industry with moderate beta (1.46).

- Focuses on DC to DC power ICs and lighting control ICs for computing, automotive, industrial, and consumer markets.

- Exposure to disruption is moderate, centered on semiconductor design and power electronics innovation.

SkyWater Technology, Inc. (SKYT)

- Smaller market cap ($1.5B), higher beta (3.49) indicating greater volatility and competitive pressure.

- Provides semiconductor manufacturing and engineering services across computation, aerospace, defense, automotive, bio-health, and industrial IoT.

- Faces technological disruption risks through advanced manufacturing and co-development of new semiconductor technologies.

MPWR vs SKYT Positioning

MPWR has a diversified product portfolio focused on power ICs and lighting controls, serving multiple end markets globally. SKYT concentrates on semiconductor manufacturing services and technology co-development, targeting specialized industries. MPWR’s larger scale contrasts with SKYT’s niche service model.

Which has the best competitive advantage?

MPWR demonstrates a very favorable moat with growing ROIC above WACC, indicating durable competitive advantage and value creation. SKYT shows a slightly unfavorable moat, shedding value despite improving profitability, reflecting weaker competitive positioning.

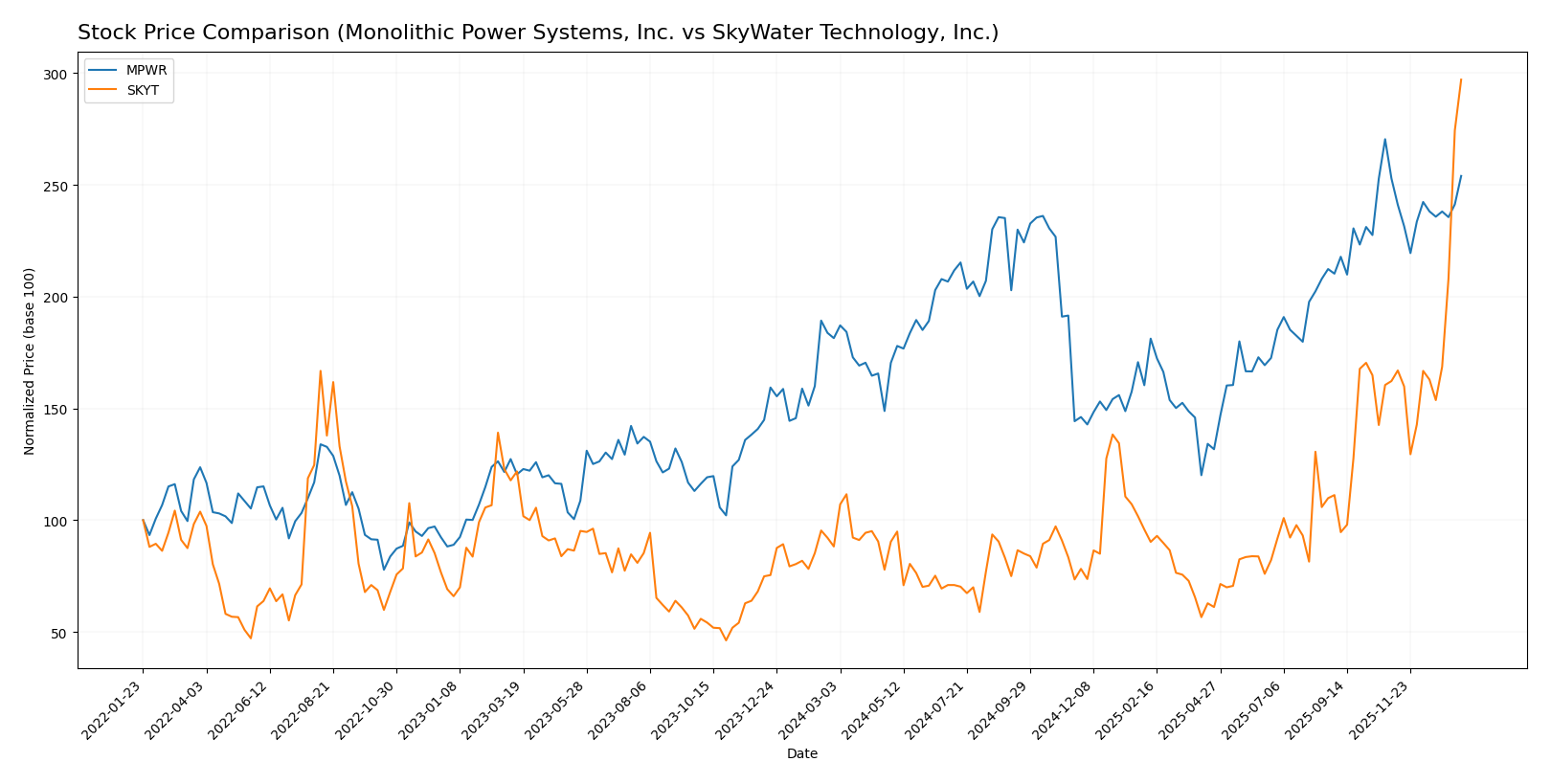

Stock Comparison

Over the past year, Monolithic Power Systems, Inc. (MPWR) and SkyWater Technology, Inc. (SKYT) exhibited strong bullish momentum, with SKYT showing a more pronounced price surge and distinct trading volume dynamics.

Trend Analysis

Monolithic Power Systems, Inc. (MPWR) recorded a 39.99% price increase over the past year, reflecting a bullish trend with acceleration. It reached a high of 1074.91 and a low of 477.39, with recent performance stabilizing at a 0.45% gain.

SkyWater Technology, Inc. (SKYT) showed a robust 236.8% price rise over the same period, demonstrating a bullish trend with acceleration. It ranged between 6.1 and 32.03, and recently gained 83.13%, maintaining buyer dominance.

Comparing both, SKYT outperformed MPWR significantly in market performance over the past year, delivering the highest price appreciation and stronger buyer volume dominance.

Target Prices

Here is the current consensus of target prices from verified analysts for the selected semiconductor companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Monolithic Power Systems, Inc. | 1375 | 1025 | 1187.5 |

| SkyWater Technology, Inc. | 25 | 25 | 25 |

Analysts expect Monolithic Power Systems to trade significantly above its current price of 1009.54 USD, indicating potential upside. SkyWater Technology’s target consensus of 25 USD is below its current 32.03 USD, suggesting a more cautious outlook.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Monolithic Power Systems, Inc. (MPWR) and SkyWater Technology, Inc. (SKYT):

Rating Comparison

MPWR Rating

- Rating: A- indicating a very favorable overall financial standing.

- Discounted Cash Flow Score: 3, moderate indication of valuation based on cash flow projections.

- ROE Score: 5, very favorable efficiency in generating profit from equity.

- ROA Score: 5, very favorable asset utilization for earnings generation.

- Debt To Equity Score: 5, very favorable low financial risk with strong balance sheet.

- Overall Score: 4, favorable summary of financial health and performance.

SKYT Rating

- Rating: B+ showing a very favorable but lower overall financial standing.

- Discounted Cash Flow Score: 1, very unfavorable valuation based on cash flow projections.

- ROE Score: 5, very favorable efficiency in generating profit from equity.

- ROA Score: 5, very favorable asset utilization for earnings generation.

- Debt To Equity Score: 1, very unfavorable financial risk due to high leverage.

- Overall Score: 3, moderate summary of financial health and performance.

Which one is the best rated?

Based strictly on the provided ratings and scores, MPWR is better rated overall with a higher rating (A-) and better scores in discounted cash flow, debt-to-equity, and overall financial health compared to SKYT’s lower rating (B+) and weaker valuation and leverage scores.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score for Monolithic Power Systems, Inc. (MPWR) and SkyWater Technology, Inc. (SKYT):

MPWR Scores

- Altman Z-Score: 46.83, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 4, classified as average financial strength.

SKYT Scores

- Altman Z-Score: 2.20, in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 5, classified as average financial strength.

Which company has the best scores?

MPWR shows a significantly higher Altman Z-Score, firmly placing it in the safe zone, while SKYT is in the grey zone. Both companies have average Piotroski Scores, with SKYT slightly higher by one point.

Grades Comparison

Here is a detailed comparison of the latest reliable grades assigned to Monolithic Power Systems, Inc. and SkyWater Technology, Inc.:

Monolithic Power Systems, Inc. Grades

The table below summarizes recent grades by reputable financial institutions for Monolithic Power Systems, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2025-12-19 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| TD Cowen | Maintain | Buy | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

| Rosenblatt | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-23 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-20 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Wolfe Research | Upgrade | Outperform | 2025-10-14 |

| Citigroup | Maintain | Buy | 2025-10-03 |

Overall, Monolithic Power Systems shows a predominantly positive grading trend, with most firms maintaining Buy or Overweight ratings and one recent upgrade to Outperform.

SkyWater Technology, Inc. Grades

The table below lists the recent grades assigned to SkyWater Technology, Inc. by recognized grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology consistently receives Buy or Overweight ratings, with no downgrades or negative revisions over the past two years.

Which company has the best grades?

Both companies hold a consensus Buy rating, but Monolithic Power Systems displays a broader range of grading firms and includes an upgrade to Outperform, indicating slightly stronger analyst conviction. This difference may influence investor perception of relative growth potential and risk.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Monolithic Power Systems, Inc. (MPWR) and SkyWater Technology, Inc. (SKYT) based on recent financial and strategic data.

| Criterion | Monolithic Power Systems, Inc. (MPWR) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Diversification | Moderate: Primarily DC to DC Products with Lighting Control niche | Moderate: Mixed services including Advanced Technology and Wafer Services |

| Profitability | High: Net margin 80.95%, ROIC 16.22%, value creator with growing profitability | Low: Negative net margin (-1.98%), ROIC 3.4%, currently shedding value but improving |

| Innovation | Strong: Consistent revenue growth in core product segments, strong ROIC trend | Developing: Growing ROIC trend but overall low profitability and high cost of capital |

| Global presence | Established: Significant revenue scale ($1.7B+ in DC to DC products) | Smaller scale: Revenue under $200M, focused on advanced technology services |

| Market Share | Strong in power management ICs with leading product line | Niche player in semiconductor foundry services, limited scale |

Key takeaways: MPWR demonstrates a robust competitive position with high profitability, efficient capital use, and steady innovation in its core markets. SKYT shows potential with improving ROIC but continues to face profitability challenges and financial risks, reflecting a less mature and riskier investment profile.

Risk Analysis

The table below summarizes key risk factors for Monolithic Power Systems, Inc. (MPWR) and SkyWater Technology, Inc. (SKYT) based on the latest 2024 data:

| Metric | Monolithic Power Systems, Inc. (MPWR) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Risk | Beta 1.46 (moderate volatility) | Beta 3.49 (high volatility) |

| Debt level | Very low debt-to-equity (0.01, favorable) | High debt-to-equity (1.33, unfavorable) |

| Regulatory Risk | Moderate (semiconductor industry) | Moderate (semiconductor manufacturing) |

| Operational Risk | Low (strong operational metrics) | Elevated (lower profitability, operational challenges) |

| Environmental Risk | Moderate (industry-related) | Moderate (industry-related) |

| Geopolitical Risk | Moderate exposure via international sales | Moderate exposure via US-focused defense contracts |

MPWR shows stronger financial health and lower debt risk, but moderate market volatility remains a concern. SKYT faces higher market risk and operational challenges, with debt levels and liquidity signaling caution. The most impactful risk for SKYT is high leverage combined with negative profitability, while MPWR’s main risk lies in market volatility and valuation metrics.

Which Stock to Choose?

Monolithic Power Systems, Inc. (MPWR) shows strong income growth with a 21.2% revenue increase in 2024 and highly favorable profitability ratios, including an 80.95% net margin and 56.8% ROE. Its debt levels are minimal with a net debt-to-EBITDA of -1.17 and a solid rating of A- indicating very favorable financial health.

SkyWater Technology, Inc. (SKYT) posts moderate revenue growth of 19.39% in 2024 but struggles with profitability, evident from its negative net margin of -1.98% and ROE of -11.79%. The company carries significant debt with a debt-to-equity ratio of 1.33 and holds a B+ rating, reflecting mixed financial signals despite favorable growth metrics.

For investors, MPWR’s very favorable rating and consistent value creation with ROIC exceeding WACC suggest it might appeal to those seeking quality and stability. Meanwhile, SKYT’s improving ROIC trend but overall unfavorable profitability and higher leverage could make it more suited for risk-tolerant investors focusing on growth potential rather than immediate returns.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Monolithic Power Systems, Inc. and SkyWater Technology, Inc. to enhance your investment decisions: