Monolithic Power Systems, Inc. (MPWR) and Onto Innovation Inc. (ONTO) are two prominent players in the semiconductor industry, each excelling in innovative technology solutions for diverse markets. MPWR focuses on power electronics and integrated circuits, while ONTO specializes in process control tools and metrology systems. Their overlapping sectors and distinct innovation strategies make them compelling candidates for investment. In this article, I will help you identify which company offers the most promising opportunity for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Monolithic Power Systems and Onto Innovation by providing an overview of these two companies and their main differences.

Monolithic Power Systems Overview

Monolithic Power Systems, Inc. focuses on designing and marketing semiconductor-based power electronics solutions for diverse markets including computing, automotive, and industrial sectors. The company’s integrated circuits convert and control voltages in devices such as portable electronics and medical equipment. Headquartered in Kirkland, Washington, it operates globally and sells through distributors and directly to manufacturers.

Onto Innovation Overview

Onto Innovation Inc. develops and manufactures process control tools, lithography systems, and analytical software for semiconductor manufacturing. Its products serve advanced packaging, wafer inspection, and process control needs in semiconductor and related industries. Founded in 1940 and based in Wilmington, Massachusetts, Onto offers standalone tools and factory-wide software suites supporting yield management and testing.

Key similarities and differences

Both companies operate in the semiconductor industry, focusing on technology solutions that support manufacturing and device performance. Monolithic Power Systems emphasizes power electronics and voltage control ICs, while Onto Innovation specializes in process control tools and software for semiconductor fabrication. Their business models differ in product focus, with Monolithic targeting voltage management and Onto concentrating on inspection and metrology systems.

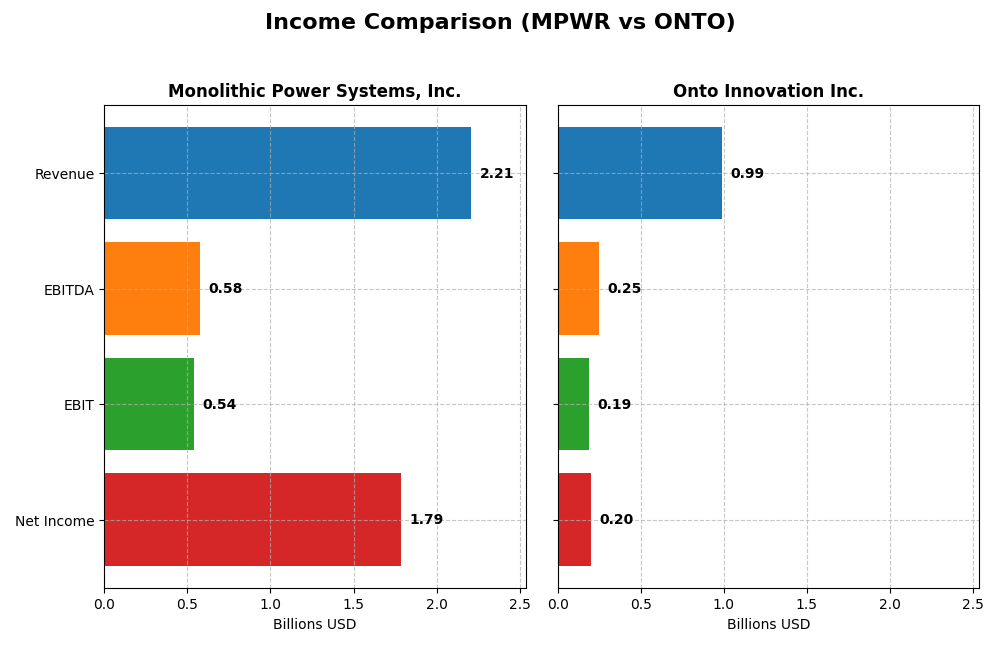

Income Statement Comparison

The following table compares the key income statement metrics for Monolithic Power Systems, Inc. and Onto Innovation Inc. for the fiscal year 2024, highlighting their financial scale and profitability.

| Metric | Monolithic Power Systems, Inc. | Onto Innovation Inc. |

|---|---|---|

| Market Cap | 48.4B | 10.7B |

| Revenue | 2.21B | 987M |

| EBITDA | 576M | 249M |

| EBIT | 539M | 187M |

| Net Income | 1.79B | 202M |

| EPS | 36.76 | 4.09 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Monolithic Power Systems, Inc.

From 2020 to 2024, Monolithic Power Systems showed strong revenue growth, reaching $2.21B in 2024, with net income surging to $1.79B. Margins remained robust, with a gross margin of 55.3% and a remarkable net margin of 81.0% in the latest year. The 2024 performance highlights significant profitability improvements and sustained expansion despite rising operating expenses.

Onto Innovation Inc.

Onto Innovation experienced steady revenue growth from $556M in 2020 to $987M in 2024, with net income increasing to $202M. Margins were consistently favorable, maintaining a gross margin above 52% and a net margin around 20%. In 2024, Onto Innovation demonstrated solid margin expansion and operating efficiency, supported by a 21% revenue increase and a 38% net margin growth year-over-year.

Which one has the stronger fundamentals?

Both companies exhibit favorable income statement trends, but Monolithic Power Systems stands out with higher margins and more pronounced net income growth, reflecting stronger profitability and operational leverage. Onto Innovation maintains consistent growth and margin stability, though at a lower scale. Overall, Monolithic Power Systems shows greater momentum in both scale and margin expansion.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Monolithic Power Systems, Inc. (MPWR) and Onto Innovation Inc. (ONTO) based on their most recent fiscal year data from 2024.

| Ratios | Monolithic Power Systems, Inc. (MPWR) | Onto Innovation Inc. (ONTO) |

|---|---|---|

| ROE | 56.80% | 10.47% |

| ROIC | 16.22% | 8.77% |

| P/E | 16.09 | 41.76 |

| P/B | 9.14 | 4.37 |

| Current Ratio | 5.31 | 8.69 |

| Quick Ratio | 3.89 | 7.00 |

| D/E (Debt-to-Equity) | 0.005 | 0.008 |

| Debt-to-Assets | 0.44% | 0.72% |

| Interest Coverage | N/A (0 reported) | N/A (0 reported) |

| Asset Turnover | 0.61 | 0.47 |

| Fixed Asset Turnover | 4.17 | 7.16 |

| Payout ratio | 13.47% | 0% |

| Dividend yield | 0.84% | 0% |

Interpretation of the Ratios

Monolithic Power Systems, Inc.

Monolithic Power Systems shows mostly strong financial ratios with favorable net margin at 80.95% and return on equity at 56.8%, signaling robust profitability and efficient capital use. Some concerns include a high price-to-book ratio of 9.14 and a current ratio of 5.31, indicating potential overvaluation and liquidity risks. The company pays dividends with a low yield of 0.84%, suggesting cautious shareholder returns.

Onto Innovation Inc.

Onto Innovation presents mixed ratio results with a favorable net margin of 20.43% but neutral return on equity at 10.47% and return on invested capital at 8.77%. The company faces unfavorable valuation metrics like a PE of 41.76 and a current ratio of 8.69. It does not pay dividends, likely focusing on reinvestment and growth priorities, with no dividend yield reported.

Which one has the best ratios?

Monolithic Power Systems holds a more favorable overall ratio profile with 57.14% of ratios rated positively, reflecting superior profitability and capital efficiency. Onto Innovation’s ratios are split evenly between favorable and unfavorable, leading to a neutral global opinion. Valuation and liquidity metrics pose concerns for both, but Monolithic Power Systems demonstrates stronger financial fundamentals overall.

Strategic Positioning

This section compares the strategic positioning of Monolithic Power Systems, Inc. (MPWR) and Onto Innovation Inc. (ONTO) in terms of market position, key segments, and exposure to technological disruption:

Monolithic Power Systems, Inc. (MPWR)

- Large market cap of $48.4B, operating globally in competitive semiconductor power electronics markets.

- Focuses on DC to DC integrated circuits and lighting control ICs across computing, automotive, industrial, and consumer markets.

- Faces technological disruption from evolving semiconductor electronics but provides integrated solutions for diverse applications.

Onto Innovation Inc. (ONTO)

- Smaller market cap of $10.7B, focusing on semiconductor process control tools with competitive pressures.

- Concentrates on process control tools, lithography, and software for semiconductor manufacturing and advanced packaging.

- Exposed to disruption in semiconductor manufacturing tools and software, requiring continuous innovation in process control.

MPWR vs ONTO Positioning

MPWR exhibits a diversified strategic approach spanning multiple end markets and product categories, supporting steady growth. ONTO maintains a more concentrated focus on semiconductor process control systems, which may limit diversification but targets specialized manufacturing needs.

Which has the best competitive advantage?

MPWR demonstrates a very favorable moat with ROIC exceeding WACC by 5.58% and growing profitability, indicating durable competitive advantage. ONTO shows a slightly unfavorable moat, currently shedding value despite improving ROIC trends.

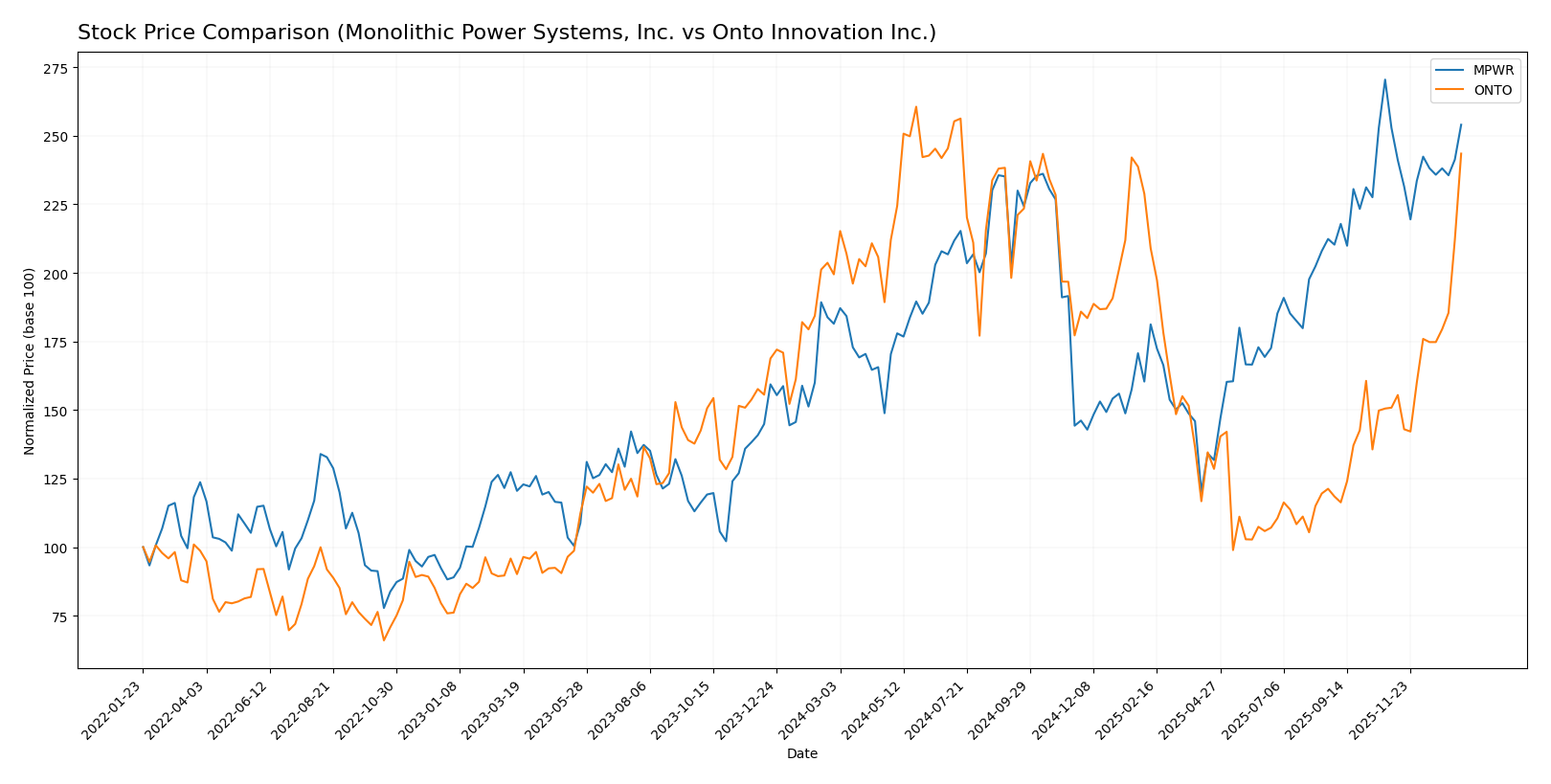

Stock Comparison

The stock prices of Monolithic Power Systems, Inc. (MPWR) and Onto Innovation Inc. (ONTO) have shown notable bullish momentum over the past year, with accelerating trends and varying volume dynamics shaping their trading behavior.

Trend Analysis

Monolithic Power Systems, Inc. (MPWR) experienced a 40.0% price increase over the past 12 months, indicating a bullish trend with accelerating momentum. The stock peaked at 1074.91 and bottomed at 477.39, showing high volatility with a standard deviation of 135.81. Recent weeks show a neutral trend with a minimal 0.45% price rise.

Onto Innovation Inc. (ONTO) recorded a 22.1% price increase during the last year, reflecting a bullish trend with acceleration. Its price ranged from 88.5 to 233.14, with moderate volatility (std deviation 42.61). Recently, ONTO surged 61.4%, strongly bullish with a steep trend slope.

Comparing both, MPWR has delivered higher overall market performance with a 40.0% gain versus ONTO’s 22.1%, although ONTO’s recent price acceleration surpasses MPWR’s short-term movement.

Target Prices

Analysts present a clear consensus on target prices for Monolithic Power Systems, Inc. and Onto Innovation Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Monolithic Power Systems, Inc. | 1375 | 1025 | 1187.5 |

| Onto Innovation Inc. | 200 | 160 | 178 |

The consensus target prices suggest upside potential for both stocks compared to their current prices: Monolithic Power Systems trades around 1009.54 USD versus a 1187.5 USD consensus, and Onto Innovation trades near 217.85 USD, above the 178 USD consensus. This indicates mixed analyst expectations with cautious optimism.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Monolithic Power Systems, Inc. (MPWR) and Onto Innovation Inc. (ONTO):

Rating Comparison

MPWR Rating

- Rating: A-, considered very favorable by analysts.

- Discounted Cash Flow Score: 3, indicating a moderate valuation level.

- ROE Score: 5, very favorable, showing efficient profit generation from equity.

- ROA Score: 5, very favorable, demonstrating excellent asset utilization.

- Debt To Equity Score: 5, very favorable, indicating low financial risk.

- Overall Score: 4, favorable overall financial standing.

ONTO Rating

- Rating: B+, also considered very favorable.

- Discounted Cash Flow Score: 3, also moderate valuation.

- ROE Score: 3, moderate, less efficient compared to MPWR.

- ROA Score: 4, favorable, good asset utilization but below MPWR’s level.

- Debt To Equity Score: 4, favorable, slightly higher financial risk than MPWR.

- Overall Score: 3, moderate overall financial standing.

Which one is the best rated?

Based strictly on the provided data, MPWR holds a higher overall rating (A- vs B+) and scores better on return on equity, return on assets, and debt to equity metrics. ONTO scores moderately in most categories but ranks below MPWR overall.

Scores Comparison

The scores comparison between Monolithic Power Systems, Inc. (MPWR) and Onto Innovation Inc. (ONTO) is as follows:

MPWR Scores

- Altman Z-Score: 46.83, indicating a safe zone, very low bankruptcy risk.

- Piotroski Score: 4, categorized as average financial strength.

ONTO Scores

- Altman Z-Score: 34.16, indicating a safe zone, very low bankruptcy risk.

- Piotroski Score: 4, categorized as average financial strength.

Which company has the best scores?

Both MPWR and ONTO have Altman Z-Scores well within the safe zone, reflecting strong financial stability. Their Piotroski Scores are identical at 4, indicating average financial strength for both companies.

Grades Comparison

Here is a comparison of the latest reliable grades assigned to Monolithic Power Systems, Inc. and Onto Innovation Inc.:

Monolithic Power Systems, Inc. Grades

The table below summarizes recent grades assigned by reputable grading companies for Monolithic Power Systems, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2025-12-19 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| TD Cowen | Maintain | Buy | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

| Rosenblatt | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-23 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-20 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Wolfe Research | Upgrade | Outperform | 2025-10-14 |

| Citigroup | Maintain | Buy | 2025-10-03 |

Overall, Monolithic Power Systems shows a predominantly positive trend with multiple “Buy” and “Overweight” ratings and one recent upgrade to “Outperform.”

Onto Innovation Inc. Grades

The following table presents recent grades from reliable grading companies for Onto Innovation Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Hold | 2026-01-14 |

| Needham | Maintain | Buy | 2026-01-06 |

| Jefferies | Maintain | Buy | 2025-12-15 |

| B. Riley Securities | Maintain | Buy | 2025-11-18 |

| Needham | Maintain | Buy | 2025-11-18 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| Oppenheimer | Maintain | Outperform | 2025-10-14 |

| Stifel | Maintain | Hold | 2025-10-13 |

| B. Riley Securities | Maintain | Buy | 2025-10-10 |

| Jefferies | Upgrade | Buy | 2025-09-23 |

Onto Innovation’s grades reflect a strong buy consensus with several “Buy” and “Outperform” ratings, balanced by a few “Hold” ratings.

Which company has the best grades?

Both companies have a consensus “Buy” rating overall, but Monolithic Power Systems features more consistent “Buy” and “Overweight” ratings with only one “Neutral,” while Onto Innovation presents a mix of “Buy,” “Outperform,” and some “Hold” ratings. This suggests Monolithic Power Systems may have slightly stronger analyst confidence, which could influence investor perceptions of stability and growth potential.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Monolithic Power Systems, Inc. (MPWR) and Onto Innovation Inc. (ONTO) based on the most recent data available.

| Criterion | Monolithic Power Systems, Inc. (MPWR) | Onto Innovation Inc. (ONTO) |

|---|---|---|

| Diversification | Focused on DC to DC and lighting control products with steady revenue growth in DC to DC segment (~$1.7B in 2023) | More diversified product lines including parts, services, and systems/software with Systems & Software revenue at $850M in 2024 |

| Profitability | Very high net margin (80.95%) and ROIC (16.22%), creating strong value | Moderate net margin (20.43%) and ROIC (8.77%), currently shedding value but improving profitability |

| Innovation | Demonstrates durable competitive advantage with growing ROIC and strong efficiency | Improving ROIC trend but still slightly unfavorable overall moat, indicating ongoing efforts to enhance competitiveness |

| Global presence | Solid global footprint supported by product demand in electronics sector | Global reach through diversified offerings in semiconductor and systems innovation |

| Market Share | Strong position in power management with consistent revenue growth | Growing market share in semiconductor innovation but faces more competitive pressure |

Key takeaways: MPWR stands out with exceptional profitability and a durable competitive moat, making it a value-creating company. ONTO shows promise with improving profitability and innovation but currently has a weaker economic moat and faces challenges in market valuation and efficiency. Investors should weigh MPWR’s stability against ONTO’s growth potential and risk profile.

Risk Analysis

Below is a comparison table highlighting key risks for Monolithic Power Systems, Inc. (MPWR) and Onto Innovation Inc. (ONTO) based on 2024 data and recent market conditions:

| Metric | Monolithic Power Systems, Inc. (MPWR) | Onto Innovation Inc. (ONTO) |

|---|---|---|

| Market Risk | Beta 1.46 indicates moderate volatility; semiconductor cyclicality impacts demand | Beta 1.46; sensitive to tech sector fluctuations, higher P/E reflects market sentiment risk |

| Debt Level | Very low debt-to-equity (0.01), minimal leverage risk | Similarly low debt (0.01), manageable financial risk |

| Regulatory Risk | Exposure to international trade policies, especially US-China semiconductor tensions | Regulatory impact from global semiconductor equipment export controls |

| Operational Risk | Dependence on supply chain and manufacturing efficiency, but strong operational metrics | Moderate operational risk with complex manufacturing and software integration |

| Environmental Risk | Moderate, with potential impact from semiconductor manufacturing environmental standards | Moderate, industry subject to environmental compliance for manufacturing processes |

| Geopolitical Risk | Significant due to multinational sales and supply chain reliance, especially Asia | High, given global footprint and sensitivity to geopolitical tensions in key markets |

The most impactful risks for both companies are geopolitical tensions affecting supply chains and trade policies, particularly in the semiconductor industry. MPWR’s low debt and strong financial health reduce financial risk, whereas ONTO faces higher market valuation risk with a higher P/E ratio, increasing sensitivity to market corrections.

Which Stock to Choose?

Monolithic Power Systems, Inc. (MPWR) shows strong income growth with a 21.2% revenue increase in 2024 and favorable profitability metrics, including a 56.8% ROE and 80.95% net margin. It maintains very low debt and holds a very favorable rating of A-.

Onto Innovation Inc. (ONTO) also posts solid income growth with a 21.01% revenue rise in 2024 and a favorable net margin of 20.43%. Its financial ratios are neutral overall, with moderate ROE and ROIC, low debt, and a very favorable B+ rating.

For investors prioritizing durable competitive advantage and strong financial ratios, MPWR might appear more favorable due to its very favorable global ratio and rating evaluations. ONTO could be more appealing for those valuing recent profitability improvements and growth potential despite a slightly unfavorable moat status.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Monolithic Power Systems, Inc. and Onto Innovation Inc. to enhance your investment decisions: