Home > Comparison > Technology > MPWR vs ON

The strategic rivalry between Monolithic Power Systems, Inc. and ON Semiconductor Corporation defines the current trajectory of the semiconductor industry. Monolithic Power excels as a niche innovator in power electronics ICs, while ON Semiconductor operates as a diversified industrial heavyweight with broad intelligent sensing and power solutions. This analysis pits focused innovation against scale-driven breadth to identify which approach delivers superior risk-adjusted returns for a diversified portfolio in 2026.

Table of contents

Companies Overview

Monolithic Power Systems and ON Semiconductor dominate critical niches within the semiconductor industry’s power and sensing segments.

Monolithic Power Systems, Inc.: Power Electronics Innovator

Monolithic Power Systems specializes in semiconductor-based power electronics for diverse markets including automotive and consumer electronics. Its core revenue derives from DC to DC integrated circuits that regulate voltage in devices like notebooks and infotainment systems. In 2026, the company emphasizes expanding its footprint in high-efficiency power solutions, targeting growth in emerging industrial and automotive applications.

ON Semiconductor Corporation: Intelligent Sensing Leader

ON Semiconductor leads in intelligent sensing and power solutions, enabling electrification in automotive and sustainable energy sectors. It generates revenue through analog, discrete, and integrated semiconductor products, serving applications from electric vehicles to solar power. Its 2026 strategy focuses on advancing electric vehicle power technologies and broadening its intelligent sensing capabilities across industrial markets.

Strategic Collision: Similarities & Divergences

Both firms compete in semiconductors but differ in focus: Monolithic Power prioritizes power management ICs, while ON emphasizes integrated sensing and power solutions. Their battleground lies in automotive electrification and industrial power systems. Investors face distinct profiles—Monolithic Power’s smaller scale targets niche innovation, whereas ON’s larger footprint leverages broad, diversified semiconductor applications.

Income Statement Comparison

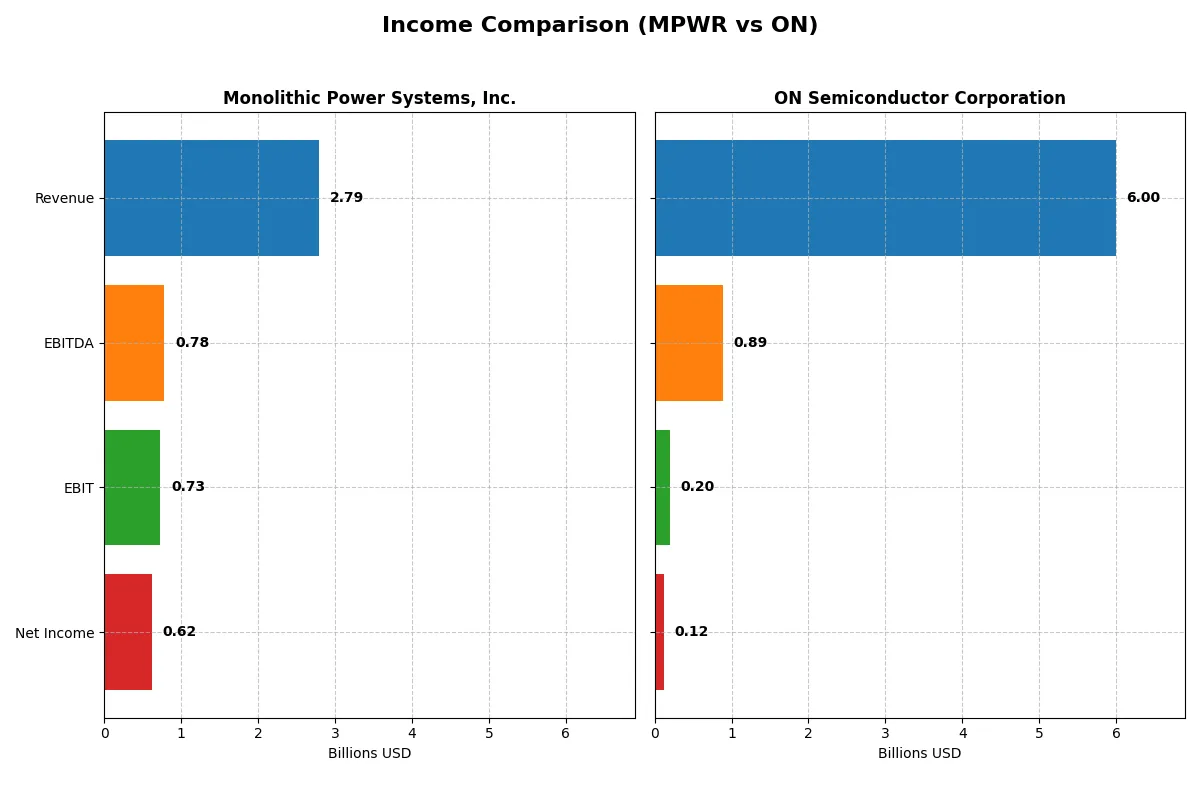

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Monolithic Power Systems, Inc. (MPWR) | ON Semiconductor Corporation (ON) |

|---|---|---|

| Revenue | 2.79B | 5.99B |

| Cost of Revenue | 1.25B | 4.06B |

| Operating Expenses | 811M | 1.19B |

| Gross Profit | 1.54B | 1.94B |

| EBITDA | 780M | 888M |

| EBIT | 729M | 202M |

| Interest Expense | 0 | 71M |

| Net Income | 616M | 121M |

| EPS | 12.82 | 0.29 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability trends of two semiconductor industry players over recent years.

Monolithic Power Systems, Inc. Analysis

Monolithic Power Systems grows revenue steadily from $1.2B in 2021 to $2.8B in 2025, with net income surging from $242M to $616M in the latest year. Its gross margin sustains above 55%, reflecting strong cost control. Despite a recent dip in net margin growth, the 2025 EBIT margin remains robust at 26%, signaling operational momentum and efficiency.

ON Semiconductor Corporation Analysis

ON Semiconductor’s revenue peaked at $8.3B in 2022 but declined to $6.0B by 2025, with net income dropping sharply from $2.2B to $121M. Its gross margin hovers near 32%, but EBIT margin contracts dramatically to just 3.4% in 2025. The sharp declines in profitability and shrinking margins highlight significant operational challenges and reduced momentum.

Margin Strength vs. Top-Line Scale

Monolithic Power Systems clearly leads in profitability and margin expansion, while ON Semiconductor leverages higher revenue but struggles with profit erosion. The numbers favor Monolithic’s efficient, margin-driven model over ON’s larger yet weakening top line. For investors prioritizing sustainable earnings, Monolithic’s profile appears more attractive.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | Monolithic Power Systems, Inc. (MPWR) | ON Semiconductor Corporation (ON) |

|---|---|---|

| ROE | 16.6% | 1.6% |

| ROIC | 14.9% | 6.2% |

| P/E | 70.7 | 183.9 |

| P/B | 11.7 | 2.9 |

| Current Ratio | 5.91 | 4.52 |

| Quick Ratio | 4.38 | 2.98 |

| D/E | 0.00 | 0.45 |

| Debt-to-Assets | 0.00 | 27.7% |

| Interest Coverage | 0 | 10.5 |

| Asset Turnover | 0.65 | 0.48 |

| Fixed Asset Turnover | 4.45 | 1.77 |

| Payout Ratio | 46.2% | 0% |

| Dividend Yield | 0.65% | 0% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, revealing hidden risks and operational excellence that numbers alone cannot show.

Monolithic Power Systems, Inc.

Monolithic Power Systems posts a strong ROE of 16.55% and a healthy net margin at 22.07%, signaling solid profitability. However, its P/E ratio of 70.69 and P/B of 11.7 mark the stock as expensive and stretched. The company pays a modest 0.65% dividend, suggesting a cautious shareholder return approach amid robust reinvestment in R&D.

ON Semiconductor Corporation

ON Semiconductor struggles with a low ROE of 1.58% and a net margin of just 2.02%, reflecting weak profitability. Its P/E ratio is extremely high at 183.93, indicating a highly expensive valuation. The absence of dividends and a moderate reinvestment strategy point to challenges in delivering shareholder returns and operational efficiency.

Premium Valuation vs. Operational Safety

Monolithic Power balances superior profitability with a premium valuation, while ON Semiconductor’s metrics reveal operational weakness and an even higher valuation multiple. Investors seeking growth with operational safety may lean toward Monolithic Power, whereas those tolerating risk for potential turnaround may consider ON.

Which one offers the Superior Shareholder Reward?

Monolithic Power Systems (MPWR) pays a modest dividend yield near 0.65% with a conservative payout ratio around 46%, supported by strong free cash flow. It also executes meaningful buybacks, enhancing shareholder value sustainably. ON Semiconductor (ON) forgoes dividends, reinvesting cash into growth and acquisitions, but with a thinner profit margin and higher debt. MPWR’s balanced distribution and robust margins offer a more attractive total return profile in 2026. I favor MPWR for superior shareholder reward due to its sustainable, multi-channel capital return strategy.

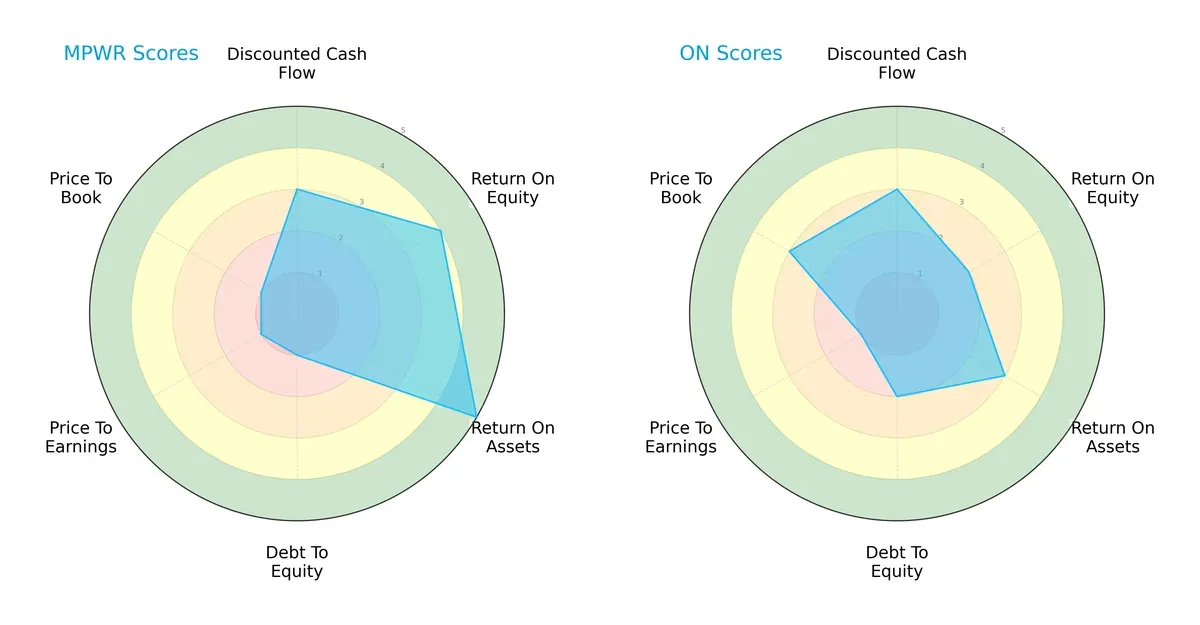

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Monolithic Power Systems, Inc. and ON Semiconductor Corporation:

Monolithic Power excels in asset efficiency (ROA 5) and equity returns (ROE 4) but suffers from a weak debt profile and valuation metrics (all scores 1). ON Semiconductor has a more balanced, though moderate, profile with less extreme lows, particularly in debt management (2) and price-to-book (3). MPWR relies heavily on operational efficiency, while ON offers steadier financial risk control.

Bankruptcy Risk: Solvency Showdown

Monolithic Power’s Altman Z-Score of 61.2 vastly outperforms ON Semiconductor’s 5.3, signaling an exceptionally strong solvency position for MPWR versus ON’s more typical safe zone score:

Financial Health: Quality of Operations

Both firms score in the average range on the Piotroski F-Score, with ON slightly ahead at 6 versus MPWR’s 5, indicating marginally stronger internal financial metrics for ON but no glaring red flags for either:

How are the two companies positioned?

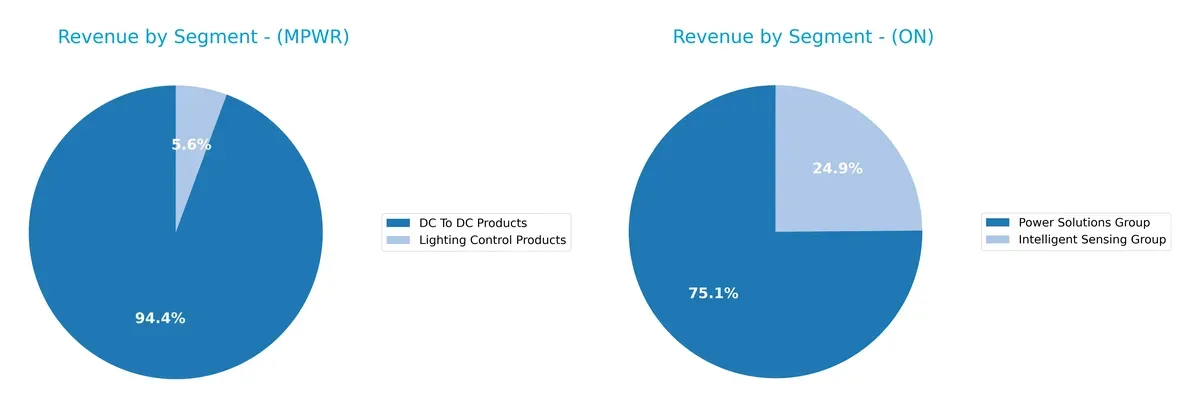

This section dissects MPWR and ON’s operational DNA by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Monolithic Power Systems, Inc. and ON Semiconductor Corporation diversify income streams and where their primary sector bets lie:

Monolithic Power Systems, Inc. relies heavily on its DC To DC Products segment, generating $1.72B in 2023 and overshadowing its Lighting Control Products at $102M. ON Semiconductor commands a far more diversified portfolio with $4.45B from Power Solutions, $2.49B from Analog Solutions, and $1.32B from Intelligent Sensing in 2023. MPWR’s concentration signals potential risk but reinforces its niche dominance. ON’s broad mix reduces exposure and supports ecosystem lock-in.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of Monolithic Power Systems, Inc. and ON Semiconductor Corporation:

Monolithic Power Systems Strengths

- High net margin at 22.07%

- Strong ROE of 16.55%

- ROIC of 14.93% above WACC

- Zero debt with infinite interest coverage

- Diverse revenue streams in DC to DC and lighting products

- Significant presence in China and Taiwan markets

ON Semiconductor Strengths

- Diverse product segments including Power Solutions and Intelligent Sensing

- Presence in multiple global markets including Hong Kong, Singapore, UK, US

- Favorable debt levels with manageable debt-to-assets

- Quick ratio favorable at 2.98 indicating liquidity

- Established revenue in Analog and Automotive sectors

Monolithic Power Systems Weaknesses

- Unfavorable high P/E of 70.69 and P/B of 11.7 indicating premium valuation

- Current ratio very high at 5.91, possibly inefficient asset use

- Dividend yield low at 0.65%

- WACC higher than ROIC, raising capital cost concerns

- Asset turnover neutral at 0.65

ON Semiconductor Weaknesses

- Very low net margin at 2.02% and ROE at 1.58%

- ROIC below WACC at 6.24%

- Unfavorable P/E at 183.93 and current ratio at 4.52

- Asset turnover weak at 0.48

- No dividend yield reported

- Interest coverage only neutral at 2.85

Both companies show diversification in products and global reach. MPWR demonstrates superior profitability and balance sheet strength but faces valuation and capital efficiency challenges. ON has broader product and geographic diversification but struggles with profitability and operational efficiency, posing strategic priorities around margin improvement and asset utilization.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competition erosion. Let’s dissect how these two semiconductor firms defend their turf:

Monolithic Power Systems, Inc.: Intangible Assets and Margin Stability

I see Monolithic Power’s moat rooted in advanced semiconductor design and brand reputation. Its 55% gross margin and 26% EBIT margin reveal robust pricing power. Though ROIC is declining, new markets like automotive electrification could deepen its moat in 2026.

ON Semiconductor Corporation: Cost Advantage Under Pressure

ON Semiconductor leans on scale and cost advantages, contrasting MPWR’s innovation moat. However, its slim 32% gross margin and 3% EBIT margin show margin compression. Declining ROIC signals shrinking economic profits, but expansion in intelligent sensing offers a growth lever.

Innovation Moat vs. Scale Cost Moat: Who Defends Better?

Monolithic Power holds the deeper moat, creating clear value with high margins and positive ROIC versus ON’s value destruction. MPWR’s intangible asset base better equips it to defend market share amid intensifying competition.

Which stock offers better returns?

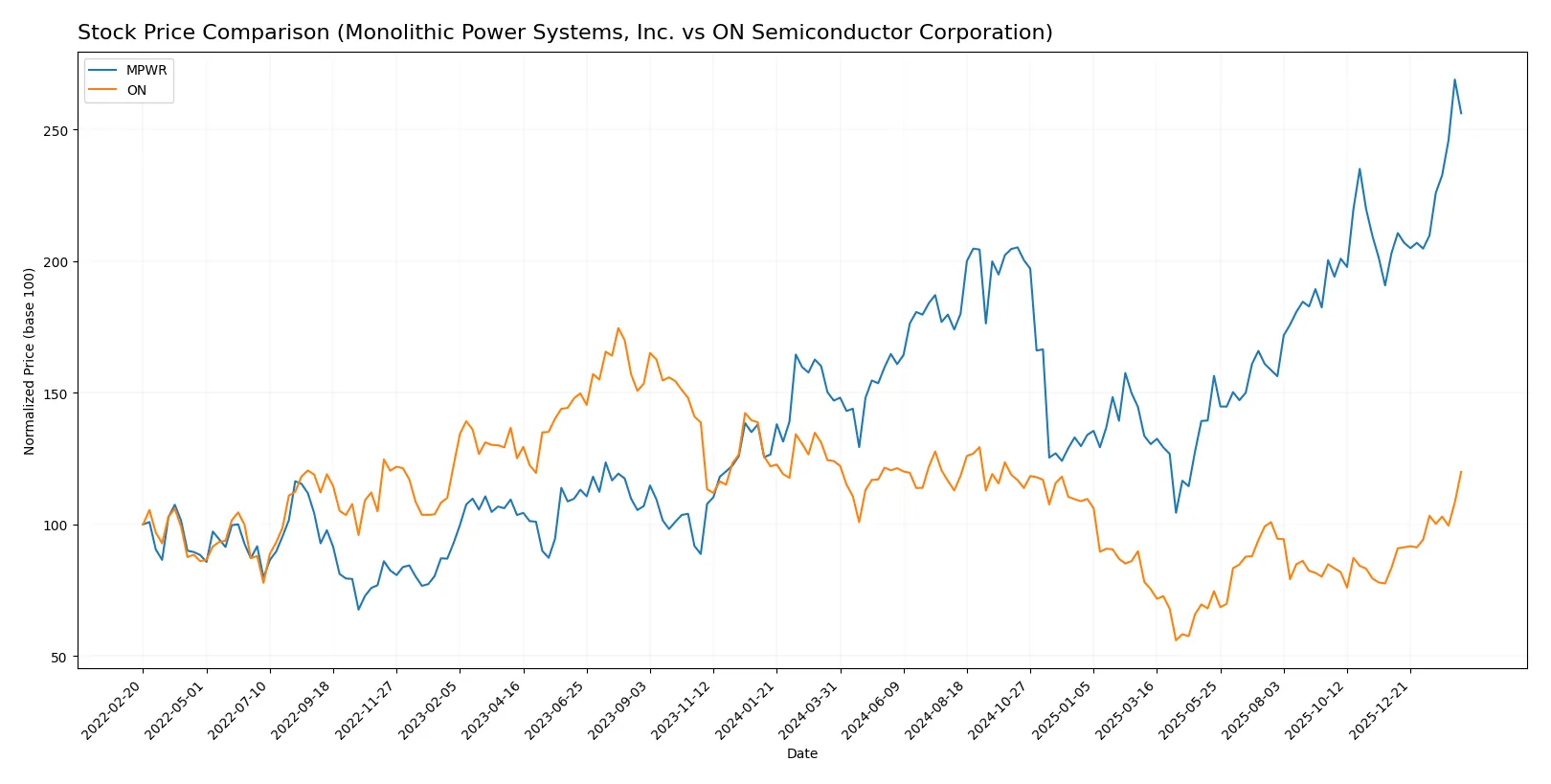

The past year shows Monolithic Power Systems surging 74.25%, signaling acceleration and strong price momentum. ON Semiconductor dropped 3.31% but gained 43.73% recently, revealing mixed trading dynamics.

Trend Comparison

Monolithic Power Systems exhibits a bullish trend over the past 12 months with a 74.25% price increase and accelerating gains, despite high volatility. Its price ranged from 477.39 to 1229.82.

ON Semiconductor shows a bearish overall trend with a 3.31% decline but accelerates recently with a 43.73% rise. The stock’s volatility remains low, fluctuating between 33.7 and 77.87.

Comparing trends, Monolithic Power Systems delivered the highest market performance over the past year, outperforming ON Semiconductor’s more mixed trajectory.

Target Prices

Analysts show a positive outlook with solid upside potential for both Monolithic Power Systems and ON Semiconductor.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Monolithic Power Systems, Inc. | 1200 | 1500 | 1313.71 |

| ON Semiconductor Corporation | 51 | 75 | 62.4 |

Monolithic Power’s consensus target price stands about 12% above the current $1171, signaling upside confidence. ON Semiconductor’s target consensus is slightly below its $72 market price, suggesting cautious optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Monolithic Power Systems, Inc. Grades

The table below shows recent grades from leading financial institutions for Monolithic Power Systems, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-09 |

| Keybanc | Maintain | Overweight | 2026-02-06 |

| Truist Securities | Maintain | Buy | 2026-02-06 |

| Needham | Maintain | Buy | 2026-02-06 |

| Rosenblatt | Maintain | Neutral | 2026-02-06 |

| Wells Fargo | Maintain | Overweight | 2026-02-06 |

| Stifel | Maintain | Buy | 2026-02-04 |

| Wells Fargo | Maintain | Overweight | 2026-01-26 |

| Wells Fargo | Upgrade | Overweight | 2026-01-15 |

| Truist Securities | Maintain | Buy | 2025-12-19 |

ON Semiconductor Corporation Grades

The table below shows recent grades from leading financial institutions for ON Semiconductor Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2026-02-10 |

| Citigroup | Maintain | Neutral | 2026-02-10 |

| Wells Fargo | Maintain | Overweight | 2026-02-10 |

| Benchmark | Downgrade | Hold | 2026-02-10 |

| Truist Securities | Maintain | Hold | 2026-02-10 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-02-10 |

| Rosenblatt | Maintain | Neutral | 2026-02-10 |

| Piper Sandler | Maintain | Overweight | 2026-02-10 |

| Keybanc | Maintain | Overweight | 2026-02-10 |

| Mizuho | Maintain | Outperform | 2026-02-10 |

Which company has the best grades?

Monolithic Power Systems consistently receives strong Buy and Overweight ratings from major institutions. ON Semiconductor shows a mix of Neutral, Hold, and Overweight ratings, with one downgrade to Hold. Investors might view Monolithic Power Systems as more favorably rated, potentially signaling stronger market confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Monolithic Power Systems, Inc.

- Strong niche in power electronics with high net margin and ROIC. Faces intense competition in semiconductor innovation.

ON Semiconductor Corporation

- Larger scale but lower profitability; competes aggressively in automotive and power solutions markets.

2. Capital Structure & Debt

Monolithic Power Systems, Inc.

- Zero debt and strong interest coverage reflect financial prudence and flexibility.

ON Semiconductor Corporation

- Moderate debt level (D/E 0.45) and lower interest coverage signal some financial risk and leverage.

3. Stock Volatility

Monolithic Power Systems, Inc.

- Beta of 1.455 indicates moderate volatility relative to the market.

ON Semiconductor Corporation

- Slightly higher beta at 1.542, suggesting greater sensitivity to market swings.

4. Regulatory & Legal

Monolithic Power Systems, Inc.

- Operates globally with exposure to semiconductor export controls, but well-managed compliance.

ON Semiconductor Corporation

- Broad product portfolio increases regulatory complexity, especially in automotive and defense sectors.

5. Supply Chain & Operations

Monolithic Power Systems, Inc.

- Relies on third-party distributors and global manufacturing; supply chain disruptions pose moderate risk.

ON Semiconductor Corporation

- Larger operational footprint and more complex supply chains increase vulnerability to global disruptions.

6. ESG & Climate Transition

Monolithic Power Systems, Inc.

- Moderate ESG focus; low debt supports sustainable operations but room to improve climate strategy.

ON Semiconductor Corporation

- Active in electrification and sustainable energy, but higher emissions risk due to scale and product mix.

7. Geopolitical Exposure

Monolithic Power Systems, Inc.

- Diverse international presence but sensitive to US-China trade tensions impacting supply chains.

ON Semiconductor Corporation

- Significant global exposure, including defense contracts, increasing geopolitical risk profile.

Which company shows a better risk-adjusted profile?

Monolithic Power Systems faces its largest risk in high valuation metrics, which may pressure returns if growth slows. ON Semiconductor’s key risk lies with its elevated debt and weaker profitability, raising financial stability concerns. MPWR’s zero debt and stronger margins grant it a superior risk-adjusted profile. Its Altman Z-Score of 61 confirms robust financial health, while ON’s score of 5.3, though safe, reflects more moderate stability. The market’s recent preference for high-growth tech stocks inflates MPWR’s P/E, warranting caution despite solid fundamentals.

Final Verdict: Which stock to choose?

Monolithic Power Systems (MPWR) commands attention with its superpower: exceptional capital efficiency and robust profitability. It generates strong returns well above its cost of capital, signaling value creation. A point of vigilance remains its stretched valuation and low dividend yield. MPWR suits portfolios targeting aggressive growth with tolerance for premium pricing.

ON Semiconductor (ON) offers a strategic moat grounded in stable recurring revenue and a solid balance sheet with manageable debt. While it lags MPWR in profitability, ON presents a safer profile with more moderate financial risk. This makes it a fit for investors pursuing Growth at a Reasonable Price (GARP) strategies looking for steadier exposure.

If you prioritize high-return growth fueled by operational excellence, MPWR is the compelling choice due to its superior ROIC and robust cash conversion. However, if you seek better stability and lower leverage within the semiconductor space, ON offers a more conservative profile despite weaker earnings momentum. Both present analytical scenarios depending on risk appetite and investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Monolithic Power Systems, Inc. and ON Semiconductor Corporation to enhance your investment decisions: