In the fast-evolving semiconductor industry, Monolithic Power Systems, Inc. (MPWR) and Nova Ltd. (NVMI) stand out as innovative players with complementary yet overlapping market focuses. MPWR excels in power electronics solutions across multiple tech sectors, while NVMI specializes in advanced process control systems for semiconductor manufacturing. Comparing these companies offers valuable insights into their growth potential and innovation strategies. Let’s explore which one presents the most compelling opportunity for investors like you.

Table of contents

Companies Overview

I will begin the comparison between Monolithic Power Systems and Nova Ltd. by providing an overview of these two companies and their main differences.

Monolithic Power Systems Overview

Monolithic Power Systems, Inc. focuses on designing and marketing semiconductor-based power electronics solutions for diverse markets including computing, automotive, industrial, and consumer electronics. The company specializes in DC-to-DC integrated circuits and lighting control ICs used in devices like portable electronics, monitors, and automotive infotainment. Headquartered in Kirkland, Washington, MPWR is positioned as a key player in power management semiconductors.

Nova Ltd. Overview

Nova Ltd. develops and sells process control systems essential for semiconductor manufacturing, covering various metrology platforms for dimensional, film, and chemical measurements. It serves integrated circuit sectors such as logic, foundries, and memory manufacturers globally. Based in Rehovot, Israel, Nova is recognized for its advanced process control technologies supporting critical semiconductor fabrication steps.

Key similarities and differences

Both companies operate in the semiconductor industry and sell their products internationally, but their business models differ significantly. MPWR focuses on power electronics ICs used across a broad range of electronic systems, while Nova specializes in metrology and process control systems crucial for semiconductor fabrication. MPWR has a larger workforce and market cap, reflecting its broader product application scope compared to Nova’s niche manufacturing equipment focus.

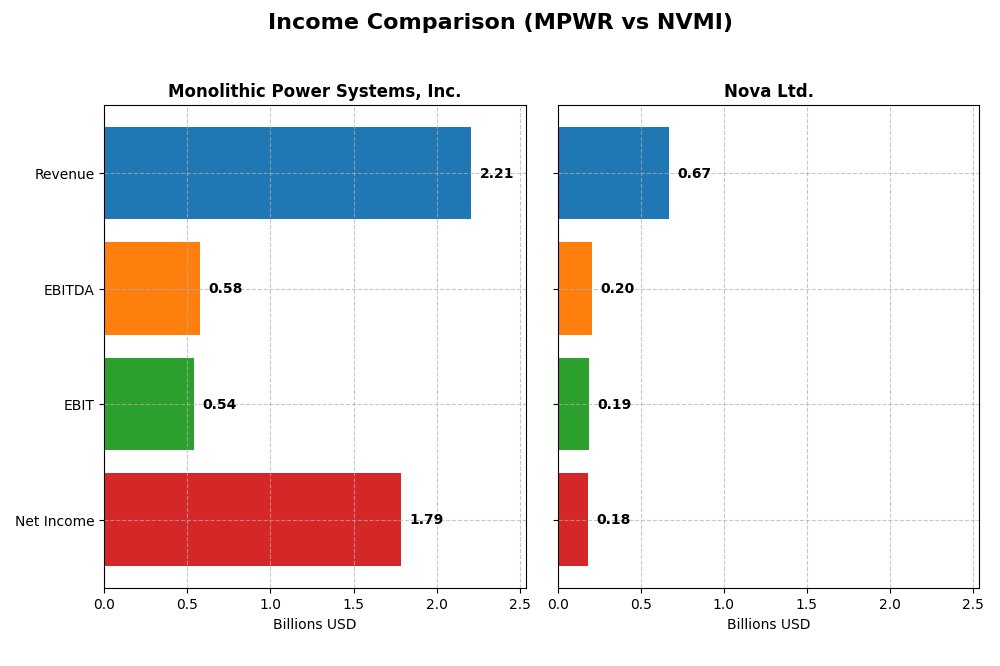

Income Statement Comparison

This table presents the most recent fiscal year income statement figures for Monolithic Power Systems, Inc. and Nova Ltd., offering a side-by-side view of key financial metrics for 2024.

| Metric | Monolithic Power Systems, Inc. | Nova Ltd. |

|---|---|---|

| Market Cap | 48.4B | 12.9B |

| Revenue | 2.21B | 672M |

| EBITDA | 576M | 205M |

| EBIT | 539M | 188M |

| Net Income | 1.79B | 185M |

| EPS | 36.76 | 6.31 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Monolithic Power Systems, Inc.

Monolithic Power Systems, Inc. showed strong growth in revenue and net income from 2020 to 2024, with revenue increasing by 161.36% and net income surging nearly 987%. Margins improved significantly, highlighted by a 55.32% gross margin and an 80.95% net margin in 2024. The latest year saw revenue grow 21.2%, with net margin and EPS rising sharply, reflecting excellent profitability expansion despite a slight unfavorable uptick in operating expenses relative to revenue.

Nova Ltd.

Nova Ltd. experienced consistent revenue and net income growth between 2020 and 2024, with revenue up 149.59% and net income increasing 283.58%. Margins remained favorable, with a 57.57% gross margin and a 27.33% net margin in 2024. The most recent year showed a robust 29.83% revenue increase and a 20.23% EBIT growth, while net margin growth was neutral, indicating steady operational efficiency and positive EPS improvement by 34.35%.

Which one has the stronger fundamentals?

Monolithic Power Systems demonstrates stronger fundamentals with higher net margin expansion, exceptional net income growth, and superior profitability margins, although operating expenses rose unfavorably relative to revenue. Nova Ltd. maintains consistent growth and solid margins with no unfavorable trends, but its net margin growth is more modest. Both companies have favorable income statement profiles, yet Monolithic Power’s margin and net income gains stand out.

Financial Ratios Comparison

This table summarizes the key financial ratios for Monolithic Power Systems, Inc. (MPWR) and Nova Ltd. (NVMI) based on their most recent fiscal year 2024 data.

| Ratios | Monolithic Power Systems, Inc. (MPWR) | Nova Ltd. (NVMI) |

|---|---|---|

| ROE | 56.8% | 19.8% |

| ROIC | 16.2% | 13.4% |

| P/E | 16.1 | 31.2 |

| P/B | 9.14 | 6.18 |

| Current Ratio | 5.31 | 2.32 |

| Quick Ratio | 3.89 | 1.92 |

| D/E | 0.005 | 0.254 |

| Debt-to-Assets | 0.44% | 16.98% |

| Interest Coverage | 0 (not reported) | 116.2 |

| Asset Turnover | 0.61 | 0.48 |

| Fixed Asset Turnover | 4.17 | 5.06 |

| Payout ratio | 13.5% | 0% |

| Dividend yield | 0.84% | 0% |

Interpretation of the Ratios

Monolithic Power Systems, Inc.

Monolithic Power Systems shows predominantly strong ratios with favorable net margin (80.95%), ROE (56.8%), and ROIC (16.22%), indicating robust profitability and capital efficiency. However, the high current ratio (5.31) and elevated price-to-book ratio suggest potential overcapitalization and valuation concerns. The company pays dividends with a modest yield of 0.84%, supported by free cash flow, though the payout remains conservative.

Nova Ltd.

Nova Ltd. exhibits generally favorable financial ratios including a net margin of 27.33%, ROE of 19.81%, and ROIC of 13.39%, but carries a higher debt-to-equity ratio (0.25) and less efficient asset turnover (0.48). The firm does not currently pay dividends, likely due to reinvestment in growth initiatives and R&D focus, aligning with its high operating cycle and capital allocation to innovation.

Which one has the best ratios?

Both companies present favorable overall ratios, yet Monolithic Power Systems demonstrates superior profitability and capital returns, albeit with some balance sheet caution. Nova Ltd. shows solid operational metrics but weaker asset efficiency and no dividend yield, reflecting a growth-oriented profile. The choice depends on investor preference for dividend income versus growth potential.

Strategic Positioning

This section compares the strategic positioning of Monolithic Power Systems, Inc. (MPWR) and Nova Ltd. (NVMI) regarding market position, key segments, and exposure to technological disruption:

Monolithic Power Systems, Inc.

- Leading semiconductor power electronics provider facing moderate competitive pressure globally.

- Focus on DC to DC power ICs and lighting control products serving multiple end markets including automotive and consumer electronics.

- Exposed to evolving semiconductor technologies, adapting integrated circuit solutions for diverse electronic systems.

Nova Ltd.

- Semiconductor process control systems supplier with niche market presence and higher competitive pressure.

- Specializes in metrology platforms for semiconductor manufacturing process control across logic, foundries, and memory sectors.

- Faces technological disruption risks tied to advances in semiconductor fabrication and process control innovations.

Monolithic Power Systems, Inc. vs Nova Ltd. Positioning

MPWR has a diversified portfolio across power electronics for broad markets, while NVMI concentrates on semiconductor process control systems. MPWR’s wider market exposure contrasts with NVMI’s specialized focus, affecting their competitive dynamics and risk profiles.

Which has the best competitive advantage?

MPWR demonstrates a very favorable economic moat with ROIC well above WACC and growing profitability, indicating a durable competitive advantage. NVMI shows only a slightly favorable moat with ROIC near WACC, suggesting limited current competitive strength despite improving profitability.

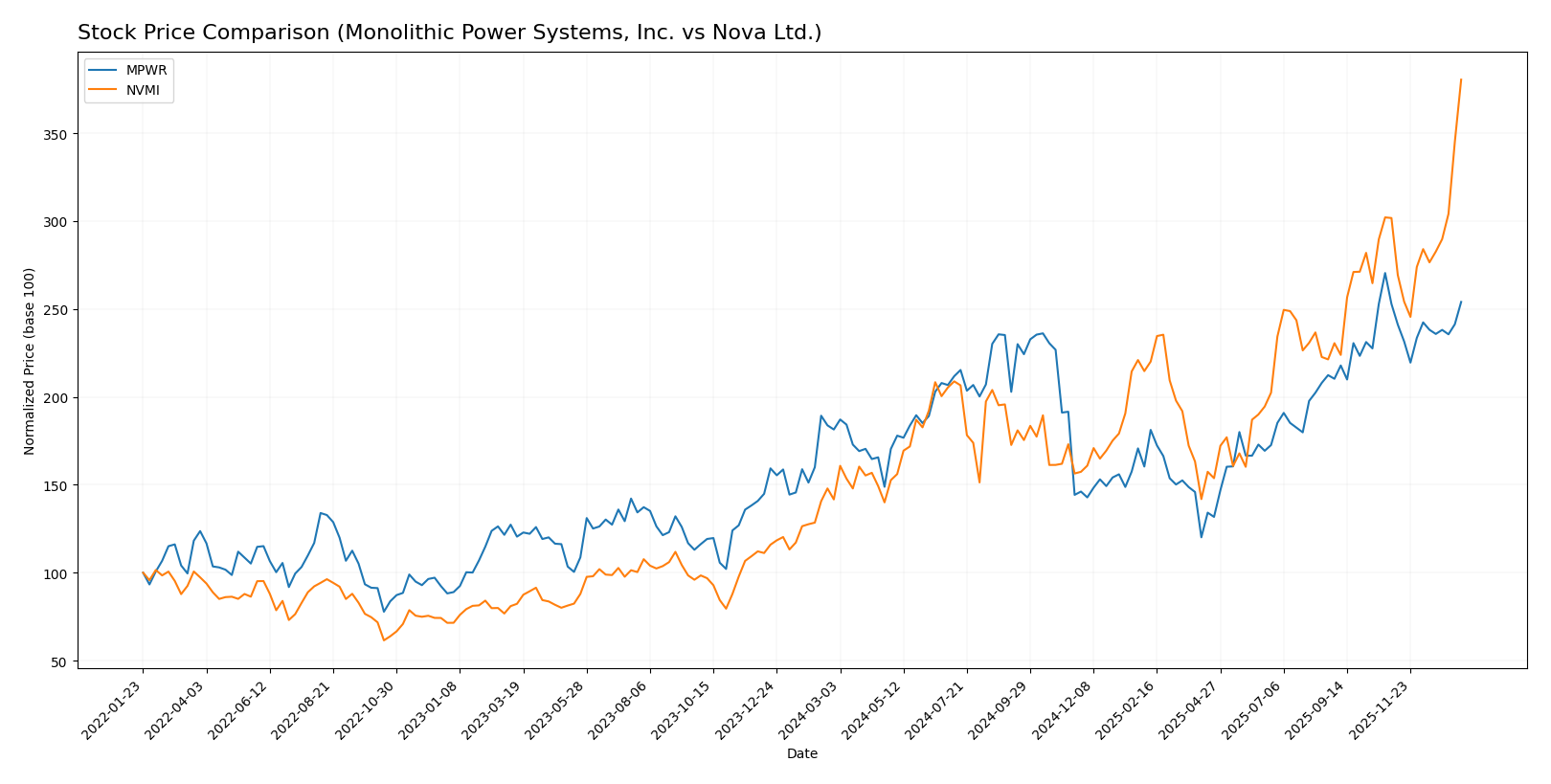

Stock Comparison

The stock price chart over the past 12 months highlights significant bullish momentum for both Monolithic Power Systems, Inc. and Nova Ltd., with notable price gains and evolving trading dynamics.

Trend Analysis

Monolithic Power Systems, Inc. experienced a 39.99% price increase over the past year, indicating a bullish trend with acceleration. The stock ranged from a low of 477.39 to a high of 1074.91, showing considerable volatility.

Nova Ltd. demonstrated a stronger bullish trend with a 168.54% price gain over the same period, also accelerating. Its price fluctuated between 159.92 and 434.55, reflecting moderate volatility compared to MPWR.

Comparing the two, Nova Ltd. delivered the highest market performance with a significantly larger percentage increase, outperforming Monolithic Power Systems, Inc. in price appreciation.

Target Prices

The current consensus target prices reflect analyst optimism for both Monolithic Power Systems, Inc. and Nova Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Monolithic Power Systems, Inc. | 1375 | 1025 | 1187.5 |

| Nova Ltd. | 390 | 335 | 362.5 |

Analysts expect Monolithic Power Systems’ stock to appreciate significantly from its current price of 1009.54 USD, while Nova Ltd.’s target consensus is below the current price of 434.55 USD, indicating mixed short-term outlooks.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Monolithic Power Systems, Inc. (MPWR) and Nova Ltd. (NVMI):

Rating Comparison

MPWR Rating

- Rating: A-, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate at 3, indicating neutral valuation assessment.

- ROE Score: Very favorable 5, showing excellent profit generation from equity.

- ROA Score: Very favorable 5, indicating highly effective asset utilization.

- Debt To Equity Score: Very favorable 5, reflecting low financial risk.

- Overall Score: Favorable 4, summarizing strong financial health.

NVMI Rating

- Rating: B-, also considered very favorable but lower than MPWR.

- Discounted Cash Flow Score: Moderate at 3, similar valuation outlook to MPWR.

- ROE Score: Favorable 4, strong but below MPWR’s score.

- ROA Score: Very favorable 5, matching MPWR in asset use efficiency.

- Debt To Equity Score: Very unfavorable 1, indicating high financial risk.

- Overall Score: Moderate 3, reflecting a less robust overall profile.

Which one is the best rated?

Based strictly on provided data, MPWR holds a better rating with an A- versus NVMI’s B-. MPWR scores higher on overall, ROE, and debt-to-equity metrics, indicating stronger financial stability and profitability.

Scores Comparison

Here is the comparison of the financial scores for Monolithic Power Systems, Inc. and Nova Ltd.:

MPWR Scores

- Altman Z-Score: 46.83, indicating a safe zone.

- Piotroski Score: 4, reflecting average financial strength.

NVMI Scores

- Altman Z-Score: 7.76, also indicating a safe zone.

- Piotroski Score: 7, reflecting strong financial strength.

Which company has the best scores?

Based on the provided data, MPWR has a much higher Altman Z-Score than NVMI, indicating lower bankruptcy risk. However, NVMI’s Piotroski Score is significantly stronger, suggesting better overall financial health.

Grades Comparison

Here is the comparison of recent reliable grades assigned to Monolithic Power Systems, Inc. and Nova Ltd.:

Monolithic Power Systems, Inc. Grades

The table below summarizes recent grades from reputable grading companies for Monolithic Power Systems, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2025-12-19 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| TD Cowen | Maintain | Buy | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

| Rosenblatt | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-23 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-20 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Wolfe Research | Upgrade | Outperform | 2025-10-14 |

| Citigroup | Maintain | Buy | 2025-10-03 |

Grades for Monolithic Power Systems, Inc. predominantly indicate buy or overweight ratings, with a recent upgrade to outperform, showing a generally positive consensus.

Nova Ltd. Grades

The table below summarizes recent grades from reputable grading companies for Nova Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2026-01-13 |

| Jefferies | Maintain | Buy | 2025-12-15 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-07 |

| Benchmark | Maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-06-24 |

| B of A Securities | Maintain | Buy | 2025-06-24 |

| Benchmark | Maintain | Buy | 2025-05-09 |

| Citigroup | Maintain | Buy | 2025-05-09 |

| B of A Securities | Maintain | Buy | 2025-04-16 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-03-14 |

Nova Ltd. receives mostly buy and overweight ratings, with some outperform grades, reflecting consistent positive analyst sentiment.

Which company has the best grades?

Both Monolithic Power Systems, Inc. and Nova Ltd. have strong buy-side support, but Monolithic Power Systems shows a higher volume of recent buy and overweight ratings including an upgrade to outperform. This may suggest a slightly stronger analyst confidence, which can influence investor sentiment and portfolio positioning.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of Monolithic Power Systems, Inc. (MPWR) and Nova Ltd. (NVMI) based on the most recent financial and operational data.

| Criterion | Monolithic Power Systems, Inc. (MPWR) | Nova Ltd. (NVMI) |

|---|---|---|

| Diversification | Strong product diversification with leading DC to DC products and lighting control segments generating $1.72B and $102M respectively (2023). | Limited product range, mainly focused on a single product line with $538M revenue (2024). |

| Profitability | Very favorable profitability metrics: net margin 80.95%, ROE 56.8%, ROIC 16.22%. | Favorable profitability: net margin 27.33%, ROE 19.81%, ROIC 13.39%. |

| Innovation | Demonstrates durable competitive advantage with growing ROIC and very favorable moat status. | Improving profitability with a growing ROIC trend but still shedding value overall; moat status slightly favorable. |

| Global presence | Established global footprint supported by large and expanding markets in power management technology. | Smaller global presence, more niche market focus, slower revenue growth but improving. |

| Market Share | Strong market position in power electronics with sustained high returns on capital. | Smaller market share with potential for growth; valuation metrics less favorable (PE 31.2, PB 6.18). |

Key takeaways: MPWR stands out with robust diversification, exceptional profitability, and a durable competitive moat, making it a strong value creator. NVMI shows promising growth in profitability but remains less diversified with a weaker competitive position, requiring cautious monitoring.

Risk Analysis

Below is a comparative table outlining the key risks associated with Monolithic Power Systems, Inc. (MPWR) and Nova Ltd. (NVMI) for the year 2026:

| Metric | Monolithic Power Systems, Inc. (MPWR) | Nova Ltd. (NVMI) |

|---|---|---|

| Market Risk | Beta 1.46 indicates moderate volatility | Beta 1.83 reflects higher volatility risk |

| Debt Level | Very low debt-to-equity at 0.01, minimal financial risk | Moderate debt-to-equity at 0.25, manageable but higher leverage |

| Regulatory Risk | US-based with standard tech regulations | Israeli company subject to complex international trade regulations |

| Operational Risk | Diverse product portfolio reduces single-point failure risk | Specialized in process control, more niche exposure |

| Environmental Risk | Moderate, semiconductor production impact | Moderate, with emphasis on process control technology |

| Geopolitical Risk | Exposure to global markets including Asia and Europe | Higher geopolitical risk due to Middle East location and global supply chain |

Synthesis: NVMI faces higher market volatility and geopolitical risks, partly due to its regional base and international trade exposure. MPWR benefits from very low debt and a strong, diversified product base, lowering its financial and operational risks. Investors should weigh NVMI’s higher leverage and geopolitical factors against MPWR’s stable financial profile.

Which Stock to Choose?

Monolithic Power Systems, Inc. (MPWR) shows strong income growth with a 161% revenue increase over five years and highly favorable profitability metrics, including an 80.95% net margin and 56.8% ROE. Its financial ratios indicate low debt levels and excellent returns, supported by a very favorable rating of A- and a very favorable economic moat.

Nova Ltd. (NVMI) exhibits robust revenue growth of 149.59% over five years with solid profitability, including a 27.33% net margin and 19.81% ROE. Financial ratios are generally favorable but with higher debt and some valuation concerns, reflected in a B- rating and a slightly favorable moat indicating improving but still limited competitive advantage.

For investors prioritizing durable competitive advantages and high returns on equity, MPWR might appear more favorable due to its very favorable rating and strong income and ratio profiles. Conversely, those inclined toward companies with accelerating growth trends and improving profitability could view NVMI as attractive, given its strong recent price momentum and favorable income growth, despite a higher debt profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Monolithic Power Systems, Inc. and Nova Ltd. to enhance your investment decisions: