In the fast-evolving semiconductor industry, Monolithic Power Systems, Inc. (MPWR) and indie Semiconductor, Inc. (INDI) stand out as innovators with distinct market focuses. MPWR excels in power electronics for diverse sectors, while INDI targets automotive semiconductors and advanced driver assistance technologies. Both companies compete in cutting-edge technology and growth potential. This article will help you decide which company offers the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between Monolithic Power Systems and indie Semiconductor by providing an overview of these two companies and their main differences.

Monolithic Power Systems Overview

Monolithic Power Systems, Inc. specializes in semiconductor-based power electronics solutions for computing, automotive, industrial, communications, and consumer markets. Founded in 1997 and headquartered in Kirkland, WA, it designs DC-to-DC integrated circuits that regulate voltages in various electronic devices. The company markets its products globally through distributors and direct sales to OEMs and manufacturers.

indie Semiconductor Overview

indie Semiconductor, Inc. focuses on automotive semiconductors and software for driver assistance, connected cars, and electrification applications. Established in 2007 and based in Aliso Viejo, CA, indie develops devices used in parking assistance, wireless charging, infotainment, and telematics. The company also offers photonic components for laser systems and optical communication markets, serving automotive and technology sectors.

Key similarities and differences

Both companies operate in the semiconductor industry and serve technology-driven markets, but Monolithic Power Systems targets a broader range of sectors including industrial and consumer electronics, while indie Semiconductor concentrates on automotive and photonics applications. Monolithic Power Systems is significantly larger with a market cap near $48.4B and over 4,000 employees, whereas indie Semiconductor’s market cap is about $857M with fewer than 1,000 employees, reflecting their different scales and market focuses.

Income Statement Comparison

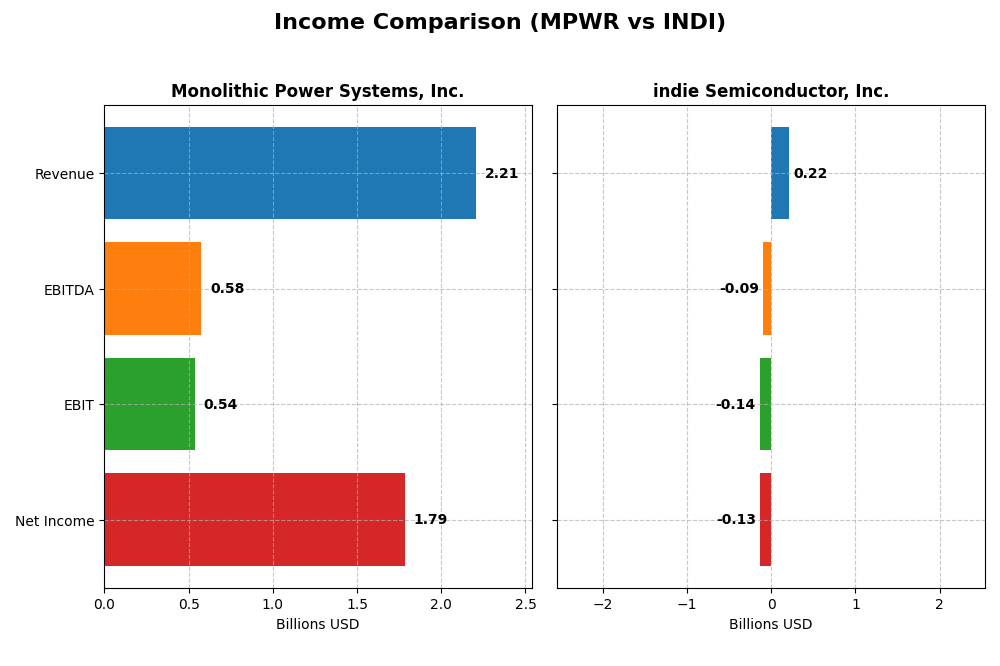

This table presents a side-by-side comparison of the most recent fiscal year income statement metrics for Monolithic Power Systems, Inc. and indie Semiconductor, Inc.

| Metric | Monolithic Power Systems, Inc. (MPWR) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Cap | 48.4B | 857M |

| Revenue | 2.21B | 217M |

| EBITDA | 576M | -94M |

| EBIT | 539M | -137M |

| Net Income | 1.79B | -133M |

| EPS | 36.76 | -0.76 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Monolithic Power Systems, Inc.

Monolithic Power Systems exhibited strong growth from 2020 to 2024, with revenue increasing 161% and net income surging nearly 987%. Margins remained robust, with a gross margin above 55% and net margin climbing to over 80% in 2024. The latest year showed a 21.2% revenue rise and significant net margin improvement, indicating accelerating profitability despite rising operating expenses.

indie Semiconductor, Inc.

indie Semiconductor displayed rapid revenue growth of 858% over the period but struggled with consistent profitability, posting negative net income and EBIT margins most years. In 2024, revenue slightly declined by 2.9%, while gross profit grew over 260%, yet net margin remained deeply negative near -61%. Operating losses expanded, reflecting ongoing challenges in cost management and scaling.

Which one has the stronger fundamentals?

Monolithic Power Systems presents stronger fundamentals, marked by sustained revenue and profit growth, favorable margin trends, and positive net income trajectory. Conversely, indie Semiconductor’s financials reveal volatile revenue with persistent losses and unfavorable EBIT and net margins. The overall income statement evaluation favors Monolithic Power Systems, highlighting its more stable and profitable business model.

Financial Ratios Comparison

The table below compares key financial ratios for Monolithic Power Systems, Inc. (MPWR) and indie Semiconductor, Inc. (INDI) based on their most recent fiscal year data ending 2024.

| Ratios | Monolithic Power Systems, Inc. (MPWR) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| ROE | 56.80% | -31.73% |

| ROIC | 16.22% | -19.25% |

| P/E | 16.09 | -5.35 |

| P/B | 9.14 | 1.70 |

| Current Ratio | 5.31 | 4.82 |

| Quick Ratio | 3.89 | 4.23 |

| D/E (Debt-to-Equity) | 0.005 | 0.95 |

| Debt-to-Assets | 0.44% | 42.34% |

| Interest Coverage | 0 (not meaningful) | -18.37 (negative) |

| Asset Turnover | 0.61 | 0.23 |

| Fixed Asset Turnover | 4.17 | 4.30 |

| Payout ratio | 13.47% | 0% |

| Dividend yield | 0.84% | 0% |

Interpretation of the Ratios

Monolithic Power Systems, Inc.

Monolithic Power Systems shows a generally favorable ratio profile with strong net margin at 80.95% and an impressive return on equity of 56.8%. However, some concerns arise from its high price-to-book ratio of 9.14 and current ratio of 5.31, which are considered unfavorable. The company pays dividends with a modest yield of 0.84%, supported by free cash flow coverage, though the yield remains low compared to industry peers.

indie Semiconductor, Inc.

indie Semiconductor displays predominantly unfavorable financial ratios, including a negative net margin of -61.2% and return on equity of -31.73%, reflecting operational challenges. Its price-to-earnings ratio is negative, indicating losses, and the company does not pay dividends, likely due to ongoing reinvestment in research and development, which accounts for a high 80.8% of revenue, and a focus on growth. The quick ratio is favorable at 4.23, suggesting good short-term liquidity.

Which one has the best ratios?

Monolithic Power Systems presents a stronger overall financial position with majority favorable ratios and positive returns, despite some valuation and liquidity concerns. In contrast, indie Semiconductor’s ratios reflect significant operational losses and weaker profitability metrics, contributing to an unfavorable ratio assessment. The difference highlights Monolithic Power Systems’ relative financial strength compared to indie Semiconductor.

Strategic Positioning

This section compares the strategic positioning of Monolithic Power Systems (MPWR) and indie Semiconductor (INDI) regarding market position, key segments, and exposure to technological disruption:

Monolithic Power Systems, Inc.

- Established leader with $48.4B market cap, moderate competitive pressure in semiconductors

- Focuses on DC to DC power ICs and lighting control products across multiple markets

- Operates in established power electronics, less exposed to rapid technological shifts

indie Semiconductor, Inc.

- Smaller player with $857M market cap, facing high competitive pressure and volatility

- Concentrates on automotive semiconductors and software for ADAS and connected car applications

- Faces disruption risks from photonic components and evolving automotive semiconductor technologies

Monolithic Power Systems vs indie Semiconductor Positioning

MPWR’s diversified portfolio across various electronics markets contrasts with INDI’s concentrated focus on automotive semiconductors. MPWR benefits from scale and market breadth, while INDI faces higher risk due to narrower exposure and smaller size.

Which has the best competitive advantage?

MPWR demonstrates a very favorable moat with growing ROIC exceeding WACC, indicating durable competitive advantage. INDI shows a very unfavorable moat with declining ROIC, reflecting value destruction and weaker competitive positioning.

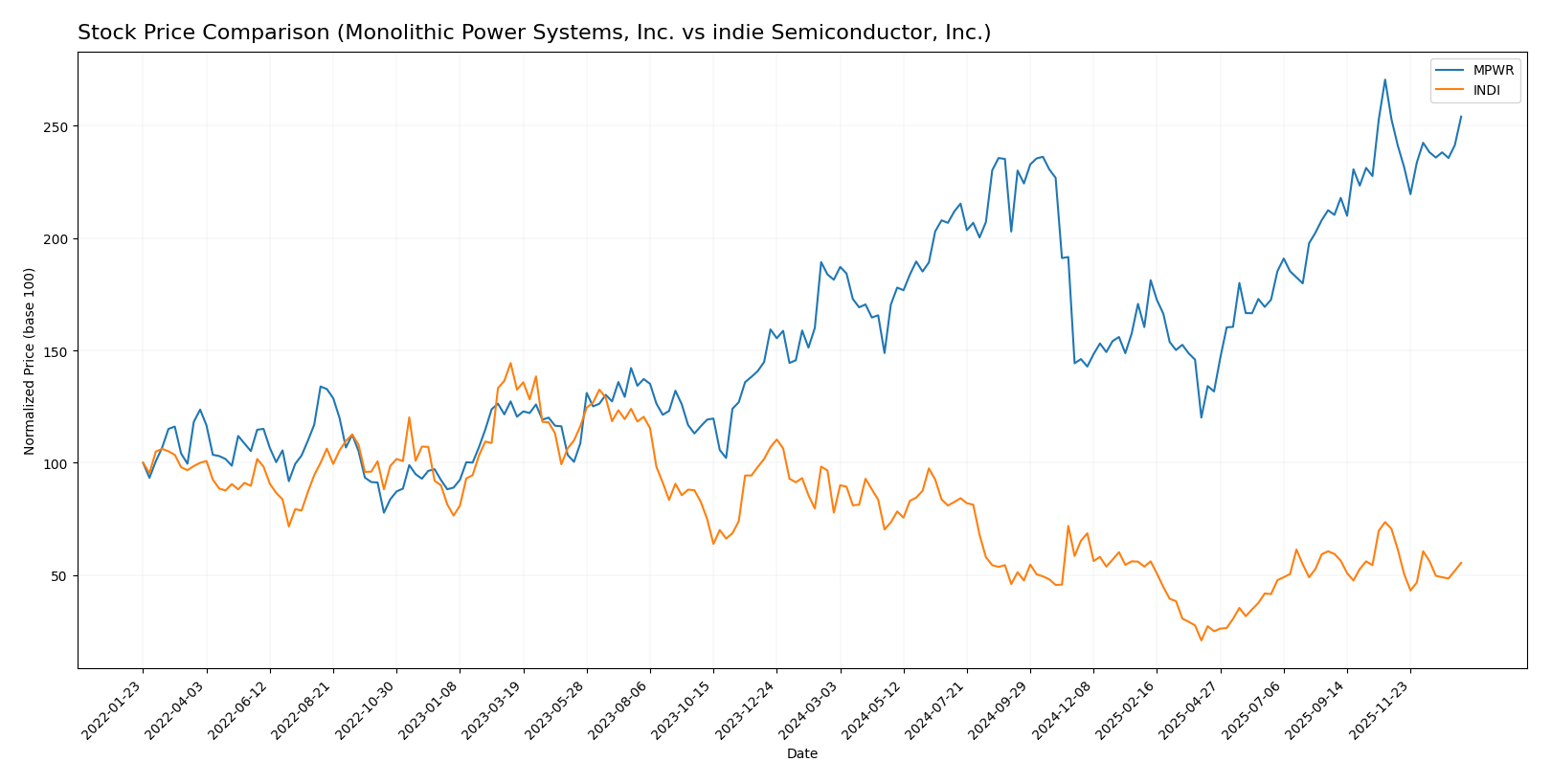

Stock Comparison

The past year has seen Monolithic Power Systems, Inc. (MPWR) exhibit a strong upward momentum with accelerating bullish trends, while indie Semiconductor, Inc. (INDI) experienced a marked bearish decline and deceleration in stock price.

Trend Analysis

Monolithic Power Systems, Inc. (MPWR) showed a significant 39.99% price increase over the past 12 months, indicating a bullish trend with acceleration. The stock reached a high of 1074.91 and a low of 477.39, with notable volatility (std deviation 135.81).

indie Semiconductor, Inc. (INDI) declined by 28.67% over the same period, reflecting a bearish trend with deceleration. The price fluctuated between 1.6 and 7.43, with low volatility (std deviation 1.35).

Comparing both, MPWR outperformed INDI significantly, delivering the highest market return over the past year according to the provided data.

Target Prices

The current consensus target prices from verified analysts indicate promising upside potential for both companies.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Monolithic Power Systems, Inc. | 1375 | 1025 | 1187.5 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

Monolithic Power Systems’ consensus target of 1187.5 suggests a potential upside from its current price of 1009.54, reflecting positive analyst sentiment. indie Semiconductor’s target price at 8 is almost double its current 4.23, indicating bullish expectations despite its higher volatility.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Monolithic Power Systems, Inc. (MPWR) and indie Semiconductor, Inc. (INDI):

Rating Comparison

MPWR Rating

- Rating: A-, indicating a very favorable overall assessment.

- Discounted Cash Flow Score: 3, a moderate valuation based on future cash flows.

- ROE Score: 5, very favorable efficiency in generating profit from equity.

- ROA Score: 5, very favorable asset utilization to generate earnings.

- Debt To Equity Score: 5, very favorable strong balance sheet with low risk.

- Overall Score: 4, considered favorable financial standing.

INDI Rating

- Rating: C-, reflecting a very unfavorable overall assessment.

- Discounted Cash Flow Score: 1, very unfavorable valuation based on future cash flows.

- ROE Score: 1, very unfavorable efficiency in generating profit from equity.

- ROA Score: 1, very unfavorable asset utilization to generate earnings.

- Debt To Equity Score: 1, very unfavorable financial risk with high debt.

- Overall Score: 1, considered very unfavorable financial standing.

Which one is the best rated?

Based strictly on the provided data, MPWR is clearly better rated, with very favorable scores in profitability and financial stability, whereas INDI shows very unfavorable scores across all key metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

MPWR Scores

- Altman Z-Score: 46.83, indicating a safe zone, very low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

INDI Scores

- Altman Z-Score: 0.12, indicating distress zone, high bankruptcy risk.

- Piotroski Score: 2, reflecting very weak financial strength.

Which company has the best scores?

Based strictly on the provided data, MPWR has significantly better Altman Z-Score and a higher Piotroski Score than INDI, indicating stronger financial health and lower bankruptcy risk.

Grades Comparison

The grades assigned to Monolithic Power Systems, Inc. and indie Semiconductor, Inc. by various reliable grading companies are as follows:

Monolithic Power Systems, Inc. Grades

The recent grades from recognized firms for Monolithic Power Systems, Inc. are summarized in the table below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2025-12-19 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| TD Cowen | Maintain | Buy | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-31 |

| Rosenblatt | Maintain | Neutral | 2025-10-31 |

| Keybanc | Maintain | Overweight | 2025-10-23 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-20 |

| Stifel | Maintain | Buy | 2025-10-17 |

| Wolfe Research | Upgrade | Outperform | 2025-10-14 |

| Citigroup | Maintain | Buy | 2025-10-03 |

Overall, Monolithic Power Systems maintains a predominantly positive grade trend with multiple “Buy” and “Overweight” ratings and one recent upgrade to “Outperform.”

indie Semiconductor, Inc. Grades

The recent grades from recognized firms for indie Semiconductor, Inc. are summarized in the table below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

indie Semiconductor shows a strong consensus of “Buy” ratings with consistent maintenance of positive outlooks, alongside a neutral rating from UBS.

Which company has the best grades?

Monolithic Power Systems, Inc. has received a larger volume of recent “Buy” and “Overweight” grades, including an upgrade to “Outperform,” indicating a slightly stronger positive sentiment compared to indie Semiconductor, Inc., which holds mostly “Buy” and “Overweight” ratings but also includes a “Neutral” grade. This difference in grading trends may influence investors’ perception of relative strength and potential risk in each stock.

Strengths and Weaknesses

Below is a comparison of Monolithic Power Systems, Inc. (MPWR) and indie Semiconductor, Inc. (INDI) based on key financial and strategic criteria.

| Criterion | Monolithic Power Systems, Inc. (MPWR) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Diversification | Strong focus on DC to DC and lighting control products, showing consistent growth and product depth | Limited product range with main revenue from products and some services; less diversified |

| Profitability | High net margin (80.95%) and ROIC (16.22%), creating value with growing profitability | Negative net margin (-61.2%) and ROIC (-19.25%), indicating value destruction and losses |

| Innovation | Demonstrates durable competitive advantage with increasing ROIC trend and product innovation | Declining ROIC trend and profitability, signaling challenges in innovation and market positioning |

| Global presence | Well-established global footprint with solid market share in power management solutions | Smaller scale with less global penetration and lower market share |

| Market Share | Leading position in power management ICs with strong customer base and revenue growth | Modest market share with fluctuating and lower revenue compared to MPWR |

Key takeaways: MPWR stands out with robust profitability, diversification, and a durable competitive moat, making it a more stable and value-creating investment. INDI faces significant challenges with declining profitability and value destruction, warranting caution for investors.

Risk Analysis

Below is a comparative table of key risk factors for Monolithic Power Systems, Inc. (MPWR) and indie Semiconductor, Inc. (INDI) based on the most recent 2024 data.

| Metric | Monolithic Power Systems, Inc. (MPWR) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Market Risk | Beta 1.46, moderate volatility | Beta 2.54, high volatility |

| Debt level | Very low debt-to-equity 0.01 | High debt-to-equity 0.95 |

| Regulatory Risk | Moderate, semiconductor industry | Elevated, automotive semiconductor focus |

| Operational Risk | Low, strong operational efficiency | Higher, weak profitability and ROIC |

| Environmental Risk | Standard industry compliance | Moderate, automotive sector scrutiny |

| Geopolitical Risk | Exposure to international markets | Exposure to international markets |

MPWR shows strong financial health with minimal debt and stable operations, making market volatility the main risk. INDI faces significant risks from high leverage, operational losses, and market volatility, increasing its bankruptcy probability as reflected by its distress Altman Z-score and weak Piotroski score.

Which Stock to Choose?

Monolithic Power Systems, Inc. (MPWR) shows strong income growth with a 161% revenue increase since 2020 and a highly favorable net margin of 80.95%. Its financial ratios are largely positive, including a 56.8% ROE and low debt levels, supported by a very favorable A- rating and a durable competitive moat.

Indie Semiconductor, Inc. (INDI) presents mixed income results with a 2.56% EPS growth overall but a negative net margin of -61.2% and declining revenue last year. Its financial ratios are mostly unfavorable, including a -31.7% ROE and weak debt coverage, reflected in a low C- rating and a very unfavorable moat assessment.

For investors focused on growth and financial strength, MPWR might appear more favorable given its robust profitability and strong rating. Conversely, those willing to accept higher risk for potential turnaround opportunities could consider INDI’s situation as an analytical case, despite its current challenges and weak rating.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Monolithic Power Systems, Inc. and indie Semiconductor, Inc. to enhance your investment decisions: