In today’s fast-evolving tech landscape, MongoDB, Inc. and VeriSign, Inc. stand out as leaders in software infrastructure, each driving innovation in essential digital services. MongoDB excels with its versatile database platforms, while VeriSign secures and manages critical internet domain infrastructure. Their overlapping roles in supporting the digital ecosystem make them compelling subjects for comparison. Join me as we explore which company offers the best investment potential for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between MongoDB and VeriSign by providing an overview of these two companies and their main differences.

MongoDB Overview

MongoDB, Inc. offers a general-purpose database platform with products including MongoDB Enterprise Advanced for enterprise clients, MongoDB Atlas as a multi-cloud database service, and a free Community Server for developers. Founded in 2007 and headquartered in New York City, it operates in the software infrastructure sector, focusing on flexible database solutions across cloud, on-premise, and hybrid environments.

VeriSign Overview

VeriSign, Inc. specializes in domain name registry services and internet infrastructure supporting global internet navigation. It manages critical domain name systems, including .com and .net, and operates internet root servers to ensure security and stability. Incorporated in 1995 and based in Reston, Virginia, VeriSign serves as a backbone provider for domain registration and internet resiliency within the software infrastructure industry.

Key similarities and differences

Both companies operate within the software infrastructure sector but focus on distinct aspects of technology. MongoDB emphasizes database management solutions catering to developers and enterprises with cloud and on-premise options. In contrast, VeriSign concentrates on internet infrastructure and domain registry services essential for internet security and stability. Their business models differ in product scope, with MongoDB offering database platforms and VeriSign providing foundational internet services.

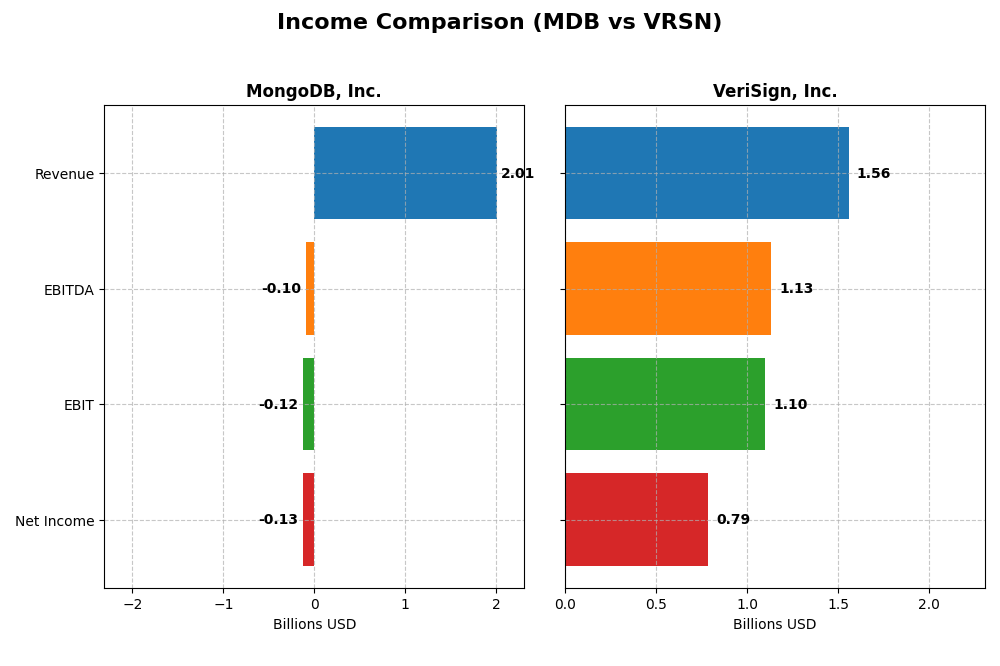

Income Statement Comparison

This table compares key income statement metrics for MongoDB, Inc. and VeriSign, Inc. based on their most recent fiscal year data.

| Metric | MongoDB, Inc. (MDB) | VeriSign, Inc. (VRSN) |

|---|---|---|

| Market Cap | 32.5B | 23.1B |

| Revenue | 2.01B | 1.56B |

| EBITDA | -97M | 1.13B |

| EBIT | -124M | 1.10B |

| Net Income | -129M | 786M |

| EPS | -1.73 | 8.01 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

MongoDB, Inc.

MongoDB’s revenue showed a strong upward trend from $590M in 2021 to $2.01B in 2025, with net losses narrowing from -$267M to -$129M. Gross margins remained favorable around 73%, but EBIT and net margins stayed negative, though improving in 2025. The latest fiscal year saw a 19.2% revenue growth and significant margin improvements, indicating operational progress.

VeriSign, Inc.

VeriSign exhibited steady revenue growth from $1.27B in 2020 to $1.56B in 2024, with net income fluctuating but remaining positive, ending at $786M. Margins were strong and stable, with gross margin above 87% and net margin at 50%. The most recent year showed moderate revenue growth of 4.3%, slight margin declines, and a small drop in net margin by 7.9%, signaling some pressure on profitability.

Which one has the stronger fundamentals?

VeriSign maintains stronger fundamentals with consistently high gross and net margins, positive net income, and solid EBIT margins, despite slower growth. MongoDB shows rapid revenue growth and improving margins but remains unprofitable. Overall, VeriSign’s profitability and margin stability contrast with MongoDB’s high growth yet ongoing losses, reflecting differing fundamental strengths and risks.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for MongoDB, Inc. and VeriSign, Inc. based on their most recent fiscal year data.

| Ratios | MongoDB, Inc. (2025) | VeriSign, Inc. (2024) |

|---|---|---|

| ROE | -4.64% | -40.13% |

| ROIC | -7.36% | 4.51% |

| P/E | -157.88 | 25.84 |

| P/B | 7.32 | -10.37 |

| Current Ratio | 5.20 | 0.43 |

| Quick Ratio | 5.20 | 0.43 |

| D/E | 0.013 | -0.92 |

| Debt-to-Assets | 1.06% | 128.08% |

| Interest Coverage | -26.70 | 14.05 |

| Asset Turnover | 0.58 | 1.11 |

| Fixed Asset Turnover | 24.78 | 6.66 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

MongoDB, Inc.

MongoDB’s ratios reveal several weaknesses: negative net margin (-6.43%) and return on equity (-4.64%) indicate profitability challenges. The high current ratio (5.2) may suggest inefficient asset use. However, favorable debt-to-equity (0.01) and fixed asset turnover (24.78) ratios show low leverage and efficient asset use. MongoDB does not pay dividends, reflecting a reinvestment strategy focused on growth and R&D.

VeriSign, Inc.

VeriSign exhibits strong profitability with a net margin of 50.45% and robust return on invested capital (451%), though its negative return on equity (-40.13%) raises concerns. Favorable interest coverage (14.57) and asset turnover (1.11) support operational strength, but a low current ratio (0.43) suggests liquidity risk. VeriSign pays dividends, but the dividend yield is currently zero, indicating possible prioritization of other capital uses.

Which one has the best ratios?

VeriSign holds a more favorable overall ratio profile with 57.14% favorable metrics, strong profitability, and efficient asset use, despite some liquidity concerns. MongoDB shows a higher proportion of unfavorable ratios (57.14%), with profitability and coverage weaknesses. Thus, VeriSign’s ratios present a stronger financial position relative to MongoDB’s current metrics.

Strategic Positioning

This section compares the strategic positioning of MongoDB and VeriSign, focusing on Market position, Key segments, and exposure to technological disruption:

MongoDB, Inc.

- Positioned as a global database platform with high market cap and competitive pressure in cloud and enterprise sectors.

- Key segments include MongoDB Atlas multi-cloud database and other subscription services driving revenue growth.

- Faces disruption from evolving cloud database technologies but offers flexible deployment options (cloud, on-premise).

VeriSign, Inc.

- Dominates domain name registry services with strong market control over .com and .net domains.

- Focuses on domain registry, root zone maintenance, and internet infrastructure services.

- Exposure limited due to critical internet infrastructure role and stable domain registry business.

MongoDB, Inc. vs VeriSign, Inc. Positioning

MongoDB adopts a diversified approach with cloud database and subscription services, while VeriSign concentrates on domain registry and internet infrastructure. MongoDB targets enterprise digital transformation, whereas VeriSign benefits from stable, essential internet infrastructure services.

Which has the best competitive advantage?

VeriSign shows a very favorable moat with high ROIC above WACC and growing profitability, indicating a durable competitive advantage. MongoDB’s moat is slightly unfavorable, reflecting value destruction despite increasing ROIC trends.

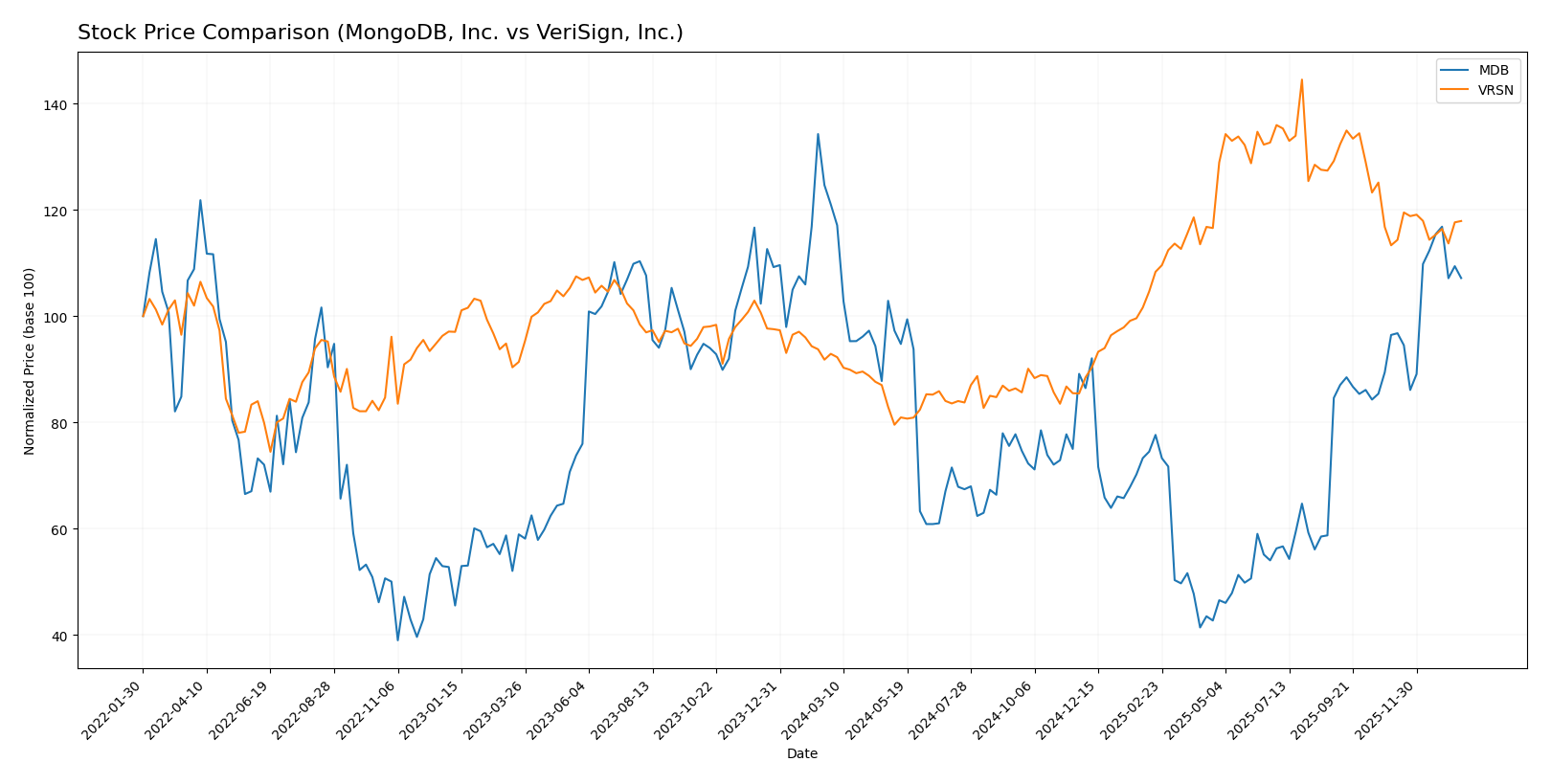

Stock Comparison

The stock price movements of MongoDB, Inc. and VeriSign, Inc. over the past 12 months reveal distinct trading dynamics, with MongoDB exhibiting a bearish trend with notable volatility and VeriSign showing steady bullish momentum albeit with deceleration.

Trend Analysis

MongoDB, Inc. experienced an overall bearish trend over the past 12 months, with a price decline of 11.46% and accelerating downward movement; the stock showed high volatility with a standard deviation of 72.49 and a recent rebound of 11.1%.

VeriSign, Inc. displayed a bullish trend over the same period, gaining 26.92% with decelerating momentum; volatility was moderate at 40.88 standard deviation, and recent gains were modest at 4.03%.

Comparing trends, VeriSign outperformed MongoDB in market performance over the past year, with a significantly higher overall price increase and more stable trading behavior.

Target Prices

Analysts show a generally optimistic outlook with well-defined target price ranges for MongoDB, Inc. and VeriSign, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MongoDB, Inc. | 500 | 375 | 445.2 |

| VeriSign, Inc. | 325 | 325 | 325 |

The consensus targets for MongoDB suggest a potential upside from its current price of 399.76 USD, while VeriSign’s fixed target of 325 USD also indicates room for appreciation above its current 249.47 USD price. Overall, analysts expect both stocks to appreciate moderately from present levels.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for MongoDB, Inc. and VeriSign, Inc.:

Rating Comparison

MDB Rating

- Rating: C, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: Moderate at 2 out of 5.

- ROE Score: Very Unfavorable at 1 out of 5.

- ROA Score: Very Unfavorable at 1 out of 5.

- Debt To Equity Score: Favorable at 4 out of 5.

- Overall Score: Moderate at 2 out of 5.

VRSN Rating

- Rating: B-, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: Favorable at 4 out of 5.

- ROE Score: Very Unfavorable at 1 out of 5.

- ROA Score: Very Favorable at 5 out of 5.

- Debt To Equity Score: Very Unfavorable at 1 out of 5.

- Overall Score: Moderate at 2 out of 5.

Which one is the best rated?

VeriSign holds a higher rating at B- compared to MongoDB’s C. VeriSign scores better in discounted cash flow and return on assets, while MongoDB has a stronger debt-to-equity score. Overall scores are equal at 2.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for MongoDB, Inc. and VeriSign, Inc.:

MDB Scores

- Altman Z-Score: 30.24, indicating a safe zone for bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

VRSN Scores

- Altman Z-Score: -4.67, indicating the company is in distress zone.

- Piotroski Score: 8, reflecting very strong financial strength.

Which company has the best scores?

Based strictly on the data, MongoDB has a much stronger Altman Z-Score, signaling safety from bankruptcy, while VeriSign exhibits a superior Piotroski Score, indicating robust financial health. Each company excels in a different score category.

Grades Comparison

Here is a detailed comparison of the latest available grades for MongoDB, Inc. and VeriSign, Inc.:

MongoDB, Inc. Grades

The following table shows recent grades assigned to MongoDB, Inc. by leading grading firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

The grades for MongoDB consistently show positive ratings, primarily “Buy,” “Overweight,” and “Outperform,” indicating broad analyst confidence.

VeriSign, Inc. Grades

The table below presents recent grades for VeriSign, Inc. from recognized grading institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2026-01-06 |

| Baird | Maintain | Outperform | 2025-07-01 |

| Baird | Maintain | Outperform | 2025-04-25 |

| Baird | Maintain | Outperform | 2025-04-01 |

| Citigroup | Maintain | Buy | 2025-02-04 |

| Citigroup | Maintain | Buy | 2025-01-03 |

| Baird | Upgrade | Outperform | 2024-12-09 |

| Baird | Maintain | Neutral | 2024-06-27 |

| Baird | Maintain | Neutral | 2024-04-26 |

| Citigroup | Maintain | Buy | 2024-04-02 |

VeriSign’s ratings are more mixed, ranging from “Neutral” to “Outperform” and “Buy,” reflecting a varied analyst perspective.

Which company has the best grades?

MongoDB, Inc. has received more consistently positive grades, primarily “Buy” and “Overweight,” compared to VeriSign, Inc., which shows a broader range including several “Neutral” ratings. This consistency suggests stronger analyst conviction for MongoDB, potentially affecting investor confidence and portfolio decisions accordingly.

Strengths and Weaknesses

Below is a comparative overview of the main strengths and weaknesses of MongoDB, Inc. (MDB) and VeriSign, Inc. (VRSN) based on their latest financial and strategic data:

| Criterion | MongoDB, Inc. (MDB) | VeriSign, Inc. (VRSN) |

|---|---|---|

| Diversification | Moderate: Revenue mostly from MongoDB Atlas and subscriptions | Limited: Focused on domain name services and internet infrastructure |

| Profitability | Weak: Negative net margin (-6.43%), negative ROE (-4.64%) | Strong: High net margin (50.45%), very favorable ROIC (451%) |

| Innovation | Growing ROIC trend indicates improving profitability and innovation | Very favorable moat with durable competitive advantage |

| Global presence | Expanding with increasing Atlas revenue globally | Well-established global presence in DNS services |

| Market Share | Growing in database services market, but shedding value overall | Leading market share in domain registry with strong value creation |

Key takeaways: VeriSign demonstrates a very favorable competitive moat with strong profitability and efficient capital use, making it a solid value creator. MongoDB shows promising growth in profitability but currently sheds value, reflecting higher risk despite innovation and revenue expansion. Investors should weigh growth potential against current financial challenges.

Risk Analysis

Below is a comparative risk table for MongoDB, Inc. (MDB) and VeriSign, Inc. (VRSN) based on the most recent data from 2025 and 2024.

| Metric | MongoDB, Inc. (MDB) | VeriSign, Inc. (VRSN) |

|---|---|---|

| Market Risk | High beta (1.38), volatile price range (140.78-444.72) | Lower beta (0.77), more stable price range (205.37-310.6) |

| Debt Level | Very low debt-to-equity (0.01), low debt-to-assets (1.06%) | Very high debt-to-assets (128.08%), negative debt-to-equity ratio |

| Regulatory Risk | Moderate, typical for cloud database providers | Moderate, linked to internet infrastructure and domain registry |

| Operational Risk | Moderate; large workforce (5558) with negative net margin (-6.43%) | Lower operational risk; smaller workforce (929), strong net margin (50.45%) |

| Environmental Risk | Low, primarily software services | Low, infrastructure services with limited environmental impact |

| Geopolitical Risk | Moderate, US-based with global cloud operations | Moderate, US-based with global internet services exposure |

MongoDB faces the most impactful risks from market volatility and operational losses, while VeriSign’s primary concerns are high leverage and regulatory dependencies. VeriSign’s distress-level Altman Z-score signals financial instability despite strong profitability. Cautious risk management is advised for both.

Which Stock to Choose?

MongoDB, Inc. (MDB) shows strong revenue growth of 239.86% over five years, with improving profitability despite a negative net margin of -6.43%. Financial ratios reveal mostly unfavorable metrics, including negative returns on equity and capital, but low debt levels and a very favorable rating “C” suggest some financial stability. MDB’s economic moat is slightly unfavorable, indicating value destruction but with a growing ROIC trend.

VeriSign, Inc. (VRSN) maintains high profitability with a 50.45% net margin and favorable income statement metrics. Its financial ratios are more balanced, with 57.14% favorable indicators, including strong returns on assets and invested capital, though the debt-to-assets ratio is high. VRSN’s rating is very favorable “B-,” and it demonstrates a very favorable economic moat with increasing profitability, despite some concerns on return on equity.

For investors prioritizing growth potential, MDB’s robust revenue and improving profitability might appear attractive despite current financial challenges. Conversely, VRSN could be more suitable for those valuing stable profitability and a durable competitive advantage, given its strong income metrics and very favorable moat. Each stock may appeal differently depending on risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MongoDB, Inc. and VeriSign, Inc. to enhance your investment decisions: