MongoDB, Inc. and UiPath Inc. are two influential players in the software infrastructure industry, each driving innovation in database management and robotic process automation, respectively. Both companies cater to enterprise clients with cutting-edge technology solutions that enhance operational efficiency. Given their overlapping focus on enabling digital transformation, comparing their market positions and growth prospects offers valuable insight. In this article, I will help you decide which company presents a more compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between MongoDB and UiPath by providing an overview of these two companies and their main differences.

MongoDB Overview

MongoDB, Inc. provides a general-purpose database platform worldwide, offering solutions such as MongoDB Enterprise Advanced for enterprise customers, MongoDB Atlas as a hosted multi-cloud database service, and a free Community Server version for developers. Founded in 2007 and headquartered in New York City, MongoDB focuses on flexible data management for cloud, on-premise, and hybrid environments, positioning itself as a key player in software infrastructure.

UiPath Overview

UiPath Inc. delivers an end-to-end robotic process automation (RPA) platform, combining AI with automation tools to help organizations build, manage, and deploy software robots. Founded in 2005 and also based in New York City, UiPath primarily serves banking, healthcare, financial services, and government sectors with its automation solutions and professional services, aiming to streamline and optimize business processes through advanced technology.

Key similarities and differences

Both MongoDB and UiPath operate in the software infrastructure industry and are headquartered in New York City, focusing on technology-driven enterprise solutions. MongoDB specializes in database management systems, while UiPath centers on automation platforms integrating AI for process optimization. Their business models differ in product focus—data storage versus robotic automation—but both offer professional services to support adoption and customer success.

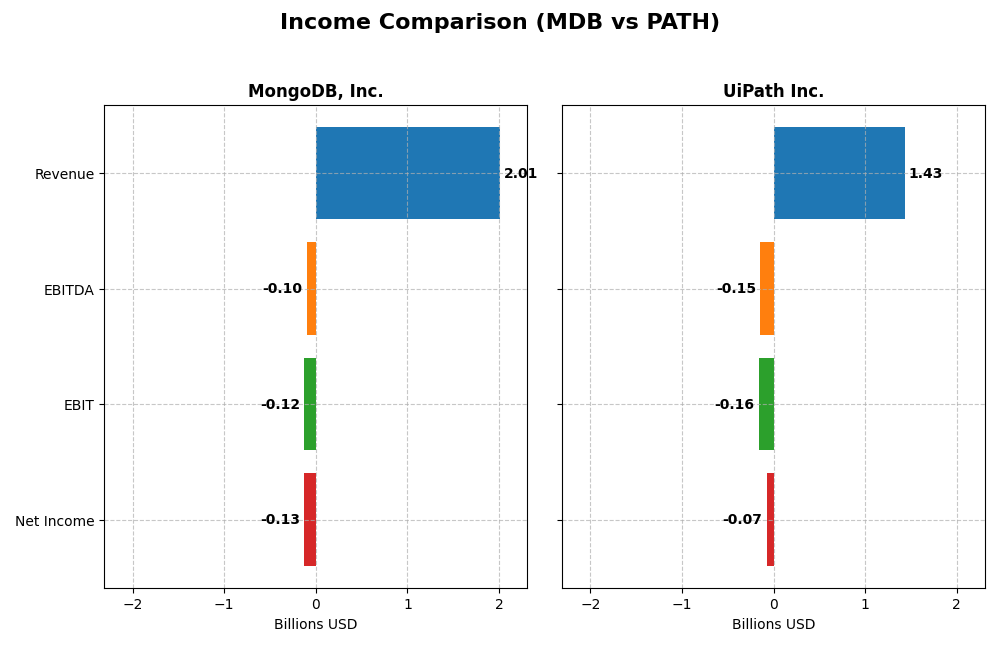

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for MongoDB, Inc. and UiPath Inc. for the fiscal year 2025, enabling a clear view of their financial performance.

| Metric | MongoDB, Inc. (MDB) | UiPath Inc. (PATH) |

|---|---|---|

| Market Cap | 32.5B | 7.7B |

| Revenue | 2.01B | 1.43B |

| EBITDA | -97M | -145M |

| EBIT | -124M | -163M |

| Net Income | -129M | -74M |

| EPS | -1.73 | -0.13 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

MongoDB, Inc.

MongoDB has demonstrated strong revenue growth, increasing from $590M in 2021 to $2B in 2025, with a favorable gross margin around 73%. Despite consistent operating losses, the net margin improved significantly, narrowing to -6.43% in 2025. The latest fiscal year showed a 19.2% revenue increase and a 38.7% improvement in net margin, indicating solid operational progress.

UiPath Inc.

UiPath’s revenue rose steadily from $608M in 2021 to $1.43B in 2025, with gross margins maintained favorably at 82.7%. Operating margins remain negative at -11.4%, though net margins improved to -5.15%. The 2025 fiscal year saw a 9.3% revenue growth and a 25.0% increase in net margin, reflecting moderate but consistent financial improvements amid continuing losses.

Which one has the stronger fundamentals?

MongoDB exhibits higher revenue growth (240% vs. 135%) and more significant net income and margin improvements over the period, supported by solid gross margins. UiPath maintains better gross margins but shows slower growth and a persistent wider EBIT loss. Overall, MongoDB’s income statement shows stronger positive trends despite ongoing losses, while UiPath’s fundamentals reflect steadier but more modest progress.

Financial Ratios Comparison

This table presents the latest available financial ratios for MongoDB, Inc. and UiPath Inc., reflecting their fiscal year 2025 performance.

| Ratios | MongoDB, Inc. (MDB) | UiPath Inc. (PATH) |

|---|---|---|

| ROE | -4.64% | -3.99% |

| ROIC | -7.36% | -7.41% |

| P/E | -157.88 | -108.04 |

| P/B | 7.32 | 4.31 |

| Current Ratio | 5.20 | 2.93 |

| Quick Ratio | 5.20 | 2.93 |

| D/E (Debt-to-Equity) | 0.01 | 0.04 |

| Debt-to-Assets | 1.06% | 2.72% |

| Interest Coverage | -26.70 | 0 |

| Asset Turnover | 0.58 | 0.50 |

| Fixed Asset Turnover | 24.78 | 14.41 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

MongoDB, Inc.

MongoDB’s financial ratios show a predominance of unfavorable metrics, with weak profitability indicated by negative net margin (-6.43%) and return on equity (-4.64%). The company’s valuation metrics are mixed, featuring a favorable price-earnings ratio but an unfavorable price-to-book ratio of 7.32. MongoDB does not pay dividends, reflecting a reinvestment strategy during its growth phase without share buybacks.

UiPath Inc.

UiPath exhibits a slightly more balanced ratio profile, with 42.86% favorable metrics, including a solid current ratio of 2.93 and low debt ratios. However, profitability remains negative, with net margin at -5.15% and return on equity at -3.99%. Like MongoDB, UiPath does not distribute dividends, likely prioritizing growth investments and R&D without engaging in share repurchases.

Which one has the best ratios?

Comparing the two, UiPath holds a marginal advantage with a higher proportion of favorable ratios and better liquidity indicators. MongoDB’s ratios signal more significant challenges in profitability and valuation despite some favorable leverage metrics. Both companies show negative returns and no dividend payouts, indicating growth-focused strategies with inherent risks.

Strategic Positioning

This section compares the strategic positioning of MongoDB, Inc. and UiPath Inc., including market position, key segments, and exposure to technological disruption:

MongoDB, Inc.

- Larger market cap of 32.5B, faces competitive pressure in software infrastructure.

- Focused on database platforms with MongoDB Atlas cloud service and subscription products.

- Moderate exposure to disruption with cloud and hybrid database offerings.

UiPath Inc.

- Smaller market cap of 7.7B, competes in automation software market.

- Offers robotic process automation platform with AI integration and subscription services.

- High exposure to AI-driven automation innovations and evolving enterprise needs.

MongoDB, Inc. vs UiPath Inc. Positioning

MongoDB has a concentrated focus on database platforms, relying heavily on its cloud service MongoDB Atlas, while UiPath operates a more diversified automation software suite combining AI, RPA, and low-code tools. MongoDB’s advantage lies in database infrastructure, UiPath in automation breadth.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC, but each shows a growing ROIC trend. Their economic moats are slightly unfavorable, indicating challenges in sustaining long-term competitive advantages despite improving profitability.

Stock Comparison

The stock prices of MongoDB, Inc. (MDB) and UiPath Inc. (PATH) have exhibited notable bearish trends over the past 12 months, with MongoDB showing signs of recent recovery and UiPath continuing a downward trajectory.

Trend Analysis

MongoDB, Inc. experienced an 11.46% price decline over the past year, marking a bearish trend with accelerating momentum. The stock showed high volatility, ranging from $154.39 to $451.52, but recently rebounded 11.1% in the last two months.

UiPath Inc. recorded a 38.53% price drop over the same 12-month period, also bearish with acceleration. Its price fluctuated between $10.04 and $23.66, with a recent 9.58% decline indicating continued weakness and low volatility.

Comparing both, MongoDB delivered higher market performance with a smaller overall loss and a recent positive reversal, whereas UiPath endured a steeper decline and ongoing bearish pressure.

Target Prices

Analysts provide a clear consensus on target prices for MongoDB, Inc. and UiPath Inc., reflecting positive expectations for both stocks.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MongoDB, Inc. | 500 | 375 | 445.2 |

| UiPath Inc. | 19 | 14 | 16.6 |

The consensus target price for MongoDB at 445.2 is notably above its current price of 399.76, indicating room for growth. UiPath’s consensus target of 16.6 also suggests a moderate upside compared to its current price of 14.34.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for MongoDB, Inc. and UiPath Inc.:

Rating Comparison

MDB Rating

- Rating: C, considered Very Favorable overall.

- Discounted Cash Flow Score: 2, Moderate valuation.

- ROE Score: 1, Very Unfavorable profitability.

- ROA Score: 1, Very Unfavorable asset usage.

- Debt To Equity Score: 4, Favorable financial risk.

- Overall Score: 2, Moderate financial standing.

PATH Rating

- Rating: B+, considered Very Favorable overall.

- Discounted Cash Flow Score: 3, Moderate valuation.

- ROE Score: 4, Favorable profitability.

- ROA Score: 4, Favorable asset usage.

- Debt To Equity Score: 4, Favorable financial risk.

- Overall Score: 3, Moderate financial standing.

Which one is the best rated?

UiPath Inc. holds a higher rating (B+) and generally better scores on profitability and asset utilization than MongoDB, Inc., which has a C rating and lower profitability scores. Overall, PATH is better rated based on the data provided.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for MongoDB, Inc. and UiPath Inc.:

MDB Scores

- Altman Z-Score: 30.2, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 4, classified as average financial strength.

PATH Scores

- Altman Z-Score: 5.3, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 7, classified as strong financial strength.

Which company has the best scores?

Based on the provided data, MDB has a much higher Altman Z-Score, indicating stronger bankruptcy safety, but PATH has a higher Piotroski Score, reflecting better overall financial strength. Each company excels in a different score metric.

Grades Comparison

The following is a comparison of the latest grades assigned to MongoDB, Inc. and UiPath Inc. by recognized financial institutions:

MongoDB, Inc. Grades

This table summarizes recent grades assigned to MongoDB, Inc. by reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| Needham | Maintain | Buy | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Piper Sandler | Maintain | Overweight | 2025-12-02 |

Overall, MongoDB, Inc. displays a strong consensus with mostly “Buy” and “Overweight” grades, indicating positive analyst sentiment.

UiPath Inc. Grades

This table summarizes recent grades assigned to UiPath Inc. by reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-01-12 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| RBC Capital | Maintain | Sector Perform | 2025-12-10 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-09 |

| DA Davidson | Maintain | Neutral | 2025-12-05 |

| Canaccord Genuity | Maintain | Buy | 2025-12-04 |

| Mizuho | Maintain | Neutral | 2025-12-04 |

| RBC Capital | Maintain | Sector Perform | 2025-12-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-04 |

| Evercore ISI Group | Maintain | In Line | 2025-12-04 |

UiPath Inc. shows a more mixed set of grades, with several “Equal Weight”, “Neutral”, and “Sector Perform” ratings alongside a single “Buy”.

Which company has the best grades?

MongoDB, Inc. has consistently received stronger grades with a dominant “Buy” and “Overweight” consensus, while UiPath Inc. ratings mostly indicate cautious or neutral stances. This divergence can influence investor confidence and portfolio positioning based on perceived growth potential and risk.

Strengths and Weaknesses

Below is a comparison table highlighting the key strengths and weaknesses of MongoDB, Inc. (MDB) and UiPath Inc. (PATH) based on the most recent financial and operational data.

| Criterion | MongoDB, Inc. (MDB) | UiPath Inc. (PATH) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from MongoDB Atlas (1.4B) with growing subscription and service segments | Moderate: Balanced between Subscription Services (802M) and License revenues (587M) |

| Profitability | Unfavorable: Negative net margin (-6.43%), ROIC -7.36% indicating value destruction | Unfavorable: Negative net margin (-5.15%), ROIC -7.41% also showing value destruction |

| Innovation | Strong: Rapid growth in cloud database platform (Atlas) revenue, ROIC trend +62.9% | Strong: Increasing ROIC trend +65.1%, expanding automation and AI software capabilities |

| Global presence | Established with significant cloud adoption globally, but less diversified geographically | Strong global footprint in automation with diverse client base worldwide |

| Market Share | Growing in cloud database market with fast Atlas revenue growth | Significant player in robotic process automation (RPA) market with growing subscription base |

Key takeaways: Both companies show strong innovation and growing profitability trends despite currently shedding value. MongoDB leads in cloud database services, while UiPath excels in automation software, each with moderate diversification and solid global presence. Caution is advised due to ongoing profitability challenges.

Risk Analysis

Below is a comparative table outlining key risks for MongoDB, Inc. (MDB) and UiPath Inc. (PATH) based on their most recent financial and operational data from 2025.

| Metric | MongoDB, Inc. (MDB) | UiPath Inc. (PATH) |

|---|---|---|

| Market Risk | Beta 1.38 indicates higher volatility vs market | Beta 1.08, moderate volatility |

| Debt level | Very low debt-to-equity at 0.01, low financial risk | Low debt-to-equity at 0.04, manageable debt |

| Regulatory Risk | Moderate; operates globally, subject to data/cloud regulations | Moderate; automation software faces evolving AI and privacy rules |

| Operational Risk | Negative net margin (-6.43%) and ROE (-4.64%) indicate operational challenges | Negative net margin (-5.15%) and ROE (-3.99%) show operational pressures |

| Environmental Risk | Low direct environmental impact due to software focus | Low direct environmental impact; software-centric |

| Geopolitical Risk | US-based with global cloud operations, exposed to trade tensions | US-based with operations in US, Romania, Japan; geopolitical exposure moderate |

In synthesis, both companies face operational risks reflected in negative profitability metrics, but their low debt levels reduce financial distress risks. MongoDB’s higher market volatility and slightly worse profitability metrics increase its risk profile. Regulatory and geopolitical risks are moderate for both, given their technology focus and global presence. Investors should weigh these factors cautiously, prioritizing strong operational improvements to mitigate the most impactful risks.

Which Stock to Choose?

MongoDB, Inc. (MDB) shows a favorable income evolution with 19.22% revenue growth in 2025 and an 85.71% favorable income statement rating. However, its financial ratios indicate an overall unfavorable status, with negative returns on equity and capital employed, but low debt levels and a strong quick ratio. The company’s rating is very favorable, though some key profitability scores are poor.

UiPath Inc. (PATH) also displays favorable income growth, albeit more moderate at 9.3% in 2025, and a slightly lower but still favorable income statement rating of 78.57%. Its financial ratios are slightly unfavorable but better than MDB’s, with favorable debt measures and some profitability scores. The company’s rating is very favorable with stronger return on equity and assets scores compared to MDB.

Considering the ratings and comprehensive financial evaluations, MDB might appeal more to growth-oriented investors given its stronger income growth, despite weaker ratios. Conversely, PATH could be more suitable for those valuing slightly better financial stability and profitability metrics, albeit with more modest income growth. Both companies show improving profitability trends but currently shed value relative to their cost of capital.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MongoDB, Inc. and UiPath Inc. to enhance your investment decisions: