In today’s fast-evolving tech landscape, MongoDB, Inc. and Teradata Corporation stand out as key players in the software infrastructure industry. Both companies provide advanced data management platforms but differ in scale and innovation approaches, targeting overlapping enterprise clients seeking cloud and multi-cloud solutions. This article will carefully analyze their strengths and risks to help you decide which company holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between MongoDB and Teradata by providing an overview of these two companies and their main differences.

MongoDB Overview

MongoDB, Inc. is a technology company specializing in software infrastructure, offering a general purpose database platform worldwide. Its product portfolio includes MongoDB Enterprise Advanced for enterprise use, the MongoDB Atlas cloud database service, and a free Community Server. Founded in 2007 and headquartered in New York City, MongoDB aims to provide flexible and scalable database solutions for cloud, on-premise, and hybrid environments.

Teradata Overview

Teradata Corporation is a technology company focused on software infrastructure and enterprise analytics through a connected multi-cloud data platform called Teradata Vantage. Established in 1979 and based in San Diego, Teradata supports clients across multiple industries by enabling data integration, ecosystem simplification, and cloud migration. The company also offers consulting and support services to optimize analytics infrastructure and drive data-driven value.

Key similarities and differences

Both MongoDB and Teradata operate in the software infrastructure sector, providing data management and analytics solutions aimed at enterprises. MongoDB emphasizes flexible database services including cloud and hybrid options, while Teradata centers on multi-cloud analytics platforms and ecosystem integration. The companies differ in scale, with MongoDB’s market cap around 32.5B and Teradata’s near 2.8B, reflecting distinct market positions and client focus areas.

Income Statement Comparison

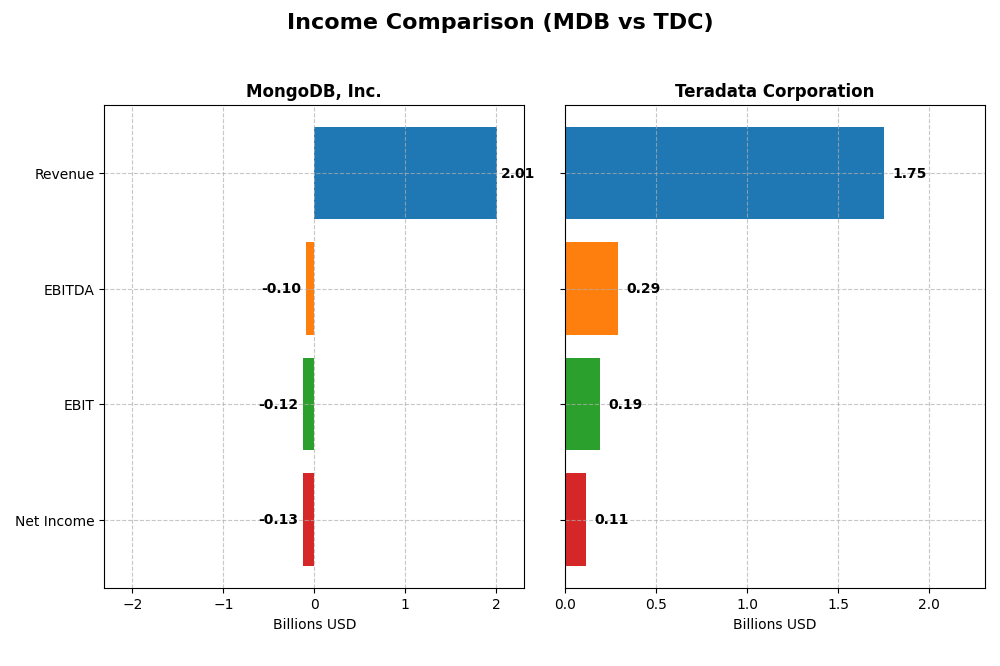

The table below compares the most recent full fiscal year income statement metrics for MongoDB, Inc. and Teradata Corporation, illustrating key financial figures for 2025 and 2024 respectively.

| Metric | MongoDB, Inc. (MDB) 2025 | Teradata Corporation (TDC) 2024 |

|---|---|---|

| Market Cap | 32.5B | 2.8B |

| Revenue | 2.01B | 1.75B |

| EBITDA | -96.5M | 293M |

| EBIT | -124M | 193M |

| Net Income | -129M | 114M |

| EPS | -1.73 | 1.18 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

MongoDB, Inc.

MongoDB’s revenue surged from $590M in 2021 to $2.0B in 2025, showing strong growth of 240% over five years. Despite consistently negative net income, the net margin improved from -45% in 2021 to -6.4% in 2025. The gross margin remained robust around 73%, and 2025 saw a marked improvement in net income and EPS growth, indicating better operational leverage.

Teradata Corporation

Teradata’s revenue fluctuated around the $1.8B mark from 2020 to 2024 but declined 4.5% in the latest year to $1.75B. Net income also dropped overall by 11.6% over five years, although 2024 showed a net margin improvement to 6.5%. Gross margin held steady near 60%, while EBIT margin remained positive at 11%, reflecting stable profitability despite recent revenue softness.

Which one has the stronger fundamentals?

MongoDB demonstrates stronger revenue growth and margin improvement trends, with 85.7% favorable income metrics, despite ongoing net losses. Teradata maintains profitability with positive net income and margins but shows declining revenue and net income trends, with only 57.1% favorable income evaluations. MongoDB’s accelerating growth contrasts with Teradata’s more stable but shrinking top line.

Financial Ratios Comparison

This table presents a clear comparison of key financial ratios for MongoDB, Inc. and Teradata Corporation based on their most recent fiscal year data.

| Ratios | MongoDB, Inc. (2025) | Teradata Corporation (2024) |

|---|---|---|

| ROE | -4.64% | 85.71% |

| ROIC | -7.36% | 16.89% |

| P/E | -157.88 | 26.34 |

| P/B | 7.32 | 22.58 |

| Current Ratio | 5.20 | 0.81 |

| Quick Ratio | 5.20 | 0.79 |

| D/E | 0.01 | 4.33 |

| Debt-to-Assets | 1.06% | 33.80% |

| Interest Coverage | -26.70 | 7.21 |

| Asset Turnover | 0.58 | 1.03 |

| Fixed Asset Turnover | 24.78 | 9.07 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

MongoDB, Inc.

MongoDB’s ratios reveal several weaknesses, including negative net margin (-6.43%), return on equity (-4.64%), and return on invested capital (-7.36%), indicating operational and profitability challenges. The company shows favorable debt levels and quick ratio but struggles with interest coverage and valuation metrics. MongoDB does not pay dividends, likely due to ongoing reinvestment and negative earnings.

Teradata Corporation

Teradata presents a mixed picture with favorable returns on equity (85.71%) and invested capital (16.89%), alongside strong interest coverage and asset turnover. However, the company’s price-to-earnings and price-to-book ratios are high, while liquidity ratios and debt-to-equity are unfavorable. Teradata also does not pay dividends, suggesting a focus on growth or capital allocation elsewhere.

Which one has the best ratios?

Teradata exhibits a more balanced and generally favorable ratio profile, particularly in profitability and operational efficiency, despite some liquidity concerns. MongoDB shows more unfavorable ratios overall, especially in profitability and coverage metrics. Therefore, Teradata’s financial ratios appear relatively stronger compared to MongoDB’s more challenged metrics.

Strategic Positioning

This section compares the strategic positioning of MongoDB, Inc. and Teradata Corporation including their Market position, Key segments, and Exposure to technological disruption:

MongoDB, Inc.

- Leading software infrastructure firm with significant market cap and moderate competitive pressure

- Focused on database platforms including MongoDB Atlas multi-cloud and enterprise advanced offerings

- Embraces cloud-based and hybrid database solutions, adapting to evolving technology landscapes

Teradata Corporation

- Smaller market cap with stable presence in enterprise analytics facing moderate competition

- Diversified multi-cloud data platform serving multiple sectors with consulting and migration services

- Provides connected multi-cloud data platforms with emphasis on ecosystem simplification and cloud migration

MongoDB vs Teradata Positioning

MongoDB’s strategy centers on a concentrated database platform with strong cloud focus, while Teradata pursues a diversified multi-cloud analytics approach spanning several industries. MongoDB benefits from a clear cloud specialization; Teradata offers broader consulting and integration services but with a smaller market cap.

Which has the best competitive advantage?

Teradata holds a very favorable moat with ROIC above WACC and strong growth, indicating durable competitive advantage. MongoDB shows a slightly unfavorable moat, shedding value despite improving profitability trends.

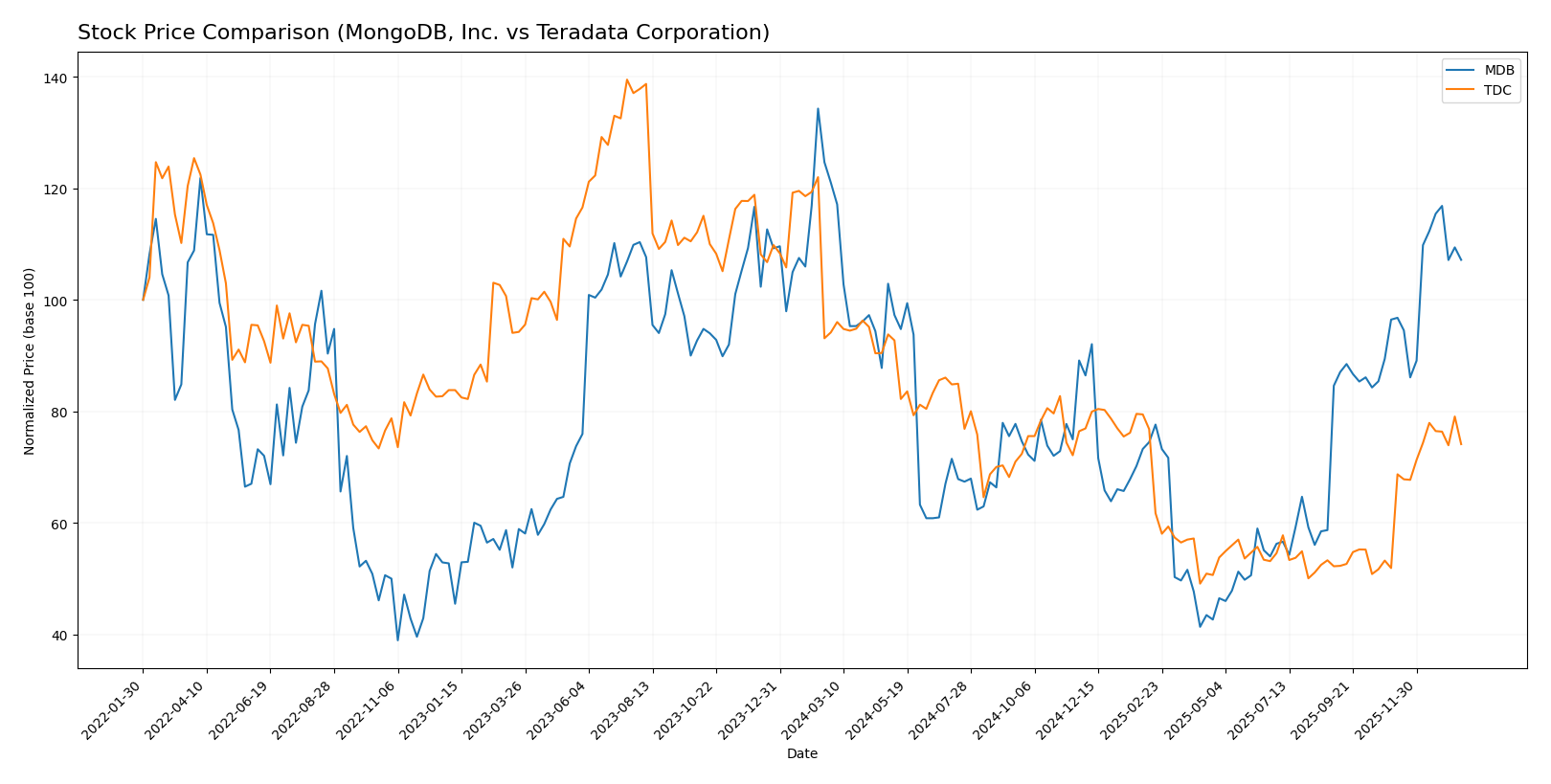

Stock Comparison

The stock prices of MongoDB, Inc. and Teradata Corporation over the past 12 months reveal contrasting bearish trends with recent bullish momentum, highlighting significant price swings and evolving trading dynamics in both securities.

Trend Analysis

MongoDB, Inc. (MDB) exhibited an 11.46% decline over the past year, indicating a bearish trend with acceleration. The stock price ranged widely from 154.39 to 451.52, showing high volatility with a recent rebound of 11.1% from November 2025 to January 2026.

Teradata Corporation (TDC) showed a more pronounced 21.26% decrease over the same period, also bearish with acceleration. Price fluctuations were narrower, between 19.73 and 38.67, with a recent strong positive shift of 42.78% in the last two and a half months.

Comparing both stocks, TDC delivered the lowest market performance over the year but experienced a sharper recent recovery than MDB, which had a less severe overall decline and higher volatility.

Target Prices

The current consensus target prices indicate positive analyst expectations for both MongoDB, Inc. and Teradata Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MongoDB, Inc. | 500 | 375 | 445.2 |

| Teradata Corporation | 35 | 27 | 31 |

Analysts see MongoDB’s stock price, currently around 399.76 USD, having potential upside towards a 445.2 USD consensus target. Teradata’s stock at 29.77 USD also shows moderate upside with a 31 USD consensus target.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for MongoDB, Inc. (MDB) and Teradata Corporation (TDC):

Rating Comparison

MDB Rating

- Rating: C, classified as Very Favorable overall rating.

- Discounted Cash Flow Score: 2, indicating a Moderate valuation level.

- ROE Score: 1, rated Very Unfavorable for equity profit generation.

- ROA Score: 1, rated Very Unfavorable for asset utilization.

- Debt To Equity Score: 4, rated Favorable reflecting lower financial risk.

- Overall Score: 2, reflecting a Moderate overall financial standing.

TDC Rating

- Rating: B+, classified as Very Favorable overall rating.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation.

- ROE Score: 5, rated Very Favorable for equity profit generation.

- ROA Score: 4, rated Favorable for asset utilization.

- Debt To Equity Score: 1, rated Very Unfavorable indicating higher financial risk.

- Overall Score: 3, reflecting a Moderate overall financial standing.

Which one is the best rated?

Based strictly on the provided data, TDC holds a better rating with a B+ and higher scores in discounted cash flow, ROE, ROA, and overall financial standing despite its unfavorable debt to equity score. MDB shows a lower C rating and mixed scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for MongoDB, Inc. and Teradata Corporation:

MDB Scores

- Altman Z-Score: 30.24, indicating a safe financial zone with very low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength and value potential.

TDC Scores

- Altman Z-Score: 0.81, placing the company in the distress zone with high bankruptcy risk.

- Piotroski Score: 8, representing very strong financial health and investment potential.

Which company has the best scores?

MongoDB has a much higher Altman Z-Score, indicating stronger bankruptcy safety, while Teradata has a significantly better Piotroski Score, reflecting stronger financial health. Each company excels in different score categories based on the data provided.

Grades Comparison

The following is a comparison of recent grades and ratings assigned to MongoDB, Inc. and Teradata Corporation by reputable grading companies:

MongoDB, Inc. Grades

This table summarizes recent grades assigned by recognized financial institutions to MongoDB, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| Needham | Maintain | Buy | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Piper Sandler | Maintain | Overweight | 2025-12-02 |

Overall, MongoDB consistently receives positive grades, predominantly “Buy” and “Overweight,” indicating strong analyst confidence.

Teradata Corporation Grades

This table summarizes recent grades assigned by recognized financial institutions to Teradata Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Underweight | 2026-01-12 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Citizens | Upgrade | Market Outperform | 2025-11-10 |

| Barclays | Maintain | Underweight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Guggenheim | Maintain | Buy | 2025-05-07 |

| Barclays | Maintain | Underweight | 2025-04-21 |

Teradata’s grades show more variability, ranging from “Underweight” to “Buy,” reflecting mixed analyst sentiment.

Which company has the best grades?

MongoDB holds a stronger and more consistent positive consensus with 35 “Buy” recommendations versus Teradata’s 14, while Teradata has a higher number of “Hold” and “Sell” ratings. This suggests MongoDB is viewed more favorably by analysts, which may influence investor sentiment and risk assessment.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for MongoDB, Inc. (MDB) and Teradata Corporation (TDC) based on their recent financial and strategic performance data.

| Criterion | MongoDB, Inc. (MDB) | Teradata Corporation (TDC) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from MongoDB Atlas and subscriptions; limited product range | High: Diverse revenue streams from consulting, recurring products, services, and software licenses |

| Profitability | Weak: Negative net margin (-6.43%), ROIC below WACC, value destroying but improving | Strong: Positive net margin (~6.5%), ROIC well above WACC, value creating with growing profitability |

| Innovation | High: Rapid growth in cloud-based database solutions and Atlas platform | Moderate: Focus on data analytics and recurring software, less emphasis on breakthrough innovation |

| Global presence | Moderate: Growing cloud adoption globally but smaller footprint | Strong: Established global data and analytics presence with international revenues |

| Market Share | Growing in cloud DB market but still competing with larger incumbents | Solid position in analytics and data warehousing markets with stable client base |

Key takeaway: Teradata demonstrates a durable competitive advantage with strong profitability and diversification, making it a safer pick for investors focused on value creation. MongoDB shows promising innovation and growth but currently struggles with profitability and value destruction, warranting cautious consideration.

Risk Analysis

Below is a comparative overview of key risk factors for MongoDB, Inc. (MDB) and Teradata Corporation (TDC) based on the most recent data available:

| Metric | MongoDB, Inc. (MDB) | Teradata Corporation (TDC) |

|---|---|---|

| Market Risk | High beta (1.38), volatile price range (141-445 USD) | Lower beta (0.57), narrower price range (18-33 USD) |

| Debt level | Very low debt-to-equity (0.01), low debt-to-assets (1.06%) | High debt-to-equity (4.33), moderate debt-to-assets (33.8%) |

| Regulatory Risk | Moderate, tech sector subject to data/privacy regulations | Moderate, similar regulatory exposure in data analytics sector |

| Operational Risk | Negative net margin (-6.43%), unfavorable ROE and ROIC | Positive net margin (6.51%), strong ROE (85.7%) and ROIC (16.9%) |

| Environmental Risk | Low, typical for software infrastructure | Low, typical for software infrastructure |

| Geopolitical Risk | Moderate, US-based with global cloud operations | Moderate, US-based with international presence |

Synthesizing these risks, MongoDB faces significant operational challenges, including negative profitability metrics and market volatility, though it maintains very low debt levels, reducing financial risk. Teradata exhibits stronger operational profitability but carries elevated debt, posing higher financial risk. Market risk is higher for MongoDB due to its beta and price swings, while both companies face typical regulatory and geopolitical uncertainties of the tech sector. Investors should weigh MongoDB’s growth potential against its profitability struggles and Teradata’s financial leverage against its solid operating returns.

Which Stock to Choose?

MongoDB, Inc. (MDB) shows strong revenue growth of 239.86% over five years with a favorable income statement overall. However, its profitability ratios and returns on equity and assets are negative, and debt metrics are favorable, reflecting low leverage. The company’s rating is very favorable, but financial ratios are mostly unfavorable, indicating operational challenges.

Teradata Corporation (TDC) has a stable income statement with moderate revenue decline but favorable EBIT and net margins. Its profitability ratios, including ROE and ROIC, are very favorable, though debt levels are relatively high. TDC’s rating is very favorable with balanced financial ratios, suggesting better operational efficiency despite some leverage concerns.

For investors focused on growth, MDB’s strong income growth and improving profitability might appear attractive despite its current financial ratio weaknesses. Conversely, risk-averse or quality-focused investors may see TDC’s consistent profitability, value creation, and stable rating as more reassuring, even with higher debt levels.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MongoDB, Inc. and Teradata Corporation to enhance your investment decisions: