In today’s fast-evolving technology landscape, selecting the right company to invest in requires careful analysis of market position and innovation strategies. Synopsys, Inc. and MongoDB, Inc. both operate within the software infrastructure sector, serving critical roles in electronic design automation and database platforms, respectively. Their overlapping focus on enabling digital transformation makes this comparison timely and relevant. Join me as we explore which company offers the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Synopsys and MongoDB by providing an overview of these two companies and their main differences.

Synopsys Overview

Synopsys, Inc. specializes in electronic design automation software used for designing and testing integrated circuits. Its offerings include platforms for digital design implementation, verification, FPGA design, and intellectual property solutions covering USB, PCI Express, and more. Synopsys serves diverse sectors such as electronics, automotive, and medicine, positioning itself as a key player in infrastructure software with a market cap near 99B USD.

MongoDB Overview

MongoDB, Inc. provides a general purpose database platform worldwide, offering commercial and cloud-based database solutions alongside a free community server. It supports hybrid environments and delivers professional consulting and training services. Headquartered in New York, MongoDB has established itself in the software infrastructure sector with a market cap of approximately 32.5B USD, focusing on database technology innovation.

Key similarities and differences

Both companies operate within the software infrastructure industry, focusing on specialized platforms that support enterprise technology needs. Synopsys emphasizes electronic design automation and intellectual property solutions, while MongoDB centers on database platforms and cloud services. Synopsys has a substantially larger market cap and workforce, reflecting its broader application scope and longer market presence compared to MongoDB’s concentrated database offering.

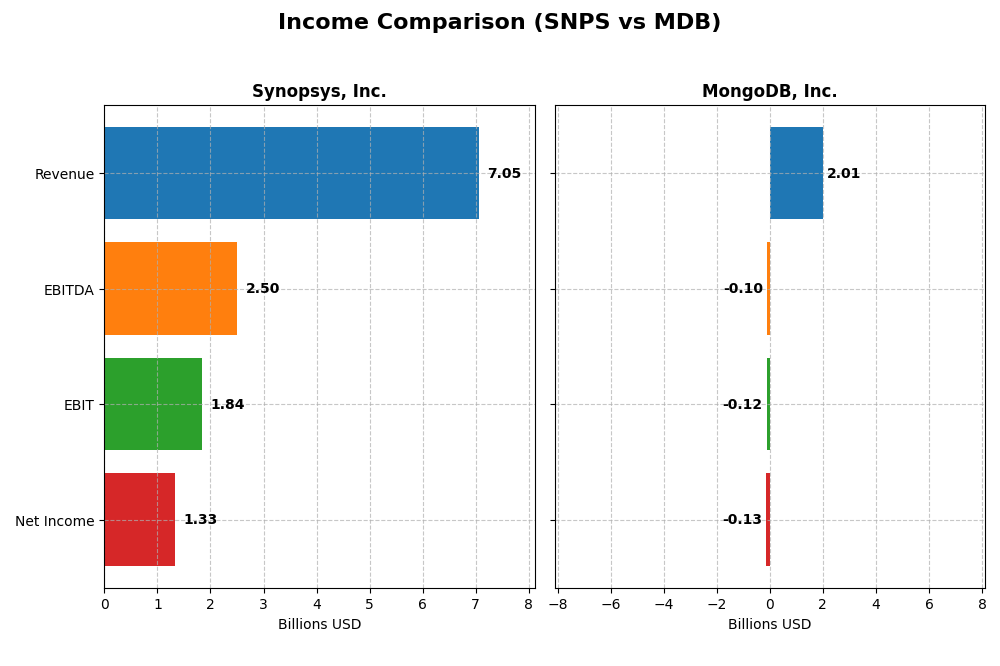

Income Statement Comparison

The table below presents the key income statement metrics for Synopsys, Inc. and MongoDB, Inc. for their most recent fiscal years, offering a clear side-by-side financial snapshot.

| Metric | Synopsys, Inc. (SNPS) | MongoDB, Inc. (MDB) |

|---|---|---|

| Market Cap | 98.8B | 32.5B |

| Revenue | 7.05B | 2.01B |

| EBITDA | 2.50B | -97M |

| EBIT | 1.84B | -124M |

| Net Income | 1.33B | -129M |

| EPS | 8.13 | -1.73 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Synopsys, Inc.

Synopsys displayed consistent revenue growth from $4.2B in 2021 to $7.1B in 2025, with net income rising from $758M to $1.33B over the same period. Gross and EBIT margins remained favorable, around 77% and 26%, respectively. However, in 2025, net margin and EPS declined significantly, reflecting margin pressure despite revenue and EBIT improvements.

MongoDB, Inc.

MongoDB showed strong revenue growth from $590M in 2021 to $2B in 2025, with net losses narrowing from -$267M to -$129M. Gross margin held favorably at about 73%, but EBIT and net margins remained negative, though they improved in 2025. The company’s growth and margin expansions suggest operational progress despite ongoing net losses.

Which one has the stronger fundamentals?

Both companies exhibit favorable revenue growth and gross margins, yet Synopsys maintains positive net income and solid EBIT margins, indicating profitability. MongoDB’s rapid revenue growth and margin improvements are promising, but persistent net losses and negative EBIT margins highlight ongoing challenges. Synopsys’s profitability contrasts with MongoDB’s continued investment phase.

Financial Ratios Comparison

The table below presents a comparison of key financial ratios for Synopsys, Inc. (SNPS) and MongoDB, Inc. (MDB) based on their most recent fiscal year data.

| Ratios | Synopsys, Inc. (SNPS) | MongoDB, Inc. (MDB) |

|---|---|---|

| ROE | 4.72% | -4.64% |

| ROIC | 1.97% | -7.36% |

| P/E | 54.36 | -157.88 |

| P/B | 2.57 | 7.32 |

| Current Ratio | 1.62 | 5.20 |

| Quick Ratio | 1.52 | 5.20 |

| D/E | 0.50 | 0.01 |

| Debt-to-Assets | 29.64% | 1.06% |

| Interest Coverage | 2.05 | -26.70 |

| Asset Turnover | 0.15 | 0.58 |

| Fixed Asset Turnover | 5.04 | 24.78 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Synopsys, Inc.

Synopsys shows a mixed ratio profile with favorable net margin (18.96%) and liquidity ratios, but unfavorable returns on equity (4.72%) and invested capital (1.97%). The valuation metrics like P/E (54.36) and asset turnover are weak. The company does not pay dividends, reflecting a possible reinvestment strategy or growth phase without shareholder payouts.

MongoDB, Inc.

MongoDB’s ratios are mostly unfavorable, including negative net margin (-6.43%), returns on equity (-4.64%), and high WACC (10.35%). However, it boasts a strong quick ratio (5.2) and low debt levels. It also does not pay dividends, likely due to ongoing losses and prioritization of growth and R&D investments over shareholder returns.

Which one has the best ratios?

Synopsys presents a more balanced financial profile with some strong liquidity and profitability ratios, despite concerns over returns and valuation. MongoDB exhibits broader weaknesses, particularly in profitability and coverage ratios, despite some favorable liquidity and leverage measures. Overall, Synopsys’s ratios appear comparatively stronger.

Strategic Positioning

This section compares the strategic positioning of Synopsys, Inc. and MongoDB, Inc. based on market position, key segments, and exposure to disruption:

Synopsys, Inc.

- Leading market position in electronic design automation with moderate competitive pressure.

- Key segments include license and maintenance, technology services, and IP solutions for integrated circuits.

- Faces technological disruption linked to rapid advancements in electronic design and software security.

MongoDB, Inc.

- Focused database platform provider with competitive pressure in cloud and enterprise markets.

- Key segments are MongoDB Atlas cloud services, other subscriptions, and professional services.

- Exposure to disruption from cloud database innovation and evolving hybrid-cloud environments.

Synopsys, Inc. vs MongoDB, Inc. Positioning

Synopsys pursues a diversified product portfolio spanning design, verification, and IP solutions, offering broad industry applications. MongoDB concentrates on database platforms and cloud services, focusing on scalability and modern deployment models. Both face industry-specific disruption risks with different scale and scope.

Which has the best competitive advantage?

Neither company currently generates returns above their cost of capital; Synopsys shows declining profitability while MongoDB’s profitability is improving. MongoDB’s growing ROIC suggests a slightly stronger competitive advantage despite value destruction.

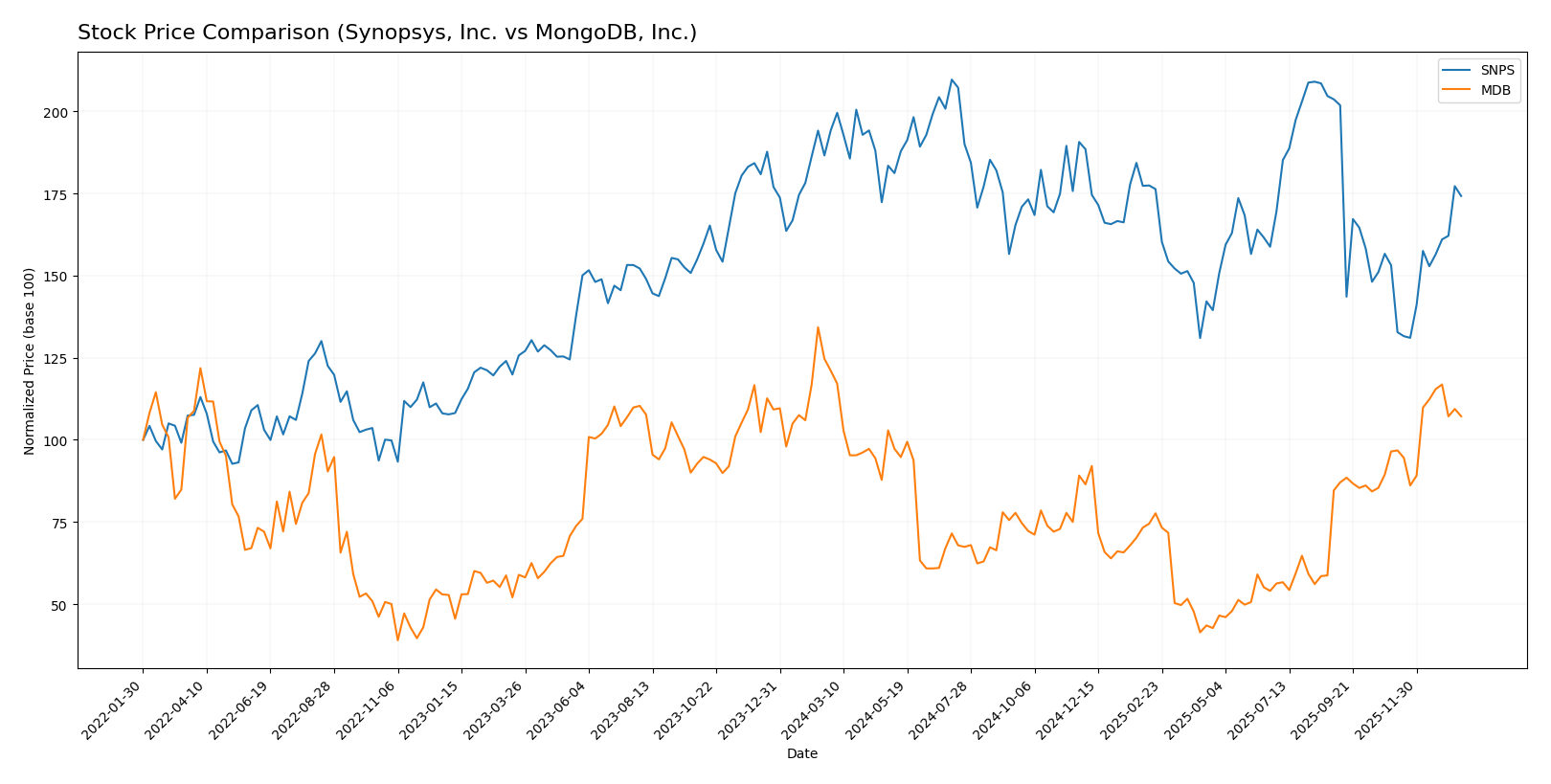

Stock Comparison

The stock price movements over the past year reveal a bearish trend for both Synopsys, Inc. and MongoDB, Inc., with notable recent recoveries indicating accelerating upward momentum in the last quarter.

Trend Analysis

Synopsys, Inc. (SNPS) experienced a 10.31% price decline over the past 12 months, indicating a bearish trend with accelerating downward momentum and a high volatility of 58.85. The stock hit a high of 621.3 and a low of 388.13, but recently rallied 13.77% from November 2025 to January 2026.

MongoDB, Inc. (MDB) showed an 11.46% decrease over the same period, reflecting a bearish trend with acceleration and even higher volatility at 72.49. The stock ranged between 451.52 and 154.39, followed by an 11.1% recent recovery from November 2025 to January 2026.

Comparing both, Synopsys delivered a slightly better market performance overall with a smaller decline and a stronger recent rebound, while MongoDB faced a steeper fall but maintained a strong buyer dominance in volume recently.

Target Prices

The current analyst consensus indicates promising upside potential for both Synopsys, Inc. and MongoDB, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Synopsys, Inc. | 600 | 425 | 530 |

| MongoDB, Inc. | 500 | 375 | 445.2 |

Analysts expect Synopsys shares to appreciate modestly above the current price of 516.31 USD, while MongoDB shows potential to rise significantly from its 399.76 USD market price. Both stocks present attractive targets relative to their present valuations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Synopsys, Inc. and MongoDB, Inc.:

Rating Comparison

SNPS Rating

- Rating: B-, considered very favorable overall.

- Discounted Cash Flow Score: Moderate at 3, indicating fair valuation.

- ROE Score: Moderate at 3, reflecting average efficiency in generating equity.

- ROA Score: Moderate at 3, showing average asset utilization.

- Debt To Equity Score: Moderate at 2, indicating balanced financial risk.

- Overall Score: Moderate at 3, representing an average overall financial standing.

MDB Rating

- Rating: C, also considered very favorable overall.

- Discounted Cash Flow Score: Moderate at 2, suggesting somewhat less value.

- ROE Score: Very unfavorable at 1, indicating low efficiency with equity.

- ROA Score: Very unfavorable at 1, reflecting poor asset use to generate earnings.

- Debt To Equity Score: Favorable at 4, showing lower financial risk.

- Overall Score: Moderate at 2, reflecting a somewhat weaker overall position.

Which one is the best rated?

Based strictly on the provided data, Synopsys holds higher ratings in overall score, ROE, ROA, and discounted cash flow, while MongoDB scores better on debt-to-equity. Synopsys is better rated overall due to stronger financial efficiency and valuation metrics.

Scores Comparison

The comparison of the Altman Z-Score and Piotroski Score for Synopsys and MongoDB is as follows:

Synopsys Scores

- Altman Z-Score: 3.54, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 4, classified as average financial strength.

MongoDB Scores

- Altman Z-Score: 30.24, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 4, classified as average financial strength.

Which company has the best scores?

MongoDB has a significantly higher Altman Z-Score than Synopsys, indicating stronger financial stability. Both companies share the same average Piotroski Score, showing similar financial strength on that metric.

Grades Comparison

Here is an overview of the recent grades assigned to Synopsys, Inc. and MongoDB, Inc.:

Synopsys, Inc. Grades

This table summarizes recent analyst grades from reputable firms for Synopsys, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Morgan Stanley | Maintain | Overweight | 2025-12-12 |

| Rosenblatt | Maintain | Buy | 2025-12-11 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| Piper Sandler | Maintain | Overweight | 2025-12-11 |

| Needham | Maintain | Buy | 2025-12-11 |

| B of A Securities | Upgrade | Buy | 2025-12-11 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-11 |

| Rosenblatt | Upgrade | Buy | 2025-12-09 |

Synopsys shows a generally positive rating trend, with most firms maintaining Buy or Overweight ratings, except a recent downgrade to Neutral by Piper Sandler.

MongoDB, Inc. Grades

This table presents recent analyst grades from recognized institutions for MongoDB, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

MongoDB maintains a strong positive consensus, with the majority of analysts assigning Buy or Outperform ratings and no downgrades reported.

Which company has the best grades?

Both companies have strong Buy consensus ratings, but MongoDB has a higher number of Buy and Outperform grades with no recent downgrades, indicating a slightly more optimistic analyst outlook. Investors might interpret MongoDB’s consistent positive ratings as a signal of stronger market confidence compared to Synopsys’s recent downgrade trend.

Strengths and Weaknesses

Here is a comparison of key strengths and weaknesses for Synopsys, Inc. (SNPS) and MongoDB, Inc. (MDB) based on their recent financial and operational data:

| Criterion | Synopsys, Inc. (SNPS) | MongoDB, Inc. (MDB) |

|---|---|---|

| Diversification | Strong diversification with License & Maintenance ($3.49B) and Technology Services ($1.55B) | Moderate diversification; heavily reliant on MongoDB Atlas ($1.41B) with Other Subscriptions ($539M) |

| Profitability | Positive net margin (18.96%) but declining ROIC (1.97%, below WACC 8.3%) | Negative net margin (-6.43%) and ROIC (-7.36%), though ROIC trend is improving |

| Innovation | Solid product base and steady technology service growth but value destruction | High innovation in cloud database services with increasing ROIC trend |

| Global presence | Established global player in semiconductor software market | Growing international presence with cloud-based offerings |

| Market Share | Large market share in EDA software, stable license revenue growth | Expanding market share in cloud database, rapid revenue growth in Atlas segment |

In summary, Synopsys offers a more diversified and profitable profile but faces challenges with declining capital efficiency. MongoDB shows strong innovation and growth potential but currently operates at a loss, though its improving ROIC suggests future value creation. Investors should weigh Synopsys’ stability against MongoDB’s growth trajectory with attention to risk tolerance.

Risk Analysis

Below is a comparison table highlighting key risk factors for Synopsys, Inc. (SNPS) and MongoDB, Inc. (MDB) based on the most recent 2025 data.

| Metric | Synopsys, Inc. (SNPS) | MongoDB, Inc. (MDB) |

|---|---|---|

| Market Risk | Beta 1.12, moderate volatility | Beta 1.38, higher volatility |

| Debt level | Debt-to-assets 29.6%, moderate | Debt-to-assets 1.1%, very low |

| Regulatory Risk | Moderate, tech sector compliance | Moderate, database/cloud sector |

| Operational Risk | Moderate, complex product line | Moderate, cloud platform reliance |

| Environmental Risk | Low, software industry | Low, software industry |

| Geopolitical Risk | Moderate, global customer base | Moderate, global cloud exposure |

Synopsys faces moderate market and debt risks but benefits from a strong Altman Z-score indicating financial stability. MongoDB shows higher market volatility and unfavorable profitability ratios, though its debt risk is minimal. Market risk and profitability remain the most impactful for these tech infrastructure companies.

Which Stock to Choose?

Synopsys, Inc. (SNPS) shows favorable income evolution with a 15.12% revenue growth in 2025 and a solid net margin near 19%. Its financial ratios are mixed, with strong liquidity and low debt but moderate returns on equity and invested capital. The company’s ROIC is below its WACC, indicating value destruction, and it holds a very favorable B- rating overall.

MongoDB, Inc. (MDB) exhibits strong revenue growth of 19.22% in 2025 and improving net margin trends despite a negative net margin currently. Its financial ratios reveal challenges in profitability and cost of capital, though it maintains low debt levels and a high current ratio. MDB’s ROIC, while growing, remains below WACC, reflecting slight value destruction, with a very favorable C rating.

For investors prioritizing stable profitability and balanced financial health, Synopsys’ consistent income and moderate risk profile might appear attractive. Conversely, those focused on growth potential and improving profitability metrics could find MongoDB’s expanding income and growing ROIC more appealing, despite current profitability challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Synopsys, Inc. and MongoDB, Inc. to enhance your investment decisions: