In the dynamic world of technology, MongoDB, Inc. and StoneCo Ltd. stand out as innovators in the software infrastructure sector. MongoDB focuses on database platforms with cloud and hybrid solutions, while StoneCo drives financial technology for commerce in Brazil. Their overlapping industry but distinct market approaches create a compelling comparison. This article will help you identify which company offers the most promising investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between MongoDB and StoneCo by providing an overview of these two companies and their main differences.

MongoDB Overview

MongoDB, Inc. offers a general-purpose database platform worldwide, targeting enterprise customers with solutions like MongoDB Enterprise Advanced, MongoDB Atlas cloud service, and a free Community Server. The company focuses on enabling flexible database deployment in cloud, on-premise, or hybrid environments. Founded in 2007 and headquartered in New York City, MongoDB is positioned as a key player in the software infrastructure industry.

StoneCo Overview

StoneCo Ltd. provides financial technology solutions primarily to merchants and integrated partners in Brazil, supporting electronic commerce across in-store, online, and mobile channels. Its proprietary Stone Hubs enhance local sales and services while catering to small- and medium-sized businesses and digital merchants. Founded in 2000 and based in the Cayman Islands, StoneCo operates as a subsidiary of HR Holdings, serving over 1.7M clients primarily in the fintech sector.

Key similarities and differences

Both MongoDB and StoneCo operate within the technology sector, focusing on software infrastructure but in distinct niches—database platforms versus financial technology solutions. MongoDB’s business model centers on database software licensing and cloud services, while StoneCo emphasizes fintech services and merchant solutions in Brazil. Each company targets different markets and customer bases, with MongoDB addressing global enterprises and StoneCo focusing on regional merchants and SMBs.

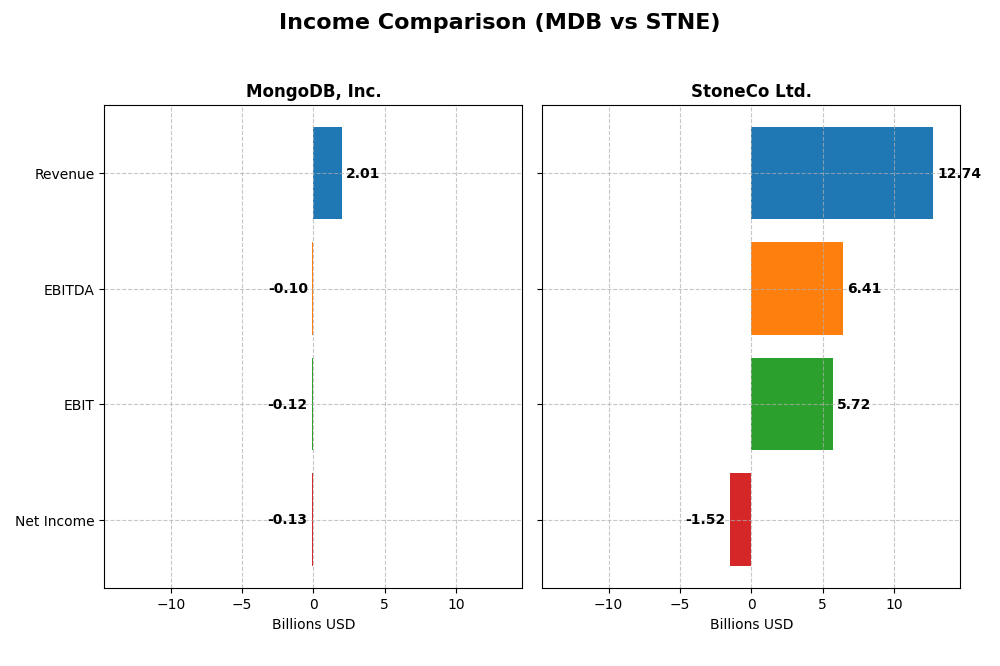

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for MongoDB, Inc. and StoneCo Ltd. based on their most recent fiscal year data.

| Metric | MongoDB, Inc. (MDB) | StoneCo Ltd. (STNE) |

|---|---|---|

| Market Cap | 32.5B USD | 3.9B BRL |

| Revenue | 2.01B USD | 12.7B BRL |

| EBITDA | -97M USD | 6.41B BRL |

| EBIT | -124M USD | 5.72B BRL |

| Net Income | -129M USD | -1.52B BRL |

| EPS | -1.73 USD | -5.02 BRL |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

MongoDB, Inc.

MongoDB showed strong revenue growth of 239.86% from 2021 to 2025, with a 19.22% increase in the latest year. Despite consistent negative net income, its net margin improved by 85.77% overall, reaching -6.43% in 2025. Gross margins remained favorable at 73.32%, while EBIT margins stayed negative but improved year-over-year, reflecting operational challenges yet positive momentum.

StoneCo Ltd.

StoneCo’s revenue expanded 302.29% over five years, growing 12.1% from 2023 to 2024. Gross margin held steady at 73.4%, and EBIT margin was strong at 44.86%. However, net income declined sharply overall by -277.41%, with a negative net margin of -11.89% in 2024. Recent EPS and net margin growth were unfavorable, pointing to profitability pressures despite top-line gains.

Which one has the stronger fundamentals?

MongoDB exhibits stronger fundamentals with significant revenue and net margin growth, alongside improving operational metrics despite losses. StoneCo’s robust EBIT margin contrasts with its steep net income decline and worsening profitability ratios. Overall, MongoDB’s income statement reflects more favorable trends in margin stability and earnings growth compared to StoneCo’s mixed performance.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for MongoDB, Inc. and StoneCo Ltd. based on their most recent fiscal year data.

| Ratios | MongoDB, Inc. (MDB) FY 2025 | StoneCo Ltd. (STNE) FY 2024 |

|---|---|---|

| ROE | -4.6% | -12.9% |

| ROIC | -7.4% | 22.4% |

| P/E | -158 | -9.8 |

| P/B | 7.32 | 1.27 |

| Current Ratio | 5.20 | 1.37 |

| Quick Ratio | 5.20 | 1.37 |

| D/E (Debt-to-Equity) | 0.013 | 1.10 |

| Debt-to-Assets | 1.06% | 23.5% |

| Interest Coverage | -26.7 | 5.57 |

| Asset Turnover | 0.58 | 0.23 |

| Fixed Asset Turnover | 24.78 | 6.95 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

MongoDB, Inc.

MongoDB exhibits mostly unfavorable financial ratios, with negative net margin (-6.43%) and return on equity (-4.64%), indicating profitability and efficiency challenges. Its current ratio is high at 5.2 but deemed unfavorable, suggesting excess liquidity that may not be efficiently used. The company does not pay dividends, likely due to negative net income and prioritizing reinvestment and growth.

StoneCo Ltd.

StoneCo shows a mixed ratio profile with a negative net margin (-11.89%) and return on equity (-12.87%), but favorable return on invested capital (22.41%) and interest coverage (5.41). Its debt-to-equity ratio of 1.1 is unfavorable, but overall StoneCo’s financial metrics appear slightly favorable. StoneCo also does not pay dividends, focusing instead on reinvestment and expansion.

Which one has the best ratios?

StoneCo has a comparatively better ratio profile with a higher proportion of favorable ratios (50%) versus MongoDB’s 35.7%, and a slightly favorable overall rating. MongoDB’s ratios lean more negative, especially in profitability and coverage metrics. Thus, StoneCo presents a relatively stronger financial ratio standing based on the data provided.

Strategic Positioning

This section compares the strategic positioning of MongoDB and StoneCo, focusing on Market position, Key segments, and Exposure to technological disruption:

MongoDB

- Leading database platform with strong market cap of 32.5B, facing high tech sector competition.

- Key segments include MongoDB Atlas cloud service (1.4B revenue in 2025), other subscriptions, and professional services.

- Exposure to cloud and database technology disruption; offers hybrid, cloud, and on-premise platforms adapting to market needs.

StoneCo

- Fintech provider focused on Brazil’s SME market, with 3.9B market cap and regional competitive pressure.

- Focused on financial technology solutions for merchants across in-store, online, and mobile channels in Brazil.

- Positioned in fintech with proprietary Stone Hubs, leveraging hyper-local sales and integrated software partnerships.

MongoDB vs StoneCo Positioning

MongoDB pursues a diversified technology platform strategy centered on cloud and database services, offering multiple subscription models and services. StoneCo concentrates on fintech solutions for Brazilian merchants, relying on proprietary distribution and localized sales. Diversification in MongoDB may spread risk, while StoneCo’s focus could benefit regional specialization but limits market scope.

Which has the best competitive advantage?

StoneCo demonstrates a very favorable moat with ROIC above WACC and strong growth, indicating durable competitive advantage. MongoDB shows a slightly unfavorable moat with ROIC below WACC despite improving profitability, suggesting weaker current value creation.

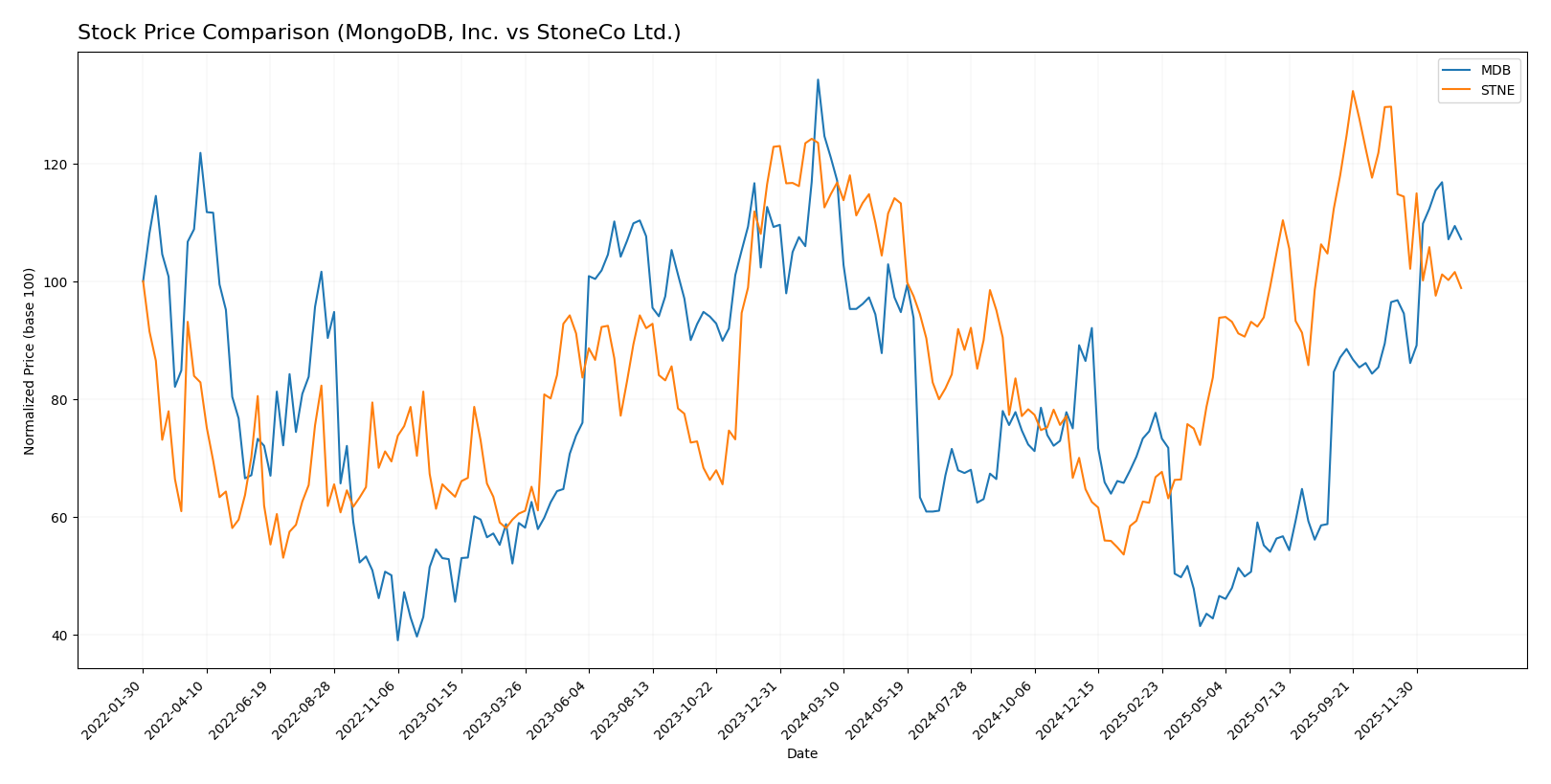

Stock Comparison

The past year shows contrasting trading dynamics between MongoDB, Inc. and StoneCo Ltd., with MongoDB experiencing a notable price rebound recently despite an overall decline, while StoneCo’s stock continues a decelerating bearish trend.

Trend Analysis

MongoDB, Inc. (MDB) exhibited an overall bearish trend over the past 12 months with a price decline of -11.46%, marked by accelerating volatility and a recent strong rebound of +11.1% since November 2025. The stock reached a low of 154.39 and a high of 451.52 during this period.

StoneCo Ltd. (STNE) also experienced a bearish trend over the last year with a price drop of -13.9%, showing decelerating volatility. Its recent trend from November 2025 to January 2026 worsened with a further -23.78% decline, hitting a low of 7.85 and a high of 19.4.

Comparing the two, MongoDB delivered a less severe overall decline and showed a positive price recovery recently, whereas StoneCo had the larger total loss and continued downward momentum, indicating MongoDB outperformed StoneCo in market performance over the past year.

Target Prices

Analysts present a mixed but generally optimistic target consensus for MongoDB, Inc. and StoneCo Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MongoDB, Inc. | 500 | 375 | 445.2 |

| StoneCo Ltd. | 20 | 20 | 20 |

MongoDB’s target consensus at 445.2 exceeds its current price of 399.76 USD, indicating potential upside. StoneCo’s target is steady at 20 USD, above its current 14.49 USD, suggesting room for growth.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for MongoDB, Inc. and StoneCo Ltd.:

Rating Comparison

MDB Rating

- Rating: C, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: Moderate at 2, indicating average valuation.

- ROE Score: Very Unfavorable at 1, showing low efficiency in equity use.

- ROA Score: Very Unfavorable at 1, indicating poor asset utilization.

- Debt To Equity Score: Favorable at 4, suggesting a strong balance sheet.

- Overall Score: Moderate at 2, reflecting average overall financial standing.

STNE Rating

- Rating: C, also classified as Very Favorable by analysts.

- Discounted Cash Flow Score: Moderate at 3, slightly stronger valuation metric.

- ROE Score: Very Unfavorable at 1, similarly low efficiency in equity use.

- ROA Score: Very Unfavorable at 1, also poor asset utilization.

- Debt To Equity Score: Very Unfavorable at 1, indicating higher financial risk.

- Overall Score: Moderate at 2, also reflecting average overall financial standing.

Which one is the best rated?

Both companies share the same overall rating and score, but MDB has a notably stronger debt-to-equity score, suggesting better financial stability. STNE has a higher discounted cash flow score, indicating a more favorable valuation metric.

Scores Comparison

Here is a comparison of the key financial scores for MongoDB, Inc. and StoneCo Ltd.:

MDB Scores

- Altman Z-Score: 30.24, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

STNE Scores

- Altman Z-Score: 1.02, in distress zone, high bankruptcy risk.

- Piotroski Score: 5, also indicating average financial strength.

Which company has the best scores?

Based strictly on the provided data, MongoDB holds a significantly safer Altman Z-Score, placing it in the safe zone, while StoneCo is in the distress zone. Their Piotroski Scores are close, with StoneCo slightly higher but both average.

Grades Comparison

The comparison of grades from reputable financial institutions for MongoDB, Inc. and StoneCo Ltd. is as follows:

MongoDB, Inc. Grades

The table below shows recent grades for MongoDB, Inc. from established grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| Needham | Maintain | Buy | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Piper Sandler | Maintain | Overweight | 2025-12-02 |

The overall trend for MongoDB, Inc. grades is consistently positive, with multiple “Buy,” “Overweight,” and “Outperform” ratings maintained by leading financial institutions.

StoneCo Ltd. Grades

The table below summarizes recent grades for StoneCo Ltd. from recognized grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Goldman Sachs | Maintain | Buy | 2025-10-14 |

| B of A Securities | Maintain | Buy | 2025-09-09 |

| UBS | Maintain | Buy | 2025-08-29 |

| JP Morgan | Maintain | Overweight | 2025-07-16 |

| Barclays | Maintain | Equal Weight | 2025-05-12 |

| Barclays | Maintain | Equal Weight | 2025-04-23 |

| Citigroup | Upgrade | Buy | 2025-04-22 |

| Barclays | Maintain | Equal Weight | 2025-03-21 |

| Morgan Stanley | Maintain | Underweight | 2025-03-21 |

| Goldman Sachs | Maintain | Buy | 2025-02-06 |

StoneCo Ltd. shows a mixed pattern with several “Buy” and “Overweight” ratings, but also some “Equal Weight” and an “Underweight” rating maintained by Morgan Stanley, indicating varied sentiment.

Which company has the best grades?

MongoDB, Inc. has received a stronger and more consistent set of positive grades, predominantly “Buy” and “Overweight,” compared to StoneCo Ltd., which has a more mixed rating profile. For investors, this difference suggests potentially higher analyst confidence in MongoDB’s prospects.

Strengths and Weaknesses

Below is a comparative overview of the key strengths and weaknesses of MongoDB, Inc. (MDB) and StoneCo Ltd. (STNE) based on the latest financial and operational data.

| Criterion | MongoDB, Inc. (MDB) | StoneCo Ltd. (STNE) |

|---|---|---|

| Diversification | Moderate: Mainly subscription and service revenue with strong growth in Atlas segment | Limited product diversification, focused on payment solutions |

| Profitability | Unfavorable: Negative net margin (-6.43%) and ROIC (-7.36%), shedding value | Mixed: Negative net margin (-11.89%) but favorable ROIC (22.41%), creating value |

| Innovation | Strong growth in MongoDB Atlas related revenue, indicating innovation in cloud DB services | Good innovation evidenced by rising ROIC and competitive fintech offerings |

| Global presence | Strong: Global cloud footprint and enterprise client base | Regional: Primarily focused on Latin American markets |

| Market Share | Growing in cloud database market, Atlas revenue up to $1.4B in 2025 | Significant player in regional fintech, but smaller scale than global peers |

Key takeaways: StoneCo demonstrates a durable competitive advantage with growing profitability and favorable financial ratios, making it slightly more attractive. MongoDB shows strong innovation and revenue growth but is currently unprofitable and shedding value, warranting caution despite improving trends.

Risk Analysis

Below is a comparative table of key risks for MongoDB, Inc. (MDB) and StoneCo Ltd. (STNE) based on the most recent data available:

| Metric | MongoDB, Inc. (MDB) | StoneCo Ltd. (STNE) |

|---|---|---|

| Market Risk | Beta 1.38, volatility moderate; tech sector sensitive to innovation cycles | Beta 1.84, higher volatility; exposure to Brazilian market economic fluctuations |

| Debt Level | Very low debt-to-equity (0.01), minimal leverage risk | High debt-to-equity (1.1), elevated financial risk |

| Regulatory Risk | Moderate, US tech regulations evolving but stable | High, Brazilian fintech regulations and currency risk |

| Operational Risk | Moderate, reliance on cloud infrastructure and service continuity | Moderate to high, dependence on local merchant adoption and payment ecosystem |

| Environmental Risk | Low, software company with limited direct environmental impact | Low, fintech with limited environmental footprint |

| Geopolitical Risk | Low, US-based with global cloud presence | High, exposure to Latin American political and economic instability |

Synthesis: StoneCo faces the most impactful risks in regulatory and geopolitical domains due to its operating environment in Brazil, compounded by high leverage. MongoDB is more exposed to market and operational risks typical of tech infrastructure providers but benefits from a strong balance sheet and low debt, reducing bankruptcy risk significantly. Investors should weigh StoneCo’s financial distress signals against MongoDB’s high valuation and negative profitability metrics.

Which Stock to Choose?

MongoDB, Inc. (MDB) has shown strong income growth with a 19.22% revenue increase in 2025 and favorable gross margin of 73.32%. However, profitability ratios remain unfavorable, with negative ROE (-4.64%) and ROIC (-7.36%), despite low debt and a very favorable rating. The company is shedding value but shows a growing ROIC trend.

StoneCo Ltd. (STNE) presents moderate revenue growth at 12.1% in 2024 and a similarly favorable gross margin of 73.4%. Its profitability ratios are mixed, with negative net margin (-11.89%) and ROE (-12.87%), but a positive ROIC at 22.41%. Debt levels are higher, and the rating is very favorable, with a very favorable moat indicating value creation and increasing profitability.

Investors focused on growth might find MongoDB’s improving income trends and low debt appealing, while those prioritizing durable value creation and profitability could see StoneCo’s positive ROIC and moat as favorable. Risk-averse investors may consider the contrasting debt and profitability profiles when assessing their preferences.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MongoDB, Inc. and StoneCo Ltd. to enhance your investment decisions: