In today’s fast-evolving tech landscape, MongoDB, Inc. and Rubrik, Inc. stand out as key players in the software infrastructure sector. Both companies innovate in data management and protection, serving diverse enterprise needs with cloud and hybrid solutions. Their overlapping markets and growth potential make them natural competitors. This article will help you uncover which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between MongoDB, Inc. and Rubrik, Inc. by providing an overview of these two companies and their main differences.

MongoDB Overview

MongoDB, Inc. provides a general purpose database platform globally, offering commercial database servers, a hosted multi-cloud database service, and a free community server. Its mission focuses on enabling developers and enterprises to deploy scalable database solutions across cloud, on-premise, and hybrid environments. Founded in 2007 and headquartered in New York City, MongoDB is a key player in the software infrastructure industry.

Rubrik Overview

Rubrik, Inc. specializes in data security solutions for individuals and enterprises worldwide, including data protection for enterprise, cloud, and SaaS environments, as well as cyber recovery and threat analytics. Established in 2013 and based in Palo Alto, California, Rubrik serves diverse sectors such as financial, healthcare, retail, and public sectors, positioning itself as a vital provider in data security software infrastructure.

Key similarities and differences

Both MongoDB and Rubrik operate in the software infrastructure sector, focusing on enterprise-level solutions. MongoDB emphasizes database platforms and development tools, while Rubrik concentrates on data security and protection services. MongoDB has a longer market presence and higher market capitalization, whereas Rubrik is newer with a distinct focus on cybersecurity and data recovery across multiple industries.

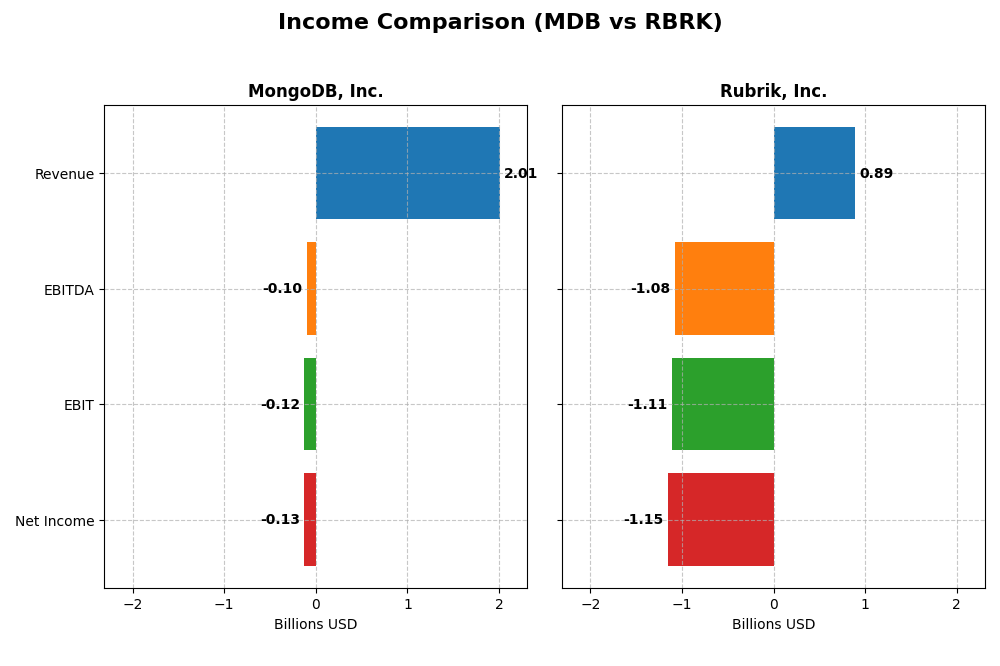

Income Statement Comparison

The table below presents a side-by-side comparison of key income statement metrics for MongoDB, Inc. and Rubrik, Inc. based on their most recent fiscal year data.

| Metric | MongoDB, Inc. (MDB) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Market Cap | 32.5B | 13.4B |

| Revenue | 2.01B | 887M |

| EBITDA | -96.5M | -1.08B |

| EBIT | -124M | -1.11B |

| Net Income | -129M | -1.15B |

| EPS | -1.73 | -7.48 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

MongoDB, Inc.

MongoDB showed strong revenue growth from 2021 to 2025, rising from $590M to $2B, with net income losses narrowing significantly. The gross margin remained robust at 73.3%, indicating efficient cost management. In 2025, revenue growth slowed to 19.2%, yet net margin improved by nearly 39%, reflecting better operational leverage despite continued overall losses.

Rubrik, Inc.

Rubrik’s revenue increased substantially from $388M in 2021 to $887M in 2025, with a strong one-year growth of 41.2%. However, net income deteriorated sharply, with net losses widening, resulting in a highly negative net margin of -130.3%. The gross margin held steady near 70%, but EBIT and net margin contracted severely in the latest year, indicating rising expenses outpacing sales gains.

Which one has the stronger fundamentals?

MongoDB presents stronger fundamentals with consistent revenue and net income improvements, favorable margin trends, and controlled interest expenses. Conversely, Rubrik, despite solid top-line growth, suffers from worsening profitability and unfavorable margin dynamics. Overall, MongoDB’s income statement shows a more favorable trajectory, while Rubrik faces significant challenges in translating revenue growth into earnings.

Financial Ratios Comparison

This table presents a side-by-side comparison of key financial ratios for MongoDB, Inc. and Rubrik, Inc. based on their most recent fiscal year data.

| Ratios | MongoDB, Inc. (MDB) | Rubrik, Inc. (RBRK) |

|---|---|---|

| ROE | -4.64% | 2.09% |

| ROIC | -7.36% | -234.85% |

| P/E | -157.88 | -9.79 |

| P/B | 7.32 | -20.42 |

| Current Ratio | 5.20 | 1.13 |

| Quick Ratio | 5.20 | 1.13 |

| D/E | 0.01 | -0.63 |

| Debt-to-Assets | 1.06% | 24.65% |

| Interest Coverage | -26.70 | -27.49 |

| Asset Turnover | 0.58 | 0.62 |

| Fixed Asset Turnover | 24.78 | 16.67 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

MongoDB, Inc.

MongoDB’s ratios reveal several weaknesses, including negative net margin (-6.43%) and return on equity (-4.64%). Its high current ratio (5.2) is flagged unfavorable, possibly indicating inefficient asset use. The company does not pay dividends, reflecting a reinvestment strategy typical for growth-oriented tech firms, prioritizing R&D and capital expenditure over shareholder payouts.

Rubrik, Inc.

Rubrik shows stronger ratios overall, with a favorable return on equity of 208.55% despite a large negative net margin (-130.26%). Its debt to equity is negative, suggesting a unique capital structure, and the weighted average cost of capital is lower than MongoDB’s. Like MongoDB, Rubrik pays no dividends, focusing on growth and investments rather than distributing cash to shareholders.

Which one has the best ratios?

Rubrik’s financial ratios appear more favorable, with a majority classified as positive, including strong returns on equity and a lower cost of capital. MongoDB, while showing some strengths such as a favorable quick ratio, presents more unfavorable indicators overall, especially profitability and leverage metrics, leading to a less positive assessment of its financial health.

Strategic Positioning

This section compares the strategic positioning of MongoDB and Rubrik, focusing on Market position, Key segments, and Exposure to technological disruption:

MongoDB, Inc.

- Large market cap $32.5B; operates in competitive software infrastructure industry with moderate beta 1.38

- Key segments include MongoDB Atlas multi-cloud DBaaS, other subscriptions, and professional services

- Positioned in cloud database innovation; no explicit disruption risk detailed in data

Rubrik, Inc.

- Smaller market cap $13.4B; software infrastructure with low beta 0.28, indicating lower volatility

- Focuses on data security: enterprise, cloud, SaaS protection, and cyber recovery across multiple sectors

- Operates in evolving data security; no explicit technological disruption exposure provided

MongoDB vs Rubrik Positioning

MongoDB’s approach is diversified across database services and cloud solutions, supporting a broad enterprise base. Rubrik concentrates on data security solutions spanning various industries. MongoDB’s larger scale contrasts with Rubrik’s focused niche and lower volatility.

Which has the best competitive advantage?

Both companies currently shed value as ROIC is below WACC. MongoDB shows improving profitability trends (slightly unfavorable moat), whereas Rubrik’s declining ROIC indicates worsening value destruction (very unfavorable moat).

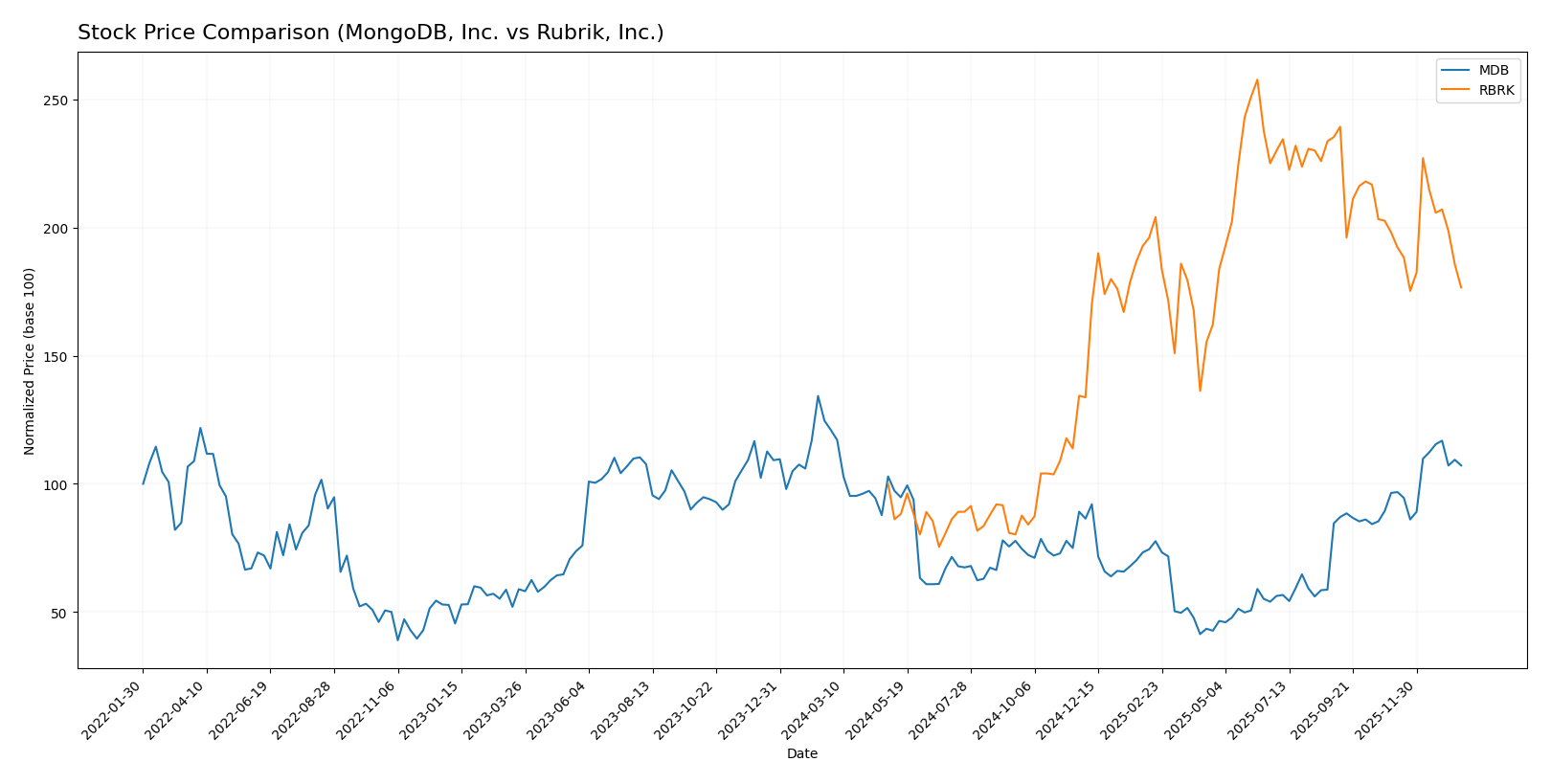

Stock Comparison

The stock prices of MongoDB, Inc. and Rubrik, Inc. over the past year reveal contrasting trajectories, with MongoDB experiencing a sustained decline followed by recent recovery, while Rubrik shows strong overall gains tempered by a recent pullback.

Trend Analysis

MongoDB, Inc. recorded an 11.46% price decline over the past 12 months, indicating a bearish trend with accelerating downward momentum and high volatility (std dev 72.49). The stock recently rebounded by 11.1%, showing a short-term bullish slope.

Rubrik, Inc. showed a 76.58% price increase over the last year, characterizing a bullish trend with decelerating gains and moderate volatility (std dev 21.4). However, its recent trend reversed with a 10.85% decline and mild negative slope.

Comparing both stocks, Rubrik delivered the highest market performance over the past year despite its recent pullback, while MongoDB’s overall trend remains bearish but with signs of near-term recovery.

Target Prices

Analysts provide a clear target price consensus for both MongoDB, Inc. and Rubrik, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MongoDB, Inc. | 500 | 375 | 445.2 |

| Rubrik, Inc. | 113 | 105 | 109.33 |

The consensus target prices suggest upside potential for MongoDB, Inc. above its current price of $399.76, while Rubrik, Inc.’s targets indicate expected gains from the current $67.10 price, reflecting positive analyst sentiment for both stocks.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for MongoDB, Inc. (MDB) and Rubrik, Inc. (RBRK):

Rating Comparison

MDB Rating

- Rating: C with a very favorable status

- Discounted Cash Flow Score: 2, moderate

- ROE Score: 1, very unfavorable

- ROA Score: 1, very unfavorable

- Debt To Equity Score: 4, favorable

- Overall Score: 2, moderate

RBRK Rating

- Rating: C with a very favorable status

- Discounted Cash Flow Score: 1, very unfavorable

- ROE Score: 5, very favorable

- ROA Score: 1, very unfavorable

- Debt To Equity Score: 1, very unfavorable

- Overall Score: 2, moderate

Which one is the best rated?

Both MDB and RBRK have the same overall rating and score of C and 2 respectively. MDB scores higher on discounted cash flow and debt to equity, while RBRK excels in return on equity. The ratings show mixed strengths without a clear overall leader.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

MDB Scores

- Altman Z-Score: 30.24, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength and investment potential.

RBRK Scores

- Altman Z-Score: 1.41, placing the company in the distress zone with high bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength and investment potential.

Which company has the best scores?

MDB has a significantly higher Altman Z-Score, indicating strong financial stability compared to RBRK’s distress zone score. Both companies share the same average Piotroski Score of 4, showing comparable financial strength.

Grades Comparison

Here is a comparison of the latest grades issued by recognized grading companies for MongoDB, Inc. and Rubrik, Inc.:

MongoDB, Inc. Grades

The following table summarizes recent grades from major financial institutions for MongoDB, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

Overall, MongoDB, Inc. has consistently received positive grades, predominantly Buy and Outperform ratings, with several Overweight endorsements, indicating strong confidence from analysts.

Rubrik, Inc. Grades

The following table presents recent grades from recognized firms for Rubrik, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| William Blair | Upgrade | Outperform | 2025-12-05 |

| Keybanc | Maintain | Overweight | 2025-12-05 |

| Wedbush | Maintain | Outperform | 2025-12-05 |

| BMO Capital | Maintain | Outperform | 2025-12-05 |

| Rosenblatt | Maintain | Buy | 2025-12-05 |

Rubrik, Inc. also enjoys predominantly positive grades, with many Overweight and Outperform ratings and a recent upgrade by William Blair, reflecting upward revisions in outlook.

Which company has the best grades?

Both MongoDB, Inc. and Rubrik, Inc. have received strong Buy and Outperform grades from reputable analysts, with MongoDB showing a larger volume of Buy ratings, while Rubrik features multiple Outperform and Overweight grades, including an upgrade. This indicates solid analyst support for both companies, which may influence investor confidence differently based on grade distribution.

Strengths and Weaknesses

Below is a comparison of MongoDB, Inc. (MDB) and Rubrik, Inc. (RBRK) based on key financial and market criteria to help investors assess their investment potential.

| Criterion | MongoDB, Inc. (MDB) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Diversification | Moderate: Mainly subscription-based with growing Atlas segment | Moderate: Primarily subscription-focused with product and maintenance revenue |

| Profitability | Unfavorable: Negative net margin (-6.43%) and ROIC (-7.36%) | Unfavorable: Negative net margin (-130.26%) and ROIC (-234.85%) |

| Innovation | Strong growth in ROIC trend (+62.87%), indicating improving efficiency | Declining ROIC trend (-219.12%), signaling weakening profitability |

| Global presence | Strong: Significant revenue growth in cloud services (Atlas $1.4B in 2025) | Moderate: Subscription revenue $829M but lower service diversification |

| Market Share | Growing in database cloud market, but value destroying currently | Struggling with value destruction and decreasing profitability |

Key takeaways: MongoDB shows promising innovation and revenue growth in cloud services despite current unprofitability. Rubrik faces stronger challenges with declining profitability and value destruction. Investors should weigh MongoDB’s improving trajectory against Rubrik’s unfavorable financial trends.

Risk Analysis

Below is a comparative risk table for MongoDB, Inc. (MDB) and Rubrik, Inc. (RBRK) based on the most recent 2025 data:

| Metric | MongoDB, Inc. (MDB) | Rubrik, Inc. (RBRK) |

|---|---|---|

| Market Risk | Beta 1.38 (higher volatility) | Beta 0.28 (lower volatility) |

| Debt Level | Very low debt-to-equity 0.01 | Moderate debt-to-assets 24.65% |

| Regulatory Risk | Moderate (US tech sector) | Moderate (US tech sector) |

| Operational Risk | Moderate (scale of 5,558 employees) | Moderate (3,200 employees) |

| Environmental Risk | Low (software industry) | Low (software industry) |

| Geopolitical Risk | Moderate (US-based global exposure) | Moderate (US-based global exposure) |

In synthesis, MongoDB faces higher market volatility but maintains very low debt, lowering financial risk. However, its unfavorable profitability and return metrics raise operational concerns. Rubrik exhibits lower market volatility but is in financial distress per Altman Z-Score and carries higher leverage. The most impactful risks lie in Rubrik’s financial distress signals and MongoDB’s weak profitability despite strong liquidity. Investors should weigh these risks carefully with focus on financial stability and market sensitivity.

Which Stock to Choose?

MongoDB, Inc. (MDB) shows a favorable income evolution with 19.22% revenue growth in 2025 and an 85.71% favorable income statement rating. However, its financial ratios are mostly unfavorable, including negative returns on equity and invested capital, but it maintains low debt and a strong current ratio. Its overall rating is very favorable, supported by a safe Altman Z-score and average Piotroski score, despite a slightly unfavorable moat due to value destruction with improving profitability.

Rubrik, Inc. (RBRK) exhibits strong revenue growth of 41.19% in 2025 but suffers from a largely unfavorable income statement with 64.29% negative indicators, including a steep net margin decline. Its financial ratios show mixed signals with a favorable return on equity but substantial unfavorable metrics, including a distress zone Altman Z-score and average Piotroski score. The company’s moat is very unfavorable, reflecting decreasing profitability and value destruction, while its rating remains very favorable overall.

Investors focused on growth may find Rubrik’s high revenue expansion and favorable return on equity attractive despite its financial risks. Conversely, those prioritizing financial stability and improving profitability might view MongoDB’s favorable income trends and stronger financial health as more suitable. Risk tolerance and investment strategy will likely influence which stock appears more favorable.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MongoDB, Inc. and Rubrik, Inc. to enhance your investment decisions: