In today’s fast-evolving technology landscape, Palo Alto Networks, Inc. and MongoDB, Inc. stand out as key players in the software infrastructure sector. Palo Alto Networks leads in cybersecurity solutions, while MongoDB specializes in innovative database platforms. Their focus on cloud and enterprise services creates notable market overlap and competitive dynamics. This article will explore both companies to help you decide which holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Palo Alto Networks and MongoDB by providing an overview of these two companies and their main differences.

Palo Alto Networks Overview

Palo Alto Networks, Inc. is a leading cybersecurity provider headquartered in Santa Clara, CA. Founded in 2005, it offers a broad range of security solutions including firewall appliances, cloud security, and threat intelligence services. The company targets medium to large enterprises, service providers, and government entities across various industries, positioning itself as a comprehensive infrastructure software player in the cybersecurity sector.

MongoDB Overview

MongoDB, Inc., based in New York City, NY, delivers a general-purpose database platform aimed at enterprise customers and developers. Founded in 2007, the company provides commercial database servers, a multi-cloud database-as-a-service, and a free community server. MongoDB focuses on flexibility in deployment—cloud, on-premise, or hybrid—serving technology-driven businesses with scalable data management solutions.

Key similarities and differences

Both Palo Alto Networks and MongoDB operate in the technology sector within the software infrastructure industry, emphasizing enterprise solutions. However, Palo Alto Networks specializes in cybersecurity and protection services, while MongoDB focuses on database management platforms. Their business models differ with Palo Alto Networks offering hardware and subscription-based security services, whereas MongoDB primarily provides software products and cloud-based database services.

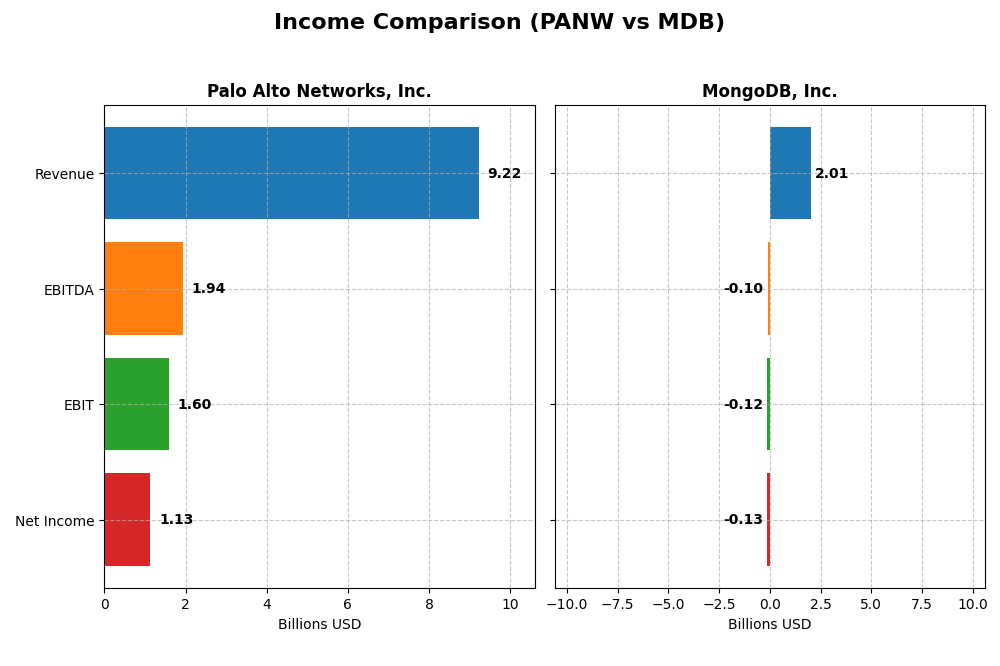

Income Statement Comparison

This table compares the key income statement metrics for Palo Alto Networks, Inc. and MongoDB, Inc. based on their most recent fiscal year results.

| Metric | Palo Alto Networks, Inc. (PANW) | MongoDB, Inc. (MDB) |

|---|---|---|

| Market Cap | 128.4B | 32.5B |

| Revenue | 9.22B | 2.01B |

| EBITDA | 1.94B | -97M |

| EBIT | 1.60B | -124M |

| Net Income | 1.13B | -129M |

| EPS | 1.71 | -1.73 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Palo Alto Networks, Inc.

Palo Alto Networks demonstrated strong revenue growth from $4.3B in 2021 to $9.2B in 2025, with net income rising from a loss to $1.13B in 2025. Margins improved significantly, with a gross margin of 73.4% and a favorable EBIT margin of 17.3%. The most recent year showed a 14.9% revenue increase but a decline in net margin and EPS, indicating margin pressure despite top-line growth.

MongoDB, Inc.

MongoDB’s revenue has surged from $590M in 2021 to $2.0B in 2025, with net losses narrowing but still negative at $129M in 2025. Gross margin remained stable around 73.3%, but EBIT and net margins stayed unfavorable at -6.2% and -6.4%, respectively. The latest year reflected healthy revenue and profit growth, with improved net margin and EPS, signaling progress towards profitability.

Which one has the stronger fundamentals?

Palo Alto Networks shows stronger fundamentals with higher and positive net income, solid margins, and sustained revenue growth, though recent margin contraction warrants attention. MongoDB has impressive revenue growth and margin stability but continues to post net losses and negative operating margins. Both companies exhibit favorable overall income statements, yet Palo Alto Networks currently holds a more robust profitability profile.

Financial Ratios Comparison

The following table compares key financial ratios for Palo Alto Networks, Inc. (PANW) and MongoDB, Inc. (MDB) based on their most recent fiscal year data.

| Ratios | Palo Alto Networks, Inc. (2025) | MongoDB, Inc. (2025) |

|---|---|---|

| ROE | 14.49% | -4.64% |

| ROIC | 5.67% | -7.36% |

| P/E | 101.43 | -157.88 |

| P/B | 14.70 | 7.32 |

| Current Ratio | 0.89 | 5.20 |

| Quick Ratio | 0.89 | 5.20 |

| D/E (Debt-to-Equity) | 0.04 | 0.01 |

| Debt-to-Assets | 1.43% | 1.06% |

| Interest Coverage | 414.3 | -26.7 |

| Asset Turnover | 0.39 | 0.58 |

| Fixed Asset Turnover | 12.56 | 24.78 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Palo Alto Networks, Inc.

Palo Alto Networks exhibits a mixed set of financial ratios with strengths in low debt levels (D/E at 0.04) and excellent interest coverage (532.53), signaling strong solvency. However, valuation multiples like PE (101.43) and PB (14.7) appear stretched, and liquidity is weak with a current ratio below 1 (0.89). The company does not pay dividends, reflecting a focus on reinvestment and growth rather than shareholder payouts.

MongoDB, Inc.

MongoDB shows mostly unfavorable profitability ratios including negative net margin (-6.43%) and ROE (-4.64%), with a concerning negative interest coverage (-15.26), indicating financial stress. Its valuation multiples are mixed with a negative PE but a moderate PB (7.32). Liquidity is strong, as shown by a high current ratio (5.2). MongoDB also does not pay dividends, likely prioritizing growth and R&D investments.

Which one has the best ratios?

Palo Alto Networks presents a slightly more favorable ratio profile, balancing strong solvency and profitability despite high valuation multiples and lower liquidity. MongoDB’s ratios are generally unfavorable, with losses and interest coverage issues overshadowing its liquidity advantage. Overall, Palo Alto Networks holds a stronger financial position based on the provided metrics.

Strategic Positioning

This section compares the strategic positioning of Palo Alto Networks and MongoDB, including their market position, key segments, and exposure to technological disruption:

Palo Alto Networks, Inc.

- Leading cybersecurity provider facing moderate competition in infrastructure software.

- Revenue driven by subscriptions, product sales, and support services in cybersecurity solutions.

- Positioned in cybersecurity with exposure to evolving threat landscapes and cloud security needs.

MongoDB, Inc.

- Database platform provider with competitive pressure in the cloud database market.

- Revenue mainly from MongoDB Atlas cloud service and other subscriptions, plus consulting.

- Positioned in cloud and hybrid database services, sensitive to cloud platform innovations.

Palo Alto Networks, Inc. vs MongoDB, Inc. Positioning

Palo Alto Networks has a diversified business model spanning subscriptions, products, and support in cybersecurity, while MongoDB focuses on cloud database services and subscriptions. Palo Alto Networks operates across multiple cybersecurity areas, whereas MongoDB concentrates on database platforms.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC but show growing profitability. Their slight unfavorable moat status indicates limited competitive advantage sustainability based on recent ROIC trends.

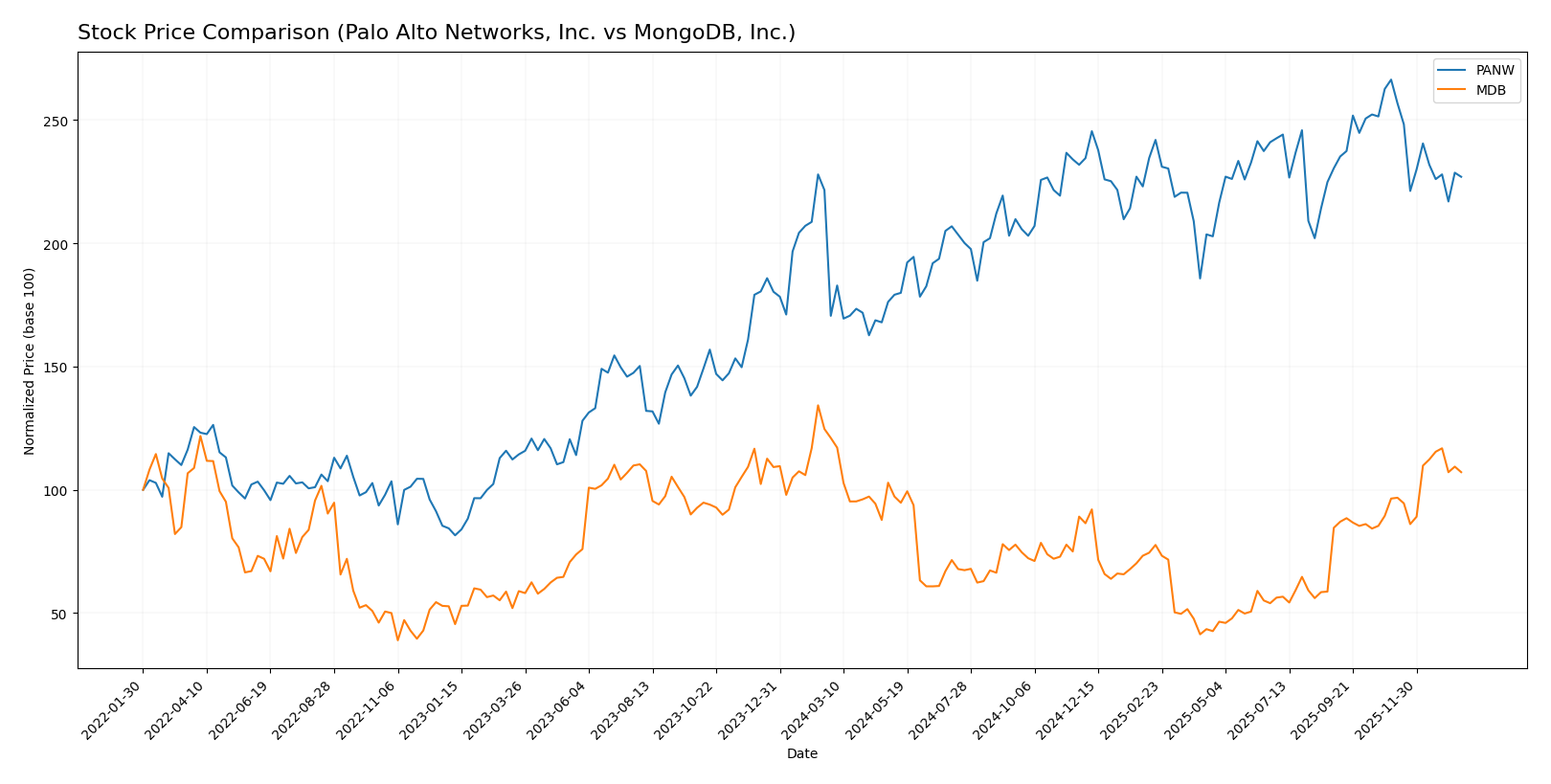

Stock Comparison

The stock price movements of Palo Alto Networks, Inc. and MongoDB, Inc. over the past 12 months reveal contrasting trends, with Palo Alto Networks showing a significant overall gain despite recent weakness, while MongoDB experiences an overall decline but recent recovery in buyer dominance.

Trend Analysis

Palo Alto Networks, Inc. posted a 33.05% increase over the past year, indicating a bullish trend with decelerating price acceleration. The stock ranged from a low of 134.51 to a high of 220.24, showing moderate volatility with a 19.95 standard deviation.

MongoDB, Inc. declined by 11.46% over the same period, marking a bearish trend with accelerating movement. It exhibited higher volatility, with a 72.49 standard deviation and prices fluctuating between 154.39 and 451.52.

Comparatively, Palo Alto Networks delivered the strongest market performance overall, despite recent short-term weakness, whereas MongoDB showed recent bullish momentum after a longer-term decline.

Target Prices

The current analyst consensus reflects optimistic target prices for both Palo Alto Networks, Inc. and MongoDB, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Palo Alto Networks, Inc. | 265 | 157 | 231.07 |

| MongoDB, Inc. | 500 | 375 | 445.2 |

Analysts expect Palo Alto Networks’ stock to appreciate significantly from its current price of $187.66, while MongoDB’s consensus target price suggests potential upside from $399.76, signaling bullish sentiment for both.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Palo Alto Networks, Inc. (PANW) and MongoDB, Inc. (MDB):

Rating Comparison

PANW Rating

- Rating: B, considered Very Favorable.

- Discounted Cash Flow Score: 4, favorable evaluation indicating good valuation.

- ROE Score: 4, favorable, indicating efficient profit generation from equity.

- ROA Score: 3, moderate, showing average asset utilization effectiveness.

- Debt To Equity Score: 4, favorable, reflecting strong balance sheet position.

- Overall Score: 3, moderate overall financial standing.

MDB Rating

- Rating: C, considered Very Favorable.

- Discounted Cash Flow Score: 2, moderate evaluation suggesting less attractiveness.

- ROE Score: 1, very unfavorable, indicating poor profit efficiency from equity.

- ROA Score: 1, very unfavorable, showing weak asset utilization effectiveness.

- Debt To Equity Score: 4, favorable, reflecting strong balance sheet position.

- Overall Score: 2, moderate overall financial standing but lower than PANW.

Which one is the best rated?

Based strictly on the provided data, PANW holds a higher rating of B with favorable scores in discounted cash flow and return on equity compared to MDB’s C rating and weaker profitability metrics. Overall, PANW is better rated.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for each company:

Palo Alto Networks Scores

- Altman Z-Score: 5.95, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

MongoDB Scores

- Altman Z-Score: 30.24, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 4, classified as average financial strength.

Which company has the best scores?

Based on the provided data, MongoDB has a significantly higher Altman Z-Score, indicating stronger financial stability. However, Palo Alto Networks has a slightly better Piotroski Score, though both companies are rated average in this category.

Grades Comparison

Here is a detailed comparison of recent grades assigned to Palo Alto Networks, Inc. and MongoDB, Inc.:

Palo Alto Networks, Inc. Grades

This table summarizes recent analyst actions and grades for Palo Alto Networks, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2026-01-13 |

| Piper Sandler | Maintain | Overweight | 2026-01-05 |

| Guggenheim | Upgrade | Neutral | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-18 |

| Goldman Sachs | Maintain | Buy | 2025-11-21 |

| HSBC | Downgrade | Reduce | 2025-11-21 |

| Needham | Maintain | Buy | 2025-11-20 |

| WestPark Capital | Maintain | Hold | 2025-11-20 |

| Bernstein | Maintain | Outperform | 2025-11-20 |

| DA Davidson | Maintain | Buy | 2025-11-20 |

Palo Alto Networks shows a mix of Buy and Hold grades, with several upgrades and one downgrade, indicating a generally positive but cautious analyst stance.

MongoDB, Inc. Grades

This table summarizes recent analyst actions and grades for MongoDB, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Morgan Stanley | Maintain | Overweight | 2025-12-02 |

MongoDB has a consistent pattern of Buy and Outperform grades with no downgrades, reflecting strong analyst confidence.

Which company has the best grades?

MongoDB, Inc. has received consistently stronger grades, mainly Buy and Outperform, compared to Palo Alto Networks’ more mixed ratings including some Hold and Reduce actions. This suggests MongoDB may be viewed more favorably by analysts, which could influence investor confidence and portfolio decisions.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Palo Alto Networks, Inc. (PANW) and MongoDB, Inc. (MDB) based on recent financial and operational data.

| Criterion | Palo Alto Networks, Inc. (PANW) | MongoDB, Inc. (MDB) |

|---|---|---|

| Diversification | Strong subscription and support revenue streams; diversified product portfolio in cybersecurity | Revenue concentrated in MongoDB Atlas and subscription services; less diversified product base |

| Profitability | Positive net margin (12.3%) and ROIC (5.67%), though ROIC below WACC; improving profitability trend | Negative net margin (-6.43%) and ROIC (-7.36%); losses persist but ROIC is improving |

| Innovation | High fixed asset turnover (12.56) indicating efficient asset use; significant R&D investment in cybersecurity | High fixed asset turnover (24.78), reflecting asset efficiency; strong cloud database innovation focus |

| Global presence | Large global footprint with steady revenue growth in subscription and support segments | Growing global adoption of cloud database services; expanding customer base internationally |

| Market Share | Leading cybersecurity market player with expanding subscription base | Strong presence in cloud database market, but facing intense competition |

Key takeaways: Palo Alto Networks shows solid diversification and improving profitability despite current value destruction, supporting a cautious but optimistic outlook. MongoDB demonstrates strong innovation and expansion potential but continues to face profitability challenges, warranting careful risk consideration.

Risk Analysis

Below is a table summarizing key risks for Palo Alto Networks, Inc. (PANW) and MongoDB, Inc. (MDB) based on their most recent financial and market data for 2025.

| Metric | Palo Alto Networks, Inc. (PANW) | MongoDB, Inc. (MDB) |

|---|---|---|

| Market Risk | Moderate, beta 0.75 indicates lower volatility compared to the market | Higher risk, beta 1.38 shows greater price sensitivity |

| Debt level | Very low debt (D/E 0.04), strong interest coverage (532.53) | Very low debt (D/E 0.01), but negative interest coverage |

| Regulatory Risk | Moderate, cybersecurity industry faces evolving regulations | Moderate, database software subject to data privacy rules |

| Operational Risk | Moderate, depends on continual innovation and cloud security demand | Moderate to high, reliant on cloud adoption and service reliability |

| Environmental Risk | Low, primarily software with limited environmental footprint | Low, software company with minimal direct environmental impact |

| Geopolitical Risk | Moderate, global operations and government contracts exposure | Moderate, global cloud services affected by geopolitical tensions |

The most impactful risks are market volatility for MongoDB due to its higher beta and operational risks tied to cloud service reliability for both companies. Palo Alto Networks’ strong debt management and interest coverage reduce financial risk substantially. However, both face regulatory pressures in fast-evolving technology sectors requiring close monitoring.

Which Stock to Choose?

Palo Alto Networks, Inc. (PANW) shows strong income growth with a favorable 14.87% revenue increase in 2025 and a solid 12.3% net margin. Its financial ratios are slightly favorable overall, supported by low debt levels and a very favorable rating of B. Despite a slightly unfavorable MOAT indicating value destruction, the trend in profitability is improving.

MongoDB, Inc. (MDB) reports a favorable revenue growth of 19.22% in 2025 but suffers from negative net margin (-6.43%) and profitability ratios, resulting in an unfavorable global ratios opinion. It maintains low debt and a very favorable rating of C, yet its MOAT is also slightly unfavorable with ongoing value destruction, albeit with improving profitability.

Investors focused on growth might find PANW’s improving profitability and favorable rating more appealing, while those tolerant of higher risk could interpret MDB’s robust revenue growth and low debt as potential for future recovery despite current profitability challenges. Both companies show increasing ROIC trends but currently destroy value, suggesting cautious evaluation aligned with individual risk profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Palo Alto Networks, Inc. and MongoDB, Inc. to enhance your investment decisions: