Home > Comparison > Technology > PLTR vs MDB

The strategic rivalry between Palantir Technologies Inc. and MongoDB, Inc. shapes the evolution of the software infrastructure sector. Palantir operates as a data integration and analytics platform with a strong government focus, while MongoDB specializes in scalable, cloud-based database solutions for enterprises. This analysis explores their differing operational models and investment merits to identify which stock offers superior risk-adjusted returns for diversified portfolios in an increasingly data-driven economy.

Table of contents

Companies Overview

Palantir Technologies Inc. and MongoDB, Inc. are pivotal players in the software infrastructure landscape, shaping data solutions globally.

Palantir Technologies Inc.: Data Integration Powerhouse

Palantir leads in software platforms for intelligence and operational data integration. Its revenue stems from Palantir Gotham and Foundry, which enable pattern recognition and operational planning in complex datasets. In 2026, Palantir emphasizes expanding its AI platform and cloud-agnostic deployment, enhancing its edge in government and commercial sectors.

MongoDB, Inc.: Flexible Database Innovator

MongoDB commands attention with its general purpose database platform, serving cloud, hybrid, and on-premise needs. Core revenue comes from MongoDB Enterprise Advanced and Atlas, its multi-cloud database-as-a-service. The company’s 2026 focus is on broadening enterprise adoption and professional services to support development and migration efforts worldwide.

Strategic Collision: Similarities & Divergences

Both operate in software infrastructure but diverge sharply: Palantir offers a closed ecosystem tailored for analytic intelligence, while MongoDB champions an open, flexible database framework. Their primary battleground is enterprise data management and cloud integration. Palantir’s complex AI-driven analytics contrasts with MongoDB’s developer-centric platform, defining distinct investment profiles rooted in specialized growth strategies.

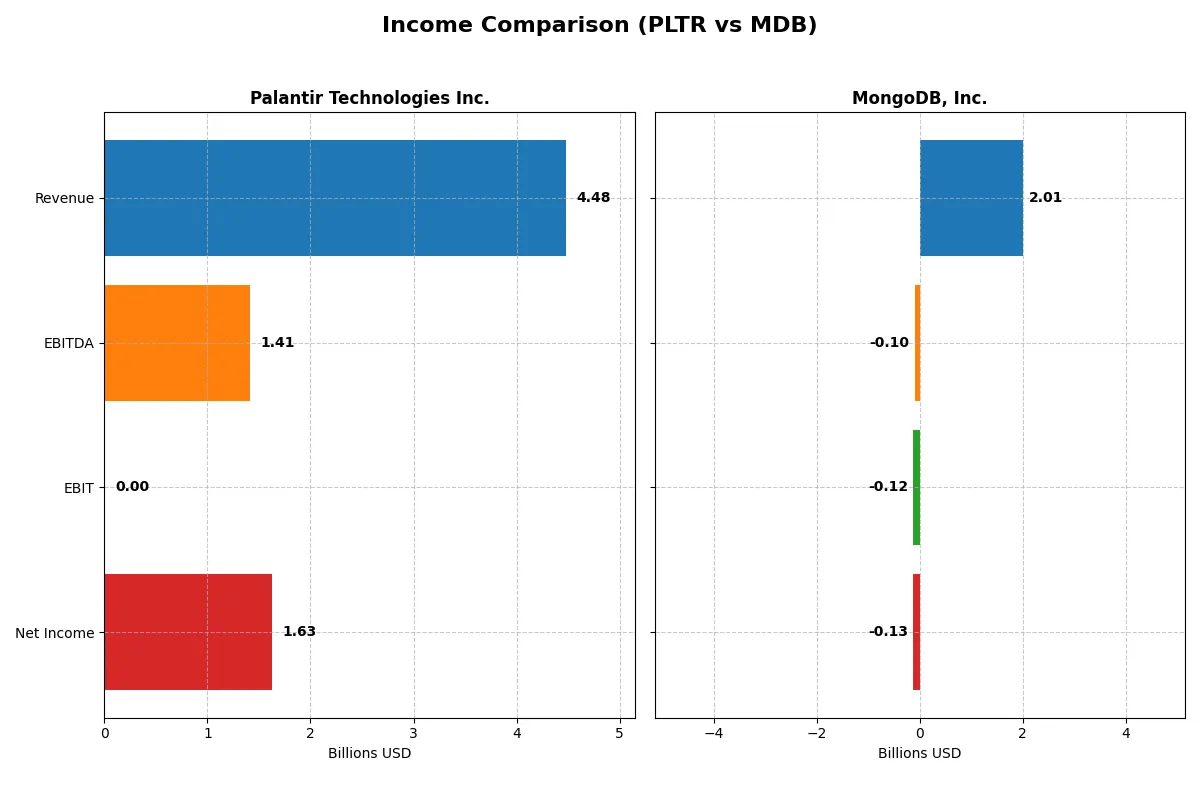

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Palantir Technologies Inc. (PLTR) | MongoDB, Inc. (MDB) |

|---|---|---|

| Revenue | 4.48B | 2.01B |

| Cost of Revenue | 789M | 535M |

| Operating Expenses | 2.27B | 1.69B |

| Gross Profit | 3.69B | 1.47B |

| EBITDA | 1.41B | -97M |

| EBIT | 0 | -124M |

| Interest Expense | 0 | 8M |

| Net Income | 1.63B | -129M |

| EPS | 0.69 | -1.73 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company runs a more efficient and profitable business engine in the current market environment.

Palantir Technologies Inc. Analysis

Palantir’s revenue surged from 1.54B in 2021 to 4.48B in 2025, showcasing a strong growth trajectory. Net income reversed losses to reach 1.63B in 2025, driving a robust net margin of 36.3%. Its gross margin stands at a healthy 82.4%, reflecting excellent cost control. Despite zero EBIT margin, Palantir’s momentum is clear with rapid margin expansion and profitability gains.

MongoDB, Inc. Analysis

MongoDB grew revenue steadily from 590M in 2021 to 2.01B in 2025, a solid but slower pace than Palantir. Net income remains negative at -129M in 2025, with a net margin of -6.4%. Its gross margin of 73.3% is decent but lower than Palantir’s. MongoDB shows improving EBIT and net margin trends, yet still operates at a loss, indicating ongoing investment in growth over immediate profitability.

Margin Strength vs. Growth Investment

Palantir clearly outperforms with superior profitability and margin strength, turning losses into substantial net income. MongoDB delivers steady revenue growth but struggles to achieve positive earnings. For investors prioritizing near-term profitability and margin efficiency, Palantir’s profile appears more compelling than MongoDB’s growth-focused but unprofitable model.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose underlying fiscal health, valuation premiums, and capital efficiency for the companies compared below:

| Ratios | Palantir Technologies Inc. (PLTR) | MongoDB, Inc. (MDB) |

|---|---|---|

| ROE | 9.2% | -4.6% |

| ROIC | 5.5% | -7.4% |

| P/E | 368.2 | -157.9 |

| P/B | 34.0 | 7.3 |

| Current Ratio | 5.96 | 5.20 |

| Quick Ratio | 5.96 | 5.20 |

| D/E | 0.048 | 0.013 |

| Debt-to-Assets | 3.8% | 1.1% |

| Interest Coverage | 0 | -26.7 |

| Asset Turnover | 0.45 | 0.58 |

| Fixed Asset Turnover | 11.9 | 24.8 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, unveiling hidden risks and operational strengths that drive shareholder value and market perception.

Palantir Technologies Inc.

Palantir posts a moderate ROE of 9.24% with a strong net margin at 16.13%, signaling operational efficiency. However, its valuation appears stretched, trading at a P/E of 368.2 and P/B of 34.01. The company reinvests heavily in R&D rather than paying dividends, supporting growth but limiting immediate shareholder returns.

MongoDB, Inc.

MongoDB suffers negative profitability metrics including a -4.64% ROE and -6.43% net margin, reflecting operational challenges. Its P/E ratio is negative but skewed favorably due to losses, while the P/B at 7.32 remains high. Like Palantir, MongoDB offers no dividends, focusing on capital reinvestment for future growth.

Premium Valuation vs. Operational Struggles

Palantir’s high valuation contrasts with MongoDB’s profitability headwinds and unfavorable ratios. Palantir offers efficiency and growth reinvestment, while MongoDB struggles with returns despite a lower valuation. Investors seeking operational resilience might prefer Palantir; those tolerating risk for turnaround potential may consider MongoDB.

Which one offers the Superior Shareholder Reward?

Palantir Technologies Inc. (PLTR) and MongoDB, Inc. (MDB) both forgo dividends, reinvesting heavily in growth and R&D. PLTR maintains a robust free cash flow per share of $0.51 and a negligible dividend payout, supporting a modest buyback program. MDB, while also sans dividends, shows stronger free cash flow at $1.62 per share but exhibits higher financial leverage and volatility. MDB’s buyback intensity is limited by its elevated debt ratios, undermining sustainability. Historically, PLTR’s conservative capital allocation and high current ratio (5.96) suggest a more stable buyback capacity. I conclude PLTR offers a more sustainable shareholder return profile in 2026, balancing reinvestment with prudent buybacks.

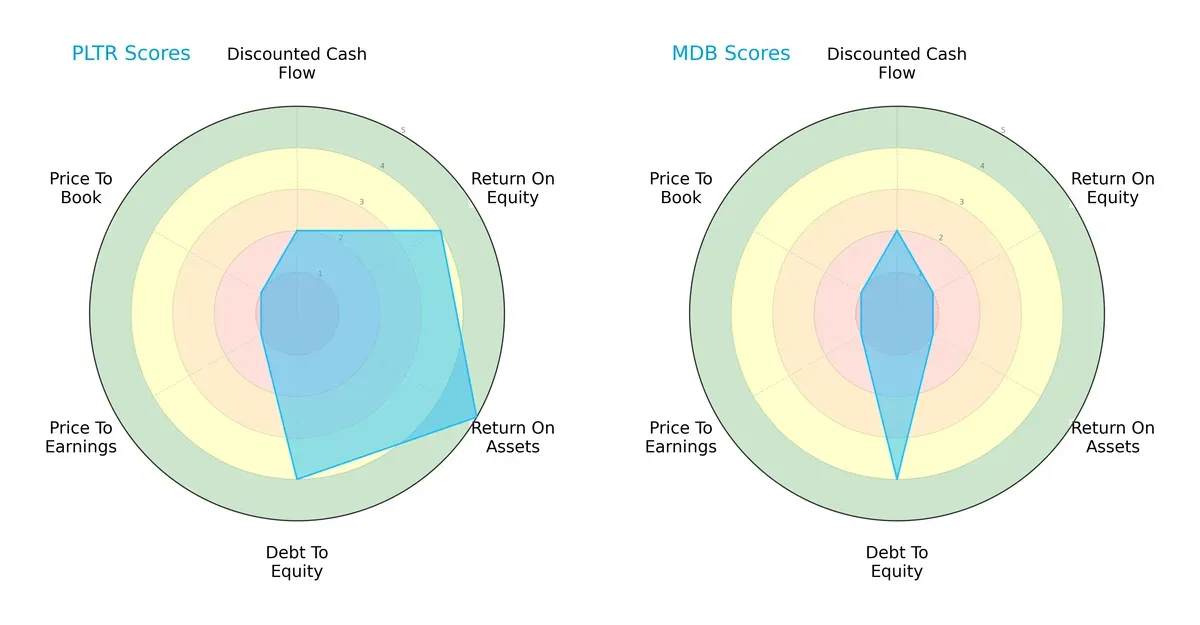

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Palantir Technologies Inc. and MongoDB, Inc., highlighting their financial strengths and valuation challenges:

Palantir shows a more balanced profile with strong ROE (4) and ROA (5) scores, indicating efficient profit and asset use. Both firms share moderate DCF scores (2) and favorable debt-to-equity ratings (4), signaling disciplined leverage. MongoDB relies heavily on its solid balance sheet but struggles with low profitability scores (ROE and ROA at 1). Valuation metrics (P/E and P/B) are weak for both, suggesting market skepticism or growth concerns.

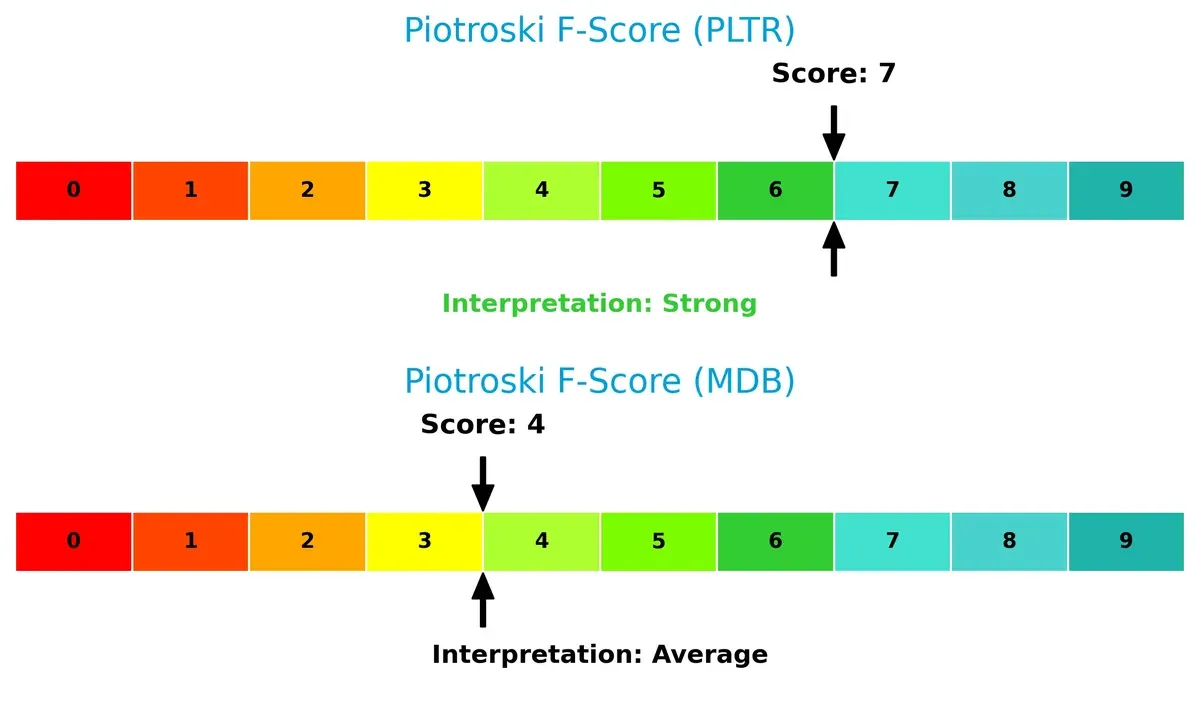

Bankruptcy Risk: Solvency Showdown

Palantir’s Altman Z-Score of 145.6 vastly exceeds MongoDB’s 30.2, placing both firmly in the safe zone but underscoring Palantir’s superior financial resilience for long-term survival in this cycle:

Financial Health: Quality of Operations

Palantir’s Piotroski F-Score of 7 signals strong financial health and operational quality, while MongoDB’s score of 4 suggests average health with potential red flags in internal metrics:

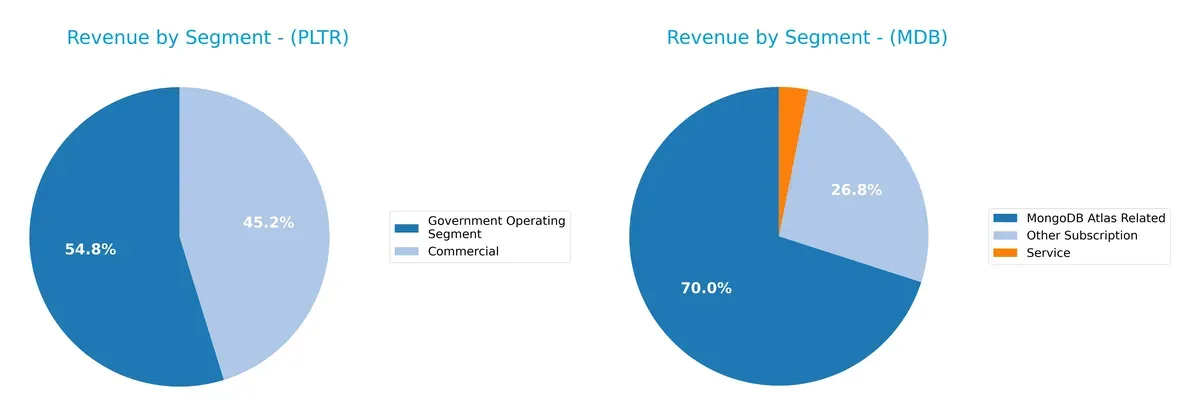

How are the two companies positioned?

This section dissects the operational DNA of Palantir and MongoDB by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to identify which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Palantir Technologies and MongoDB diversify their income streams and where their primary sector bets lie:

Palantir anchors its revenue in two segments: $1.57B government and $1.30B commercial in 2024, showing moderate diversification. MongoDB pivots heavily on $1.40B MongoDB Atlas, complemented by $539M other subscriptions and $63M services, reflecting a more varied SaaS ecosystem. Palantir’s government focus signals infrastructure dominance but carries concentration risk. MongoDB’s broader mix underpins stronger resilience and lock-in within cloud-based data services.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Palantir Technologies Inc. and MongoDB, Inc.:

PLTR Strengths

- Diverse revenue from Commercial and Government segments

- Strong net margin at 16.13%

- Low debt-to-assets at 3.77%

- Favorable fixed asset turnover at 11.92

- High quick ratio indicating liquidity

MDB Strengths

- Growing subscription revenue stream

- Favorable quick ratio at 5.2

- Very low debt-to-assets at 1.06%

- High fixed asset turnover at 24.78

- Favorable P/E reflecting market expectations

PLTR Weaknesses

- Unfavorable ROE at 9.24%

- Unfavorable high P/E at 368.2

- Unavailable WACC data

- Unfavorable interest coverage at 0

- Moderate asset turnover at 0.45

- Unfavorable current ratio despite liquidity

MDB Weaknesses

- Negative net margin and ROE (-6.43%, -4.64%)

- Negative ROIC (-7.36%) below WACC (10.36%)

- Unfavorable interest coverage at -15.26

- Unfavorable PB ratio at 7.32

- Unfavorable current ratio at 5.2

Palantir maintains strong profitability and prudent leverage but faces valuation and operational efficiency challenges. MongoDB shows significant operational losses and coverage issues despite solid asset management and low leverage. Both companies exhibit strengths in liquidity and asset turnover, crucial for scaling their business models.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable barrier protecting long-term profits from relentless competitive erosion in tech infrastructure firms:

Palantir Technologies Inc.: Data Integration & Defense Moat

Palantir’s competitive edge stems from its high switching costs and deep government ties. Its 36% net margin proves margin stability. Expansion into AI platforms in 2026 may deepen this moat.

MongoDB, Inc.: Developer Adoption & Cloud Platform Moat

MongoDB leverages broad developer adoption and cloud flexibility, contrasting Palantir’s government focus. Despite negative ROIC vs. WACC, revenue growth signals rising market traction and potential cloud market disruption.

Switching Costs vs. Developer Ecosystem: The Moat Showdown

Palantir’s wider moat rests on entrenched government contracts and high switching costs. MongoDB’s growing developer base builds a promising but narrower moat. Palantir is better positioned to defend its market share long term.

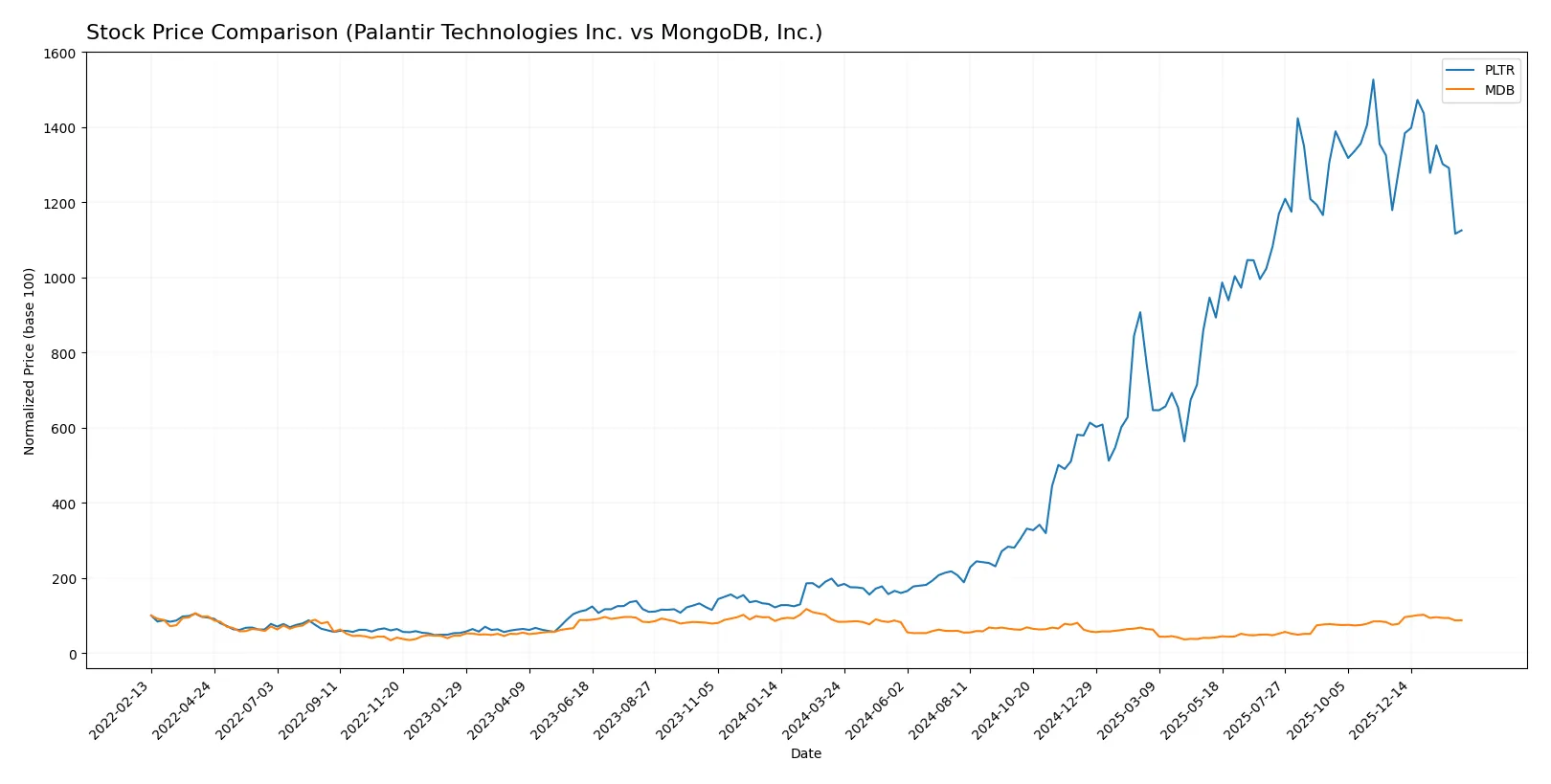

Which stock offers better returns?

The past year shows divergent dynamics between Palantir Technologies and MongoDB, with Palantir’s price surging overall but recently slipping, while MongoDB’s gains accelerate steadily.

Trend Comparison

Palantir’s 12-month price rose 529.03%, marking a strong bullish trend with deceleration. The stock peaked at 200.47 and bottomed at 20.47, with recent minor decline of -4.58%.

MongoDB gained 4.85% over the same 12 months, showing a bullish accelerating trend. Its price ranged between 154.39 and 435.85, with recent 16.03% rise confirming positive momentum.

Palantir’s overall return far exceeds MongoDB’s, but MongoDB’s recent acceleration contrasts with Palantir’s recent slight decline in market performance.

Target Prices

Analysts maintain optimistic target prices for Palantir Technologies Inc. and MongoDB, Inc., reflecting strong growth expectations.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Palantir Technologies Inc. | 160 | 223 | 199.08 |

| MongoDB, Inc. | 375 | 500 | 445.2 |

The consensus targets imply upside potential of roughly 35% for Palantir and 20% for MongoDB versus current prices, signaling confidence in their software infrastructure franchises.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Palantir Technologies Inc. Grades

The latest grades from major institutions for Palantir Technologies Inc. are summarized below.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Buy | Buy | 2026-01-12 |

| Goldman Sachs | Maintain | Neutral | 2025-11-04 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

| Piper Sandler | Maintain | Overweight | 2025-11-04 |

| DA Davidson | Maintain | Neutral | 2025-11-04 |

| B of A Securities | Maintain | Buy | 2025-11-04 |

| Baird | Maintain | Neutral | 2025-11-04 |

| RBC Capital | Maintain | Underperform | 2025-11-04 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-11-04 |

| UBS | Maintain | Neutral | 2025-11-04 |

MongoDB, Inc. Grades

Below is a selection of recent institutional grades for MongoDB, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2026-01-20 |

| Needham | Maintain | Buy | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Mizuho | Maintain | Neutral | 2025-12-02 |

Which company has the best grades?

MongoDB, Inc. consistently receives strong buy and outperform ratings, indicating high analyst confidence. Palantir shows a more mixed profile with several neutral and underperform grades. This divergence may influence investor sentiment and portfolio weighting.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing Palantir Technologies Inc. and MongoDB, Inc. in the 2026 market environment:

1. Market & Competition

Palantir Technologies Inc.

- Operates in a highly specialized defense and intelligence software niche with strong government ties, but faces growing commercial sector competition.

MongoDB, Inc.

- Competes broadly in the cloud database market, facing intense pressure from larger cloud providers and open-source alternatives.

2. Capital Structure & Debt

Palantir Technologies Inc.

- Low debt-to-equity ratio (0.05) and low debt-to-assets (3.77%), reflecting conservative leverage and financial stability.

MongoDB, Inc.

- Exceptionally low debt levels (debt-to-equity 0.01, debt-to-assets 1.06%) but negative interest coverage signals operational losses impacting debt servicing.

3. Stock Volatility

Palantir Technologies Inc.

- Beta of 1.687 indicates higher volatility than the market, with a wide trading range (66.12-207.52), increasing investor risk.

MongoDB, Inc.

- Slightly lower beta at 1.381 but still volatile, with a broad price range (140.78-444.72) reflecting market sensitivity.

4. Regulatory & Legal

Palantir Technologies Inc.

- Heavy reliance on government contracts exposes it to regulatory scrutiny and potential geopolitical policy shifts.

MongoDB, Inc.

- Faces compliance risks in global cloud data regulations and privacy laws, which can affect service offerings and market access.

5. Supply Chain & Operations

Palantir Technologies Inc.

- Highly software-centric model limits physical supply chain risks but depends on reliable cloud infrastructure partners.

MongoDB, Inc.

- Cloud service dependencies and hybrid deployment models introduce operational risks tied to third-party infrastructure stability.

6. ESG & Climate Transition

Palantir Technologies Inc.

- ESG risks stem mainly from data privacy and ethical concerns around intelligence software applications.

MongoDB, Inc.

- Faces ESG pressures related to energy consumption of cloud infrastructure and commitments to sustainable operations.

7. Geopolitical Exposure

Palantir Technologies Inc.

- Significant geopolitical risk due to government and defense sector focus, especially amid U.S. and allied relations.

MongoDB, Inc.

- Moderate geopolitical exposure through global cloud operations but less sensitive to defense-related geopolitical shifts.

Which company shows a better risk-adjusted profile?

Palantir’s biggest risk is geopolitical and regulatory dependence on government contracts, exposing it to policy volatility. MongoDB’s core risk lies in persistent operating losses and negative returns on capital, undermining financial stability despite low debt. Palantir presents a better risk-adjusted profile, supported by a strong Altman Z-score (145.6) and a robust Piotroski score (7), signaling financial resilience. MongoDB’s weaker Piotroski score (4) and unfavorable profitability metrics elevate its risk profile. Palantir’s stable leverage and favorable operational metrics justify a more cautious but optimistic stance in volatile markets.

Final Verdict: Which stock to choose?

Palantir Technologies Inc. wields unmatched efficiency in transforming data into actionable intelligence, driving its rapid revenue and net income growth. Its superpower lies in robust working capital management and an impressive Altman Z-score signaling financial safety. The main point of vigilance remains its sky-high valuation multiples, which could pressure returns. This profile suits aggressive growth investors comfortable with premium pricing.

MongoDB, Inc. commands a strategic moat through its cloud-native database platform, securing recurring revenue and accelerating profitability trends. Though its ROIC lags behind Palantir’s and it shows some value destruction, its improving ROIC trend and solid balance sheet suggest growing operational strength. It offers better stability relative to Palantir’s valuation stretch, fitting GARP-focused portfolios seeking growth with moderated risk.

If you prioritize rapid expansion fueled by operational efficiency and can tolerate valuation premium, Palantir is the compelling choice due to its accelerating profitability and strong financial health. However, if you seek a more balanced growth-at-a-reasonable-price profile with a defensible cloud moat and improving returns, MongoDB offers better stability and a clearer path to sustainable value creation.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Palantir Technologies Inc. and MongoDB, Inc. to enhance your investment decisions: