MongoDB, Inc. and Okta, Inc. are two prominent players in the software infrastructure sector, each driving innovation in database management and identity security, respectively. Both companies serve a broad range of enterprise clients, reflecting overlapping markets in cloud-based solutions. This comparison aims to clarify which firm presents a more compelling investment opportunity in today’s evolving tech landscape. Let’s explore their strengths to help you make an informed decision.

Table of contents

Companies Overview

I will begin the comparison between MongoDB and Okta by providing an overview of these two companies and their main differences.

MongoDB Overview

MongoDB, Inc. operates as a general-purpose database platform, offering solutions like MongoDB Enterprise Advanced for enterprise environments, MongoDB Atlas as a multi-cloud database service, and a free Community Server for developers. Founded in 2007 and headquartered in New York City, MongoDB focuses on providing flexible database management across cloud, on-premise, and hybrid setups, positioning itself strongly within the software infrastructure industry.

Okta Overview

Okta, Inc. specializes in identity solutions, delivering a comprehensive platform called Okta Identity Cloud that supports user and device profile management, single sign-on, multi-factor authentication, and API access management. Established in 2009 and based in San Francisco, Okta caters to enterprises, SMBs, government, and non-profits worldwide, emphasizing secure identity and access management within the software infrastructure sector.

Key similarities and differences

Both MongoDB and Okta operate in the software infrastructure industry, targeting enterprise customers with cloud-based solutions. While MongoDB focuses on database management platforms suitable for diverse deployment environments, Okta concentrates on identity and access management services, aiming to secure user authentication and authorization. They share a SaaS-oriented approach but address distinct aspects of enterprise software infrastructure.

Income Statement Comparison

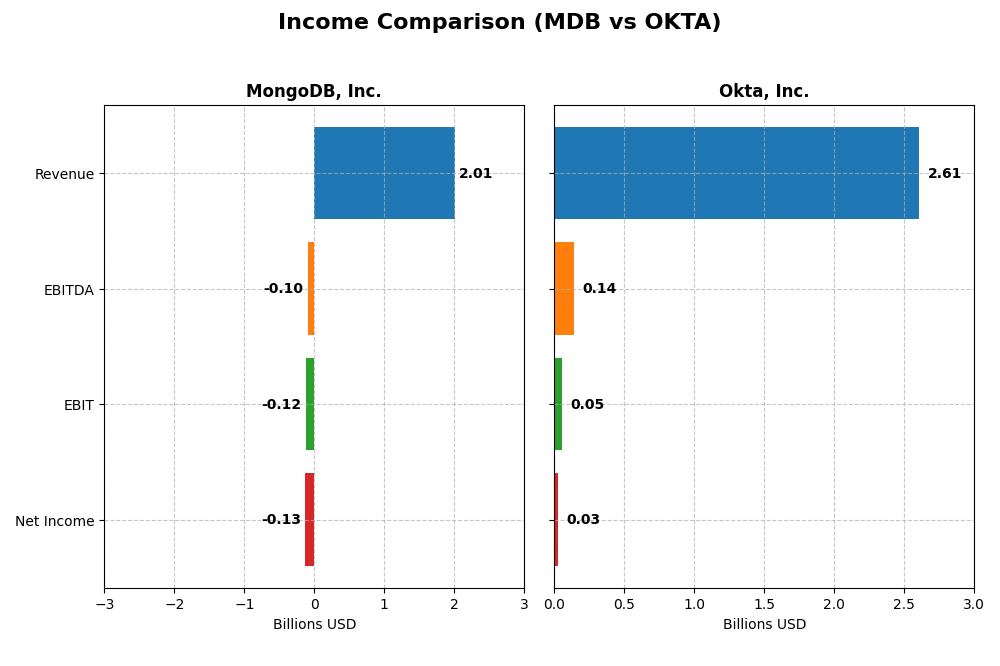

This table compares key income statement metrics for MongoDB, Inc. and Okta, Inc. for the most recent fiscal year, highlighting their financial performance in 2025.

| Metric | MongoDB, Inc. (MDB) | Okta, Inc. (OKTA) |

|---|---|---|

| Market Cap | 32.5B | 15.2B |

| Revenue | 2.01B | 2.61B |

| EBITDA | -96.5M | 139M |

| EBIT | -123.5M | 51M |

| Net Income | -129.1M | 28M |

| EPS | -1.73 | 0.17 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

MongoDB, Inc.

MongoDB’s revenue showed a strong upward trend, increasing from $590M in 2021 to $2.01B in 2025, reflecting a 240% growth over five years. Despite consistent negative net income, losses narrowed from -$267M in 2021 to -$129M in 2025. Gross margins remained favorable at 73.3% in 2025, though EBIT and net margins stayed negative. The latest year saw improved revenue growth (19.2%) and better net margin performance.

Okta, Inc.

Okta’s revenue grew steadily from $835M in 2021 to $2.61B in 2025, a 213% increase over the period. Net income turned positive in 2025 with $28M after several years of losses, aided by improved margins. Gross margin was strong at 76.3% in 2025, while EBIT margin shifted to a neutral 1.95%. The recent fiscal year showed solid revenue growth (15.3%) and significant net margin improvement, reversing prior negative trends.

Which one has the stronger fundamentals?

Both companies demonstrate favorable overall income statement evaluations with robust revenue growth and improving margins. MongoDB excels in gross margin and growth rates but struggles with persistent net losses. Okta shows a recent transition to profitability and neutral EBIT margins, indicating stronger bottom-line fundamentals. The choice depends on weighing MongoDB’s growth potential against Okta’s improved profitability trajectory.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for MongoDB, Inc. and Okta, Inc. based on their most recent fiscal year data (2025).

| Ratios | MongoDB, Inc. (MDB) | Okta, Inc. (OKTA) |

|---|---|---|

| ROE | -4.64% | 0.44% |

| ROIC | -7.36% | -0.61% |

| P/E | -157.9 | 570.6 |

| P/B | 7.32 | 2.49 |

| Current Ratio | 5.20 | 1.35 |

| Quick Ratio | 5.20 | 1.35 |

| D/E | 0.013 | 0.149 |

| Debt-to-Assets | 1.06% | 10.09% |

| Interest Coverage | -26.7 | -14.8 |

| Asset Turnover | 0.58 | 0.28 |

| Fixed Asset Turnover | 24.78 | 22.31 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

MongoDB, Inc.

MongoDB displays several unfavorable ratios, including negative net margin (-6.43%), return on equity (-4.64%), and return on invested capital (-7.36%). Its high current ratio (5.2) is flagged as unfavorable, while quick ratio is favorable at 5.2. Debt levels are low and favorable, but interest coverage is negative, raising concerns. The company does not pay dividends, likely due to ongoing reinvestment and growth strategies.

Okta, Inc.

Okta shows a mixed picture with unfavorable net margin (1.07%) and return on capital ratios, though its weighted average cost of capital (7.18%) and interest coverage (10.2) are favorable. The company maintains moderate leverage and liquidity ratios, with a neutral price-to-book ratio. Okta does not pay dividends, reflecting a focus on reinvestment and expanding its business footprint.

Which one has the best ratios?

Okta exhibits a more balanced ratio profile, with a higher proportion of favorable ratios (42.86%) and fewer unfavorable ones compared to MongoDB, whose ratios are predominantly unfavorable (57.14%). Okta’s neutral global ratios opinion contrasts with MongoDB’s unfavorable standing, suggesting relatively stronger financial health in Okta’s metrics.

Strategic Positioning

This section compares the strategic positioning of MongoDB, Inc. and Okta, Inc. in terms of Market position, Key segments, and Exposure to technological disruption:

MongoDB, Inc.

- Market leader in general purpose database platforms, facing competitive pressure in cloud and on-premises markets.

- Key segments include MongoDB Atlas multi-cloud DBaaS, enterprise subscriptions, and professional services driving revenue growth.

- Exposed to cloud database innovation disruption; leverages cloud, hybrid, and on-premise deployment flexibility to adapt.

Okta, Inc.

- Provides identity solutions with broad client base including enterprises and government, facing competitive identity management market.

- Focuses on subscription-based identity cloud services and Auth0 products targeting security and access management.

- Subject to fast-changing identity security tech; offers adaptive authentication and cloud-to-on-premise integration capabilities.

MongoDB, Inc. vs Okta, Inc. Positioning

MongoDB pursues a diversified model with multiple database offerings and service lines, while Okta concentrates on identity and access management solutions. MongoDB’s broad platform contrasts with Okta’s specialized security focus, each presenting unique growth drivers and market challenges.

Which has the best competitive advantage?

Both companies show slightly unfavorable MOAT status with growing ROIC trends but currently shed value. Okta’s higher ROIC growth suggests improving efficiency, yet neither shows a definitive sustainable competitive advantage based on current capital returns.

Stock Comparison

The stock price movements over the past 12 months reveal distinct trading dynamics, with MongoDB, Inc. exhibiting a bearish trend marked by acceleration and high volatility, while Okta, Inc. shows a bullish trend with moderate volatility and accelerating momentum.

Trend Analysis

MongoDB, Inc.’s stock price declined by 11.46% over the past year, indicating a bearish trend with acceleration and significant volatility (std deviation 72.49). The stock ranged between $154.39 and $451.52, with recent upward momentum reversing part of the loss.

Okta, Inc.’s stock price increased by 7.58% over the same period, reflecting a bullish trend with accelerating gains and lower volatility (std deviation 11.38). The stock traded between $72.24 and $127.30, though recent price movement shows a slight retracement.

Comparing both, Okta, Inc. has delivered the highest market performance over the past year, with a positive price change contrasting MongoDB’s overall decline despite recent rebounds.

Target Prices

The consensus target prices for MongoDB, Inc. and Okta, Inc. reflect optimistic analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MongoDB, Inc. | 500 | 375 | 445.2 |

| Okta, Inc. | 140 | 60 | 110.67 |

Analysts expect MongoDB’s stock to appreciate from the current price of $399.76 toward a $445 consensus, while Okta’s target consensus of $110.67 suggests potential upside from $89.55.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for MongoDB, Inc. and Okta, Inc.:

Rating Comparison

MDB Rating

- Rating: C, indicating a very favorable status overall.

- Discounted Cash Flow Score: 2, assessed as moderate, reflecting average valuation based on cash flows.

- ROE Score: 1, very unfavorable, indicating weak profit generation from equity.

- ROA Score: 1, very unfavorable, suggesting poor asset utilization for earnings.

- Debt To Equity Score: 4, favorable, showing strong balance sheet with low financial risk.

- Overall Score: 2, moderate, summarizing an average financial standing.

OKTA Rating

- Rating: B, indicating a very favorable status overall.

- Discounted Cash Flow Score: 4, favorable, suggesting better undervaluation or future cash flow outlook.

- ROE Score: 2, moderate, showing more efficient profit generation from shareholders’ equity.

- ROA Score: 3, moderate, reflecting better effectiveness in using assets to generate profits.

- Debt To Equity Score: 4, favorable, also indicating strong financial stability with manageable debt.

- Overall Score: 3, moderate, representing a slightly stronger overall financial position than MDB.

Which one is the best rated?

Based strictly on the provided data, Okta holds a higher overall rating (B vs. C) and scores better in discounted cash flow, ROE, and ROA metrics, while both have equally favorable debt-to-equity scores. Okta is thus better rated overall.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for MongoDB and Okta:

MDB Scores

- Altman Z-Score of 30.24 indicates a very safe zone, extremely low bankruptcy risk.

- Piotroski Score of 4 shows average financial strength and moderate investment quality.

OKTA Scores

- Altman Z-Score of 4.15 places Okta in the safe zone, low bankruptcy risk.

- Piotroski Score of 8 reflects very strong financial health and strong investment potential.

Which company has the best scores?

Okta has a lower but still safe Altman Z-Score and a much higher Piotroski Score, indicating stronger financial health compared to MongoDB, which has an exceptionally high Altman Z-Score but only average Piotroski results.

Grades Comparison

Here is the comparison of recent grades and ratings for MongoDB, Inc. and Okta, Inc.:

MongoDB, Inc. Grades

This table summarizes the latest grades from recognized financial institutions for MongoDB, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| Needham | Maintain | Buy | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-07 |

| Needham | Maintain | Buy | 2026-01-06 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Argus Research | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-03 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-02 |

| Piper Sandler | Maintain | Overweight | 2025-12-02 |

MongoDB’s grades consistently show a positive outlook with multiple Buy and Overweight ratings maintained across several reputable firms.

Okta, Inc. Grades

This table summarizes the latest grades from recognized financial institutions for Okta, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stephens & Co. | Upgrade | Overweight | 2026-01-14 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Jefferies | Upgrade | Buy | 2025-12-16 |

| Needham | Maintain | Buy | 2025-12-12 |

| BTIG | Maintain | Buy | 2025-12-04 |

| Susquehanna | Maintain | Neutral | 2025-12-03 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-03 |

| Canaccord Genuity | Maintain | Buy | 2025-12-03 |

| Scotiabank | Maintain | Sector Perform | 2025-12-03 |

Okta’s grades indicate a generally positive sentiment with recent upgrades and a mixture of Buy, Overweight, and Neutral ratings.

Which company has the best grades?

Both MongoDB and Okta hold predominantly Buy and Overweight ratings from key institutions. MongoDB shows slightly more consistency in maintaining Buy ratings, while Okta has recent upgrades and a broader range of ratings including Neutral. These patterns suggest strong analyst confidence in both, potentially influencing investor perception and portfolio decisions.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for MongoDB, Inc. (MDB) and Okta, Inc. (OKTA) based on their latest financial and operational data.

| Criterion | MongoDB, Inc. (MDB) | Okta, Inc. (OKTA) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from MongoDB Atlas (1.4B) and other subscriptions (539M) | Moderate: Revenue primarily from subscriptions (2.56B) with minor technology services (54M) |

| Profitability | Weak: Negative net margin (-6.43%), ROIC -7.36%, value destroying but improving profitability | Weak: Slightly positive net margin (1.07%), ROIC -0.61%, also value destroying yet improving |

| Innovation | Strong: High growth in Atlas revenue indicates innovation success in cloud database services | Strong: Rapid growth in subscription revenue reflects innovation in identity management |

| Global presence | Good: Growing revenues indicate expanding market reach, especially in cloud services | Good: Solid global footprint with strong subscription growth across regions |

| Market Share | Growing: Atlas product shows significant market traction and adoption | Growing: Increasing subscription base suggests expanding market share in identity solutions |

Key takeaways: Both MDB and OKTA show strong innovation and growing market presence driven by subscription models. However, both companies are currently value destroyers with negative or weak profitability metrics, though their improving ROIC trends signal potential turnaround if operational efficiency continues to improve. Investors should weigh growth potential against current profitability challenges.

Risk Analysis

Below is a comparative table summarizing key risks for MongoDB, Inc. (MDB) and Okta, Inc. (OKTA) based on the most recent data from 2025.

| Metric | MongoDB, Inc. (MDB) | Okta, Inc. (OKTA) |

|---|---|---|

| Market Risk | High beta (1.38) indicates more volatility; stock price range wide (140.78-444.72) | Lower beta (0.76) suggests less volatility; price range narrower (75.05-127.57) |

| Debt level | Very low debt-to-assets (1.06%) and debt/equity (0.01) – low financial risk | Moderate debt-to-assets (10.09%) and debt/equity (0.15) – manageable financial risk |

| Regulatory Risk | Moderate; operates in cloud and database sectors with evolving compliance requirements | Moderate; identity/security software subject to data privacy and cybersecurity regulations |

| Operational Risk | Negative net margin (-6.43%) and unfavorable ROE (-4.64%) indicate profitability challenges | Slightly positive net margin (1.07%) but low ROE (0.44%); operational efficiency needs improvement |

| Environmental Risk | Low direct environmental impact typical for software sector | Low environmental footprint, but increased focus on sustainable IT might affect costs |

| Geopolitical Risk | US-based but global cloud infrastructure exposure could be affected by international tensions | Similar global exposure with reliance on international clients and cloud data centers |

The most likely and impactful risks revolve around operational profitability and market volatility. MongoDB faces higher volatility and weaker profitability metrics, despite very low debt, which increases financial caution. Okta shows more stable market risk and stronger financial health scores but still struggles with thin margins. Both companies must navigate regulatory and geopolitical pressures inherent in cloud and security software sectors.

Which Stock to Choose?

MongoDB, Inc. (MDB) shows a favorable income evolution with 19.22% revenue growth in 2025 and an overall positive income statement rating. However, its financial ratios are largely unfavorable, with negative profitability and some debt metrics positive, while the rating stands at a moderate level with a very favorable overall grade C.

Okta, Inc. (OKTA) presents steady income growth of 15.33% in 2025 and an overall favorable income statement rating. Its financial ratios are balanced with a neutral global opinion, supported by moderate profitability and manageable debt levels. The rating is moderate with a very favorable grade B, supported by strong Piotroski and safe Altman Z-Scores.

For investors focused on growth, MDB’s strong income growth and improving profitability might appear attractive despite unfavorable ratios. Conversely, risk-averse or quality-focused investors may find OKTA’s balanced ratios and stronger financial health indicators more suitable, reflecting a potentially more stable profile.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MongoDB, Inc. and Okta, Inc. to enhance your investment decisions: