Home > Comparison > Consumer Defensive > MDLZ vs KHC

The strategic rivalry between Mondelez International, Inc. and The Kraft Heinz Company drives competition in the consumer defensive sector. Mondelez operates as a global snack food confectioner with a broad, diversified brand portfolio. In contrast, Kraft Heinz focuses on packaged foods with a strong emphasis on condiments and dairy. This analysis evaluates their distinct operational models to identify which company offers a superior risk-adjusted return for a diversified portfolio.

Table of contents

Companies Overview

Mondelez International and The Kraft Heinz Company both wield significant influence in the global packaged foods market.

Mondelez International, Inc.: Global Snack Food Powerhouse

Mondelez dominates the snack food industry, generating revenue through biscuits, chocolates, gums, and powdered beverages. Its portfolio includes iconic brands like Oreo and Cadbury. In 2026, Mondelez focuses on expanding its multinational footprint and strengthening e-commerce channels to capture evolving consumer preferences.

The Kraft Heinz Company: Packaged Foods Veteran

Kraft Heinz stands as a major player in packaged foods, with products spanning condiments, dairy, meals, and beverages. Its revenue derives from direct sales and broad distribution networks across North America and internationally. The firm’s 2026 strategy emphasizes product innovation and channel diversification to sustain competitive relevance.

Strategic Collision: Similarities & Divergences

Both companies compete fiercely in the consumer defensive sector but adopt different philosophies. Mondelez invests heavily in global snack brands and digital sales, while Kraft Heinz maintains a diverse product range with emphasis on traditional grocery channels. Their primary battleground is market share in North America’s retail and e-commerce arenas. This strategic divide shapes their distinct risk and growth profiles.

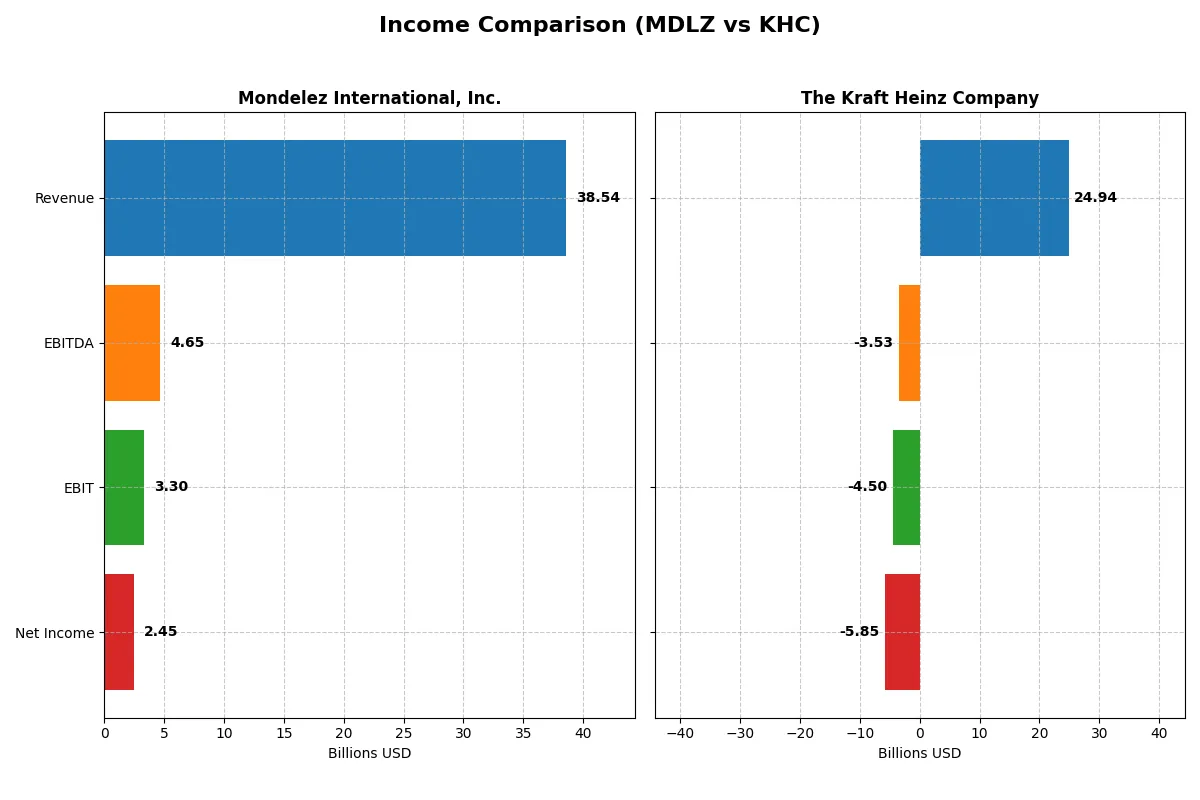

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Mondelez International, Inc. (MDLZ) | The Kraft Heinz Company (KHC) |

|---|---|---|

| Revenue | 38.5B | 24.9B |

| Cost of Revenue | 27.7B | 16.6B |

| Operating Expenses | 7.17B | 12.98B |

| Gross Profit | 10.8B | 8.31B |

| EBITDA | 4.65B | -3.53B |

| EBIT | 3.30B | -4.50B |

| Interest Expense | 0.28B | 0.95B |

| Net Income | 2.45B | -5.85B |

| EPS | 1.89 | -4.93 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates with greater efficiency and financial discipline over recent years.

Mondelez International, Inc. Analysis

Mondelez’s revenue climbed steadily from $28.7B in 2021 to $38.5B in 2025, signaling solid top-line growth. However, net income shrank from $4.3B to $2.5B, reflecting margin compression. Its 2025 gross margin of 28% remains favorable, but net margin declined to 6.4%, indicating weakening profitability despite stable operating expenses.

The Kraft Heinz Company Analysis

Kraft Heinz’s revenue declined from $26.0B in 2021 to $24.9B in 2025, showing top-line contraction. The company reported a stark net loss of $5.8B in 2025, a sharp reversal from modest profits earlier. Its 2025 gross margin of 33.3% is strong, yet the negative EBIT margin of -18% highlights severe operating inefficiencies and escalating expenses.

Margin Strength vs. Revenue Resilience

Mondelez delivers revenue growth with margin erosion, contrasting Kraft Heinz’s shrinking sales but significantly deteriorating profitability. Mondelez’s positive net income and controlled interest expense favor financial stability. Kraft Heinz faces a deeper crisis with heavy losses and poor EBIT margins. Investors seeking resilience may favor Mondelez’s consistent scale and moderate profitability.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | Mondelez International, Inc. (MDLZ) | The Kraft Heinz Company (KHC) |

|---|---|---|

| ROE | 9.49% | -14.03% |

| ROIC | 5.13% | -6.40% |

| P/E | 28.42 | -4.90 |

| P/B | 2.70 | 0.69 |

| Current Ratio | 0.59 | 1.15 |

| Quick Ratio | 0.39 | 0.79 |

| D/E | 0.87 | 0.46 |

| Debt-to-Assets | 31.3% | 23.6% |

| Interest Coverage | 12.8 | -4.93 |

| Asset Turnover | 0.54 | 0.30 |

| Fixed Asset Turnover | 3.38 | 3.41 |

| Payout ratio | 101.5% | -32.5% |

| Dividend yield | 3.57% | 6.63% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, unveiling hidden risks and operational strengths that shape investment outcomes.

Mondelez International, Inc.

Mondelez shows moderate profitability with a 9.5% ROE and a neutral 6.4% net margin. The stock trades at a stretched P/E of 28.4, signaling expensive valuation. However, a 3.6% dividend yield and strong interest coverage highlight shareholder returns and financial stability despite a weak current ratio of 0.59.

The Kraft Heinz Company

Kraft Heinz suffers from negative profitability metrics: a -14% ROE and -23.4% net margin. Its valuation appears cheap with a negative P/E and a low 0.69 price-to-book ratio. The company maintains a solid current ratio of 1.15 and a 6.6% dividend yield, but poor interest coverage and asset turnover raise concerns about operational efficiency.

Premium Valuation vs. Operational Safety

Mondelez balances higher profitability and shareholder returns with a premium valuation, while Kraft Heinz offers a cheaper but riskier profile with weak earnings. Investors seeking stability may prefer Mondelez, whereas value seekers might lean toward Kraft Heinz’s distressed metrics.

Which one offers the Superior Shareholder Reward?

I observe Mondelez International (MDLZ) balances a moderate 3.57% dividend yield with a sustainable payout ratio near 101%, supported by solid free cash flow (2.5/share). It executes modest buybacks, enhancing total return. Kraft Heinz (KHC) yields a higher 6.63% but suffers negative profitability and erratic payout ratios, risking dividend sustainability despite aggressive buybacks. I view MDLZ’s consistent cash flow and prudent distribution as superior for long-term value, making it the better total return choice in 2026.

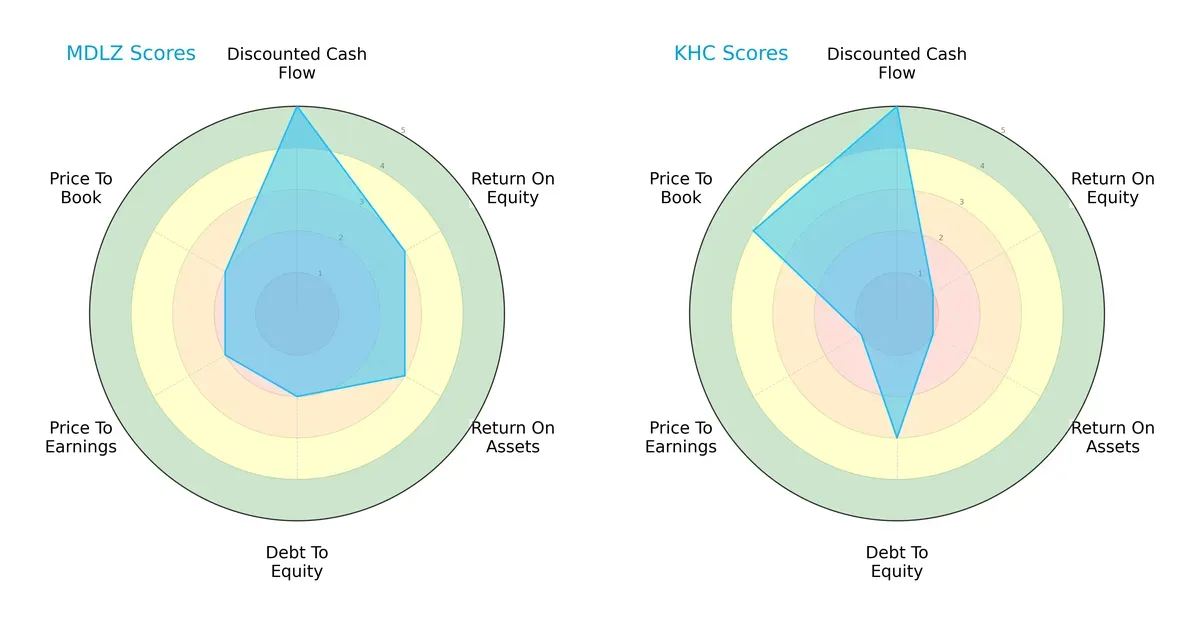

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Mondelez International, Inc. and The Kraft Heinz Company, highlighting their strategic strengths and weaknesses:

Mondelez shows a balanced profile with strong DCF (5) and moderate ROE (3) and ROA (3) scores, but weaker debt management and valuation metrics (all score 2). Kraft Heinz leans heavily on cash flow strength (DCF 5) and a solid debt position (3), yet severely underperforms on profitability (ROE 1, ROA 1) and valuation (P/E 1), despite a favorable price-to-book (4). Mondelez offers a more consistent operational and valuation mix, while Kraft Heinz relies on financial leverage and a bargain valuation to compensate for weak returns.

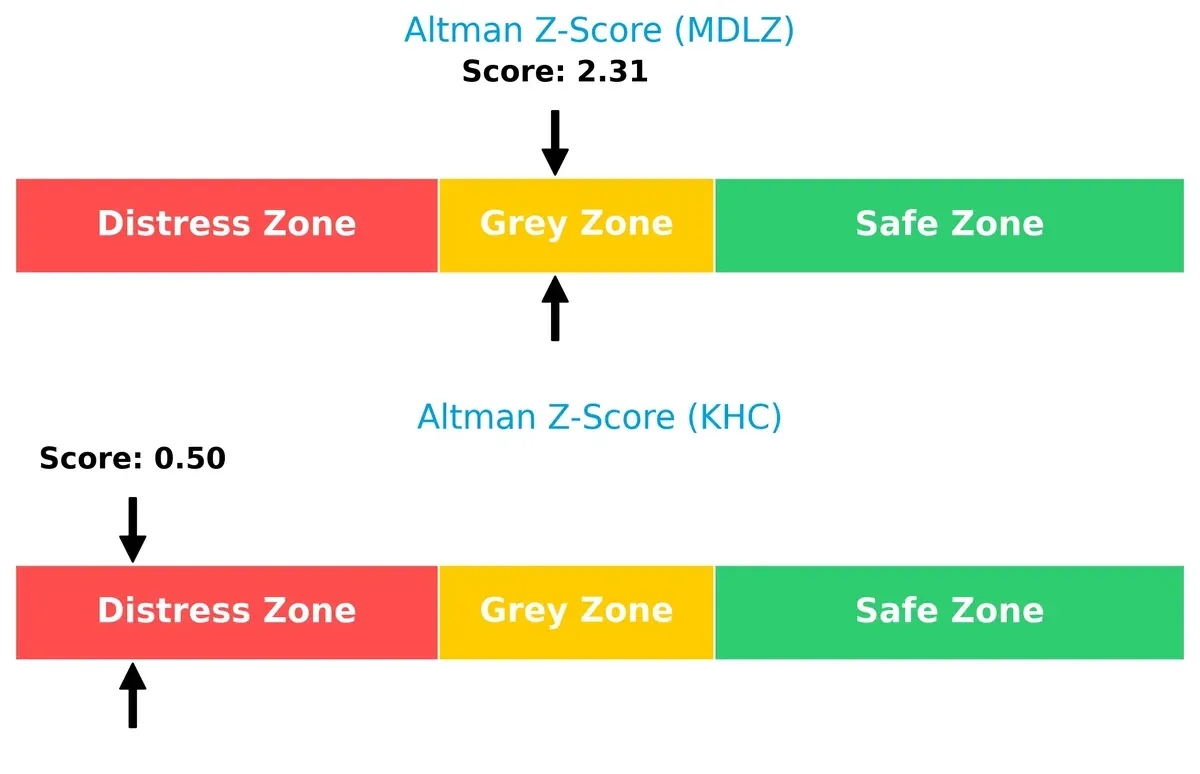

Bankruptcy Risk: Solvency Showdown

Mondelez’s Altman Z-Score of 2.31 places it safely in the grey zone, signaling moderate bankruptcy risk in this cycle. Kraft Heinz’s 0.50 score warns of distress and heightened insolvency risk:

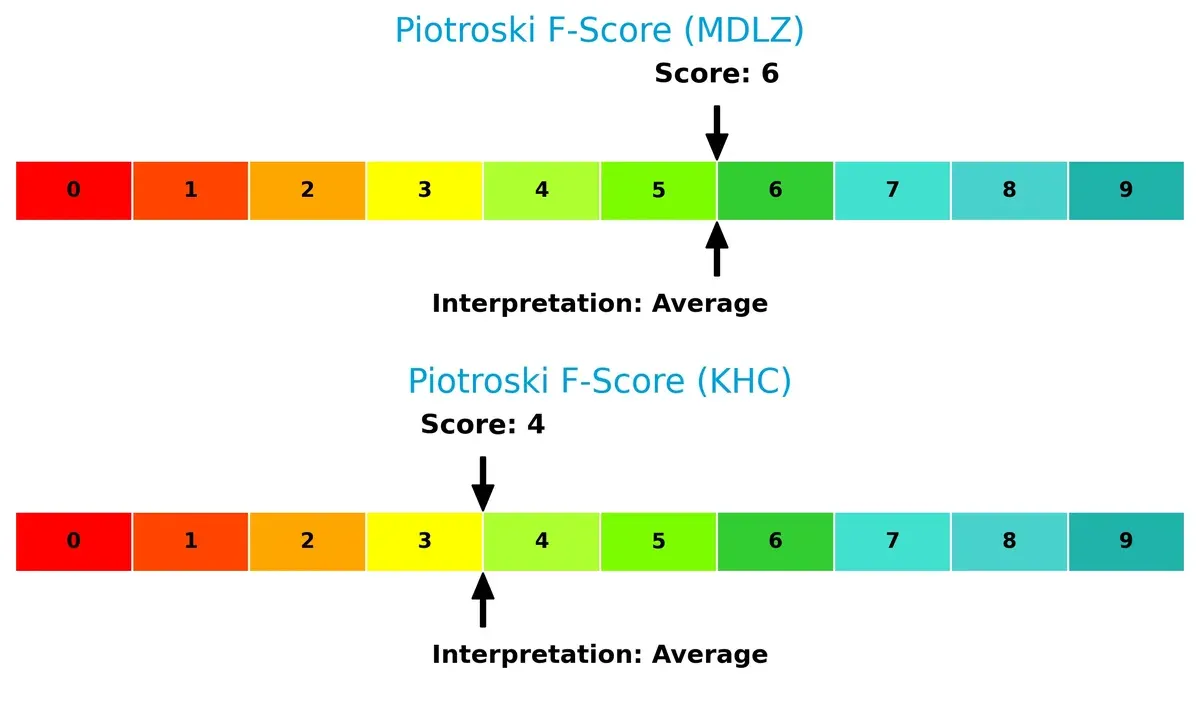

Financial Health: Quality of Operations

Both companies score in the average range on the Piotroski F-Score, but Mondelez’s 6 surpasses Kraft Heinz’s 4, indicating stronger operational quality and fewer red flags in financial health:

How are the two companies positioned?

This section dissects the operational DNA of Mondelez and Kraft Heinz by comparing their revenue distribution and internal strengths and weaknesses. The final objective is to confront their economic moats to identify which offers the most resilient, sustainable competitive advantage today.

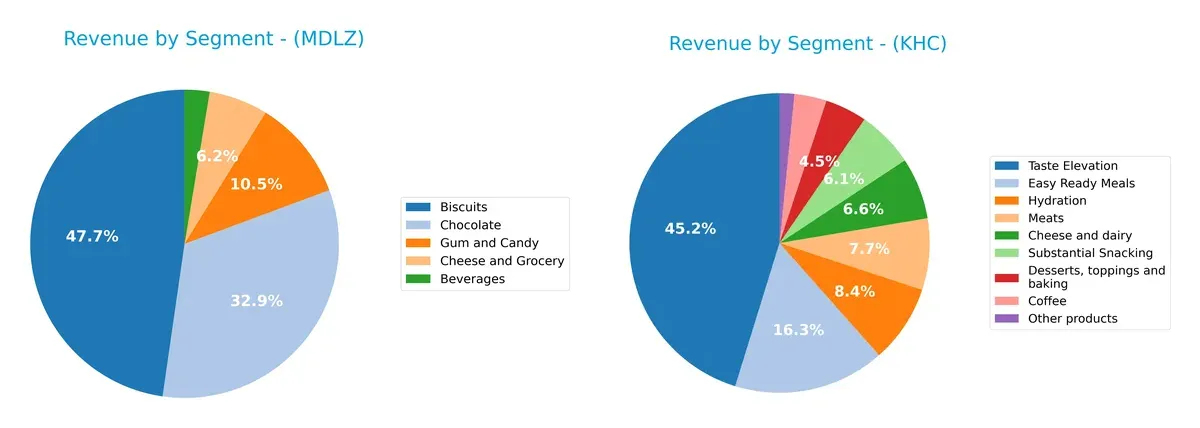

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Mondelez International and The Kraft Heinz Company diversify their income streams and where their primary sector bets lie:

Mondelez anchors its revenue in Biscuits ($18.4B) and Chocolate ($12.7B), showing a focused yet diverse snack portfolio. Kraft Heinz pivots around Taste Elevation ($11.3B), but also spreads revenue across Easy Ready Meals ($4.1B) and Condiments & Sauces ($8.9B). Mondelez’s mix reduces concentration risk through multiple strong segments. Kraft Heinz leans on a flagship segment, risking dependency but benefiting from ecosystem dominance in condiments and meals.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Mondelez International, Inc. and The Kraft Heinz Company:

Mondelez International Strengths

- Diversified product portfolio with strong Biscuits and Chocolate sales

- Favorable WACC and interest coverage ratios

- Strong global presence across Europe, Asia, and the Americas

- Consistent dividend yield of 3.57%

- Efficient fixed asset turnover at 3.38

The Kraft Heinz Company Strengths

- Favorable WACC and low debt-to-assets ratio

- Solid presence in the US market with $16.8B revenue

- Favorable price-to-book ratio at 0.69

- Diversified product lines including Easy Ready Meals and Condiments

- Higher dividend yield neutrality at 6.63%

Mondelez International Weaknesses

- Unfavorable return on equity at 9.49%

- Low current and quick ratios indicating liquidity concerns

- Unfavorable PE ratio at 28.42

- Neutral net margin at 6.36%

- Moderate debt-to-equity ratio at 0.87

The Kraft Heinz Company Weaknesses

- Negative net margin and returns (ROE -14.03%, ROIC -6.4%)

- Negative interest coverage at -4.75 signals financial stress

- Unfavorable asset turnover at 0.3

- Quick ratio below 1 at 0.79

- Unfavorable price-to-earnings ratio at -4.9

Both companies show balanced strengths in diversification and fixed asset efficiency. However, Mondelez’s liquidity and profitability metrics warrant caution, while Kraft Heinz faces significant profitability and coverage challenges that impact its financial flexibility. These factors should inform their strategic financial management going forward.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole barrier protecting long-term profits from relentless competitive erosion. Here’s how Mondelez and Kraft Heinz stack up:

Mondelez International, Inc.: Global Brand Power with Geographic Diversification

Mondelez’s moat stems from strong brand equity and global scale, reflected in steady gross margins near 28%. Yet, declining ROIC signals margin pressure. Expanding in emerging markets may deepen its advantage in 2026.

The Kraft Heinz Company: Legacy Brand with Cost Challenges

Kraft Heinz relies on cost advantages but suffers from deteriorating profitability and a negative ROIC trend. Unlike Mondelez, its shrinking revenue and margins threaten its competitive standing. New product innovation is critical to stabilization.

Brand Equity vs. Cost Efficiency: Who Holds the Moat?

Mondelez’s broader geographic reach and stronger brand portfolio give it a wider moat despite margin pressures. Kraft Heinz’s steep ROIC decline and shrinking revenue highlight a weaker fortress. Mondelez stands better poised to defend market share in 2026.

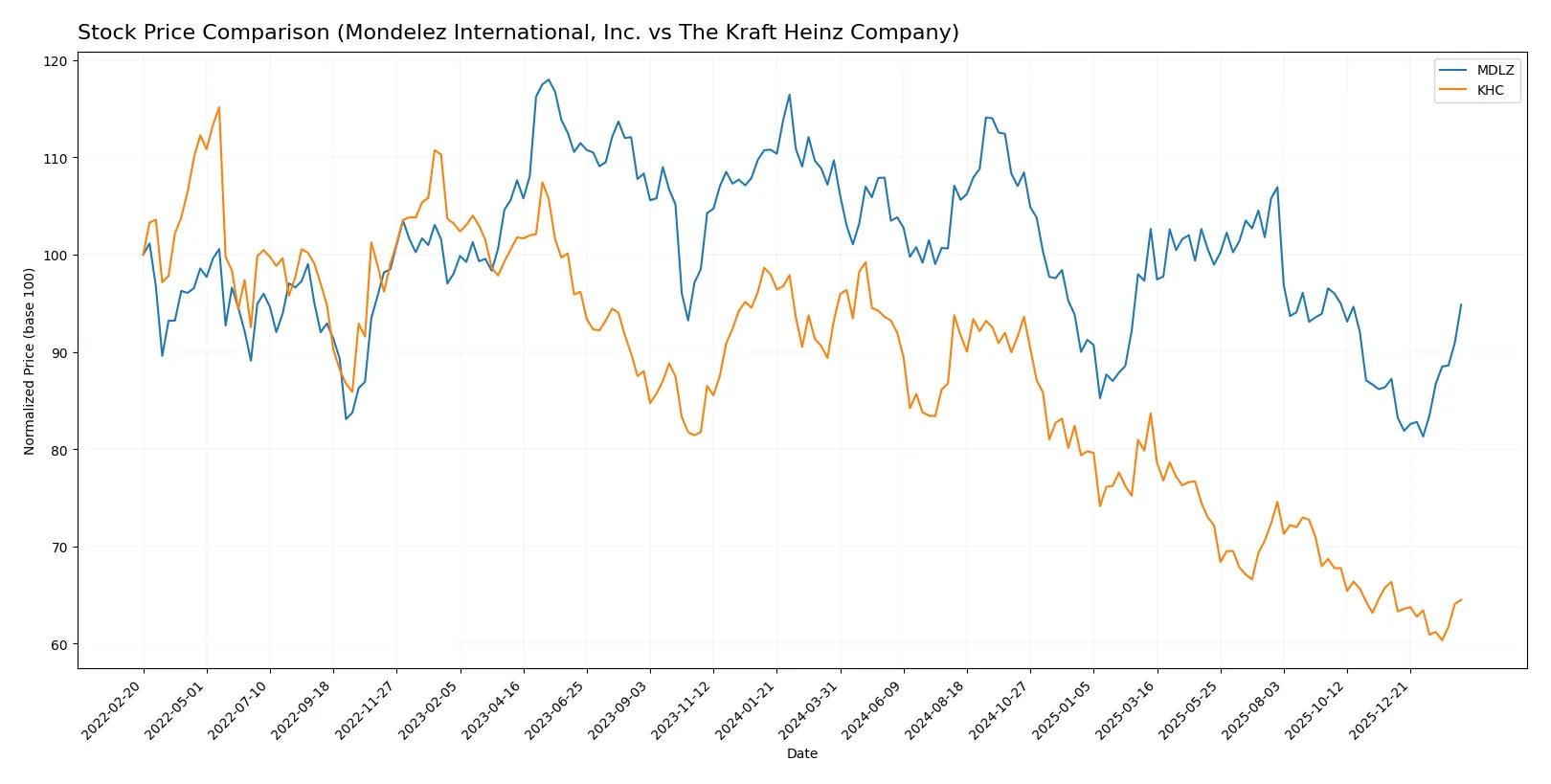

Which stock offers better returns?

The past year reveals divergent price dynamics: Mondelez International’s shares fell sharply but gained momentum recently, while Kraft Heinz’s stock shows a steeper overall decline with persistent weakness into early 2026.

Trend Comparison

Mondelez International’s stock declined 13.55% over the past year, reflecting a bearish trend with accelerating downward momentum. The price ranged between 75.31 and 53.65, showing heightened volatility (5.24 std dev).

The Kraft Heinz Company’s shares fell 30.82%, marking a stronger bearish trend with accelerating losses. Its price fluctuated between 38.16 and 23.2, accompanied by lower volatility (4.19 std dev).

Mondelez outperformed Kraft Heinz despite both stocks trending down. Mondelez’s recent 8.72% rebound contrasts with Kraft Heinz’s continued 2.78% decline, indicating stronger market resilience.

Target Prices

Analysts present a moderate upside potential for Mondelez International and The Kraft Heinz Company based on current consensus targets.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Mondelez International, Inc. | 61 | 84 | 67.64 |

| The Kraft Heinz Company | 23 | 28 | 25.11 |

Mondelez’s target consensus sits slightly above its current price of $62.59, signaling modest growth expectations. Kraft Heinz’s consensus of $25.11 also suggests a mild premium over its current $24.80 price, reflecting cautious optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables summarize recent institutional grades for Mondelez International, Inc. and The Kraft Heinz Company:

Mondelez International, Inc. Grades

This table shows recent analyst grades and actions from reputable institutions.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-02-12 |

| DA Davidson | Maintain | Neutral | 2026-02-09 |

| JP Morgan | Maintain | Overweight | 2026-02-04 |

| Stifel | Maintain | Buy | 2026-02-04 |

| DA Davidson | Maintain | Neutral | 2026-02-04 |

| Piper Sandler | Maintain | Neutral | 2026-02-04 |

| Wells Fargo | Maintain | Overweight | 2026-02-04 |

| DA Davidson | Maintain | Neutral | 2026-01-29 |

| JP Morgan | Maintain | Overweight | 2026-01-21 |

| UBS | Maintain | Neutral | 2026-01-14 |

The Kraft Heinz Company Grades

Below is a summary of institutional grades and recent changes for Kraft Heinz.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2026-02-13 |

| JP Morgan | Downgrade | Underweight | 2026-02-12 |

| Jefferies | Maintain | Hold | 2026-01-21 |

| JP Morgan | Maintain | Neutral | 2026-01-21 |

| Morgan Stanley | Downgrade | Underweight | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-14 |

| Piper Sandler | Maintain | Neutral | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-30 |

| UBS | Maintain | Neutral | 2025-10-30 |

Which company has the best grades?

Mondelez consistently earns Overweight and Buy ratings, signaling stronger analyst confidence. Kraft Heinz shows a mix, with recent downgrades to Underweight by major firms. Investors may view Mondelez’s grades as a sign of greater institutional support.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Mondelez International, Inc.

- Operates globally in snack foods with strong brand portfolio but faces intense competition in confectionery and snacks.

The Kraft Heinz Company

- Competes in packaged foods with legacy brands but struggles to innovate and maintain market share.

2. Capital Structure & Debt

Mondelez International, Inc.

- Moderate debt levels with a debt-to-assets ratio of 31.3%, interest coverage favorable at 11.7x.

The Kraft Heinz Company

- Lower debt-to-assets at 23.6%, but negative interest coverage at -4.75x signals distress in servicing debt.

3. Stock Volatility

Mondelez International, Inc.

- Beta of 0.40 indicates low volatility relative to the market, offering stability.

The Kraft Heinz Company

- Extremely low beta of 0.05 suggests minimal market sensitivity but potential lack of momentum.

4. Regulatory & Legal

Mondelez International, Inc.

- Faces typical food industry regulations globally, with no recent major legal issues reported.

The Kraft Heinz Company

- Also subject to food safety and labeling rules; legacy operational challenges could raise compliance costs.

5. Supply Chain & Operations

Mondelez International, Inc.

- Extensive global supply chain with risks from geopolitical tensions and raw material inflation.

The Kraft Heinz Company

- Supply chain more concentrated regionally, but operational inefficiencies and lower asset turnover (0.3) are concerns.

6. ESG & Climate Transition

Mondelez International, Inc.

- Increasing focus on sustainability initiatives aligns with consumer trends; some exposure to climate-related raw material risks.

The Kraft Heinz Company

- ESG efforts less visible; potential risks in climate transition due to legacy production processes.

7. Geopolitical Exposure

Mondelez International, Inc.

- Operates in multiple continents, exposing it to currency fluctuations and regional instabilities.

The Kraft Heinz Company

- More concentrated in North America and Europe, limiting but not eliminating geopolitical risks.

Which company shows a better risk-adjusted profile?

Mondelez’s strongest risk lies in global supply chain complexity and geopolitical exposure, balanced by solid capital structure and steady market position. Kraft Heinz’s most severe risk is financial distress, evidenced by negative margins and poor interest coverage. Mondelez exhibits a better risk-adjusted profile due to healthier liquidity and debt metrics. Kraft Heinz’s Altman Z-score in the distress zone and negative profitability highlight urgent restructuring needs. The contrast in interest coverage—Mondelez at 11.7x vs. Kraft Heinz negative—justifies my heightened concern for Kraft Heinz’s financial stability.

Final Verdict: Which stock to choose?

Mondelez International’s superpower lies in its resilient brand portfolio and steady cash generation. It maintains operational efficiency despite recent profitability pressures. A point of vigilance is its below-par liquidity and signs of declining capital returns. It suits investors with a tolerance for cyclical challenges in pursuit of stable long-term growth.

The Kraft Heinz Company’s strategic moat centers on its entrenched market presence and attractive valuation metrics. It offers a comparatively stronger liquidity profile and less leverage risk. However, its ongoing value destruction and weak profitability call for caution. It fits portfolios seeking deep value exposure with a higher risk appetite.

If you prioritize consistent cash flow and brand strength, Mondelez outshines with its efficient asset use and market resilience. However, if you seek a value-oriented turnaround play with better short-term liquidity, Kraft Heinz offers that angle despite profitability headwinds. Both require careful risk management given their fundamental challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Mondelez International, Inc. and The Kraft Heinz Company to enhance your investment decisions: