In the fast-evolving software application sector, monday.com Ltd. (MNDY) and PagerDuty, Inc. (PD) stand out as innovative leaders reshaping work management and digital operations. Both companies offer cloud-based platforms that streamline complex workflows and enhance productivity across industries worldwide. This comparison explores their market positions, growth strategies, and technological edge to help you decide which stock could be a valuable addition to your investment portfolio. Let’s dive into the details and uncover the most promising opportunity.

Table of contents

Companies Overview

I will begin the comparison between monday.com Ltd. and PagerDuty, Inc. by providing an overview of these two companies and their main differences.

monday.com Ltd. Overview

monday.com Ltd. develops cloud-based software applications globally, focusing on its Work OS platform that enables customizable work management tools. The company targets various sectors including marketing, CRM, and project management, serving organizations, educational institutions, and government units. Headquartered in Tel Aviv, Israel, monday.com operates in the software application industry with a market cap of approximately 7.3B USD.

PagerDuty, Inc. Overview

PagerDuty, Inc. provides a digital operations management platform that uses machine learning to analyze data from software systems across multiple industries such as telecommunications, retail, and financial services. Founded in 2009 and based in San Francisco, California, PagerDuty serves clients internationally and is positioned within the software application sector with a market cap near 1.1B USD.

Key similarities and differences

Both companies operate in the software application industry and offer platforms designed to improve operational efficiency. monday.com emphasizes customizable work management solutions across diverse business functions, while PagerDuty specializes in digital operations management with a focus on predictive analytics using machine learning. monday.com has a significantly larger market capitalization and workforce compared to PagerDuty, reflecting different scales and market reach.

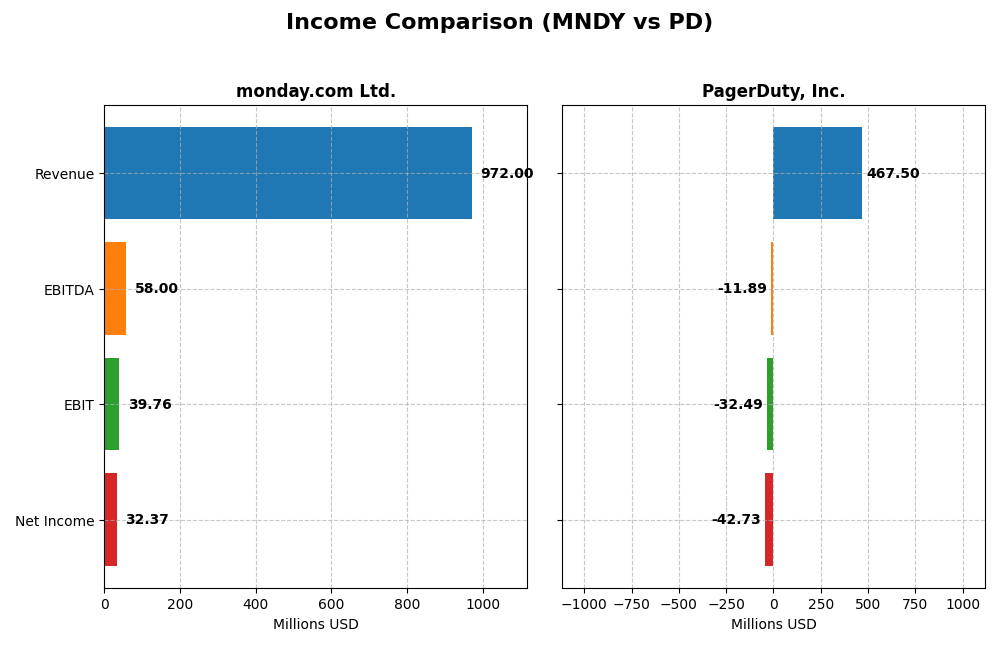

Income Statement Comparison

This table presents a side-by-side comparison of the most recent fiscal year income statement metrics for monday.com Ltd. and PagerDuty, Inc., highlighting key financial figures for analysis.

| Metric | monday.com Ltd. (MNDY) | PagerDuty, Inc. (PD) |

|---|---|---|

| Market Cap | 7.3B | 1.1B |

| Revenue | 972M | 467M |

| EBITDA | 58M | -12M |

| EBIT | 40M | -32M |

| Net Income | 32M | -43M |

| EPS | 0.65 | -0.59 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

monday.com Ltd.

monday.com Ltd. has shown strong revenue growth from 2020 to 2024, reaching $972M in 2024, with net income turning positive at $32M after years of losses. Gross margin remains robust at 89.33%, indicating efficient cost management. The 2024 year saw significant improvements in EBIT and net margins, reflecting better operational leverage and profitability.

PagerDuty, Inc.

PagerDuty’s revenue increased steadily, reaching $467M in 2025, with net losses narrowing to $43M from wider losses in prior years. The gross margin is solid at 82.96%, though EBIT and net margins remain negative, at -6.95% and -9.14% respectively. Despite losses, the company achieved favorable growth in revenue, EBIT, and net margin over the recent year, indicating some operational progress.

Which one has the stronger fundamentals?

Both companies exhibit favorable revenue and gross profit growth with solid gross margins above 80%. monday.com Ltd. demonstrates stronger profitability trends, turning net positive and improving EBIT margins, while PagerDuty still operates at a loss with negative EBIT and net margins. monday.com’s superior margin stability and net income growth make its fundamentals comparatively stronger based on the available income statement data.

Financial Ratios Comparison

The table below compares key financial ratios of monday.com Ltd. (MNDY) and PagerDuty, Inc. (PD) based on their most recent fiscal year data.

| Ratios | monday.com Ltd. (2024) | PagerDuty, Inc. (2025) |

|---|---|---|

| ROE | 3.14% | -32.92% |

| ROIC | -1.73% | -9.66% |

| P/E | 363 | -39.87 |

| P/B | 11.41 | 13.12 |

| Current Ratio | 2.66 | 1.87 |

| Quick Ratio | 2.66 | 1.87 |

| D/E (Debt-to-Equity) | 0.10 | 3.57 |

| Debt-to-Assets | 6.29% | 50.00% |

| Interest Coverage | 0 | -6.46 |

| Asset Turnover | 0.58 | 0.50 |

| Fixed Asset Turnover | 7.13 | 16.61 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

monday.com Ltd.

monday.com Ltd. shows a mix of strengths and weaknesses in its financial ratios. Favorable metrics include a solid current ratio of 2.66 and a low debt-to-equity ratio of 0.1, indicating good liquidity and conservative leverage. However, low returns on equity (3.14%) and invested capital (-1.73%) raise concerns about profitability. The company does not pay dividends, reflecting a reinvestment strategy typical in tech firms focused on growth.

PagerDuty, Inc.

PagerDuty, Inc. presents several unfavorable ratios, including a negative net margin of -9.14% and a highly negative return on equity of -32.92%, signaling operational challenges. Its debt-to-equity ratio of 3.57 and debt-to-assets at 50% are high, suggesting financial risk. The firm also does not pay dividends, likely prioritizing reinvestment and research over shareholder payouts. Its current ratio of 1.87 is adequate but less robust than its peer.

Which one has the best ratios?

Comparing both, monday.com Ltd. has a more balanced ratio profile with a higher proportion of favorable metrics, better liquidity, and lower leverage. PagerDuty’s ratios indicate greater financial stress and less profitability, with more unfavorable evaluations. Overall, monday.com shows stronger ratio fundamentals, while PagerDuty faces notable financial and operational challenges.

Strategic Positioning

This section compares the strategic positioning of monday.com Ltd. and PagerDuty, Inc., focusing on market position, key segments, and exposure to technological disruption:

monday.com Ltd.

- Large market cap of 7.3B; faces competitive pressure in software applications globally.

- Offers Work OS, a modular cloud-based work management system across various industries.

- Operates internationally with broad software applications; potential disruption from evolving cloud and AI tech.

PagerDuty, Inc.

- Smaller market cap of 1.1B; competes in digital operations management platforms.

- Provides a machine learning-driven digital operations platform for multiple sectors.

- Uses advanced data correlation and prediction; exposed to machine learning and automation changes.

monday.com Ltd. vs PagerDuty, Inc. Positioning

monday.com shows a diversified software platform targeting broad work management needs, while PagerDuty focuses on specialized digital operations with machine learning. monday.com’s scale offers breadth, whereas PagerDuty’s niche approach centers on operational efficiency.

Which has the best competitive advantage?

Both companies exhibit slightly unfavorable MOAT evaluations due to ROIC below WACC, though both show improving profitability trends. Neither demonstrates a strong economic moat based on current capital efficiency data.

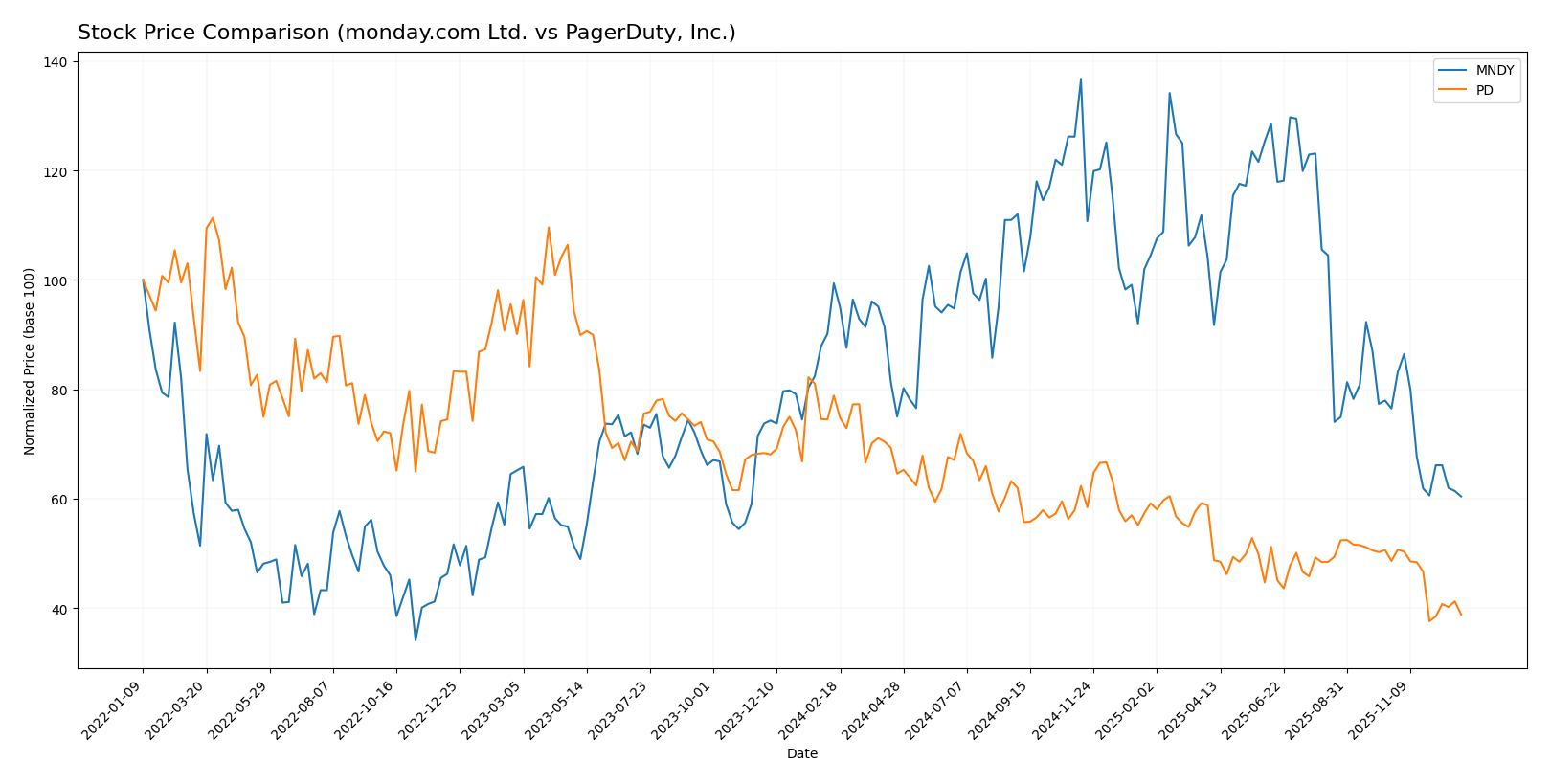

Stock Comparison

The stock price movements of monday.com Ltd. and PagerDuty, Inc. over the past year reveal notable declines with distinct volatility profiles and trading volume dynamics, reflecting bearish trends with deceleration phases.

Trend Analysis

monday.com Ltd. experienced a bearish trend with a -39.21% price change over the past 12 months, showing deceleration and high volatility with a standard deviation of 45.17. The stock ranged between 324.31 and 143.42.

PagerDuty, Inc. also showed a bearish trend with a -50.76% price change over the last year, accompanied by deceleration and much lower volatility, reflected by a standard deviation of 2.93. Its price oscillated between 25.16 and 12.00.

Comparing the two, monday.com Ltd. delivered a higher market performance than PagerDuty, Inc., as its decline was less severe, despite both stocks showing bearish trends and deceleration.

Target Prices

Analysts present a clear target price consensus for monday.com Ltd. and PagerDuty, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| monday.com Ltd. | 330 | 202 | 277.18 |

| PagerDuty, Inc. | 19 | 15 | 16.75 |

The consensus target prices suggest significant upside potential for both stocks compared to their current prices: monday.com Ltd. at $143.42 and PagerDuty, Inc. at $12.39, reflecting positive analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for monday.com Ltd. and PagerDuty, Inc.:

Rating Comparison

monday.com Ltd. Rating

- Rating: B-, categorized as Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable view.

- ROE Score: 2, assessed as Moderate efficiency.

- ROA Score: 3, showing Moderate asset utilization.

- Debt To Equity Score: 3, Moderate financial risk level.

- Overall Score: 2, reflecting a Moderate overall standing.

PagerDuty, Inc. Rating

- Rating: A-, also considered Very Favorable by analysts.

- Discounted Cash Flow Score: 4, also Favorable.

- ROE Score: 5, rated Very Favorable for profit generation.

- ROA Score: 5, Very Favorable for asset utilization.

- Debt To Equity Score: 1, Very Unfavorable due to higher risk.

- Overall Score: 4, indicating a Favorable overall standing.

Which one is the best rated?

PagerDuty, Inc. holds a stronger position with a higher overall score and superior ROE and ROA ratings, despite its less favorable debt-to-equity score. monday.com Ltd. scores moderately across most metrics with better debt management.

Scores Comparison

Here is the comparison of the Altman Z-Score and Piotroski Score for monday.com Ltd. and PagerDuty, Inc.:

monday.com Ltd. Scores

- Altman Z-Score: 7.39, indicating a safe zone status

- Piotroski Score: 5, categorized as average

PagerDuty, Inc. Scores

- Altman Z-Score: 1.37, indicating distress zone

- Piotroski Score: 7, categorized as strong

Which company has the best scores?

monday.com Ltd. shows a significantly higher Altman Z-Score, placing it in a safe financial zone, while PagerDuty has a stronger Piotroski Score, indicating better financial strength. Both scores highlight different strengths strictly from the provided data.

Grades Comparison

The following section compares the latest available grades for monday.com Ltd. and PagerDuty, Inc.:

monday.com Ltd. Grades

This table summarizes recent grades and rating actions for monday.com Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-12-23 |

| Tigress Financial | Maintain | Buy | 2025-12-11 |

| Morgan Stanley | Maintain | Overweight | 2025-11-11 |

| Piper Sandler | Maintain | Overweight | 2025-11-11 |

| B of A Securities | Maintain | Neutral | 2025-11-11 |

| JP Morgan | Maintain | Overweight | 2025-11-11 |

| Canaccord Genuity | Maintain | Buy | 2025-11-11 |

| Jefferies | Maintain | Buy | 2025-11-11 |

| Wells Fargo | Maintain | Overweight | 2025-11-11 |

| Baird | Maintain | Outperform | 2025-11-11 |

Overall, monday.com Ltd. maintains predominantly positive grades with consistent buy and overweight ratings, indicating stable analyst confidence.

PagerDuty, Inc. Grades

This table summarizes recent grades and rating actions for PagerDuty, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Outperform | 2025-11-26 |

| Craig-Hallum | Downgrade | Hold | 2025-11-26 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-26 |

| TD Cowen | Maintain | Buy | 2025-11-26 |

| Truist Securities | Maintain | Buy | 2025-11-19 |

| Baird | Maintain | Neutral | 2025-09-04 |

| Canaccord Genuity | Maintain | Buy | 2025-09-04 |

| RBC Capital | Maintain | Outperform | 2025-09-04 |

| Canaccord Genuity | Maintain | Buy | 2025-06-02 |

| Truist Securities | Maintain | Buy | 2025-05-30 |

PagerDuty, Inc.’s grades show a mix of buy and outperform ratings, though a recent downgrade to hold suggests some analyst caution.

Which company has the best grades?

monday.com Ltd. consistently receives strong buy and overweight ratings from multiple firms, while PagerDuty, Inc. shows a wider range including a recent downgrade to hold. This contrast may influence investor confidence differently, potentially affecting portfolio allocation decisions based on perceived stability and analyst sentiment.

Strengths and Weaknesses

Below is a comparative overview of monday.com Ltd. and PagerDuty, Inc. based on recent financial and strategic metrics.

| Criterion | monday.com Ltd. (MNDY) | PagerDuty, Inc. (PD) |

|---|---|---|

| Diversification | Moderate focus on project management tools, limited product range | Narrow product focus on incident response software |

| Profitability | Low net margin (3.33%), ROIC negative but improving | Negative net margin (-9.14%), ROIC negative with slight growth |

| Innovation | Moderate innovation with growing ROIC trend | Innovation present but profitability challenges persist |

| Global presence | Growing international footprint but limited scale | Stronger global presence in IT operations management |

| Market Share | Strong in collaboration software niche | Leading in incident management software niche |

Key takeaways: Both companies are currently shedding value with negative ROIC versus WACC, but show improving profitability trends. monday.com has a more balanced financial profile with favorable liquidity and leverage ratios, while PagerDuty faces more financial challenges despite a stronger market position in its niche. Investors should weigh innovation and growth potential against current profitability and risk.

Risk Analysis

Below is a comparative risk overview for monday.com Ltd. (MNDY) and PagerDuty, Inc. (PD) based on the most recent data.

| Metric | monday.com Ltd. (MNDY) | PagerDuty, Inc. (PD) |

|---|---|---|

| Market Risk | Beta 1.26; higher volatility, wider price range (141.2-342.64 USD) | Beta 0.69; lower volatility, tighter price range (11.13-20 USD) |

| Debt level | Low debt-to-equity (0.1), debt/assets 6.3% (favorable) | High debt-to-equity (3.57), debt/assets 50% (unfavorable) |

| Regulatory Risk | Moderate, Israeli HQ with global operations | Moderate, US-based with international exposure |

| Operational Risk | Neutral asset turnover (0.58), moderate profitability (ROE 3.14%) | Lower profitability (ROE -32.9%), moderate asset turnover (0.5) |

| Environmental Risk | Low exposure typical for software sector | Low exposure typical for software sector |

| Geopolitical Risk | Higher due to Israel location | Moderate, US-based with global presence |

The most impactful risks are PagerDuty’s high leverage and negative profitability, placing it in financial distress territory (Altman Z-score 1.37). monday.com shows better financial stability (Altman Z-score 7.39) but with high valuation multiples and moderate growth risks. Investors should weigh PagerDuty’s financial risk against its strong operational scores and monday.com’s valuation premium with stable fundamentals.

Which Stock to Choose?

monday.com Ltd. (MNDY) shows strong income growth with a favorable global income statement evaluation and improving profitability, despite an unfavorable ROIC below WACC indicating value destruction. Its financial ratios are mixed, with 43% favorable and 43% unfavorable, but it maintains low debt and a solid rating of B-.

PagerDuty, Inc. (PD) also presents favorable income growth, though with a negative net margin and ROIC below WACC signaling value destruction. Its financial ratios lean toward unfavorable at 57%, challenged by high debt levels, but it holds a stronger overall rating of A- and a solid Piotroski score.

Investors prioritizing financial stability and stronger ratings might find PagerDuty more aligned with their profile, while those focusing on income growth and improving profitability could view monday.com as a potential opportunity, considering its mixed financial health and lower debt burden.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of monday.com Ltd. and PagerDuty, Inc. to enhance your investment decisions: