Home > Comparison > Healthcare > UNH vs MOH

The strategic rivalry between UnitedHealth Group Incorporated and Molina Healthcare, Inc. shapes the healthcare plans industry’s competitive landscape. UnitedHealth operates as a diversified healthcare giant with broad national reach and integrated services. Molina focuses on managed care for low-income populations within Medicaid and Medicare programs. This head-to-head contrasts scale and diversification against niche specialization. This analysis aims to identify which corporate model delivers superior risk-adjusted returns for a balanced portfolio.

Table of contents

Companies Overview

UnitedHealth Group and Molina Healthcare play pivotal roles in the U.S. healthcare plans market. Both target distinct segments but share a commitment to managed care.

UnitedHealth Group: Diversified Healthcare Powerhouse

UnitedHealth Group dominates as a diversified health care company serving multiple customer segments. Its core revenue stems from four segments: UnitedHealthcare’s health benefit plans, OptumHealth’s care delivery, OptumInsight’s data services, and OptumRx’s pharmacy care. In 2026, it focused strategically on integrating these segments to enhance consumer engagement and expand specialized care services.

Molina Healthcare: Focused Medicaid and Medicare Specialist

Molina Healthcare specializes in managed health care services for low-income populations, primarily Medicaid and Medicare beneficiaries. Its revenue comes from serving roughly 5.2M members across 18 states. In 2026, Molina prioritized expanding its footprint in government-sponsored healthcare programs and optimizing managed care operations within these markets.

Strategic Collision: Similarities & Divergences

While both firms operate in healthcare plans, UnitedHealth Group embraces a diversified, integrated model spanning multiple care and data services. Molina adopts a focused approach targeting government-sponsored programs for underserved populations. Their main battleground is market share in Medicaid and Medicare plans. UnitedHealth’s broad scale contrasts with Molina’s niche specialization, creating distinct investment profiles based on diversification versus concentration.

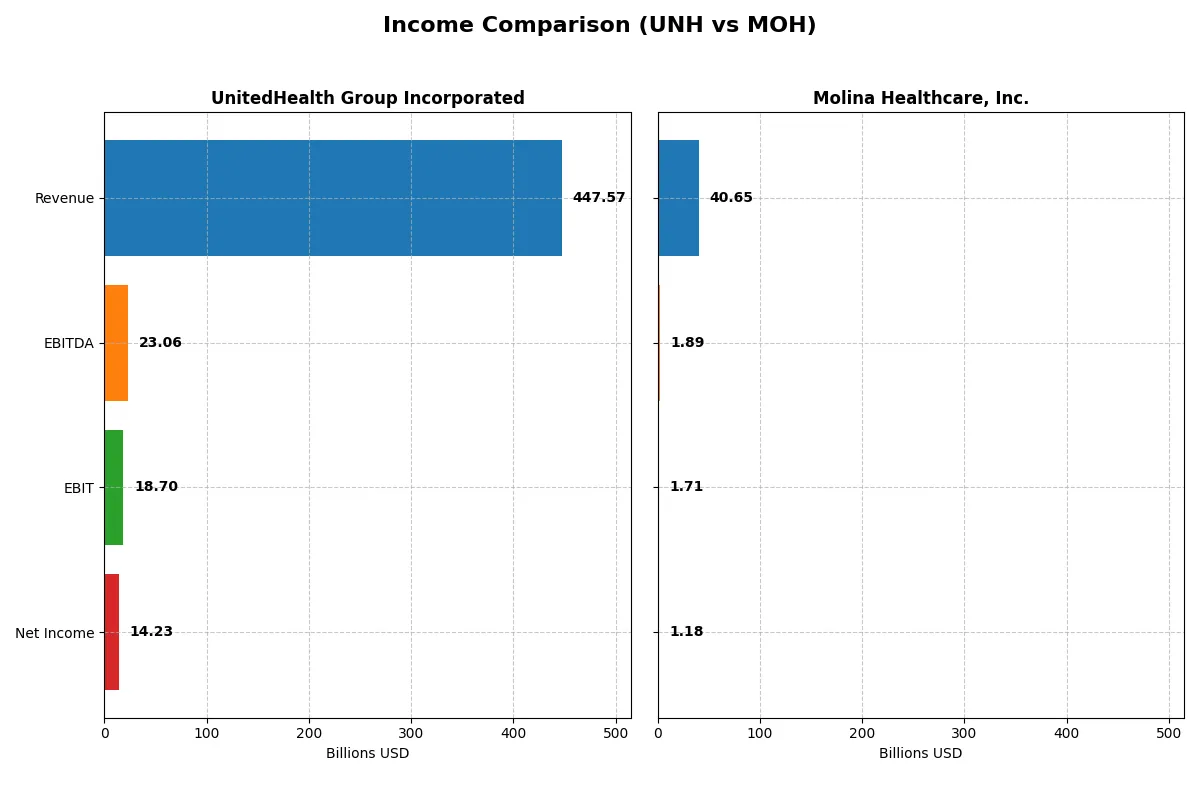

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | UnitedHealth Group Incorporated (UNH) | Molina Healthcare, Inc. (MOH) |

|---|---|---|

| Revenue | 448B | 41B |

| Cost of Revenue | 365B | 36B |

| Operating Expenses | 64B | 3.03B |

| Gross Profit | 83B | 4.74B |

| EBITDA | 23.1B | 1.89B |

| EBIT | 18.7B | 1.71B |

| Interest Expense | 4B | 118M |

| Net Income | 14.2B | 1.18B |

| EPS | 15.66 | 20.52 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

The income statement comparison reveals which company converts revenue into profit more efficiently and sustains margin strength under market pressures.

UnitedHealth Group Incorporated Analysis

UnitedHealth’s revenue climbed steadily from 287.6B in 2021 to 447.6B in 2025, reflecting strong top-line growth. However, net income receded from 22.4B in 2023 to 14.2B in 2025, signaling margin compression. Its gross margin held around 18.5%, but EBIT and net margins contracted sharply, with operating expenses growing in tandem with revenue, indicating reduced operational efficiency in the latest year.

Molina Healthcare, Inc. Analysis

Molina Healthcare’s revenue expanded rapidly from 19.4B in 2020 to 40.7B in 2024, doubling over four years. Net income rose commensurately from 673M to 1.18B, maintaining a modest 2.9% net margin. Gross and EBIT margins remained stable near 11.6% and 4.2%, respectively. Recent growth rates in revenue (19.3%) and EBIT (8.5%) demonstrate improving profitability and operational scalability, despite a slight dip in net margin.

Margin Resilience vs. Growth Trajectory

UnitedHealth commands superior scale and higher gross margins but struggles with declining net income and compressed profitability. Molina Healthcare posts faster revenue and net income growth, sustaining stable margins with better operational leverage. For investors, Molina’s momentum and margin stability may offer a more attractive growth profile, while UnitedHealth’s size masks emerging margin risks.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared:

| Ratios | UnitedHealth Group (UNH) | Molina Healthcare (MOH) |

|---|---|---|

| ROE | 14.2% | 26.2% |

| ROIC | 9.4% | 16.4% |

| P/E | 21.1 | 14.2 |

| P/B | 3.0 | 3.7 |

| Current Ratio | 0.79 | 1.62 |

| Quick Ratio | 0.79 | 1.62 |

| D/E | 0.78 | 0.69 |

| Debt-to-Assets | 25.3% | 19.9% |

| Interest Coverage | 4.7 | 14.5 |

| Asset Turnover | 1.45 | 2.60 |

| Fixed Asset Turnover | 0 | 141.1 |

| Payout ratio | 97.2% | 0 |

| Dividend yield | 4.6% | 0 |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as the company’s DNA, unveiling operational strengths and hidden risks critical for informed investment decisions.

UnitedHealth Group Incorporated

UnitedHealth shows a neutral 14.2% ROE and 9.5% ROIC, reflecting solid profitability. Its P/E of 21.1 positions the stock as fairly valued, though a 3.0 P/B ratio signals some premium pricing. The 4.6% dividend yield rewards shareholders, balancing modest growth reinvestment with steady income.

Molina Healthcare, Inc.

Molina Healthcare boasts a robust 26.2% ROE and 16.4% ROIC, indicating strong operational efficiency. Its lower P/E of 14.2 suggests the stock trades at a discount. With no dividend payout, Molina reinvests heavily in growth. Favorable liquidity and coverage ratios further underscore financial health.

Premium Valuation vs. Operational Efficiency

Molina Healthcare offers superior profitability and a cheaper valuation, supported by strong liquidity. UnitedHealth provides reliable dividends but carries a slightly stretched price-to-book ratio. Investors seeking growth and operational strength may prefer Molina, while those valuing income might lean toward UnitedHealth.

Which one offers the Superior Shareholder Reward?

UnitedHealth Group (UNH) delivers a more balanced and sustainable shareholder reward in 2026. Its 4.6% dividend yield is well-covered by free cash flow (FCF payout ratio ~97%), complemented by steady buybacks. Molina Healthcare (MOH) pays no dividend but reinvests aggressively in growth with modest buybacks. UNH’s high payout and consistent buybacks offer a superior total return profile, blending income and capital appreciation, while MOH’s reinvestment strategy carries more execution risk and less immediate shareholder reward.

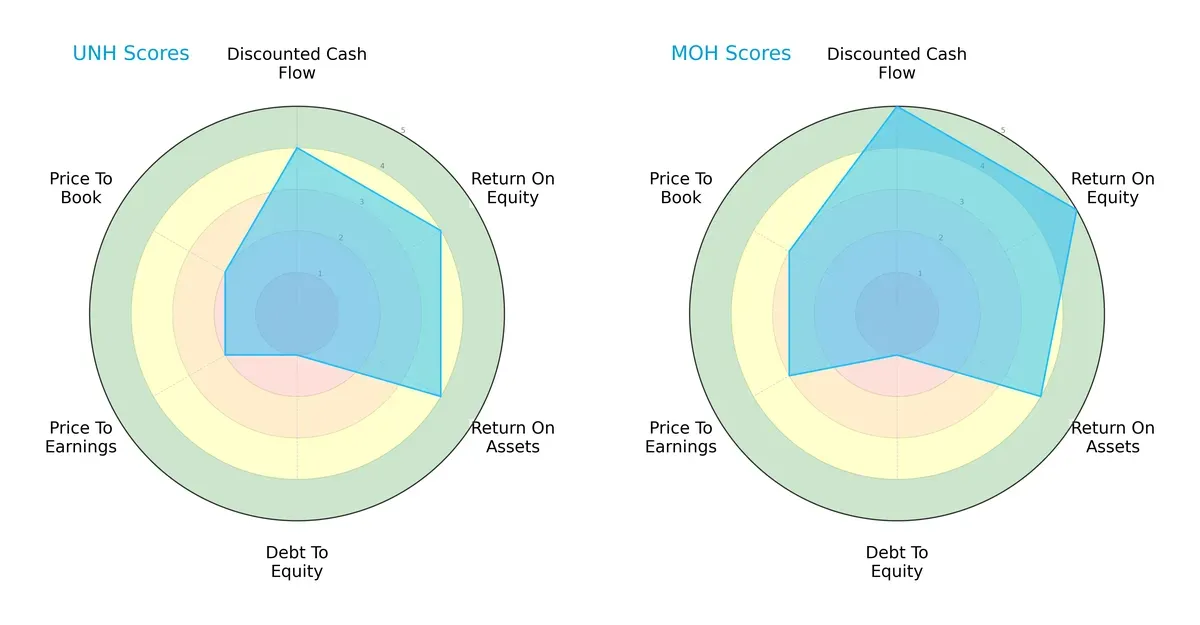

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of UnitedHealth Group and Molina Healthcare, highlighting their distinct financial strengths and valuation approaches:

Molina Healthcare outperforms UnitedHealth with a stronger overall score (4 vs. 3), excelling in DCF (5 vs. 4), ROE (5 vs. 4), and P/E (3 vs. 2). Both share a weak debt-to-equity profile (score 1), signaling elevated leverage risk. UnitedHealth shows a balanced operational efficiency, but Molina leans on superior profitability and valuation metrics for its edge.

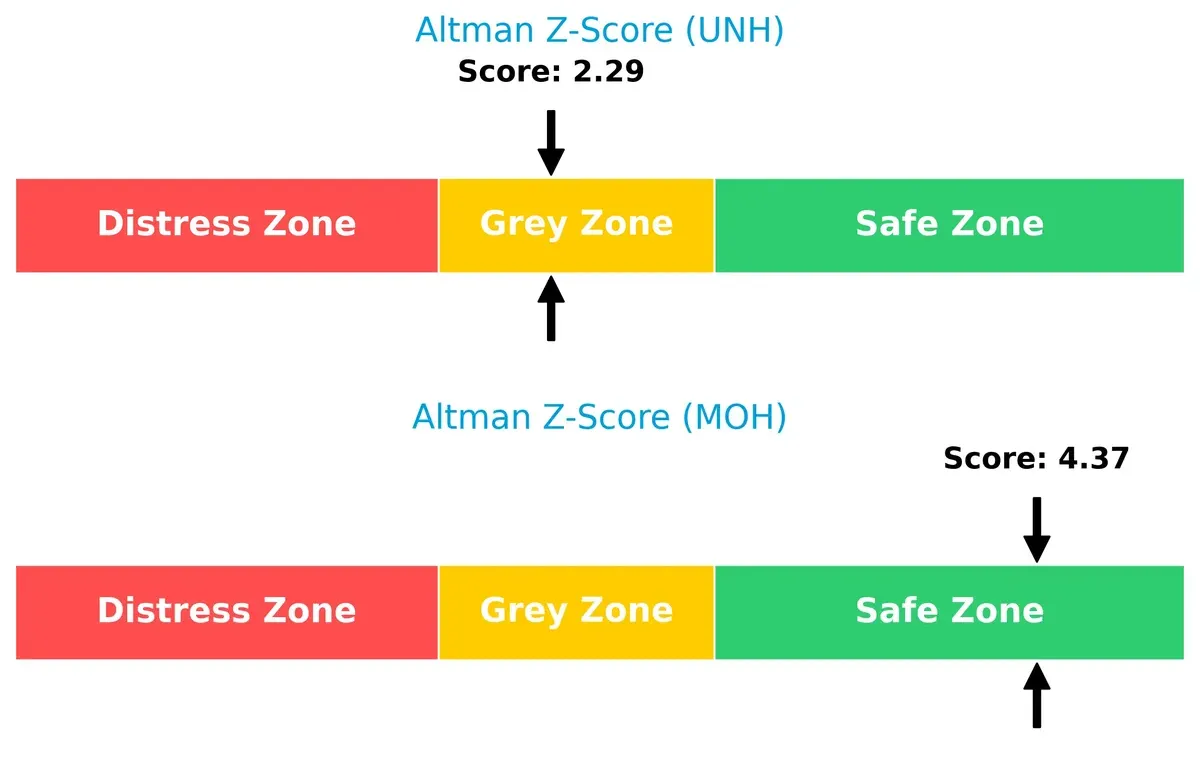

Bankruptcy Risk: Solvency Showdown

Molina Healthcare’s Altman Z-Score of 4.37 places it firmly in the safe zone, while UnitedHealth’s 2.29 signals moderate bankruptcy risk in the grey zone:

This gulf underscores Molina’s stronger solvency and resilience through economic cycles. UnitedHealth’s score warns investors to watch leverage closely amid evolving healthcare dynamics.

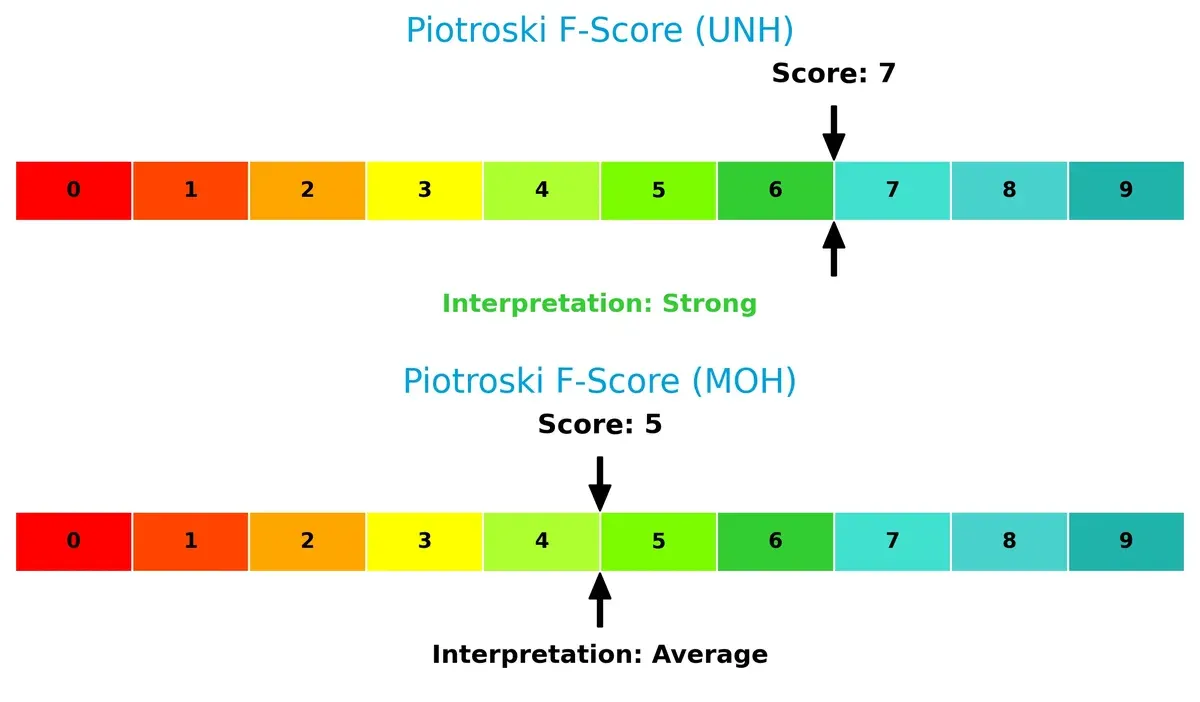

Financial Health: Quality of Operations

UnitedHealth’s Piotroski F-Score of 7 indicates strong internal financial health, outperforming Molina’s average score of 5:

UnitedHealth demonstrates more robust profitability and operational efficiency. Molina’s middling score suggests caution around its internal metrics despite its market valuation strengths. This contrast highlights the trade-off between financial quality and valuation appeal.

How are the two companies positioned?

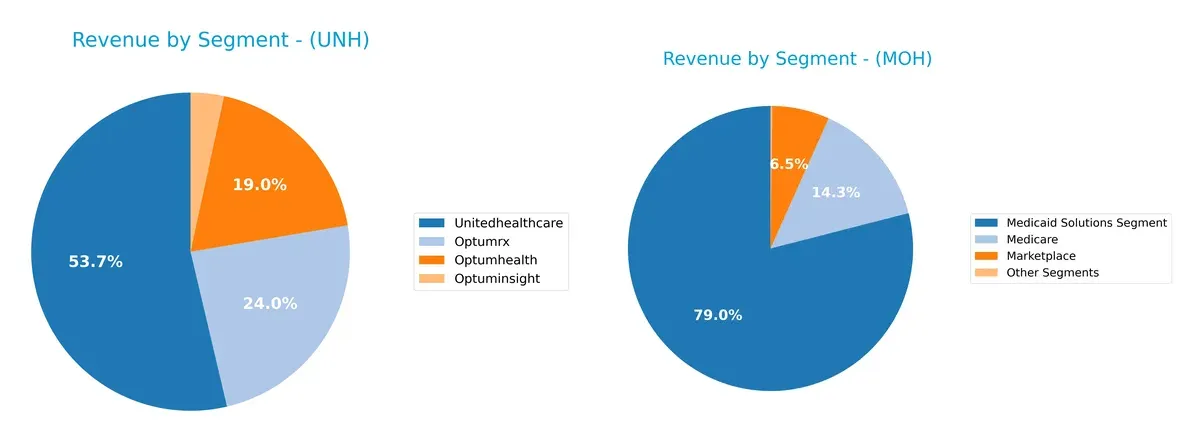

This section dissects the operational DNA of UnitedHealth and Molina by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats to reveal which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

This comparison visually dissects how UnitedHealth Group and Molina Healthcare diversify their income streams and highlights their primary sector bets:

UnitedHealth Group dwarfs Molina with a complex, multi-segment mix anchored by UnitedHealthcare at $298B and Optumrx at $133B. This diversified portfolio mitigates concentration risk and leverages ecosystem lock-in through healthcare services and technology. Molina, by contrast, pivots heavily on its Medicaid Solutions segment at $31B, exposing it to policy shifts but dominating niche government healthcare markets. UnitedHealth’s broad infrastructure dominance contrasts Molina’s focused Medicaid specialization.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of UnitedHealth Group and Molina Healthcare:

UnitedHealth Group Strengths

- Highly diversified revenue streams across multiple healthcare segments

- Favorable debt-to-assets ratio at 25.32%

- Strong asset turnover at 1.45

- Attractive dividend yield of 4.6%

- WACC below ROIC, indicating value creation

Molina Healthcare Strengths

- Superior profitability metrics with ROE at 26.22% and ROIC at 16.38%

- Favorable current and quick ratios at 1.62

- Strong interest coverage ratio of 14.47

- High asset and fixed asset turnover rates (2.6 and 141.15)

- Lower debt-to-assets ratio at 19.95%

UnitedHealth Group Weaknesses

- Unfavorable net margin at 3.18%

- Low liquidity with current and quick ratios below 1 at 0.79

- Price-to-book ratio high at 3.0

- Fixed asset turnover reported as zero, indicating inefficiency

- Overall slightly unfavorable global ratio profile

Molina Healthcare Weaknesses

- Low net margin at 2.9% despite strong ROE

- No dividend yield, limiting income appeal

- Price-to-book ratio elevated at 3.72

- Some reliance on Medicaid segment limits diversification

- Minority neutral and unfavorable financial ratios

UnitedHealth Group shows strength in diversification and yield but faces liquidity and margin challenges. Molina excels in profitability and liquidity but has less diversification and no dividend. These profiles reflect differing strategic focuses and risk exposures.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the sole shield preserving long-term profits against relentless competition erosion. Let’s dissect the defensive strengths of two healthcare giants:

UnitedHealth Group Incorporated: Diversified Healthcare Ecosystem Moat

UnitedHealth’s moat stems from a complex network of integrated healthcare services and data analytics. This manifests in a solid ROIC exceeding WACC by 4%, but profitability shows signs of pressure in 2026. Expansion into specialized care and digital health could deepen its moat but faces margin headwinds.

Molina Healthcare, Inc.: Focused Medicaid Market Niche

Molina leverages targeted government program expertise, delivering cost-efficient Medicaid services. Its ROIC outpaces WACC by nearly 11%, signaling efficient capital use. Unlike UnitedHealth, Molina grows revenue faster and sustains margin gains, poised to capitalize on expanding state Medicaid enrollments in 2026.

Ecosystem Breadth vs. Niche Depth: Moat Strength Showdown

UnitedHealth’s diversified healthcare ecosystem offers a broad but slightly eroding moat. Molina’s focused Medicaid niche delivers a deeper, more efficient capital return. Molina appears better positioned to defend and grow market share amid evolving healthcare policies.

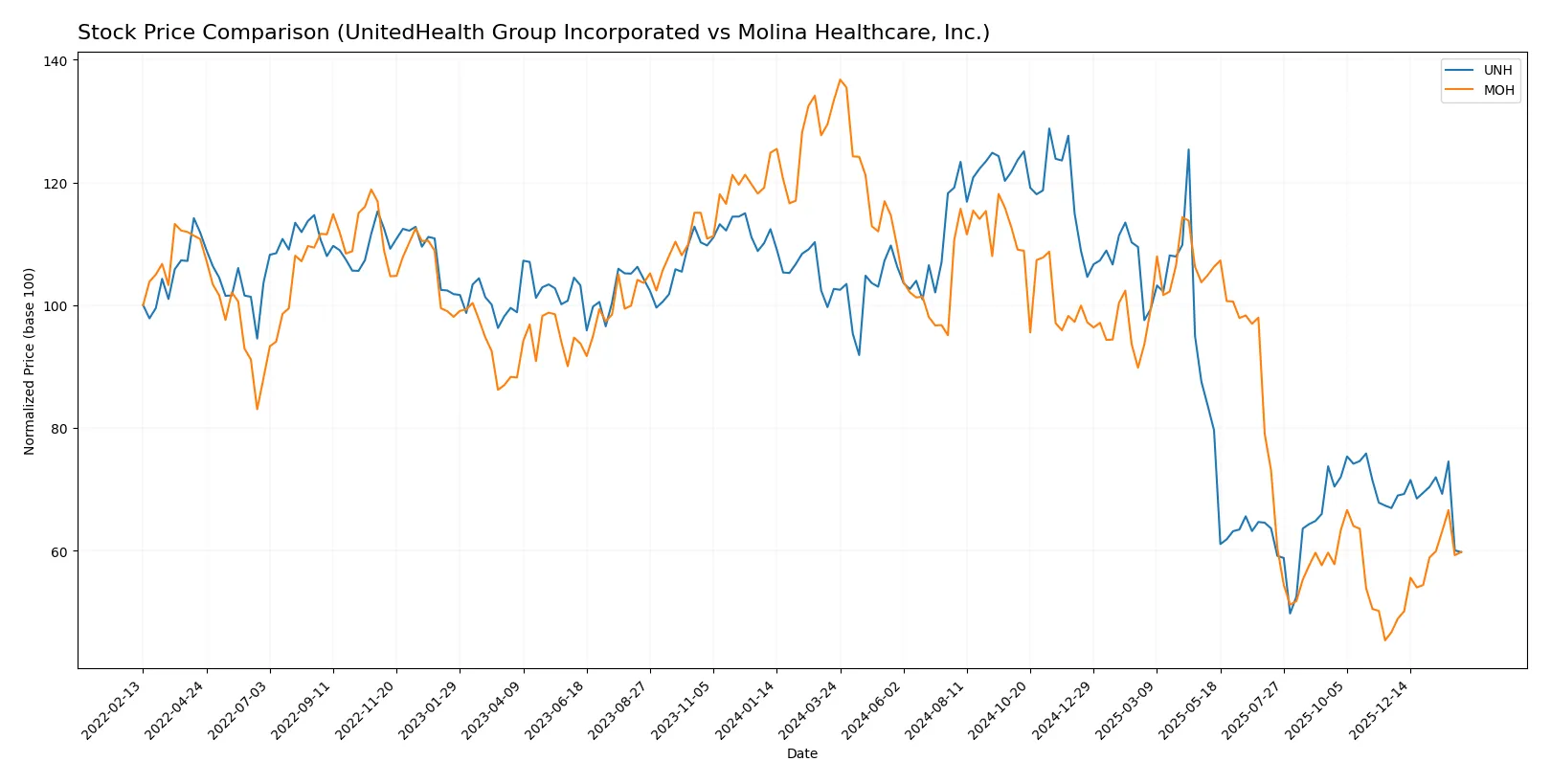

Which stock offers better returns?

The past year shows pronounced declines for both stocks, with recent trading revealing diverging momentum amid contrasting buyer dominance.

Trend Comparison

UnitedHealth Group’s stock fell 41.81% over the last 12 months, marking a bearish trend with accelerating decline and high volatility. Its recent three-month drop of 10.74% reflects persistent downward pressure.

Molina Healthcare’s stock dropped 55.2% in the same period, also bearish and accelerating, but its recent 28% rise signals a strong rebound with increasing buyer dominance.

Comparing trends, Molina Healthcare shows a sharper overall loss but a stronger recent recovery, outperforming UnitedHealth in market performance since late 2025.

Target Prices

Analysts set a positive outlook for UnitedHealth Group and Molina Healthcare with solid upside potential.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| UnitedHealth Group Incorporated | 327 | 444 | 385.38 |

| Molina Healthcare, Inc. | 158 | 224 | 181 |

UnitedHealth’s consensus target of 385.38 suggests a 35% upside from the current 285.59 price. Molina Healthcare’s target near 181 aligns closely with its current 181.18 price, indicating a more neutral stance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

UnitedHealth Group Incorporated Grades

The following table summarizes recent grades from reputable financial institutions for UnitedHealth Group Incorporated:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-30 |

| Wells Fargo | Maintain | Overweight | 2026-01-30 |

| RBC Capital | Maintain | Outperform | 2026-01-28 |

| Leerink Partners | Maintain | Outperform | 2026-01-28 |

| UBS | Maintain | Buy | 2026-01-28 |

| Oppenheimer | Maintain | Outperform | 2026-01-28 |

| Jefferies | Maintain | Buy | 2026-01-28 |

| Morgan Stanley | Maintain | Overweight | 2026-01-23 |

| Barclays | Maintain | Overweight | 2026-01-05 |

| Bernstein | Maintain | Outperform | 2025-10-30 |

Molina Healthcare, Inc. Grades

The following table summarizes recent grades from reputable financial institutions for Molina Healthcare, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-07 |

| Barclays | Maintain | Underweight | 2026-01-05 |

| Wells Fargo | Maintain | Overweight | 2025-11-12 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-24 |

| UBS | Maintain | Neutral | 2025-10-24 |

| Goldman Sachs | Maintain | Neutral | 2025-10-24 |

| Barclays | Downgrade | Underweight | 2025-10-24 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-14 |

| Wells Fargo | Maintain | Overweight | 2025-10-07 |

| Bernstein | Maintain | Outperform | 2025-09-05 |

Which company has the best grades?

UnitedHealth consistently receives higher marks, with multiple “Outperform” and “Buy” ratings. In contrast, Molina’s grades vary more, including “Underweight” and “Neutral.” Investors may interpret UnitedHealth’s stronger grades as a signal of greater confidence from analysts.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

UnitedHealth Group Incorporated

- Dominates with a large market cap of $259B and diversified segments, but faces pressure from pricing and innovation.

Molina Healthcare, Inc.

- Smaller $9.8B market cap with niche focus on Medicaid/Medicare; competition limited but growth dependent on government policies.

2. Capital Structure & Debt

UnitedHealth Group Incorporated

- Debt-to-assets favorable at 25.3%, but current and quick ratios low at 0.79, signaling liquidity concerns.

Molina Healthcare, Inc.

- Stronger liquidity with current and quick ratios at 1.62; debt-to-assets at 19.95% supports a solid balance sheet.

3. Stock Volatility

UnitedHealth Group Incorporated

- Very low beta of 0.415 signals defensive stock with less price volatility.

Molina Healthcare, Inc.

- Slightly higher beta at 0.493, still below market average, indicating moderate volatility.

4. Regulatory & Legal

UnitedHealth Group Incorporated

- Faces complex regulatory scrutiny due to broad healthcare services and government contracts.

Molina Healthcare, Inc.

- Regulatory risk concentrated on Medicaid/Medicare policies and state-level changes, which can sharply impact margins.

5. Supply Chain & Operations

UnitedHealth Group Incorporated

- Operates a vast, integrated network including Optum segments, reducing operational risk.

Molina Healthcare, Inc.

- Smaller scale operations focused on government programs may face challenges scaling efficiently.

6. ESG & Climate Transition

UnitedHealth Group Incorporated

- Larger footprint demands robust ESG initiatives; pressure to improve sustainability disclosures and reduce carbon impact.

Molina Healthcare, Inc.

- ESG efforts less publicized; smaller footprint but must monitor emerging healthcare climate regulations.

7. Geopolitical Exposure

UnitedHealth Group Incorporated

- Primarily US-based with limited direct geopolitical risk but vulnerable to federal healthcare policy shifts.

Molina Healthcare, Inc.

- Concentrated US exposure with reliance on state and federal healthcare programs, sensitive to political changes.

Which company shows a better risk-adjusted profile?

Molina Healthcare faces its largest risk from regulatory dependence on Medicaid and Medicare policies, which can rapidly alter its revenue base. UnitedHealth’s critical risk stems from liquidity constraints, indicated by its unfavorable current ratio despite its scale. Molina’s stronger liquidity and favorable financial ratios translate into a better risk-adjusted profile. Notably, Molina’s Altman Z-score places it firmly in the safe zone, while UnitedHealth remains in the grey zone, underscoring Molina’s comparatively lower bankruptcy risk.

Final Verdict: Which stock to choose?

UnitedHealth’s superpower lies in its massive scale and operational efficiency, making it a cash-generating powerhouse. However, its stretched liquidity ratios present a point of vigilance. It suits investors seeking a core holding in a large-cap, stable healthcare portfolio with moderate growth expectations.

Molina Healthcare benefits from a strategic moat built on its focused Medicaid and government program expertise. It offers a stronger safety profile with healthier liquidity and superior returns on capital. This stock fits well in a GARP portfolio that values growth with a reasonable margin of safety.

If you prioritize scale and steady cash flow, UnitedHealth is compelling due to its entrenched market position and efficiency. However, if you seek higher growth potential with better financial stability, Molina Healthcare outshines by delivering superior returns and a cleaner balance sheet. Each appeals to distinct investor profiles balancing growth and risk differently.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of UnitedHealth Group Incorporated and Molina Healthcare, Inc. to enhance your investment decisions: