Home > Comparison > Healthcare > REGN vs MRNA

The strategic rivalry between Regeneron Pharmaceuticals and Moderna defines the evolution of the biotechnology sector. Regeneron operates as a diversified pharmaceutical developer with a broad therapeutic portfolio, while Moderna specializes in cutting-edge mRNA technology targeting infectious and rare diseases. This analysis pits Regeneron’s established pipeline against Moderna’s innovative platform, evaluating which trajectory offers a superior risk-adjusted return for a balanced healthcare allocation.

Table of contents

Companies Overview

Regeneron and Moderna stand as key innovators reshaping biotechnology’s future.

Regeneron Pharmaceuticals, Inc.: Precision Medicine Pioneer

Regeneron dominates the biotech sector with a strong portfolio of medicines treating eye diseases, inflammatory conditions, and cancers. Its core revenue stems from flagship drugs like EYLEA and Dupixent. In 2026, Regeneron focuses on expanding its pipeline through collaborations and advancing treatments across rare and infectious diseases.

Moderna, Inc.: mRNA Technology Trailblazer

Moderna centers on developing messenger RNA therapeutics and vaccines for infectious and rare diseases. Its revenue primarily derives from respiratory and public health vaccines, including COVID-19 variants. The company’s 2026 strategy emphasizes broadening its mRNA platform into oncology and autoimmune disorders, leveraging strategic alliances to accelerate innovation.

Strategic Collision: Similarities & Divergences

Both companies invest heavily in cutting-edge biotech but diverge in approach: Regeneron builds on a diversified drug portfolio with multiple therapeutic areas, while Moderna focuses on a platform-centric mRNA technology. Their primary battleground is the infectious disease and immunotherapy markets. Investors face contrasting profiles—Regeneron offers stability through established products, Moderna carries higher growth potential but with greater volatility.

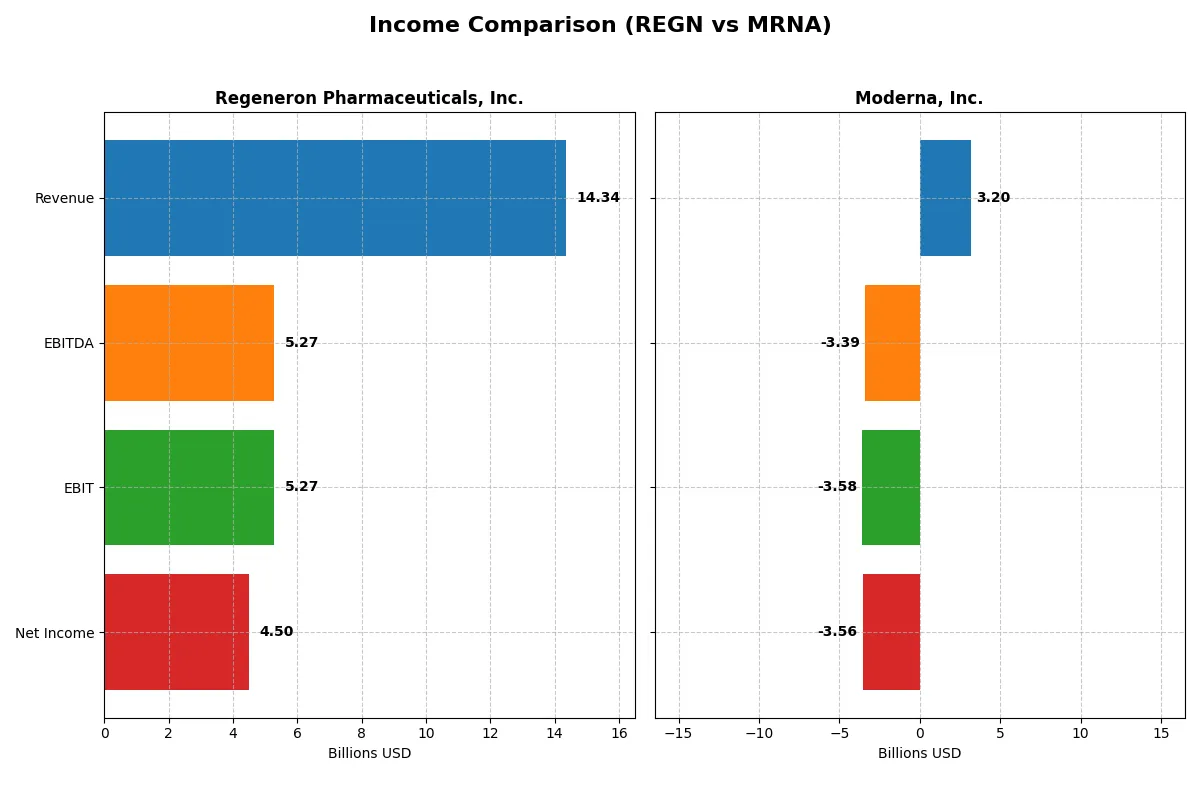

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Regeneron Pharmaceuticals, Inc. (REGN) | Moderna, Inc. (MRNA) |

|---|---|---|

| Revenue | 14.34B | 3.20B |

| Cost of Revenue | 1.97B | 1.46B |

| Operating Expenses | 8.68B | 5.68B |

| Gross Profit | 12.37B | 1.74B |

| EBITDA | 5.27B | -3.39B |

| EBIT | 5.27B | -3.58B |

| Interest Expense | 44M | 24M |

| Net Income | 4.50B | -3.56B |

| EPS | 43.07 | -9.27 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison exposes the true efficiency and profitability of Regeneron Pharmaceuticals and Moderna’s corporate engines.

Regeneron Pharmaceuticals, Inc. Analysis

Regeneron’s revenue showed modest growth, reaching $14.3B in 2025, with net income at $4.5B. It maintains robust gross margins above 86%, reflecting strong cost control. Despite slight revenue stagnation, its net margin of 31.4% and improving EBIT margin demonstrate solid operational efficiency and stable profitability momentum.

Moderna, Inc. Analysis

Moderna’s revenue plunged 53% to $3.2B in 2024, with a significant net loss of $3.6B. Gross margin at 54% remains decent, but the company struggles with negative EBIT and net margins near -111%, indicating severe profitability challenges. Despite some EPS growth, operational losses and declining revenue question its near-term income statement health.

Margin Strength vs. Revenue Resilience

Regeneron clearly outperforms Moderna with superior margin profiles and positive net income, reflecting a more efficient business model. Moderna’s sharp revenue decline and persistent net losses highlight operational stress. For investors prioritizing steady profitability and margin resilience, Regeneron offers a fundamentally stronger income statement profile.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Regeneron Pharmaceuticals, Inc. (REGN) | Moderna, Inc. (MRNA) |

|---|---|---|

| ROE | 14.4% | -32.7% |

| ROIC | 8.5% | -32.5% |

| P/E | 17.9 | -4.5 |

| P/B | 2.58 | 1.46 |

| Current Ratio | 36.5 | 3.67 |

| Quick Ratio | 32.3 | 3.62 |

| D/E (Debt-to-Equity) | 0.087 | 0.069 |

| Debt-to-Assets | 6.7% | 5.3% |

| Interest Coverage | 84.3 | -164.4 |

| Asset Turnover | 0.35 | 0.23 |

| Fixed Asset Turnover | 2.80 | 1.08 |

| Payout ratio | 8.2% | 0% |

| Dividend yield | 0.46% | 0% |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, uncovering hidden risks and operational strengths that shape investment decisions.

Regeneron Pharmaceuticals, Inc.

Regeneron displays solid profitability with a 14.41% ROE and a strong 31.41% net margin, indicating operational efficiency. Its P/E of 17.92 and P/B of 2.58 suggest a fairly valued stock, neither stretched nor cheap. The company returns value modestly, offering a 0.46% dividend yield while reinvesting heavily in R&D, fueling future growth.

Moderna, Inc.

Moderna struggles with deeply negative profitability metrics: a -32.67% ROE and -111.32% net margin highlight ongoing operational challenges. Despite favorable valuation multiples—P/E at -4.48 and P/B at 1.46—the stock appears risky. It pays no dividends, instead directing resources aggressively into R&D, aiming to reverse losses and capture growth opportunities.

Balanced Efficiency vs. High-Risk Reinvestment

Regeneron offers a balanced profile with stable profitability and reasonable valuation, managing risk prudently. Moderna’s attractive valuation masks operational losses and financial stress. Investors seeking steady returns align better with Regeneron, while those tolerating volatility for potential turnaround may consider Moderna’s growth focus.

Which one offers the Superior Shareholder Reward?

I see Regeneron (REGN) offers a modest dividend yield of 0.46%, backed by a low payout ratio near 8%. Its steady dividend plus consistent buybacks support shareholder returns sustainably. Moderna (MRNA) pays no dividend, reinvesting heavily in R&D and growth, but suffers persistent losses and negative margins. Regeneron’s disciplined buyback and cash flow-backed dividends deliver a more reliable total return in 2026. I conclude REGN offers superior shareholder reward due to sustainable distributions and capital allocation, unlike MRNA’s riskier reinvestment model amid ongoing profitability challenges.

Comparative Score Analysis: The Strategic Profile

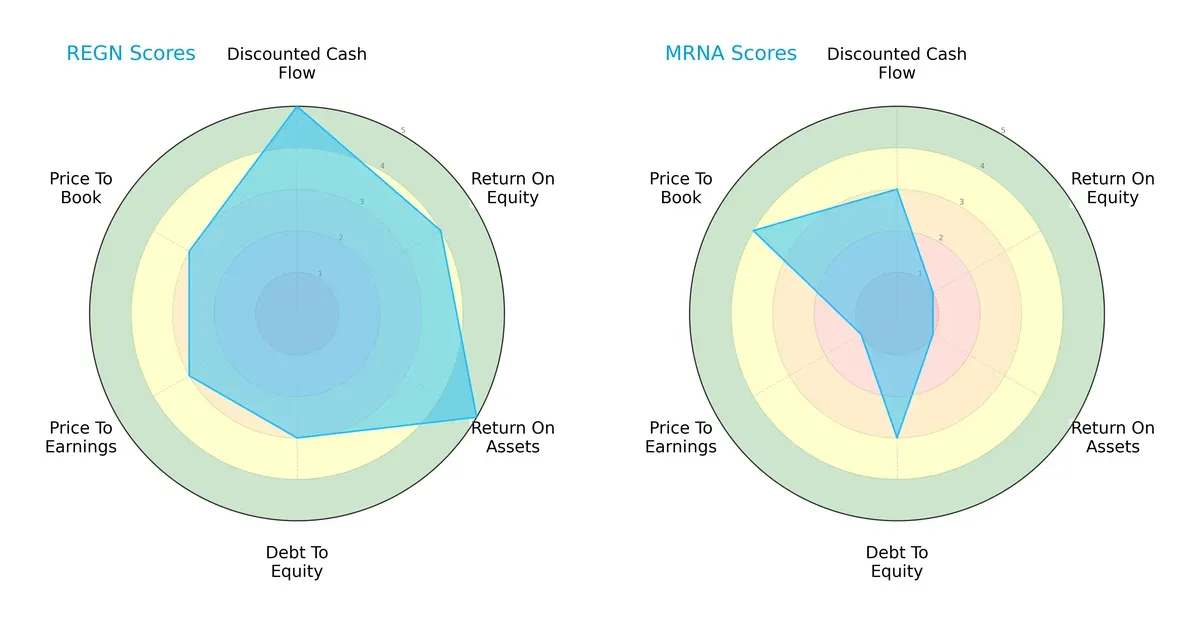

The radar chart reveals the fundamental DNA and financial trade-offs of Regeneron Pharmaceuticals and Moderna, highlighting their distinct investment profiles:

Regeneron demonstrates a more balanced and robust profile with strong DCF (5), ROE (4), and ROA (5) scores. Moderna shows weaknesses in profitability metrics, scoring 1 in both ROE and ROA, but has a slight edge in price-to-book valuation (4 vs. 3). Regeneron’s moderate debt-to-equity and valuation scores indicate prudent financial management, while Moderna relies heavily on valuation appeal but suffers operational inefficiencies.

Bankruptcy Risk: Solvency Showdown

Regeneron’s Altman Z-Score of 18.3 vastly exceeds Moderna’s 4.5, signaling far stronger long-term solvency and resilience in this market cycle:

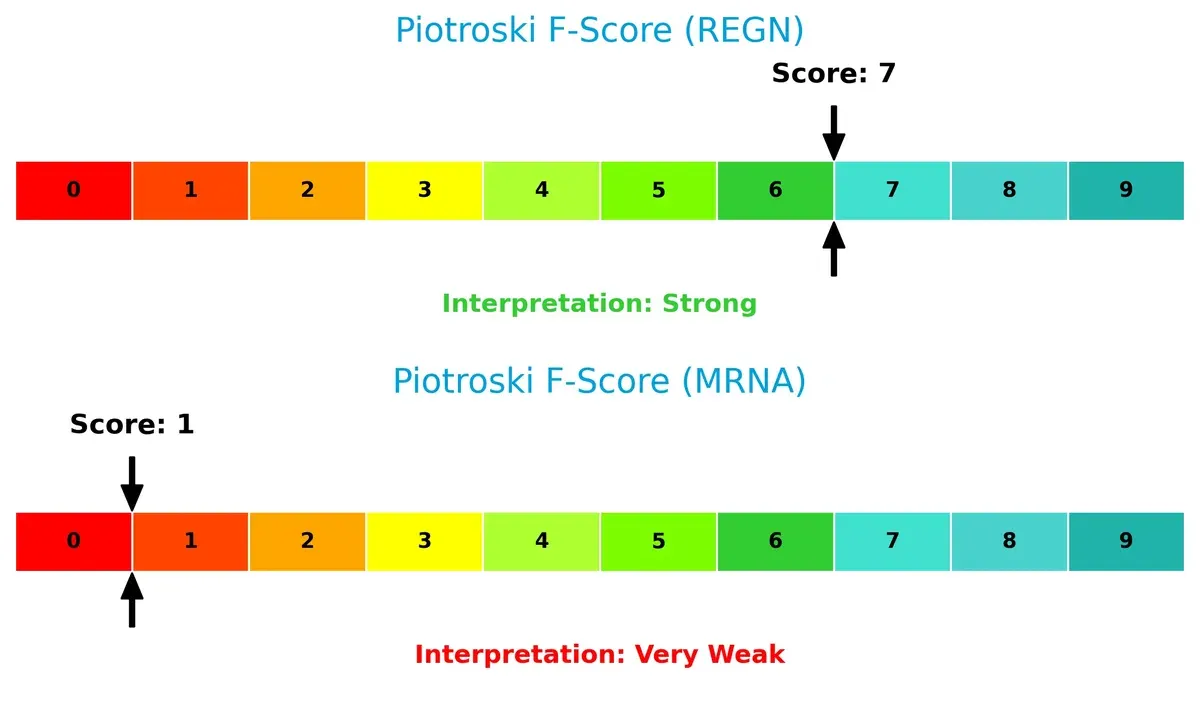

Financial Health: Quality of Operations

Regeneron’s Piotroski F-Score of 7 suggests solid financial health and operational quality. Moderna’s score of 1 raises red flags about its internal metrics and financial stability:

How are the two companies positioned?

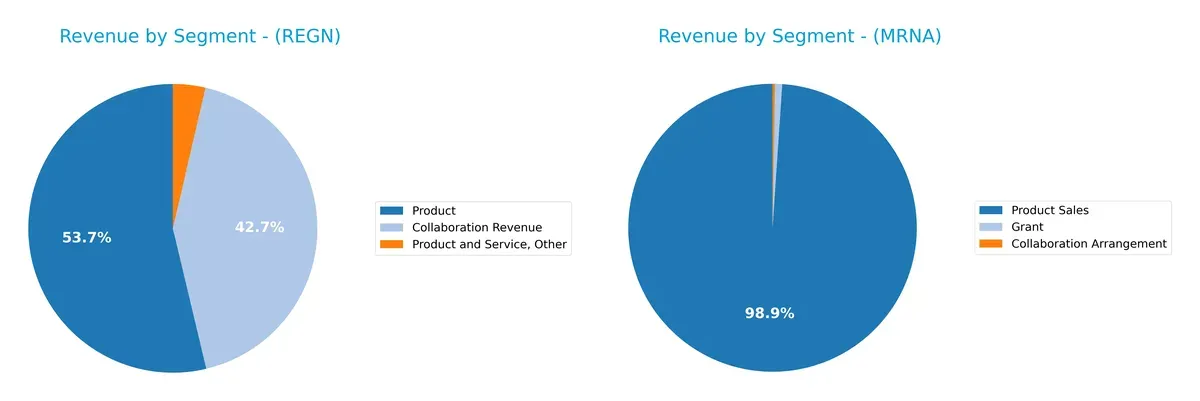

This section dissects Regeneron and Moderna’s operational DNA by comparing revenue distribution and internal dynamics. The objective is to confront their economic moats and identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Regeneron Pharmaceuticals and Moderna diversify their income streams and highlights their primary sector bets:

Regeneron anchors its revenue with $7.6B from product sales and a significant $6.1B from collaboration revenue, showing a well-balanced mix. Moderna relies heavily on $4.5B in product sales, with minimal collaboration income. Regeneron’s diversification reduces risk and leverages ecosystem partnerships, while Moderna’s concentration pivots on mRNA medicines, exposing it to product cycle volatility. The contrast underscores Regeneron’s strategic ecosystem lock-in versus Moderna’s focused innovation bet.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Regeneron Pharmaceuticals, Inc. and Moderna, Inc.:

Regeneron Strengths

- High net margin at 31.41%

- Low debt-to-assets at 6.67%

- Strong interest coverage of 120.42

- Favorable quick ratio of 32.31

- Diverse collaboration and product revenues

- Neutral ROIC above WACC at 8.48%

Moderna Strengths

- Favorable price-to-book at 1.46

- Favorable price-to-earnings despite negative earnings

- Low debt-to-assets at 5.28%

- Favorable quick ratio of 3.62

- Broad geographic revenue including US, Europe, and Rest of World

- Focused product sales in mRNA medicines

Regeneron Weaknesses

- Extremely high current ratio at 36.51, indicating inefficient capital use

- Unfavorable asset turnover at 0.35

- Low dividend yield at 0.46%

- Neutral ROE at 14.41%

- Moderate P/E and P/B ratios limiting growth perception

Moderna Weaknesses

- Negative net margin at -111.32%

- Negative ROE and ROIC around -32%

- Unfavorable interest coverage at -149.29

- Unfavorable current ratio at 3.67

- Unfavorable asset turnover at 0.23

- No dividend yield

Regeneron shows strong profitability and capital structure discipline but suffers from low asset efficiency and capital deployment concerns. Moderna demonstrates geographic reach and valuation appeal but faces significant profitability and coverage challenges, reflecting operational risks. Each company’s strategy must address these structural strengths and weaknesses to improve investor confidence.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat protects long-term profits from relentless competition and market pressures. Here’s how Regeneron and Moderna stack up:

Regeneron Pharmaceuticals, Inc.: Intangible Assets Moat

Regeneron’s competitive edge stems from its deep portfolio of patented drugs and robust R&D pipeline. This manifests in high ROIC above WACC, signaling value creation despite a declining trend. New product launches in rare diseases could deepen its moat in 2026.

Moderna, Inc.: Innovation-Driven Cost Advantage

Moderna’s moat relies on pioneering mRNA technology, differentiating it from Regeneron’s patent-heavy model. However, its negative ROIC versus WACC reveals value destruction and unstable profitability. Expansion into diverse vaccine markets offers upside, but risks remain high.

Patents vs. Platform Innovation: The Moat Battle

Regeneron holds the deeper moat with consistent value creation and margin stability, unlike Moderna’s negative returns and volatile growth. Regeneron is better positioned to defend its market share amid biotech’s competitive intensity.

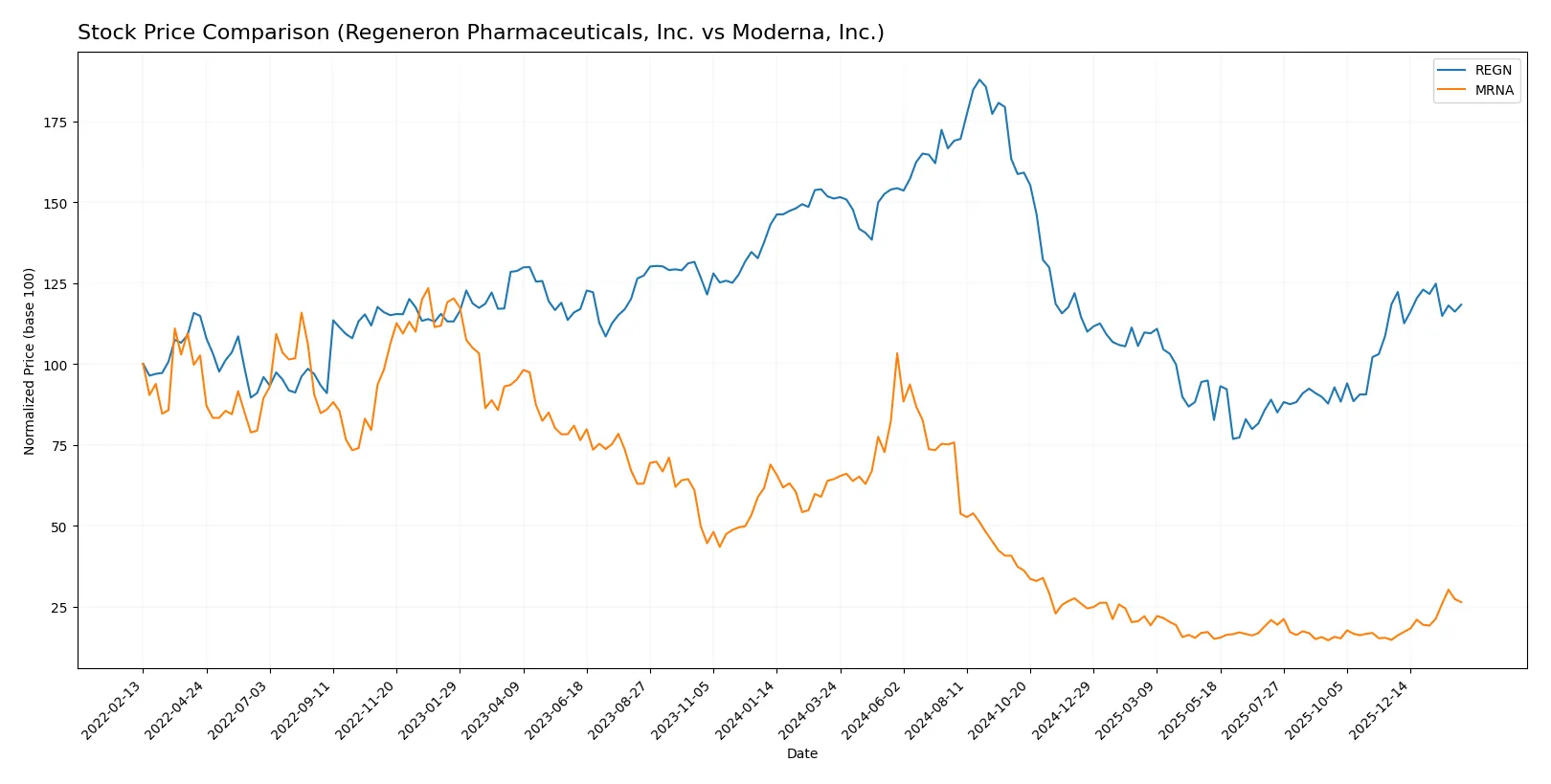

Which stock offers better returns?

Over the past year, Regeneron and Moderna have shown distinct price dynamics, with both stocks experiencing bearish trends but diverging sharply in recent months.

Trend Comparison

Regeneron’s stock price declined 21.72% over 12 months, accelerating downward with a high volatility of 199.22 and a range between 490.28 and 1199.12. Recent weeks show a slight neutral trend with minimal change (-0.12%).

Moderna’s stock fell sharply by 59.03% over the year, also accelerating downwards, though with lower volatility at 37.39. However, recent months reveal a strong bullish rebound, rising 79.38% with a positive slope of 2.03.

Moderna delivered the highest market performance recently, reversing a deep decline, while Regeneron maintained a broadly bearish trajectory with limited recent recovery.

Target Prices

Analysts present a mixed but insightful consensus on target prices for Regeneron Pharmaceuticals and Moderna.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Regeneron Pharmaceuticals, Inc. | 700 | 1,057 | 851.06 |

| Moderna, Inc. | 15 | 63 | 30 |

Regeneron’s target consensus at 851 compares favorably to its current price of 755, suggesting upside potential. Moderna’s consensus target of 30 sits well below its current price of 42.55, indicating caution or profit-taking among analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables present the latest institutional grades for Regeneron Pharmaceuticals, Inc. and Moderna, Inc.:

Regeneron Pharmaceuticals, Inc. Grades

This table summarizes recent grades and actions from key grading firms for Regeneron Pharmaceuticals, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | maintain | Outperform | 2026-01-22 |

| Truist Securities | maintain | Buy | 2026-01-08 |

| B of A Securities | upgrade | Buy | 2026-01-07 |

| Morgan Stanley | maintain | Equal Weight | 2025-12-12 |

| Wells Fargo | maintain | Equal Weight | 2025-12-10 |

| Canaccord Genuity | maintain | Buy | 2025-12-04 |

| BMO Capital | maintain | Outperform | 2025-12-04 |

| Morgan Stanley | downgrade | Equal Weight | 2025-12-03 |

| Scotiabank | maintain | Sector Perform | 2025-11-24 |

| Wells Fargo | maintain | Equal Weight | 2025-11-20 |

Moderna, Inc. Grades

This table outlines recent institutional grades and actions for Moderna, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | maintain | Equal Weight | 2025-12-12 |

| Piper Sandler | maintain | Overweight | 2025-11-21 |

| Leerink Partners | maintain | Underperform | 2025-11-21 |

| RBC Capital | maintain | Sector Perform | 2025-11-21 |

| B of A Securities | maintain | Underperform | 2025-11-10 |

| Barclays | maintain | Equal Weight | 2025-11-07 |

| Citigroup | maintain | Neutral | 2025-10-23 |

| JP Morgan | maintain | Underweight | 2025-10-23 |

| UBS | maintain | Buy | 2025-10-23 |

| Needham | maintain | Hold | 2025-10-20 |

Which company has the best grades?

Regeneron consistently receives more positive grades, including multiple Buy and Outperform ratings. Moderna’s grades trend more conservatively, with several Underperform and Equal Weight ratings. This divergence may influence investor confidence and portfolio positioning.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing Regeneron Pharmaceuticals, Inc. and Moderna, Inc. in the 2026 market environment:

1. Market & Competition

Regeneron Pharmaceuticals, Inc.

- Established product portfolio with diversified therapies reduces competitive pressure.

Moderna, Inc.

- Reliance on mRNA technology and vaccines exposes it to fast-evolving biotech competition.

2. Capital Structure & Debt

Regeneron Pharmaceuticals, Inc.

- Low debt-to-equity ratio (0.09) indicates strong financial stability.

Moderna, Inc.

- Similarly low leverage (0.07) but weaker interest coverage signals risk in servicing debt.

3. Stock Volatility

Regeneron Pharmaceuticals, Inc.

- Beta at 0.389 shows low stock volatility, appealing for risk-averse investors.

Moderna, Inc.

- Higher beta of 1.338 reflects significant stock price swings and higher risk.

4. Regulatory & Legal

Regeneron Pharmaceuticals, Inc.

- Broad regulatory approvals for existing drugs mitigate immediate legal risks.

Moderna, Inc.

- Heavy regulatory scrutiny on novel mRNA products poses ongoing compliance challenges.

5. Supply Chain & Operations

Regeneron Pharmaceuticals, Inc.

- Mature supply chain with global partnerships reduces operational disruptions.

Moderna, Inc.

- Emerging supply chain infrastructure remains vulnerable to bottlenecks and delays.

6. ESG & Climate Transition

Regeneron Pharmaceuticals, Inc.

- Moderate ESG focus with room to improve sustainability practices.

Moderna, Inc.

- Increasing ESG initiatives, but still developing comprehensive climate transition strategy.

7. Geopolitical Exposure

Regeneron Pharmaceuticals, Inc.

- Limited geopolitical risk primarily due to strong US market base.

Moderna, Inc.

- Greater international exposure heightens risks from geopolitical tensions and trade policies.

Which company shows a better risk-adjusted profile?

Regeneron faces its most impactful risk in operational efficiency, given an unfavorable asset turnover ratio, signaling slower asset utilization. Moderna’s greatest risk is severe profitability weakness, with negative net margin and ROE reflecting ongoing losses. Between the two, Regeneron displays a better risk-adjusted profile, underpinned by a strong Altman Z-Score (18.3, safe zone) and a robust Piotroski Score (7, strong). Moderna’s volatile stock and weak profitability metrics, including a very weak Piotroski Score of 1, confirm elevated risk. Regeneron’s steady operational foundation justifies greater investor confidence in 2026.

Final Verdict: Which stock to choose?

Regeneron Pharmaceuticals boasts a superpower in its robust value creation, consistently generating returns above its cost of capital. Its operational efficiency and strong cash flow quality make it a reliable contender. However, the unusually high current ratio signals liquidity management that requires vigilance. It fits well in a portfolio seeking steady, slightly favorable growth.

Moderna’s strategic moat lies in its innovative pipeline and rapid development capabilities, supported by significant R&D investment. It presents a more volatile profile but benefits from a solid balance sheet and recurring revenue potential. Compared to Regeneron, Moderna offers a growth-at-a-reasonable-price appeal, suited for investors willing to embrace higher risk for upside.

If you prioritize capital preservation and consistent value creation, Regeneron outshines as the compelling choice due to its financial stability and strong returns. However, if you seek aggressive growth with exposure to biotech innovation, Moderna offers superior upside potential despite its current profitability challenges. Both profiles demand careful risk management aligned with your investment horizon.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Regeneron Pharmaceuticals, Inc. and Moderna, Inc. to enhance your investment decisions: