Home > Comparison > Consumer Cyclical > MBLY vs OUST

The strategic rivalry between Mobileye Global Inc. and Ouster, Inc. defines the current trajectory of advanced sensing technologies. Mobileye operates as a consumer cyclical auto-parts leader specializing in autonomous driving systems, while Ouster focuses on high-tech lidar hardware within the broader technology sector. This head-to-head pits established scale against innovative precision. This analysis aims to reveal which corporate path offers superior risk-adjusted returns for a diversified portfolio in 2026 and beyond.

Table of contents

Companies Overview

Mobileye and Ouster command pivotal roles in advancing automotive and sensing technologies globally. Their innovations shape future mobility and automation markets.

Mobileye Global Inc.: Autonomous Driving Pioneer

Mobileye dominates the advanced driver assistance systems (ADAS) market, generating revenue through cutting-edge safety and autonomous driving solutions. Its strategic focus in 2026 centers on expanding cloud-enhanced driver assist technologies and scaling autonomous mobility services. Mobileye’s integration of real-time detection and over-the-air updates solidifies its competitive advantage in safety and operational efficiency.

Ouster, Inc.: Digital Lidar Innovator

Ouster specializes in high-resolution digital lidar sensors that enable 3D vision for vehicles, robots, and infrastructure. Its revenue engine relies on delivering innovative OS scanning and DF solid-state flash sensors. The company’s 2026 strategy targets broadening sensor adoption across diverse industrial and mobility applications, leveraging its compact and versatile sensor technologies to capture emerging market opportunities.

Strategic Collision: Similarities & Divergences

Both companies focus on enhancing autonomous and smart mobility but diverge in approach: Mobileye builds a software-driven ecosystem for autonomous vehicles, while Ouster emphasizes hardware innovation in lidar sensing. Their primary battleground lies in the integration of perception technologies into next-gen mobility platforms. Mobileye offers a more mature, scalable solution; Ouster presents a high-growth, hardware-centric profile with elevated volatility.

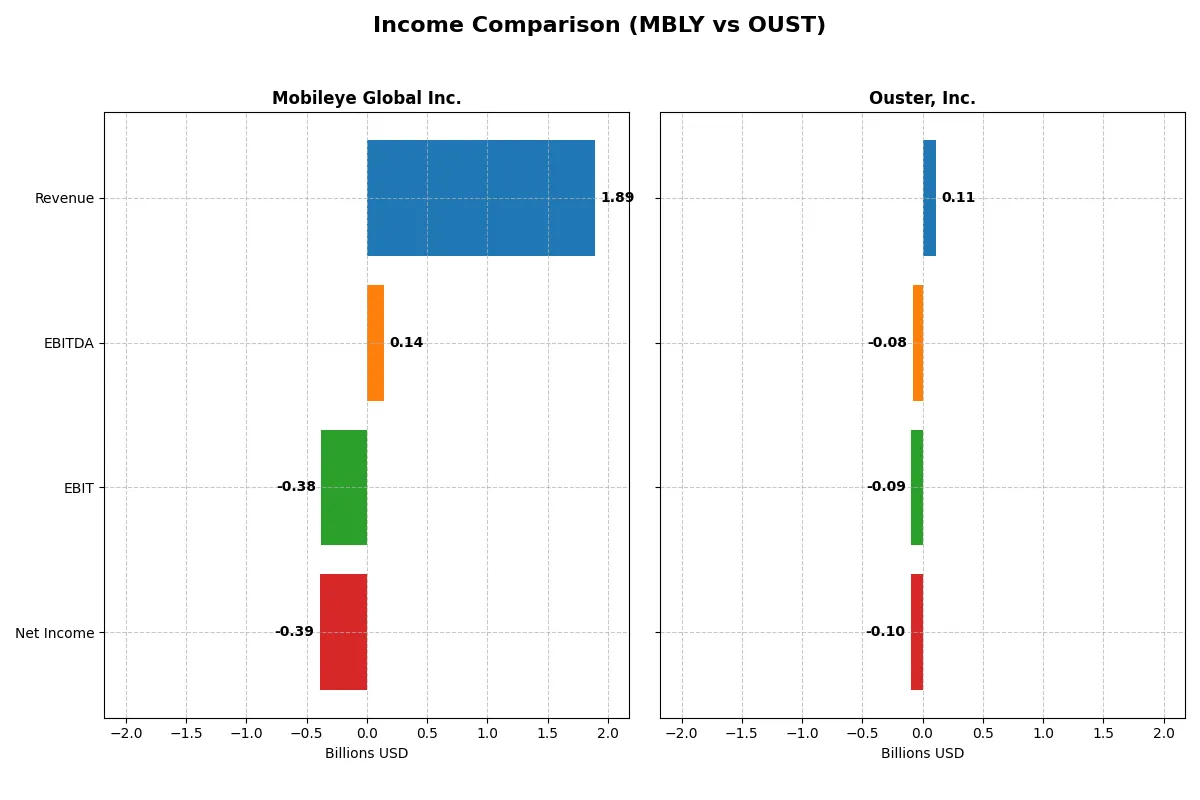

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Mobileye Global Inc. (MBLY) | Ouster, Inc. (OUST) |

|---|---|---|

| Revenue | 1.89B | 111.1M |

| Cost of Revenue | 990M | 70.6M |

| Operating Expenses | 1.34B | 144.6M |

| Gross Profit | 904M | 40.5M |

| EBITDA | 140M | -79.9M |

| EBIT | -377M | -94.7M |

| Interest Expense | 0 | 1.8M |

| Net Income | -392M | -97.0M |

| EPS | -0.48 | -2.08 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true operational efficiency and profitability momentum of each company’s financial engine.

Mobileye Global Inc. Analysis

Mobileye’s revenue grew steadily from $1.39B in 2021 to $1.89B in 2025, showing a 36.7% rise over five years. Despite healthy gross margins near 48%, net income remains negative, with a significant loss of $392M in 2025. Operating losses narrowed sharply in 2025, indicating improving efficiency and stronger momentum.

Ouster, Inc. Analysis

Ouster posted rapid revenue growth from $19M in 2020 to $111M in 2024, a striking 488% increase. Its gross margin improved to 36.4% in 2024, but net losses remain steep at $97M. Ouster’s operating losses shrank substantially year-over-year, reflecting meaningful progress in scaling and cost control.

Growth Momentum vs. Margin Discipline

Mobileye delivers higher absolute revenue with robust gross margins, but persistent net losses constrain profitability. Ouster excels in growth velocity and margin expansion, yet it remains deeply unprofitable on a net basis. Investors seeking scale and margin stability may favor Mobileye, while those prioritizing rapid growth might lean toward Ouster’s dynamic profile.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Mobileye Global Inc. (MBLY) | Ouster, Inc. (OUST) |

|---|---|---|

| ROE | -3.3% | -53.6% |

| ROIC | -3.6% | -50.8% |

| P/E | -21.6 | -5.9 |

| P/B | 0.71 | 3.15 |

| Current Ratio | 6.1 | 2.8 |

| Quick Ratio | 5.3 | 2.6 |

| D/E | 0 | 0.11 |

| Debt-to-Assets | 0 | 7.3% |

| Interest Coverage | 0 | -57.1 |

| Asset Turnover | 0.15 | 0.40 |

| Fixed Asset Turnover | 4.00 | 4.54 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, unveiling hidden risks and operational strengths that define its market stance and investor appeal.

Mobileye Global Inc.

Mobileye shows weak profitability with a negative ROE of -3.3% and a net margin of -20.7%, signaling operational challenges. Its valuation looks attractive with a P/E of -21.61 and a P/B of 0.71, suggesting the stock is undervalued. Mobileye retains earnings for heavy R&D investment, foregoing dividends to fuel growth.

Ouster, Inc.

Ouster suffers from deep losses, posting a -53.64% ROE and a net margin of -87.35%, reflecting severe inefficiency. The P/E ratio is favorable at -5.87, but a high P/B of 3.15 indicates premium pricing relative to assets. Ouster does not pay dividends, reinvesting heavily in R&D to drive future innovation.

Undervaluation Meets High Risk: Growth vs. Profitability

Mobileye balances undervaluation and moderate operational risk better than Ouster, which faces steeper losses and stretched valuation. Investors seeking growth with tempered risk may prefer Mobileye’s profile, while Ouster suits those chasing aggressive innovation despite financial instability.

Which one offers the Superior Shareholder Reward?

Mobileye Global Inc. (MBLY) avoids dividends, relying on modest free cash flow (FCF) and a buyback program that remains limited but growing. Its 2025 FCF per share stands at $0.64, with a cash ratio of 4.5, signaling strong liquidity to support buybacks. Ouster, Inc. (OUST) pays no dividends and generates negative FCF (-$0.8 per share in 2024), reflecting ongoing heavy reinvestment and losses. Ouster’s limited buyback capacity is constrained by weaker liquidity (cash ratio 0.58). Historically, Mobileye’s conservative payout and buyback align with its improving margin trajectory, suggesting a more sustainable shareholder return model. I conclude MBLY offers a superior total return profile for 2026 investors due to its stronger cash flow, disciplined capital allocation, and prudent buyback potential.

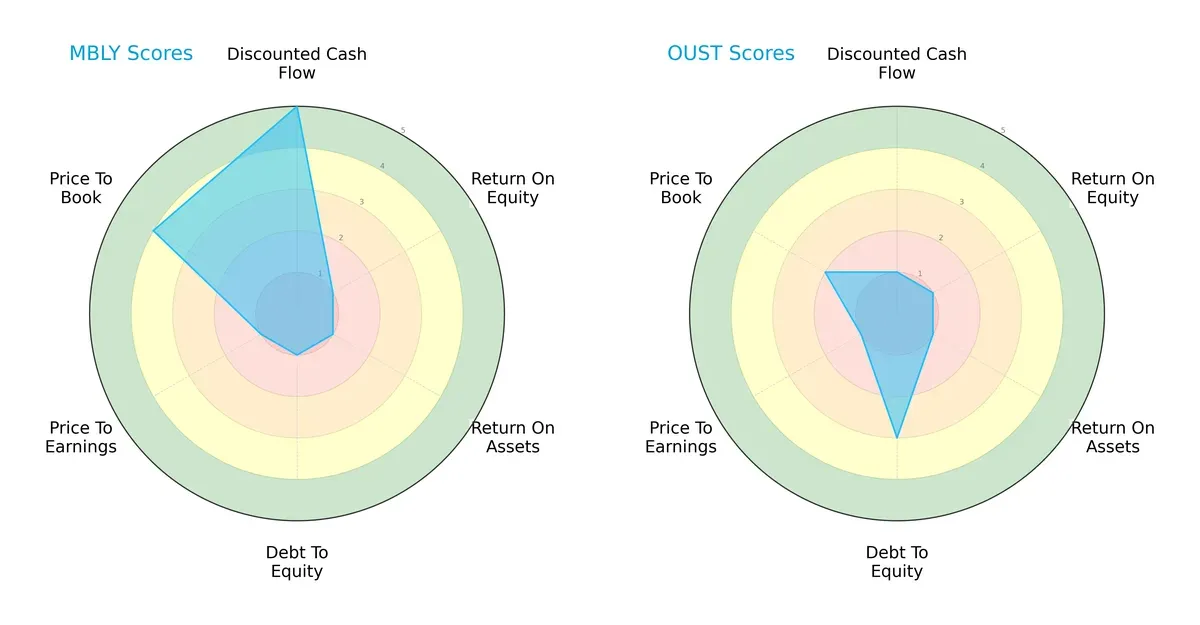

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Mobileye Global Inc. and Ouster, Inc., highlighting their core strengths and vulnerabilities:

Mobileye excels in discounted cash flow and price-to-book valuation, signaling strong future cash generation and asset value. However, it struggles with profitability (ROE, ROA) and carries high financial risk (debt-to-equity). Ouster maintains a moderate debt profile but underperforms in cash flow and valuation metrics. Mobileye’s profile is more unbalanced, relying heavily on cash flow strength, while Ouster shows a less concentrated but overall weaker score distribution.

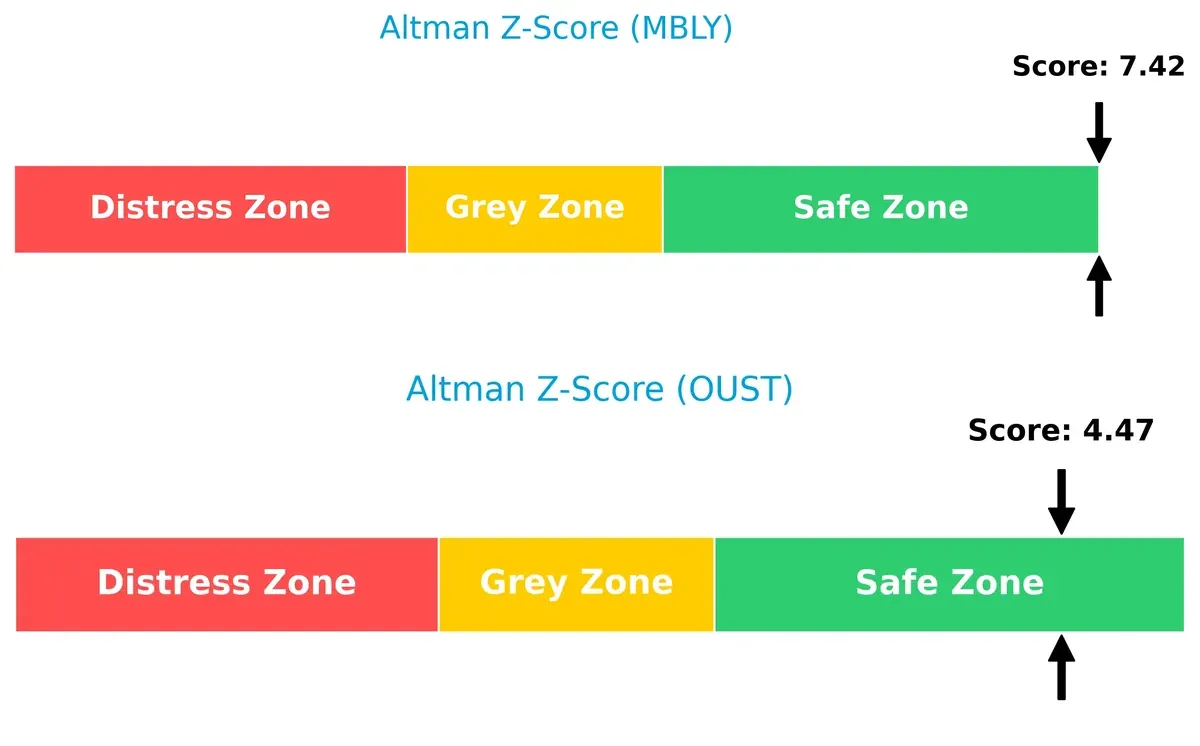

Bankruptcy Risk: Solvency Showdown

Mobileye’s Altman Z-Score of 7.42 versus Ouster’s 4.47 places both firms comfortably in the safe zone, indicating strong solvency and low bankruptcy risk in this cycle:

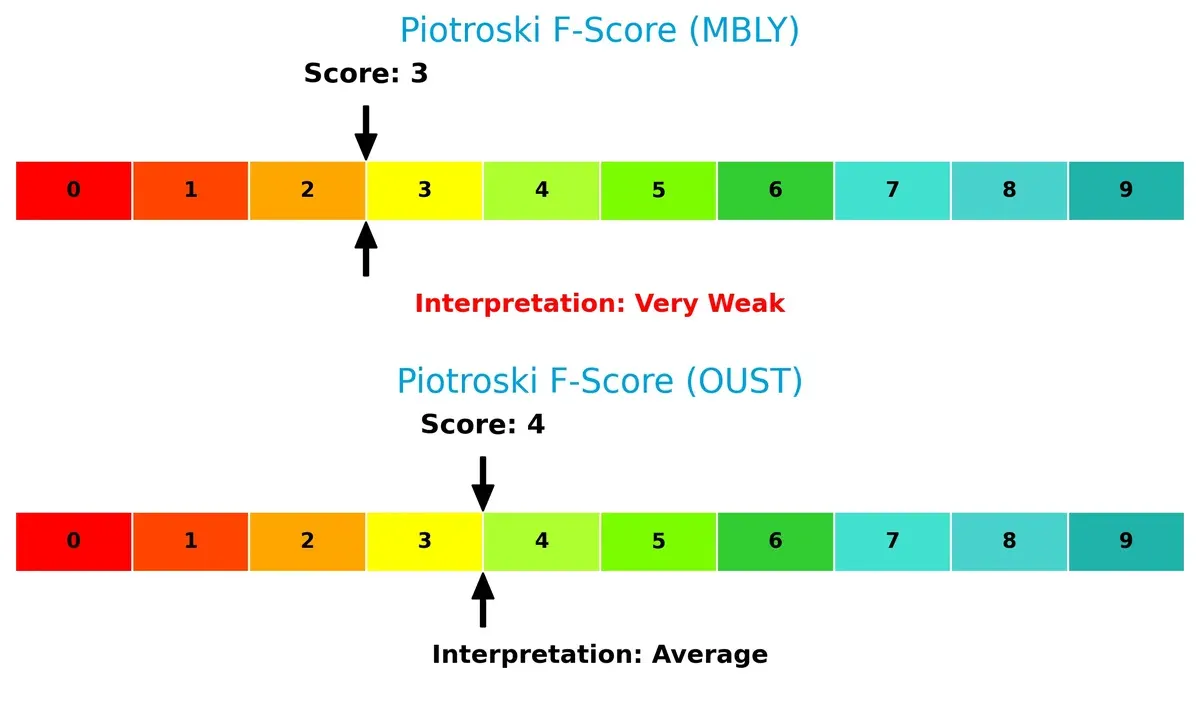

Financial Health: Quality of Operations

Mobileye’s Piotroski F-Score of 3 signals very weak financial health, raising red flags on internal operational metrics. Ouster’s score of 4 is only marginally better but remains below average, reflecting ongoing challenges in profitability and efficiency:

How are the two companies positioned?

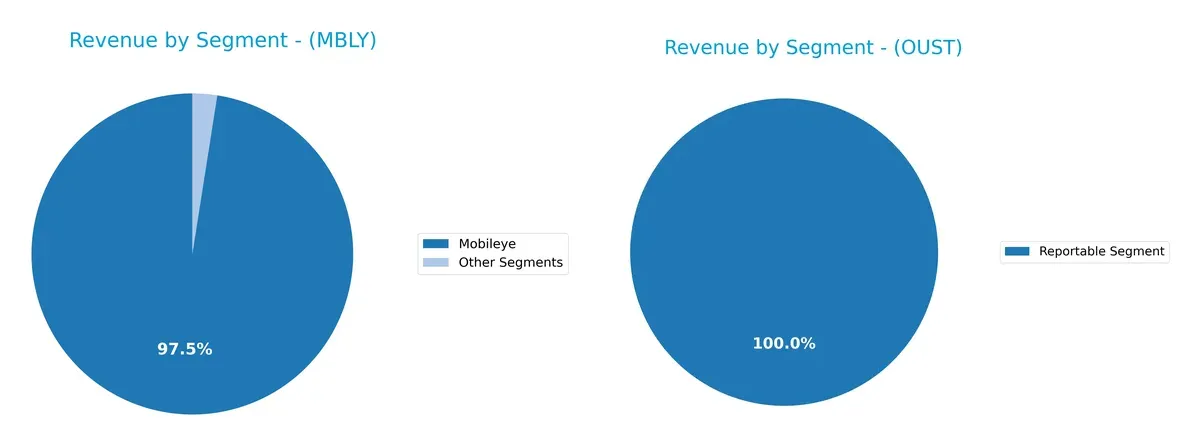

This section dissects the operational DNA of MBLY and OUST by comparing their revenue distribution by segment and internal dynamics, including strengths and weaknesses. The final objective is to confront their economic moats to identify which business model offers the most resilient and sustainable competitive advantage in today’s market landscape.

Revenue Segmentation: The Strategic Mix

The following visual comparison dissects how Mobileye Global Inc. and Ouster, Inc. diversify their income streams and where their primary sector bets lie:

Mobileye’s revenue dwarfs Ouster’s, anchored by its Mobileye segment at $1.6B in 2024, with minimal contribution from other segments. Ouster reports a single $111M segment, showing less granularity. Mobileye’s heavy reliance on one dominant segment reveals ecosystem lock-in and infrastructure dominance, while Ouster’s less diversified profile signals higher concentration risk and scale challenges. I see Mobileye’s focus as a moat; Ouster must broaden to compete.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Mobileye Global Inc. and Ouster, Inc.:

Mobileye Strengths

- Diverse global revenue across China, US, Europe, and Asia

- High fixed asset turnover at 4.0 indicating efficient asset use

- Strong balance sheet with zero debt and favorable quick ratio

Ouster Strengths

- Favorable current and quick ratios indicate solid short-term liquidity

- Positive fixed asset turnover at 4.54 shows asset efficiency

- Presence in Americas, Asia Pacific, and EMEA regions supports geographic reach

Mobileye Weaknesses

- Negative profitability metrics: net margin -20.7%, ROE -3.3%, ROIC -3.64%

- Unfavorable current ratio at 6.1 may signal inefficient working capital

- Zero interest coverage raises concerns on debt servicing despite no debt

Ouster Weaknesses

- Severely negative profitability: net margin -87.35%, ROE -53.64%, ROIC -50.84%

- High WACC at 17.5% increases capital costs

- Negative interest coverage and unfavorable PB ratio indicate financial stress

Mobileye shows a geographically diversified revenue base and a strong asset utilization profile, but struggles with profitability and working capital efficiency. Ouster presents liquidity strengths and asset efficiency but faces more severe profitability and cost of capital challenges. Both companies must address these weaknesses to improve financial stability and support growth.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion. Let’s dissect how these companies defend their turf:

Mobileye Global Inc.: Intellectual Property & Market Leadership

Mobileye’s moat stems from advanced ADAS technology and strong IP. This yields high gross margins (48%) but negative EBIT margins signal scaling challenges. New autonomous solutions could deepen its moat if profitability improves.

Ouster, Inc.: Innovation in Digital Lidar Technology

Ouster relies on cutting-edge lidar sensor tech, differentiating from Mobileye’s software-driven moat. Despite severe losses, its improving ROIC trend and rapid revenue growth (33% last year) hint at strengthening competitive positioning and future market disruption potential.

Verdict: Technology IP vs. Hardware Innovation

Mobileye’s moat is broader, built on software dominance and scale. Ouster’s is narrower but deepening with innovation momentum. Mobileye remains better equipped to defend market share, but Ouster’s improving fundamentals deserve close watch.

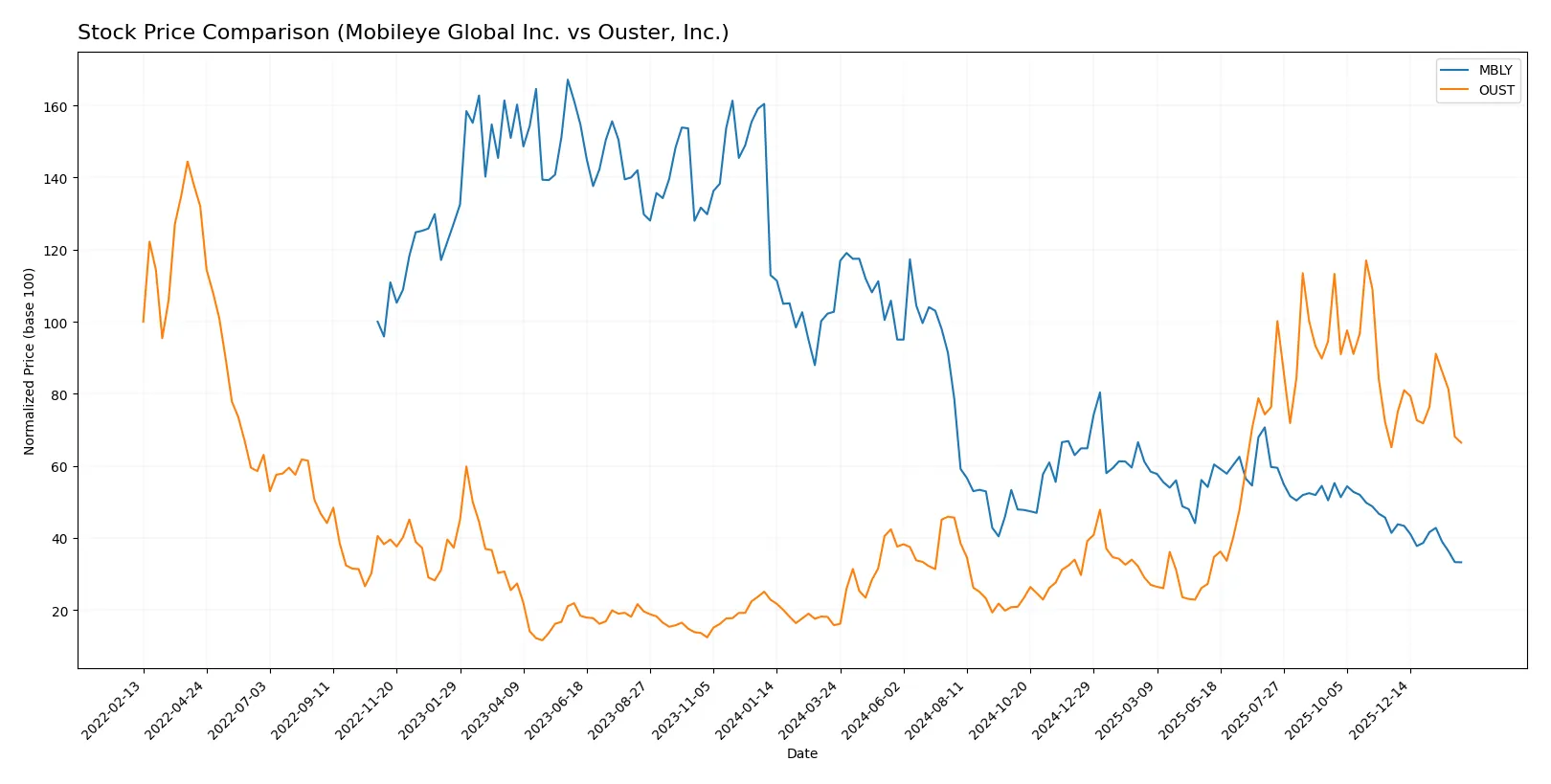

Which stock offers better returns?

Over the past year, Mobileye Global Inc. faced a steep decline, while Ouster, Inc. gained substantial ground with notable price swings and evolving trading volumes.

Trend Comparison

Mobileye’s stock fell 67.66% over 12 months, marking a bearish trend with decelerating losses and a high volatility of 6.1. The price peaked at 32.15 and bottomed at 8.97.

Ouster’s stock surged 321.78% in the same period, reflecting a bullish trend despite deceleration. Volatility was higher at 8.53, with a peak of 35.8 and a low of 4.82.

Comparing trends, Ouster delivered the strongest market performance, significantly outperforming Mobileye’s prolonged bearish trajectory.

Target Prices

Analysts present a broad yet optimistic target price consensus for Mobileye Global Inc. and Ouster, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Mobileye Global Inc. | 11 | 28 | 16.71 |

| Ouster, Inc. | 33 | 39 | 36.67 |

Mobileye’s target consensus at $16.71 far exceeds its current price near $8.97, signaling strong upside potential. Ouster’s consensus of $36.67 doubles its current $20.33 price, reflecting high growth expectations despite elevated volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Mobileye Global Inc. Grades

Here are the latest institutional grades for Mobileye Global Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | Maintain | Buy | 2026-01-29 |

| RBC Capital | Maintain | Sector Perform | 2026-01-23 |

| Needham | Maintain | Buy | 2026-01-23 |

| UBS | Maintain | Neutral | 2026-01-23 |

| Canaccord Genuity | Maintain | Buy | 2026-01-23 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-23 |

| Wells Fargo | Maintain | Overweight | 2026-01-23 |

| HSBC | Downgrade | Hold | 2026-01-23 |

| UBS | Maintain | Neutral | 2026-01-14 |

| Wolfe Research | Downgrade | Peer Perform | 2026-01-12 |

Ouster, Inc. Grades

Here are the latest institutional grades for Ouster, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Upgrade | Overweight | 2025-11-07 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-11-06 |

| WestPark Capital | Maintain | Buy | 2025-11-05 |

| Rosenblatt | Maintain | Buy | 2025-11-05 |

| WestPark Capital | Upgrade | Buy | 2025-08-13 |

| Oppenheimer | Maintain | Outperform | 2025-07-16 |

| WestPark Capital | Downgrade | Hold | 2025-06-12 |

| WestPark Capital | Upgrade | Buy | 2025-05-09 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-03-21 |

| WestPark Capital | Maintain | Hold | 2025-03-21 |

Which company has the best grades?

Mobileye shows a mixture of Buy and Hold ratings with some downgrades, reflecting mixed sentiment. Ouster’s grades lean more consistently bullish, with multiple upgrades to Overweight and Buy. Investors may see Ouster as having stronger recent institutional support.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing both Mobileye Global Inc. and Ouster, Inc. in the 2026 market environment:

1. Market & Competition

Mobileye Global Inc.

- Established in advanced driver assistance systems with strong parent Intel backing but faces intensifying competition in ADAS and autonomous tech.

Ouster, Inc.

- Operates in a niche lidar market with high innovation but struggles with smaller scale and fierce technology competition.

2. Capital Structure & Debt

Mobileye Global Inc.

- Zero debt, excellent debt-to-assets ratio, reducing financial risk and interest burden.

Ouster, Inc.

- Low debt levels but higher weighted average cost of capital (WACC) at 17.5%, indicating costlier capital.

3. Stock Volatility

Mobileye Global Inc.

- Beta of 0.563 signals lower volatility, offering relatively stable stock price swings.

Ouster, Inc.

- Beta of 2.935 reveals high stock volatility, increasing investment risk.

4. Regulatory & Legal

Mobileye Global Inc.

- Subject to automotive safety and data privacy regulations, with risks from evolving autonomous vehicle policies.

Ouster, Inc.

- Faces regulatory scrutiny on lidar sensor standards and export controls in tech-heavy sectors.

5. Supply Chain & Operations

Mobileye Global Inc.

- Robust supply chain backed by Intel, yet global semiconductor shortages remain a systemic risk.

Ouster, Inc.

- Smaller operational scale increases vulnerability to supply disruptions and production inefficiencies.

6. ESG & Climate Transition

Mobileye Global Inc.

- Focuses on safety and reducing vehicle emissions indirectly via ADAS, but must improve ESG disclosures.

Ouster, Inc.

- Technology aids in environmental monitoring, but limited ESG track record raises investor caution.

7. Geopolitical Exposure

Mobileye Global Inc.

- Headquarters in Israel expose it to Middle East geopolitical tensions affecting operations.

Ouster, Inc.

- US-based with less geopolitical risk but sensitive to trade policies affecting tech exports.

Which company shows a better risk-adjusted profile?

Mobileye’s strongest risk is geopolitical exposure due to its Israel base, while Ouster’s primary risk lies in its extreme financial distress and stock volatility. Mobileye offers a more balanced risk-adjusted profile, benefiting from low leverage and stable stock behavior. Ouster’s high beta and poor profitability metrics signal elevated risk despite promising technology. The safe-zone Altman Z-score for both contrasts with Ouster’s weak Piotroski score, underscoring its fragile financial footing. Mobileye’s zero debt and stable operations justify my preference for its risk resilience in 2026.

Final Verdict: Which stock to choose?

Mobileye Global Inc. (MBLY) boasts a superpower in scaling innovation with robust revenue growth and a strong cash position that fuels aggressive R&D. Its main point of vigilance is persistent value destruction, reflected in a declining ROIC below WACC. MBLY suits an aggressive growth portfolio willing to weather short-term profitability challenges.

Ouster, Inc. (OUST) leverages a strategic moat in sensor technology innovation and benefits from a growing ROIC trend, signaling improving operational efficiency. It offers a relatively safer financial profile with a solid current ratio and moderate debt levels compared to MBLY. OUST fits a GARP (Growth at a Reasonable Price) portfolio seeking improving fundamentals amid volatility.

If you prioritize rapid innovation and can tolerate current value erosion, MBLY is the compelling choice due to its strong cash generation and market traction. However, if you seek improving profitability with better financial stability, OUST offers superior operational momentum and a clearer path toward sustainable value creation. Both present risks; investor profiles and risk tolerance should guide the analytical scenario.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Mobileye Global Inc. and Ouster, Inc. to enhance your investment decisions: