Home > Comparison > Consumer Cyclical > MBLY vs INDI

The strategic rivalry between Mobileye Global Inc. and indie Semiconductor, Inc. shapes the future of automotive technology. Mobileye operates as a consumer cyclical leader in advanced driver assistance systems, while indie Semiconductor focuses on semiconductor solutions for automotive applications within the technology sector. This head-to-head reflects a battle between established ADAS innovation and emerging semiconductor integration. This analysis will identify which company offers superior risk-adjusted returns for a diversified portfolio.

Table of contents

Companies Overview

Mobileye Global Inc. and indie Semiconductor, Inc. play pivotal roles in advancing automotive technology and safety.

Mobileye Global Inc.: Leader in Autonomous Driving Systems

Mobileye dominates the ADAS and autonomous driving market by developing real-time driver assistance and safety solutions. Its revenue stems from licensing its technology and deploying advanced systems globally. In 2026, Mobileye focuses on expanding its cloud-enhanced driver assist offerings and pushing Level 4 autonomous driving capabilities.

indie Semiconductor, Inc.: Innovator in Automotive Semiconductors

indie Semiconductor specializes in automotive semiconductor and software solutions for ADAS, connectivity, and electrification. It generates revenue by supplying components that enhance user experience and vehicle connectivity. The company’s 2026 strategy centers on broadening its photonic and wireless charging technologies within the automotive sector.

Strategic Collision: Similarities & Divergences

Mobileye pursues a software-centric, cloud-driven ecosystem, while indie emphasizes semiconductor hardware innovation. Their battleground lies in the evolving ADAS and autonomous vehicle technology space. Mobileye offers a mature, scalable platform; indie presents a high-beta, growth-oriented profile targeting emerging automotive components.

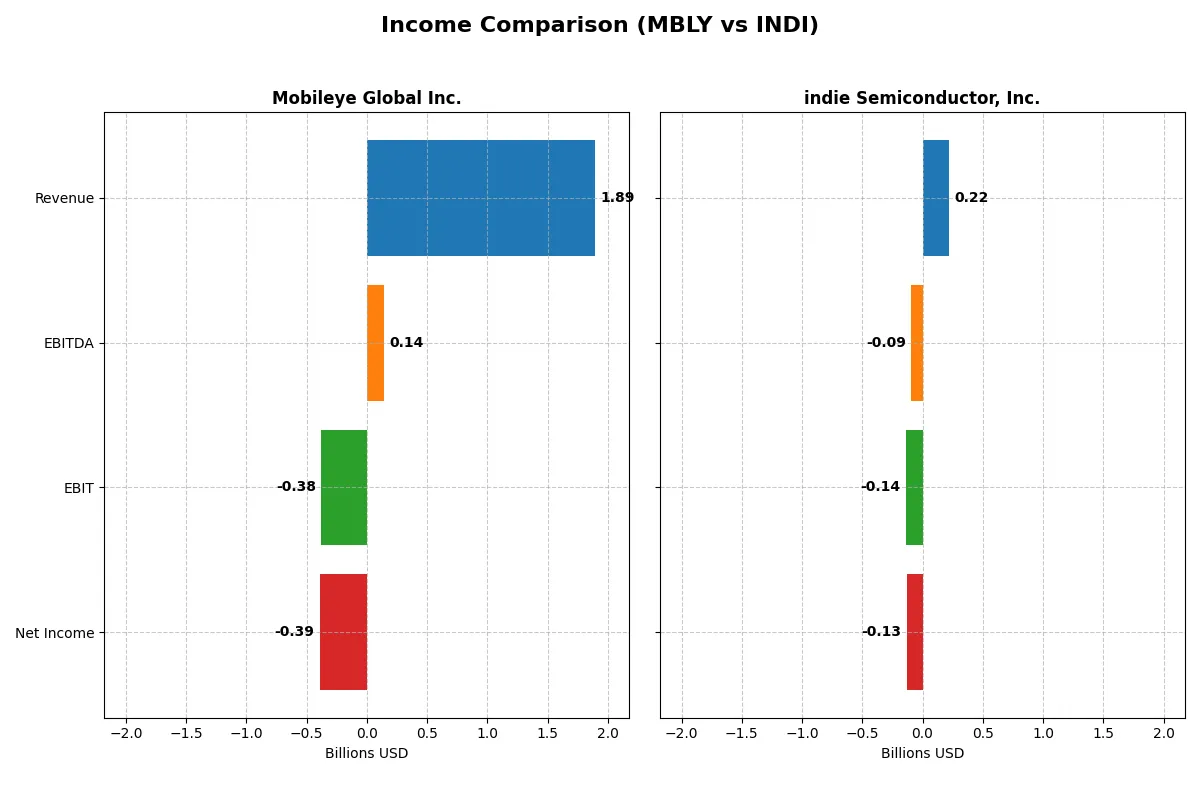

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Mobileye Global Inc. (MBLY) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| Revenue | 1.89B | 217M |

| Cost of Revenue | 990M | 126M |

| Operating Expenses | 1.34B | 260M |

| Gross Profit | 904M | 90M |

| EBITDA | 140M | -94M |

| EBIT | -377M | -137M |

| Interest Expense | 0 | 9.26M |

| Net Income | -392M | -133M |

| EPS | -0.48 | -0.76 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability of Mobileye Global Inc. and indie Semiconductor, Inc. over recent fiscal years.

Mobileye Global Inc. Analysis

Mobileye’s revenue grew steadily from 1.39B in 2021 to 1.89B in 2025, showing a 14.5% rise in the latest year. Gross margins remain strong at 47.7%, reflecting efficient cost control. However, net income stayed negative at -392M in 2025, despite an 88.9% improvement in net margin. Operating losses narrowed sharply, signaling improving momentum.

indie Semiconductor, Inc. Analysis

Indie Semiconductor’s revenue climbed impressively by 858% from 22.6M in 2020 to 217M in 2024 but dipped 2.9% year-over-year. Its gross margin improved to 41.7%, showing better product mix or cost management. Yet, the company posted a large net loss of -133M in 2024, with a steep negative net margin of -61.2%, indicating persistent profitability challenges despite some EPS growth.

Margin Strength vs. Revenue Expansion

Mobileye displays superior margin health and efficiency with a consistently favorable gross margin and improving operating results. Indie Semiconductor boasts remarkable revenue growth but struggles with deep operating losses and poor net margins. For investors, Mobileye’s profile suggests greater earnings discipline, while Indie offers high growth tempered by profitability risks.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | Mobileye Global Inc. (MBLY) | indie Semiconductor, Inc. (INDI) |

|---|---|---|

| ROE | -3.3% | -31.7% |

| ROIC | -3.6% | -19.3% |

| P/E | -21.6 | -5.3 |

| P/B | 0.71 | 1.70 |

| Current Ratio | 6.10 | 4.82 |

| Quick Ratio | 5.30 | 4.23 |

| D/E | 0 | 0.95 |

| Debt-to-Assets | 0 | 0.42 |

| Interest Coverage | 0 | -18.4 |

| Asset Turnover | 0.15 | 0.23 |

| Fixed Asset Turnover | 4.00 | 4.30 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

| Fiscal Year | 2025 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Ratios act as a company’s DNA, revealing hidden risks and operational excellence that numbers alone cannot expose.

Mobileye Global Inc.

Mobileye shows weak profitability with a negative ROE of -3.3% and a stretched net margin at -20.7%. Its valuation looks attractive, with a P/E ratio favorably negative and a low P/B of 0.71. The firm pays no dividend, reinvesting heavily in R&D, demonstrating a growth-focused capital allocation.

indie Semiconductor, Inc.

indie Semiconductor suffers deep profitability issues, posting a negative ROE of -31.7% and a net margin of -61.2%. The P/E ratio is also negative but lower in absolute terms, indicating cheaper valuation relative to losses. It holds a higher debt level and no dividends, reflecting financial stress and reliance on R&D for future growth.

Growth Investment vs. Profitability Struggles

Mobileye balances a stretched margin with strong reinvestment and a solid valuation, while indie Semiconductor’s deeper losses and heavier debt weigh on risk. Mobileye fits investors favoring operational resilience, whereas indie suits those targeting high-risk, growth-stage profiles.

Which one offers the Superior Shareholder Reward?

Mobileye Global Inc. (MBLY) and indie Semiconductor, Inc. (INDI) both pay no dividends, focusing instead on reinvestment and buybacks. MBLY demonstrates a strong free cash flow per share of 0.64 and a disciplined capital expenditure coverage ratio of 7.6x, supporting sustainable share buybacks. INDI, however, suffers negative free cash flow (-0.42 per share) and negative operating cash flow, limiting buyback capacity. MBLY’s buyback intensity and cash-rich balance sheet contrast sharply with INDI’s heavy leverage (debt-to-assets 42%) and cash burn. I conclude MBLY offers a far more sustainable and attractive shareholder return profile in 2026, driven by prudent capital allocation and solid cash generation.

Comparative Score Analysis: The Strategic Profile

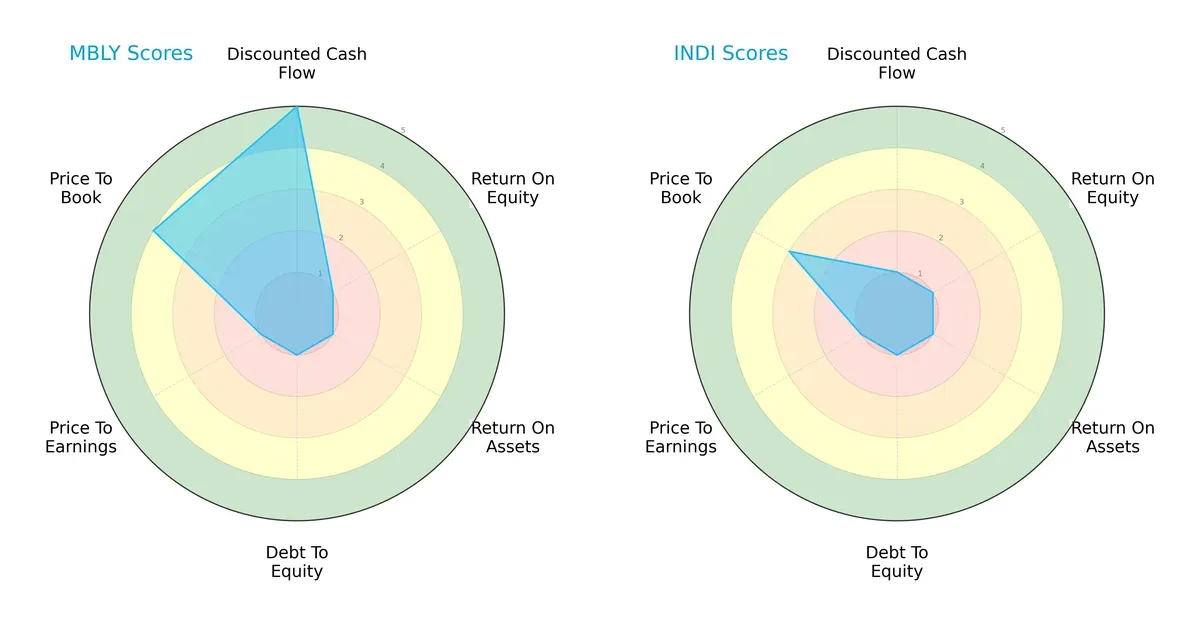

The radar chart reveals the fundamental DNA and trade-offs of Mobileye Global Inc. and indie Semiconductor, Inc., highlighting their distinct financial strengths and weaknesses:

Mobileye excels in discounted cash flow (DCF) with a very favorable score of 5, while indie Semiconductor scores only 1, indicating valuation concerns. Both struggle with return on equity (ROE), return on assets (ROA), and debt-to-equity ratios, scoring very unfavorably. Price-to-book (P/B) scores favor Mobileye (4) over indie (3), suggesting Mobileye offers better value relative to its book assets. Overall, Mobileye presents a more balanced profile, relying heavily on strong cash flow projections. indie Semiconductor suffers from broad weaknesses without a clear competitive edge.

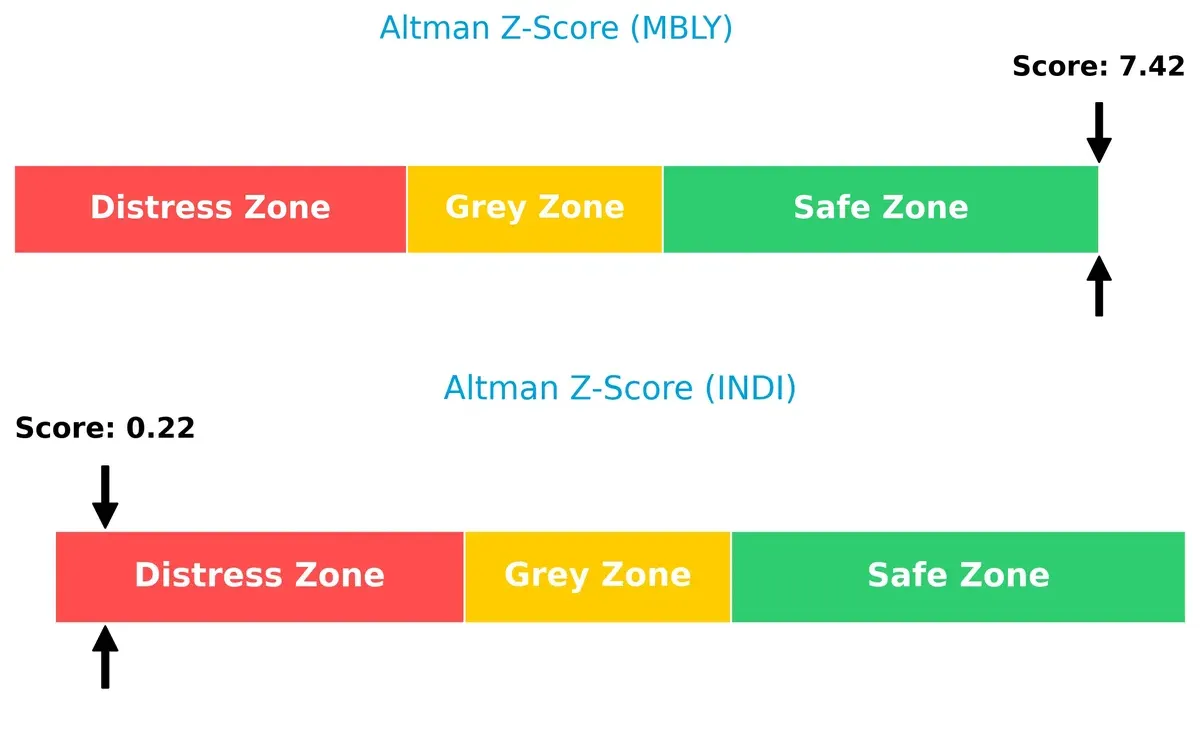

Bankruptcy Risk: Solvency Showdown

Mobileye’s Altman Z-Score of 7.42 firmly places it in the safe zone, signaling robust long-term survival prospects. In contrast, indie Semiconductor’s score of 0.22 indicates severe financial distress and high bankruptcy risk in the current cycle:

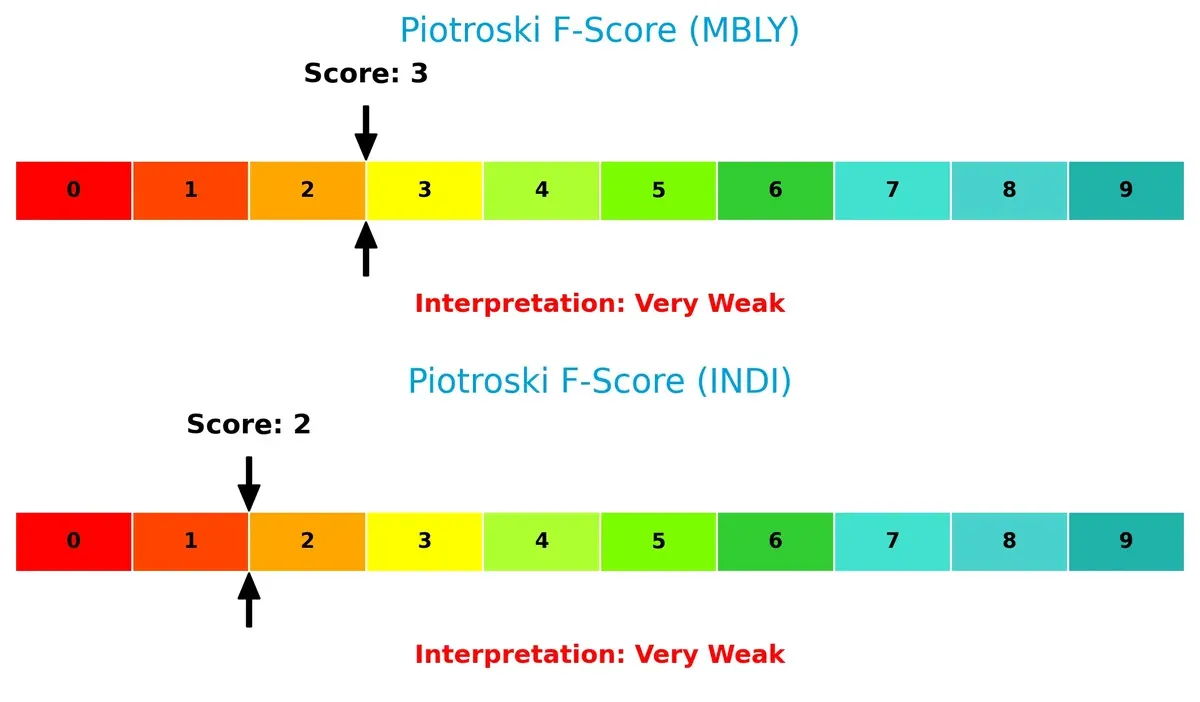

Financial Health: Quality of Operations

Both companies register very weak Piotroski F-Scores, with Mobileye at 3 and indie Semiconductor at 2. This signals concerning internal financial health for both, but Mobileye slightly outperforms indie, suggesting marginally better operational quality and financial controls:

How are the two companies positioned?

This section dissects Mobileye and indie Semiconductor’s operational DNA through revenue segmentation and an analysis of strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient, sustainable competitive advantage today.

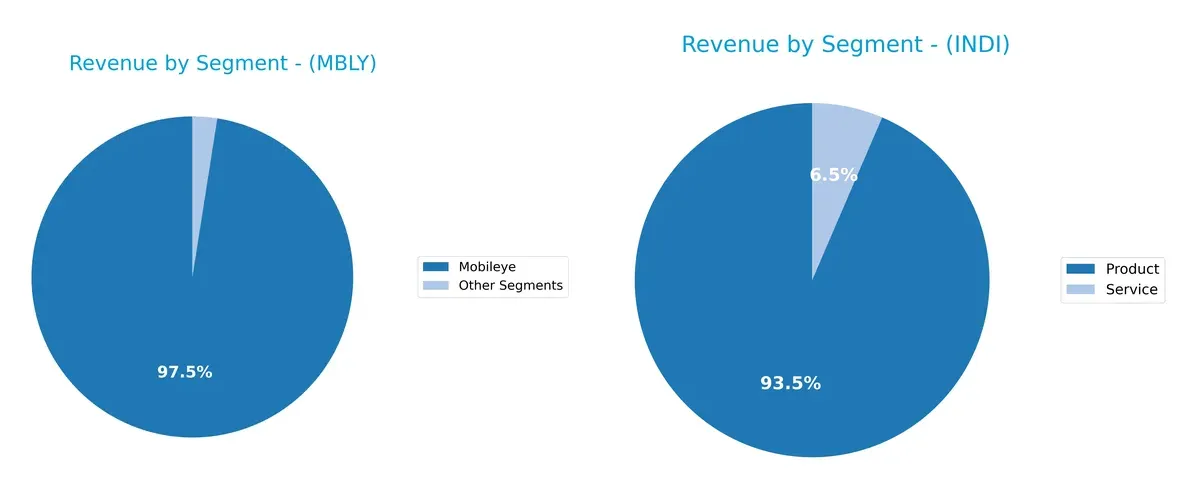

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Mobileye Global Inc. and indie Semiconductor, Inc. diversify their income streams and highlights where their primary sector bets lie:

Mobileye anchors its revenue heavily in the Mobileye segment, with $1.6B in 2024, dwarfing its $41M from other segments. In contrast, indie Semiconductor shows a more balanced mix, pivoting between $203M in Products and $14M in Services. Mobileye’s concentration signals infrastructure dominance but raises concentration risk. Indie’s diversification suggests resilience, reducing dependency on a single revenue stream amid semiconductor market cycles.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Mobileye Global Inc. and indie Semiconductor, Inc.:

Mobileye Global Inc. Strengths

- Strong global presence with significant revenue from US, China, and Europe

- Favorable fixed asset turnover at 4.0

- Zero debt supports financial stability

- Quick ratio of 5.3 indicates good liquidity

indie Semiconductor, Inc. Strengths

- Increasing product revenue signals growth potential

- Favorable fixed asset turnover at 4.3

- Quick ratio of 4.23 suggests solid short-term liquidity

- Positive PE ratio despite losses

Mobileye Global Inc. Weaknesses

- Negative net margin (-20.7%) and ROIC (-3.64%) reflect weak profitability

- Unfavorable current ratio at 6.1 may indicate inefficient asset use

- Zero interest coverage is a red flag for debt servicing

- Declining revenue in key regions like China and US

indie Semiconductor, Inc. Weaknesses

- Deeply negative net margin (-61.2%) and ROIC (-19.25%) show severe profitability issues

- High debt-to-equity (0.95) and unfavorable WACC at 11.32% increase financial risk

- Negative interest coverage signals struggle to meet debt costs

- Smaller global footprint and lower total revenue

Mobileye shows strengths in global reach and asset efficiency but struggles with profitability and some liquidity metrics. indie Semiconductor faces more pronounced profitability and leverage challenges, coupled with a smaller scale, which may impact its strategic flexibility.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion:

Mobileye Global Inc.: Intangible Assets Powerhouse

Mobileye’s moat stems from proprietary autonomous driving technology and advanced driver-assistance systems. This translates into strong gross margins near 48%, though negative net margins reflect heavy R&D investment. New product launches and expanding ADAS adoption could strengthen its edge in 2026.

indie Semiconductor, Inc.: Specialized Technology Niche

indie Semiconductor relies on specialized automotive semiconductors and software. Its moat differs by focusing on diversified automotive applications rather than full autonomous systems. Despite weaker margins and volatile revenue, innovation in connectivity and electrification presents upside for market penetration.

Verdict: Autonomous Tech Leadership vs. Semiconductor Specialization

Mobileye’s intangible asset moat is deeper, supported by higher margins and a clearer path to scale. indie Semiconductor faces tougher margin pressure and slower revenue growth. Mobileye stands better poised to defend market share amid intensifying competition.

Which stock offers better returns?

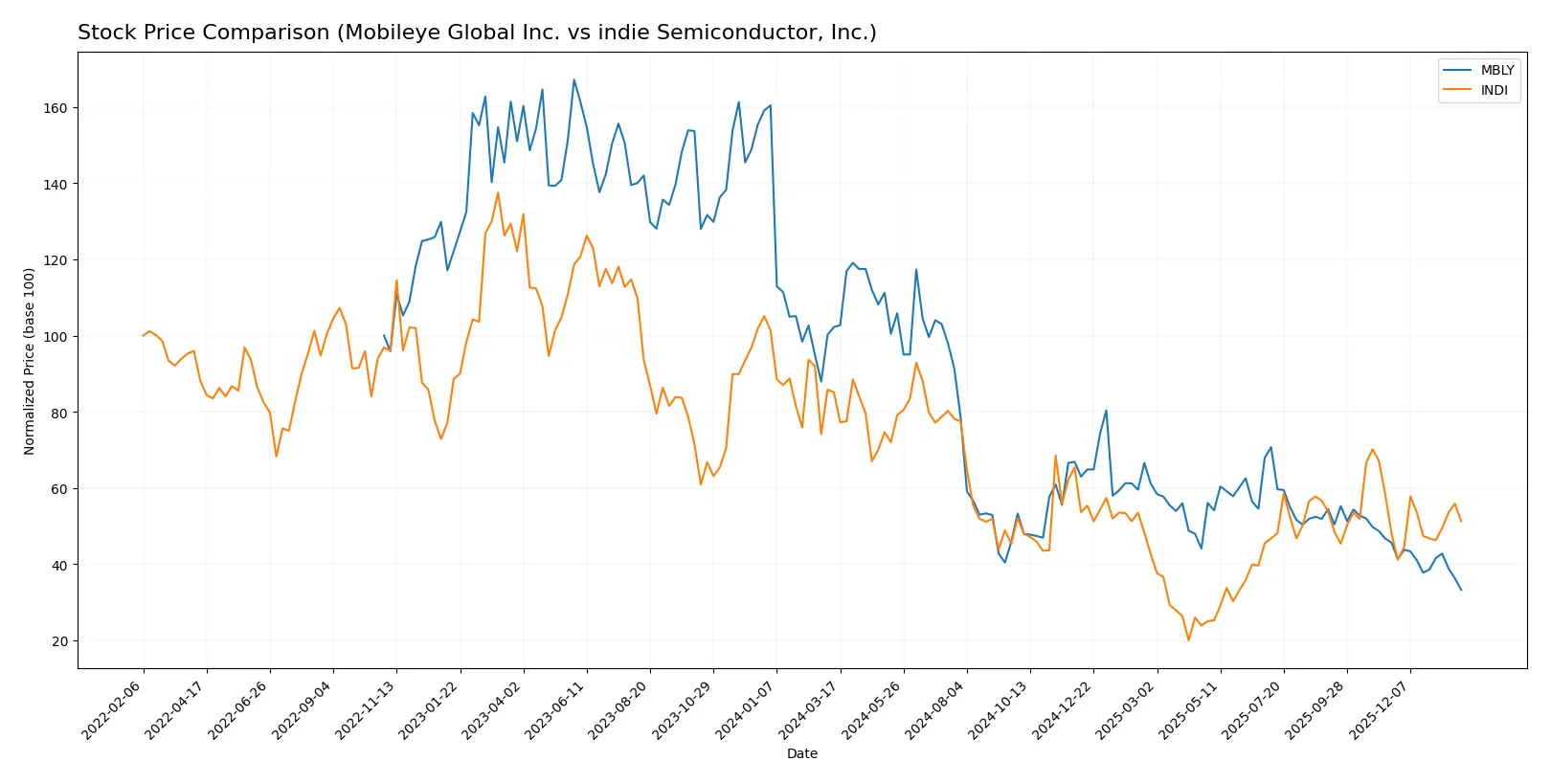

Stock prices for Mobileye Global Inc. and indie Semiconductor, Inc. showed significant declines over the past year, with contrasting recent trading dynamics suggesting shifts in momentum.

Trend Comparison

Mobileye Global Inc. (MBLY) experienced a 67.46% price decline over the past year, marking a bearish trend with decelerating losses and high volatility, peaking at 32.15 and dropping to 8.98.

indie Semiconductor, Inc. (INDI) recorded a 39.79% decline over the same period, also bearish but with accelerating losses and lower volatility; recent months saw a modest 6.49% price gain.

Comparatively, INDI outperformed MBLY, delivering a smaller annual loss and showing signs of recent recovery, whereas MBLY’s declines remain more severe and persistent.

Target Prices

Analysts present a cautiously optimistic target consensus for both Mobileye Global Inc. and indie Semiconductor, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Mobileye Global Inc. | 11 | 28 | 16.71 |

| indie Semiconductor, Inc. | 8 | 8 | 8 |

Mobileye’s consensus target of 16.71 implies nearly double the current price (8.98), signaling growth potential. indie Semiconductor’s target of 8 sits close to its current 4.1 price, suggesting moderate upside expectations.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Mobileye Global Inc. Grades

The latest institutional grade updates for Mobileye Global Inc. are summarized below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | Maintain | Buy | 2026-01-29 |

| RBC Capital | Maintain | Sector Perform | 2026-01-23 |

| Needham | Maintain | Buy | 2026-01-23 |

| UBS | Maintain | Neutral | 2026-01-23 |

| Canaccord Genuity | Maintain | Buy | 2026-01-23 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-23 |

| Wells Fargo | Maintain | Overweight | 2026-01-23 |

| HSBC | Downgrade | Hold | 2026-01-23 |

| UBS | Maintain | Neutral | 2026-01-14 |

| Wolfe Research | Downgrade | Peer Perform | 2026-01-12 |

indie Semiconductor, Inc. Grades

The institutional grade history for indie Semiconductor, Inc. is shown below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

Which company has the best grades?

Mobileye Global Inc. has a mix of Buy and Neutral grades, with some downgrades to Hold and Peer Perform. indie Semiconductor, Inc. holds consistently strong Buy and Overweight ratings. Investors may interpret indie’s steadier Buy consensus as a more favorable signal for institutional confidence.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Mobileye Global Inc.

- Dominates ADAS with strong OEM partnerships but faces rising autonomous tech rivals.

indie Semiconductor, Inc.

- Competes in a fragmented semiconductor market with volatile demand and many entrenched players.

2. Capital Structure & Debt

Mobileye Global Inc.

- Debt-free balance sheet reduces financial risk and interest burden.

indie Semiconductor, Inc.

- High debt-to-equity ratio (~0.95) signals elevated leverage and refinancing risk.

3. Stock Volatility

Mobileye Global Inc.

- Low beta (0.56) implies defensive stock with lower market sensitivity.

indie Semiconductor, Inc.

- High beta (2.54) indicates significant price swings and higher investor risk.

4. Regulatory & Legal

Mobileye Global Inc.

- Exposure to global automotive safety standards and data privacy rules.

indie Semiconductor, Inc.

- Faces complex semiconductor export controls and evolving automotive regulations.

5. Supply Chain & Operations

Mobileye Global Inc.

- Benefits from Intel’s global supply chain but vulnerable to chip shortage fluctuations.

indie Semiconductor, Inc.

- Smaller scale heightens risk from supply disruptions and component shortages.

6. ESG & Climate Transition

Mobileye Global Inc.

- Strong focus on autonomous driving aligns with emission reduction goals.

indie Semiconductor, Inc.

- Automotive electrification offers growth but requires heavy R&D investment.

7. Geopolitical Exposure

Mobileye Global Inc.

- Israeli headquarters pose geopolitical risks amid Middle East tensions.

indie Semiconductor, Inc.

- US-based but exposed to global semiconductor trade tensions, especially with China.

Which company shows a better risk-adjusted profile?

Mobileye faces its largest risk in geopolitical exposure but maintains a robust financial position with no debt and low stock volatility. indie Semiconductor’s biggest concern is its highly leveraged capital structure combined with weak profitability and distress-level bankruptcy risk. Mobileye’s Altman Z-score of 7.42 places it safely above distress thresholds, whereas indie’s 0.22 signals imminent financial distress. This stark contrast, along with Mobileye’s stable market position, makes it the better risk-adjusted choice in 2026.

Final Verdict: Which stock to choose?

Mobileye Global Inc. (MBLY) impresses with its unmatched efficiency in leveraging intangible assets and strong cash flow generation despite current profitability setbacks. Its high current ratio signals a liquidity cushion but also suggests capital tied up in operations—a point of vigilance. It suits aggressive growth portfolios willing to tolerate short-term losses for potential long-term innovation payoffs.

indie Semiconductor, Inc. (INDI) presents a strategic moat rooted in high R&D intensity and a solid intangible asset base, aiming to carve out niche semiconductor markets. Compared to MBLY, it carries higher financial risk and weaker profitability, making it a riskier choice. INDI fits portfolios focused on GARP—seeking growth potential balanced with valuation discipline and room for operational improvements.

If you prioritize operational resilience and cash flow strength, MBLY is the compelling choice due to its superior liquidity and more stable capital structure. However, if you seek speculative growth with exposure to semiconductor innovation and can tolerate elevated financial risk, INDI offers potential upside despite its current value destruction trend. Both require careful risk management given their ongoing profitability challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Mobileye Global Inc. and indie Semiconductor, Inc. to enhance your investment decisions: