In the rapidly evolving landscape of enterprise software, MicroStrategy Incorporated (MSTR) and Domo, Inc. (DOMO) stand out as key players in the application software industry. Both companies are focused on delivering innovative analytics solutions, yet they differ significantly in their market strategies and technological approaches. As we delve into their operations, financial health, and growth potential, I aim to uncover which company presents a more compelling opportunity for investors. Let’s explore the strengths and weaknesses of each company to guide your investment decisions.

Table of contents

Company Overview

MicroStrategy Incorporated Overview

MicroStrategy (MSTR) is a leading provider of enterprise analytics software and services, headquartered in Tysons Corner, Virginia. Established in 1989, the company focuses on delivering a modern analytics experience across various platforms through its flagship product. MicroStrategy’s platform empowers users with hyperintelligence products, robust visualization, and reporting capabilities while ensuring secure and governed access to trusted data. The firm caters to a diverse clientele spanning multiple industries, including finance, healthcare, and retail, and offers a range of consulting and educational services to enhance customer engagement and return on investment.

Domo, Inc. Overview

Domo (DOMO), founded in 2010 and based in American Fork, Utah, operates a cloud-based business intelligence platform that connects executives to frontline employees with real-time data and insights. The platform enables organizations to manage operations seamlessly from mobile devices, enhancing decision-making efficiency. Domo serves clients globally, providing them with tools to visualize and analyze data quickly. The company aims to democratize data access across organizations, making it easier for employees at all levels to harness information for better business outcomes.

Key similarities and differences

Both MicroStrategy and Domo operate within the software application industry, focusing on analytics solutions. However, MicroStrategy emphasizes enterprise-level analytics with extensive consulting services, while Domo concentrates on cloud-based solutions that facilitate real-time data access and insights for all employees. This difference highlights MicroStrategy’s broader market reach compared to Domo’s more niche focus on mobile and user-friendly interfaces.

Income Statement Comparison

The following table provides a comparison of key income statement metrics for MicroStrategy Incorporated (MSTR) and Domo, Inc. (DOMO) for their most recent fiscal years.

| Metric | [MicroStrategy] | [Domo] |

|---|---|---|

| Market Cap | 51.65B | 0.35B |

| Revenue | 463.46M | 317.04M |

| EBITDA | -1.85B | -50.05M |

| EBIT | -1.87B | -59.28M |

| Net Income | -1.17B | -81.94M |

| EPS | -6.06 | -2.13 |

| Fiscal Year | 2024 | 2025 |

Interpretation of Income Statement

In reviewing the income statements of both companies, MicroStrategy reported a decline in revenue to 463.46M, reflecting challenges in maintaining growth, while Domo’s revenue slightly increased to 317.04M. Both companies, however, are grappling with substantial net losses, with MicroStrategy showing a net income loss of 1.17B and Domo at 81.94M. Margin stability remains a concern, as both companies exhibit negative EBITDA and EBIT, indicating ongoing operational challenges. Although Domo has shown slight revenue growth, the overall financial performance suggests a cautious approach toward investment in these stocks, given their substantial operating losses and lack of profitability.

Financial Ratios Comparison

In this section, I present a comparative analysis of key financial metrics for MicroStrategy Incorporated (MSTR) and Domo, Inc. (DOMO), focusing on their most recent revenue and financial ratios.

| Metric | MSTR | DOMO |

|---|---|---|

| ROE | -6.40% | 46.23% |

| ROIC | -4.38% | 197.65% |

| P/E | -47.80 | -5.18 |

| P/B | 3.06 | -1.84 |

| Current Ratio | 0.71 | 0.56 |

| Quick Ratio | 0.71 | 0.56 |

| D/E | 0.40 | -0.76 |

| Debt-to-Assets | 0.28 | 0.63 |

| Interest Coverage | -29.92 | 0.00 |

| Asset Turnover | 0.018 | 1.48 |

| Fixed Asset Turnover | 5.73 | 8.17 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

MicroStrategy shows concerning financial health with negative ROE and ROIC, indicating inefficiency in generating returns on equity and investments. The high P/E ratio suggests an inflated valuation relative to earnings. Conversely, Domo displays strong profitability metrics, notably a robust ROE and high asset turnover, implying effective utilization of resources. However, both firms exhibit liquidity challenges, as reflected in their current and quick ratios below 1, indicating potential short-term financial strain.

Dividend and Shareholder Returns

Neither MicroStrategy (MSTR) nor Domo (DOMO) pays dividends, reflecting their focus on reinvestment strategies amidst ongoing growth phases. Both companies prioritize research and development over shareholder distributions. While they do not offer dividends, both engage in share buybacks, which can support share value. However, the lack of dividends raises questions about long-term value creation for shareholders, as sustained growth is essential to justify this approach.

Strategic Positioning

MicroStrategy (MSTR) holds a significant share in the enterprise analytics software market, leveraging its comprehensive platform to cater to various industries. With a market cap of 52B, its competitive pressure is heightened by new entrants and technological disruptions in data analytics. In contrast, Domo (DOMO) operates with a smaller market cap of 347M, facing challenges in scalability and market presence. Both companies must navigate evolving market dynamics to maintain their competitive edge and growth potential.

Stock Comparison

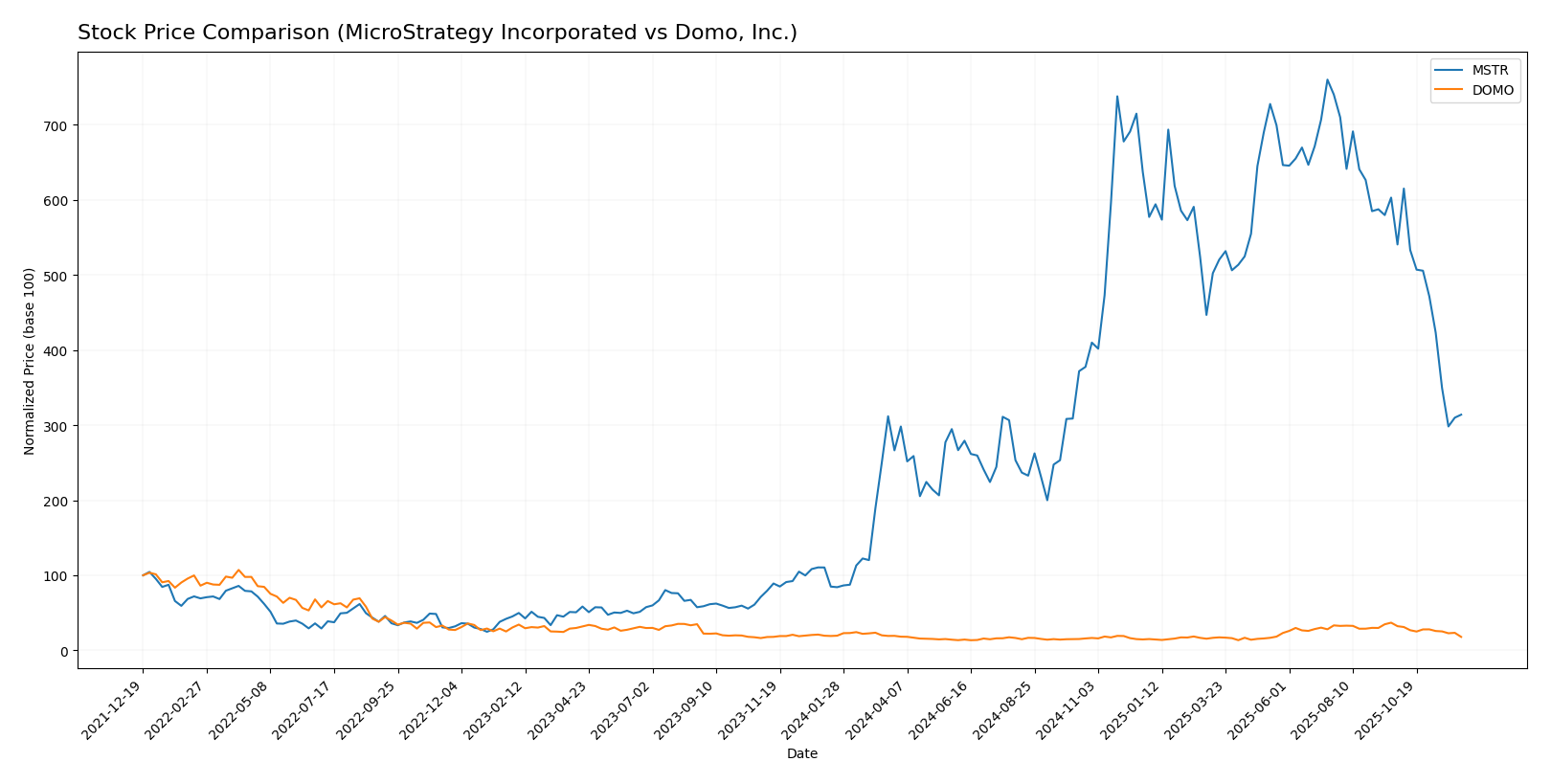

In this section, I will analyze the stock price movements and trading dynamics of MicroStrategy Incorporated (MSTR) and Domo, Inc. (DOMO) over the past year, highlighting key price changes and trends.

Trend Analysis

MicroStrategy Incorporated (MSTR) has experienced a significant price change of +269.65% over the past year, indicating a strong bullish trend. However, there has been recent deceleration in the trend, with a notable decline of -47.94% from September 21, 2025, to December 7, 2025. The stock reached a high of 434.58 and a low of 48.1 during this period, with a standard deviation of 111.9, reflecting substantial volatility in the stock’s price.

Domo, Inc. (DOMO), on the other hand, has seen a price change of -6.32% over the past year, categorizing it as a bearish trend. The stock has also experienced a recent decline of -51.34% from September 21, 2025, to December 7, 2025. It reached a high of 18.06 and a low of 6.62, with a standard deviation of 2.99, indicating lower volatility compared to MSTR.

In summary, MSTR is currently in a bullish long-term trend despite recent declines, while DOMO is facing a bearish trend with a significant recent drop in price.

Analyst Opinions

Recent analyst recommendations for MicroStrategy (MSTR) and Domo (DOMO) indicate a cautious stance, with both companies receiving a “C” rating. Analysts highlight MSTR’s significant debt-to-equity ratio as a risk, while Domo’s low scores in discounted cash flow and price-to-earnings metrics raise concerns. Notably, both companies have an overall score of 2, suggesting limited growth potential. The consensus for the current year leans towards a “hold” recommendation for both stocks, reflecting a guarded approach amidst market uncertainties.

Stock Grades

As of late 2025, I have gathered reliable stock grade data from credible grading companies for two companies: MicroStrategy Incorporated (MSTR) and Domo, Inc. (DOMO).

MicroStrategy Incorporated Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Monness, Crespi, Hardt | upgrade | Neutral | 2025-11-10 |

| HC Wainwright & Co. | maintain | Buy | 2025-11-03 |

| Canaccord Genuity | maintain | Buy | 2025-11-03 |

| BTIG | maintain | Buy | 2025-10-31 |

| TD Cowen | maintain | Buy | 2025-10-31 |

| Cantor Fitzgerald | maintain | Overweight | 2025-10-31 |

| Wells Fargo | downgrade | Equal Weight | 2025-09-30 |

| TD Cowen | maintain | Buy | 2025-09-16 |

| Canaccord Genuity | maintain | Buy | 2025-08-26 |

| Mizuho | maintain | Outperform | 2025-08-11 |

Domo, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | maintain | Buy | 2025-12-05 |

| DA Davidson | maintain | Neutral | 2025-12-01 |

| JMP Securities | maintain | Market Outperform | 2025-09-10 |

| DA Davidson | maintain | Neutral | 2025-08-28 |

| Cantor Fitzgerald | maintain | Overweight | 2025-08-28 |

| TD Cowen | upgrade | Buy | 2025-08-26 |

| JMP Securities | maintain | Market Outperform | 2025-06-25 |

| Cantor Fitzgerald | maintain | Overweight | 2025-06-25 |

| Cantor Fitzgerald | maintain | Overweight | 2025-05-22 |

| Lake Street | maintain | Hold | 2025-05-22 |

In summary, MicroStrategy has seen some adjustments with a notable upgrade to Neutral, while maintaining a strong Buy from several firms. Domo continues to maintain a mix of Buy and Neutral ratings, reflecting a stable outlook among analysts. Overall, both companies show a cautious but positive sentiment in the current market landscape.

Target Prices

The current consensus target prices for the specified companies indicate varying levels of expectation from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MicroStrategy Incorporated (MSTR) | 705 | 175 | 478.5 |

| Domo, Inc. (DOMO) | 50 | 10 | 22.5 |

For MicroStrategy, analysts have a consensus target of 478.5, significantly above its current price of 179.82, suggesting a bullish outlook. In contrast, Domo’s consensus of 22.5 also indicates potential upside from its current price of 8.76.

Strengths and Weaknesses

The following table outlines the strengths and weaknesses of MicroStrategy Incorporated (MSTR) and Domo, Inc. (DOMO) based on the most recent data.

| Criterion | MicroStrategy (MSTR) | Domo (DOMO) |

|---|---|---|

| Diversification | Moderate | Low |

| Profitability | Negative margins | Negative margins |

| Innovation | High | Moderate |

| Global presence | Strong | Moderate |

| Market Share | Moderate | Low |

| Debt level | High | High |

Key takeaways reveal that while MicroStrategy demonstrates strong innovation and global presence, both companies struggle with profitability and carry high debt levels. Domo shows lower diversification and market share, indicating potential risks for investors.

Risk Analysis

The following table summarizes the key risks associated with MicroStrategy Incorporated and Domo, Inc., focusing on various metrics that could impact their performance.

| Metric | MicroStrategy (MSTR) | Domo (DOMO) |

|---|---|---|

| Market Risk | High | Moderate |

| Regulatory Risk | Moderate | High |

| Operational Risk | High | Moderate |

| Environmental Risk | Low | Low |

| Geopolitical Risk | Moderate | Moderate |

Both companies face significant market risk primarily due to their reliance on technology trends. Additionally, Domo’s higher regulatory risk stems from a complex compliance environment in the cloud services sector, which could impact its operations.

Which one to choose?

In comparing MicroStrategy (MSTR) and Domo (DOMO), both companies face challenges, reflected in their financials and market performance. MSTR shows a market cap of approximately 56B and a bullish trend with a price increase of 269.65% over the year, despite a recent downturn of 47.94%. Its gross profit margin stands at 72%, but it struggles with net income and has negative profit margins. Analyst ratings for MSTR are stable at a C grade.

Conversely, Domo has a market cap of about 326M and has been on a bearish trend with a price decrease of 6.32%. Despite a gross profit margin of 74%, it also faces negative profitability, indicated by its C rating.

Investors focused on growth may lean towards MSTR due to its significant price movements, while those prioritizing operational efficiency might consider Domo for its higher gross margin. Both companies face risks related to competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of MicroStrategy Incorporated and Domo, Inc. to enhance your investment decisions: