In the dynamic semiconductor industry, Microchip Technology Incorporated (MCHP) and Tower Semiconductor Ltd. (TSEM) stand out as key players with overlapping markets and distinct innovation approaches. Microchip focuses on embedded control solutions, while Tower specializes in analog mixed-signal foundry services. This comparison explores their strategic strengths and market positions to help you decide which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Microchip Technology Incorporated and Tower Semiconductor Ltd. by providing an overview of these two companies and their main differences.

Microchip Technology Incorporated Overview

Microchip Technology Incorporated is a US-based company specializing in smart, connected, and secure embedded control solutions. It develops and sells microcontrollers, microprocessors, analog products, memory products, and offers wafer foundry and manufacturing services. The company serves automotive, industrial, computing, and communications sectors, employing 22,300 people and operating globally from its headquarters in Chandler, Arizona.

Tower Semiconductor Ltd. Overview

Tower Semiconductor Ltd. is an independent foundry headquartered in Israel, focusing on analog-intensive mixed-signal semiconductor devices. It provides process technologies such as SiGe, BiCMOS, and CMOS for markets including consumer electronics, automotive, aerospace, and medical devices. The company supports integrated device manufacturers and fabless companies with wafer fabrication and design services, employing 5,613 staff across multiple regions.

Key similarities and differences

Both companies operate in the semiconductor industry and provide manufacturing services, but Microchip emphasizes embedded control solutions and a wider product range including microcontrollers and memory. Tower focuses on analog mixed-signal foundry services and customizable process technologies. Microchip is larger in market capitalization and workforce, while Tower has a more specialized foundry business model with a global customer base in diverse markets.

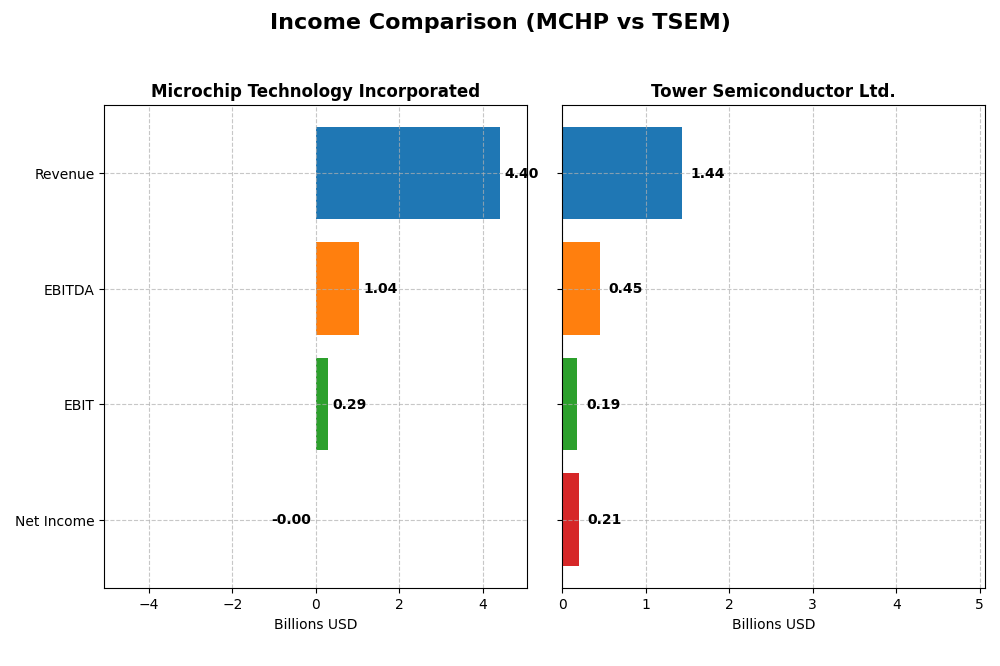

Income Statement Comparison

The table below presents a side-by-side comparison of the most recent fiscal year income statement metrics for Microchip Technology Incorporated and Tower Semiconductor Ltd.

| Metric | Microchip Technology Incorporated | Tower Semiconductor Ltd. |

|---|---|---|

| Market Cap | 40.2B USD | 13.9B USD |

| Revenue | 4.4B USD | 1.44B USD |

| EBITDA | 1.04B USD | 451M USD |

| EBIT | 290M USD | 185M USD |

| Net Income | -0.5M USD | 208M USD |

| EPS | -0.005 USD | 1.87 USD |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Microchip Technology Incorporated

From 2021 to 2025, Microchip Technology saw declining revenue and net income, with revenue dropping nearly 19% overall and net income turning negative in 2025. Gross margin remained favorable at 56.07%, but EBIT and net margins deteriorated, with net margin turning slightly negative last year. The 2025 fiscal year marked a steep decline, with a 42% revenue drop and net income loss.

Tower Semiconductor Ltd.

Tower Semiconductor demonstrated overall revenue growth of 13.5% and a strong net income increase of 153% over the 2020-2024 period. Margins were favorable, including a 23.64% gross margin and a 14.47% net margin in 2024. Despite a recent slowdown in EBIT and net income growth in the latest year, the company maintained positive profitability and margin improvements over the full period.

Which one has the stronger fundamentals?

Comparing fundamentals, Tower Semiconductor shows a more favorable income statement profile with consistent revenue and net income growth, as well as strong margins. In contrast, Microchip Technology’s income statement is marked by declining revenue and a negative net margin in the most recent year, reflecting unfavorable trends. Overall, Tower Semiconductor exhibits stronger financial fundamentals based on income metrics.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Microchip Technology Incorporated (MCHP) and Tower Semiconductor Ltd. (TSEM) based on their most recent fiscal year data.

| Ratios | Microchip Technology Incorporated (MCHP) FY 2025 | Tower Semiconductor Ltd. (TSEM) FY 2024 |

|---|---|---|

| ROE | -0.007% | 7.83% |

| ROIC | -0.027% | 6.41% |

| P/E | -52,021 | 27.54 |

| P/B | 3.67 | 2.16 |

| Current Ratio | 2.59 | 6.18 |

| Quick Ratio | 1.47 | 5.23 |

| D/E (Debt-to-Equity) | 0.80 | 0.07 |

| Debt-to-Assets | 36.9% | 5.9% |

| Interest Coverage | 1.18 | 32.64 |

| Asset Turnover | 0.29 | 0.47 |

| Fixed Asset Turnover | 3.72 | 1.11 |

| Payout ratio | -1951.4% | 0% |

| Dividend yield | 3.75% | 0% |

Interpretation of the Ratios

Microchip Technology Incorporated

Microchip’s ratios show a mixed picture with slightly unfavorable overall metrics. Key concerns include negative net margin, return on equity, and return on invested capital, indicating profitability challenges despite a strong current ratio of 2.59 and quick ratio of 1.47. The dividend yield at 3.75% is favorable, but coverage by free cash flow appears strained, suggesting risk in sustaining dividends alongside share buybacks.

Tower Semiconductor Ltd.

Tower Semiconductor presents a slightly favorable ratio profile, with a strong net margin of 14.47% and high interest coverage at 31.57, signaling solid operational efficiency. However, its price-to-earnings ratio of 27.54 is unfavorable, and the company does not pay dividends, likely focusing on reinvestment and growth. The low debt-to-assets ratio and healthy quick ratio support its financial stability.

Which one has the best ratios?

Evaluating both companies, Tower Semiconductor holds a slight edge with more favorable profitability and financial health indicators, including better net margin and interest coverage. Microchip’s higher dividend yield is offset by weak profitability and coverage concerns. Overall, Tower Semiconductor’s ratios are marginally stronger, reflecting better operational and capital structure metrics.

Strategic Positioning

This section compares the strategic positioning of Microchip Technology Incorporated and Tower Semiconductor Ltd., focusing on market position, key segments, and exposure to technological disruption:

Microchip Technology Incorporated

- Large market cap of 40B, faces high competitive pressure in a broad semiconductor industry.

- Key segments include microcontrollers, embedded processors, analog and interface products, and technology licensing revenues.

- Exposure to disruption through embedded flash tech licensing and FPGA products; broad product scope may diffuse risk.

Tower Semiconductor Ltd.

- Smaller market cap of 13.9B, competes as an independent foundry in analog mixed-signal devices.

- Focuses on analog intensive mixed-signal semiconductors and wafer fabrication services for diverse markets.

- Offers customizable process technologies like SiGe, BiCMOS, MEMS, exposing it to evolving fabrication tech demands.

Microchip Technology Incorporated vs Tower Semiconductor Ltd. Positioning

Microchip adopts a diversified product strategy across multiple semiconductor segments and licensing, supporting broad market reach. Tower Semiconductor concentrates on analog mixed-signal foundry services with customizable tech, offering specialization but narrower focus. Each approach carries distinct scale and market exposure implications.

Which has the best competitive advantage?

Both companies are shedding value currently, but Tower shows a slightly unfavorable moat with improving ROIC, while Microchip’s moat is very unfavorable with declining profitability, indicating Tower may hold a marginally stronger competitive position based on MOAT evaluation.

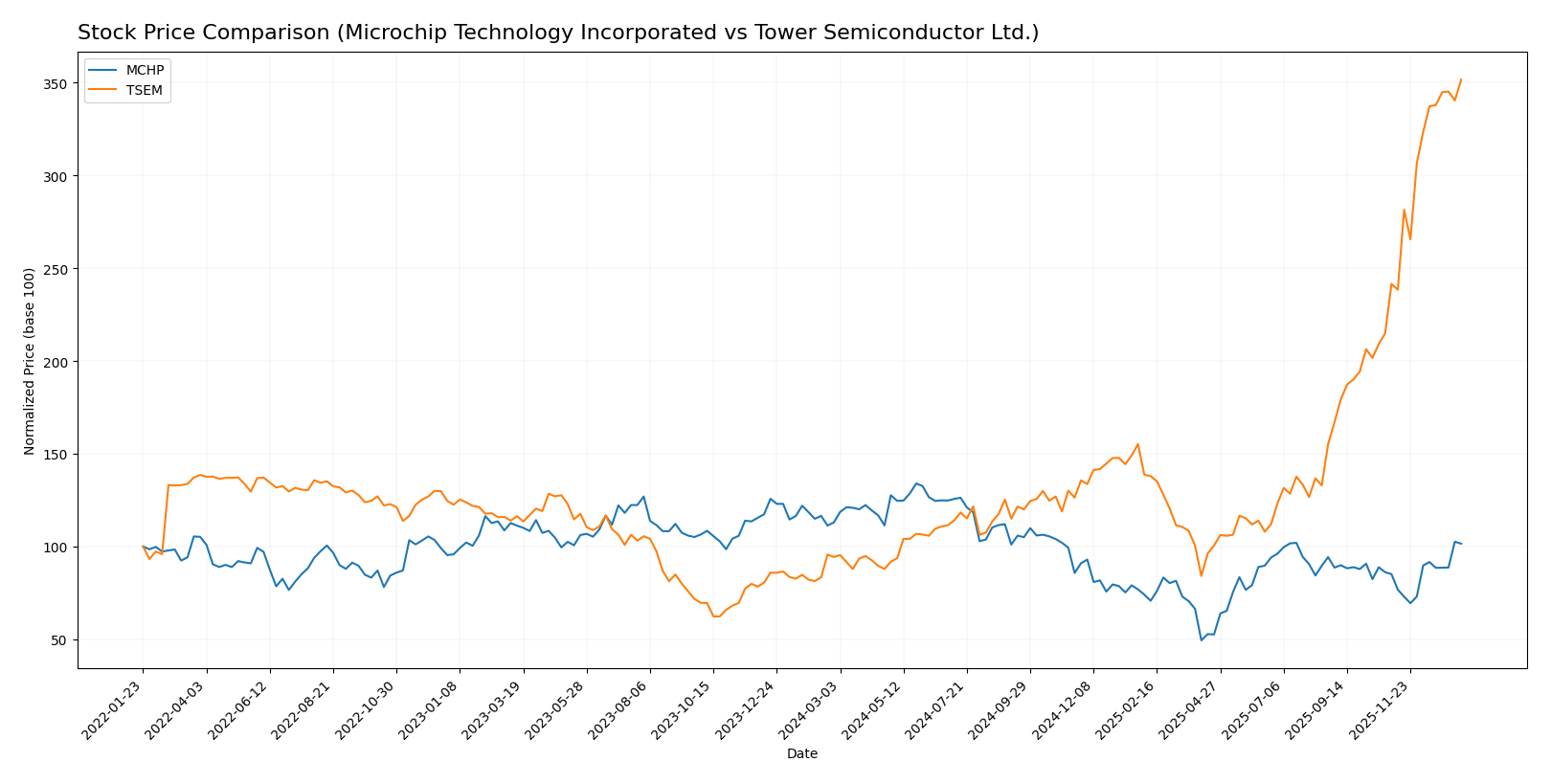

Stock Comparison

The stock price movements of Microchip Technology Incorporated and Tower Semiconductor Ltd. over the past year reveal contrasting dynamics, with Microchip showing a bearish trend and Tower Semiconductor demonstrating strong bullish momentum.

Trend Analysis

Microchip Technology Incorporated’s stock experienced a 10.13% decline over the past 12 months, indicating a bearish trend with accelerating downward momentum. The price ranged from a low of 36.22 to a high of 98.23, reflecting significant volatility (std deviation 14.38).

Tower Semiconductor Ltd. saw a 272.71% increase in stock price over the same period, marking a bullish trend with acceleration. The stock fluctuated between 29.65 and 124.0, exhibiting higher volatility than Microchip (std deviation 23.67).

Comparing these trends, Tower Semiconductor delivered the highest market performance with a strong bullish trajectory, while Microchip’s stock followed a bearish path despite recent short-term gains.

Target Prices

Here is the current analyst target price consensus for Microchip Technology Incorporated and Tower Semiconductor Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Microchip Technology Incorporated | 85 | 60 | 77.44 |

| Tower Semiconductor Ltd. | 125 | 66 | 96 |

Analysts expect Microchip’s stock to appreciate modestly above its current price of 74.45 USD, while Tower Semiconductor’s consensus target of 96 USD suggests a potential downside compared to its recent price around 124 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Microchip Technology Incorporated (MCHP) and Tower Semiconductor Ltd. (TSEM):

Rating Comparison

MCHP Rating

- Overall rating C- indicates a very favorable status despite a very unfavorable overall score of 1.

- Discounted Cash Flow Score of 3 reflects a moderate valuation assessment.

- Return on Equity Score of 1 shows very unfavorable profit generation efficiency.

- Return on Assets Score of 1 demonstrates very unfavorable asset utilization.

- Debt To Equity Score of 1 is very unfavorable, indicating higher financial risk.

- Overall Score of 1 is very unfavorable, reflecting weak overall financial health.

TSEM Rating

- Overall rating B+ is very favorable with a moderate overall score of 3.

- Discounted Cash Flow Score of 3 also reflects a moderate valuation assessment.

- Return on Equity Score of 3 indicates moderate efficiency in generating profits.

- Return on Assets Score of 4 is favorable, showing good asset utilization.

- Debt To Equity Score of 4 is favorable, indicating lower financial risk.

- Overall Score of 3 is moderate, indicating better financial standing.

Which one is the best rated?

Based strictly on the provided data, TSEM is better rated overall, with a very favorable rating (B+) and higher scores in ROE, ROA, and Debt to Equity, compared to MCHP’s lower scores and C- rating.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Microchip Technology (MCHP) and Tower Semiconductor (TSEM):

MCHP Scores

- Altman Z-Score: 3.999, indicating a safe zone from bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

TSEM Scores

- Altman Z-Score: 21.056, well within the safe zone for financial stability.

- Piotroski Score: 7, showing strong financial health and investment potential.

Which company has the best scores?

Based strictly on the provided data, TSEM outperforms MCHP with a much higher Altman Z-Score and a significantly stronger Piotroski Score, indicating better financial stability and strength.

Grades Comparison

The grades and ratings for Microchip Technology Incorporated and Tower Semiconductor Ltd. are as follows:

Microchip Technology Incorporated Grades

This table summarizes recent grades from verifiable grading companies for Microchip Technology Incorporated.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Overweight | 2026-01-15 |

| B. Riley Securities | Maintain | Buy | 2026-01-12 |

| Mizuho | Maintain | Outperform | 2026-01-09 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-07 |

| JP Morgan | Maintain | Overweight | 2026-01-06 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-06 |

| Stifel | Maintain | Buy | 2026-01-06 |

| Rosenblatt | Maintain | Buy | 2026-01-06 |

| Needham | Maintain | Buy | 2026-01-06 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-16 |

The overall trend for Microchip Technology Incorporated shows a majority of buy and overweight grades maintained, indicating a generally positive rating consensus.

Tower Semiconductor Ltd. Grades

This table summarizes recent grades from verifiable grading companies for Tower Semiconductor Ltd.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2026-01-09 |

| Wedbush | Downgrade | Neutral | 2025-12-31 |

| Benchmark | Maintain | Buy | 2025-11-11 |

| Susquehanna | Maintain | Positive | 2025-11-11 |

| Wedbush | Maintain | Outperform | 2025-11-11 |

| Barclays | Maintain | Equal Weight | 2025-11-11 |

| Benchmark | Maintain | Buy | 2025-09-08 |

| Susquehanna | Maintain | Positive | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-05 |

| Benchmark | Maintain | Buy | 2025-08-04 |

Tower Semiconductor Ltd. shows a majority of buy and positive grades, though with a notable downgrade from Wedbush to neutral at the end of 2025.

Which company has the best grades?

Microchip Technology Incorporated has received more consistent buy and overweight ratings from multiple firms, while Tower Semiconductor Ltd. shows some variability including a recent downgrade. This consistency may influence investor confidence in grade stability and outlook.

Strengths and Weaknesses

Below is a comparative analysis of Microchip Technology Incorporated (MCHP) and Tower Semiconductor Ltd. (TSEM) based on key financial and strategic criteria.

| Criterion | Microchip Technology Incorporated (MCHP) | Tower Semiconductor Ltd. (TSEM) |

|---|---|---|

| Diversification | Moderate: Primarily semiconductor products with minor licensing revenue (4.27B semiconductor sales in 2025, licensing 131M) | Focused on semiconductor foundry services, less diversified |

| Profitability | Weak: Negative net margin (-0.01%), ROIC below WACC, value destroying | Moderate: Positive net margin (14.47%), ROIC slightly above WACC but still shedding value |

| Innovation | Moderate: Technology licensing segment supports innovation | Moderate: Improving ROIC trend indicates growing efficiency and innovation |

| Global presence | Strong: Established global footprint in semiconductor markets | Moderate: Growing but smaller footprint, mostly in foundry services |

| Market Share | Large in microcontroller and analog semiconductor markets | Smaller niche player with growing market share in specialty foundry |

Key takeaways: MCHP shows declining profitability and value destruction despite a strong market presence and product diversification. TSEM, while also shedding value, demonstrates improving profitability trends and operational efficiency, making it slightly more favorable for investors focused on growth potential. Both companies require careful risk evaluation before investment.

Risk Analysis

Below is a comparative table summarizing key risks for Microchip Technology Incorporated (MCHP) and Tower Semiconductor Ltd. (TSEM) based on the most recent data available:

| Metric | Microchip Technology Incorporated (MCHP) | Tower Semiconductor Ltd. (TSEM) |

|---|---|---|

| Market Risk | High beta (1.445) indicates higher volatility and sensitivity to market swings. | Lower beta (0.876) suggests moderate market risk and lower volatility. |

| Debt Level | Moderate debt-to-equity ratio (0.8); interest coverage is low (1.15), signaling potential difficulty servicing debt. | Low debt-to-equity ratio (0.07) and strong interest coverage (31.57), indicating low financial leverage risk. |

| Regulatory Risk | Exposure to US and global semiconductor regulations, with potential impacts from trade policies and export controls. | Similar regulatory exposure, with added geopolitical sensitivity due to Israeli headquarters. |

| Operational Risk | Large global footprint with 22,300 employees; complexity may increase operational risks. | Smaller scale (5,613 employees) but dependent on foundry services, which could be disrupted. |

| Environmental Risk | Industry-wide pressure to reduce carbon footprint; no specific unfavorable data reported. | Similar industry environmental challenges; no direct data indicating elevated risk. |

| Geopolitical Risk | US-based, less exposed to geopolitical tensions but impacted by global supply chain issues. | Higher geopolitical risk due to Israel location, potential regional conflicts affecting operations. |

In synthesis, Microchip faces higher market risk and moderate debt concerns, with operational complexity adding to risk exposure. Tower Semiconductor has a stronger balance sheet and lower financial risk but faces notable geopolitical risks due to its Israeli base. Investors should weigh Microchip’s financial leverage and market volatility against Tower’s geopolitical and operational uncertainties when managing portfolio risk.

Which Stock to Choose?

Microchip Technology Incorporated (MCHP) shows a declining income trend with a -42.35% revenue drop in the last year and unfavorable profitability ratios. Its financial ratios are slightly unfavorable, with mixed debt levels and a very unfavorable rating of C-. The company is shedding value with a very unfavorable MOAT status.

Tower Semiconductor Ltd. (TSEM) presents a generally favorable income statement with positive overall growth and a strong gross margin of 23.64%. Its financial ratios are slightly favorable, supported by low debt and solid liquidity. The rating is B+ with a slightly unfavorable MOAT due to value destruction despite improving profitability.

Investors seeking growth potential might find TSEM more appealing given its favorable income evaluation and improving profitability trend. Conversely, those with a risk-averse profile might view MCHP’s challenges and unfavorable ratings as signals to wait for clearer financial recovery.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Microchip Technology Incorporated and Tower Semiconductor Ltd. to enhance your investment decisions: