Taiwan Semiconductor Manufacturing Company Limited (TSM) and Microchip Technology Incorporated (MCHP) are two key players in the semiconductor industry, each with distinct market focuses and innovation strategies. TSM leads in advanced wafer fabrication, while MCHP specializes in embedded control solutions. Comparing these companies offers valuable insights into different growth opportunities within technology. Join me as we explore which stock presents the most compelling investment case in 2026.

Table of contents

Companies Overview

I will begin the comparison between Taiwan Semiconductor Manufacturing Company Limited and Microchip Technology Incorporated by providing an overview of these two companies and their main differences.

Taiwan Semiconductor Manufacturing Company Limited Overview

Taiwan Semiconductor Manufacturing Company Limited (TSM) is a global leader in semiconductor manufacturing, offering a wide range of wafer fabrication processes, including CMOS logic, mixed-signal, and embedded memory technologies. Founded in 1987 and based in Hsinchu City, Taiwan, TSM serves diverse markets such as high-performance computing, smartphones, IoT, automotive, and digital consumer electronics, maintaining a strong international presence.

Microchip Technology Incorporated Overview

Microchip Technology Incorporated (MCHP), headquartered in Chandler, Arizona, develops and sells embedded control solutions including microcontrollers, microprocessors, and analog products. Since its founding in 1989, MCHP has focused on smart, connected, and secure applications across automotive, industrial, computing, and communications sectors, providing development tools, memory products, and subcontracting manufacturing services globally.

Key similarities and differences

Both TSM and MCHP operate in the semiconductor industry, focusing on technology innovation and serving international markets. TSM primarily manufactures integrated circuits and wafer fabrication, while MCHP specializes in embedded control solutions and microcontrollers, with a broader product range including analog and memory products. The companies differ in scale, with TSM’s market capitalization substantially exceeding that of MCHP and employing nearly three times more staff.

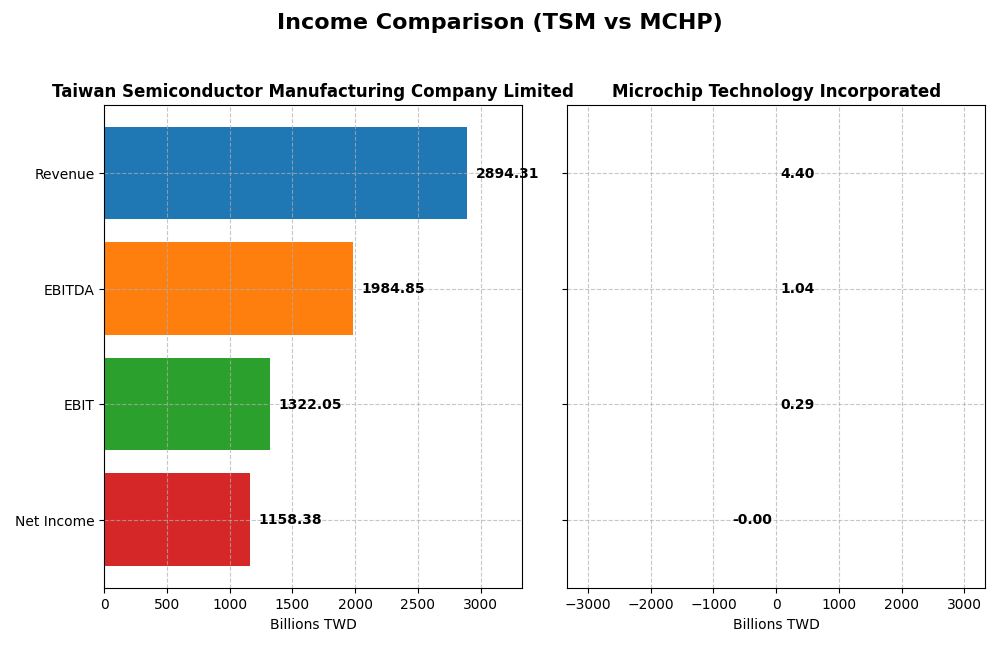

Income Statement Comparison

This table compares key income statement metrics for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Microchip Technology Incorporated (MCHP) for their most recent fiscal years.

| Metric | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Microchip Technology Incorporated (MCHP) |

|---|---|---|

| Market Cap | 1.70T TWD | 40.2B USD |

| Revenue | 2.89T TWD | 4.40B USD |

| EBITDA | 1.98T TWD | 1.04B USD |

| EBIT | 1.32T TWD | 290M USD |

| Net Income | 1.16T TWD | -0.5M USD |

| EPS | 223.4 TWD | -0.005 USD |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Taiwan Semiconductor Manufacturing Company Limited

Taiwan Semiconductor Manufacturing Company Limited (TSM) showed strong revenue growth, increasing from 1.34T TWD in 2020 to 2.89T TWD in 2024, with net income rising from 510B to 1.16T TWD. Margins remained stable and favorable, with a gross margin of 56.12% and net margin of 40.02%. The latest year saw robust revenue growth of 33.9%, while net margin growth was moderate at 1.58%, indicating sustained profitability.

Microchip Technology Incorporated

Microchip Technology Incorporated (MCHP) experienced declining revenue, falling from $5.44B in 2021 to $4.40B in 2025, with net income turning negative in 2025 at -$2.7M after peaking at $2.24B in 2023. Gross margin remained favorable at 56.07%, but EBIT and net margins weakened, with a net margin of -0.01%. The most recent year showed a sharp revenue drop of 42.35% and deteriorating profitability, reflecting significant financial challenges.

Which one has the stronger fundamentals?

TSM presents stronger fundamentals with consistent revenue and net income growth, stable and favorable margins, and a positive income statement outlook. In contrast, MCHP faces unfavorable trends with declining revenues, negative net income, and weak margin performance. The overall evaluation favors TSM’s solid financial health and growth trajectory over MCHP’s recent struggles.

Financial Ratios Comparison

The table below compares key financial ratios for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Microchip Technology Incorporated (MCHP) based on the most recent full fiscal year data available.

| Ratios | TSM (2024) | MCHP (2025) |

|---|---|---|

| ROE | 27.3% | -0.007% |

| ROIC | 20.0% | -0.027% |

| P/E | 29.0 | -52021 |

| P/B | 7.92 | 3.67 |

| Current Ratio | 2.36 | 2.59 |

| Quick Ratio | 2.14 | 1.47 |

| D/E | 0.25 | 0.80 |

| Debt-to-Assets | 15.6% | 36.9% |

| Interest Coverage | 126.0 | 1.18 |

| Asset Turnover | 0.43 | 0.29 |

| Fixed Asset Turnover | 0.88 | 3.72 |

| Payout Ratio | 31.3% | -1951 |

| Dividend Yield | 1.08% | 3.75% |

Interpretation of the Ratios

Taiwan Semiconductor Manufacturing Company Limited

Taiwan Semiconductor displays mostly strong ratios, with favorable returns on equity (27.29%) and invested capital (20.0%), supported by a solid current ratio of 2.36. Concerns arise from high price-to-earnings (29.04) and price-to-book (7.92) ratios, indicating potential overvaluation. Dividend yield at 1.08% is stable, reflecting moderate shareholder returns with balanced payout coverage and no evident distribution risks.

Microchip Technology Incorporated

Microchip shows weak profitability with negative net margin and returns on equity and invested capital close to zero, raising concerns about earnings quality and debt servicing given its low interest coverage of 1.15. However, liquidity ratios remain healthy and dividend yield is attractive at 3.75%, supported by share buybacks despite underlying operational challenges and elevated debt levels.

Which one has the best ratios?

Overall, Taiwan Semiconductor Manufacturing Company Limited holds the advantage with predominantly favorable profitability, liquidity, and leverage metrics, despite valuation concerns. Microchip Technology’s ratios reveal operational and financial stress, reflected in negative profitability and coverage ratios, making its financial health less robust in comparison.

Strategic Positioning

This section compares the strategic positioning of Taiwan Semiconductor Manufacturing Company Limited (TSM) and Microchip Technology Incorporated (MCHP) regarding market position, key segments, and exposure to technological disruption:

Taiwan Semiconductor Manufacturing Company Limited

- Leading global semiconductor manufacturer facing intense competition in wafer fabrication.

- Dominates wafer fabrication with high-performance computing, smartphones, automotive segments driving revenue.

- Invests in advanced wafer fabrication technologies; exposure to risks from rapid semiconductor process innovations.

Microchip Technology Incorporated

- Mid-sized semiconductor firm focusing on embedded control solutions with competitive pressure in niche markets.

- Offers diverse embedded microcontrollers and analog products targeting automotive, industrial, and communications sectors.

- Provides specialized microcontrollers and FPGA products; faces disruption from evolving embedded and connectivity technologies.

TSM vs MCHP Positioning

TSM employs a concentrated strategy focused on wafer manufacturing in high-growth segments, while MCHP pursues a diversified embedded control product range. TSM’s scale offers strong market influence; MCHP’s breadth targets multiple specialized applications, each with distinct risks and growth drivers.

Which has the best competitive advantage?

TSM holds a slightly favorable moat, creating value despite declining profitability, whereas MCHP shows a very unfavorable moat with value destruction and a steep ROIC decline, indicating weaker competitive advantage.

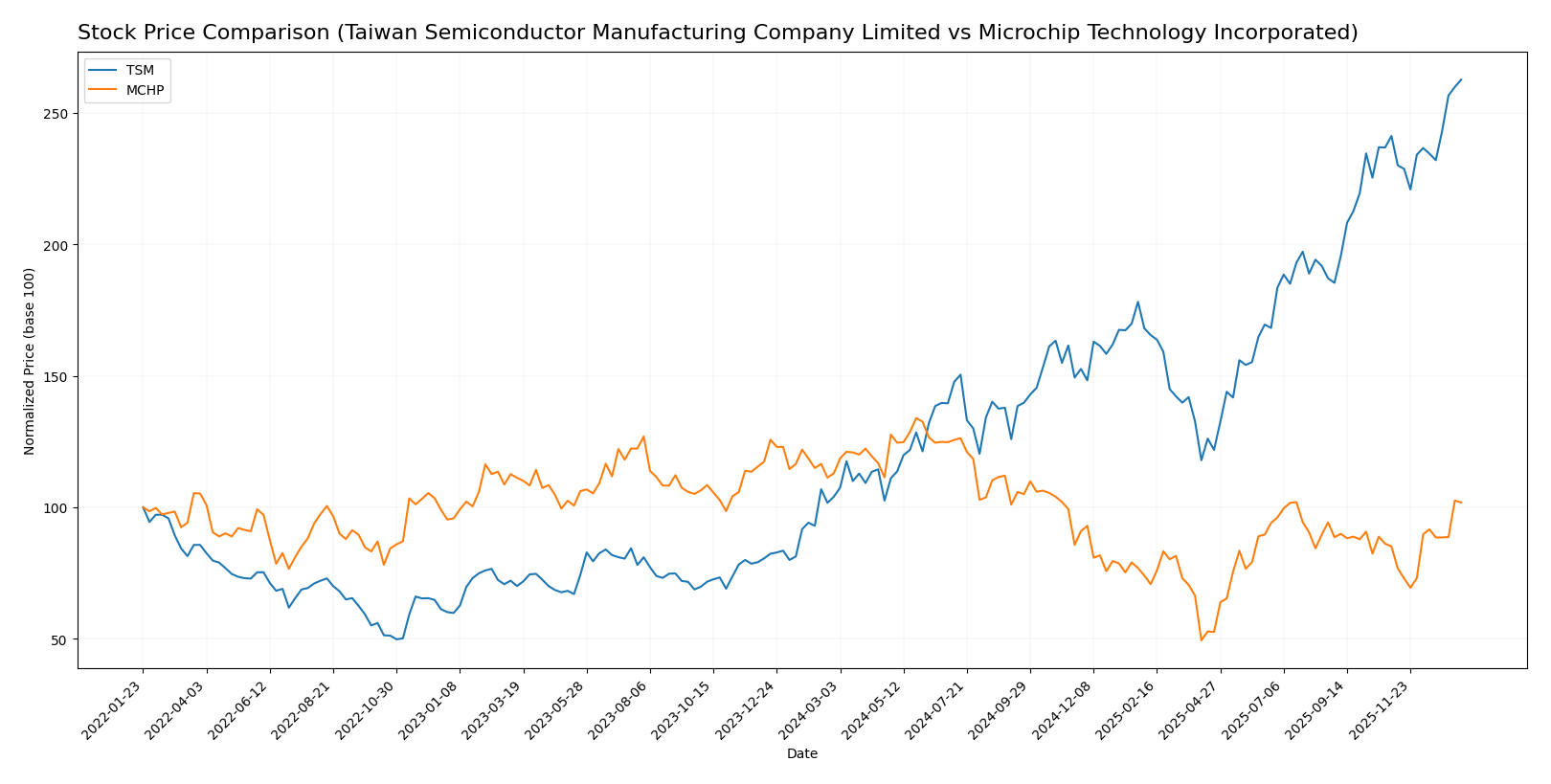

Stock Comparison

The stock price movements of Taiwan Semiconductor Manufacturing Company Limited and Microchip Technology Incorporated over the past year reveal contrasting trading dynamics, with TSM showing significant gains amid volume fluctuations and MCHP experiencing a notable decline tempered by recent recovery.

Trend Analysis

Taiwan Semiconductor Manufacturing Company Limited’s stock exhibited a strong bullish trend over the past 12 months, with a 152.54% price increase and accelerating momentum, reaching a high of 327.11 and a low of 127.7, supported by high volatility (std deviation 51.25).

Microchip Technology Incorporated’s stock showed a bearish trend over the same period, declining by 9.85% despite acceleration, with price volatility at 14.38 and a high of 98.23 and low of 36.22, though recent gains of 19.64% signal short-term recovery.

Comparing the two, Taiwan Semiconductor Manufacturing Company Limited delivered the highest market performance over the past year, outperforming Microchip Technology Incorporated in both overall price appreciation and trend acceleration.

Target Prices

Analysts present a positive target consensus for Taiwan Semiconductor Manufacturing Company Limited and Microchip Technology Incorporated.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Taiwan Semiconductor Manufacturing Company Limited | 400 | 330 | 361.25 |

| Microchip Technology Incorporated | 85 | 60 | 76.5 |

The consensus target prices for TSM and MCHP suggest upside potential compared to their current prices of 327.11 and 74.68 respectively, indicating generally optimistic analyst expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Microchip Technology Incorporated (MCHP):

Rating Comparison

TSM Rating

- Rating: A- indicating a very favorable assessment of the company’s financial standing.

- Discounted Cash Flow Score: 5, very favorable, suggesting strong future cash flow projections.

- ROE Score: 5, very favorable, showing highly efficient profit generation from equity.

- ROA Score: 5, very favorable, demonstrating excellent asset utilization to generate earnings.

- Debt To Equity Score: 3, moderate, implying a balanced but notable reliance on debt.

- Overall Score: 4, favorable, summarizing a strong financial position.

MCHP Rating

- Rating: C- reflecting a very unfavorable view of the company’s financial position.

- Discounted Cash Flow Score: 3, moderate, indicating average valuation based on cash flow.

- ROE Score: 1, very unfavorable, indicating poor profit generation efficiency.

- ROA Score: 1, very unfavorable, reflecting weak asset utilization for earnings.

- Debt To Equity Score: 1, very unfavorable, indicating high financial risk due to debt levels.

- Overall Score: 1, very unfavorable, summarizing weak financial health.

Which one is the best rated?

TSM is clearly better rated than MCHP across all provided metrics, with very favorable scores in cash flow, returns, and overall financial health, while MCHP shows very unfavorable ratings in most categories.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

TSM Scores

- Altman Z-Score: 2.94, classified in the grey zone indicating moderate bankruptcy risk.

- Piotroski Score: 8, considered very strong, indicating robust financial health.

MCHP Scores

- Altman Z-Score: 4.00, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 3, considered very weak, indicating poor financial strength.

Which company has the best scores?

Based on the provided data, MCHP has a better Altman Z-Score, indicating stronger bankruptcy safety. However, TSM significantly outperforms MCHP on the Piotroski Score, showing much stronger financial health.

Grades Comparison

Here is a detailed comparison of the recent grades assigned to Taiwan Semiconductor Manufacturing Company Limited and Microchip Technology Incorporated:

Taiwan Semiconductor Manufacturing Company Limited Grades

The following table shows recent grades and actions by recognized grading companies for TSM:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Bernstein | Maintain | Outperform | 2025-12-08 |

| Needham | Maintain | Buy | 2025-10-27 |

| Barclays | Maintain | Overweight | 2025-10-17 |

| Needham | Maintain | Buy | 2025-10-16 |

| Susquehanna | Maintain | Positive | 2025-10-10 |

| Barclays | Maintain | Overweight | 2025-10-09 |

| Barclays | Maintain | Overweight | 2025-09-16 |

| Needham | Maintain | Buy | 2025-07-17 |

| Susquehanna | Maintain | Positive | 2025-07-14 |

| Needham | Maintain | Buy | 2025-07-01 |

Grades for TSM show consistent positive recommendations, predominantly “Buy” and “Outperform,” with no downgrades or negative outlooks.

Microchip Technology Incorporated Grades

The following table displays recent grades and actions by recognized grading companies for MCHP:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Buy | 2026-01-12 |

| Mizuho | Maintain | Outperform | 2026-01-09 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-07 |

| JP Morgan | Maintain | Overweight | 2026-01-06 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-06 |

| Needham | Maintain | Buy | 2026-01-06 |

| Rosenblatt | Maintain | Buy | 2026-01-06 |

| Stifel | Maintain | Buy | 2026-01-06 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-16 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

Grades for MCHP reflect a mix of “Buy,” “Outperform,” and “Overweight” ratings, alongside some “Equal Weight” and “Neutral” assessments, indicating a more varied analyst outlook.

Which company has the best grades?

Microchip Technology Incorporated has received a broader spectrum of grades, including strong “Buy” and “Outperform” ratings but also several “Equal Weight” and “Neutral” calls. Taiwan Semiconductor Manufacturing Company Limited shows more uniform positive ratings, mainly “Buy” and “Outperform,” suggesting a more consistently favorable analyst consensus. For investors, this could imply differing risk and return profiles reflected in analyst sentiment.

Strengths and Weaknesses

Below is a comparative overview of Taiwan Semiconductor Manufacturing Company Limited (TSM) and Microchip Technology Incorporated (MCHP) based on key financial and operational criteria as of 2026.

| Criterion | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Microchip Technology Incorporated (MCHP) |

|---|---|---|

| Diversification | Focused primarily on wafer manufacturing with significant revenue (1.99T TWD in wafers FY2022); less diversified product range | Mainly semiconductor products with technology licensing; smaller revenue scale (~4.27B USD in 2025) |

| Profitability | High net margin (40.02%) and ROIC (20.0%), creating value despite a slight declining trend | Negative net margin and ROIC, indicating value destruction and declining profitability |

| Innovation | Strong investment in wafer tech, but ROIC trend declining slightly, suggesting innovation pressure | Innovation seems weaker given negative profitability and declining ROIC trend |

| Global presence | Leading global semiconductor foundry with broad international client base | More limited global footprint compared to TSM |

| Market Share | Dominant market share in semiconductor manufacturing | Smaller market share, niche in semiconductor products and licensing |

Key takeaways: TSM stands out with strong profitability, solid global presence, and leadership in wafer manufacturing, though profitability growth is slowing. MCHP faces challenges with profitability and value creation, signaling higher investment risk despite a stable product segment.

Risk Analysis

Below is a table summarizing key risks for Taiwan Semiconductor Manufacturing Company Limited (TSM) and Microchip Technology Incorporated (MCHP) based on the most recent data from 2025–2026.

| Metric | Taiwan Semiconductor Manufacturing Company Limited (TSM) | Microchip Technology Incorporated (MCHP) |

|---|---|---|

| Market Risk | Moderate (Beta 1.27) — Exposure to cyclical semiconductor demand fluctuations | Higher (Beta 1.45) — More volatile market sensitivity |

| Debt level | Low (Debt/Equity 0.25) — Strong balance sheet, low financial risk | Moderate to high (Debt/Equity 0.8) — Increased leverage with moderate risk |

| Regulatory Risk | Moderate — Operating in Taiwan with geopolitical tensions affecting supply chains | Moderate — US-based but subject to complex global trade regulations |

| Operational Risk | Low — Leading-edge manufacturing technology with strong operational efficiency | Moderate — Challenges in profit margins and operational efficiency |

| Environmental Risk | Moderate — Semiconductor manufacturing involves chemical use and energy consumption | Moderate — Similar industry risks, with focus on sustainability efforts |

| Geopolitical Risk | High — Taiwan-China tensions could disrupt operations and supply chains | Moderate — US-China trade tensions impact supply and demand |

In synthesis, TSM faces the most impactful risk from geopolitical tensions, particularly Taiwan-China relations, which could disrupt its global supply chains. However, it maintains a strong financial position and operational efficiency, mitigating many other risks. On the other hand, MCHP exhibits higher financial leverage and weaker profitability metrics, increasing its financial and operational risks. Investors should weigh TSM’s geopolitical exposure against its robust fundamentals, while MCHP’s financial health and market volatility warrant cautious consideration.

Which Stock to Choose?

Taiwan Semiconductor Manufacturing Company Limited (TSM) shows strong income growth with a 33.89% revenue increase in 2024 and favorable profitability metrics, including a 40.02% net margin, 27.29% ROE, and a solid debt profile. Its financial ratios are mostly favorable, with a very favorable A- rating and a slightly favorable moat status despite a declining ROIC trend.

Microchip Technology Incorporated (MCHP) reports an unfavorable income evolution marked by a -42.35% revenue decline in 2025 and negative net margin, ROE, and ROIC values. Its financial ratios are slightly unfavorable overall, with mixed ratings including a very unfavorable overall score (C-), a very unfavorable moat evaluation, and a declining profitability trend.

Investors focused on stable profitability and consistent value creation may find TSM more favorable given its strong income growth, solid financial ratios, and very favorable rating. Conversely, those with a higher risk tolerance and interest in potential turnaround scenarios might consider MCHP’s current valuation and recent stock price acceleration, despite its unfavorable fundamentals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Taiwan Semiconductor Manufacturing Company Limited and Microchip Technology Incorporated to enhance your investment decisions: