In the dynamic semiconductor sector, Microchip Technology Incorporated (MCHP) and SkyWater Technology, Inc. (SKYT) stand out with distinct approaches yet overlapping market footprints. Microchip excels in embedded control solutions and broad product range, while SkyWater specializes in semiconductor manufacturing services and innovation partnerships. This comparison aims to clarify which company offers the most compelling investment opportunity amid evolving industry demands. Join me as we dissect their strengths to find the smarter portfolio addition.

Table of contents

Companies Overview

I will begin the comparison between Microchip Technology Incorporated and SkyWater Technology, Inc. by providing an overview of these two companies and their main differences.

Microchip Technology Incorporated Overview

Microchip Technology Incorporated develops, manufactures, and sells embedded control solutions globally, focusing on microcontrollers, microprocessors, and analog products. The company serves diverse markets including automotive, industrial, and communications, offering a broad range of semiconductor products and licensing technologies. Headquartered in Chandler, Arizona, Microchip is a well-established player with a market cap of approximately 40B USD and over 22,000 employees.

SkyWater Technology, Inc. Overview

SkyWater Technology, Inc. provides semiconductor development and manufacturing services, including engineering support and production of silicon-based analog and mixed-signal integrated circuits. It targets industries such as aerospace, defense, automotive, and bio-health. Founded in 2017 and based in Bloomington, Minnesota, SkyWater is smaller with a market cap of around 1.5B USD and employs about 700 people.

Key similarities and differences

Both companies operate in the semiconductor industry and serve diverse sectors requiring advanced chip technologies. Microchip focuses on designing and selling a wide variety of microcontrollers and analog components, while SkyWater specializes in semiconductor manufacturing and process development services. Microchip’s larger scale and broader product portfolio contrast with SkyWater’s niche in foundry services and emerging market presence.

Income Statement Comparison

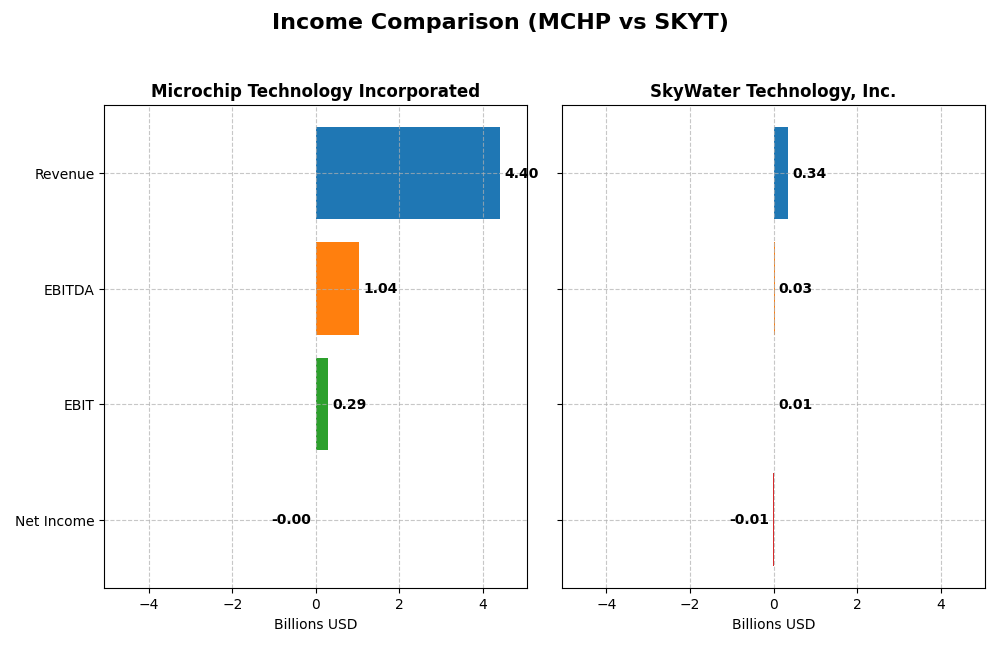

This table presents a side-by-side comparison of key income statement metrics for Microchip Technology Incorporated and SkyWater Technology, Inc. for their most recent fiscal years.

| Metric | Microchip Technology Incorporated (MCHP) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Cap | 40.2B | 1.54B |

| Revenue | 4.40B | 342M |

| EBITDA | 1.04B | 25.3M |

| EBIT | 290M | 6.56M |

| Net Income | -0.5M | -6.79M |

| EPS | -0.005 | -0.14 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Microchip Technology Incorporated

Microchip Technology’s revenue and net income have declined significantly from 2021 to 2025, with revenue dropping from $5.4B in 2021 to $4.4B in 2025, and net income turning negative in the latest year after peaking in 2023. Gross margin remained relatively strong at 56.07%, but net margin deteriorated to almost zero in 2025. The most recent fiscal year showed sharp declines in revenue, profitability, and earnings per share, indicating an unfavorable trend.

SkyWater Technology, Inc.

SkyWater Technology demonstrated consistent revenue growth from $140M in 2020 to $342M in 2024, with net losses narrowing in the same period. Gross margin improved to 20.34%, and net margin, while still negative at -1.98%, showed a favorable growth trajectory. The latest year saw revenue and profitability gains alongside improved earnings per share, reflecting a favorable upward momentum in the company’s financial performance.

Which one has the stronger fundamentals?

SkyWater Technology exhibits stronger fundamentals with positive revenue growth and improving margins over the recent years, contrasting with Microchip’s significant revenue and net income declines. Despite Microchip’s higher gross margin, its deteriorating net margin and negative earnings growth weigh heavily. SkyWater’s overall favorable income statement evaluation suggests better momentum and financial health compared to Microchip’s unfavorable trends.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Microchip Technology Incorporated (MCHP) and SkyWater Technology, Inc. (SKYT) based on their most recent fiscal year data.

| Ratios | Microchip Technology Incorporated (MCHP) FY 2025 | SkyWater Technology, Inc. (SKYT) FY 2024 |

|---|---|---|

| ROE | -0.007% | -11.79% |

| ROIC | -0.027% | 3.40% |

| P/E | -52,021 | -100.26 |

| P/B | 3.67 | 11.82 |

| Current Ratio | 2.59 | 0.86 |

| Quick Ratio | 1.47 | 0.76 |

| D/E (Debt to Equity) | 0.80 | 1.33 |

| Debt-to-Assets | 36.85% | 24.46% |

| Interest Coverage | 1.18 | 0.74 |

| Asset Turnover | 0.29 | 1.09 |

| Fixed Asset Turnover | 3.72 | 2.07 |

| Payout ratio | -1951.4% | 0% |

| Dividend yield | 3.75% | 0% |

Interpretation of the Ratios

Microchip Technology Incorporated

Microchip Technology presents a mixed ratio profile with a slightly unfavorable overall assessment. Key concerns include negative net margin, return on equity, and return on invested capital, alongside weak interest coverage and asset turnover. However, liquidity ratios like current and quick ratio are favorable, and the firm maintains a solid dividend yield of 3.75%, supported by a consistent payout, though some caution remains due to coverage risks.

SkyWater Technology, Inc.

SkyWater Technology’s ratios are largely unfavorable, marked by negative profitability metrics such as net margin, return on equity, and a high weighted average cost of capital at 19.8%. Liquidity ratios are weak, and leverage appears elevated with a debt-to-equity of 1.33. The company does not pay dividends, reflecting its negative earnings and reinvestment focus amid significant operational challenges.

Which one has the best ratios?

Between the two, Microchip Technology shows a stronger liquidity position and dividend yield alongside some favorable turnover ratios, despite profitability concerns. SkyWater Technology faces more pronounced operational and financial difficulties, with most ratios unfavorable and no dividend returns. Thus, Microchip’s ratio profile is comparatively more balanced and less risky.

Strategic Positioning

This section compares the strategic positioning of Microchip Technology Incorporated and SkyWater Technology, Inc., including Market position, Key segments, and disruption:

Microchip Technology Incorporated

- Large market cap $40B in semiconductors, facing competitive pressure in global markets.

- Focused on diverse semiconductor products and technology licensing, driving revenues.

- Exposure to embedded control solutions and licensing, with established tech but facing industry changes.

SkyWater Technology, Inc.

- Smaller market cap $1.5B, operating in semiconductor development and manufacturing niche.

- Primarily offers semiconductor manufacturing and advanced technology services.

- Engaged in co-creation with customers, focusing on niche tech and foundry services.

Microchip Technology Incorporated vs SkyWater Technology, Inc. Positioning

Microchip has a diversified product base spanning multiple semiconductor segments and licensing, offering scale advantages. SkyWater concentrates on specialized wafer and technology services with closer customer collaboration, implying narrower but focused operations.

Which has the best competitive advantage?

Both firms currently shed value, but SkyWater shows improving profitability with growing ROIC, while Microchip experiences declining returns. SkyWater’s slightly unfavorable moat suggests a more positive trajectory in capital efficiency than Microchip’s very unfavorable status.

Stock Comparison

The past year reveals contrasting stock price dynamics between Microchip Technology Incorporated and SkyWater Technology, Inc., with Microchip showing a prolonged bearish trend despite recent gains, while SkyWater exhibits strong bullish momentum and accelerating growth.

Trend Analysis

Microchip Technology Incorporated experienced a bearish trend over the past 12 months, with a -10.13% price change and accelerating decline, though recent weeks show a 19.27% rebound with moderate volatility.

SkyWater Technology, Inc. demonstrated a robust bullish trend over the same period, gaining 236.8% with accelerating momentum and relatively low volatility; recent performance surged 83.13%, maintaining strong upward slope.

Comparing these trends, SkyWater significantly outperformed Microchip in market performance, delivering the highest gains and sustained bullish acceleration over the past year.

Target Prices

The current analyst consensus presents clear target price ranges for both Microchip Technology Incorporated and SkyWater Technology, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Microchip Technology Incorporated | 85 | 60 | 77.44 |

| SkyWater Technology, Inc. | 25 | 25 | 25 |

Analysts expect Microchip Technology’s stock to maintain a moderate upside from its current price of 74.45 USD, while SkyWater Technology’s target is notably below its current price of 32.03 USD, indicating a more cautious outlook.

Analyst Opinions Comparison

This section compares the analysts’ ratings and financial grades for Microchip Technology Incorporated and SkyWater Technology, Inc.:

Rating Comparison

Microchip Technology Incorporated Rating

- Rating: C-, classified as Very Favorable overall rating.

- Discounted Cash Flow Score: 3, indicating a Moderate valuation outlook.

- ROE Score: 1, signaling Very Unfavorable efficiency in generating equity returns.

- ROA Score: 1, showing Very Unfavorable asset utilization.

- Debt To Equity Score: 1, reflecting a Very Unfavorable financial risk level.

- Overall Score: 1, marked as Very Unfavorable financial standing.

SkyWater Technology, Inc. Rating

- Rating: B+, classified as Very Favorable overall rating.

- Discounted Cash Flow Score: 1, indicating a Very Unfavorable outlook.

- ROE Score: 5, indicating Very Favorable efficiency in equity returns.

- ROA Score: 5, showing Very Favorable asset utilization.

- Debt To Equity Score: 1, reflecting a Very Unfavorable financial risk level.

- Overall Score: 3, marked as Moderate financial standing.

Which one is the best rated?

Based strictly on the provided data, SkyWater Technology, Inc. holds a stronger rating with a B+ and higher overall score of 3, compared to Microchip Technology’s C- and overall score of 1. SkyWater also excels in ROE and ROA metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

MCHP Scores

- Altman Z-Score: 4.00, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

SKYT Scores

- Altman Z-Score: 2.20, placing it in the grey zone with moderate bankruptcy risk.

- Piotroski Score: 5, indicating average financial strength.

Which company has the best scores?

Based strictly on the provided data, MCHP shows a stronger Altman Z-Score indicating better financial stability, while SKYT has a better Piotroski Score reflecting stronger financial health. Neither company dominates both metrics.

Grades Comparison

Here is a detailed comparison of the latest grades from reputable grading companies for the two companies:

Microchip Technology Incorporated Grades

The table below shows the recent grades assigned by well-known financial institutions to Microchip Technology Incorporated:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Overweight | 2026-01-15 |

| B. Riley Securities | Maintain | Buy | 2026-01-12 |

| Mizuho | Maintain | Outperform | 2026-01-09 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-07 |

| JP Morgan | Maintain | Overweight | 2026-01-06 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-06 |

| Stifel | Maintain | Buy | 2026-01-06 |

| Rosenblatt | Maintain | Buy | 2026-01-06 |

| Needham | Maintain | Buy | 2026-01-06 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-16 |

Microchip Technology Incorporated’s grades predominantly indicate a positive outlook with multiple buy and overweight ratings and no downgrades.

SkyWater Technology, Inc. Grades

Below are the recent grades from established grading firms for SkyWater Technology, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

| Piper Sandler | Maintain | Overweight | 2024-10-25 |

| Piper Sandler | Maintain | Overweight | 2024-08-08 |

| Needham | Maintain | Buy | 2024-05-09 |

SkyWater Technology’s ratings consistently show a buy or overweight consensus with no negative revisions, reflecting steady support from analysts.

Which company has the best grades?

Microchip Technology Incorporated has received a broader range of grades from multiple firms, including strong buy equivalents such as outperform and overweight, while SkyWater Technology’s grades are uniformly buy or overweight. Microchip’s more frequent and recent grading activity may provide investors with more current insights, whereas SkyWater’s steady buy ratings suggest consistent confidence but with fewer recent updates.

Strengths and Weaknesses

Below is a comparison of Microchip Technology Incorporated (MCHP) and SkyWater Technology, Inc. (SKYT) based on key criteria relevant to investors.

| Criterion | Microchip Technology Incorporated (MCHP) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Diversification | Primarily focused on semiconductor products with growing revenues in this segment; limited diversification beyond technology licensing | Offers a mix of wafer services and advanced technology services, showing moderate diversification within semiconductor manufacturing services |

| Profitability | Negative net margin (-0.01%) and ROIC (-3%); value destroying with declining profitability | Negative net margin (-1.98%) and ROIC (3.4% but below WACC); slightly unfavorable but improving ROIC trend |

| Innovation | Moderate innovation with technology licensing revenue around $131M in 2025, but declining profitability limits reinvestment | Innovation through advanced technology services and wafer fabrication, showing investment increase but profitability still negative |

| Global presence | Large global semiconductor footprint with revenues exceeding $4.27B in semiconductor products | Smaller scale with total revenues under $250M; more niche and regional presence |

| Market Share | Established player with significant market share in semiconductor components | Smaller market share focused on specialty foundry services and advanced tech |

Key takeaways: MCHP shows solid revenue scale but suffers from declining profitability and value destruction, signaling caution. SKYT, though smaller and currently unprofitable, demonstrates improving ROIC and diversified service offerings, indicating potential growth but higher risk. Investors should weigh the stability and scale of MCHP against the growth prospects and financial challenges of SKYT.

Risk Analysis

Below is a comparative table highlighting key risk factors for Microchip Technology Incorporated (MCHP) and SkyWater Technology, Inc. (SKYT) based on the most recent data from 2025 and 2024 respectively:

| Metric | Microchip Technology Incorporated (MCHP) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Market Risk | Beta 1.445 indicates moderate volatility | Beta 3.487 reflects high volatility |

| Debt Level | Debt-to-equity 0.8 (neutral risk) | Debt-to-equity 1.33 (high risk) |

| Regulatory Risk | Moderate, US-based semiconductor industry | Moderate, US-based but smaller scale |

| Operational Risk | Large, complex operations with 22.3K employees | Smaller scale with 702 employees, higher operational leverage |

| Environmental Risk | Standard industry risks, no recent issues | Typical for semiconductor manufacturing |

| Geopolitical Risk | Exposure to Americas, Europe, Asia | Primarily US-focused, less diversified |

The most significant risks are SKYT’s high market volatility and elevated debt levels, increasing its financial vulnerability. MCHP faces moderate market risk but maintains stronger liquidity and safer bankruptcy risk (Altman Z-Score in safe zone). SKYT’s grey zone Altman Z-Score and weaker liquidity ratios warrant caution despite its growth potential.

Which Stock to Choose?

Microchip Technology Incorporated (MCHP) shows a declining income trend with a 42% revenue drop in 2025 and an unfavorable net margin at -0.01%. Financial ratios are slightly unfavorable, reflecting negative profitability and moderate debt levels, despite a strong current ratio. The company’s rating is very favorable overall, though key profitability scores are very unfavorable, and the moat evaluation signals value destruction with declining ROIC.

SkyWater Technology, Inc. (SKYT) exhibits a favorable income evolution, with nearly 20% revenue growth in 2024 and improved net margin growth. Its financial ratios remain largely unfavorable, marked by negative returns and high debt-to-equity, though asset turnover is favorable. The rating is very favorable, supported by strong return scores, while the moat is slightly unfavorable but with a growing ROIC trend indicating improving profitability.

Investors seeking growth might find SkyWater’s improving income and expanding profitability appealing despite its financial risks and moderate credit standing. Conversely, those prioritizing a strong rating and liquidity might view Microchip’s current financial structure favorably, although its declining profitability and value destruction could signal caution. Ultimately, the choice could depend on an investor’s tolerance for risk and preference for growth versus stability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Microchip Technology Incorporated and SkyWater Technology, Inc. to enhance your investment decisions: