In the dynamic semiconductor industry, Microchip Technology Incorporated (MCHP) and Onto Innovation Inc. (ONTO) stand out for their distinct yet complementary innovation strategies. MCHP focuses on embedded control solutions and microcontrollers, while ONTO specializes in process control tools and metrology systems. This comparison explores their market positions and growth potential, helping you decide which company holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Microchip Technology Incorporated and Onto Innovation Inc. by providing an overview of these two companies and their main differences.

Microchip Technology Incorporated Overview

Microchip Technology Incorporated develops, manufactures, and sells smart, connected embedded control solutions globally. It offers a broad range of microcontrollers, microprocessors, analog and interface products, memory solutions, and specialized engineering services. The company serves diverse sectors including automotive, industrial, and communications, positioning itself as a comprehensive provider in the semiconductor market with a strong presence in the Americas, Europe, and Asia.

Onto Innovation Inc. Overview

Onto Innovation Inc. designs and manufactures process control tools focused on macro defect inspection, optical metrology, lithography, and process control software. Its products support semiconductor and advanced packaging manufacturers worldwide, with applications in LED, power devices, and data storage. Founded in 1940 and headquartered in Massachusetts, Onto Innovation emphasizes precision process control and yield management solutions in the semiconductor industry.

Key similarities and differences

Both Microchip Technology and Onto Innovation operate within the semiconductor sector, but their business models differ significantly. Microchip offers a wide portfolio of embedded control and memory products, focusing on integrated circuit components. Onto Innovation specializes in manufacturing process control tools and analytical software for semiconductor production and packaging. While Microchip has a larger workforce and market cap, Onto Innovation concentrates on niche process control technologies and services.

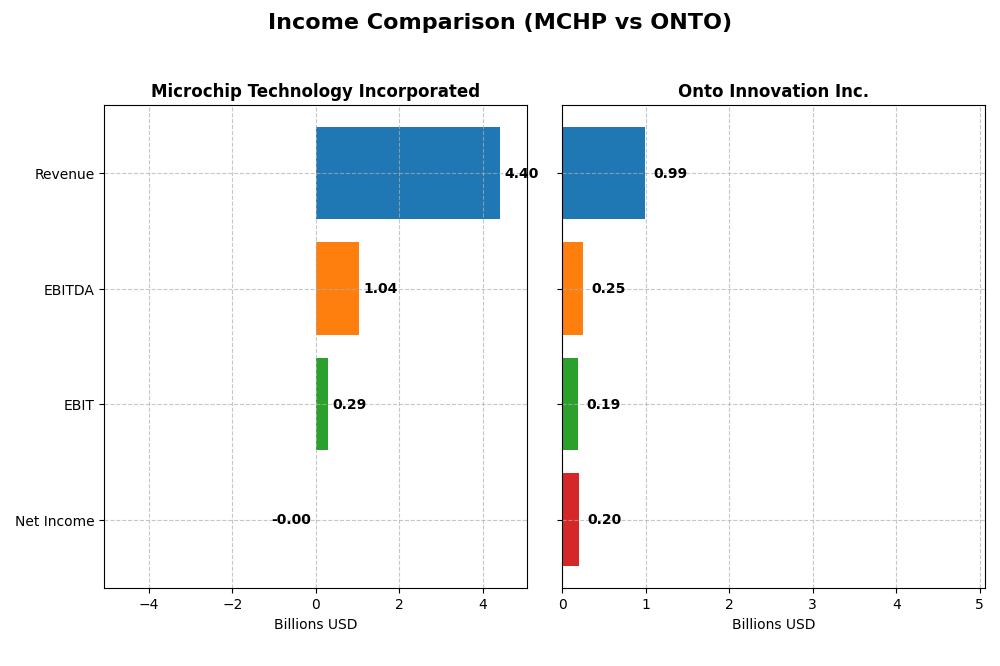

Income Statement Comparison

Below is a comparison of key income statement metrics for Microchip Technology Incorporated and Onto Innovation Inc. for their most recent fiscal years.

| Metric | Microchip Technology Incorporated | Onto Innovation Inc. |

|---|---|---|

| Market Cap | 40.2B | 10.7B |

| Revenue | 4.40B (FY 2025) | 987M (FY 2024) |

| EBITDA | 1.04B (FY 2025) | 249M (FY 2024) |

| EBIT | 290M (FY 2025) | 187M (FY 2024) |

| Net Income | -0.5M (FY 2025) | 202M (FY 2024) |

| EPS | -0.005 (FY 2025) | 4.09 (FY 2024) |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Microchip Technology Incorporated

Microchip Technology’s revenue declined from $8.44B in 2023 to $4.40B in 2025, with net income dropping from $2.24B to a slight loss of $0.5M. Gross margin remained stable around 56%, but the net margin turned negative in 2025, reflecting a challenging year. The sharp decrease in revenue and earnings signifies a significant slowdown and margin pressure in the latest fiscal year.

Onto Innovation Inc.

Onto Innovation experienced consistent revenue growth from $556M in 2020 to $987M in 2024, with net income rising from $31M to $202M. Margins improved notably, with gross margin at 52.19% and net margin reaching 20.43% in 2024. The latest year showed strong growth across all key metrics, including a 21% revenue increase and a 37.55% net margin expansion, indicating solid operational performance.

Which one has the stronger fundamentals?

Onto Innovation demonstrates stronger fundamentals with uniformly favorable growth and margin improvements over the period, including robust net income and EPS growth. In contrast, Microchip shows unfavorable trends with significant revenue and earnings declines and a deteriorating net margin. Onto’s stable and expanding profitability contrasts with Microchip’s recent financial setbacks.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Microchip Technology Incorporated (MCHP) and Onto Innovation Inc. (ONTO) based on their most recent fiscal year data.

| Ratios | Microchip Technology Incorporated (MCHP) FY 2025 | Onto Innovation Inc. (ONTO) FY 2024 |

|---|---|---|

| ROE | -0.007% | 10.47% |

| ROIC | -0.027% | 8.77% |

| P/E | -52,021 | 41.76 |

| P/B | 3.67 | 4.37 |

| Current Ratio | 2.59 | 8.69 |

| Quick Ratio | 1.47 | 7.00 |

| D/E (Debt-to-Equity) | 0.80 | 0.008 |

| Debt-to-Assets | 36.85% | 0.72% |

| Interest Coverage | 1.18 | 0 |

| Asset Turnover | 0.29 | 0.47 |

| Fixed Asset Turnover | 3.72 | 7.16 |

| Payout ratio | -1951.4% | 0% |

| Dividend yield | 3.75% | 0% |

Interpretation of the Ratios

Microchip Technology Incorporated

Microchip shows a mixed ratio profile with strengths in liquidity as its current and quick ratios are favorable, but weaknesses in profitability with negative net margin, ROE, and ROIC. Its dividend yield is attractive at 3.75%, indicating shareholder returns, though some caution is warranted due to interest coverage and asset turnover concerns.

Onto Innovation Inc.

Onto Innovation presents solid profitability metrics with a favorable net margin and decent returns, though its valuation ratios like P/E and P/B appear stretched. The company does not pay dividends, aligning with its reinvestment and growth strategy, supported by a strong balance sheet and favorable debt ratios indicating low leverage risk.

Which one has the best ratios?

Comparing both, Onto Innovation offers stronger profitability and balance sheet metrics with neutral overall rating, while Microchip has mixed signals with slightly unfavorable global ratios despite better dividend yield. The choice depends on investor preference for income versus growth potential and risk tolerance.

Strategic Positioning

This section compares the strategic positioning of Microchip Technology Incorporated and Onto Innovation Inc. regarding market position, key segments, and exposure to technological disruption:

Microchip Technology Incorporated

- Large market cap of 40B with significant competitive pressure in semiconductors.

- Focuses on embedded control solutions, microcontrollers, analog and mixed-signal products driving semiconductor sales.

- Exposure to disruption through embedded flash and non-volatile memory licensing and FPGA products.

Onto Innovation Inc.

- Smaller market cap of 10.7B, facing competitive pressure in semiconductor process control tools.

- Concentrates on process control tools, optical metrology, lithography, and related software services.

- Exposure centered on process control software and advanced packaging device manufacturing.

Microchip Technology Incorporated vs Onto Innovation Inc. Positioning

Microchip shows a diversified approach across multiple semiconductor segments, including licensing and manufacturing services. Onto Innovation is more concentrated on process control and metrology solutions. Microchip’s broad product mix contrasts with Onto’s specialized product and software focus.

Which has the best competitive advantage?

Both companies are shedding value with ROIC below WACC, but Onto Innovation shows improving profitability trends, while Microchip has declining ROIC, indicating Onto may have a slightly stronger competitive advantage.

Stock Comparison

The stock price chart highlights contrasting trading dynamics over the past year, with Microchip Technology showing a bearish trend marked by recent acceleration, while Onto Innovation demonstrates a strong bullish momentum and heightened buyer activity.

Trend Analysis

Microchip Technology Incorporated (MCHP) experienced a 10.13% price decline over the past 12 months, indicating a bearish trend with accelerating downward momentum and a price range between 36.22 and 98.23. Recent weeks show a 19.27% rebound with reduced volatility.

Onto Innovation Inc. (ONTO) delivered a 22.07% price increase over the same period, reflecting a bullish trend with accelerating gains and a wide price range from 88.5 to 233.14. Recent performance surged 61.42%, supported by strong buyer dominance.

Comparing both stocks, Onto Innovation outperformed Microchip Technology significantly in the last year, showing the highest market performance with sustained bullish acceleration and stronger buyer volume.

Target Prices

Analysts present a clear bullish consensus for Microchip Technology Incorporated and Onto Innovation Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Microchip Technology Incorporated | 85 | 60 | 77.44 |

| Onto Innovation Inc. | 200 | 160 | 178 |

For Microchip Technology, the consensus target price of 77.44 USD is slightly above the current price of 74.45 USD, indicating moderate upside potential. Onto Innovation shows a consensus target of 178 USD, which is notably below its current price of 217.85 USD, suggesting caution despite recent strong performance.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Microchip Technology Incorporated and Onto Innovation Inc.:

Rating Comparison

Microchip Technology Incorporated Rating

- Rating: C-, rated Very Favorable overall

- Discounted Cash Flow Score: 3, Moderate

- ROE Score: 1, Very Unfavorable

- ROA Score: 1, Very Unfavorable

- Debt To Equity Score: 1, Very Unfavorable

- Overall Score: 1, Very Unfavorable

Onto Innovation Inc. Rating

- Rating: B+, rated Very Favorable overall

- Discounted Cash Flow Score: 3, Moderate

- ROE Score: 3, Moderate

- ROA Score: 4, Favorable

- Debt To Equity Score: 4, Favorable

- Overall Score: 3, Moderate

Which one is the best rated?

Based strictly on the provided data, Onto Innovation Inc. holds a stronger position with a B+ rating and higher scores across ROE, ROA, debt-to-equity, and overall metrics compared to Microchip Technology’s lower scores and C- rating.

Scores Comparison

The following table presents a comparison of the Altman Z-Score and Piotroski Score for Microchip Technology Incorporated and Onto Innovation Inc.:

MCHP Scores

- Altman Z-Score: 4.00, indicating a safe zone and low bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

ONTO Scores

- Altman Z-Score: 34.16, indicating a safe zone and very low bankruptcy risk.

- Piotroski Score: 4, classified as average financial strength.

Which company has the best scores?

Based strictly on the provided data, ONTO has a significantly higher Altman Z-Score and a better Piotroski Score than MCHP. This indicates ONTO is financially stronger and less likely to face bankruptcy risks compared to MCHP.

Grades Comparison

This section compares the latest reliable grades and ratings for Microchip Technology Incorporated and Onto Innovation Inc.:

Microchip Technology Incorporated Grades

Here are the recent grades from reputable financial firms for Microchip Technology Incorporated:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Overweight | 2026-01-15 |

| B. Riley Securities | Maintain | Buy | 2026-01-12 |

| Mizuho | Maintain | Outperform | 2026-01-09 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-07 |

| JP Morgan | Maintain | Overweight | 2026-01-06 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-06 |

| Stifel | Maintain | Buy | 2026-01-06 |

| Rosenblatt | Maintain | Buy | 2026-01-06 |

| Needham | Maintain | Buy | 2026-01-06 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-16 |

Overall, Microchip Technology shows a strong consensus with multiple buy and overweight ratings, indicating positive analyst sentiment across major firms.

Onto Innovation Inc. Grades

The following table presents recent grades issued by recognized financial institutions for Onto Innovation Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Hold | 2026-01-14 |

| Needham | Maintain | Buy | 2026-01-06 |

| Jefferies | Maintain | Buy | 2025-12-15 |

| B. Riley Securities | Maintain | Buy | 2025-11-18 |

| Needham | Maintain | Buy | 2025-11-18 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| Oppenheimer | Maintain | Outperform | 2025-10-14 |

| Stifel | Maintain | Hold | 2025-10-13 |

| B. Riley Securities | Maintain | Buy | 2025-10-10 |

| Jefferies | Upgrade | Buy | 2025-09-23 |

Onto Innovation maintains a consensus leaning towards buy ratings, with some hold ratings tempering the overall outlook but consistent analyst support.

Which company has the best grades?

Microchip Technology Incorporated generally receives stronger and more consistent buy and overweight ratings compared to Onto Innovation Inc., whose grades include several hold recommendations. This difference may influence investors’ perception of risk and growth potential between the two companies.

Strengths and Weaknesses

Below is a comparative table highlighting the key strengths and weaknesses of Microchip Technology Incorporated (MCHP) and Onto Innovation Inc. (ONTO) based on recent financial and operational data.

| Criterion | Microchip Technology Incorporated (MCHP) | Onto Innovation Inc. (ONTO) |

|---|---|---|

| Diversification | Strong focus on semiconductor products with stable licensing revenue; limited product diversification | Broad revenue streams from parts, services, and systems/software segments |

| Profitability | Negative net margin (-0.01%) and declining ROIC; value destroying | Positive net margin (20.43%) and growing ROIC; improving profitability |

| Innovation | Moderate, supported by technology licensing but with declining returns | High, evidenced by significant growth in systems and software revenue |

| Global presence | Large global semiconductor market exposure | Global innovation solutions, but smaller scale than MCHP |

| Market Share | Established player in semiconductor products; revenue fluctuating around $4.3B in 2025 | Growing market share in innovation systems, revenue reaching $900M+ in 2024 |

Key takeaways: MCHP has a solid product base but suffers from declining profitability and value destruction, signaling caution. ONTO shows promising growth and improving profitability, supported by diversified revenue streams and innovation, making it a more attractive growth candidate despite some financial risks.

Risk Analysis

Below is a comparison of key risks for Microchip Technology Incorporated (MCHP) and Onto Innovation Inc. (ONTO) based on the most recent data available for 2025 and 2024 respectively.

| Metric | Microchip Technology Incorporated (MCHP) | Onto Innovation Inc. (ONTO) |

|---|---|---|

| Market Risk | Beta 1.445, moderate volatility | Beta 1.461, moderate volatility |

| Debt level | Debt/Equity 0.8 (neutral), Debt to Assets 36.85% (neutral) | Debt/Equity 0.01 (favorable), Debt to Assets 0.72% (favorable) |

| Regulatory Risk | Moderate, typical for semiconductor industry | Moderate, industry-specific regulations apply |

| Operational Risk | Unfavorable asset turnover (0.29), interest coverage low (1.15) | Favorable interest coverage (infinite), but high current ratio may suggest capital inefficiency |

| Environmental Risk | Standard for tech sector, no major issues reported | Standard for tech sector, no major issues reported |

| Geopolitical Risk | Exposure to Americas, Europe, Asia; supply chain sensitivity | Primarily US-based, less global exposure |

The most impactful risks are operational inefficiencies and financial leverage for Microchip Technology, which shows weak profitability and interest coverage, raising caution. Onto Innovation exhibits very low debt and strong interest coverage, reducing financial risk, but high valuation multiples and capital structure inefficiencies could pose medium-term concerns. Both face typical sector regulatory and geopolitical risks, but Onto’s US-centric exposure slightly lowers geopolitical risk compared to Microchip’s broader footprint.

Which Stock to Choose?

Microchip Technology Incorporated (MCHP) shows a declining income trend with a -42% revenue drop in the last year and unfavorable net margin and profitability ratios. Its debt level is moderate, and despite a strong current ratio, the overall rating is very unfavorable, reflecting value destruction.

Onto Innovation Inc. (ONTO) exhibits robust income growth with a 21% revenue increase last year and consistently favorable profitability metrics. The company maintains very low debt, a strong current ratio, and a moderate overall rating, indicating improving financial health and growing profitability.

Investors seeking growth opportunities might find ONTO’s favorable income evolution and improving profitability appealing, while more risk-tolerant profiles could interpret MCHP’s current challenges as potential turnaround prospects given its stronger liquidity. However, both companies show signs of value destruction when comparing ROIC to WACC, suggesting cautious evaluation.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Microchip Technology Incorporated and Onto Innovation Inc. to enhance your investment decisions: