In today’s rapidly evolving semiconductor industry, Microchip Technology Incorporated (MCHP) and ON Semiconductor Corporation (ON) stand out as key players driving innovation and market growth. Both companies focus on advanced embedded control and power solutions, serving overlapping markets including automotive and industrial sectors. This article will analyze their strategies and financial health to help you decide which stock could be a more compelling addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Microchip Technology Incorporated and ON Semiconductor Corporation by providing an overview of these two companies and their main differences.

Microchip Technology Incorporated Overview

Microchip Technology Incorporated develops, manufactures, and sells smart, connected, and secure embedded control solutions globally. The company offers a wide range of microcontrollers, microprocessors, analog, interface, and memory products tailored for automotive, industrial, computing, communications, and security applications. Headquartered in Chandler, Arizona, Microchip is a significant player in the semiconductor industry with a market cap of approximately 40.2B USD.

ON Semiconductor Corporation Overview

ON Semiconductor Corporation specializes in intelligent sensing and power solutions that support the electrification of automotive and sustainable energy sectors. Its product portfolio includes analog, discrete, and integrated semiconductors, as well as image sensors and power management devices. Based in Scottsdale, Arizona, ON Semiconductor operates through several segments and has a market capitalization near 24.7B USD, focusing on innovation in power and sensing technologies.

Key similarities and differences

Both Microchip and ON Semiconductor operate within the semiconductor industry and provide analog and mixed-signal products. However, Microchip concentrates on embedded control solutions and microcontrollers, while ON Semiconductor emphasizes intelligent power technologies and sensing for automotive electrification and energy sustainability. Despite overlapping in semiconductor manufacturing, their product focus and market segments differ, reflecting diverse strategic priorities and technological specializations.

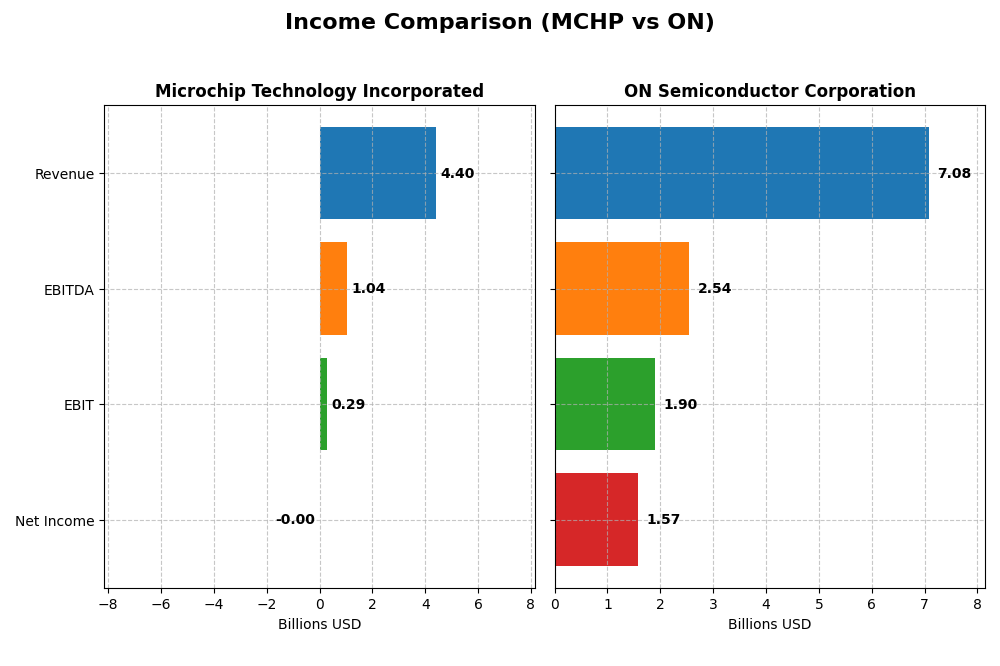

Income Statement Comparison

The table below compares key income statement metrics for Microchip Technology Incorporated and ON Semiconductor Corporation for their most recent fiscal years.

| Metric | Microchip Technology Incorporated | ON Semiconductor Corporation |

|---|---|---|

| Market Cap | 40.2B | 24.7B |

| Revenue | 4.40B | 7.08B |

| EBITDA | 1.04B | 2.54B |

| EBIT | 290M | 1.90B |

| Net Income | -0.5M | 1.57B |

| EPS | -0.005 | 3.68 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Microchip Technology Incorporated

Microchip Technology’s revenue and net income trended downward from 2021 to 2025, with revenue decreasing from 5.44B to 4.40B and net income collapsing into a slight loss in 2025. Gross margins remained relatively favorable at 56.07%, but EBIT and net margins deteriorated significantly, culminating in a net margin near zero. The latest year saw steep declines in revenue (-42%) and profitability, signaling operational challenges.

ON Semiconductor Corporation

ON Semiconductor showed overall revenue growth of 34.77% from 2020 to 2024, albeit a 14% decline in the most recent year. Net income expanded sharply over the period by over 570%, with a solid net margin of 22.21% in 2024. Despite a recent drop in EPS and EBIT, margins stayed favorable, and the company maintained a positive trajectory in profitability and operational efficiency.

Which one has the stronger fundamentals?

ON Semiconductor exhibits stronger fundamentals, evidenced by sustained revenue growth, robust net margins, and significant net income improvements over the period. Microchip Technology’s recent financials are marked by sharp declines and an unfavorable income statement outlook, including a near-zero net margin. ON’s more consistent profitability and margin strength position it more favorably in this comparison.

Financial Ratios Comparison

The table below compares key financial ratios for Microchip Technology Incorporated (MCHP) and ON Semiconductor Corporation (ON) based on their most recent fiscal year data.

| Ratios | Microchip Technology Incorporated (MCHP) | ON Semiconductor Corporation (ON) |

|---|---|---|

| ROE | -0.007% | 17.88% |

| ROIC | -0.027% | 11.88% |

| P/E | -52,021 | 17.13 |

| P/B | 3.67 | 3.06 |

| Current Ratio | 2.59 | 5.06 |

| Quick Ratio | 1.47 | 3.38 |

| D/E (Debt-to-Equity) | 0.80 | 0.38 |

| Debt-to-Assets | 0.37 | 0.24 |

| Interest Coverage | 1.18 | 28.37 |

| Asset Turnover | 0.29 | 0.50 |

| Fixed Asset Turnover | 3.72 | 1.61 |

| Payout ratio | -1951.4% | 0% |

| Dividend yield | 3.75% | 0% |

Interpretation of the Ratios

Microchip Technology Incorporated

Microchip Technology shows a mixed ratio profile with a slightly unfavorable overall view. Key concerns include negative net margin, return on equity, and return on invested capital, indicating profitability challenges. However, liquidity ratios like current (2.59) and quick ratios are favorable, suggesting good short-term financial health. The company offers a 3.75% dividend yield, supported by a manageable payout ratio, but free cash flow coverage appears weak, posing risks for sustainability.

ON Semiconductor Corporation

ON Semiconductor displays a generally favorable ratio set with positive net margin (22.21%), ROE (17.88%), and ROIC (11.88%), reflecting solid profitability. Some ratios like a high current ratio (5.06) are unfavorable, possibly indicating excess liquidity or inefficient asset use. The company does not pay dividends, likely reinvesting earnings into growth and R&D, aligning with its high free cash flow generation and conservative leverage profile.

Which one has the best ratios?

ON Semiconductor holds a slightly favorable overall ratio evaluation, driven by strong profitability and effective capital management, despite some liquidity concerns. Microchip Technology’s ratios are slightly unfavorable, mainly due to negative profitability metrics, despite better liquidity and dividend yield. Therefore, ON Semiconductor currently presents a more robust financial ratio profile based on the latest data.

Strategic Positioning

This section compares the strategic positioning of Microchip Technology Incorporated and ON Semiconductor Corporation, including market position, key segments, and exposure to disruption:

Microchip Technology Incorporated

- Larger market cap of 40B, facing moderate competitive pressure in the semiconductor industry.

- Focuses on embedded control solutions, microcontrollers, analog and mixed-signal products, and technology licensing.

- Exposure through general-purpose microcontrollers and analog products, with less emphasis on disruptive technologies.

ON Semiconductor Corporation

- Smaller market cap of 25B, with competitive pressure in the semiconductor sector.

- Operates in power solutions, intelligent sensing, and analog solutions segments globally.

- Positioned in electrification, intelligent sensing, and power technologies driving automotive and sustainable energy.

Microchip Technology Incorporated vs ON Semiconductor Corporation Positioning

Microchip’s strategy is more concentrated on embedded control and related technologies, while ON Semiconductor pursues a diversified approach across power, sensing, and analog segments. Microchip benefits from a strong licensing business, whereas ON targets growth in automotive electrification and energy sustainability.

Which has the best competitive advantage?

ON Semiconductor shows a slightly favorable moat with growing ROIC, indicating improving profitability and emerging competitive advantage. Microchip demonstrates a very unfavorable moat with declining ROIC, reflecting value destruction and weaker capital efficiency.

Stock Comparison

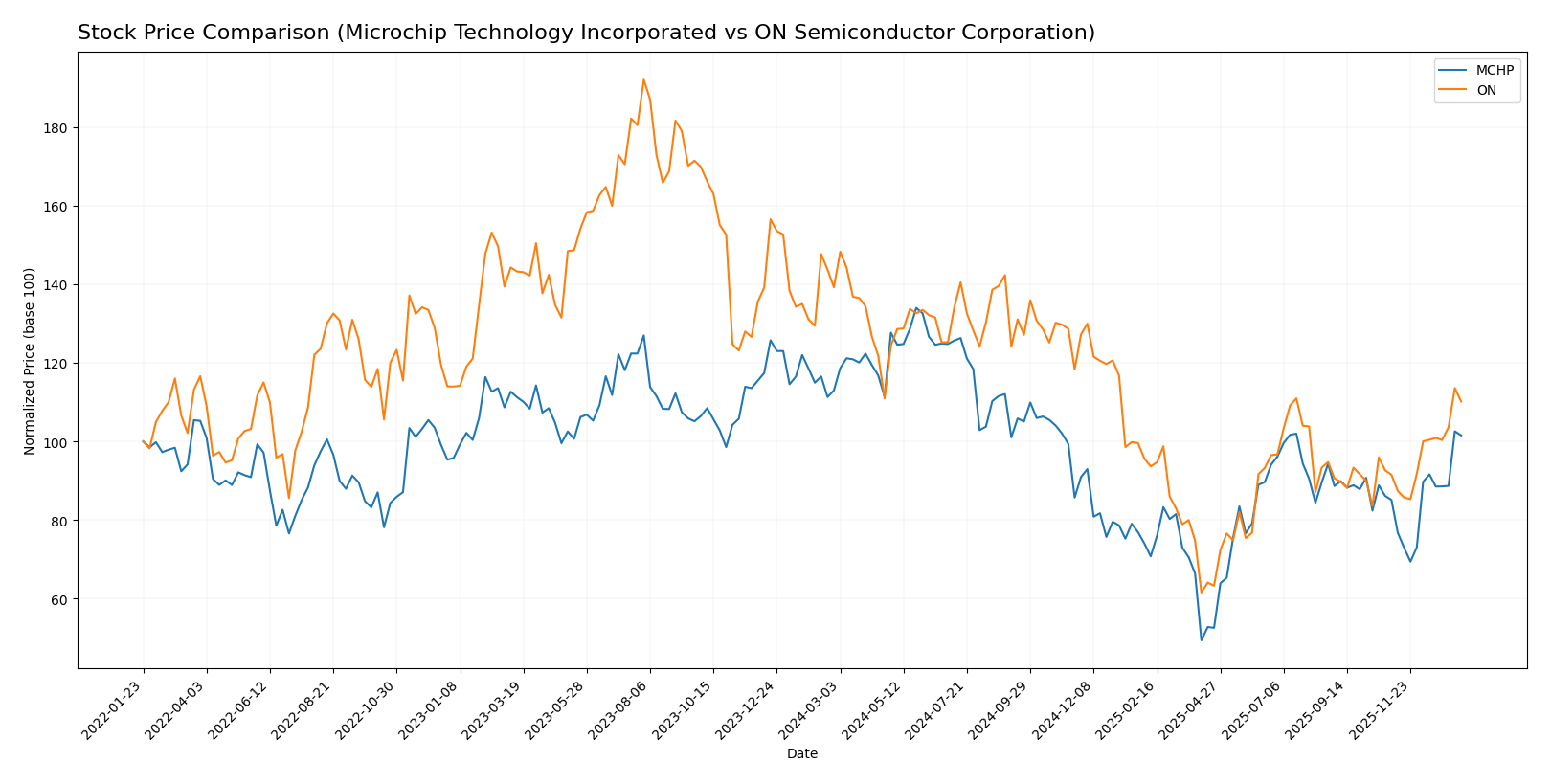

The stock prices of Microchip Technology Incorporated (MCHP) and ON Semiconductor Corporation (ON) have shown significant downward trends over the past 12 months, followed by a recent strong rebound phase in both equities.

Trend Analysis

Microchip Technology Incorporated’s stock experienced a bearish trend over the past year with a price decline of 10.13% and accelerating momentum. The stock showed high volatility, ranging from 36.22 to 98.23, and recently rebounded with a 19.27% gain in the last two and a half months.

ON Semiconductor Corporation’s stock also followed a bearish trend over the past 12 months, declining 20.88% with acceleration and moderate volatility between 33.7 and 81.14. It rebounded recently by 20.37%, showing a slight deceleration relative to Microchip.

Comparing both, ON Semiconductor delivered a larger overall decline but a slightly stronger recent rebound. Microchip’s smaller total loss contrasts with ON’s deeper drop, making ON’s recent market performance marginally more pronounced.

Target Prices

The current consensus target prices for Microchip Technology Incorporated and ON Semiconductor Corporation reflect moderate upside potential based on analyst estimates.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Microchip Technology Incorporated | 85 | 60 | 77.44 |

| ON Semiconductor Corporation | 64 | 51 | 58.33 |

Analysts expect Microchip’s stock to trade above its current price of 74.45 USD, signaling potential gains, while ON Semiconductor’s consensus target is slightly below its current price of 60.28 USD.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Microchip Technology Incorporated (MCHP) and ON Semiconductor Corporation (ON):

Rating Comparison

MCHP Rating

- Rating: C-, evaluated as Very Favorable overall rating status.

- Discounted Cash Flow Score: 3, indicating a Moderate valuation based on future cash flow.

- ROE Score: 1, considered Very Unfavorable for efficient profit generation from equity.

- ROA Score: 1, Very Unfavorable, showing poor asset utilization.

- Debt To Equity Score: 1, Very Unfavorable, indicating higher financial risk due to debt.

- Overall Score: 1, Very Unfavorable summary of financial standing.

ON Rating

- Rating: B-, evaluated as Very Favorable overall rating status.

- Discounted Cash Flow Score: 3, indicating a Moderate valuation based on future cash flow.

- ROE Score: 2, Moderate, showing better profit generation efficiency from equity than MCHP.

- ROA Score: 3, Moderate, indicating better asset utilization compared to MCHP.

- Debt To Equity Score: 2, Moderate, showing a stronger balance sheet and lower financial risk.

- Overall Score: 2, Moderate summary of financial standing.

Which one is the best rated?

ON Semiconductor holds a stronger analyst rating with a B- compared to MCHP’s C-. ON also scores better across ROE, ROA, debt-to-equity, and overall financial standing, reflecting a more favorable evaluation.

Scores Comparison

Here is a comparison of the financial stability and strength scores for Microchip Technology (MCHP) and ON Semiconductor (ON):

MCHP Scores

- Altman Z-Score: 3.999, indicating a safe zone status.

- Piotroski Score: 3, classified as very weak strength.

ON Scores

- Altman Z-Score: 4.838, indicating a safe zone status.

- Piotroski Score: 6, classified as average strength.

Which company has the best scores?

ON Semiconductor holds higher scores in both Altman Z-Score and Piotroski Score compared to Microchip Technology. ON’s scores indicate stronger financial health and lower bankruptcy risk based on the provided data.

Grades Comparison

Here is a comparison of recent grades and recommendations for Microchip Technology Incorporated and ON Semiconductor Corporation:

Microchip Technology Incorporated Grades

The following table summarizes recent grades from major grading companies for Microchip Technology Incorporated:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Overweight | 2026-01-15 |

| B. Riley Securities | Maintain | Buy | 2026-01-12 |

| Mizuho | Maintain | Outperform | 2026-01-09 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-07 |

| JP Morgan | Maintain | Overweight | 2026-01-06 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-06 |

| Stifel | Maintain | Buy | 2026-01-06 |

| Rosenblatt | Maintain | Buy | 2026-01-06 |

| Needham | Maintain | Buy | 2026-01-06 |

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-16 |

Overall, the grades for Microchip Technology show a consistent pattern of buy and overweight recommendations, indicating positive analyst sentiment.

ON Semiconductor Corporation Grades

The following table summarizes recent grades from major grading companies for ON Semiconductor Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Overweight | 2026-01-07 |

| Truist Securities | Maintain | Hold | 2025-12-19 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-24 |

| Truist Securities | Maintain | Hold | 2025-11-04 |

| Baird | Maintain | Neutral | 2025-11-04 |

| Rosenblatt | Maintain | Neutral | 2025-11-04 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

| TD Cowen | Maintain | Buy | 2025-11-04 |

| UBS | Maintain | Neutral | 2025-10-27 |

| B of A Securities | Maintain | Neutral | 2025-09-05 |

The grades for ON Semiconductor reflect a mixed consensus with several hold and neutral ratings alongside some buy and overweight recommendations.

Which company has the best grades?

Microchip Technology Incorporated has received more favorable grades, predominantly buy and overweight, compared to ON Semiconductor Corporation’s more mixed ratings. This could suggest stronger analyst confidence in Microchip’s outlook, potentially influencing investor sentiment toward a more positive risk-reward profile for that company.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Microchip Technology Incorporated (MCHP) and ON Semiconductor Corporation (ON) based on recent financial and strategic data.

| Criterion | Microchip Technology Incorporated (MCHP) | ON Semiconductor Corporation (ON) |

|---|---|---|

| Diversification | Primarily focused on semiconductor products with a modest technology licensing segment; moderate product concentration risks. | Diversified across three main segments: Power Solutions, Analog Solutions, and Intelligent Sensing, reducing dependency on a single market. |

| Profitability | Negative net margin (-0.01%) and ROIC (-3%) indicating value destruction; declining profitability trend. | Strong profitability with net margin 22.21%, ROIC 11.88%, and growing profitability trend. |

| Innovation | Limited recent innovation impact; declining ROIC suggests challenges in sustaining competitive advantage. | Positive innovation evident in expanding Intelligent Sensing and Analog segments; improving ROIC trend supports growing competitive edge. |

| Global presence | Global semiconductor market presence but limited data on geographic diversification. | Strong global footprint, supported by diverse product groups serving multiple industries worldwide. |

| Market Share | Revenue from semiconductor products dropped from $8.3B in 2023 to $4.3B in 2025, indicating shrinking market share or sales contraction. | Revenue growing steadily, with $7.1B in 2024 across segments, reflecting solid or increasing market share. |

Key takeaways: ON Semiconductor demonstrates stronger financial health, diversification, and growth in profitability, making it a more compelling option. Microchip Technology is currently facing declining returns and profitability, signaling higher risk. Investors should weigh these factors carefully when considering exposure to these companies.

Risk Analysis

Below is a comparative table summarizing key risk factors for Microchip Technology Incorporated (MCHP) and ON Semiconductor Corporation (ON) based on the latest available data:

| Metric | Microchip Technology Incorporated (MCHP) | ON Semiconductor Corporation (ON) |

|---|---|---|

| Market Risk | Beta 1.445 indicates moderate volatility | Beta 1.543 indicates higher volatility |

| Debt level | Debt-to-equity 0.8 (neutral), interest coverage 1.15 (unfavorable) | Debt-to-equity 0.38 (favorable), interest coverage 30.49 (favorable) |

| Regulatory Risk | Moderate, typical for semiconductor industry | Moderate, with exposure to automotive and energy regulations |

| Operational Risk | Slightly unfavorable net margin and ROE, low asset turnover | Favorable net margin and ROE, stronger operational efficiency |

| Environmental Risk | Standard semiconductor manufacturing risks | Focus on sustainable energy solutions, but exposed to industrial regulations |

| Geopolitical Risk | Global supply chain exposure, primarily US-based | Global operations with some sensitivity to trade policies |

Microchip shows higher financial stress with weaker profitability and interest coverage, increasing operational and debt risks. ON Semiconductor benefits from stronger profitability, lower leverage, and better interest coverage but faces higher market volatility. Investors should weigh ON’s operational strength against Microchip’s financial caution.

Which Stock to Choose?

Microchip Technology Incorporated (MCHP) shows a declining income trend with a negative net margin and reduced profitability over 2021-2025. Its financial ratios are slightly unfavorable, reflecting weak returns and mixed liquidity. Debt levels are moderate, but the rating is very unfavorable despite a safe Altman Z-Score.

ON Semiconductor Corporation (ON) displays a generally favorable income evolution with positive net margins and improving profitability from 2020-2024. Its financial ratios are slightly favorable, supported by strong returns and solid liquidity. Debt metrics are low, and the company holds a very favorable rating with a safe Altman Z-Score and average Piotroski score.

Considering ratings and financial evaluations, ON may appear more attractive for investors seeking improving profitability and stronger financial health, while MCHP might be interpreted as riskier due to declining income and value destruction. Growth-oriented investors could lean toward ON, whereas risk-averse profiles might prefer to await clearer signals from MCHP.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Microchip Technology Incorporated and ON Semiconductor Corporation to enhance your investment decisions: