In the fast-evolving semiconductor industry, Microchip Technology Incorporated (MCHP) and CEVA, Inc. (CEVA) stand out for their innovation and market presence. Both companies operate in overlapping sectors, focusing on embedded control solutions, wireless connectivity, and AI-driven technologies. While Microchip offers a broad product portfolio, CEVA specializes in licensing advanced digital signal processors. This article will help you decide which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Microchip Technology Incorporated and CEVA, Inc. by providing an overview of these two companies and their main differences.

Microchip Technology Incorporated Overview

Microchip Technology Incorporated develops, manufactures, and sells embedded control solutions globally, focusing on microcontrollers, microprocessors, and analog products. The company serves diverse industries such as automotive, industrial, and communications, providing both hardware and software development tools. With a market cap of approximately 35B USD, Microchip is a significant player in the semiconductor sector, headquartered in Chandler, Arizona.

CEVA, Inc. Overview

CEVA, Inc. operates as a licensor of wireless connectivity and smart sensing technologies, offering digital signal processors, AI processors, and software platforms. Its licensing model targets semiconductor and OEM companies in markets like mobile, IoT, and automotive. With a market cap near 540M USD and a workforce of around 400 employees, CEVA is a specialized technology provider based in Rockville, Maryland.

Key similarities and differences

Both companies operate in the semiconductor industry and have a presence in wireless and embedded technologies. Microchip focuses on manufacturing physical products and providing development tools, while CEVA emphasizes licensing intellectual property in DSP and AI processors. Microchip’s business model is product and service-driven with a broad market scope, whereas CEVA’s model relies on technology licensing to semiconductor and OEM partners, reflecting different approaches to market engagement.

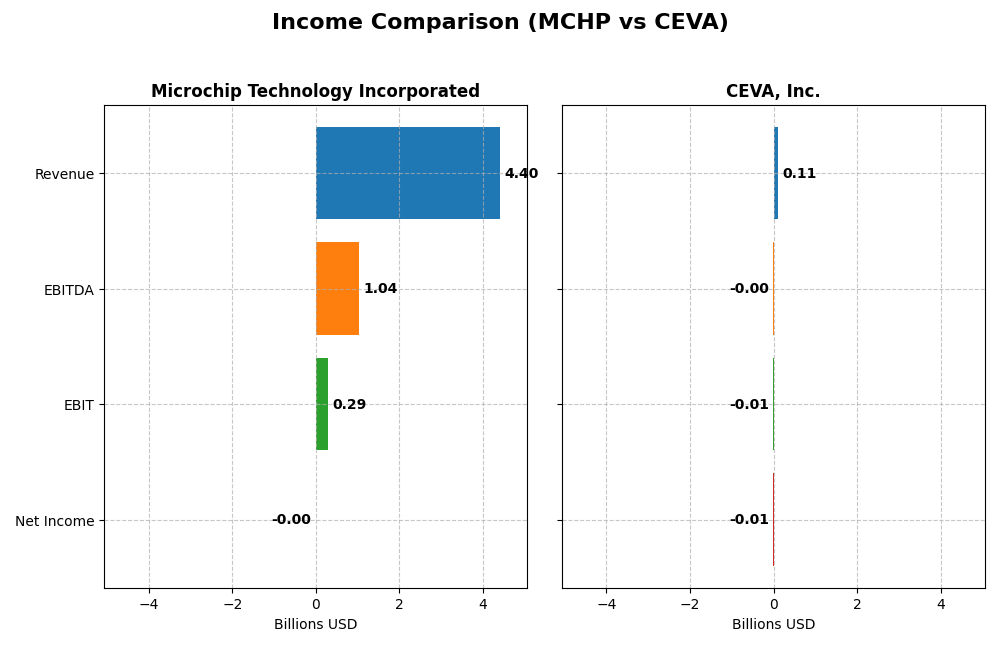

Income Statement Comparison

This table presents the latest available fiscal year income statement figures for Microchip Technology Incorporated and CEVA, Inc., facilitating a direct financial comparison.

| Metric | Microchip Technology Incorporated | CEVA, Inc. |

|---|---|---|

| Market Cap | 35B | 538M |

| Revenue | 4.4B | 107M |

| EBITDA | 1.04B | -3.4M |

| EBIT | 290M | -7.5M |

| Net Income | -0.5M | -8.8M |

| EPS | -0.005 | -0.37 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Microchip Technology Incorporated

Microchip Technology showed a declining trend in revenue and net income from 2021 to 2025, with revenue falling from 5.44B in 2021 to 4.40B in 2025 and net income turning negative in 2025 after consistent profits. Gross margin remained favorable at 56.07%, but net margin dropped sharply to -0.01% in 2025, reflecting significant margin deterioration and a severe earnings decline in the latest fiscal year.

CEVA, Inc.

CEVA’s revenue grew modestly from 100.3M in 2020 to 106.9M in 2024, with net income fluctuating and remaining negative overall. The company maintained a strong gross margin of 88.06%, although operating and net margins were negative in 2024 at -7.06% and -8.22%, respectively. The latest year showed improved profitability trends including favorable growth in revenue, EBIT, and EPS margins.

Which one has the stronger fundamentals?

CEVA presents stronger fundamentals in terms of recent margin improvements, positive revenue growth, and a favorable overall income statement evaluation. Conversely, Microchip Technology’s fundamentals weakened considerably, with declining revenue, negative net income, and unfavorable margin trends dominating its financial profile, indicating greater challenges over the period analyzed.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Microchip Technology Incorporated and CEVA, Inc. for the most recent fiscal year available, providing a clear snapshot of their financial health and performance.

| Ratios | Microchip Technology Incorporated (2025) | CEVA, Inc. (2024) |

|---|---|---|

| ROE | -0.007% | -3.30% |

| ROIC | -0.03% | -8.56% |

| P/E | -52021 | -84.79 |

| P/B | 3.67 | 2.79 |

| Current Ratio | 2.59 | 7.09 |

| Quick Ratio | 1.47 | 7.09 |

| D/E (Debt-to-Equity) | 0.80 | 0.021 |

| Debt-to-Assets | 37% | 1.79% |

| Interest Coverage | 1.18 | 0 |

| Asset Turnover | 0.29 | 0.34 |

| Fixed Asset Turnover | 3.72 | 8.43 |

| Payout ratio | -1951.4% | 0% |

| Dividend yield | 3.75% | 0% |

Interpretation of the Ratios

Microchip Technology Incorporated

Microchip Technology shows a mixed ratio profile with slightly unfavorable overall metrics. Key concerns include negative net margin, return on equity, and return on invested capital, alongside weak interest coverage and asset turnover ratios. However, liquidity ratios such as current and quick ratios are favorable. The company pays dividends with a solid 3.75% yield, supported by manageable payout risks.

CEVA, Inc.

CEVA’s ratios reflect several unfavorable aspects, including a steep negative net margin, return on equity, and return on invested capital, compounded by a high weighted average cost of capital and zero dividend yield. It maintains a strong quick ratio and low leverage, but weak interest coverage and asset turnover. CEVA does not pay dividends, likely reflecting its loss-making status and focus on reinvestment.

Which one has the best ratios?

Between the two, Microchip Technology presents a slightly better ratio profile than CEVA, with more favorable liquidity and dividend yield metrics despite some profitability weaknesses. CEVA faces more pronounced unfavorable ratios, especially in profitability and cost of capital, alongside the absence of shareholder returns through dividends.

Strategic Positioning

This section compares the strategic positioning of Microchip Technology Incorporated and CEVA, Inc. including market position, key segments, and exposure to technological disruption:

Microchip Technology Incorporated

- Large market cap of 35B with established NASDAQ presence; faces competitive pressure in semiconductors sector.

- Diverse product portfolio including microcontrollers, analog, memory, FPGA, and licensing segments driving revenue.

- Exposure to technological disruption through embedded control solutions, but benefits from broad application base.

CEVA, Inc.

- Smaller market cap near 540M, focused on licensing in wireless and smart sensing technologies.

- Concentrated on licensing digital signal processors and AI technologies for mobile, IoT, and automotive sectors.

- Faces disruption risk in wireless and AI IP licensing but leverages advanced DSP and AI processor platforms.

Microchip Technology Incorporated vs CEVA, Inc. Positioning

Microchip adopts a diversified product strategy across semiconductors and licensing, offering broad application coverage. CEVA focuses on licensing wireless connectivity and AI processors, concentrating on IP development. Microchip’s scale provides stability; CEVA’s niche approach targets specialized markets.

Which has the best competitive advantage?

Both companies show very unfavorable MOAT evaluations with declining ROIC below WACC, indicating value destruction and weakening profitability. Neither currently demonstrates a sustainable competitive advantage based on their capital efficiency.

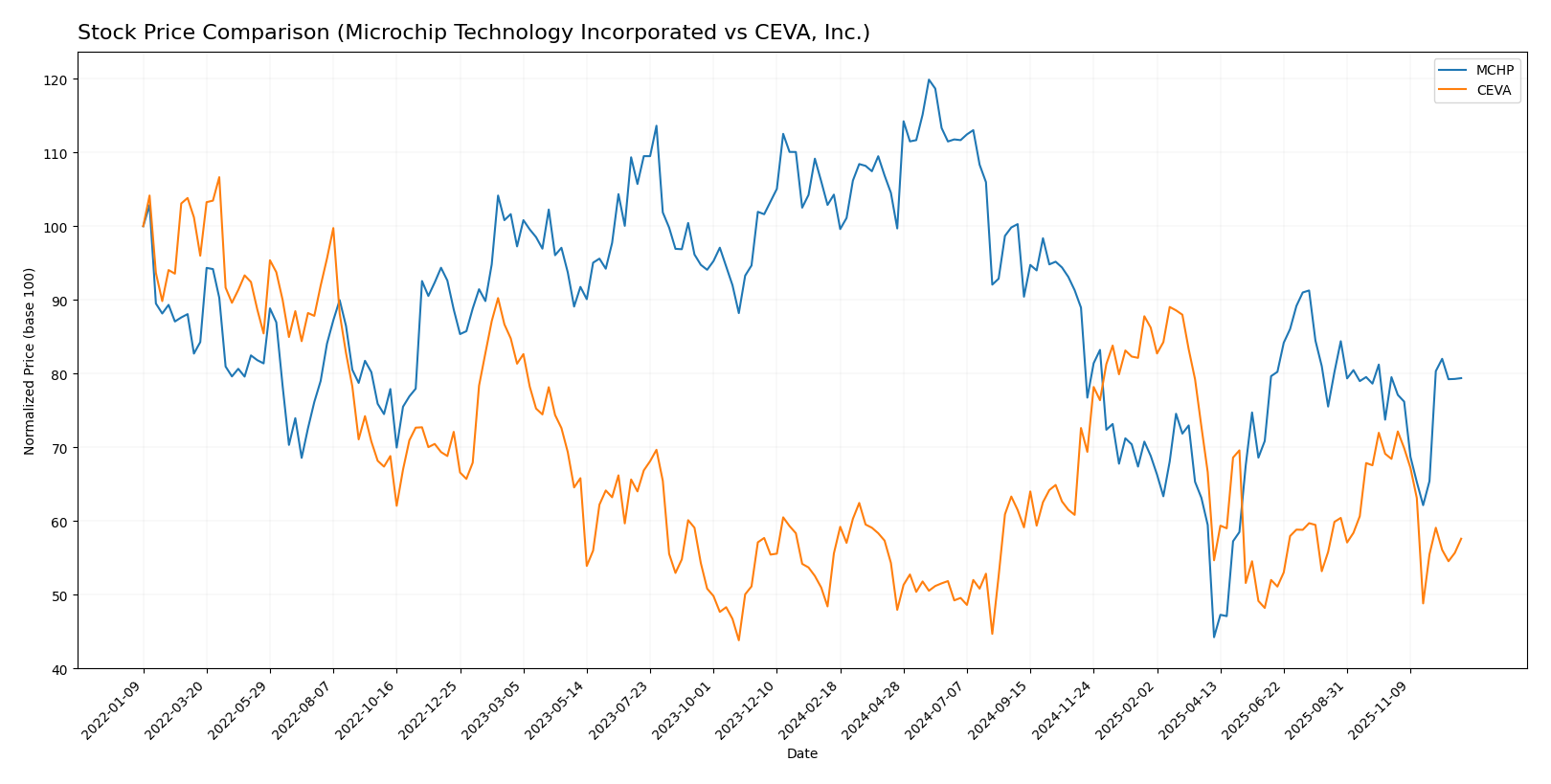

Stock Comparison

The stock price movements over the past year reveal distinct dynamics, with Microchip Technology Incorporated experiencing a significant bearish trend marked by high volatility, while CEVA, Inc. shows a modest bullish trend with decelerating momentum.

Trend Analysis

Microchip Technology Incorporated’s stock declined by 23.89% over the past 12 months, reflecting a bearish trend with accelerating downward momentum and high volatility, with prices ranging from 98.23 to 36.22.

CEVA, Inc. recorded a 3.6% gain over the same period, indicating a bullish trend with decelerating momentum and lower volatility, with prices fluctuating between 34.67 and 17.39.

Comparing the two, CEVA, Inc. delivered the highest market performance with a positive return, whereas Microchip Technology Incorporated faced a steep decline during the analyzed timeframe.

Target Prices

The current analyst consensus presents optimistic target prices for both Microchip Technology Incorporated and CEVA, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Microchip Technology Incorporated | 85 | 60 | 73.83 |

| CEVA, Inc. | 28 | 28 | 28 |

Analysts expect Microchip Technology’s stock to rise moderately above its current price of 65.03 USD, with a consensus near 74 USD. CEVA’s target price of 28 USD suggests upside potential from the current 22.42 USD, indicating positive sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Microchip Technology Incorporated and CEVA, Inc.:

Rating Comparison

Microchip Technology Incorporated Rating

- Rating: C-, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate score of 3.

- ROE Score: Very unfavorable score of 1.

- ROA Score: Very unfavorable score of 1.

- Debt To Equity Score: Very unfavorable score of 1.

- Overall Score: Very unfavorable score of 1.

CEVA, Inc. Rating

- Rating: C+, also considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate score of 3.

- ROE Score: Very unfavorable score of 1.

- ROA Score: Very unfavorable score of 1.

- Debt To Equity Score: Favorable score of 4.

- Overall Score: Moderate score of 2.

Which one is the best rated?

Based strictly on the provided data, CEVA holds a better overall rating and score compared to Microchip Technology. CEVA’s debt-to-equity score is notably stronger, contributing to its higher overall assessment.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Microchip Technology Incorporated and CEVA, Inc.:

MCHP Scores

- Altman Z-Score: 3.60, indicating a safe zone status.

- Piotroski Score: 3, classified as very weak financial strength.

CEVA Scores

- Altman Z-Score: 11.52, indicating a safe zone status.

- Piotroski Score: 4, classified as average financial strength.

Which company has the best scores?

CEVA shows higher scores in both Altman Z-Score and Piotroski Score compared to MCHP, indicating relatively stronger financial stability and health based on the provided data.

Grades Comparison

Here is a comparison of the latest grades assigned to Microchip Technology Incorporated and CEVA, Inc.:

Microchip Technology Incorporated Grades

The table below summarizes recent grades from reliable grading firms for Microchip Technology Incorporated.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-16 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

| Needham | Maintain | Buy | 2025-12-04 |

| Rosenblatt | Maintain | Buy | 2025-12-03 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

| Citigroup | Maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-11-07 |

| Stifel | Maintain | Buy | 2025-11-07 |

| Truist Securities | Maintain | Hold | 2025-11-07 |

| Needham | Maintain | Buy | 2025-11-07 |

Microchip’s grades show a generally positive trend, with multiple buy ratings and a recent upgrade to overweight, indicating confidence among several analysts.

CEVA, Inc. Grades

The following table presents recent grades from recognized grading firms for CEVA, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2025-11-12 |

| Rosenblatt | Maintain | Buy | 2025-11-11 |

| Rosenblatt | Maintain | Buy | 2025-08-14 |

| Oppenheimer | Maintain | Outperform | 2025-05-09 |

| Rosenblatt | Maintain | Buy | 2025-05-08 |

| Barclays | Maintain | Overweight | 2025-05-08 |

| Rosenblatt | Maintain | Buy | 2025-04-23 |

| Barclays | Maintain | Overweight | 2025-02-14 |

| Rosenblatt | Maintain | Buy | 2025-02-14 |

| Rosenblatt | Maintain | Buy | 2025-02-11 |

CEVA’s grades consistently reflect strong buy and overweight ratings, with no downgrades, highlighting stable positive sentiment.

Which company has the best grades?

Both Microchip Technology Incorporated and CEVA, Inc. have predominantly positive grades, but CEVA shows a more consistent pattern of buy and overweight ratings, while Microchip has a mix including neutral and hold ratings. This suggests CEVA may be viewed with slightly higher confidence by analysts, potentially influencing investor perception of growth prospects and risk.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Microchip Technology Incorporated (MCHP) and CEVA, Inc. based on their most recent financial and operational data.

| Criterion | Microchip Technology Incorporated (MCHP) | CEVA, Inc. |

|---|---|---|

| Diversification | Strong product diversification with major revenue from semiconductor products and technology licensing totaling over 4.3B in 2025 | More concentrated revenue streams with licensing and royalties around 107M in 2024, narrower product range |

| Profitability | Declining profitability with negative net margin (-0.01%) and ROIC (-3%), indicating value destruction | Worse profitability metrics with net margin at -8.22% and ROIC at -8.56%, signaling significant value loss |

| Innovation | Investment in technology licensing shows moderate innovation efforts; however, declining ROIC trend suggests challenges | Focus on licensing and royalties with some growth in smart sensing and connectivity, but overall declining ROIC |

| Global presence | Established global footprint in semiconductor markets supporting large-scale operations | Smaller scale with niche technology licensing, less global diversification |

| Market Share | Large market share in semiconductor products segment generating multi-billion-dollar revenues | Smaller market share focused on licensing and royalties, with total revenues below 200M |

Key takeaways: Both companies face declining profitability and value destruction risks, but Microchip benefits from greater diversification and larger market footprint. CEVA’s narrower focus and weaker financials suggest higher investment risk. Careful risk management is advised before investing.

Risk Analysis

Below is a comparative risk assessment table for Microchip Technology Incorporated (MCHP) and CEVA, Inc. based on the most recent fiscal data and market conditions:

| Metric | Microchip Technology Incorporated (MCHP) | CEVA, Inc. |

|---|---|---|

| Market Risk | Beta 1.463: Above market volatility | Beta 1.466: Similar volatility |

| Debt Level | Debt/Equity 0.8 (neutral risk) | Debt/Equity 0.02 (low risk) |

| Regulatory Risk | Moderate, semiconductor industry scrutiny | Moderate, IP licensing regulations |

| Operational Risk | Unfavorable net margin and ROE (-1%) | Unfavorable net margin (-8.22%) |

| Environmental Risk | Moderate, manufacturing footprint | Lower, software-focused business |

| Geopolitical Risk | Exposure to Americas, Europe, Asia | Global licensing, less direct exposure |

The most likely and impactful risks are operational and market risks for both companies. Microchip faces pressure from weak profitability and moderate debt levels amid semiconductor cyclical challenges. CEVA’s profitability struggles are more severe, though it benefits from minimal debt and software licensing business model, reducing capital risk. Investors should monitor profitability trends and geopolitical tensions affecting semiconductor supply chains.

Which Stock to Choose?

Microchip Technology Incorporated (MCHP) has shown a declining income with unfavorable net margin and profitability ratios, and a very unfavorable ROIC compared to WACC, indicating value destruction. Its financial ratios are mixed, with a slightly unfavorable global opinion, moderate debt levels, and a very favorable rating despite weaknesses in key profitability scores.

CEVA, Inc. displays a favorable income growth trend with a high gross margin but negative net margin and profitability ratios. The company’s financial ratios are overall unfavorable with some strengths in liquidity and low debt. Its ROIC compared to WACC is also very unfavorable, signaling value destruction, though it holds a very favorable rating with moderate overall scores.

Investors focused on growth might find CEVA’s improving income statement and favorable rating more appealing, while those prioritizing stability and balance sheet strength could see MCHP’s safer financial zone and dividend yield as more suitable. Both companies exhibit signs of value destruction, suggesting cautious interpretation of their financial health.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Microchip Technology Incorporated and CEVA, Inc. to enhance your investment decisions: