Microchip Technology Incorporated (MCHP) and Arm Holdings plc (ARM) are two leading players in the semiconductor industry, each driving innovation in microcontrollers and processor architectures. While Microchip focuses on embedded control solutions across diverse applications, Arm specializes in CPU designs and licensing for a vast range of devices. This comparison explores their market positions and innovation strategies to help you identify the most promising investment opportunity. Let’s uncover which company stands out for your portfolio.

Table of contents

Companies Overview

I will begin the comparison between Microchip Technology Incorporated and Arm Holdings plc American Depositary Shares by providing an overview of these two companies and their main differences.

Microchip Technology Incorporated Overview

Microchip Technology Incorporated develops, manufactures, and sells embedded control solutions globally, focusing on microcontrollers, microprocessors, and analog products. The company serves automotive, industrial, computing, and communications sectors with a wide range of semiconductor components and development tools. Headquartered in Chandler, Arizona, Microchip emphasizes secure, connected, and programmable technologies.

Arm Holdings plc American Depositary Shares Overview

Arm Holdings plc designs and licenses CPU products and related semiconductor technologies used by manufacturers worldwide. Its offerings include microprocessors, graphics units, and software tools applied across automotive, computing, consumer electronics, and IoT markets. Based in Cambridge, UK, Arm operates as a subsidiary of Kronos II LLC, providing intellectual property rather than manufacturing physical chips.

Key similarities and differences

Both companies operate in the semiconductor industry, addressing diverse technology markets including automotive and computing. Microchip focuses on manufacturing embedded controllers and analog components, while Arm specializes in CPU architecture and IP licensing without direct manufacturing. This fundamental difference defines their business models: product manufacturing versus technology licensing and design.

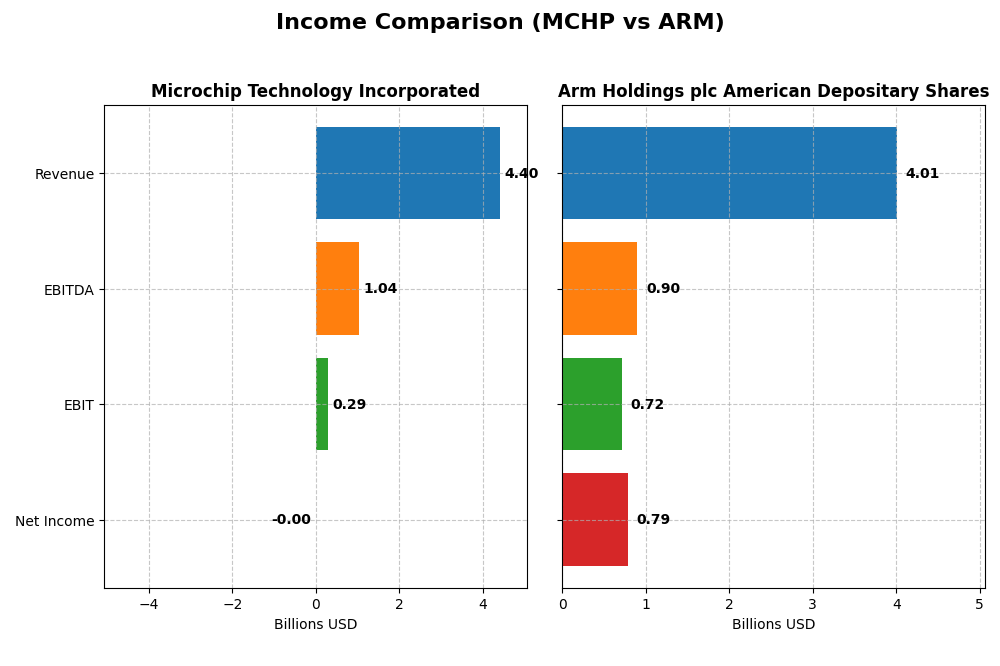

Income Statement Comparison

The table below compares the most recent fiscal year income statement metrics for Microchip Technology Incorporated and Arm Holdings plc American Depositary Shares, highlighting key financial performance figures.

| Metric | Microchip Technology Incorporated | Arm Holdings plc American Depositary Shares |

|---|---|---|

| Market Cap | 35.0B | 121.2B |

| Revenue | 4.40B | 4.01B |

| EBITDA | 1.04B | 903M |

| EBIT | 290M | 720M |

| Net Income | -0.5M | 792M |

| EPS | -0.005 | 0.75 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Microchip Technology Incorporated

Microchip Technology’s revenue declined notably by 42.35% in the most recent year, continuing an overall downward trend since 2021. Net income shifted from a strong positive to a slight net loss, reflecting deteriorating profitability. Gross margin remained relatively stable at 56.07%, but net margin turned unfavorable at -0.01%, signaling margin compression and a challenging fiscal 2025.

Arm Holdings plc American Depositary Shares

Arm Holdings experienced robust revenue growth of 23.94% in 2025, part of a near doubling over the five-year period. Net income and margins improved significantly, with a net margin of 19.77% and EBIT margin of 17.97%, both favorable. The consistent increase in profitability and strong operational leverage marked fiscal 2025 as a year of solid fundamental expansion.

Which one has the stronger fundamentals?

Arm Holdings demonstrates stronger fundamentals with consistent revenue and net income growth, alongside favorable margin expansion and zero interest expense. Microchip Technology’s recent financials reveal a significant decline in revenue and net income, coupled with unfavorable net margins. Overall, Arm’s income statement presents a more favorable and stable performance compared to Microchip’s recent challenges.

Financial Ratios Comparison

The following table presents a side-by-side comparison of key financial ratios for Microchip Technology Incorporated (MCHP) and Arm Holdings plc American Depositary Shares (ARM) based on their most recent fiscal year data ending March 31, 2025.

| Ratios | Microchip Technology Incorporated (MCHP) | Arm Holdings plc ADS (ARM) |

|---|---|---|

| ROE | -0.007% | 11.58% |

| ROIC | -0.03% | 10.28% |

| P/E | -52,021 | 141.58 |

| P/B | 3.67 | 16.40 |

| Current Ratio | 2.59 | 5.20 |

| Quick Ratio | 1.47 | 5.20 |

| D/E (Debt-to-Equity) | 0.80 | 0.05 |

| Debt-to-Assets | 36.85% | 3.99% |

| Interest Coverage | 1.18 | 0 |

| Asset Turnover | 0.29 | 0.45 |

| Fixed Asset Turnover | 3.72 | 5.61 |

| Payout Ratio | -1951.4% | 0 |

| Dividend Yield | 3.75% | 0% |

Interpretation of the Ratios

Microchip Technology Incorporated

Microchip shows a mixed ratio profile with strengths in liquidity, evidenced by a current ratio of 2.59 and a quick ratio of 1.47, both favorable. However, profitability metrics like net margin, ROE, and ROIC are slightly unfavorable, indicating operational challenges. Debt metrics are neutral, but interest coverage is weak. The company pays dividends with a 3.75% yield, suggesting steady shareholder returns, though coverage and sustainability should be monitored.

Arm Holdings plc American Depositary Shares

Arm’s ratios reflect strong liquidity and low leverage, with a quick ratio of 5.2 and debt-to-assets at 3.99%, both favorable. Profitability is mixed: net margin is favorable, but ROIC and WACC are unfavorable, alongside high valuation multiples (PE and PB). Arm does not pay dividends, likely focusing on reinvestment and growth, supported by robust R&D expenditure and positive free cash flow to equity.

Which one has the best ratios?

Both Microchip and Arm have slightly unfavorable overall ratio assessments. Microchip’s liquidity and dividend yield provide some stability, while Arm excels in leverage and cash flow but struggles with valuation and some profitability metrics. The choice depends on investor preference for dividend income versus growth potential, as neither company stands out decisively across all ratio categories.

Strategic Positioning

This section compares the strategic positioning of Microchip Technology Incorporated and Arm Holdings plc across market position, key segments, and exposure to technological disruption:

Microchip Technology Incorporated

- Positioned in semiconductors with competitive pressure from diverse markets globally.

- Focuses on embedded control solutions and semiconductor products driving revenue growth.

- Faces disruption risks in embedded systems but maintains legacy product diversification.

Arm Holdings plc American Depositary Shares

- Dominates semiconductor IP licensing amid high industry volatility and competition.

- Specializes in CPU architecture, IP licensing, and royalties across multiple tech sectors.

- Exposed to rapid innovation cycles in microprocessor design and IP licensing models.

Microchip Technology Incorporated vs Arm Holdings plc Positioning

Microchip adopts a diversified product portfolio in embedded controls and semiconductors, while Arm concentrates on IP licensing and CPU design. Microchip’s broad segments offer resilience, whereas Arm’s focused licensing model leverages recurring royalty income but depends on external manufacturers.

Which has the best competitive advantage?

Both companies currently shed value with ROIC below WACC; however, Microchip shows declining profitability, whereas Arm’s profitability is stable but unfavorable, implying neither has a clear moat advantage based on recent ROIC trends.

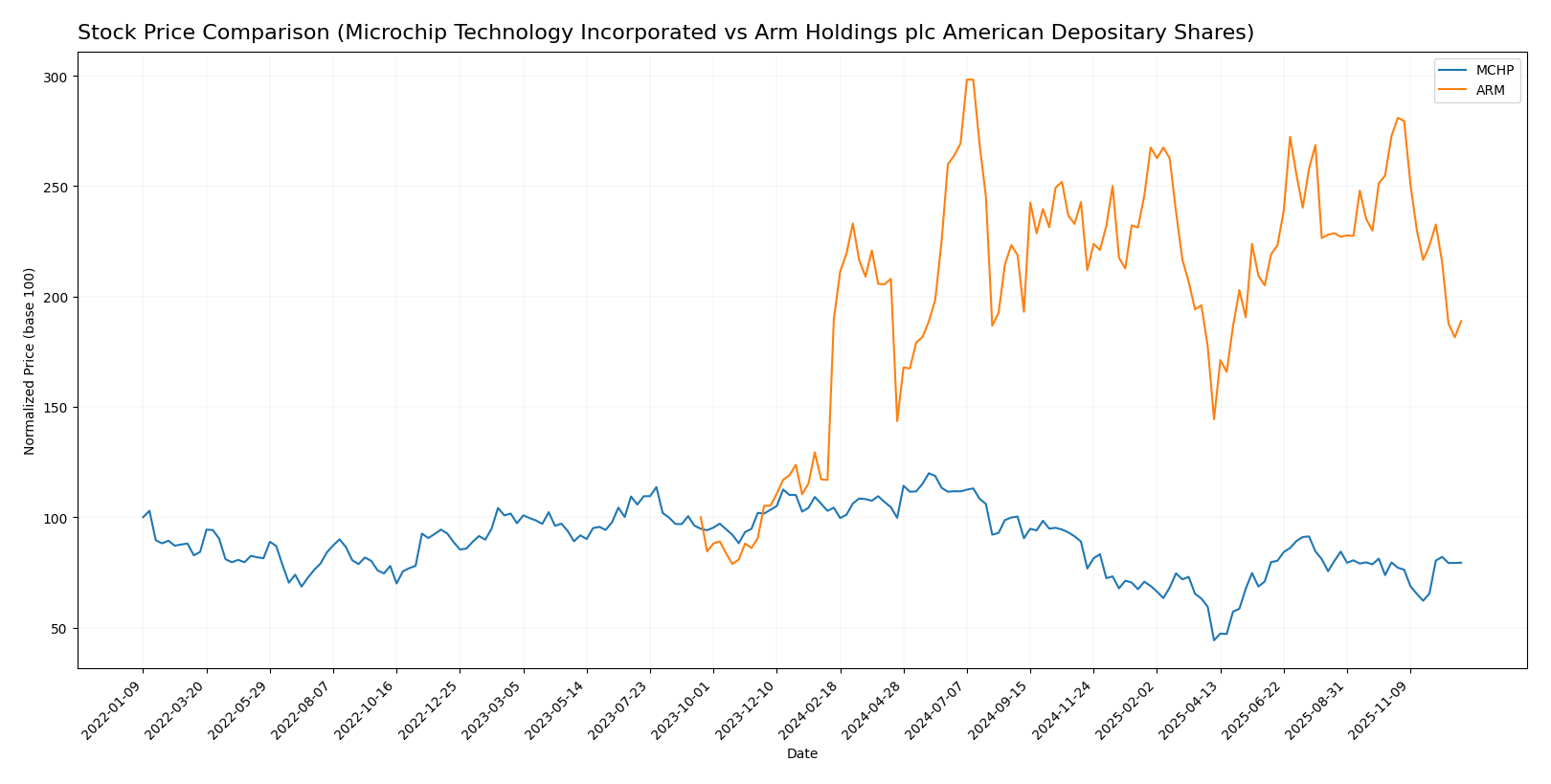

Stock Comparison

The stock price chart over the past 12 months reveals contrasting dynamics: Microchip Technology Incorporated experienced a marked decline with accelerating bearish momentum, while Arm Holdings plc showed a modest overall drop with recent sharp sell-offs and decelerating trend.

Trend Analysis

Microchip Technology Incorporated’s stock showed a bearish trend over the past 12 months with a price decline of -23.89%, an accelerating downtrend, and a high volatility level (14.5 std deviation). Recent weeks indicate a near-neutral short-term trend.

Arm Holdings plc’s stock also trended bearish overall with a slight price drop of -0.42% and decelerating momentum. However, recent performance sharply worsened, falling -30.72% amid high volatility (20.44 std deviation).

Comparing both, Microchip Technology posted the largest cumulative loss over the year, while Arm Holdings’ recent steep decline has intensified its underperformance, with Arm showing the lower market performance in the recent period.

Target Prices

The current analyst consensus presents optimistic target prices for Microchip Technology Incorporated and Arm Holdings plc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Microchip Technology Incorporated | 85 | 60 | 73.83 |

| Arm Holdings plc American Depositary Shares | 210 | 120 | 173.33 |

Analysts expect Microchip’s stock to appreciate moderately above its current price of $65.03, while Arm Holdings shows a higher upside potential compared to its current $114.73 price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Microchip Technology Incorporated and Arm Holdings plc American Depositary Shares:

Rating Comparison

MCHP Rating

- Rating: C- indicating a very favorable evaluation in general rating status.

- Discounted Cash Flow Score: 3 showing a moderate outlook on future cash flows.

- ROE Score: 1 indicating very unfavorable efficiency in generating equity profit.

- ROA Score: 1 suggesting very unfavorable asset utilization.

- Debt To Equity Score: 1 reflecting very unfavorable financial risk.

- Overall Score: 1 marking a very unfavorable comprehensive rating.

ARM Rating

- Rating: B- with a very favorable overall rating status.

- Discounted Cash Flow Score: 2 reflecting a moderate valuation based on DCF.

- ROE Score: 3 representing a moderate ability to generate profit from equity.

- ROA Score: 4 showing favorable effectiveness in asset utilization.

- Debt To Equity Score: 4 indicating favorable balance sheet strength.

- Overall Score: 3 representing a moderate overall financial standing.

Which one is the best rated?

Arm Holdings plc is better rated overall with a B- rating and higher scores in ROE, ROA, debt-to-equity, and overall score, while Microchip Technology holds lower marks across these key metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

MCHP Scores

- Altman Z-Score: 3.6, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

ARM Scores

- Altman Z-Score: 32.4, well within the safe zone, very low bankruptcy risk.

- Piotroski Score: 7, indicating strong financial health.

Which company has the best scores?

ARM has a significantly higher Altman Z-Score and a stronger Piotroski Score compared to MCHP. Therefore, ARM demonstrates better financial stability and health based on the provided scores.

Grades Comparison

The following is a comparison of the latest reliable grades from recognized financial institutions for both companies:

Microchip Technology Incorporated Grades

This table presents recent grades assigned by reputable grading companies for Microchip Technology Incorporated.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Cantor Fitzgerald | Upgrade | Overweight | 2025-12-16 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

| Needham | Maintain | Buy | 2025-12-04 |

| Rosenblatt | Maintain | Buy | 2025-12-03 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-07 |

| Citigroup | Maintain | Buy | 2025-11-07 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-11-07 |

| Stifel | Maintain | Buy | 2025-11-07 |

| Truist Securities | Maintain | Hold | 2025-11-07 |

| Needham | Maintain | Buy | 2025-11-07 |

Overall, Microchip Technology’s grades mostly indicate a Buy consensus with some Neutral and Hold ratings, and a recent upgrade by Cantor Fitzgerald.

Arm Holdings plc American Depositary Shares Grades

This table presents recent grades assigned by reputable grading companies for Arm Holdings plc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2025-12-16 |

| Goldman Sachs | Downgrade | Sell | 2025-12-15 |

| Loop Capital | Maintain | Buy | 2025-11-12 |

| Rosenblatt | Maintain | Buy | 2025-11-06 |

| Barclays | Maintain | Overweight | 2025-11-06 |

| Mizuho | Maintain | Outperform | 2025-11-06 |

| Needham | Maintain | Hold | 2025-11-06 |

| UBS | Maintain | Buy | 2025-11-06 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Keybanc | Maintain | Overweight | 2025-11-06 |

Arm Holdings’ grades show a strong Buy and Overweight sentiment, but include a recent Sell downgrade from Goldman Sachs, indicating some divergence among analysts.

Which company has the best grades?

Microchip Technology Incorporated shows a consistent Buy rating trend with fewer conflicting opinions, while Arm Holdings displays a broader range of ratings including a notable Sell downgrade. This variation could affect investor confidence differently depending on risk tolerance and market conditions.

Strengths and Weaknesses

The table below compares key strengths and weaknesses of Microchip Technology Incorporated (MCHP) and Arm Holdings plc (ARM) based on their recent financial and operational metrics.

| Criterion | Microchip Technology Incorporated (MCHP) | Arm Holdings plc (ARM) |

|---|---|---|

| Diversification | Moderate: Primarily semiconductor products with some licensing | Focused on licensing and royalty revenue streams |

| Profitability | Weak: Negative net margin and ROIC, value destroying | Strong net margin but ROIC below WACC, value destroying |

| Innovation | Moderate: Steady semiconductor product development | High: Leading in chip architecture licensing |

| Global presence | Strong: Well-established in semiconductor markets worldwide | Strong: Global licensing footprint |

| Market Share | Significant in embedded microcontrollers | Leading in processor IP licensing |

Key takeaways: Both companies face challenges in value creation as their ROICs are below WACC, indicating current value destruction. Arm’s strong profitability and innovation in licensing contrast with Microchip’s broader product base and moderate innovation but declining profitability. Investors should weigh Arm’s innovation and market niche against Microchip’s diversification risks.

Risk Analysis

Below is a comparative table of key risks for Microchip Technology Incorporated (MCHP) and Arm Holdings plc (ARM) based on the most recent financial and operational data from 2025.

| Metric | Microchip Technology Incorporated (MCHP) | Arm Holdings plc American Depositary Shares (ARM) |

|---|---|---|

| Market Risk | Beta 1.46 indicates moderate volatility; semiconductor sector cyclicality | Beta 4.25 reflects high volatility; sensitivity to tech sector swings |

| Debt level | Debt-to-equity 0.8 (neutral); interest coverage 1.15 (unfavorable) signals moderate leverage and potential difficulty covering interest | Very low debt-to-equity 0.05 (favorable); infinite interest coverage, low financial risk |

| Regulatory Risk | US-based, subject to export controls and semiconductor trade regulations | UK-based, exposed to international trade policies, including US-China tech tensions |

| Operational Risk | Large global footprint with 22.3K employees; supply chain disruptions could impact | Smaller workforce (8.3K); dependency on licensing model; operational risks tied to IP protection |

| Environmental Risk | Moderate, with manufacturing footprint; increasing pressure for sustainability | Moderate; focus on licensing reduces direct environmental impact but subject to industry standards |

| Geopolitical Risk | Significant exposure to US-China trade relations and global supply chain | High exposure to geopolitical tensions due to operations spanning US, China, Taiwan, and South Korea |

The most impactful risks are ARM’s high market volatility and geopolitical exposure, given its international presence and tech sector sensitivity. For MCHP, debt servicing risk and supply chain disruptions pose tangible threats. Both companies maintain safe Altman Z-Scores, but ARM’s stronger financial health and lower leverage offer better risk resilience.

Which Stock to Choose?

Microchip Technology Incorporated (MCHP) shows a declining income with a -42% revenue drop last year and negative profitability. Its financial ratios are slightly unfavorable overall, with mixed liquidity and debt metrics. The company is shedding value with a very unfavorable MOAT rating and holds a very favorable rating but weak return scores.

Arm Holdings plc (ARM) reports strong income growth with nearly 24% revenue increase and favorable profitability metrics. Its ratios present a mixed picture, slightly unfavorable overall, but with strong liquidity and low debt. ARM’s MOAT is unfavorable due to value destruction, yet it scores very favorably in ratings and shows strong financial health scores.

Investors focused on growth and income trends might find ARM more appealing given its strong income evolution and profitability, while those prioritizing financial stability and dividend yield could interpret MCHP’s mixed ratios and value metrics differently. Both stocks show some challenges, so risk tolerance and investment strategy will influence the preference.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Microchip Technology Incorporated and Arm Holdings plc American Depositary Shares to enhance your investment decisions: