MercadoLibre, Inc. (MELI) and Ulta Beauty, Inc. (ULTA) are two prominent players within the specialty retail sector, yet they serve distinctly different markets—e-commerce in Latin America and beauty retail in the United States, respectively. Both companies emphasize innovation to enhance customer experience and expand market share. This article will analyze their strategies and growth potential to help you decide which company could be a stronger addition to your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between MercadoLibre and Ulta Beauty by providing an overview of these two companies and their main differences.

MercadoLibre Overview

MercadoLibre, Inc. operates online commerce platforms primarily in Latin America, focusing on e-commerce and financial technology solutions. The company’s mission is to provide a comprehensive marketplace and payment platform, including logistics, loans, advertising, and classified listings. With a market cap of $110B and over 84K employees, MercadoLibre holds a significant position in specialty retail and fintech within the Latin American market.

Ulta Beauty Overview

Ulta Beauty, Inc. is a U.S.-based retailer specializing in beauty products and salon services. The company offers a wide range of cosmetics, skincare, haircare, and salon styling services, along with private label products. Ulta operates 1,308 stores across all 50 states and sells through its website and apps. Its market cap stands at nearly $30B, supported by a workforce of 20K employees, making it a prominent player in the U.S. specialty retail sector.

Key similarities and differences

Both companies operate in the consumer cyclical sector and specialty retail industry, serving large customer bases through physical and online channels. MercadoLibre focuses on e-commerce platforms and fintech services in Latin America, while Ulta Beauty centers on physical retail and salon services in the U.S. MercadoLibre’s business model integrates marketplace, payments, and logistics, contrasting with Ulta’s product and service retail approach. Their geographic focus and scale also differ significantly.

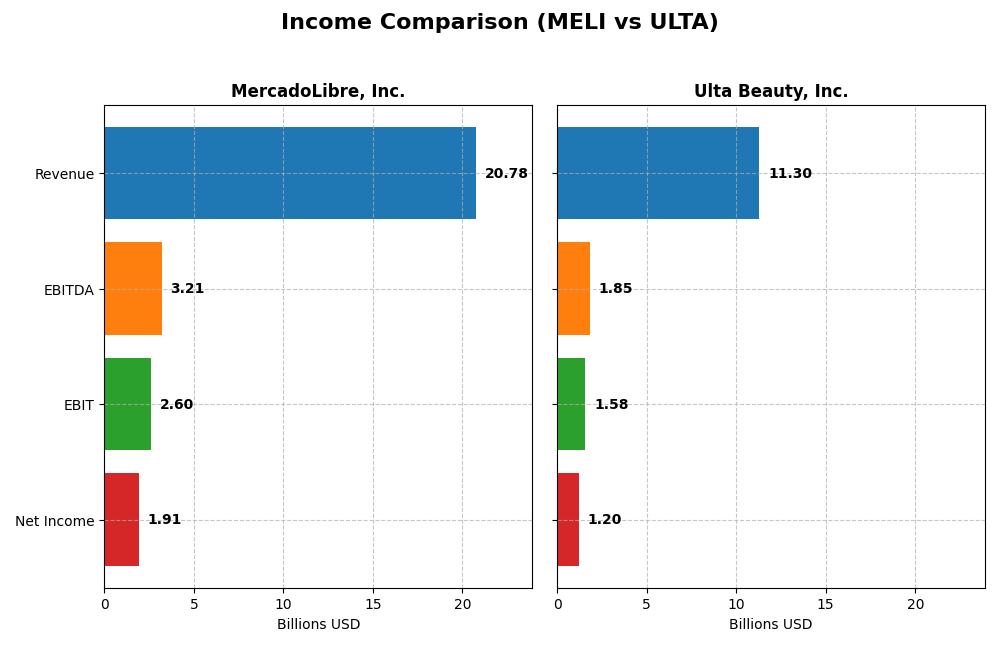

Income Statement Comparison

This table compares the latest full-year income statement metrics of MercadoLibre, Inc. and Ulta Beauty, Inc., highlighting key financial performance indicators for 2024.

| Metric | MercadoLibre, Inc. (MELI) | Ulta Beauty, Inc. (ULTA) |

|---|---|---|

| Market Cap | 110.4B | 29.9B |

| Revenue | 20.8B | 11.3B |

| EBITDA | 3.21B | 1.85B |

| EBIT | 2.60B | 1.58B |

| Net Income | 1.91B | 1.20B |

| EPS | 37.69 | 25.44 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

MercadoLibre, Inc.

From 2020 to 2024, MercadoLibre exhibited strong revenue growth, surging from $3.97B to $20.78B, with net income rising substantially from a loss of $4M to $1.91B. Margins improved markedly, with gross margin at 46.09% and net margin at 9.2% in 2024. The latest year showed accelerated growth, with revenue and net income increasing by over 37% and 40%, respectively, reflecting robust operational efficiency.

Ulta Beauty, Inc.

Ulta Beauty’s revenue grew steadily from $6.15B in 2020 to $11.30B in 2024, while net income increased from $176M to $1.20B. Margins remained favorable, with a gross margin of 38.84% and a net margin of 10.63% in 2024. However, recent growth slowed, with revenue up only 0.79% and net margin down 7.69% year-on-year, indicating some pressure on profitability despite overall expansion.

Which one has the stronger fundamentals?

MercadoLibre demonstrates stronger fundamentals with more pronounced revenue and net income growth over the period, alongside improving and higher margins. Ulta Beauty, while profitable with stable margins, shows slower recent growth and some margin contraction. MercadoLibre’s consistent margin expansion and rapid earnings growth present a more favorable financial trajectory based on the income statement data.

Financial Ratios Comparison

The table below presents a comparison of key financial ratios for MercadoLibre, Inc. (MELI) and Ulta Beauty, Inc. (ULTA) based on the most recent fiscal year data available.

| Ratios | MercadoLibre, Inc. (2024) | Ulta Beauty, Inc. (2024) |

|---|---|---|

| ROE | 43.9% | 48.3% |

| ROIC | 17.7% | 26.6% |

| P/E | 45.1 | 16.2 |

| P/B | 19.8 | 7.82 |

| Current Ratio | 1.21 | 1.70 |

| Quick Ratio | 1.20 | 0.60 |

| D/E (Debt to Equity Ratio) | 1.57 | 0.77 |

| Debt-to-Assets | 27.2% | 32.0% |

| Interest Coverage | 17.2 | 0 |

| Asset Turnover | 0.82 | 1.88 |

| Fixed Asset Turnover | 8.38 | 3.96 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

MercadoLibre, Inc.

MercadoLibre shows a mixed ratio profile with strong returns on equity (43.92%) and invested capital (17.73%), alongside favorable interest coverage and quick ratio. However, its high price-to-earnings (45.11) and price-to-book (19.81) ratios raise valuation concerns. The company does not pay dividends, likely focusing on reinvestment and growth strategies typical for a tech-driven platform.

Ulta Beauty, Inc.

Ulta Beauty presents robust profitability with net margin at 10.63%, return on equity of 48.27%, and return on invested capital of 26.61%, reflecting operational strength. Its favorable current ratio and asset turnover contrast with a weak quick ratio and an unfavorable price-to-book ratio. Ulta also does not pay dividends, suggesting emphasis on reinvestment or other capital uses rather than shareholder payouts.

Which one has the best ratios?

Ulta Beauty holds a more favorable overall ratios evaluation, with 57.14% of its metrics rated positively, including stronger profitability and liquidity measures. MercadoLibre is slightly favorable but hindered by higher valuation multiples and leverage concerns. Thus, Ulta shows a more consistently positive financial ratio profile in this comparison.

Strategic Positioning

This section compares the strategic positioning of MercadoLibre and Ulta Beauty, focusing on market position, key segments, and exposure to disruption:

MercadoLibre, Inc.

- Leading Latin American online commerce platform facing regional competition.

- Diverse segments: online marketplace, fintech services, logistics, ads.

- High exposure to e-commerce and fintech technological innovation.

Ulta Beauty, Inc.

- US-based specialty retailer with strong presence in beauty products.

- Concentrated on beauty products, salon services, and private label goods.

- Moderate exposure with digital sales and salon service technologies.

MercadoLibre vs Ulta Beauty Positioning

MercadoLibre pursues a diversified approach across commerce, fintech, and logistics in Latin America, offering multiple revenue streams. Ulta focuses on a concentrated US beauty retail model, combining product sales with salon services, limiting geographic and segment diversification.

Which has the best competitive advantage?

Both companies show very favorable MOATs with growing ROICs. MercadoLibre’s broad service ecosystem contrasts with Ulta’s focused retail and service model, each demonstrating durable competitive advantages in their respective markets.

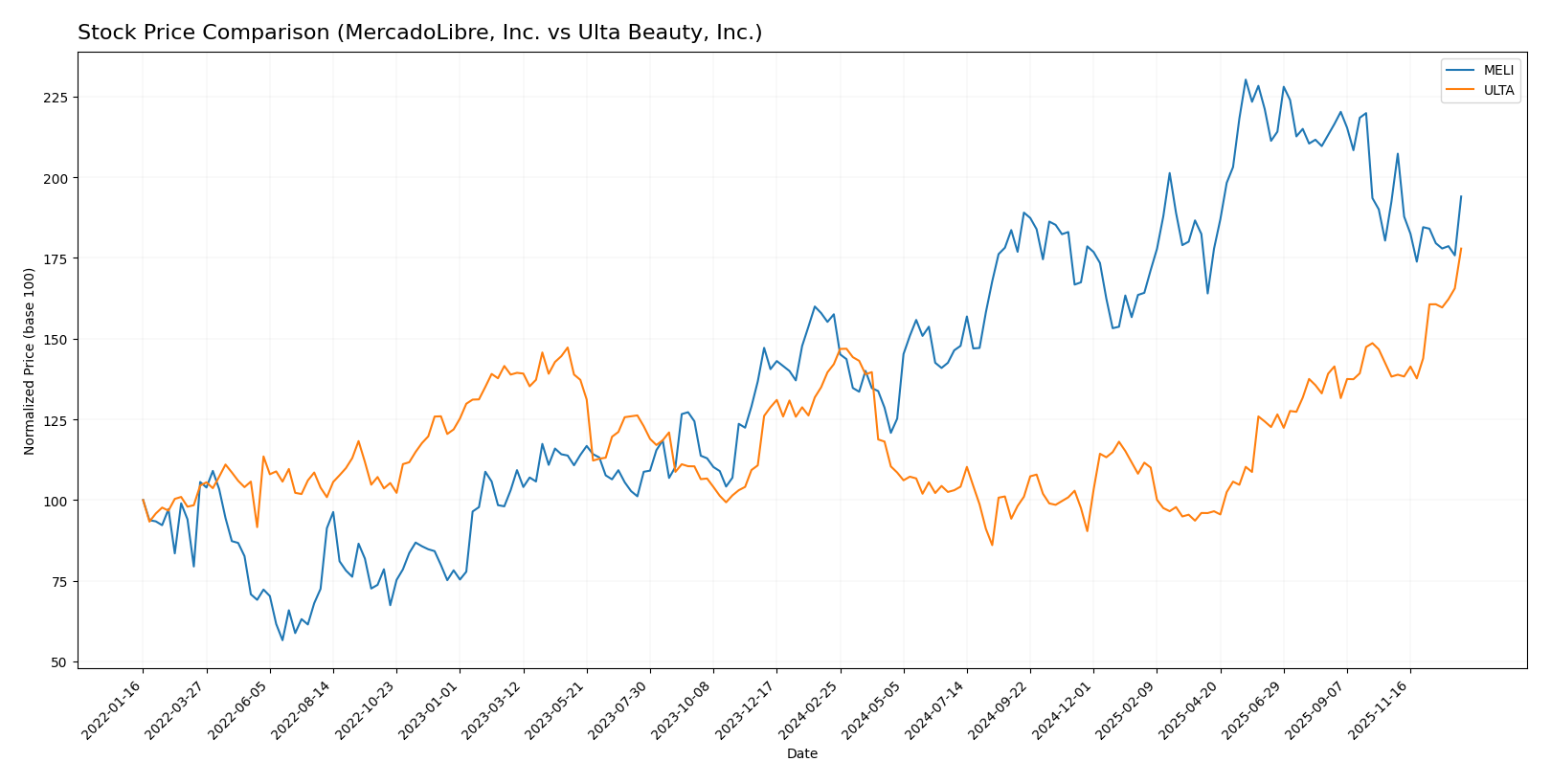

Stock Comparison

The past year has seen notable bullish trends for MercadoLibre, Inc. and Ulta Beauty, Inc., with contrasting recent trading dynamics highlighting shifts in momentum and volume dominance.

Trend Analysis

MercadoLibre, Inc. (MELI) exhibited a bullish trend over the past 12 months with a 23.16% price increase, though showing deceleration and a recent neutral trend with only a 0.8% gain from October 2025 to January 2026.

Ulta Beauty, Inc. (ULTA) demonstrated a stronger bullish trend, gaining 25.2% over the last year with acceleration, and a robust recent surge of 28.69% between October 2025 and January 2026.

Comparing both, Ulta Beauty delivered the highest market performance over the past year and recent months, supported by accelerating price gains and buyer-dominant volume in the latest period.

Target Prices

Analysts present a positive consensus for MercadoLibre, Inc. and Ulta Beauty, Inc. with clear target ranges and consensus prices.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| MercadoLibre, Inc. | 2900 | 2700 | 2830 |

| Ulta Beauty, Inc. | 780 | 425 | 648.4 |

For MercadoLibre, the consensus target of 2,830 USD is significantly above the current price of 2,178 USD, indicating expected upside potential. Ulta Beauty’s consensus target of 648.4 USD is slightly below the current price of 666 USD, suggesting a more cautious outlook from analysts.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for MercadoLibre, Inc. and Ulta Beauty, Inc.:

Rating Comparison

MercadoLibre Rating

- Rating: B-, considered very favorable overall.

- Discounted Cash Flow Score: 3, indicating moderate valuation level.

- ROE Score: 5, very favorable efficiency in generating equity profit.

- ROA Score: 4, favorable asset utilization efficiency.

- Debt To Equity Score: 1, very unfavorable financial risk profile.

- Overall Score: 3, moderate overall financial standing.

Ulta Beauty Rating

- Rating: A-, considered very favorable overall.

- Discounted Cash Flow Score: 4, indicating favorable valuation level.

- ROE Score: 5, very favorable efficiency in generating equity profit.

- ROA Score: 5, very favorable asset utilization efficiency.

- Debt To Equity Score: 2, moderate financial risk profile.

- Overall Score: 4, favorable overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Ulta Beauty holds a higher overall rating (A- vs. B-) and better scores in discounted cash flow, ROA, debt-to-equity, and overall financial standing, indicating it is better rated than MercadoLibre.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

MELI Scores

- Altman Z-Score: 3.46, indicating a safe zone status with low bankruptcy risk.

- Piotroski Score: 4, classified as average financial strength.

ULTA Scores

- Altman Z-Score: 6.64, indicating a safe zone status with very low bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

Which company has the best scores?

ULTA has a higher Altman Z-Score (6.64) than MELI (3.46), indicating stronger financial stability. ULTAs Piotroski Score (6) also exceeds MELIs (4), showing comparatively better financial health.

Grades Comparison

The following presents a comparison of recent analyst grades for MercadoLibre, Inc. and Ulta Beauty, Inc.:

MercadoLibre, Inc. Grades

This table summarizes recent analyst grades for MercadoLibre, Inc. from reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wedbush | Maintain | Outperform | 2025-12-19 |

| BTIG | Maintain | Buy | 2025-12-04 |

| UBS | Maintain | Buy | 2025-11-24 |

| BTIG | Maintain | Buy | 2025-11-14 |

| JP Morgan | Maintain | Neutral | 2025-11-03 |

| Morgan Stanley | Maintain | Overweight | 2025-11-03 |

| Barclays | Maintain | Overweight | 2025-10-30 |

| Benchmark | Maintain | Buy | 2025-10-30 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-21 |

MercadoLibre’s grades predominantly show Buy and Outperform ratings, indicating strong analyst confidence with no recent downgrades.

Ulta Beauty, Inc. Grades

This table summarizes recent analyst grades for Ulta Beauty, Inc. from reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Neutral | 2026-01-08 |

| UBS | Maintain | Buy | 2026-01-07 |

| Argus Research | Maintain | Buy | 2026-01-02 |

| Oppenheimer | Maintain | Outperform | 2025-12-10 |

| TD Cowen | Upgrade | Buy | 2025-12-08 |

| Morgan Stanley | Maintain | Overweight | 2025-12-08 |

| Guggenheim | Maintain | Neutral | 2025-12-05 |

| UBS | Maintain | Buy | 2025-12-05 |

| Canaccord Genuity | Maintain | Buy | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

Ulta Beauty shows a mix of Buy, Outperform, and Neutral grades, with one recent upgrade, reflecting generally positive but slightly more varied analyst sentiment.

Which company has the best grades?

Both companies have a consensus “Buy” rating, but MercadoLibre presents a stronger concentration of Buy and Outperform grades with fewer Neutral ratings. This profile may suggest relatively higher analyst conviction in MercadoLibre’s prospects compared to Ulta Beauty, where Neutral ratings are more frequent. Investors might interpret this as MercadoLibre having a clearer positive outlook among analysts.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of MercadoLibre, Inc. (MELI) and Ulta Beauty, Inc. (ULTA) based on their recent financial and market data.

| Criterion | MercadoLibre, Inc. (MELI) | Ulta Beauty, Inc. (ULTA) |

|---|---|---|

| Diversification | Strong with broad e-commerce and fintech segments; service revenue dominates at $18.6B in 2024 | Focused on beauty retail and salon services; ecommerce growing but less diversified |

| Profitability | Moderate net margin (9.2%), strong ROIC (17.7%), ROE (43.9%) | Higher net margin (10.6%), superior ROIC (26.6%), ROE (48.3%) |

| Innovation | High investment in fintech and marketplace technology | Innovation driven by customer experience and salon services integration |

| Global presence | Strong Latin American footprint, growing cross-border commerce | Primarily US-focused with expanding online presence |

| Market Share | Leading position in Latin American e-commerce and fintech | Leading US beauty retailer with solid market share |

Key takeaways: MELI offers strong diversification and a durable competitive moat driven by fintech and commerce innovation in Latin America, while ULTA excels in profitability and US market dominance with a favorable financial profile. Both show growing ROIC, indicating sustainable value creation.

Risk Analysis

Below is a comparative table summarizing key risks for MercadoLibre, Inc. (MELI) and Ulta Beauty, Inc. (ULTA) based on their latest 2024 data:

| Metric | MercadoLibre, Inc. (MELI) | Ulta Beauty, Inc. (ULTA) |

|---|---|---|

| Market Risk | High beta (1.42) indicates greater volatility and sensitivity to market swings | Lower beta (0.85) reflects more stability against market fluctuations |

| Debt level | Debt-to-equity ratio unfavorable at 1.57, moderate leverage risk | Debt-to-equity neutral at 0.77, manageable leverage |

| Regulatory Risk | Moderate, operating in multiple Latin American countries with varying regulations | Moderate, US-focused but exposed to evolving consumer and safety regulations |

| Operational Risk | Complex logistics and fintech operations increase operational complexity | Retail and service operations with supply chain and staffing challenges |

| Environmental Risk | Moderate, logistics and marketplace platform have environmental impact | Moderate, retail operations with packaging and waste concerns |

| Geopolitical Risk | Elevated, due to exposure to Latin American economic and political instability | Lower, primarily US market reduces geopolitical exposure |

In synthesis, MercadoLibre’s most impactful risks arise from its higher market volatility and geopolitical exposure in Latin America, along with elevated debt levels that could affect financial flexibility. Ulta Beauty shows lower market and geopolitical risks but must manage operational challenges and supply chain resilience. Both companies face regulatory and environmental risks typical for their sectors, with Ulta demonstrating stronger financial stability overall.

Which Stock to Choose?

MercadoLibre, Inc. (MELI) shows strong income growth with a 37.53% revenue increase in 2024 and a highly favorable income statement overall. Its profitability is robust, reflected in a 43.92% ROE and a 17.73% ROIC, though valuation ratios like P/E and P/B are less attractive. MELI carries moderate debt and holds a very favorable rating, supported by a solid financial moat with growing ROIC.

Ulta Beauty, Inc. (ULTA) presents stable income with modest 0.79% revenue growth in 2024 and a generally favorable income statement despite some recent declines in margins. Profitability ratios are strong, including a 48.27% ROE and 26.61% ROIC, with a more balanced debt situation. Its rating is very favorable, and it demonstrates a durable competitive advantage with improving returns on capital.

Considering ratings and the overall financial analysis, MELI might appeal to investors seeking high growth potential supported by strong profitability but facing valuation challenges. Conversely, ULTA could be seen as more favorable for investors prioritizing consistent profitability and a solid competitive moat with balanced valuation metrics. The choice could depend on whether an investor favors growth dynamics or stability in financial ratios.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of MercadoLibre, Inc. and Ulta Beauty, Inc. to enhance your investment decisions: